Audit of the Expenditures of The Canadian Section Of The International Joint Commission

Global Affairs Canada

Office of the Chief Audit Executive

November 2016

Table of contents

Executive Summary

In accordance with the Global Affairs Canada‘s approved 2016-2019 Risk-Based Audit Plan, the Office of the Chief Audit Executive conducted an Audit of the expenditures of the Canadian Section (CS) of the International Joint Commission.

The objective of the audit was to provide reasonable assurance that core controls over financial management at the Canadian Section of the International Joint Commission were operating effectively and resulted in compliance with the key requirements of applicable legislations, regulations, and Treasury Board Secretariat (TBS) and CS policies.

The International Joint Commission (IJC) is a binational body that aims to prevent and resolve freshwater disputes between Canada and the U.S. It was created by the Boundary Waters Treaty, signed by United States of America and Great Britain on behalf of Canada in 1909. The treaty provides general principles for preventing and resolving disputes over waters shared between the two countries, and for settling other transboundary issuesFootnote 1. The IJC is composed of six Commissioners, three appointed by each government, who are supported by staff at the Canadian Section office located in Ottawa, and the U.S. Section office located in Washington, and by staff located at the Great Lakes Regional Office in Windsor, who carry out the Commission’s activities under the Great Lakes Water Quality Agreement. The IJC is funded by the United States and Canada directly through the U.S. and Canadian sections. For the Canadian side, the IJC falls within the portfolio of the Minister of Foreign Affairs. The Canadian Section manages its operations independent of Global Affairs Canada and is subject to and in compliance with the rules and obligations that apply in accordance with Schedule IV of the Financial Administration Act.

Why is this Important?

Canadians expect the government to be well managed and to be accountable for the safeguarding of public assets and the stewardship—efficient, effective, and economical use—of public funds. They also expect reliable and transparent reporting on how the government spends public funds to achieve results for CanadiansFootnote 2. In this context, effective and efficient use of public resources is required of all governmental organisations, departments and agencies. Though the CS is not a governmental organisation, as part of a binational organisation that receives funding from the Government of Canada, its operations are expected to be guided by principles of value for money, accountability, transparency and risk management, and have in place a system of internal controls and procedures to ensure sound stewardship of its resources.

What did we examine?

The audit examined Governance, Policy frameworks, and internal controls over financial management in place at CS (See Appendix A for more information about the Audit). The audit also examined financial transactions, records and processes in relation to the following selected expenditures categoriesFootnote 3 incurred in fiscal years 2014–15 and 2015-16:

- Purchase of goods and services;

- Travel, hospitality, conference and event expenditures;

- Salaries for casual employees, and overtime.

What did we find?

Overall, the audit concludes that the CS has put in place practices that support sound financial management and that core controls over financial management regarding the transactions tested resulted in compliance with key requirements contained in the policies, directives and corresponding legislation examined as part of the audit. The exceptions noted in transactions tested were of acceptable risk. Based on the limited number of cases where conformance needed enhancement, opportunities for improvement were identified, including increasing compliance with contracting, travel and hospitality respective policy requirements and ensuring that the supporting documentation associated with appropriate contract administration, travel and hospitality pre-approval and claims processing are available on file, or electronically traceable. Recommendations have been included in the report to address the areas which could be improved.

Statement of Conformance

In my professional judgment as the Chief Audit Executive, this audit was conducted in conformance with the Institute of Internal Auditors' International Standards for the Professional Practice of Internal Auditing and with the Internal Auditing Standards for the Government of Canada, as supported by the results of the quality assurance and improvement program. Sufficient and appropriate audit procedures were conducted, and evidence gathered, to support the accuracy of the findings and conclusion in this report, and to provide an audit level of assurance. The findings and conclusion are based on a comparison of the conditions, as they existed at the time, against pre-established audit criteria that were agreed upon with management and are only applicable to the entity examined and for the scope and time period covered by the audit.

________________________________

Brahim Achtoutal

Chief Audit Executive

1. Background

In accordance with the Global Affairs Canada‘s approved 2016-2019 Risk-Based Audit Plan (RBAP), the Office of the Chief Audit Executive conducted the Audit of the Expenditures of the Canadian Section of the International Joint Commission. The audit was added to the RBAP at the request of senior management of Global Affairs Canada following consultation with the Canadian Section of the International Joint Commission.

The International Joint Commission (IJC) is a binational body that aims to prevent and resolve freshwater disputes between Canada and the U.S. The two countries cooperate to manage these waters wisely and to protect them for the benefit of today’s citizens and future generations. The IJC has two main responsibilities: regulating and approving projects that affect water levels and flows across the boundary and investigating transboundary issues and recommending solutions to governments.

The IJC is composed of six commissioners, three on the part of the United States (U.S) appointed by the President of the U.S., and three on the part of the Canada appointed by the Governor-in-Council. Each section is led by an appointed Secretary. The IJC is supported by staff at the Canadian Section office located in Ottawa, and the U.S. Section office located in Washington, and by staff located at the Great Lakes Regional Office (GLRO) in Windsor. The GLRO consist of a staff of 14 employees comprised of both Canadian and American citizens to carry out the Commission’s activities under the Great Lakes Water Quality Agreement. It is led by a Director who is appointed for a 4-year mandate on a rotational basis, alternating between American and Canadian staff. Currently, the GLRO is led by an American Director until 2018.

The IJC is governed by a set of Guiding PrinciplesFootnote 4 and Rules of ProcedureFootnote 5 that promote and foster an environment of integrity and due diligence. The Guiding Principles provide a foundation to ensure that the Commission adheres to the highest ethical standards in all its activities. The Rules of Procedure outline the Secretary’s role and key responsibilities within the organization. This includes reporting on all financial, employment, and contractual matters to all three Commissioners.

The IJC is funded by the U.S. and Canada governments directly through their respective sections. The GLRO is jointly funded by Canada and the U.S. with an equal contribution. The IJC expenditures reporting reflect U.S. Fiscal Year October 1 to September 30 and the Canadian Fiscal Year April 1 to March 31 and expenditures are reported in U.S. and Canadian dollars with no adjustment for the exchange rate.

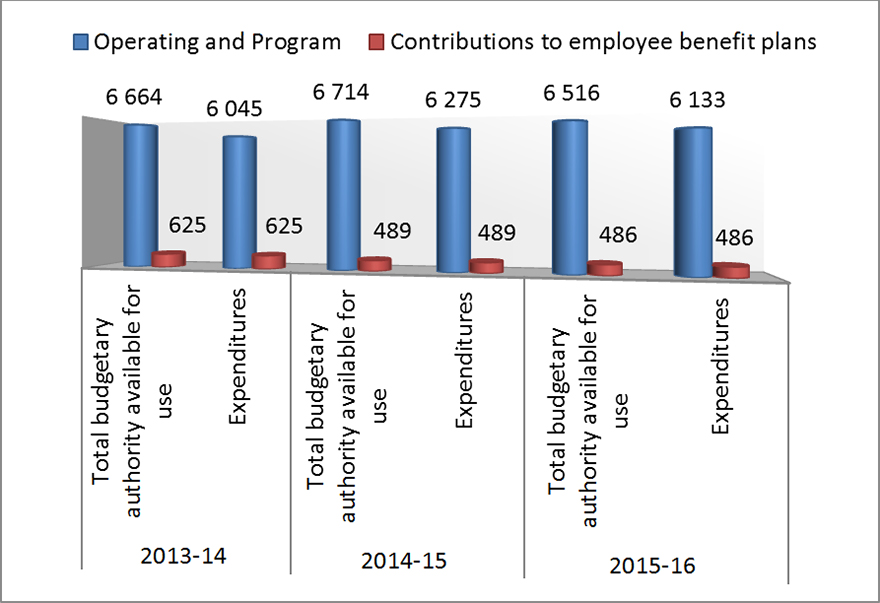

In 2015-16, the CS received approximately $6.516 million in annual appropriations for operating and program, and $486 thousand for contributions to employee benefit plans from the Canadian federal government. For the same fiscal year, approximately 73% of the expenditures were spent on Boundary Waters Treaty while 27% were spent on Great Lakes Water Quality Agreement. The CS is supported by 33 employees located in Ottawa and Windsor. Appendix B provides details on budget, main expenditures and employees.

The IJC falls within the portfolio of the Minister of Foreign Affairs, thus; the Minister is responsible to the Parliament for ensuring the CS’s sound financial management.

The Financial Administration Act (FAA) states that departmental Deputy heads are accountable for, amongst other things, ensuring resources are organized to deliver departmental objectives in compliance with government policy and procedures, and ensuring that there are effective systems of internal control. Furthermore, the Treasury Board Secretary (TBS) Policy on Financial Management Governance, states that the Deputy heads are responsible for “establishing a sound financial management governance structure that fosters prudent stewardship of public resources in the delivery of the mandate of the organization”. In addition, the Policy on Internal Control states that organizations must establish and maintain broad systems of internal control to mitigate risks.

In accordance to the rules and principals mentioned above, it is expected that the CS exercise sound financial management and control within the applicable requirements of the Financial Administration Act and regulations, and be guided by principles of value for money, accountability, transparency, and risk management.

2. Observations and Recommendations

The audit examined governance, policy frameworks, and internal controls over financial management in place at the CS and reviewed a judgmental sample of 159 transactions for a total dollar value of $1,068,253 from the following expenditures and processes (see Appendix C for details):

- Procurement of goods and services, including acquisition cards;

- Travel, hospitality, conference and event expenditures;

- Salaries for casual employees; and

- Overtime.

2.1 Governance and Policy Framework for Financial Management

Establishing a governance and policy framework and defining roles and responsibilities over financial management provides an organization with the ability to design and implement sound financial management practices.

The CS has a governing body comprised by three Canadian Commissioners, one of whom is the chair, who provide oversight over financial management alongside the Secretary. This oversight function is mainly exercised through the monthly financial reporting, which provide opportunities to review and discuss budget and spending. Furthermore, the Commissioners are regularly informed of overall financial situation, including budget updates from the GLRO during the International Joint Commission Executive meetings.

The CS has established and implemented a suite of policies, directives, guidelines and tools to support sound financial management. The audit team noted that the CS has adopted many of the TBS policies and directives and where necessary, it has developed its own policies, directives and procedures which are aligned with TBS policies and directives. It should be noted that the CS is considered a micro-organisation and is an entity listed under Schedule IV of the Financial Administration Act, and, as a result, it is not required to adopt all Treasury Board Secretariat (TBS) Policy Suite. In this context, the audit team noted that, the CS has not adopted the government policy requirement to proactively disclose contracts over $10,000 as well as travel and hospitality expenses incurred by senior officials, which aims to enhance transparency and accountability expected by Canadians from organizations funded by public money.

The audit noted that roles and responsibilities related to financial management are defined and communicated. Furthermore, interviews indicated that employees understand their roles and responsibilities in regard to financial, contracting, and human resources management. Roles and responsibilities in regards to financial management are clearly defined and understood.

Recommendation #1:

The Secretary of the Canadian Section of the International Joint Commission should, to the extent possible for a binational organization, consider establishing and implementing a policy of proactive disclosure for contracts over $10,000 as well as travel and hospitality expenses incurred by senior officials.

2.2 Internal controls

The audit examined a sample of 159 transactions to ensure that core controls are operating effectively and resulted in compliance with the key requirements contained in policies, directives and corresponding legislation tested. Appendix C provides details of the sampled transactions.

Approval, spending and payment authorities

The audit team noted that the Financial Delegation instrument of the CS is appropriate, current, and approved in accordance with the TBS Directive on Delegation of Financial Authorities for Disbursements. Accordingly, the Delegation of Financial Signing Authorities matrix is signed by the Minister of Foreign Affairs. Furthermore, the audit team found that key authorities such as expenditure initiation, certification and payment authorities are sufficiently restricted to appropriate individuals within CS.

The audit reviewed the operational processes and procedures and found that core controls are in place for expenditure initiation, commitment, verification and payment including segregation of duties. The review of the 159 financial transactions indicated that overall the approval, certification and payment authorities were properly segregated and exercised. Furthermore, account verification and quality assurance were performed before approving and processing payments.

Travel, Hospitality and Conferences Expenditures

The audit team expected to find that travel, hospitality and conference expenses were properly authorized, verified and had the required supporting documents prior to payment in accordance with:

- The CS’s Directive on Travel, Hospitality, Conference and Event Expenditures;

- The CS’s established delegated authorities; and

- The TBS authorized allowances.

Travel

Travel shall be pre-authorized in writing to ensure that all travel arrangements are in compliance with the provisions of the directive. Travellers must also forward for approval their travel expense claim, along with all supporting documents, including original receipts and an explanation for any deviation from the Directive. All travel expense claims should be processed in accordance with the delegation of financial signing authorities.

The audit team reviewed a sample of 38 travel claims and found that, overall:

- Travel was properly pre-authorized; and,

- Travel expense claims were processed in accordance with the established delegated authorities and the Directive on Travel, Hospitality, Conference and Event Expenditures.

The audit team found few exceptions with regards to proper supporting documentation and justifications for deviation from the Directive on Travel, Hospitality, Conference and Event Expenditures.

Hospitality

Hospitality expenses must be formally pre-authorised by the appropriate level of delegation to validate the expense before an event is held and cost reimbursement requests must be accompanied by required documentation.

The examination of 14 hospitality claims indicated few instances where pre-authorization had not been obtained. Consistent pre-authorization of hospitality events and enhanced employees’ awareness of the need to submit documents required for claims reimbursements (i.e. list of attendance) could be improved.

Conferences

Conferences and events are subject to pre-approval, spending and payment authorities in accordance with CS’s established delegated authorities. All 18 conferences claims examined were pre-authorized and, spending and payment authorities were exercised in accordance with CS’s established delegated authorities.

Procurement of Goods and Services

The CS has chosen to comply with the TBS contracting policy, which requires that contracting practices result in openness, fairness and transparency in the spending of public funds.

The audit examined a sample of 32 contracts to procure goods and services to ensure that:

- Sufficient documentation support the notion that contracts are being awarded in an open, fair and transparent manner;

- Appropriate contracting methods were selected;

- Contracts were reviewed and approved;

- Contract files contained a complete audit trail that included details such as decisions, contract content and administration; and,

- Invoices submitted for payment were in accordance with contract terms, contained sufficient information for certification of payment, and were approved by an individual with the appropriate authority.

The audit team found sufficient documentation to support that contracts were awarded in an open, fair and transparent manner. In addition, the audit team found that documentation was on file to support justification for non-competitive contracting and the appropriate contracting vehicle was used for the selected transactions within its terms and conditions. As well, the justifications for contract amendments were always on file. Furthermore, invoices submitted for payment were in accordance with contract terms, contained sufficient information for certification of payment, and were approved by an individual with the appropriate authority. Finally, contracts were reviewed and approved properly.

However, the examination indicated that the CS needs to enhance awareness of details pertaining to contract administration including that contracting files contain all required documentation (i.e. evaluation reports signed by all individual evaluators, evidence of signed consensus decision on bids’ assessments, or the equivalent electronically traceable communication). In addition, in few instances, the work was performed after contract expiry date or before an amendment was issued.

Finally, the audit team examined a sample of 24 transactions from a bank acquisition card to ensure purchases were in accordance with policy requirements and were certified prior to payment. The audit team found the bank acquisition card was used in accordance with prevailing policy and guidelines. Furthermore, acquisition card purchases were reconciled against monthly statements by the cardholder prior to certification and payment.

Salaries for Casual Employees and Overtime

The audit reviewed a sample of 30 pay transactions of casual employees and three (3) overtime claims to ensure appropriate pre-approval of overtime, approval of timesheets, and accuracy of salaries and overtime paid. The audit found that salaries were paid in accordance with number of hour worked and appropriate rate of pay. Timesheets tested were accurate and submitted with appropriate approvals. Furthermore, terms and conditions of casual workers comply with the section 50.2 of the Public Service Employment Act (PSEA) stipulating that “the period of employment of a casual worker may not exceed 90 working days in one calendar year in any particular department or other organization”.

Recommendation #2:

The Secretary of the Canadian Section of the International Joint Commission should enhance employees’ awareness of policy and documentation requirements with regard to contracting activities, travel and hospitality expenditures, to ensure continued consistency and rigor in these processes.

3. Conclusion

The audit found that, overall the CS has put in place policy framework and oversight mechanisms that support sound financial management. As well, core controls over financial management are in place and resulted in compliance with the key requirements contained in the policies, directives and corresponding legislation tested as part of the audit.

The audit team has identified some areas of improvement, including ensuring employees are aware of all contracting, travel and hospitality respective policy requirements and ensuring all documentation required is on file to support evidence of appropriate contract administration, travel and hospitality pre-approval and claims processing. The audit team also noted that the CS does not proactively disclose contracts over $10,000 as well as travel and hospitality expenses incurred by senior officials.

Appendix A: About the Audit

Objective

The objective of this audit was to provide reasonable assurance that core controls over financial management at the Canadian Section of the International Joint Commission were operating effectively and resulted in compliance with the key requirements of applicable legislations, regulations, and TBS and IJC policies.

Scope

The scope of this audit included financial transactions, records and processes conducted by the CS in fiscal years 2014–15 and 2015-16. The audit examined Governance, Policy frameworks, and internal controls over financial management in place at SC. The audit also examined a sample of transactions for the following selected expenditures categories and processes:

- Procurement of goods and services including acquisition cards;

- Travel, hospitality, conference and event expenditures;

- Salaries for casual employees; and

- Overtime.

The audit did not examine advertised staffing, compensation and appointment processes as well as the payroll administration.

Criteria

The criteria were developed following the completion of the detailed risk assessment and considered the Audit Criteria related to the Management Accountability Framework developed by the office of Comptroller General of the Treasury Board Secretariat. The audit criteria were discussed and agreed upon with the auditees. The detailed criteria are presented as follows.

| Criteria |

|---|

1. The governance and oversight structures are effective and roles and responsibilities are clearly articulated and communicated to support sound financial governance and management. |

2. Policy framework is developed and implemented to support sound financial management practices and to ensure compliance with applicable legal and regulatory requirements. |

3. Sound management practices are in place to ensure compliance with the FAA, TBS and IJC policies and directives related to expenditure initiation, commitment, transaction, certification and payment authorities and activities. |

4. Expenses are processed and reported in a comprehensive, accurate, consistent and timely manner in the financial system. |

Approach and Methodology

In order to conclude on the above criteria, and based on identified and assessed key risks and internal controls associated with the related business processes, the audit methodology included, but was not limited to the following:

- Identified and reviewed relevant legislations, regulations, policies, directives, and guidelines;

- Conducted walkthroughs of the identified financial management processes and systems, and identify core controls;

- Performed data analysis;

- Reviewed a judgmental risk-based sample of transactions for identified financial management processes and expenditure categories, and assess effectiveness of core controls; and

- Conducted interviews with key stakeholders.

Sampling Methodology

To select the sample, the following strategy was designed and applied:

- Obtained the population of expenditures for FY 2014-15 and FY 2015-16;

- Reviewed population to determine expense categories through interviews and data analysis (trend variances, value, number of transactions, type of expenses, processes, etc.);

- Stratified the population by expenses categories; and

- Selected a judgmental risk-based sample of transactions for each identified sub-populations (high dollar value, transaction type, misappropriation and error likelihood, reputational risk, etc.).

The audit team examined a judgmental sample of 159 transactions drawn as follow: 32 contracts to procure goods and services, 24 transactions from acquisition card, 38 travel transactions, 14 hospitality transactions, 18 conference transactions, 30 pay transactions of casual employees and three (3) overtime claims.

Appendix B: Budget, Main Expenditures And Employees

Figure 1: Authorities and Actual Expenditures from 2013-14 to 2015-16 ($000)Footnote 6

Text version

Operating Program Contributions to employee benefit plans Total budgetary authority available for use Expenditures Total budgetary authority available for use Expenditures 2013-2014 2014-2015 2015-2016 2013-2014 2014-2015 2015-2016 2013-2014 2014-2015 2015-2016 2013-2014 2014-2015 2015-2016 6 664 6 714 6 516 6 045 6 275 6 133 625 489 486 625 489 486

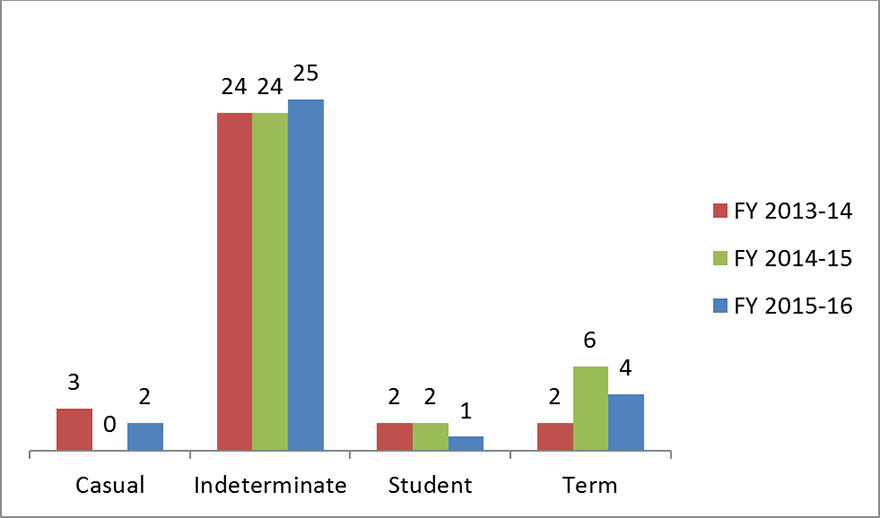

Figure 2: Employee population by Employee Type, as of March 31st of the fiscal yearFootnote 7

Text version

Casual Interminate Student Term FY

2013-14FY

2014-15FY

2015-16FY

2013-14FY

2014-15FY

2015-16FY

2013-14FY

2014-15FY

2015-16FY

2013-14FY

2014-15FY

2015-163 0 2 24 24 25 2 2 1 2 6 4

| Expenses Description | 2014-2015 | 2015-2016 | ||

|---|---|---|---|---|

| Salary full-time indeterminate | $2,177,199 | 35% | $2,228,231 | 36% |

| Scientific services / Consultants | $889,713 | 14% | $1,250,202 | 20% |

| Salary term, part time, seasonal & casual | $742,099 | 12% | $865,976 | 14% |

| Rental of office, hearing and meeting accommodation | $259,647 | 4% | $272,234 | 4% |

| Computer & Office equipment and arts (note 1) | $477,917 | 8% | $41,140 | 1% |

| Non-Public Servant Travel | $234,977 | 4% | $180,697 | 3% |

| Human resources services (note2) | $68,775 | 1% | $283,787 | 5% |

| Public Servant Travel | $164,677 | 3% | $162,173 | 3% |

| Translation & Interpretation services | $106,627 | 2% | $105,811 | 2% |

| Maternity & parental allowance | $133,265 | 2% | $30,330 | - |

| Other professional services | $99,798 | 2% | $56,892 | 1% |

| License/Maintenance fees for Application Software (IM software) | $23,146 | - | $97,297 | 2% |

| Data Communications services (blackberry) | $51,227 | 1% | $54,078 | 1% |

| License/Maintenance fees for Server Operating System and Utilities | $68,262 | 1% | $33,336 | 1% |

| Performance pay bonus | $41,061 | 1% | $39,148 | 1% |

| License/Maintenance fees for Client Software (Email software) | $33,584 | 1% | $44,637 | 1% |

| Salary expense for employee secondments | $49,830 | 1% | $27,896 | - |

| Severance pay (note 3) | $71,857 | 1% | - | - |

| Cash Out – WFA (note 4) | - | - | $43,845 | 1% |

| Others | $578,039 | 9% | $315,021 | 5% |

| Total | $ 6,271,700 | $ 6,132,731 | ||

Note 1: The variance is due to major investment / work on the network and servers conducted in 2014-15.

Note 2: The variance is due to the payment following the signature of the MOU with Environment and Climate Change Canada (ECCC) to outsource CS’s human resource function.

Note 3: The amount is to compensate (pay and benefits) an indeterminate employee in HR function who left following the signature of the MOU with ECCC.

Note 4: The Amount is related to the Work Force Adjustment exercise. The amount was paid in 2015-16 due to delay in processing the Transition Support Measure which is a cash payment.

Appendix C: Sample Description

| Expenses Category (Sub-population) | Sub-Population Dollar Value | # of Transactions Sampled | Sample Value Dollar Value | Sample as % of Sub- Population tested |

|---|---|---|---|---|

| Salaries for Term, Student and Casuals | $1,608,075 | 30 | $124,390 | 8% |

| Overtime | $30,368 | 3 | $19,862 | 65% |

| Contracting and Procurement | $3,820,335 | 32 | $843,167 | 22% |

| Acquisition Cards | $108,693 | 24 | $10,295 | 9% |

| Travel | $579,227 | 38 | $56,042 | 10% |

| Hospitality | $20,318 | 14 | $5,771 | 57% |

| Conferences | $14,210 | 18 | $8,726 | 61% |

| Total | $6,181,225Footnote 9 | 159 | $1,068,253 | 17% |

Appendix D: Management Action Plan

| Audit Recommendation | Management Action | Expected Completion Date |

|---|---|---|

| 1. The Secretary of the Canadian Section of the International Joint Commission should, to the extent possible for a binational organization, consider establishing and implementing a policy of proactive disclosure for contracts over $10,000 as well as travel and hospitality expenses incurred by senior officials. | The Canadian Section, will, continue to include a financial summary of IJC expenditures in its publicly available annual report. During its regular mid-year and main estimates discussion with GAC, a summary of contracts over $10,000 and a summary of travel and hospitality expenses of senior officials will be provided. | Semi-annual meeting with Director of U.S. Transboundary Affairs Division. |

| 2. The Secretary of the Canadian Section of the International Joint Commission should enhance employees’ awareness of policy and documentation requirements with regard to contracting activities, travel and hospitality expenditures, to ensure continued consistency and rigor in these processes. | Existing guidance documents for managers and staff, including the Managers guide, the contractual process and authorities check lists, Treasury Board guidance on travel and expenditures will be made available on the IJC Intra net site, and refresher briefings will be held during regular staff meetings. In addition to the monthly financial monitoring reports provided to senior management, the Finance officer will report on any anomalies or non-compliance incidents. | Ongoing internal IJC activities. |