Audit of management practices of missions - Cairo

Global Affairs Canada

Office of the Chief Audit Executive

October 2017

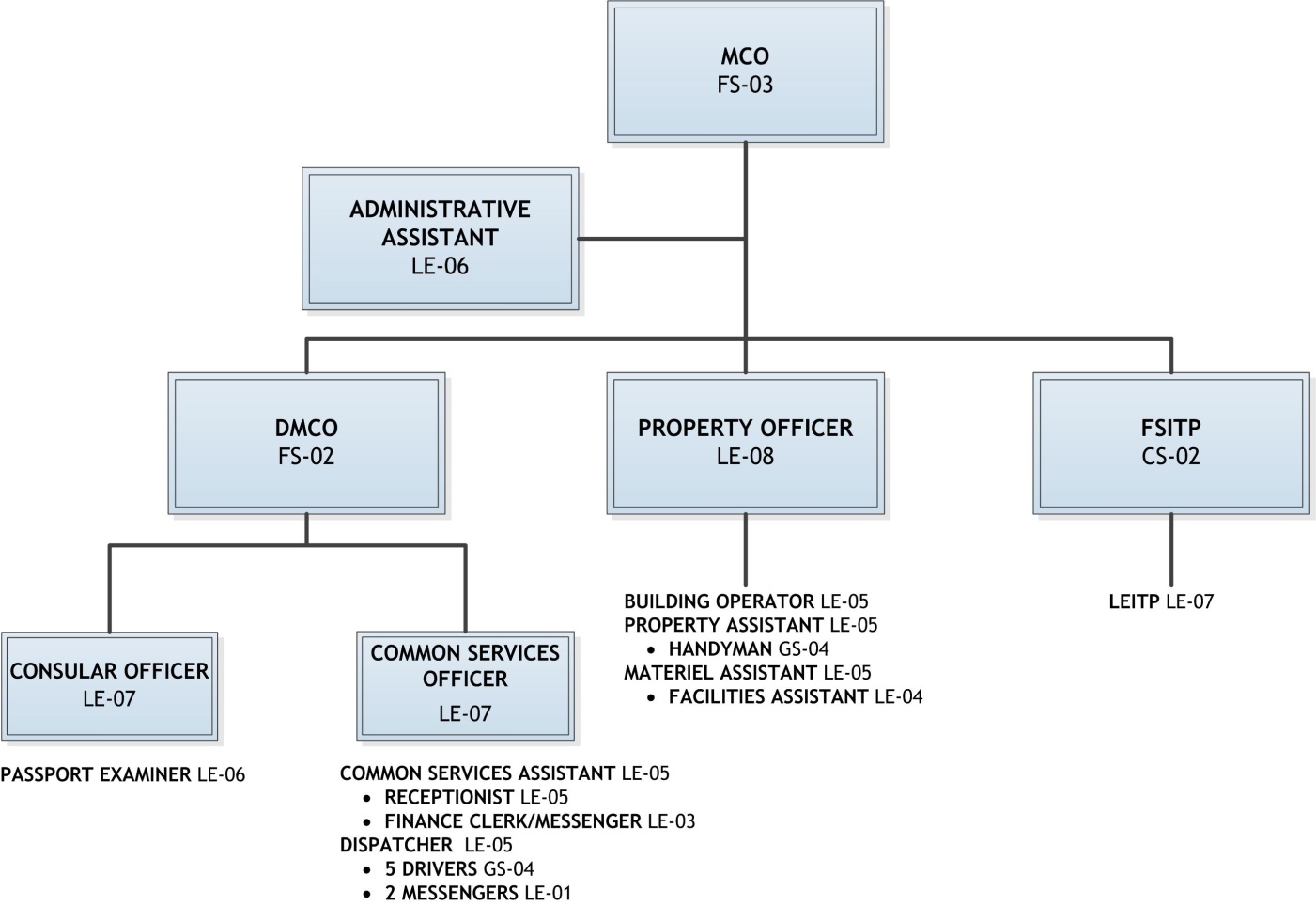

Global Affairs Canada manages Canada’s International Platform Branch — a global network of 179 Missions in 109 countries that supports the international work of Global Affairs Canada and 37 partner departments, agencies and co-locators Footnote 1. Administrative activities that support the Department’s Missions require effective and efficient management practices to help ensure sound stewardship of resources. Rationale for this audit In 2015, the Department initiated an internal investigation into the Canadian Embassy in Haiti, and found that fraudulent schemes had been put in place by locally engaged staff that resulted in estimated government losses of $1.7 million. Given the findings in Haiti, the Deputy Minister of Foreign Affairs requested a series of management practice audits of selected Missions to determine whether similar issues could be taking place at other Canadian Missions abroad. The Office of the Chief Audit Executive conducted a risk assessment to identify those Missions susceptible to higher levels of fraud risk and therefore selected for audit. A first phase of Mission audits was initiated in 2016-17. As part of a second phase initiated in 2017-18, the Cairo Mission was one of five Missions operating in a higher fraud risk environment selected for audit. What was examined The objective of this audit was to provide assurance that sound management practices and effective controls are in place to ensure good stewardship of resources at the Cairo Mission to support the achievement of Global Affairs Canada objectives. This audit examined the Mission’s management practices related to the Management and Consular Services Program with regard to oversight and monitoring, procurement and asset management, and human resources between April 2015 and June 2017. What was found Overall, the audit team found that processes established by Headquarters relating to finance, procurement, contracting, asset management and overtime are not consistently followed and some key controls are not in place or are circumvented. There is an absence of Mission-generated, reliable information for decision-making to promote and demonstrate good stewardship of resources. Specifically, the audit team found that the process to manage consular revenues had a number of control weaknesses, which can create opportunities for misuse of consular funds. Specifically, the audit noted that consular revenues were inappropriately used as advances to locally engaged staff for cash purchases for the Property and Materiel section. The audit team also found weaknesses in the procurement and management of assets at the Mission. There was evidence of a lack of consideration of value for money in procurement actions and questionable choices of procurement methods. Moreover, there was a lost opportunity to claim exemptions for the Egyptian value-added tax applied to local purchases due to the Mission’s lack of clarity with regard to the method of claiming exemptions. Instances of a lack of effective controls were found surrounding cash, vehicle fleet and inventory management. Instances were found where the Mission cash accounts were not used and reconciled according to departmental procedures. The Mission does not have a transportation policy to set out accepted practices for its vehicle fleet usage, which resulted in inefficient and questionable practices, as well as weaknesses relating to oversight and control of drivers’ overtime. In addition, there was no analysis of fuel consumption of official vehicles, which increases the risk of unwarranted fuel expenses. Furthermore, access to inventory storage areas is not controlled and no up-to-date inventory tracking mechanism is in place to ensure the safeguarding of Crown assets. Conclusion The audit concluded that there are significant weaknesses in management practices and controls to ensure good stewardship of resources at the Cairo Mission. Processes established by Headquarters were not consistently followed and some key controls were circumvented. There was a lack of Mission-generated, reliable information for decision-making to support the achievement of Global Affairs Canada objectives. Recommendations are detailed in Section 5 of this report. Statement of Conformance In my professional judgment as Chief Audit Executive, this audit was conducted in conformance with the Institute of Internal Auditors' International Standards for the Professional Practice of Internal Auditing and with the Treasury Board Policy and Directive on Internal Audit, as supported by the results of the quality assurance and improvement program. Sufficient and appropriate audit procedures were conducted, and evidence gathered, to support the accuracy of the findings and conclusion in this report, and to provide an audit level of assurance. The findings and conclusion are based on a comparison of the conditions, as they existed at the time, against pre-established audit criteria that were agreed upon with management and are only applicable to the entity examined and for the scope and time period covered by the audit. Brahim Achtoutal Global Affairs Canada (the Department) manages Canada’s diplomatic and consular relations, promotes international trade and leads Canada’s international development and humanitarian assistance programs. It also manages Canada’s International Platform Branch — a global network of 179 Missions in 109 countries that supports the international work of Global Affairs Canada and 37 partner departments, agencies and co-locators.Footnote 2 According to the 2016-17 Global Affairs Canada Departmental Results Report, $931M was spent to operate and support the Missions. Administrative activities that support the Department’s Missions require effective and efficient management practices to help ensure sound stewardship of resources. In 2015, the Department initiated an internal investigation into the Canadian Embassy in Haiti, and found that fraudulent schemes had been put in place by locally engaged staff that resulted in estimated government losses of $1.7 million. Given the findings in Haiti, the Deputy Minister of Foreign Affairs requested a series of management practice audits of selected Missions to determine whether similar issues could be taking place at other Canadian embassies abroad. The Office of the Chief Audit Executive conducted a risk assessment to identify those Missions susceptible to higher levels of fraud risk and therefore selected for audit. The following factors were considered: As a result of this work, and in consultation with senior officials in the Department, a first phase of Mission audits was initiated in 2016-17 and five Missions that operate in higher fraud risk environments were selected for audit. These were: Abuja (Nigeria); Algiers (Algeria); Moscow (Russia); Nairobi (Kenya); and New Delhi (India). An additional Mission that operates in a lower fraud risk environment, Seoul (South Korea), was selected for comparative purposes. As part of a second phase of Mission audits initiated in 2017-18, five more Missions that operate in higher fraud risk environments were selected for audit. These were: Cairo (Egypt); Amman (Jordan); Jakarta (Indonesia); Kingston (Jamaica); and Sao Paulo (Brazil). An additional Mission that operates in a lower fraud risk environment, Madrid (Spain), was selected for comparative purposes. The Embassy of Canada in Cairo The Embassy of Canada (the Mission) in Cairo (Egypt) is a medium-sized Mission comprised of 21 Canada-based staff (CBS) and 53 locally engaged staff (LES) for a total of 74 employees. The Mission composition includes the following programs: Management and Consular Services; Trade; Foreign Policy and Diplomacy Service; Immigration; Development; Defence Attaché; and Mission Security. Cairo is the capital of Egypt, one of the largest cities in Africa and one of the most densely populated cities in the world. According to Transparency International’s Corruption Perception IndexFootnote 4, corruption within the local government and businesses is common place. Since the Egyptian Revolution of 2011 (known as the January 25th Revolution), the security situation in Egypt has deteriorated significantly. There is a significant risk of terrorist attacks throughout the country. On May 26, 2017, a group of gunmen attacked a bus on route to a monastery located south of Cairo in the Minya Governorate. The incident resulted in at least 26 deaths and many injured.Footnote 5 [REDACTED] The Egyptian economy has been significantly affected by inflation since the government chose to float the Egyptian pound in 2016 and implement an energy subsidy reform. Unemployment continues to be high, at over 12% in the final quarter of 2016. Footnote 6 Taking the above factors into consideration, the Cairo Mission faces challenges resulting from the country’s current economic and political situation. As such, the Mission is designated as a hardship [REDACTED]. Consequently, living and working in this environment can be challenging for CBS, and it is difficult for the Department to find staff with the appropriate experience and competencies to work in such a challenging environment. The Mission has also recently moved to a new Chancery which has added some strain to its operations due to retrofitting of the property. Common Services Program The Common Services Program in the Cairo Mission provides administrative support to the Mission’s programs and is responsible for financial transactions and human resources activities. Accountability and responsibility for the Common Services Program are held by the Head of Mission (HOM). The Cairo Mission received administrative support from the Common Service Delivery Point (CSDP) in London until February 2017 when support was transferred to the CSDP in Brussels. The move resulted in a shift of some financial processes, such as decentralizing the Procure-to-Pay (P2P) upload process from the Common Services to individual programs. The Common Services Program is managed by a Management Consular Officer (MCO) at the FS-03level. The MCO is supported by a Deputy MCO (DMCO) at the FS-02 level. The Mission’s Common Services Program expenditures increased from 2013-2014 to 2016-2017, as shown in Table 1 below. Source: FAS Expenditures Report as at April 26, 2017 The DMCO manages the Program’s Common Services section consisting of Finance, Human Resources and General Administrative services. General Administrative services include the business lines of reception, diplomatic and internal mail, and transportation using the mission’s vehicle fleet. The DMCO is responsible for 12 LES staff, including drivers. The Program’s Property and Materiel section is managed by an LE-08 Property Manager supported by five LES staff. This section is responsible for the Chancery, the official residence (OR) and staff quarters (SQs). Details of the Mission’s inventory of properties and vehicles are shown in Table 2 below. Source: Real Property: 2016-17 PRIME database; Vehicles: 2017 Mission Inventory Consular Program The Cairo Mission, through its Consular Program, provides consular services and assistance to Canadians, including passport, citizenship and notarial services. The Consular Program is managed by the DMCO, who is supported by an LE-07 Consular Officer and an LE-06 Consular Assistant. As part of this service, the Mission is responsible for collecting, safeguarding, recording and depositing consular fees in a timely manner. Appendix A shows the organizational chart for the Management and Consular Services Program in the Cairo Mission. The objective of this audit was to provide assurance that sound management practices and effective controls are in place to ensure good stewardship of resources at the Cairo Mission to support the achievement of Global Affairs Canada objectives. The audit team examined management practices related to the Management and Consular Services Program at the Mission, specifically in the areas of human resources, local procurement, and asset management. Detailed audit criteria are listed in Appendix B. Audit results were derived from the examination of documentation, data analysis of Mission expenditures and walk-throughs of key common services, property and materiel, and consular processes. The audit team conducted work on-site at the Mission from May 28 to June 8, 2017. A review of a sample of contracts, expenditures, payroll transactions, overtime payments, and staffing actions was undertaken, and the inventory system was examined. Interviews were conducted with the HOM, CBS management and key LES within the Management and Consular Services Program, as well as staff at Headquarters (HQ) and the CSDP London. The audit team performed on-site visits to storage facilities, local vendors, the Mission’s bank and a sample of SQs. In addition, the audit team met with three like-minded Missions – Australia, the United Kingdom and the European Union – to gather information regarding their challenges and good practices. This section sets out key findings and observations, divided into six general themes: accountability and oversight; planning and budgeting; monitoring; local procurement; asset management; and human resources and LES staffing. It was expected that Mission and HQ management would exercise effective oversight of Mission activities and expenditures to ensure proper stewardship of resources. The audit examined roles and responsibilities of Mission staff in the management of the Management and Consular Services Program. Accountability in the Cairo Mission rests with the HOM who reports to the Assistant Deputy Minister (ADM) of the Europe, Middle East and Maghreb (EGM) Branch. HQ has a role in supporting and enforcing HOM accountability, including the provision of Common and Consular Services. Specifically, the MCO reports to the HOM and is also accountable to the International Platform Branch. At the time of the audit, the HOM had been posted to Cairo for approximately three years. During this time, the transition of financial services from the CSDP in London to the CSDP in Brussels and a move to a new Chancery, including ongoing projects related to construction and retrofitting of the OR and new Chancery, added additional complexity to Mission management. In addition to these challenges, service expectations between the Cairo Mission and the CSDP in London (and subsequently the CSDP in Brussels) remained unclear, as a Service Level Agreement (SLA) was never formally established. Two key oversight functions expected to be in place at Missions are the Committee on Mission Management (CMM) which oversees management and administrative matters, and the Contract Review Board (CRB) which oversees contracting practices. The audit team found that the CMM appropriately exercises its oversight function and meets regularly on a bi-weekly basis to discuss a range of issues, including budgets, asset management and maintenance, and human resources. However, the audit team also found no evidence of a functioning CRB, and thus there was limited oversight of contracting practices. The audit team noted that HOM and DHOM accountabilities were documented through performance management agreements. However, roles and responsibilities for key personnel in the Management and Consular Services Program were unclear; as a result, key elements of oversight were unfulfilled, such as in the areas of contracting, inventory management and consular revenues. The audit team also found that CBS do not always have the sufficient knowledge and tools to perform their duties, which could have a negative impact on achieving the Mission’s mandate. The LES play key roles in supporting Mission management through their subject-matter, cultural and linguistic knowledge. Since the LES remain at the Mission while the CBS rotate, it would be expected that they provide consistency in carrying out the appropriate processes and procedures that comply with Government of Canada policies. The audit team found that LES roles and responsibilities are not clearly defined, communicated or understood. [REDACTED] LES do not have sufficient knowledge and tools to carry out their responsibilities. For example, the Department has a corporate web application, Modus that hosts the business processes and related tools for employees to perform their work and to stay informed of departmental practices. The audit team found that only one of the ten LES employees interviewed was aware of this web application, which has existed since September 2015. It was expected that planning and budgeting would be based on need and there would be a rationale for planned activities and forecasted expenditures. The Mission uses Strategia, the corporate integrated planning and reporting tool, for its annual integrated financial planning exercise. This ensures that the Mission’s financial planning and budgeting aligns with departmental planning commitments. Once the budget is finalized by HQ, the Common Services Officer (CSO) on behalf of the MCO ensures that commitments are entered into the financial system and funds are available in the Mission’s bank account. The CSO also checks salary and other expense information on an on-going basis for each Financial Status report (FINSTAT) period. The Mission also has a Property Management Plan which is overseen by the Mission’s Housing Committee. However, the audit team found that the required needs assessment and review of material asset lifecycle was limited, which led to unnecessary purchases at year end. The audit team found that a detailed breakdown of planned activities and expenditures was not developed to support day-to-day activities of the Mission. For example, the Mission had no vehicle maintenance plan, making it difficult to assess whether vehicle maintenance was carried out based on life-cycle needs. Moreover, insufficient planning and budgeting in key managerial areas, such as property maintenance, asset replacement and materiel purchases, led to a significant spike in spending on goods and utilities in March 2017, which is indicative of limited planning. It was expected that monitoring activities would be performed to provide general information on Mission compliance with Government of Canada and Department specific policies and procedures. Procurement The audit team found that Mission management is not provided with information on procurement trends that could highlight irregularities or areas of higher risk. Due to unclear roles and responsibilities for procurement, no one employee is responsible for tracking information on sole source and competitive contracts, Local Purchase Orders (LPO), contract amendments or renewals. This limits management’s ability to carry out effective monitoring in support of decision-making. The audit team further found that there was no challenge function performed for contracts over $10,000. This was due to limited use of corporate tools at the Mission’s disposal and lack of procurement knowledge on the part of the Mission management team. Moreover, there was not always an alignment between details of work on an invoice and the pre-approved transaction. This can create a risk of non-compliance with procurement procedures and may result in an increased opportunity for misappropriation of funds. Overtime Another area of concern to the audit team was the monitoring of LES overtime, as it was noted that there was no formal pre-approval for Common Services LES overtime. In particular, the audit team found that the greatest amount of overtime was claimed by the Mission’s drivers. From April 2016 to February 2017, the six Mission drivers earned overtime pay representing on average 58% of their salaries. The lack of a Mission transportation policy with clear and enforceable guidelines was stated as a reason for which the DMCO and the dispatcher were unable to control the use of drivers outside office hours. Although the practice of providing overtime for driver stand-by had been discontinued, there were still concerns with regard to the efficiency of driver overtime usage, as overtime incurred outside of office hours was not formally pre-approved. Concerns were also raised regarding the use of drivers by CBS employees for personal reasons. Moreover, [REDACTED] which added to the amount of overtime claimed. This lack of monitoring leads to increased health and safety risks related to significant overtime and a risk that overtime may not be warranted or actually performed. The audit team expected that procurement of goods and services would be in compliance with Treasury Board Contracting Policy and would achieve the best value for money. The audit team examined the mechanisms and tools in place to procure goods and services at the Mission. A sample of 34 procurement transactions and contracts was reviewed by the audit team. Procurement and Contract Management The Mission’s financial transactions are processed by the CSDP in Brussels. Segregation of duties related to procurement approval and payment was appropriately carried out, as payment authority (Section 33 of the Financial Administration Act (FAA)) is under the responsibility of the CSDP in Brussels and certification of receipt of goods or services (Section 34 of the FAA) is under the Mission’s responsibility. However, in four of the 34 procurement transactions reviewed, Section 34 certification of receipt of goods or services received was not always appropriately carried out. The audit team also found instances where year-end purchases were made unnecessarily without a clear need for the goods. For example, 20 high value televisions were bought at fiscal year-end 2017 and then were stored in the warehouse where they remained at the time of the audit. This means that there was neither urgency nor a demonstrated need for this purchase. For five of the 34 procurement transactions reviewed, the audit team found that the Mission paid suppliers in cash obtained through advances approved by Mission management and issued by the CSDP to LES employees. This is not consistent with the purpose of Section 34 certification, since for these five transactions FAA Section 34 was signed at the time of the cash advance rather than at the time of receipt of the goods or services, and therefore the quality and the quantity of the goods or services were not guaranteed. In addition, the Mission used preferred vendors for electronics, car repairs and cleaning services without documented justification on file prior to initiating transactions. A review of seven local contracts revealed instances of non-compliance with contracting regulations and policies. In two instances, services were offered after the contract had expired, one for HVAC maintenance and another for security services. In another instance, a cleaning contract was extended for three years at 147% of the original contract amount, which is contrary to departmental policy which indicates a contract cannot exceed 50% of the original value. In addition, the audit team noted that contracts were not always entered into the Departmental Financial and Administration System (FAS), which resulted in invoice payments not being linked to purchase orders or linked to the appropriate contract. As a result, it is difficult for the Department to trace payments against contracts, and this could cause a risk of duplicate payments. Moreover, not all contracts greater than $10,000 were publicly disclosed, as required by proactive disclosure requirements. Value Added Tax It was expected that the Cairo Mission would be operating in accordance with the procedures related to exemption and reimbursement of the value-added tax (VAT) to ensure that tax was not paid for exempted goods and services. Prior to September 2016, the VAT was 10% of the value of goods and services procured in Egypt, and subsequently the rate increased to 13% until July 2017, when it again was increased to 14%. Prior to 2011, the Mission was reimbursed for the VAT by the Egyptian government and in 2011 the Canadian Government became exempted from the VAT for certain expenditures. This exemption was formalized in 2014 through a reciprocal arrangement letter between the Egyptian Government and the Canadian Government, which lists categories of exemptions for expenditures exceeding $180 USD. The audit team reviewed a sample of purchases subject to the VAT exemption and found that the Mission continued to pay the VAT on several expenditures due to a lack of clarity with regard to the method of claiming VAT exemption. For the period under audit, this amounted to over $81,000 CDN in unrecoverable taxes. Another area of risk identified by the audit team concerned the management of assets at the Mission, specifically the management of inventory, properties, vehicles, petty cash and consular revenues. Inventory Control and Disposal It was expected that once an asset was purchased, it would be recorded, safeguarded, tracked through its lifecycle and disposed of in accordance with policies and procedures. The Mission has an inventory of properties that includes Crown-owned and leased buildings tracked in the Physical Resources Information – Mission Environment (PRIME). The Mission also has an inventory of vehicles, tracked in FAS from purchase to disposal. Additionally, there are six types of materiel inventory repositories: information technology (IT) equipment; fine art; SQ-related assets; storage in the Chancery basement; storage in the former Chancery building; and a warehouse. The Mission also keeps an inventory of supplies. The audit team found that the IT equipment and fine art inventories were adequately tracked and safeguarded. However, the audit team found issues with the other inventories. The corporate inventory tracking system, Radio Frequency Identification (RFID), is not being used by the Mission as expected. Instead, storage in the Chancery basement, the warehouse and storage of SQ related assets were tracked using Excel spreadsheets which did not always track the value, condition or quantity of the asset and was not up to date. Items found on-site, such as tires, area rugs and furniture, could not always be traced to the inventory lists and SQ-related items that were put into storage remained on SQ inventory lists. As a result, some inefficiency in the use of assets was found. For example, a freezer was purchased in 2015 and subsequently put into storage, while the warehouse already held a freezer purchased in 2014. The audit team also found that there was no inventory tracking for the new Chancery’s assets, such as furniture, kitchen appliances, and televisions. In addition, because there is no control over access to inventories stored in the old chancery basement, which held several high-value items, there is a risk of misappropriation or loss of Crown assets. The audit team examined the disposal of one of the Mission’s vehicles and determined that the disposal steps were performed in accordance with departmental policies and procedures. The audit team also examined a disposal of materiel assets. It was noted that unsold assets were returned to storage rather than subsequently disposed of, and this led to an unnecessary use of storage space which was costing the Mission approximately $11,000 CDN per year in rental fees. Fleet Management It was expected that the Mission would manage its fleet in accordance with the Department’s Mission Fleet Management Guidelines and have a Mission transportation policy outlining proper conduct and management of the Mission fleet. The audit team noted that controls are in place for vehicle fleet management, such as a weekly schedule for each driver which is used to track vehicle usage. The Mission also installed a Global Positioning System to track the location of vehicles, allowing the dispatcher to provide route changes and directions for drivers in real time. This is a good management tool for monitoring fleet operations and for ensuring personnel security. Key Mission staff were not aware of the requirements of the Department’s Mission Fleet Management Guidelines and there was no Mission transportation policy in place. As a result, a number of issues were observed. [REDACTED] The audit team also found that use of Mission vehicles outside office hours was not monitored to ensure only approved use occurred. The audit team noted that the Mission paid fines incurred by drivers for traffic violations. This is contrary to departmental policy which stipulates that, payment of such fines must not be paid from departmental funds and is the responsibility of the driver who incurred the cost, whether in a departmental vehicle or personal motor vehicle. The audit team found a lack of controls over vehicle maintenance, fuel consumption and parking expenses. Vehicle maintenance (including repairs and purchasing of parts) was not planned, tracked nor monitored. This lack of history of vehicle maintenance makes it difficult to Mission’s management to assess the necessity of the repair and maintenance. The audit team also examined vehicle usage compared to gas consumption and found that in one instance, the fuel consumption was significantly higher than expected. The audit team also found that under the current master lease agreement, the Mission rents 12-hour parking space for its vehicle fleet. In January 2016, the Mission increased from 12 to 24 the hours paid for the 11 parking spots leased at the Chancery building, without justification, resulting in increased costs of over $15,000 USD for the year. Moreover, the lease agreement was not amended to reflect the increased cost. [REDACTED] This results in parking costs inefficiencies. Petty Cash and Emergency Cash Parcel The Mission has [REDACTED] petty cash accounts ranging from approximately [REDACTED] At the time of the audit, the petty cash account [REDACTED] did not have any documentation or receipts to support the use of funds. The audit team also found that petty cash transaction limits at the Mission were significantly lower than allowed by departmental policy; that is, approximately $75 CDN per transaction as opposed to the Departmental ceiling of $200 CDN. The employees interviewed were not aware of the Departmental ceiling for petty cash transactions, which contributed to Mission employees sometimes using personal funds to cover Mission cash purchases above $75 CDN. In addition, departmental procedures require that regular petty cash counts and reconciliations be performed by Mission management. The audit team found that these counts and reconciliations were not done as required. The Cairo Mission has an Emergency Cash Parcel (ECP), a special fund to be used only in emergency or crisis to evacuate CBS and their dependents and to enable the Mission to continue to provide essential services. While all the cash was accounted for, the audit team found evidence that funds were inappropriately accessed to pay for travel advances to [REDACTED] CBS employees. Consular Revenues The audit team expected that fees collected for consular services would be properly accounted for, reconciled, safeguarded and deposited as required. The Cairo Mission collects consular fees for issuing passports and travel documents, as well as for providing notarial services. The Mission also collects fees on behalf of Immigration, Refugees and Citizenship Canada (IRCC) for services, such as issuing citizenship certificates. The majority of revenues are received in cash. Overall, the audit team found a number of control weaknesses in the management of consular revenues. Specifically, contrary to departmental policies and procedures, Mission management had borrowed consular revenues to purchase office supplies and to provide cash advances for purchases in the Mission’s Property and Materiel section. In one instance, over $10,000 CDN was borrowed from consular revenues. The audit team also found that, contrary to departmental policies and procedures, the consular fees were not safeguarded in a secure location. As such, consular fees received, which were sometimes significant amounts of cash, were kept in a filing cabinet open and accessible during work hours. Although departmental policies and procedures require copies of customer receipts for consular fees to be retained and reconciled, the audit team found that receipts were discarded. As well, a required Daily Summary Report was not completed, lacking key information such as client names and fees received, and also lacking the appropriate approval. As a result, this report could not be used for daily reconciliation of consular fees. In addition, consular fees must be transferred from the Consular to the Common Services section daily and a receipt issued by the CSO to confirm this transfer. The audit team found that the Consular Section held onto consular revenues on average ten days before transferring them as required to Common Services. In one instance, the consular fees were kept in the Consular Section for over seven months. Departmental policies and procedures require that incidents or suspected incidents of losses of money must be reported in writing to the MCO who is responsible for notifying the HOM and Mission Security Officer (MSO). The audit team found that consular revenue losses were not tracked or reported to the HOM as required. In one instance, the audit team observed the [REDACTED] using personal funds to cover a shortage at the end of the day. Not reporting these revenue losses limits the HOM’s ability to make proper adjustment to the cash management practices surrounding consular revenues. Canadian Currency on Hand In addition to local currency, consular fees can be paid in Canadian currencies (via cash, cheques or through the Mission Online Payment Service (MOPS)). While MOPS is the preferred payment method, significant cash payments are made in Canadian funds. Because bank accounts in Canadian funds are not available in Egypt, the Canadian funds collected must be transferred directly to HQ, normally through Classified Diplomatic Mail. [REDACTED] The Mission is currently working with Financial Operations, International Division and Mission Operations, Policies and Innovation Division to find a better solution for the transfer of Canadian currency. The audit team examined staffing files to determine whether adequate human resources management practices and controls were in place. The auditors expected that staffing actions undertaken during the audit period would be in compliance with relevant policies and procedures, were conducted in a fair, open and transparent manner, and that staffing files would contain the required documentation. The audit team found that one of four staffing actions examined was not conducted in an open, fair and transparent manner. This staffing action related to the hiring of a locally engaged staff at the most senior level. In this case, the CSDP in London had advised the Mission to conduct an external process given the senior level of the position and the availability of qualified external candidates; however, an internal process was chosen, significantly limiting the pool of candidates and compromising the transparency, openness and fairness of the process. A sample of personnel files of key LES was reviewed to ensure retention of required documentation, such as job descriptions, performance agreements and any documentation related to disciplinary actions. The audit team found that overall the personnel files reviewed were properly documented. The audit team concluded that there are significant weaknesses in management practices and controls to ensure good stewardship of resources at the Cairo Mission. There is lack of management oversight in the areas of local procurement, asset management, and human resources and staffing of locally engaged staff. Processes established by Headquarters in these areas were not consistently followed and some key controls were not in place or were circumvented. Specific concerns relate to the management of consular revenues, the Emergency Cash Parcel, staffing actions of locally engaged staff, the value-added tax, vehicle fleet management and locally engaged staff overtime. There was also a lack of Mission-generated, reliable information for decision-making to promote and demonstrate good stewardship of resources. The audit team verbally debriefed the Head of Mission on the major audit findings after completion of on-site work. Recommendations to the Cairo Mission: Recommendations to Headquarters: The organizational chart shows the structure of the Management and Consular Services Program at the Mission in Cairo and the reporting relationships. At the top of the hierarchy, there is a Management Consular Officer (MCO) at the FS-03 level. The MCO is supported by an administrative Assistant at the LE-06 level. The MCO is also supported by a Deputy MCO (DMCO) at the FS-02 level. Reporting to the DMCO, there is a Consular Officer at the LE-07 level, to which reports a Passport Examiner at the LE-06 level. The DMCO is also supported by a Common Services Officer at the LE-07 level, to which report a Common Services Assistant at the LE-05 level and a Dispatcher at the LE-05 level. The Common Services Assistant is supported by a Receptionist at the LE-05 level and a Finance Clerk/Messenger at the LE-03 level, while the Dispatcher is supported by five Drivers at the GS-04 level and two Messengers at the LE-01 level. Additionally, the MCO is supported by a Property Officer at the LE-08 level. Reporting to the Property Officer, there is a Building Operator at the LE-05 level, a Property Assistant at the LE-05 level and a Materiel Assistant at the LE-05 level. Reporting to the Property Assistant, there is a Handyman at the GS-04 level, and reporting to the Materiel Assistant, there is a Facilities Assistant at the LE-04 level. Finally, the MCO is also supported by a Foreign Service Information Technology Professional (FSITP) at the CS-02 level. Reporting to the FSITP, there is a Locally Engaged Information Technology Professional (LEITP) at the LE-07 level. Objective The objective of this audit was to provide assurance that sound management practices and effective controls are in place to ensure good stewardship of resources at the Cairo Mission to support the achievement of Global Affairs Canada objectives. Scope The scope of the audit included those management practices and controls in place to support the Cairo Mission operations. Specifically, the audit examined processes related to the management of consular revenues, procurement and asset management (including cash, materials, vehicles and property). Human resource processes relating to LES staffing actions, LES payroll and overtime were also examined. The most up-to-date documentation available as at June 2017 was reviewed. In addition, Common Services Program expenditures and data for property and fleet were examined from 2013-14 to 2016-17. A sample of files and transactions were tested from activities that took place from 2015-16 to 2016-17, as shown in Table 3. Criteria were developed based on a detailed risk assessment. Criterion 1: Adequate and effective oversight and accountabilities are in place to support stewardship of Mission resources. 1.1 Management exercises effective oversight of procurement, asset management and human resource activities. 1.2 Authorities and accountabilities for procurement, asset management and human resources are clear, communicated and understood. 1.3 Planning processes are in place for procurement, asset management and human resources, which consider needs, asset life cycle, and resources. 1.4 Monitoring and reporting of procurement, asset management and human resource activities take place to inform decision-making. Criterion 2: Effective management practices and controls are in place to ensure stewardship of Mission resources and compliance with relevant policies and legislative requirements. 2.1 Effective controls are in place to ensure that procurement of goods and services comply with relevant policies and legislative requirements and achieve value for money. 2.2 Effective controls are in place to ensure that procurement expenditures are accurate, appropriate, and legitimate. 2.3 Inventory control and asset management practices are adequate and appropriate. 2.4 Cash is managed in accordance with relevant policies and legislative requirements. 2.5 LES staffing actions comply with relevant policies and legislative requirements and are fair, open and transparent. 2.6 LES salaries and overtime payments are accurate and complete. Approach and Methodology In order to conclude on the above criteria, and based on identified and assessed key risks and internal controls associated with the related business processes, the audit methodology included, but was not limited to the following: 1. The Head of Mission should ensure that responsibilities and accountabilities of Canada-based staff and locally engaged staff are clear, communicated, and that consequences of poor performance are reflected in performance appraisals and corrective actions taken when required. December 2017 Ongoing 2.The Head of Mission should take measures to strengthen oversight, controls and monitoring to ensure that staffing, procurement and contracting processes comply with governmental policies and regulations and provide value for money, with corrective actions when non-compliance is detected. December 2017 Ongoing December 2017 Ongoing December 2017 Ongoing Completed Ongoing The Assistant Deputy Minister and Chief Financial Officer, Corporate Planning, Finance and Information Technology Branch, in collaboration with the Assistant Deputy Minister, International Platform Branch, will review the use of Classified Diplomatic Mail for funds in transit for the Cairo Mission. ADM – SCM ADM – ACM December 31, 2017 Table of Contents

Executive summary

Chief Audit Executive1. Background

Fund Centre Fund Expenditures 2013-2014 2014-2015 2015-2016 2016-2017 Common Services Operations and Maintenance 346,755 558,353 481,892 600,709 Capital 25,171 27,140 29,376 81,589 LES Salary 777,220 716,971 798,455 586,627 Property and Materiel Operations and Maintenance 1,136,387 1,219,777 1,611,397 1,764,859 Total 2,285,533 2,522,241 2,921,120 3,033,784 Real Property Crown-owned Crown-leased Total Official Residence 1 - 1 Staff Quarters - 20 20 New Chancery 1 - 1 Old Chancery (including annex) 1 - 1 Other (Parking) - 1 1 Other (Storage) - 2 2 Total 3 23 26 Vehicle Fleet Armoured Standard (soft shell) Total [REDACTED] [REDACTED] [REDACTED] 2. Audit objective and scope

3. Observations

3.1 Accountability and oversight

3.2 Planning and budgeting

3.3 Monitoring

3.4 Local procurement

3.5 Asset management

3.6 Human resources and LES staffing

4. Conclusion

5. Recommendations

Appendix A: Organizational chart for the management and consular services program

Appendix A: Long Description

Appendix B: About the audit

Description of Testing Sample Number of samples Procurement transactions with associated contract or purchase order 8 Procurement transactions through direct purchase (no associated contract or purchase order) 24 Petty cash transactions 2 Overtime transactions 6 Visits to staff quarters to review maintenance work and on-site inventory 4 Disposed asset files 2 LES staffing action files 4 LES personnel files 8 Total 58 Criteria:

Appendix C : Management action plan

Audit Recommendation to Cairo Mission Management Action Plan Area Responsible Expected Completion Date HOM HOM 3. The Head of Mission should ensure that controls are in place to manage employees’ overtime according to applicable policies and guidelines. HOM 4. The Head of Mission should ensure that proper management of the inventory cycle is undertaken including recording, tracking and maintaining inventory, adequate access controls and timely disposal of surplus and obsolete assets. HOM 5. The Head of Mission should ensure that consular revenue and cash management practices comply with departmental policies and procedures, and that the value-added tax exemption process is applied. HOM Audit Recommendations to Headquarters Management Action Plan Area Responsible Expected Completion Date 1. The Assistant Deputy Minister International Platform Branch, in collaboration with the Assistant Deputy Minister and Chief Financial Officer, Corporate Planning, Finance and Information Technology Branch, should ensure that Service Level Agreements are signed between the Mission and its assigned Common Service Delivery Point. The Service Level Agreement document, owned and managed by AFS, has been fully reviewed by all stakeholders and was updated in early fall of 2017. The English version has now been released to the CSDPs with the French version being reviewed now (mid-Oct). The CSDPs are in the process of updating their agreements to the new templates with a deadline of end November for completion. ADM - ACM ADM – SCM November 30, 2017 2. The Assistant Deputy Minister and Chief Financial Officer, Corporate Planning, Finance and Information Technology Branch, in collaboration with the Assistant Deputy Minister, International Platform Branch, should review the decision to discontinue access to Classified Diplomatic Mail for funds in transit. The ADM and CFO should identify and implement measures to eliminate the need to transfer cash to headquarters where possible and establish an acceptable approach for the transfer of Canadian currency to Headquarters when there is no other alternative. The Assistant Deputy Minister and Chief Financial Officer, Corporate Planning, Finance and Information Technology Branch will also review the procedures for the transfer of Canadian currency to Headquarters from the Cairo Mission. ADM – SCM March 31, 2018 3. The Assistant Deputy Minister, Human Resources Branch, should ensure proper oversight of the Mission’s staffing of senior locally engaged staff positions to ensure openness, transparency and fairness. Heads of Mission are fully delegated for the staffing process and in this specific case they were provided advice for their consideration.

As per the delegated instrument, Missions will continue to exercise their delegation and ADM HCM will provide advice when required. Oversight will be done using the departmental risk framework to monitor staffing activities across the international network, with a deliverable date of April 2018. ADM - HCM April 2018 Appendix D: Acronyms

- Date modified: