Risk-Based Audit Plan 2017-2018

April 2017

Table of Contents

Introduction

The Treasury Board of Canada Policy on Internal Audit seeks to contribute to the improvement of public sector management by ensuring a strong, credible, effective and sustainable internal audit function within departments as well as government-wide. In response to this requirement, Global Affairs Canada has developed this 2017-2018 Risk-Based Audit Plan. This plan details the assurance and advisory services that the Office of the Chief Audit Executive (OCAE) will provide, independent of line management, to sustain a strong, credible internal audit regime that contributes directly to sound risk management, control and governance.

The mandate of Global Affairs CanadaFootnote 1 is to manage Canada's diplomatic and consular relations, to encourage the country's international trade and to lead Canada’s international development and humanitarian assistance. Global Affairs Canada was renamed in 2015 from the Department of Foreign Affairs, Trade and Development which brought together the portfolios of Foreign Affairs, Trade and Development under a single organization for greater cohesion in conducting Canada’s external affairs.

The Department administers a broad array of funding programs to protect Canadians and advance Canada’s priorities, interests and leadership abroad, including funding to international organizations. In addition, services are provided to Canadian businesses, Canadians travelling or living abroad, Canadian citizens, and foreign representatives and their dependents in Canada.

In Canada, Global Affairs Canada operates its headquarters in the National Capital Region and has regional offices in eight locations across the country. Global Affairs Canada also manages 179 missions in 112 countriesFootnote 2. These missions house departmental employees who carry out the Global Affairs Canada mandate abroad, as well as 34 partner departments, agencies and co-locators. For 2017-2018, there is $6.09 billion in planned spendingFootnote 3 and as of December 31, 2016 there were 9,643 active Global Affairs Canada Employees, of which 6,012 were Canada Based Staff while 3,631 were Locally Engaged Staff positions at missions abroadFootnote 4.

1.1 Purpose

The Office of the Chief Audit Executive of Global Affairs Canada prepared this document for the Deputy Minister to outline the 2017-2018 Risk-Based Audit Plan (RBAP or the Plan) for the Department. The Plan is designed to support the allocation of audit resources to those areas that represent the most significant risks to the achievement of Global Affairs Canada’s objectives and to respond to the requirements of the Treasury Board Policy on Internal Audit (April 1, 2017). In considering the appropriateness of the Plan, the Deputy Minister is advised by an independent Departmental Audit Committee (DAC) comprised of three external members.

1.2 The Role and Scope of Internal Audit

Internal auditing in the Government of Canada is a professional, independent and objective appraisal functionFootnote 5. As per the Financial Administration Act, the Department is required to have an internal audit capacity, designed to add value to departmental operations by using a disciplined, evidence-based approach to assessing and improving the effectiveness of risk management, control and governance processes.

Internal audit provides oversight over management systems and practices, including emerging risks in an ever-changing environment. In order to ensure internal audit's organizational independence, the Chief Audit Executive reports directly to the Deputy Minister of Foreign Affairs who is the Department’s accounting officer. This enables the provision of independent and objective advice on performance regarding operations, safeguarding of assets, reliability and integrity of reporting and compliance with laws and policies.

The practice of internal audit at Global Affairs Canada, including the development of the RBAP, is in line with the International Professional Practices Frameworkfrom the Institute of Internal Auditors (IIA), the suite of internal audit policies from the Treasury Board, and guidance from the Office of the Comptroller General (OCG) within the Treasury Board of Canada Secretariat.

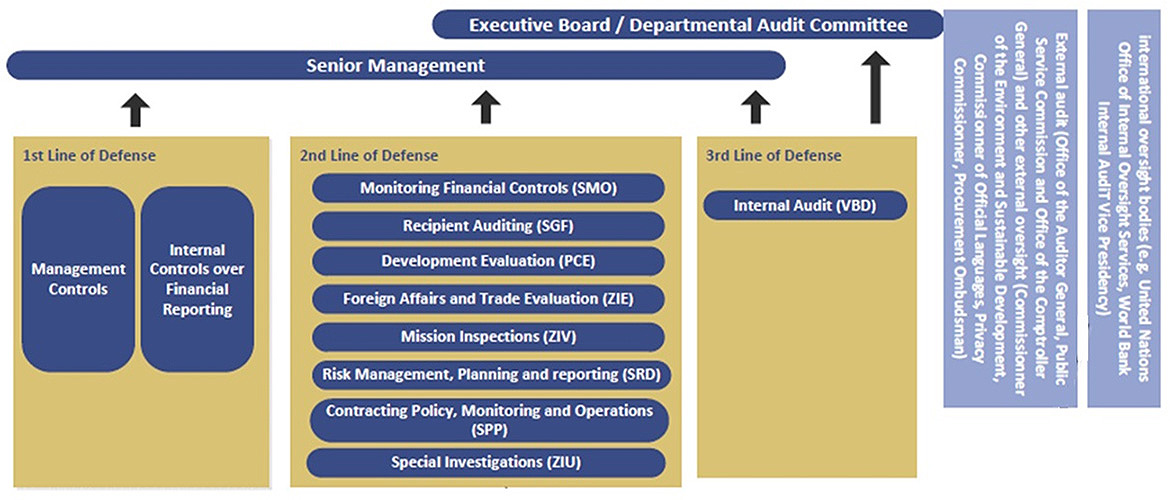

The Institute of Internal AuditorsFootnote 6 endorses the 'Three Lines of Defence in Effective Risk Management and Control' model as a way of explaining the relationship between these functions and as a guide to how responsibilities should be defined:

- First line of defence - Functions that own and manage risk. Operational management has ownership, responsibility and accountability for directly assessing, controlling and mitigating risks.

- Second line of defence - Functions that oversee risk and compliance. Consists of activities covered by several components of internal governance (compliance, risk management, quality, information technology and other control functions). This line of defence monitors and facilitates the implementation of effective risk management practices by operational management and assists the risk owners in reporting adequate risk related information up and down the organization.

- Third line of defence - Functions that provide independent assurance. An independent internal audit function will, through a risk-based approach to its work, provide assurance to the organization’s Executive Board and senior management. This assurance will cover how effectively the organization assesses and manages its risks and will include assurance on the effectiveness of the first and second lines of defence. It encompasses all elements of an institution’s risk management framework (from risk identification, risk assessment and response, to communication of risk related information) and all categories of organizational objectives: strategic, ethical, operational, reporting and compliance.

Exhibit 1 outlines the three lines of defense in effective risk management and control at Global Affairs Canada. Internal audit is considered to be the third line of defence within the Department and as such plays a key role in the corporate governance structure to provide assurance in the areas of risk management, control and governance processes:

Exhibit 1 – Three Lines of Defence - Global Affairs Canada

Source: Adapted from IIA Position Paper: The Three Lines of Defense in Effective Risk Management and Control, January 2013

Text version

The diagram outlines the three lines of defence in effective risk management and control at Global Affairs Canada.

The first line of defence consists of Management Controls and Internal Controls over Financial Reporting.

The second line of defence consists of Monitoring Financial Controls (SMO), Recipient Auditing (SGF), Development Evaluation (PCE), Foreign Affairs and Trade Evaluation (ZIE), Mission Inspections (ZIV), Risk Management, Planning and Reporting (SRD), Contracting Policy, Monitoring and Operations (SPP), and Special Investigations (ZIU).

The third line of defence consists of Internal Audit (VBD).

While the three lines of defence report to Senior Management, only the third line of defence also reports to the Executive Board/Departmental Audit Committee.

Additionally, residing outside Global Affairs Canada’s structure, there are international oversight bodies (e.g. United Nations Office of Internal Oversight Services, World Bank Internal Audit Vice Presidency). There are also external audits (Office of the Auditor General, Public Service Commission and Office of the Comptroller General) and other external oversight providers (Commissioner of the Environment and Sustainable Development, Commissioner of Official Languages, Privacy Commissioner, Procurement Ombudsman).

At Global Affairs Canada, the Executive Board provides direction to senior management by setting the organization’s risk appetite. The Executive Board also seeks to identify the principal risks facing the organization. Thereafter, the Executive Board assures itself on an ongoing basis that senior management is responding appropriately to these risks.

Management exercises primary ownership and responsibility for operating risk management and control. As such, management provides leadership and direction to the employees in respect of risk management, and controls the organization’s overall risk-taking activities in relation to the agreed levels of risk.

To ensure the effectiveness of an organization’s risk management framework, the Executive Board needs to be able to rely on adequate line functions – including monitoring and assurance functions – within the organization.

In addition to the provision of oversight services, OCAE also acts as the secretariat for the DAC which is comprised of three independent external members as well as two internal Deputy-level ex-officio members. The DAC provides objective advice and recommendations regarding the sufficiency, quality and results of assurance on the adequacy and functioning of the Department's risk management, control and governance framework and processes (including accountability and auditing systems).

Risk-Based Audit Planning Approach

To meet the requirement of the Treasury Board of Canada Directive on Internal Audit for the establishment of a multi-year plan for internal audit, an assessment of Global Affairs Canada’s areas of risk was conducted by the OCAE’s Risk-Based Audit Plan (RBAP) project team and OCAE management. The RBAP was then updated to ensure that internal audit resources continue to be targeted to the areas of highest risk and significance.

The engagements included in this plan were identified as a result of a comprehensive planning process, which is outlined below.

2.1 Development of the Audit Universe

The Global Affairs Canada audit universe is reviewed at the outset of the RBAP process in order to ensure a clear relationship with the Department’s Program Alignment Architecture (PAA) while allowing for maximum flexibility in designing engagements that target areas of risk (see Appendix A – Global Affairs Audit Universe). The audit universe is comprised of auditable elements organized on the basis of the PAA sub-programs as well as the Department’s internal services. This approach includes elements at the program delivery, service delivery or internal service level, and facilitates the consideration of in-depth vertical or horizontal organization-wide engagements.

The PAA and the organizational chart were considered in the development of the universe as well as recognized finance, audit and IT frameworks such as COBITFootnote 7 and COSOFootnote 8. As part of the Treasury Board of Canada Policy on Results the PAA will undergo a significant transformation in 2018-2019 as it becomes the Departmental Results Framework. The OCAE will adjust the audit universe accordingly based on the outcome of this exercise.

2.2 Senior Management Consultations and Documentation Review

The RBAP process includes consultations with senior management representing key branches and areas of activity in the Department. A range of senior management consultations were undertaken in support of the RBAP, with selected Assistant Deputy Ministers and the Corporate Management Committee, all of which contributed to the development of the Plan.

The objective of the consultations was to obtain input on risk, proposed audit engagements and upcoming changes and challenges in the operating environment. Senior managers were encouraged to share information on their specific areas of responsibility and horizontal risks across the Department, based on their experience and knowledge of operations.

An extensive review of corporate and external documents was also carried out. This included various internal and external plans, operational reports, and information on monitoring, performance, upcoming initiatives and priorities. The objective of this review was to gain knowledge on the internal and external operating environments.

2.3 Risk Assessment and Prioritization

A focused and structured analysis of the audit universe for operational, strategic, security, reputational and fraud risks was conducted by the OCAE using the risk assessment scale outlined in Table 1 below. The assessment also considered the risks identified as part of the annual corporate risk planning exercise. It is important to note that estimates of materiality of programs and operations were considered in the assessment of risk (unless detailed information was not available). As the Department finalizes the merger of financial systems, it is expected that information regarding materiality will become even more precise.

| Risk Level | Description |

|---|---|

| Very High | A major event that will require Global Affairs Canada to make large scale, long term realignment to its operations, objectives or finances. |

| High | A critical event that, with proper management, can be endured by Global Affairs Canada. |

| Medium | A significant event that can be managed under normal circumstances by Global Affairs Canada. The consequences could mean that the activity could be subject to significant review or changed ways of operations. |

| Low | An event, the consequences of which can be absorbed through normal activity or minimal management effort. |

This analysis resulted in the auditable elements being prioritized based on inherent risk and past and future assurance engagements (including internal and external audits) to provide a comprehensive base for selecting the engagements to be included in this plan.

2.4 Consideration of Other Assurance Provider Activities

Further to the OCAE’s role as liaison between the Department and external assurance providers such as the Office of the Auditor General of Canada and the Office of the Comptroller General of Canada, the OCAE aims to coordinate its risk-based audit planning activities with these entities with a view to: 1) ensuring audit coverage of high risk areas; and 2) minimizing overlap and duplication, thus reducing the audit burden on auditees.

Risk-Based Audit Plan 2017-2018

3.1 Overview

This section presents an overview of the Global Affairs Canada 2017-2018 Risk-Based Audit Plan (see Table 2).

| Continuous Auditing |

|---|

|

| New Engagements |

Management Practices at Selected Missions -

|

3.2 Audit Coverage

The next section describes how the RBAP addresses areas of higher risk and significance. There is coverage of all ‘Very High’ and ‘High’ audible entities for which it was determined that audit work is a priority. These entities derive from the audit universe detailed in Appendix A.

In support of the Chief Audit Executive’s annual report to the Deputy Minister and the Departmental Audit Committee, the RBAP also endeavours to address all areas of management from Treasury Board’s Management Accountability Framework (MAF). Appendix B - Crosswalk between Management Accountability Framework Areas of Management and Planned Audits for 2017-2018 summarizes the extent to which the elements of this framework are covered in the planned audits for 2017-2018.

In addition, the RBAP also sought to ensure coverage of the Global Affairs Canada Ministers’ mandate letters as reflected in their policy and programming priorities. For a crosswalk linking these priorities to relevant planned engagements, please refer to Appendix C – Crosswalk of Ministerial Mandate Letters to Planned Audits.

Appendix A – Global Affairs Canada Audit Universe

| Strategic Outcome | Program | Sub-Program |

|---|---|---|

| 1. Canada’s International Agenda | 1.1 Integrated Foreign Affairs, Trade and Development Policy | 1.1.1 International Information and Analysis |

| 1.1.2 International Policy Advice | ||

| 1.2 Diplomacy, Advocacy, and International Agreements | 1.2.1 Bilateral and Regional Diplomacy and Advocacy | |

| 1.2.2 Summitry and Multilateral Diplomacy and Advocacy | ||

| 1.2.3 Assessed Contributions to International Organizations | ||

| 1.2.4 Trade Agreements, Negotiations, Dispute Settlement and Controls | ||

| 2. International Commercial and Consular Services for Canadians | 2.1 International Commerce | 2.1.1 International Business Development through Promotion of Exports and Trade in Canada and abroad |

| 2.1.2 Foreign Direct Investment in Canada | ||

| 2.1.3 International Innovation, Science and Technology | ||

| 2.2 Consular Services and Emergency Management | 2.2.1 Consular Assistance for Canadians | |

| 2.2.2 Emergency Preparedness and Response | ||

| 3. International Assistance and Poverty Alleviation | 3.1 International Security and Democratic Development | 3.1.1 International Security and Threat Reduction |

| 3.1.2 Advancing Democracy, Human Rights, Freedom, and the Rule of Law | ||

| 3.2 International Development | 3.2.1 Sustainable Economic Growth | |

| 3.2.2 Children and Youth, including Maternal, Newborn and Child Health | ||

| 3.2.3 Food Security | ||

| 3.2.4 Multisector Assistance, Social Development and Development Engagement | ||

| 3.3 International Humanitarian Assistance | 3.3.1 Humanitarian Programming | |

| 3.3.2 Partners for Humanitarian Assistance | ||

| 4. Canada’s Network Abroad | 4.1 Mission Network Governance, Strategic Direction and Common Services | 4.1.1. Management of Common Services |

| 4.1.2 Real Property | ||

| 4.1.3 Security (see 5.12) | ||

| 4.1.4 Information Management / Information Technology | ||

| 4.1.5 Locally Engaged Staff Supporting Other Government Departments | ||

| 4.2 Management of Government of Canada Terms and Conditions of Employment Abroad | 4.2.1 Administration of Foreign Service Directives | |

| 4.2.2 Administration of Locally Engaged Staff Pension, Insurance and Social Security Programs | ||

| 5. Internal Services | 5.1 Management and Oversight | |

| 5.2 Communications | ||

| 5.3 Legal | ||

| 5.4 Human Resources ManagementFootnote 9 | 5.4.1 Organizational Design, Human Resources Planning, and Reporting | |

| 5.4.2 Job and Position Management | ||

| 5.4.3 Staffing and Employee Integration | ||

| 5.4.4 Total Compensation | ||

| 5.4.5 Employee Performance, Learning, Development, and Recognition | ||

| 5.4.6 Permanent and Temporary Separation | ||

| 5.4.7 Workplace Management | ||

| 5.5 Financial ManagementFootnote 10 | 5.5.1 Resource Management | |

| 5.5.2 Reporting | ||

| 5.5.3 Corporate Accounting | ||

| 5.5.4 Transfer Payment Programs | ||

| 5.5.5 Costing | ||

| 5.5.6 Internal Controls over Financial Reporting | ||

| 5.6 Information Management | ||

| 5.7 Information Technology | ||

| 5.8 Real Property | ||

| 5.9 Materiel | ||

| 5.10 Acquisition | ||

| 5.11 Occupational Health and SafetyFootnote 11 | ||

| 5.12 SecurityFootnote 12 | 5.12.1 Business Continuity Planning | |

| 5.12.2 Emergency Management | ||

| 5.12.3 Mission Security | ||

| 5.12.4 Domestic Security | ||

| 5.12.5 IT Security |

Appendix B – Crosswalk between Management Accountability Framework Areas of Management and Planned Audits for 2017-2018

| 2017-2018 Audit Projects | People Management | Financial Management | Integrated Risk, Planning and Performance | IM/IT Management | Assets & Acquired Services | Security Management | Service Management |

|---|---|---|---|---|---|---|---|

| 1. Continuous Auditing – Foreign Service Directives | ✓ | ✓ | ✓ | ||||

| 2. Continuous Auditing – Contracting | ✓ | ✓ | ✓ | ✓ | |||

| 3. IT Security – Threat and Vulnerability Management | ✓ | ✓ | |||||

| 4. Management Practices at Selected Missions – Cairo, Amman, Madrid, Jakarta, Kingston, São Paulo | ✓ | ✓ | ✓ | ✓ | |||

| 5. IM/IT Governance | ✓ | ✓ | |||||

| 6. Physical Security | ✓ | ✓ | |||||

| 7. Review of Management Consular Officers’ Training | ✓ | ✓ | ✓ | ||||

| 8. Real Property – Lifecycle Management | ✓ | ✓ | |||||

| 9. Field Support Service (FSS) Implementation | ✓ | ✓ | ✓ | ||||

| 10. International Civil Aviation Organization | ✓ | ✓ | ✓ | ||||

| 11. Results and Delivery | ✓ | ||||||

| 12. Human Resources – Planning | ✓ | ✓ | ✓ | ||||

| 13. Repayable Contributions | ✓ | ✓ | |||||

| 14. CanExport Program | ✓ | ✓ | ✓ |

Appendix C – Crosswalk of Ministerial Mandate Letters to Planned Audits

The following table outlines the Risk-Based Audit Plan’s audit coverage against Global Affairs Canada’s Ministers’ mandate lettersFootnote *.

| Priority | 2017-2018 Engagements | 2018-2019 Engagements | 2019-2020 Engagements |

|---|---|---|---|

| Foreign Affairs | |||

| Reduce Impediments to Trade and Commerce (with the United States) | Trade: Dispute Settlement and Litigation | ||

| Clean Energy / Environment / Climate Change | Repayable Contributions | Climate Change Initiatives | |

| Defence and Foreign Policy / National Security | Peace and Stabilization Operations Program (formerly Global Peace and Security Fund) | ||

| Public Diplomacy / Stakeholder Engagement (Canada/abroad) |

| ||

| Educational and Cultural Interaction | |||

| International Trade | |||

| Implement / Consult on Trade Agreements | Results and Delivery | ||

| Trade and Export Strategy (promotion / investment / implementation) | CanExport Program | Trade Commissioner Service | |

| Invest in Clean Technology / Energy | Repayable Contributions | Climate Change Initiatives | |

| International Development | |||

| Development Assistance | International Humanitarian Assistance |

| |

| Governance / Human Rights |

| ||

| Development Innovation Climate / Development Financing | Repayable Contributions | Climate Change Initiatives | |

- Date modified: