Audit of the CanExport Program

March 2018

Table of Contents

Executive summary

In accordance with Global Affairs Canada’s 2016-2019 Risk-Based Audit Plan, the Office of the Chief Audit Executive conducted an audit of the CanExport Program. The objective of this audit was to assess whether adequate systems, processes, and procedures are in place to ensure that the CanExport Program is administered and managed in an effective and efficient manner, and in compliance with the Treasury Board Policy on Transfer Payments.

Why was this audit important?

The CanExport Program was announced in March 2015 as part of the Economic Action Plan and launched in January 2016. The Program is one of five pillars of the existing Global Market Support Program within Global Affairs Canada’s Canadian Trade Commissioner Service, with total allocated funding of $50 million over five years. The Program supports Global Affairs Canada’s mandate to promote Canada’s trade and economic interests in markets abroad and supports the efforts of Canadian companies to target markets for their products, services, and technologies. It is managed and delivered in partnership with the Industrial Research Assistance Program within the National Research Council, and aims at leveraging expertise and networks in administering programming for Canadian small- and medium-sized enterprises. The Minister of Foreign Affairs has delegated legal and financial authorities to the Industrial Research Assistance Program of the National Research Council to administer funding.

What was examined?

The audit examined whether adequate governance and management structures are in place to provide oversight of Program administration and to support the achievement of Program results. Specifically, the audit examined whether applications submitted for Program funding were assessed with due diligence to ensure that approved companies were eligible and possessed the capacity to deliver the CanExport Program. The audit also assessed whether measures and systems are in place to record, collect, track, and report on Program performance and financial information. The audit covered program management and administration activities between January 2016 and May 2017. For further information, see Appendix A – About the Audit.

What was found?

The audit team found that the Program’s governance and management structures are an integral part of the overall Global Market Support Program, with a Steering Committee and Advisory Board established specifically for the Program. Accountability, authority, roles, and responsibilities for Program delivery and administration are clearly defined, understood and respected. The audit team also found that assessment of applications for funding were consistently performed based on pre-determined criteria, and that established program administration service standards were respected.

The audit team also found that the contribution agreements examined were not in compliance with the Treasury Board Directive on Transfer Payments as they did not include all required funding provisions. Further, Global Affairs Canada performed limited financial monitoring of Program funding disbursements and commitments.

What was concluded?

The audit team concluded that although the CanExport Program has governance and management structures in place and functioning well, the assessment of applications for funding were consistently performed, and established program administration service standards were respected, the contribution agreements for the Program were not in compliance with the Treasury Board Directive on Transfer payments as they did not include all required funding provisions. Opportunities for improvement were also identified in terms of financial monitoring over Program disbursements and funding commitments.

Statement of Conformance

In my professional judgment as Chief Audit Executive, this audit was conducted in conformance with the Treasury Board Policy and Directive on Internal Audit, as supported by the results of the quality assurance and improvement program. Sufficient and appropriate audit procedures were conducted, and evidence gathered, to support the accuracy of the findings and conclusion in this report, and to provide an audit level of assurance. The findings and conclusion are based on a comparison of the conditions, as they existed at the time, against pre-established audit criteria that were agreed upon with management and are only applicable to the entity examined and for the scope and time period covered by the audit.

Brahim Achtoutal

Chief Audit Executive

Date

1. Introduction

In accordance with Global Affairs Canada’s 2016-2019 Risk-Based Audit Plan, the Office of the Chief Audit Executive conducted an audit of the CanExport Program. The objective of this audit was to assess whether adequate systems, processes, and procedures are in place to ensure that the CanExport Program is administered and managed in an effective and efficient manner, and in compliance with the Treasury Board Policy on Transfer Payments.

1.1 Background

The CanExport Program was announced in March 2015 as part of the Economic Action Plan and launched in January 2016. The Program is one of five pillars of the existing Global Market Support Program (GMSP) within Global Affairs Canada’s Canadian Trade Commissioner Service, with total allocated funding of $50 million over five years. It supports Global Affairs Canada’s mandate to promote Canada’s trade and economic interests in markets abroad and supports the efforts of Canadian companies to target markets for their products, services, and technologies. The Program was created to provide direct financial assistance to Canadian small- and medium-sized enterprises (SMEs) seeking to develop new export opportunities and markets. The Program provides matching contributions of between $10,000 and $99,999 to SMEs who provide 50 percent of total eligible costs.

The Minister of International Trade is accountable for the Program, while the Assistant Deputy Minister, International Business Development and Chief Trade Officer (BFM), Global Affairs Canada, is accountable for Program delivery and results. The Regional Network and Intergovernmental Relations Division (BSI) of Global Affairs Canada is responsible for management of the Program.

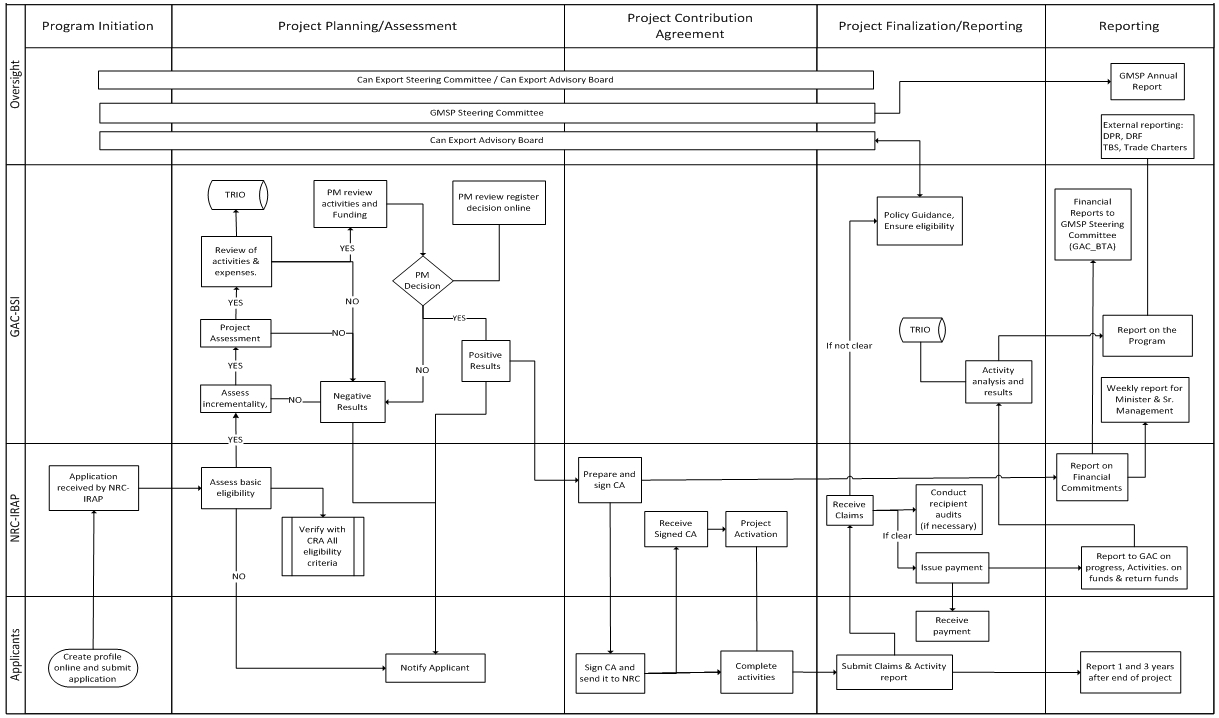

The Program is administered jointly by Global Affairs Canada and the National Research Council’s Industrial Research Assistance Program (NRC-IRAP). A Memorandum of Understanding (MOU) between the two departments sets out roles, responsibilities and modalities for shared delivery of the Program. Global Affairs Canada is primarily responsible for promotion of the Program, and assessment and approval of applications. NRC-IRAP is responsible for assessing applicants’ basic eligibility (in consultation with the Canada Revenue Agency), signing contribution agreements with recipients on behalf of Global Affairs Canada, reviewing project expenditure claims and making payments, and providing post-project reports to Global Affairs Canada. See Appendix B for the CanExport Program Business Flowchart. As of March 31, 2017, the Program had approved 624 applications from all provinces across Canada in a variety of sectors and industries. See Table 1 for CanExport Program Funding by Fiscal Year.

| Fiscal Year | # of Approved Projects | # of duly signed CAs | Program Disbursements | |||

|---|---|---|---|---|---|---|

| Operations and Maintenance (O&M) | Grants and Contributions (G&Cs) | |||||

| Budgeted | Actual | Budgeted | Actual | |||

| FY2015-2016 | 27 | 27 | $761k | $463k | $2,000k | $125k |

| FY2016-2017 | 597 | 579 | $761k | $933k | $13,354k | $8,629k |

| Total | 624 | 606 | $1,522k | $1,396k | $15,354k | $8,754k |

Source: Data provided by the Regional Network and Intergovernmental Relations Unit, Global Affairs Canada. Data related to O&M was not audited.

1.2 Audit Objective and Scope

The objective of this audit was to assess whether adequate systems, processes, and procedures are in place to ensure that the CanExport Program is administered and managed in an effective and efficient manner, and is in compliance with the Treasury Board Policy on Transfer Payments.

The audit examined the following areas:

- Program governance and management structures;

- Accountabilities, roles, responsibilities, and authorities;

- Oversight of Program administration in relation to Program partnership with the National Research Council and the Canadian Revenue Agency;

- Risk management;

- Assessment of applications for Program funding; and

- Management of performance and financial information.

The audit covered Program management and administration activities between January 2016 and May 2017. The focus of this audit was on Program activities carried out by Global Affairs Canada, and did not assess the performance of the Department’s partner organization, NRC-IRAP.

2. Audit findings and recommendations

2.1 Governance Structure

It was expected that the CanExport Program would have a management framework in place to support effective and efficient Program management and to ensure the achievement of Program objectives.

2.1.1 Committees

The audit team examined the management framework in place and found that three Committees constitute the backbone of the oversight structure for the Program. Each has Terms of Reference, meetings are held regularly, decisions are made in a timely manner, and the Committees function in accordance with their respective mandates.

The CanExport Program was integrated into the existing Global Market Support Program (GMSP) and is managed under amended GMSP Terms and Conditions. The GMSP has in place a Steering Committee for all its sub-programs to address operational and financial issues, to discuss policies, procedures, and processes, and to respond to any recommendations requiring approval at the Assistant Deputy Minister level. A communications flow has been developed to guide how Directors and Directors General are informed of GMSP implementation status, as well as how Assistant Deputy Minister approval is obtained when required.

An additional CanExport Program Steering Committee was created for decision-making on operational and financial issues, as well as the creation of Program policies, procedures and processes. It is co-chaired by the Chief Trade Commissioner, Global Affairs Canada, and the Vice-President, NRC-IRAP. Terms of Reference for this Committee have been established, it meets regularly, and Program results are presented annually to this Committee.

Further, a Program Advisory Board was created to address operational issues to ensure timely decision-making. This Board serves two purposes: to interpret the CanExport guidelines (for instance, on questions related to eligible expenses during the assessment of applications or the claims review process); and to review appeals related to decisions on applications. The Program Advisory Board members are from both Global Affairs Canada and NRC-IRAP at the operational levels (specifically, the Director, Program Manager, and Program Officer Levels). Actions recommended by this Advisory Board are presented to the CanExport Program Steering Committee for approval.

2.1.2 Roles and responsibilities

The audit team found that roles and responsibilities are clearly defined. The CanExport Program is jointly administered by the International Business Development, Investment and Innovation Branch (BFM), Global Affairs Canada, and NRC-IRAP. Roles and responsibilities of both parties for the implementation of the Program are clearly defined in a MOU signed by the President of NRC and the Deputy Minister of International Trade.

Administration of the Program is performed by four full-time Global Affairs Canada employees who are Trade Commissioners, specifically, a Program Manager and three Program Officers. Program administration roles and responsibilities are clearly communicated in the Trade Commissioner work description and in more detail in employee Performance Management Plans. A Program workflow chart also defines roles and responsibilities, and a web-based program administration system is used to receive, assess, and track project applications. Various types of user profiles were created in the system, which align with defined roles, responsibilities, and authorities required to deliver the Program.

In order to deliver the Program, these employees have a range of tools (such as reference documents and guidelines), complemented with general training offered within the Commercial Officer Development Program, certification training under the Forum for International Trade Training, and daily coaching by the Program Manager. For Trade Commissioners that promote the Program to their clients and can be requested from time to time to provide their input as part of the assessment process, there has been a series of webinars, training tools on the wiki, in-person training in regional offices across Canada, and presentations at Headquarters.

2.1.3 Risk Management

One of the expected results of the Treasury Board Directive on Transfer Payments is that risk-based approaches are adopted to the design of transfer payment programs, the preparation of terms and conditions and funding agreements, and recipient monitoring and auditing.

The audit team found that risks related to the implementation of the CanExport Program were assessed and mitigation measures were developed by Global Affairs Canada. Program risks and mitigation strategies are recorded in the GMSP global risk register and are discussed at the GMSP Steering Committee, where they are updated and mitigation measures adjusted when necessary.

Various risk factors are taken into account in assessments of applications. These risk factors include: the soundness of the export business case and its activities; the export preparedness and previous history of the applicant; the alignment of each project with the overall Government of Canada trade strategies; and the market potential for the applicant’s products or services in the target market.

Although the audit did not assess the activities of NRC-IRAP, because Global Affairs Canada is accountable for Program funding, the audit team assessed NRC-IRAP’s control regime for Global Affairs’ funds to ensure that the appropriate controls are in place to manage any risks related to expense claims and Departmental funds. The audit team found that when NRC-IRAP reviews expense claims, they review one in every five claims rather than using a risk-based approach, which would consider key risk criteria. Because Program funding per recipient is limited to between $10,000 and $99,999, financial risks related to the Program are considered low. Nevertheless, a good management practice suggests that a risk-based verification strategy, based on such criteria as the risk profile of the recipient, experience of the recipient and materiality, would help allocate scarce resources on claim reviews more effectively. The audit team was told that the claims review process would be moving to a risk-based approach based on available data analysis and patterns established since the Program launch.

Another risk mitigation measure to ensure that program funding is used for the intended purpose and is in compliance with the terms and conditions set out in the contribution agreement is to perform recipient audits.Footnote 1 As indicated in the Program’s Terms and Conditions, it was expected that a strategy and plan for recipient audits would be established to verify that program funding is used for intended purposes. Although NRC-IRAP is responsible for carrying out these recipient audits, the Department, which provides funding to the Program, plays a role in ensuring appropriate oversight of its funds. The audit team was informed that, for projects completed in 2016-17, NRC-IRAP is in the process of drafting a CanExport Program recipient audit strategy and plan.

Overall, the CanExport Program has a management framework in place to support effective and efficient Program management and ensure the achievement of Program objectives. Specifically, there are committees established that exercise appropriate oversight of the Program, roles and responsibilities of both partner departments are defined and fulfilled, and the risks are identified, managed and mitigated.

2.2 Program Administration

2.2.1 Application assessment and approval processes

It was expected that application assessment and approval processes for the CanExport Program would be in place to ensure that project selection decisions are aligned with Departmental priorities and the Program strategy. The audit team found that assessments were conducted in a consistent manner and that Program Managers had sufficient information to make a final approval or refusal decisions based on the assessment performed.

The assessment of funding applications consists of two components: an assessment of the SME’s basic eligibility, such as the company’s total revenue, number of full-time employees and legal status; and an assessment of the proposed project, including incrementalityFootnote 2, soundness of the export business case, and the project’s alignment with Government of Canada trade strategies. NRC-IRAP is responsible for conducting the basic eligibility assessment of the SME and Global Affairs Canada is responsible for assessing the project suitability application. The final decision for approval or refusal of submitted applications rests with the Program Manager of Global Affairs Canada.

The audit team selected a sample of 65 project applications that were submitted since Program inception, specifically a random sample of 25 applications that were refused and a judgemental sample of 40 applications that were successful. Of the successful applications, 14 projects were completed and 26 were still active at the time of the audit. The audit team found that all 65 of the applications examined were assessed by NRC-IRAP for basic eligibility, as required, all 40 of the successful applications examined by Global Affairs Canada were assessed for project suitability, as required, and all 25 of the unsuccessful applications examined were informed of the decision, as required. In analyzing the rationale for the 25 unsuccessful applications, the audit team found that 11 of the 25 applications were refused at the basic eligibility assessment stage and the remaining 14 were refused at the project suitability assessment stage.

To ensure applicants have an appropriate expectation of the application assessment process, service standards have been established for the CanExport Program. Applicants can expect to be informed of the results of the completed application assessment within 25 working days. This service standard is published in the Applicant Guide posted on the Program’s website. The audit team found that this established service standard is monitored by Global Affairs Canada and was met in 62 out of 65 (95 percent) of the applications reviewed.

2.2.2 Contribution agreement

It was expected that contribution agreements for the CanExport Program would be compliant with the requirements of the Treasury Board Policy and Directive on Transfer Payments. The audit team examined a sample of 40 contribution agreements used by the Program to see if they included all applicable funding agreement provisions as required. Of the 21 applicable provisions assessed, the audit team found the contribution agreements contained the required information for 18 of them. The information for three of the provisions was not included as required, and hence the contribution agreements were not in compliance with the Directive. The audit team noted, however, that this information was contained in other Program documentation provided to the recipient. This related to:

- a description of the results expected to be achieved by the recipient;

- required documentation to account for the use of the funding, demonstrate that obligations and objectives are met and support the Department’s accountability and performance measurement ; and

- any limits on the amounts payable for particular categories of eligible costs.

The audit team found that the expected results, against which recipients should report actual results, were not described in contribution agreements. To include expected results in contribution agreements as one of the recipients’ responsibilities would ensure that data collection to be used for project results reporting can be performed as early as possible. In addition, the reporting of results would be easily consolidated to demonstrate the achievement of overall Program objectives.

The audit team also found that in the contribution agreements examined, the required documentation to account for the use of the funding, demonstrate that obligations and objectives are met, and support the Department’s accountability and performance measurement, were not described. In all 40 contribution agreements examined there is a clause in the reporting schedule indicating that “[a] report on the Recipient’s performance should be presented annually for the duration of this Contribution Agreement.” However, it is not clear what kind of information should be presented in this report, to support the Department’s accountability and performance measurement requirements.

Applicants are required to respect any limits on the amount payable for particular cost categories to ensure activities and costs are eligible for Program funding. The audit team found that in the sample of contribution agreements examined, the limits in terms of travel costs (only two travellers allowed for each trip), although indicated in funding guidelines, were not included in any of the 40 agreements examined.

In addition, the audit team found that the project start and end dates were stated in the agreements. In 28 of the 40 contribution agreements examined (70 percent), the project start date was prior to the date of the signed agreement (the “effective date”), including 11 for which the project start date was prior to the project approval date. Although this practice is not disallowed, the Treasury Board of Canada Secretariat Guide on Grants, Contributions and Other Transfer Payments indicates that contribution agreements should be signed before the project start date and before eligible expenses are incurred and, when eligible expenditures are to be incurred prior to formal approval, it must be made clear to the applicant that the department will not reimburse these expenditures if the formal written agreement is not signed. This was not observed by the audit team.

Further, the audit team found that eligible expenses were not consistently defined and communicated to recipients in all program documentation. While the Applicants’ Guidelines and the CanExport Claim Instructions indicate that expenditures incurred between the project start date and the contribution agreement effective date are considered eligible, the approval letter to recipients states that these expenditures are disallowed. This leads to inconsistent information to recipients on what are considered eligible project expenditures and can create potential risk to the Program.

2.2.3 Claim review process

Review of claims submitted for project expenditure reimbursements are the responsibility of NRC-IRAP. Although it was not within the scope of the audit to verify whether reimbursed project expenditures assessed through NRC-IRAP’s review of claims would be eligible, the audit team examined whether measures are in place to ensure the review considers the risk that ineligible expenditures may be allowed and whether the review is conducted in an effective and efficient manner.

Upon project completion, or at the end of the fiscal year for multi-year projects, NRC-IRAP validates one out of every five claims. NRC-IRAP uses a checklist to assist in validating claims which requires additional supporting documents and invoices from the recipient. The audit team found that the use of this checklist ensures consistency in the review of claims amongst review officers. From the sample of 40 projects, nine of them were validated by NRC-IRAP. For seven of the nine claims validated, the claim submitted by the recipient was adjusted and a lower amount reimbursed. For those seven projects, NRC-IRAP identified the reasons for the adjustment. Follow-up actions were also undertaken by the CanExport Program Manager at NRC-IRAP.

Recommendation 1:

The Assistant Deputy Minister, International Business Development, Investment, and Innovation and Chief Trade Commissioner, in coordination with Grants and Contributions Management, should ensure that contribution agreements for the CanExport Program are in compliance with the Treasury Board Directive on Transfer Payments by including all funding provisions required.

2.3 Program Performance and Financial Reporting

2.3.1 Program Performance Reporting

It was expected that Global Affairs Canada collects and reports on Program performance information to demonstrate that Program objectives are met. The audit team found that appropriate Program performance reporting mechanisms have been established to demonstrate progress and achievement of Program objectives.

When the Program was approved, the Terms and Conditions of the GMSP were amended to add the CanExport Program as one of the existing pillars, and a Performance Management Strategy Framework was established by the Department for all the GMSP programs. This Strategy describes performance indicators and targets for the Program outputs and outcomes which are aligned with those in the Treasury Board submission for the approval of the Program.

In addition, the Strategy describes information to be included in the project report. The project reporting requirements are to be defined in the contribution agreement and the report is to be provided when the final project expenditure claim is made. These reports were reviewed by the Department’s CanExport Program Officers and project results data is recorded in the Department’s Client Relationship Management System (TRIO2). This system is used by the Trade Commissioner Service to manage relations and activities with Canadian client organizations. The audit team reviewed a sample of 17 completed projects (14 completed projects at the time of sample selection and three projects that were completed during the course of the audit). The audit team found that in these 17 projects that had submitted a final claim for fiscal year 2016-17, all final project reports had been submitted and all included the information that was requested in the claim template.

Program performance and progress are reported through various mechanisms. One of the key reports is the Program’s input into the GMSP annual report, which presents financial and performance information for each of the pillars. The CanExport Program is also reported on in key reports to Parliament, including the Departmental Results Report, the Departmental Plan, and an annual report to Treasury Board Secretariat on the use of contribution funding and Program results achieved. Reports are also prepared for the Minister and Senior Management of Global Affairs Canada on the delivery of the Program and for the Program’s Steering Committee on Program results.

2.3.2 Financial reporting and monitoring

It was expected that financial information for the CanExport Program would be correctly recorded, analyzed and reported in a timely manner to ensure that Program funding is used for intended purposes and that sound stewardship of funds is exercised. The audit team found that at the end of fiscal year 2016-2017, the actual Program expenditures were correctly recorded and reported, but funding commitments were not recorded in the Department’s financial system.

According to the MOU between Global Affairs Canada and NRC-IRAP, project financial information, such as committed funds and actual payments for each project, is recorded in NRC-IRAP’s financial system and not directly accessible by Global Affairs Canada. The audit team found that the Department is regularly informed by NRC-IRAP of financial performance at the Program level through a Financial Commitment Report, which includes the Program budget, commitments, actual total spending and potential lapsing of funds. This report is provided on a monthly basis during the fiscal year, on a weekly basis towards the end of the fiscal year, and is monitored by Global Affairs Canada. The Coordination and Administration Unit of the Department prepares a consolidated financial report presented to the GMSP Steering Committee. Potential lapsing and additional funding needs for each of the GMSP Programs are identified so that the GMSP Steering Committee can make appropriate funding allocation decisions among its five pillars.

For fiscal year 2016-2017, a total of $13.4 million in funding was committed and allocated to the Program. An amount of $8.4 million was accounted for by submitted claims and payments, and $4.9 million of unspent funding was returned to the Department. This was due to the fact that several recipients with project funding commitments for fiscal year 2016-2017 did not submit their claims on time at year end.

For reported actual Program spending and returned funding for fiscal year 2016-2017, the audit team examined whether the Department had performed reconciliations on supporting financial data for the Program to demonstrate that due diligence had been exercised to ensure the financial information was accurate, reliable and complete. The audit team found that limited reconciliation had been performed.

The audit team analyzed the information reported on commitments and payments, and found that all project payments, for a total of $8.4 million, were accurate and had been approved by the Department. The amount paid to each project did not exceed the maximum contribution allowed in the respective contribution agreements. The audit team also found that financial transactions between the two departments were appropriately recorded in Global Affairs Canada’s financial system. However, the audit team observed two instances where additional reconciliation efforts should have been made by the Program. Specifically, the audit team received two types of NRC-IRAP financial reports that presented different year-end funding commitment information to Global Affairs Canada. Further, the audit team found that NRC-IRAP created commitments for three projects for which Global Affairs Canada had not allocated funding for that fiscal year. The committed funds to recipients in effective contribution agreements at fiscal year-end constitute a contractual obligation and, when it reaches the specified threshold, it must be disclosed in the Department’s financial statements.

Recommendation 2:

The Assistant Deputy Minister, International Business Development, Investment, and Innovation and Chief Trade Commissioner, should increase the level of financial monitoring over Program disbursements and funding commitments.

3. Conclusion

The audit team concluded that although the CanExport Program has governance and management structures in place and functioning well, the assessment of applications for funding were consistently performed, and established program administration service standards were respected, the contribution agreements for the Program were not in compliance with the Treasury Board Directive on Transfer payments as they did not include all required funding provisions. Opportunities for improvement were also identified in terms of financial monitoring over Program disbursements and funding commitments.

Appendix A: About the audit

Audit Objective

The audit objective was to assess whether adequate systems, processes, and procedures are in place to ensure that the CanExport Program is administered and managed in an effective and efficient manner, in compliance with the Treasury Board Policy on Transfer Payments.

| Criteria | Sub-criteria |

|---|---|

| 1. A management framework is in place to support the effective and efficient management of the CanExport Program and to ensure the achievement of Program objectives. | 1.1 Due diligence, oversight and monitoring functions are appropriately performed for the CanExport Program. |

| 1.2 Accountability, roles and responsibilities for the management and delivery of the CanExport Program are clearly defined, communicated, and discharged in accordance with the MOU. | |

| 1.3 The Program’s administration and delivery is risk-based and in compliance with the Treasury Board Policy and Directive on Transfer Payments. | |

| 1.4 Training, tools and guidance are available to administer the Can Export Program. | |

| 1.5 Reasonable and practical service standards for Program delivery are established, communicated, applied and monitored. | |

| 2. Application assessment and approval processes for the Can Export Program are in place to ensure that project selection decisions are aligned with Departmental priorities and the Program strategy. | 2.1 Assessment criteria for applications, including eligibility assessments, and project selection approval are developed, documented and communicated. |

| 2.2 Applications are consistently evaluated against pre-established criteria. | |

| 2.3 For project selection decisions, due diligence is exercised in accordance with the established requirements. | |

| 2.4 Funding agreements for the Program are developed and signed based on approval and in compliance with the Policy on Transfer Payments. | |

| 3. Performance information for the Can Export Program is managed to demonstrate that Program objectives are achieved. | 3.1 A Program performance measurement framework is established and communicated. |

| 3.2 The Program has systems and tools to collect, track, and report Program and project performance information in line with the Program performance measurement framework and funding agreements respectively. | |

| 4. Financial information for the CanExport Program is correctly recorded, analyzed, and reported in a timely manner. | 4.1 Accurate, complete, and timely financial information is collected, tracked and recorded in the applicable financial systems, and reported to support decision making. |

| 4.2 Financial information is analysed to identify and explain significant variances against established plans and budgets. |

Scope

The audit focused on processes, controls, and tools in place to support project and financial management and results, performance measurement, and accountability for results of the CanExport Program. The audit did not perform a substantive audit testing of Program administration that is carried out by the NRC-IRAP.

Methodology

The audit was conducted in conformance with the Institute of Internal Auditors’ International Standards for the Professional Practice of Internal Auditing and with the Treasury Board Policy and Directive on Internal Audit. These standards require that the audit be planned and performed in such a way as to obtain reasonable assurance that the audit objective is achieved.

In order to conclude on the audit objectives, the following methods were used to gather evidence:

- Identification and review of relevant policies, directives, and guidelines;

- Review and analysis of documents related to Program operations;

- Interviews with the Program management team, Program officers and other stakeholders;

- Performance of walkthrough and mapping of the Program administration processes and systems, and identification of key risks and controls;

- Selection of samples of transactions and projects for detailed testing;

- Analysis of financial and non-financial information; and

- Other relevant activities as required.

Appendix B: CanExport program business processes

Source: Process Mapping of the CanExport Program conducted by the Office of the Chief Audit Executive

The flowchart illustrates Global Affairs Canada’s CanExport Program Business Processes. The different steps of the processes and the actors involved are presented below in order: Program Initiation: Project Planning/Assessment: No: Yes: No: Yes: No: Yes: No: Yes: No: Yes: Project Contribution Agreement: Reporting: Project Finalization/Reporting: Reporting: Project Finalization/Reporting: If it is not clear: If it is clear: Reporting: Project Finalization/Reporting: Reporting: In parallel, GMSP Steering Committee provides oversight for the GMSP Annual report in the reporting phase. Additionally, Can Export Steering Committee / Can Export Advisory Board provide oversight.Text version

Project Contribution Agreement:

Appendix C: Recommendations and management action plan

| Audit Recommendations | Management Action Plan | Area Responsible | Expected Completion Date |

|---|---|---|---|

| Include clear reference to the content of the online application and program guidelines in the CA to fully incorporate these specific elements:

| Regional Network and Intergovernmental Relations Division (BSI) under International Business Development, Investment and Innovation Branch (BFM) Grants and Contributions Management (SGD) | April 2018 |

|

| Regional Network and Intergovernmental Relations Division (BSI) under International Business Development, Investment and Innovation Branch (BFM) |

|

APPENDIX D: LIST OF ACRONYMS

- ADM

- Assistant Deputy Minister

- BFM

- International Business Development, Investment and Innovation Branch

- BSI

- Regional Network and Intergovernmental Relations Division

- GMSP

- Global Markets Support Program

- MOU

- Memorandum of Understanding

- NRC-IRAP

- National Research Council’s Industrial Assistance Research Program

- SME

- Small- and Medium-sized Enterprise

- TRIO2

- Client Relationship Management System

- Date modified: