Audit of Real Property - Life Cycle Management

Global Affairs Canada

Office of the Chief Audit Executive

October 2017

Table of Contents

- Symbols and Acronyms

- Executive Summary

- 1. Background

- 2. Audit Objective and Scope

- 3. Audit Observations

- 3.1 Real Property Strategy

- 3.2 Policy Framework

- 3.3 Accountability and Decision-Making Structure

- 3.4 Information for Decision-Making

- 3.5 Real Property Life Cycle Management

- 4. Conclusion

- Appendix A: About the Audit

- Appendix B: Current Transformative Initiatives

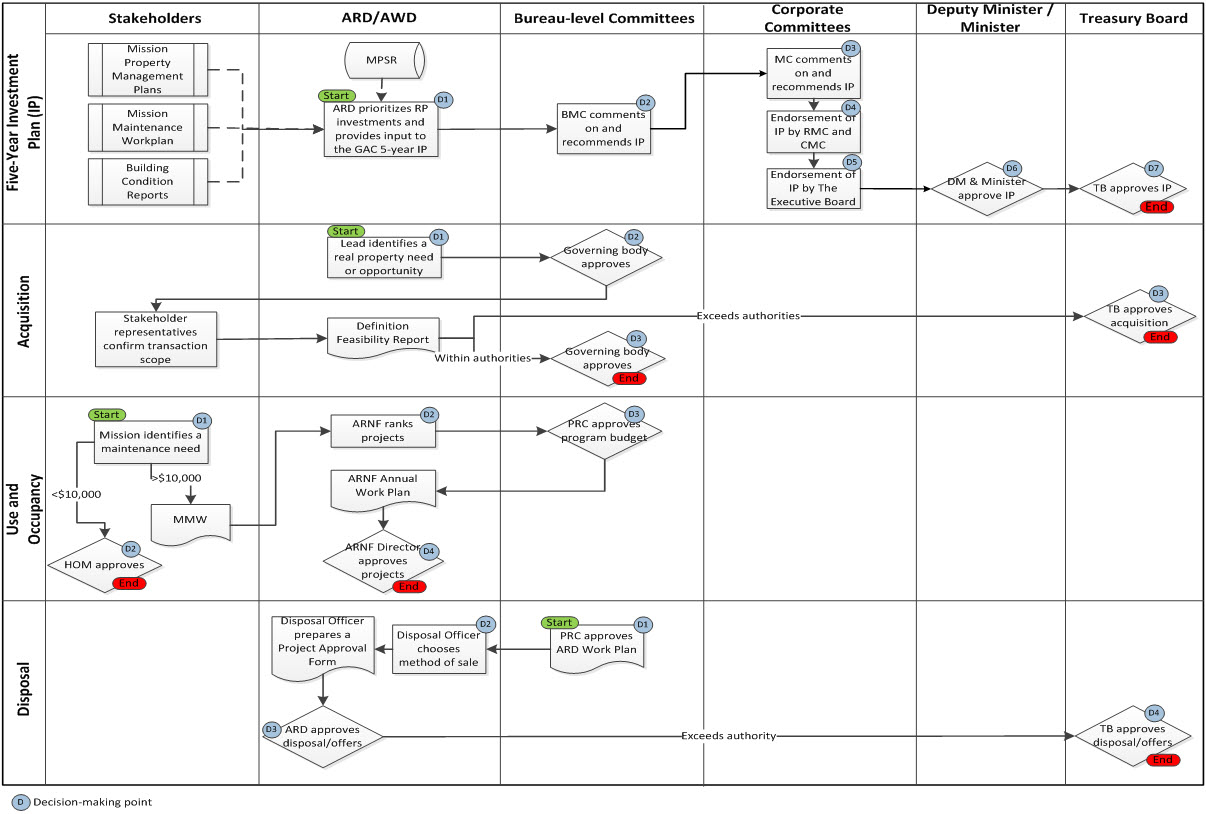

- Appendix C: Real Property Life Cycle Management Decision-Making Process Flow

- Appendix D: Audit Recommendations and Management Action Plan

Symbols and Acronyms

List of Symbols

- ACM

- International Platform Branch

- ADM

- Assistant Deputy Minister

- ARA

- Property Program Division

- ARD

- Planning and Stewardship Bureau

- ARN

- Real Estate Operations Division

- ARNB

- Mission Property Budget

- ARNF

- Life Cycle Management

- ARO

- Strategic Policy and Planning Division

- AWB

- Professional and Technical Services Division

- AWC

- Physical Security Abroad Division

- AWD

- Project Delivery, Professional and Technical Services Bureau

- AWP

- Capital Project Delivery Division

- AWT

- Commissioning and Engineering Services

- SID

- Information Management and Technology Bureau

List of Acronyms

- BI

- Business Intelligence

- BCR

- Building Condition Report

- BMC

- Bureau Management Committee

- BPC

- Bureau Project Committee

- CMC

- Corporate Management Committee

- DM

- Deputy Minister

- FAS

- Financial Administration System

- GAC

- Global Affairs Canada

- GL

- General Ledger

- HOM

- Head Of Mission

- IM

- Information management

- IP

- Investment Plan

- IT

- Information Technology

- MC

- Mission Committee

- MMW

- Mission maintenance work plan

- MOU

- Memorandum of Understanding

- MPMP

- Mission property management plan

- MPSR

- Major Project Status Reporting

- OPI

- Office of Primary Interest

- Portable Document Format

- PRC

- Program Review Committee

- PRIME

- Physical Ressources Information Mission Environnent

- QMS

- Quality Management System

- RMC

- Resource Management Committee

- RMO

- Regional Maintenance Officer

- RP

- Real Property

- SOA

- Special Operating Agency

- TB

- Treasury Board

- TBS

- Treasury Board Secretariat

Executive Summary

In accordance with Global Affairs Canada’s 2017-2020 Risk-Based Audit Plan, the Office of the Chief Audit Executive conducted an internal audit of Real Property – Life Cycle Management. The objective of the audit was to provide assurance that the Department’s real property lifecycle management decisions are adequately informed and support the achievement of the government-wide and departmental program objectives in a cost-effective manner.

Rationale for this Audit

Under the Department of Foreign Affairs, Trade and Development Act and the Treasury Board of Canada Secretariat Common Services Policy, Global Affairs Canada is mandated to manage the procurement of goods, services and real property in support of 179 diplomatic and consular missions in 109 countries. The Department provides real property services to 37 organizations abroad, including partner departments (federal departments and agencies) and co-locators (Crown corporations, provincial governments and other national governments).

The international footprint of Global Affairs Canada as well as the size and value of its real property portfolio abroad emphasize the importance of real property. More specifically, the real property inventory comprises 2,149 Crown-owned and Crown-leased properties with an estimated replacement value at $3 billion, as well as 364 properties that are privately leased by personnel.Footnote 1

What was examined

The audit examined Global Affairs Canada’s decision-making process including how decisions are made, informed and supported throughout the life cycle of the real property management (i.e. investment planning, acquisition, maintenance and operation, disposal), and the progress made in response to recommendations from previous audits and studies that relate to our audit objective.

What was found

Global Affairs Canada’s real property life cycle management approach has evolved in recent years following recommendations resulting from the implementation of recommendations from past audits and studies. Most recommendations have been addressed, although some actions have been delayed or not yet fully implemented.

The Department has developed a five-year investment plan. However, it is not supported by a comprehensive real property strategy that takes into consideration evolving requirements and would ensure the investment plan supports the department in achieving its objectives and delivering expected results.

Government policies, legislation, and regulations are generally well integrated into the Department’s internal policies, processes, and procedures. However, updating the relevant source documentation is necessary in order to better align departmental practices with Government policies.

Several committees provide oversight over real property life cycle management. Each committee plays a key role in reviewing and approval of the investment plan, acquisitions, and disposal transactions.

The Department does not have asset management plans to support strategic investment planning. Estimated spending in real property maintenance and betterment activities is well below the Department’s target range, thus increasing the likelihood that real properties may not be maintained at an acceptable level.

The real property information is maintained in different information systems, repositories and formats. Although some useful real property information is captured and certain performance measures have been developed, a comprehensive real property performance framework with a suite of performance indicators is not in place to support well-informed decision-making. Furthermore, it was found that real property information is not always accurate, complete and fully used to inform real property investment decision-making.

Conclusion

The audit concluded that while progress has been made in responding to recommendations from previous internal audit and third-party review, more emphasis needs to be put on the completion of those recommendations. In addition, the Department lacks a proactive and strategic approach in managing its real property portfolio. More importantly, significant efforts are required to improve the quality of information used for decision-making on the life cycle management of real property.

Statement of Conformance

In my professional judgment as Chief Audit Executive, this audit was conducted in conformance with Treasury Board Policy and Directive on Internal Audit, as supported by the results of the quality assurance and improvement program. Sufficient and appropriate audit procedures were conducted, and evidence gathered, to support the accuracy of the findings and conclusion in this report, and to provide an audit level of assurance. The findings and conclusion are based on a comparison of the conditions, as they existed at the time, against pre-established audit criteria that were agreed upon with management and are only applicable to the entity examined and for the scope and time period covered by the audit.

____________________________

Brahim Achtoutal

Chief Audit Executive

1. Background

1.1 Real Property Portfolio

Under the Department of Foreign Affairs, Trade and Development Act and the Treasury Board of Canada Secretariat Common Services Policy, Global Affairs Canada is mandated to manage the procurement of goods, services and real property in support of 179 diplomatic and consular missions in 109 countries. Properties are distributed across regions, namely Sub-Saharan Africa, Asia-Pacific, Europe, the Middle East and Maghreb, and the Americas. The Department provides real property services to 37 organizations abroad, including partner departments (federal departments and agencies) and co-locators (Crown corporations, provincial governments and other national governments).

As of May 16, 2017, the Department’s real property portfolio abroad has 2,149 Crown-owned and Crown-leased properties with an estimated replacement value at $3 billionFootnote 2. This includes: chanceries, official residences, office space, staff quarters and other properties, as shown in Table 1 below.

| Property Use | Quantity | ||

|---|---|---|---|

| Crown-Leased | Crown-Owned | Total | |

| Official Residence | 29 | 57 | 86 |

| Staff Quarters | 1,189 | 403 | 1,592 |

| Staff Quarters-HOM | 31 | 2 | 33 |

| Chancery | 79 | 64 | 143 |

| Chancery Annex | 23 | 12 | 35 |

| Compound | 15 | 28 | 43 |

| Office Space | 54 | 2 | 56 |

| Parking (Only) | 49 | 14 | 63 |

| Storage | 38 | 9 | 47 |

| Recreation Facility | 12 | 12 | |

| Vacant Land | 11 | 11 | |

| Other | 14 | 14 | 28 |

| Total | 1,521 | 628 | 2,149 |

Investments in real property abroad were projected to be $1,739.8 million for the period from 2015-2016 to 2019-2020, including $715.1 million in projectsFootnote 4, $145.7 million in asset acquisitionsFootnote 5 and $879 million in acquired servicesFootnote 6.

1.2 Government Policy Framework

The Government policy framework with respect to the management of real property is composed of the Treasury Board Policy on the Management of Real Property, Policy on the Management of Project, Policy on Investment Planning, Common Services Policy, Appraisals and Estimates Standard for Real Property, Federal Real Property and Federal Immovables Act, and Policy Framework for the Management of Assets and Acquired Services.

1.3 Organizational Structure

The International Platform Branch (ACM) is the single window for delivering common services for all government departments and agencies operating within the diplomatic and consular framework. Responsibilities of the Branch encompass real property, diplomatic courier services and, procurement and contracting. Within ACM, the Physical Resource Bureau, the unit responsible for the real property portfolio abroad, was divided into two bureaus in 2016-2017: the Planning and Stewardship Bureau (ARD) and the Project Delivery, Professional and Technical Services Bureau (AWD). The main objective was aligning the organizational structure with a Corporate Real Estate Model. Each bureau is led by a Director General reporting to the ACM Assistant Deputy Minister.

ARD is responsible for managing the department’s real property portfolio and encompasses three divisions: Real Property, Strategic Policy and Planning (ARO), Property Program (ARA) and Real Estate Operations (ARN). The Physical Security Abroad (AWC), the Capital Project Delivery (AWP), the Commissioning and Engineering Services (AWT) and the Professional and Technical Services (AWB) divisions are placed under the responsibility of AWD. The team members of AWD execute their roles and responsibilities taking into consideration the strategies and plans set forth by ARD.

1.4 Decision Making Processes

The departmental real property life cycle management involves many key decisions made at different stages (as shown in Appendix C). Throughout the year, ARD identifies real property investment opportunities and scores them using a prioritization model. ARD develops a Real Property Investment Plan on an annual basis which provides input to the departmental Investment Plan. The departmental Investment Plan has a 5 year horizon. However, after the 3rd year, the plan is revised and submitted for approval to Treasury Board. Following this approval, the revised Investment Plan becomes the new plan with a 5 year horizon.

Stakeholders are consulted during the preparation of a feasibility study for an acquisition or a transaction. If the proposed initiative falls within the Department’s delegated authorities, approval can be given by a bureau level committee.

Missions, under the authority of the Heads of mission, are responsible for the day-to-day operations and maintenance of real property assets inclusive of preventative maintenance, repairs and minor repair projects valued up to $10,000 per project. Mission Property Budget (ARNB) oversees the allocation of mission property budgets. The Life Cycle Management division (ARNF) is responsible for a program of minor projects valued above $10,000 and below $500,000 to address repairs, recapitalization and betterments. Interventions include providing advice, contracting guidance and budget coordination. Missions are responsible for the implementation of each individual project. AWD projects managers are assigned to more complex projects. Projects valued above $500,000 are defined as major projects. Sponsorship responsibility falls under the ARA Division according to the Major Project Delivery process.

On an annual basis, ARD develops Revenue Generation Plan as part of the ARD Work Plan. This plan, which identifies asset disposals (ex. sales and lease termination), is approved by the Program Review Committee.

1.5 Current Transformation Initiatives

As detailed in Appendix B, several initiatives are presently proceeding to enhance the organizational and governance structure, develop accountability and client engagement frameworks, establish global and regional real property portfolio plans, modernize the information systems, and review the funding model for the purpose of improving real property life cycle management.

2. Audit Objective and Scope

In accordance with Global Affairs Canada’s 2017-2020 Risk-Based Audit Plan, the Office of the Chief Audit Executive conducted an internal audit of Real Property – Life Cycle Management. The objective of the audit was to provide assurance that the Department’s real property lifecycle management decisions are adequately informed and support the achievement of the government-wide and departmental program objectives in a cost-effective manner. Detailed audit criteria and sub-criteria are outlined in Appendix A.

The audit examined Global Affairs Canada’s decision-making process including how decisions are made, informed and supported throughout the life cycle of the real property management (i.e. investment planning, acquisition, maintenance and operation, disposal).

The audit examined Global Affairs Canada’s real property abroad with a focus on the department’s Crown-owned and Crown-leased properties. The audit covered the period from April 2015 to March 2017.

The following areas were excluded from the audit:

- Real property located in Canada, as Public Service and Procurement Canada is the custodian of these properties

- Privately-leased properties, as an evaluation on private leases is currently planned by the Evaluation Branch

- The use of real property by other government departments

- Physical security, as this will be the focus of a separate internal audit.

The audit also assessed the progress made in response to recommendations from previous audits and studies that relate to our audit objective.

3. Audit Observations

This section sets out key findings and observations, divided into four general themes addressing decision making framework, policy framework, management framework, information for decision making and real property life cycle management.

Audit observations were derived from the examination of documentation, data analytics, walkthroughs of key processes, analysis of financial and non-financial information, and interviews. In addition, a sample of real property investments, acquisition and disposal transactions, and maintenance activities undertaken by the missions was reviewed.

3.1 Real Property Strategy

According to the Treasury Board Policy on the Management of Real Property, the Department is expected to develop an appropriate real property management framework that supports timely, informed real property management decisions, and the strategic outcome of programs.

A real property strategy sets the vision, priorities and objectives for real property management to support existing and changing programs at a sustainable life-cycle cost. The strategy is an overarching document intended to deal with all matters relating to real property portfolio and sets out a roadmap to provide the right assets, in the right place at the right time to meet the operational requirements. The audit team expected to find that the Department’s investment plan with respect to real properties abroad was based on a long-term strategic approach.

The audit team examined the Departmental Investment Plan 2015-16 to 2019-20. It provides a detailed description of the investment planning process, outlines Departmental priorities and objectives as they pertain to management of real property assets abroad and identifies the priority and additional investments over the five year period. The audit team found that the investment plan presents planned spending on projects, assets and acquired services over a five-year planning period within the department’s reference levels without setting out an integrated long-term strategic approach to managing the department’s real property in support of its programs. Though the investment plan includes essential elements such as key performance indicators and risk-based investment planning; the plan is not covering all matters relating to its real property portfolio, such as the expected strategic outcome that reflects the departmental and government-wide objectives, and an integrated strategic approach for managing real properties. As a consequence, it is difficult for the decision-makers to assess whether the investment plan supports the department in achieving its objectives and delivering expected results.

The audit team also found that maintenance and life-cycle management do not receive significant attention during the investment planning process. The Department does not have asset management plans in support of a well-informed long-term real property strategy, which impacts its ability to effectively prioritize its investments and demonstrate sound stewardship. An asset management plan is a road map that informs effective strategic investment planning decision-making. The individual asset management plans are essential for identifying real property funding requirements and determining the allocation of funding across the real property portfolio. The inputs into the asset management plans process include asset management reports, building condition reports, sector input, health and safety, and environmental concerns. In the Department, building condition reports are not completed for all properties, thereby limiting its ability to prepare asset management plans. The identification of real property projects is more reactive than proactive due to a lack of formal structure to gather real property information. As a result, the Department’s ability to develop a long-term strategic approach and effective decision-making is undermined.

Recommendation #1

The Assistant Deputy Minister of International Platform Branch should ensure that the investment planning process is supported by a real property strategy and asset management plans.

3.2 Policy Framework

The audit team expected to find that relevant Government policies, legislation and regulations have been taken into consideration into the Department's internal policies, processes and procedures that articulate the policy direction and management expectations.

The audit team compared Treasury Board policies and legislation requirements against Departmental policies, guidelines and processes for real property life cycle management and found that Government policies, legislation and regulations are generally integrated into the Department’s internal policies, processes and procedures. However some areas for improvements were identified for a better alignment with Government policies and guidance on the management of real property. One example is related to the Heritage Building conservation. Treasury Board policy states that the heritage character of federal buildings must be evaluated by Parks Canada. This requirement is not reflected in the Quality Management System (QMS) or in the Property Management Manual, although the Department has a Memorandum of Understanding (MOU) with Parks Canada, which expired in 2016.

In accordance with the Treasury Board Guide to the Management of Real Property, in 2014 the Department developed the Real Property Management Framework which provides a brief overview of key aspects of life cycle management, including amongst others, the governance structure; authorities and delegations; management’s responsibilities; investment planning; financial and human resources management; performance measurement; policies, practices, and procedures; and information systems. This Framework is complemented by additional source documents that provide further guidance on several aspects of life cycle management. For example, the Department developed the Real Property Transaction Management Framework document which applies specifically to the management of real property acquisition and disposal transactions abroad and the Property Management Manual which applies, amongst others, to acquisitions of chancery, official residence and leasing.

The audit team found that in general, the real property management policies, guidelines and processes for maintenance activities are adequately developed and communicated. However, the Real Property Management Framework, the Property Management Manual, and theQMS have not yet been updated to reflect changes to the organizational and governance structures that were recently implemented or are in the process of being implemented following recommendations from the 2015 third-party review. Revisions are required to reflect the new divisions that have been moved under the direction of AWD.

Recommendation #2

The Assistant Deputy Minister of International Platform Branch should update relevant source documents to reflect recent changes to the organizational structure and to ensure alignment with Treasury Board Policy requirements.

3.3 Accountability and Decision-Making Structure

The audit team expected to find that the Department’s real property management would be governed by a well-established management framework including decision-making process, organizational structure, oversight mechanisms, roles and responsibilities, accountabilities and authorities.

The missions, the ARA Portfolio Managers, the ARNF Facilities Managers (FM) and several committees play a role in the real property investment planning process. The ARA Portfolio Managers and the FM are involved in the identification and prioritization of the investment opportunities, in consultation with Heads of Mission, geographic branches and other stakeholders as needed. Heads of Mission are also involved in the departmental governance for investment planning through Heads of Mission representation on the Executive Board, the Corporate Management Committee (CMC), the Resource Management Committee (RMC) and Mission Committee. The Mission Committee and the Bureau Management Committee (BMC) review and approve the investment prioritization criteria, comment on prioritized investments, and make recommendations to the CMC.

The CMC reviews the investment plan to ensure it is internally consistent and aligned to departmental priorities. The RMC makes investment allocation and reallocation decisions and the ADM Steering Committee on Security reviews all investments that have an impact on safety and security The Executive Board provides the final endorsement of the investment plan, prior to a formal Deputy Minister and Minister approval.

The audit found that the five-year departmental investment plan and the annual real property investment plans were approved by the appropriate chain of approvals. In addition, the audit team reviewed a sample of four real property investments abroad and found that the required approval authorities were respected.

Senior management recognizes that the Department’s governance framework for investment planning requires less distributed accountability. The terms of references of a Real Property Investment Review Board have recently been drafted. This Board will serve as an expert consultative group, and members would include Department representatives as well as non-departmental stakeholders with a material interest in Canada’s overseas network of properties.

Accountabilities, roles and responsibilities with respect to investment planning, management of acquisition and disposal transactions, real property maintenance and betterment activities are defined in different documents. However, those documents are not always clear and need to reflect the new organizational structure and management initiatives.

3.4 Information for Decision-making

3.4.1 Information systems

An appropriate information system is an important element of any real property management framework, as historical, current, and reliable information is vital to an informed decision making and to the forecasting of future trends and needs. It was expected that the Department has established information systems that would provide complete, accurate, and current real property (physical and financial performance) information to support effective decision-making.

The Department maintains its real property information in a variety of systems, applications, and formats. The main information system used is PRIME (Physical Resources Information Mission Environment), which contains information on all of the Department's properties, including physical data, budget forecasts, acquisition, fit-up and lease costs, and disposal status. Since PRIME was created as an information repository, it has very limited reporting capacity. The Department's reporting software, Business Intelligence (BI) is an interface solution sometimes used to extract information on mission properties from various data bases such as PRIME and the Departments’ financial system (FAS), and prepare reports.

Missions and Property Program Division (ARA) staff share responsibility for the input of data on property assets and leases in PRIME. Quality control of this data is assured through review by Property Analysts on an on-going basis. Leasing and Disposal Officers review individual lease terms, floor space leased, budgetary projections, options and salient lease terms for input and verification at the time of the annual reference level update exercise.

Despite these controls, the audit team found that PRIME information is not always complete and accurate. For example, PRIME indicates that a chancery is being leased by the Kyiv mission while this is no longer relevant; Kyiv has recently acquired a chancery. Incomplete and inaccurate real property information can lead to ineffective decision-making.

Strategia is an integrated portal linking plans as well as planned and allocated budgets by all Department business lines including missions.

In addition to PRIME and Strategia, real property information is maintained in a variety of ways, including SQL databases, Excel worksheets, and Portable Document Format (PDF) documents and printed documents. With the information located in multiple locations and formats, manual intervention is often required in order to extract information relevant for reports.

Some of the information captured by the Department does not enable accurate reporting on current situation of assets. FAS records actual real property costs using a number of General Leger (GL) accounts to capture various types of real property information. The audit team noticed that FAS does not distinguish between capitalization and recapitalization expenditures for new real property investments. More specifically, new construction projects are coded under the same GL as betterment and major maintenance capital projects. This means that not only it will be very difficult for the Department to track the amount spent on maintenance and betterment, but also that the realty replacement cost may be misstated.

Building Condition Reports (BCR) describe the physical condition of properties following an in-person assessment. They are used to develop investment strategies and work plans for short-, medium- and long-term repair and recapitalization. Currently, the reports are requested on an ad hoc basis and are not centralized in one repository nor in a standardized format. Building condition reports, not being available for all properties, limit the Department’s ability to be well informed of the properties’ condition.

3.4.2 Performance Measurement

The audit team expected to find that the Department would have functionality and utilization information to determine what type of properties is needed, as well as relevant performance data to identify if properties are performing effectively and economically in delivering programs.

The audit team was provided with limited evidence of physical and financial performance measures being tracked by the Department on a periodic basis. For instance, the Space Utilization Index is tracked on an ad hoc basis every few years. Limited real property performance measures are disclosed in annual Department Performance Report.

A comprehensive real property performance framework with a suite of performance indicators such as facility condition index, cost per square meter or percentage of maintenance spending is not in place to assess real property portfolio performance and support informed appropriate and timely decisions. Therefore, senior management does not have all the required information to analyse performance and make informed decisions regarding program delivery.

Recommendation #3

The Assistant Deputy Minister of International Platform Branch should ensure that complete, accurate and timely information, and key performance indicators on the real property portfolio are provided to senior management for decision making.

3.5 Real Property Life Cycle Management

3.5.1 Investment Planning

The audit team expected to find that investments in real property assets abroad would be identified, analyzed and prioritized, taking into account: the departmental and Government of Canada objectives; internal and external risks and initiatives; operational and program needs, including mission and client requirements; priority criteria; and complete costs and funding availability.

The audit team found that the Department has developed a six-step investment planning process consisting of: 1) identifying business plan and priorities; 2) confirming the investment prioritization criteria; 3) identifying the investments; 4) analyzing the investments; 5) prioritizing the investments; and 6) approving the investment plan.

The review of a sample of four real property investments revealed that they were aligned with departmental and Government of Canada priorities and in response to operational and program needs that were well identified. The audit team found that for all investment projects reviewed, a risk assessment was completed using the Project Complexity Risk Assessment Tool. In addition, Baseline Threat Assessment supports two of those investments that were deemed to be “Government Imperatives”. All sample projects were subject to the prioritization model. The prioritization model for real property investments includes two “must do” categories (Business Continuity and Government Directive / Imperative) and five scored criteria (Security; Program Requirements; Health, Safety and Seismic; Cost Savings Opportunity; and Sound Stewardship). A rating weighting system was used to reflect the relative importance of each criterion.

The audit team found that the five-year investment plan and annual real property investment plans took into consideration estimated costs and funding known at the time of development. More specifically, the five-year investment plan provides total available funds and estimated costs under three categories: projects, assets and acquired services. The annual real property investment plans are strictly focused on capital requirements and related funding sources. They do not address investments under the categories “Assets” and “Acquired Services”.

The audit team was informed that a rough order of magnitude estimate is generally used for costing potential investments as well as those that are at a preliminary stage. As an initiative moves into the investigation, definition or implementation phases, available indicative or substantive estimates are taken into consideration in the development of the investment plans.

3.5.2 Acquisitions and Disposals

The audit team expected to find that acquisition and disposal decisions of real property assets abroad would be listed on either the five-year investment plan or subsequent annual real property investment plans, would be based on a thorough and documented analysis of all reasonable alternatives and would consider the cost-effectiveness over the life cycle of the asset.

Through its review of a sample of acquisition and disposal transactions, the audit team noted all transactions were supported by a rationale. The audit team found that one acquisition is associated with a project identified on the five-year investment plan for the period from 2015-2016 to 2019-2020. Another acquisition appears on the 2017-2018 annual real property investment plan. The audit team was unable to confirm if the other two acquisitions, which relate to the Official Residence Right-sizing Program, were included in the five-year departmental investment plan or in the annual real property investment plans. The audit team was not provided with a detailed list of projects supporting the amount of $715.1 million reported under the category “Projects” in the five-year departmental investment plan; only a list of major projects totalling $679.3 million was provided.

In addition, the information supporting the calculations for the amounts reported in the five-year departmental investment plan under the categories “Assets” and “Acquired Services” was not readily available. The lack of supporting calculation will make future adjustments of the plan difficult and less efficient.

Through its review of a sample of four acquisitions and one disposal transactions, the audit team found that all the transactions were based on a thorough and documented analysis of all reasonable alternatives and considered the cost-effectiveness over the life cycle of the asset.

For all acquisitions, relevant information was gathered and sent to an expert consulting firm for the purpose of calculating and validating the net present value of proposed options. Data factored into this cost-effectiveness analysis included, amongst others, the estimated asset purchase price, when applicable, the estimated asset residual value, and the estimated transaction costs such as operating and maintenance and recapitalization.

3.5.3 Maintenance

The audit team expected to find that real property maintenance investment decisions would be informed in order to maintain the real property portfolio in a sustainable and financially responsible manner.

The Planning and Stewardship Bureau (ARD) is the Office of Primary Interest (OPI) for maintenance and betterment with some responsibilities devolved to the mission. Funding of projects is allocated to priorities and assets are maintained on a risk-based assessment.

Potential maintenance and repair work identified through missions are captured through the annual planning cycle and are reflected in the Mission Property Management Plan (MPMP) and Mission Maintenance Workplan (MMW). The MPMP, which is updated annually, includes information on mission staff, properties and local property markets. It is regularly consulted by Portfolio Managers. The MMW includes a list of minor projects suggested by mission. Prioritization is based on risks and the related need to undertake urgent mitigation or repairs. It is developed in parallel with the MPMP for the upcoming fiscal year, and enables missions to indicate their expectations for repair projects. The MMW is stored in Strategia. Due to lack of expertise to plan projects and awareness of maintenance requirements at missions, these processes, and tools are limited to enable an integrated decision-making on maintenance programs priorities and resource management.

The audit noted that routine maintenance repairs are undertaken in a reactive manner due to the lack of planning and inspection. In addition, the audit team noted that although mission staff is responsible for routine maintenance, they sometimes execute this role in a limited manner. Reasons for this include: insufficient staff training and technical oversight, limited reference documents such as guidelines, misunderstanding of role, limited human and financial resources, and workload challenges. As a consequence, delays in maintenance activities may increase in the long run the likelihood of incurring higher maintenance and recapitalization costs.

Projects in excess of $10,000 and less than $500,000 fall under the responsibility of ARN, a division within ARD. The audit found that although funding of projects is based on a risk-based assessment, health and safety issues are given priority while maintenance issues are insufficiently funded.

The Treasury Board Guide to the Management of Real Property states that, at the strategic planning level, a rule of thumb is emerging in the public and private sectors that ascribes a notional amount that should be invested annually for the proper care of built assets. The informal rule of thumb is that a minimum 2 per cent of what it would cost to rebuild an asset is what should be invested annually for its maintenance and repair. Assuming that a built asset will last about 50 years, an additional 2 per cent should be invested in capital projects that renew the life of the asset. The rule of thumb for a minimum level of annual investment to maintain real property in good condition is therefore thought to be 4 per cent of replacement value.

The audit team found that spending in real property “asset lifecycle management” activities was forecasted to $284.6 million for the period from 2015-2016 to 2019-2020, representing a yearly average of $56.9 million. Compared against the TB guidelines recommending investing a minimum of 4 per cent of the real property replacement value, planned investments to improve real property asset conditions are well below the Department’s target range of $60 million to $120 million.

Furthermore, in the 2016-2017 Departmental Performance Report, it is stated that the Department spent $26.1 million for “Repair and Maintenance and Recapitalization”. With a portfolio value estimated at $3.1 billion, the percentage invested in the care of built assets (0.83%) is well under the required levels outlined in the TBS Guide, thus increasing the likelihood that real properties are not maintained at an acceptable level.

Without reliable information on building conditions, and the associated cost of required maintenance and repair activities, it is difficult for decision-makers to assess the appropriate allocation of resources in order to maintain the real property portfolio in a sustainable and financially responsible manner.

Recommendation #4

The Assistant Deputy Minister of International Platform Branch should increase support for building maintenance by revamping procedures, guidelines and tools to support missions in their role.

4. Conclusion

The audit concluded that while progress has been made in responding to recommendations from previous internal audit and third-party review, more emphasis needs to be put on the completion of those recommendations. In addition, the Department lacks a proactive and strategic approach in managing its real property portfolio. More importantly, significant efforts are required to improve the quality of information used for decision-making on the life cycle management of real property.

Appendix A: About the Audit

Objective

The objective of this audit was to provide assurance that Global Affairs Canada’s real property life cycle management decisions are adequately informed and support the achievement of the government-wide and departmental program objectives in a cost-effective manner.

Scope

The audit examined Global Affairs Canada’s decision-making process including how decisions are made, informed and supported throughout the life cycle of the real property management (i.e. investment planning, acquisition, use and occupancy, disposal). The audit examined Global Affairs Canada’s real property abroad with a focus only on Global Affairs Canada’s Crown-owned and Crown-leased properties. The audit covered the period from April 2015 to March 2017. The audit also assessed the progress made in response to recommendations from previous audits and studies that relate to our audit objective.

The following areas were excluded from the audit:

- Real property located in Canada, as Public Service and Procurement Canada is the custodian of these properties

- Privately-leased properties, as an evaluation on private leases is currently planned by the Evaluation Branch

- The use of real property by other government departments

- Physical security, as this will be the focus of a separate internal audit

As detailed below, we reviewed a sample of real property investments, acquisition and disposal transactions, and mission maintenance and betterment activities and projects.

| Mission | Review of Investment Planning Process | Review of Acquisition Process | Review of Disposal Process | Review of Maintenance Activities Funded Through the Missions’ Budgets | Review of Mission Minor Maintenance and Betterment Projects Funded Through ARNF Related Programs |

|---|---|---|---|---|---|

| Paris | ✗ | ✗ | |||

| Tel Aviv | ✗ | ||||

| Nairobi | ✗ | ||||

| Abuja | ✗ | ✗ | ✗ | ||

| Kyiv | ✗ | ✗ | |||

| Seoul | ✗ | ✗ | ✗ | ||

| Cairo (site visit) | |||||

| Algiers (site visit) | ✗ | ||||

| Nairobi (site visit) | ✗ | ✗ | |||

| Moscow (site visit) | ✗ | ||||

| Riyadh | ✗ | ||||

| Washington | ✗ |

Criteria

Criteria were developed based on a detailed risk assessment.

| Criterion 1 | The real property investment plan reflects the departmental and government-wide objectives. |

| Criterion 2 | Decisions for real property acquisition and disposal are supported by adequate analysis of reasonable alternatives to meet operational needs in a cost-effective manner. |

| Criterion 3 | Maintenance decisions ensure that real properties are managed in a sustainable and financially responsible manner. |

| Criterion 4 | Real property information, including physical and financial performance of real property assets abroad, is recorded in the departmental systems for decision-making, monitoring, and reporting purposes. |

Methodology

The audit was conducted in accordance with the Government of Canada Policy on Internal Audit and the Internal Audit Standards for the Government of Canada. These standards require that the audit be planned and performed in such a way as to obtain reasonable assurance that the audit objective is achieved. In order to conclude on the audit objectives, the following methods were used to gather evidence:

- Identify and review relevant regulations, policies, and directives

- Review and analyze relevant documents related to operations

- Review previous audits and a third-party review of real property function to assess the status of management action plan implementation

- Conduct walkthroughs of processes and systems, and identification of key controls

- Interview key departmental officials

- Perform data analysis

- Perform analysis of financial and non-financial information

- Review a sample of real property investments, acquisition and disposal transactions, and maintenance activities undertaken by the missions

- Apply other relevant methods as deemed necessary by the audit team

Appendix B: Current Transformative Initiatives

In 1993, the Physical Resources Bureau was granted a Special Operating Agency (SOA) status to facilitate the development and implementation of major real property projects abroad. On November 1, 2006, the Treasury Board Policy Framework for the Management of Assets and Acquired Services took effect and became applicable to the Department, regardless of Physical Resources Bureau’s SOA status. This policy framework and its associated policy instruments set the direction for the management of assets and acquired services to ensure the conduct of these activities provides value for money and demonstrates sound stewardship in program delivery.

As a result, several policy requirements were not implemented within ARD and resulted in recommendations in the 2011 internal audit of real property. Since then, the Department has made strides to better exercise due diligence, provide sound stewardship and improve its decision-making capabilities.

Furthermore, an independent review of the international real property program administered by the Physical Resource Bureau was undertaken in 2015. Building on the recommendations of the third-party report, a high level Action Plan and related Real Property Transformation Work Plan were developed. Several initiatives are presently proceeding to enhance the organizational and governance structure, develop accountability and client engagement frameworks, establish global and regional real property portfolio plans, modernize the information systems, and review the funding model for the purpose of improving real property life cycle management.

A Branch Change Management Office was established to monitor and report on the implementation progress as well as to support the work of the managers assigned to deliver on each of the recommendations. The intended timeline of 2017-2018 to fully implement all recommendations was extended to 2018-2019.

One of the most urgent goals of the action plan was the restructuration of the Physical Resource Bureau by dividing it into 2 Bureau: one with a strong owner-investor function and the other responsible for project delivery and related services.

Several transformational initiatives have recently been initiated and / or are currently being implemented to enhance long-term real property strategic planning. New positions are in process of being created to establish organizational unit whose mandate will be to support the development of global and regional portfolio plans, and asset management.

A Client Engagement section is being created in ARA. First task will be developing a Client Engagement Framework to facilitate the management of client demands and related funding, which in turn will facilitate investment planning decision-making and result in a better alignment of service planning with delivery and client requirements. Completion is expected by the end of fiscal year 2018-2019.

Management expects to identify options to the approach consisting of integrating client requirements within the global and regional portfolio plans, and to identify potential solutions for improved supply management by the end of fiscal year 2017-2018.

The Department conducted a mission survey in 2016 that focused on the condition of main building components. Management plans to use the results of the survey to identify properties that should be considered high priorities for the completion of building condition reports/property condition assessments.

A strategy and plan to conduct Building Condition Reports in priority missions has been developed. This initiative will be launched shortly.

An IM / IT Needs Assessment project has been launched. The Governance Committee composed of ARD, AWD and Information Management and Technology Bureau (SID) Directors General to provide advice and guidance on real property information management (IM) and information technology (IT) systems. Consultations with other government departments as well as a market survey of IM/IT vendors were completed and shared with the Governance Committee. A consultation and need gathering plan has been developed and internal consultations are nearly completed. Recommendations are expected by the end of December 2017.

Management intends to consult Finance Canada and the Treasury Board secretariat to discuss funding gaps and options to increase flexibility and sources of funds. A report on funding sustainability, including a feasibility assessment, flexibilities and implementation plans, is expected by the end of fiscal year 2017-2018 for the Department and Central Agencies’ endorsement.

Appendix C: Real Property Life Cycle Management Decision-making Process Flow

Text version

The flowchart illustrates Global Affairs Canada’s Real Property Life Cycle Management Decision-making Process.

The different steps of the process and the actors involved are presented below in order:

1. Five-Year Investment Plan:

Start

- Planning and Stewardship Bureau (ARD) / Project Delivery, Professional and Technical Services Bureau (AWD):

- Process/Activity: ARD prioritizes Real Property investments and provides input to Global Affairs Canada’s 5-year Investment Plan (Decision-making point 1). Decision-making point 1 is supported by the following database and stakeholders:

- Database: Major Project Status Reporting

- Stakeholders:

- Mission Property Management Plans

- Mission Maintenance Workplan

- Building Condition Reports

- Bureau-level Committees:

- Process/Activity: Bureau Management Committee comments on and recommends the Investment Plan (Decision-making point 2)

- Corporate Committees:

- Process/Activity: Mission Committee comments on and recommends the Investment Plan (Decision-making point 3)

- Process/Activity: Endorsement of Investment Plan by Resource Management Committee and Corporate Management Committee (Decision-making point 4)

- Process/Activity: Endorsement of Investment Plan by the Executive Board (Decision-making point 5)

- Deputy Minister/Minister:

- Process/Activity: Deputy Minister and Minister approve the Investment Plan (Decision-making point 6)

- Treasury Board:

- Process/Activity: Treasury Board approves the Investment Plan (Decision-making point 7)

End

2. Acquisition:

Start

- ARD/AWD:

- Process/Activity: Lead identifies a real property need or opportunity (Decision-making point 1)

- Bureau-level Committees:

- Process/Activity: Governing body approves (Decision-making point 2)

- Stakeholders:

- Process/Activity: Stakeholder representatives confirm transaction scope

- ARD/AWD:

- Document: Definition Feasibility Report

If it is within authorities:

- Bureau-level Committees:

- Process/Activity: Governing body approves (Decision-making point 3)

End

If it exceeds authorities:

- Treasury Board:

- Process/Activity: Treasury Board approves acquisition (Decision-making point 3)

End

3. Use and Occupancy:

Start

- Stakeholders:

- Process/Activity: Mission identifies a maintenance need (Decision-making point 1)

If the project costs less than $10,000:

- Process/Activity: Head of Mission approves (Decision-making point 2)

End

If the project costs more than $10,000:

- Document: Mission Maintenance Workplan

- ARD/AWD:

- Process/Activity: Life Cycle Management (ARNF) ranks projects (Decision-making point 2)

- Bureau-level Committees:

- Process/Activity: Program Review Committee approves program budget (Decision-making point 3)

- ARD/AWD:

- Document: ARNF Annual Work Plan

- Process/Activity: ARNF Director approves project (Decision-making point 4)

End

4. Disposal:

Start

- Bureau-level Committees:

- Document: Program Review Committee approves ARD Work Plan (Decision-making point 1)

- ARD/AWD:

- Process/Activity: Disposal Officer chooses method of sale (Decision-making point 2)

- Document: Disposal Officer prepares a Project Approval Form

- Process/Activity: ARD approves disposal/offers (Decision-making point 3)

If the disposal exceeds authority:

- Treasury Board:

- Process/Activity: Treasury Board approves disposal/offers (Decision-making point 4)

End

Appendix D: Audit Recommendations and Management Action Plan

| Audit Recommendations | Management Action Plan | Area Responsible | Expected Completion Date |

|---|---|---|---|

| 1. The Assistant Deputy Minister of International Platform Branch should ensure that the investment planning process is supported by a real property strategy and asset management plans. | The Global Portfolio Management Section has been established and will develop a real property strategy including elements such as site master plans, surplus space strategy and sustainable development strategy, and related asset management plans. Building condition reports for crown-owned chanceries and official residences will be completed by an external service provider in collaboration with missions. | ACM / ARD / ARA | December 2018 |

| 2. The Assistant Deputy Minister of International Platform Branch should update relevant source documents to reflect recent changes to the organizational structure and to ensure alignment with Treasury Board Policy requirements. | Source documents will be updated to reflect recent changes to the organizational structure. | ACM / ARD / ARO | March 2018 |

| 3. The Assistant Deputy Minister of International Platform Branch should ensure that complete, accurate and timely information, and key performance indicators on the real property portfolio are provided to senior management for decision making. | Existing key performance indicators for chanceries which include facility condition rating, space utilization index and seismic risk estimation will be operationalized in a timely manner to support strategy development and senior decision making. A Real Property IM/IT Needs Assessment will be completed recommending the adoption of an Integrated Workplace Management System (IWMS) product to bring together in one real property solution all of the processes, date and analytics necessary to run a corporate real estate program, publish key performance indicators and facilitate decision making. | ACM / ARD / ARO / ARA | March 2018 |

| 4. The Assistant Deputy Minister of International Platform Branch should increase support for building maintenance by revamping procedures, guidelines and tools to support missions in their role. | The International Platform branch will ensure that mission employees are given access to updated reference documents such as real property guidelines, tools and procedures in order to support them in their roles. Support functions will be reinforced with web-based training and online documentation. | ACM / ARN | December 2018 |

- Date modified: