Renewing Canada’s IES - Proposed pillar: Diversification in international education

Published on March 1, 2023

Overview

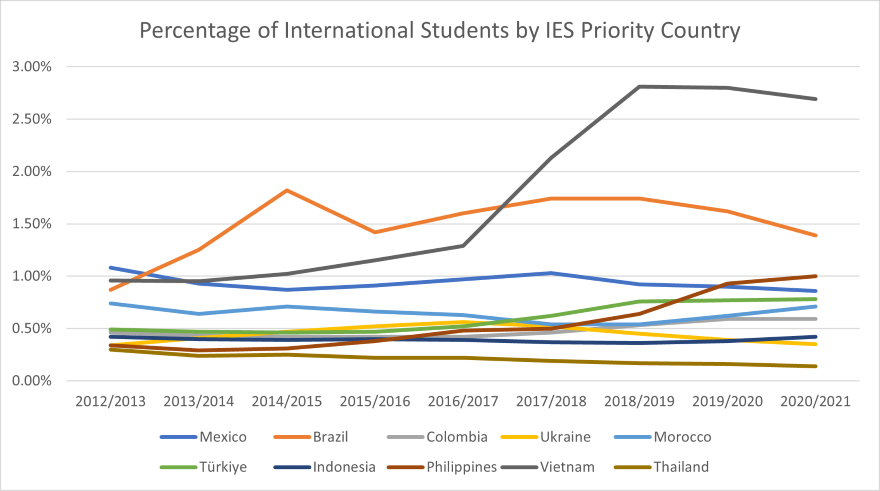

Diversification was one of the key pillars of the 2019-2024 International Education Strategy. The 2019 strategy committed to “increasing the diversity of inbound student populations, skill sets and programs” in order to “help build labour markets, spur economic development in target regions and industries, and support diversity at Canada’s educational institutions”. The 2019 strategy also identified 11 priority countries for diversification in student recruitment, Brazil, Colombia, France, Indonesia, Mexico, Morocco, the Philippines, Thailand, Türkiye, the Ukraine and Vietnam.

Figure 1: Percentage of international students by IES priority country

View accessible version of figure 1

The COVID-19 pandemic had a negative impact on the GoC’s diversification efforts as travel restrictions hindered travel to new and emerging markets, and Government of Canada decisions limited advertising campaigns. Nonetheless, GAC worked with IRCC to operationalize the diversification pillar over the last four years. This has taken various forms, based on the tools and platforms available. Key initiatives have included: GAC’s advertising campaigns, the scholarships program, promoting diversification in incoming international student cohorts through the TCS network abroad and launching a labour market study to identify labour market and skills gaps in Canada in order to diversify areas of international students.

Meanwhile new and improved scholarship options, including the Study in Canada Scholarships have increased the opportunities for Canadian post-secondary institutions to welcome international students from a wider range of backgrounds and countries. For the academic year 2022-23, the program’s uptake increased significantly as a sign of post-COVID mobility recovery: 198 applications were received and 131 students were selected from 20 countries across Africa, the MENA region, Europe, and Asia.

Since 2019 the Trade Commissioner Service (TCS) has reduced the proportion of officers dedicated to education in some oversubscribed markets like China and India. The officers that remain involved in education in those markets have shifted their focus on diversifying the source regions within their markets, and on promoting commercial outcomes such as corporate/executive training as well as institutional partnerships. At the same time, the TCS has increased the funding of promotion activities in key priority markets identified for diversification under the IES, and grown its presence at education-related events, promoting education-related outcomes as well as providing platforms for client institutions to both recruit and partner. Most of this work was done virtually during the pandemic, but since fall 2022 in-person activities have resumed.

In digital marketing, GAC has sought to diversify its reach to prospective students by executing its annual digital advertising campaigns in up to 25 markets, across all major continents, and in nine languages. The campaigns promote all levels of study and highlight the diverse regions across Canada as study destinations. In addition, country-specific content on www.EduCanada.ca is now available in several third-languages to align with IES priority countries. Finally, GAC manages an active presence on social media (Facebook, LinkedIn, Instagram, and YouTube) under the EduCanada brand, to attract and engage with international students. International users account for approximately 90% of followers on Instagram and Facebook with Brazil, Mexico, Bangladesh, Côte d’Ivoire and Morocco as top markets.

Despite GAC’s efforts, in a review of recent trends in international student behaviour released in 2022 by Statistics Canada, it was noted that, despite its growing size, the international student population in Canada has become less diverse over the past two decades in terms of source countries, destinations in Canada, and fields of study. India and China remain the two primary source countries of international students to Canada, accounting for approximately 50% of our total international student population.

It is clear that more work lies ahead on this critical pillar for the international education sector and diversification will continue to feature as one of the key pillars of the next version of the strategy. In the next iteration, the definition of diversification will be expanded to include not only diversification of source country, but also diversification of destinations within Canada, programs and study levels, as well as regional diversification within source countries.

Current trends

Source countries

- According to StatsCan, from 2010/2011 to 2020/21 the largest source countries for international students shifted, with the top 5 countries changing from China, France, India, United States, and South Korea in 2010/11 to India, China, France, Iran, and Vietnam in 2020/21. The greatest growth came from India (1,078%), while the only significant decline was Saudi Arabia (-72%).

- In 2021, the majority of international students, 35% and 17% respectively, came from India and China.

The majority of international students from India come from India’s northern regions, and in particular from Punjab. This leaves enormous opportunity for Canada to diversify to other regions in India such as the South, East and West, given that those regions are home to some of India’s longest and most-established schools and post-secondary institutions.

With China, there has been a decline in student numbers. Strict and long-lasting Chinese COVID-19 restrictions have also had a notable impact on the number of Chinese students going abroad. While COVID-related travel restrictions have now been lifted by China, the effects of this policy may continue to be felt as Chinese students remain more reluctant to travel and study abroad. The number of Chinese students studying abroad is not expected to fully rebound to pre-COVID levels as it is expected that fewer Chinese students will come to Canada in the future as China grows its domestic offer of high quality education, favouring self-sufficiency over international education. As China’s domestic capacity continues to grow and with declining demographics, its school-aged cohort continues to decline, and fewer Chinese students will choose to study abroad, including in Canada, making it even more imperative for Canada to diversify and attract students from new and emerging markets.

Destinations within Canada

- For destinations within Canada, Ontario, Quebec, and British Colombia have consistently attracted the largest share of international students, with the percentage growing from 80% in 2010/11 to 83% in 2020/21.

- Toronto (222,000), Vancouver (141,000), and Montreal (93,000) accounted for roughly 54% of all international students in 2021. From 2010/11 to 2020/21, of the three cities, Toronto saw the highest growth in number of international students (178%) followed by Montreal (153%) and Vancouver (112%).

Study levels

- For study levels, the share of international students in college programs grew from 24.4% in 2010/11 to 38% in 2020/21, while at the university level during the same period the share dropped from 75.6% to 61.9%.

- Within universities, from 2010/11 to 2020/21 the share of international students studying at the bachelor’s degree level grew from 59.4% to 67.2%, the master’s degree level remained relatively stable, shrinking from 19% to 18.5%, while at the doctoral level the share declined from 10.5% to 9.5%.

- From 2000 to 2019, there were drops in the proportion of international students studying at the primary level (10% to 5%), secondary level (18% to 11%), while the proportion of non-university postsecondary programs grew from 27% in 2000 to 41% in 2019.

- According to Languages Canada, in 2021 there were 53,686 international students studying a language program in Canada, down 62.5% from 2012 (the earliest year statistics are available). The decline can be partly attributed to the increase in supply of language programs offered within international students’ home countries, as well as the proliferation of language learning IT tools and apps.

Programs of study

- Looking at programs of study, according to Statistics Canada, from 2010/11 to 2020/21 the proportion of international students studying in STEM programs grew from 29.5% to 35.8%, outpacing Canadian students (18.8% to 23.6%), and driven largely by an increase in students studying mathematics and computer and information sciences (395% growth).

- Business and administration continues to be the most popular field of study, constituting 30% of all international students in 2020/21. Health care, education, and legal studies continue to be the fields of study with the lowest number of students, constituting 4%, .08%, and .05% respectively.

The way forward: Diversification and IES 2024

- Diversification will continue to be an important theme in the next iteration of the IES, and will include a comprehensive definition of diversification including diversification of destinations within Canada, diversification of programs, study levels and regional diversification within source countries.

- Regional diversification within our top source countries will also be an important element of the next IES. The proportion of Indian international students in Canada has grown significantly over the last 10 years, growing from 7% in 2010/11 to 31% in 2020/21. A significant share of these students are concentrated from the region of Punjab, while other areas of the country are relatively underrepresented. Indian international students predominantly study at the college level in Canada (69%) and of those students 50% are in business and administration programs. Many of these students choose to study at the college level as they see it as a pathway to Canadian PR, thus using the Canadian education system for their immigration objectives. Students from India, specifically Punjab, have faced increasing rejection rates on their study permits, reaching up to 50%, and tend to be those most impacted by the actions of unscrupulous education agents. Ensuring that these students have the tools to succeed, and are not victimized in the process of applying to Canadian education institutions, while encouraging diversification into other regions of the country, will benefit both Canada and the more vulnerable students from Punjab.

- Canada’s recently released Indo-Pacific Strategy is an ambitious, comprehensive and integrated policy framework for Canadian engagement across the Indo-Pacific region. It is supported by new investments totaling nearly $2.3 billion over five years across a wide range of programs, and is a whole-of-government strategy to step up Canada’s presence and engagement in the region over the next decade.

- The Indo-Pacific Strategy is well aligned with Canada’s current International Education Strategy objectives, including diversification of student recruitment from countries in the region and deepening of regional expertise and ties through mobility. While initiatives are still under development, some of them will directly support Canada’s international education efforts, for example through the expansion of the Canada-ASEAN Scholarships and Educational Exchanges for Development (SEED) program; the bolstering of visa processing in the region and the Indo-Pacific Engagement Initiative, which will provide Canadian students and researchers with new study and research opportunities in and on the region, and support network building in the Indo-Pacific to strengthen Canada’s voice on priority issues and create partnerships.

- In terms of diversity of location within Canada, increasing the diversity of study locations within Canada can spread the burden on services that can be seen in some communities, while spreading the economic benefits of international students more equitably. Increasing international student enrollment at smaller urban and peri-urban centres, in particular, should be a priority as international students can add greater diversity, and post-graduation contribute to labour market gaps in those communities.

- Aligning labour market and skills gaps will continue to be a critical pillar of the next IES, and a theme that other competitor countries are also focusing efforts on. In order to respond Canada’s ongoing labour market challenges, and as outlined in the 2019 IES, Global Affairs Canada has launched a labour market study to identify top areas of labour market and skills gaps in Canada both at the national as well as the provincial, territorial levels. The results from this study will be used to inform GAC’s digital marketing campaigns and used on other platforms (such as the EduCanada website and other EduCanada social media platforms), in the hopes of influencing prospective students to study areas aligned with Canada’s labour shortages. Diversifying the field of studies away from programs that face an overabundance of workers or more general programs, to those which are facing shortages, will create new opportunities for international students, especially those interested pathways to permanent residency, and will ultimately lead to diversification in programs of studies.

- The next iteration of the IES will also explore greater diversification within the different study levels. As numbers indicate, Canada currently attracts the largest share of students at the College and University (Bachelor) level. The next iteration of the strategy will focus greater effort in promoting programs at the Master’s and PhD levels, as well as, Elementary/Secondary education, language education and French language institutions outside of Quebec.

Questions

- What initiatives could the GAC and the Trade Commissioner Service implement to better diversify Canada’s international student cohort?

- Is expanding the definition of diversification to include destination of study, study programs and levels, as well as regional diversity within our top source countries an important priority?

- Do you foresee any challenges in Canada’s diversification efforts?

- What are your priority markets and/or regions for the next 3-5 years? What were the main factors in deciding those markets?

- Should we align IES diversification efforts with the markets highlighted in the Indo-Pacific strategy?

- Which markets do you see as offering the strongest potential for growth?

- Date Modified: