Audit of repayable contributions

Global Affairs Canada

Office of the Chief Audit Executive

Tabling Date

September 2018

Table of Contents

- Executive summary

- 1. Background

- 2. Audit objective and scope

- 3. Observations and recommendations

- 4. Conclusion

- Appendix A: About the audit

- Appendix B: Repayable contribution arrangements

- Appendix C: Global Affairs Canada repayable contributions business processes

- Appendix D: Management Action Plan

- Appendix E: Acronyms and definitions

Executive summary

The Audit of Repayable Contributions was identified as part of the Global Affairs Canada 2017-2020 Risk Based Audit Plan, and recommended by the Departmental Audit Committee for approval by the Deputy Minister.

Why it is important

This audit is important because the Government of Canada, mainly through Global Affairs Canada, has committed to provide $2.65 billionFootnote 1 to help developing countries adapt to climate change and mitigate its adverse effects. The majority of this climate financing to date is made of repayable contributions to Multilateral Development Banks in order to achieve specific objectives using blended finance. Canada is a leader in blended finance, which constitutes a new and innovative approach that Global Affairs Canada will increasingly use to deliver international assistance. In Federal Budget 2018, the Government of Canada announced that Global Affairs Canada will provide an additional $1.5 billion over five years in repayable contributions to two new programs in order to support innovation in Canada’s international assistance.

What was examined

The objective of this audit was to provide reasonable assurance that a management control framework for repayable contributions programs is adequately designed and effective to support Global Affairs Canada in meeting its priorities, and its compliance with the applicable Treasury Board policies, directives and operational standards.

The audit focused on the key components of a management control framework, such as the governance structure and strategic direction, roles and responsibilities, risk management practice, and monitoring and reporting on results.

The audit covered all eight (8) repayable contribution initiatives approved to date, including six (6) signed repayable contribution arrangements and two repayable contribution initiatives that had no signed arrangement at the time of the audit.

What was found

The Department has put in place key effective measures that, while put together, form most of the expected elements of a management control framework to ensure that it meets governmental priorities and it is generally compliant with the applicable Treasury Board policies, directives and operational standards. Areas for improvement are identified below.

The audit team found that the Government’s strategic direction was reflected into the repayable contribution arrangements. However, the Department did not define a policy and programming strategy at the departmental level to manage its growing portfolio of arrangements. The Department has demonstrated progress in clarifying roles and responsibilities by creating the Office of Innovative Finance that supports Programs’ programming of repayable contributions and term sheets defining respective roles and responsibilities. However, there are areas where roles and responsibilities are still not formally defined, especially after arrangements have been signed.

The audit team found that, at the initiative level, the Department has exercised due diligence for managing risks associated with repayable contributions, in compliance with applicable government policies. However, the Department did not have a tailored risk management framework for its repayable contribution portfolio. This will be especially important given the Budget 2018 announcement of an additional $1.5 billion in concessional funding over five years to support innovation in Canada’s international assistance.

The audit team found that Global Affairs Canada is exercising oversight over repayable contributions through different means that vary based on the type of funding arrangement. The Office of Innovative Finance and Programs have developed tools to monitor the implementation of the arrangements, such as performance and financial status. The Department receives performance information for each arrangement. However, the format of project results presentation does not always facilitate progress review against indicators. Nevertheless, the audit team found improvement in the most recent performance reporting from recipients. Finally, the audit team found that the Department did not yet have formal business processes to manage repayments.

Conclusion

The Department has put in place key effective measures that, while put together, form most of the expected elements of a management control framework to ensure that it meets governmental priorities and it is generally compliant with the applicable Treasury Board policies, directives and operational standards.

Areas for improvement were identified as establishing a formal governance structure for repayable contributions, including clarifying accountabilities, developing a risk management framework, ensuring full compliance with applicable accounting standards, and formalizing the repayment tracking process.

Recommendations:

- Recommendation #1: The Assistant Deputy Minister of Corporate Planning, Finance and Information Technology and Chief Financial Officer, the Assistant Deputy Minister of Global Issues and Development, the Assistant Deputy Minister of Sub-Saharan Africa, and the other Geographic Assistant Deputy Ministers (Europe, Maghreb & Middle East, Americas, and Asia Pacific) should designate a single accountability point to provide a departmental strategic direction for the use of repayable contributions and to further clarify and formally define roles and responsibilities of all relevant branches.

- Recommendation #2: The Assistant Deputy Minister of Corporate Planning, Finance and Information Technology and Chief Financial Officer, the Assistant Deputy Minister of Global Issues and Development, the Assistant Deputy Minister of Sub-Saharan Africa, and the other Geographic Assistant Deputy Ministers (Europe, Maghreb & Middle East, Americas, and Asia Pacific) should develop a risk management framework tailored to repayable contributions portfolio and integrated to the corporate risk profile to ensure that risks specifically associated with this financial instrument are systematically, strategically, and more thoroughly identified, assessed, and mitigated.

- Recommendation #3: The Assistant Deputy Minister of Corporate Planning, Finance and Information Technology and Chief Financial Officer should ensure that the future terms of repayable contribution arrangements clearly support the Department’s accounting of these arrangements, and review the approach for the accounting and presentation of the repayable contributions to ensure consistency with applicable accounting standards.

- Recommendation #4: The Assistant Deputy Minister of Global Issues and Development and the Geographic Assistant Deputy Ministers (Sub-Saharan Africa, Europe, Maghreb & Middle East, Americas, and Asia Pacific) should ensure that the recipients of repayable contributions consistently and clearly report results against pre-defined performance indicators.

- Recommendation #5: The Assistant Deputy Minister of Global Issues and Development and the Geographic Assistant Deputy Ministers (Sub-Saharan Africa, Europe, Maghreb & Middle East, Americas, and Asia Pacific) and the Assistant Deputy Minister of Corporate Planning, Finance and Information Technology and Chief Financial Officer should formalize repayment tracking process to ensure that repayments are recorded in a timely manner.

Statement of Conformance

In my professional judgment as Chief Audit Executive, this audit was conducted in conformance with the Institute of Internal Auditors' International Standards for the Professional Practice of Internal Auditing and with the Treasury Board Policy and Directive on Internal Audit, as supported by the results of the quality assurance and improvement program. Sufficient and appropriate audit procedures were conducted, and evidence gathered, to support the accuracy of the findings and conclusion in this report, and to provide an audit level of assurance. The findings and conclusion are based on a comparison of the conditions, as they existed at the time, against pre-established audit criteria that were agreed upon with management and are only applicable to the entity examined and for the scope and time period covered by the audit.

Chief Audit Executive

1. Background

The Audit of Repayable Contributions was identified as part of the Global Affairs Canada 2017-2020 Risk Based Audit Plan, and recommended by the Departmental Audit Committee for approval by the Deputy Minister.

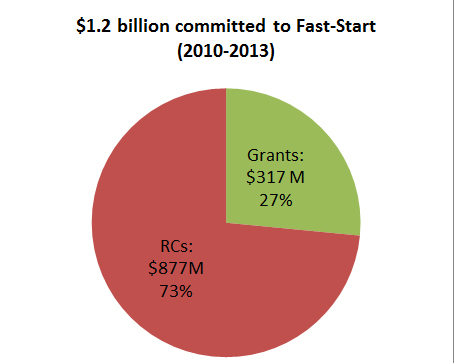

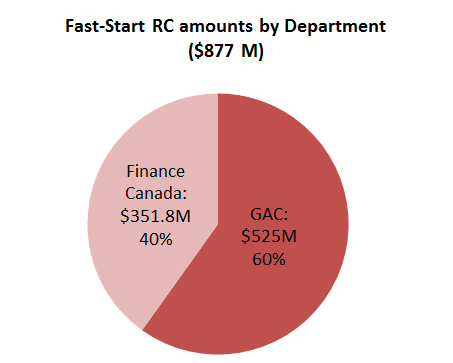

In December 2009, Canada endorsed the Copenhagen Accord, a global agreement signed under the United Nations Framework Convention on Climate Change. According to the terms of this agreement, developed countries have committed to provide “fast-start financing” of approximately US$30 billion for the period of 2010-2011 to 2012-2013. To fulfill its share of this commitment, Canada delivered $1.2 billion in funding to developing countries over this period. Through the mechanism of fast-start financing, Canada provided both grants ($317 million) and repayable contributions ($877 million) to various partners and recipients, including repayable contributions to Multilateral Development Banks (MDBs). Canada’s repayable contributions served largely to catalyze private sector investments in climate change mitigation and adaptation projects that would otherwise not have been viable without Canada’s concessional finance.

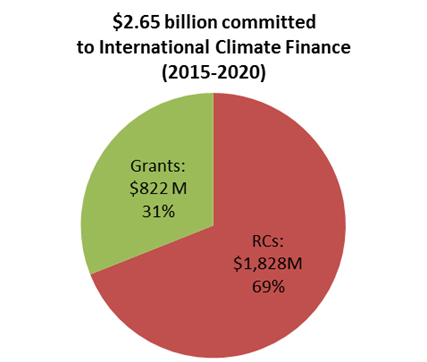

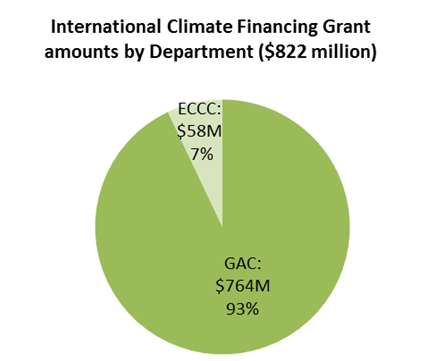

In November 2015, in the lead up to the Paris Climate Conference, the Prime Minister announced Canada’s climate finance commitment of $2.65 billion by 2020-2021. This commitment was reiterated in Budget 2016 and is Canada’s largest international climate finance commitment to date. This commitment is intended to help developing countries transition to low-carbon economies and adapt to climate change. Of the $2.65 billion climate financing commitment, $1,828 million is in the form of repayable contributions, with the balance of $822 million in the form of grants. Global Affairs Canada (GAC) plays a key role in delivering on Canada’s climate commitment. The Department is expected to program the full amount ($1,828 million) of the repayable contribution allocation and $764 million (93%) of the grants. Environment and Climate Change Canada (ECCC) will deliver on the remaining 7% of grant funding. See Charts 1 and 2 for detailed distribution by departments and type of funding.

Canada’s new $2.65 billion climate finance approach builds from the fast-start experience and will continue to use repayable contributions to work with multilateral and private partners and to scale up the leveraging of private sector resources. More recently in the Federal Budget 2018, the Government of Canada announced that $1.5 billion over five years would be provided to two new programs to support innovation in Canada’s international assistance: the International Assistance Innovation Program and the Sovereign Loans Program. The parameters of the funding envelope imply that non-grant, repayable funding will be provided to support innovative programming. This announcement was aligned with Canada's Feminist International Assistance Policy that charts a new way forward for Canada's Official Development Aid.

Chart 1 - Distribution of funds for Fast-Start Climate Finance commitmentsFootnote 2

Text version

Chart 1 - Distribution of funds for Fast-Start Climate Finance commitments

Between 2010 and 2013, Canada provided $1.2 billion in funding to Multilateral Development Banks. Through the mechanism of Fast-Start financing, 27% of the Canada funds was provided in the form of grants ($317 million) and 73% in the form of repayable contributions ($877 million) to recipients including repayable contributions to Multilateral Development Banks. Canada’s repayable contributions serve largely to catalyze private sector investments in climate change mitigation and adaptation projects that would otherwise not have been viable without Canada’s concessional finance.

Text version

The Fast-Start repayable contributions envelop of $877 million was split between Finance Canada and Global Affairs Canada. Global Affairs Canada was responsible to deliver $525 million (60%) of the funding while Finance Canada was responsible to deliver $351.8 million (40%).

Note: The grant portion under Fast-Start was disbursed in full by GAC.

Chart 2 - Distribution of funds for International Climate Finance commitmentsFootnote 3

Text version

Of the $2.65 billion in climate financing commitment from 2015 - 2020, $1,828 million (69%) is in the form of repayable contributions, with the balance of $822 million (31%) in the form of grants.

Text version

Of the $822 million in the form of grants, Global Affairs Canada is expected to program $764 million (93%) of the grants and Environment and Climate Change Canada will deliver on the remaining $58 million (7%) of grant funding.

Note: The RC portion under international climate finance will be fully disbursed by GAC.Departmental Context

The Department uses grants and contributions to fulfill its mandate for the majority of its programs. While the current Department's international development assistance toolkit largely limits its partners to primarily not-for-profit entities, repayable contributions were introduced on an ad hoc basis with exceptional Treasury Board authorities as a suitable funding instrument for effectively working with various recipients to finance revenue-generating projects, such as renewable energy. Canada is now considered to be a world leader in using blended finance to deliver its international development assistance.

The following policy parameters are used to guide the Departmental position in funding instrument negotiations related to the $2.65 billion climate finance envelop:

- All projects will have direct, measurable climate change mitigation and/or adaptation benefits that are documented;

- There must be an effort made to include projects that address adaptation, where possible;

- Gender equality, particularly the empowerment of women and girls, will be maximized;

- Private sector investment must be leveraged; and,

- Projects will focus on the poorest and most vulnerable by giving preference to low and lower-middle-income countries when possible.

Contributions that are to be repayable, conditionally or unconditionally, are considered transfer payments and as such are governed by the Treasury Board Policy on Transfer Payments and its directive. The Department currently has no conditionally repayable contribution initiatives but eight (8) unconditionally repayable contributions (URC) initiatives that have obtained Treasury Board authorities to enter into negotiation, of which six (6) had signed arrangements at the time the audit team conducted its work while a seventh one was signed after the audit team had completed its work. The total value of these initiatives, as approved by Treasury Board, is $1,458.5 M. See Appendix B for detailed list of repayable contribution initiatives.

In May 2018, the Minister of the Department obtained the authority to use Conditionally Repayable Contributions to deliver Canada’s official international development aid.

Stakeholders

Due to the nature of the current repayable contribution initiatives that focuses on global climate change, at this time, repayable contributions are administered and managed by two Bureaus at the Department: seven (7) out of the eight (8) repayable contribution initiatives are managed by Food Security and Environment Bureau (MSD) within the Global Issues and Development Branch (MFM), and one initiative is managed by the Pan-Africa Bureau (WFD) within the Sub-Saharan Africa Branch (WGM).

While Programs (MSD and WFD) maintain ownership of the projects, the Office of the Chief Financial Officer (OCFO) established the Office of Innovative Finance during fiscal year 2016-17 to formalize the Department’s specialized financial engineering and contractual expertise and to ensure sound stewardship of the departmental repayable contributions portfolio. In addition, the OIF, in collaboration

with other SCM units, plays a leading role in the interpretation of the Transfer Payment Policy and Directive related to repayable contributions, interpretation and guidance regarding authorities, and support related to other relevant Government of Canada financial policies.

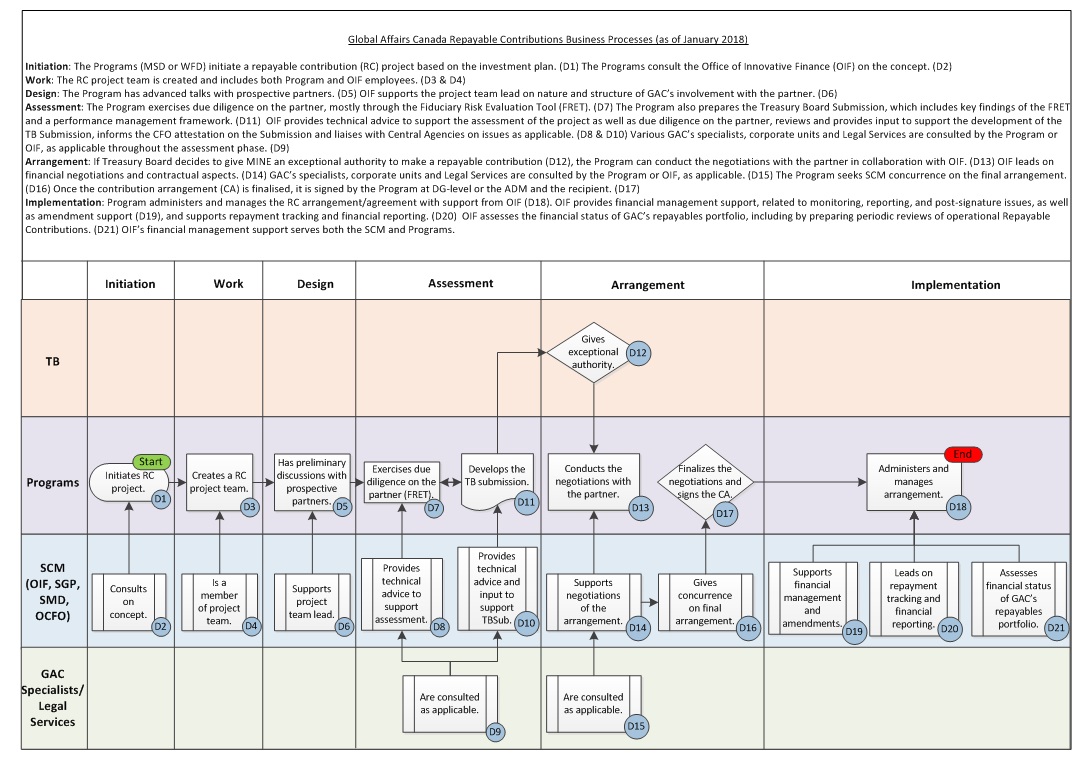

A process map outlining current roles and responsibilities for various stakeholders in the course of the administration and management of the Department's repayable contribution arrangements has been developed by the audit team and validated with the Programs and the Office of Innovative Finance, and is presented in Appendix C (GAC's Repayable Contribution Business Processes).

2. Audit objective and scope

The objective of this audit is to provide reasonable assurance that a management control framework for repayable contributions programs is adequately designed and effective to support Global Affairs Canada in meeting its priorities and its compliance with the applicable Treasury Board policies, directives and operational standards.

The audit focused on key components of a management control framework, such as the governance structure and strategic direction, roles and responsibilities, risk management practice, and monitoring and reporting of results. Observations and recommendations were developed under these themes and are intended to apply to all programs that are currently managing or will manage repayable contributions in the near future. Detailed audit criteria are listed in Appendix A.

3. Observations and recommendations

Audit results are derived from examination of documentation, such as applicable policies, directives, the six (6) repayable contribution arrangements that had been signed at the time of the audit, and initiative performance and financial reports. The audit team conducted group and individual interviews with both officers and managers from Programs (MSD, WFD) and the OCFO who were involved in the management of repayable contributions across the Department at Headquarters.

3.1 Strategic Direction and Roles and Responsibilities

Treasury Board’s Policy on Transfer Payments states that the Department has to ensure that transfer payment programs are, and remain, relevant and effective in meeting departmental and government objectives. It also states that the Department should ensure that roles, responsibilities, and accountabilities for the management of transfer payment programs are clearly defined and understood.

3.1.1 Strategic Direction

It was expected that policy direction and programming strategy for the use of repayable contributions had been established and clearly communicated to guide the Programs’ operations and decision-making.

The audit team found that government level strategic direction requirements are reflected in the repayable contribution arrangements. To fulfill its commitments at the Paris Climate Conference (2015) and the Copenhagen Accord (2009), the Government of Canada provided policy parameters to Global

Affairs Canada to guide the Departmental position in the negotiations related to the repayable contribution initiatives. The audit team reviewed six (6) repayable contribution arrangements and found that all six (6) clearly include clauses ensuring that governmental objectives are met. For instance, repayable contribution arrangements include eligibility criteria for project selection that have been developed based on the government objectives and performance results reporting requirements with indicators measuring the achievement of these objectives.

To date, the Department has used repayable contributions to deliver climate finance and it obtained exceptional Treasury Board authorities for each repayable contribution. Therefore, given the limited focus and close Treasury Board oversight, the need to develop a departmental policy direction or a programming strategy for the use of repayable contributions did not arise. However, repayable contributions will be used more broadly going forward, reflecting the Minister’s expanded development finance toolkit as well as the Budget 2018 innovation envelope. In this context, departmental policy direction and a programming strategy would inform how repayable contributions can be used to support Global Affairs Canada’s mandate and achieve departmental objectives. Without a formal departmental policy direction and/or program investment strategy, it is difficult for Programs to set criteria for type and size of investments and priorities for investing in specific regions and countries to ensure integration with the rest of the department’s international assistance programming.

3.1.2 Accountability, roles and responsibilities

It was expected that roles, responsibilities, and accountabilities shared by the Programs and supporting branches for the management of repayable contributions would be clearly defined, understood, and fulfilled.

The audit team found that SGD, MSD, and WFD have shared roles and responsibilities in the management of repayable contributions. These key stakeholders generally understand their respective roles and responsibilities and have made significant progress to define them during the negotiation of the arrangements.

In August 2016, the Deputy Minister of International Development approved the creation of the Office of Innovative Finance (OIF) under SCM as a one-stop shop for financial and contractual expertise to support the design, structuring and negotiation of all repayable contributions, as well as to lead on technical/financial aspects of negotiations. In addition, the OIF provides post-signature support, such as monitoring, reporting, amendments, and tracking repayments. The creation of the OIF enhanced the role of the OCFO in supporting the management of repayable contributions by exercising shared fiduciary accountability with the Programs and centralizing the specialized expertise.

In 2017, the OIF, in discussions with MSD and WFD, the two program branches, drafted negotiation term sheets outlining proposed roles and responsibilities for Programs and the OIF, based on their relative areas of expertise. The audit found that term sheets were finalized and confirmed the roles of the Programs and OIF in negotiations for the two repayable contributions arrangements signed in 2017, CFPS II and AREI.

However, the audit team found that other areas in the management of repayable contribution arrangements, notably after they have been signed, have not been formally defined. Key stakeholders have stated that the lack of a single accountability point led to some confusion on who is ultimately responsible for the different aspects of managing repayable contributions. Formally establishing the

Department’s repayable contribution governance, including the clarification and formal definition of accountabilities, roles, and responsibilities of all key stakeholders, would better support efficient and effective management of repayable contributions and help ensure that Programs and the OIF lead in their areas of expertise at vital decision points to achieve GAC’s objectives.

Recommendation #1: The Assistant Deputy Minister of Corporate Planning, Finance and Information Technology and Chief Financial Officer, the Assistant Deputy Minister of Global Issues and Development, the Assistant Deputy Minister of Sub-Saharan Africa, and the other Geographic Assistant Deputy Ministers (Europe, Maghreb & Middle East, Americas, and Asia Pacific) should designate a single accountability point to provide a departmental strategic direction for the use of repayable contributions and to further clarify and formally define roles and responsibilities of all relevant branches.

3.2 Risk Management and Compliance with Applicable Policies

The Treasury Board’s Directive on Transfer Payments states that the Department is expected to review the risks specific to the transfer payment program, the potential risks associated with applicants and recipients, and the measures that will be used to manage these risks. It was expected that risks related to repayable contributions would be identified, assessed, and understood. It was also expected that cost-effective risk mitigation strategies related to key risks identified would be developed and implemented.

The audit team found that the Department generally complies with applicable government policies and guidance regarding risk. The OIF, MSD, and WFD are fully aware of the risks related to repayable contributions, including credit, market, and capacity risks, as well as their shared fiduciary accountabilities for managing these risks.

As a non-traditional financial instrument, repayable contributions present different financial, fiduciary, and capacity risks. More specifically, repayable contributions have inherent credit risk, such that repayments may not be received in accordance to agreed amounts and timeframes. It also includes currency and market risks related to the volatility in the value of investments resulting from market factors. Due to the special expertise required for establishing and managing repayable contributions, which is generally not available within the traditional grants and contributions program community, the Department is exposed to a capacity risk where the existing human resource capacity, skill set, and a number of allocated employees may not allow for the effective and efficient management of the growing repayable contributions portfolio. These specific risks do not apply to the programming of traditional grants and contributions.

3.2.1 Risk identification and assessment

The Department uses the Fiduciary Risk Evaluation Tool (FRET) to identify and assess repayable contribution initiatives risks and to develop related mitigation strategies. Programs (MSD, WFD) are responsible to complete the FRET, supported by the OIF for the blended finance factors, while the Financial Risk Assessment Unit (SGFA) provides the financial analysis for all FRETs and is responsible for filling the two risk factors on financial viability. The FRET is completed prior to the approval of a repayable contribution initiative and is supposed to be updated annually once the arrangement is signed. The FRET guides project managers through a set of questions organized by risk factors to identify and assess risks on a scale from low to high.

The audit team noted that new evaluation criteria for credit and market risks were added to the existing FRET to ensure that risks specific to repayable contributions are assessed. To assist program managers’ understanding of blended finance , Financial Management Grants and Contributions (SGF) has been providing targeted training to the Programs on Canada’s and other countries approaches to blended finance, as well as various finance elements, such as loans, equity, and guarantees/contingents. In addition, SGF developed guides to be used by Programs (MSD, WFD) on how to use and complete the FRET, such as the FRET Walkthrough.

The audit team reviewed the risk assessment that was conducted for each of the first six (6) repayable contribution initiatives and found that the risk assessment performed for four (4) initiatives (CFPS, GCF, CFPS II, and AREI) were completed against each of the risk criteria in the FRET. The risk assessment conducted for the first two (2) arrangements (C2F and CTF) signed in 2012 had not been completed. At the time, the new criteria for credit and market risks in the FRET had not been created yet but the original criteria were also incomplete. Considering that these were the first two repayable contribution arrangements of the Department and that the FRET was more specifically built for traditional grants and contributions initiatives, GAC sought advice and guidance from external experts to complement its traditional risk assessment and due diligence processes.

The development of additional evaluation criteria for credit and market risks in the FRET, SGF’s targeted training provided to Programs (MSD, WFD), and the support provided by the OIF to Programs regarding the blended finance factors represent good practices to ensure that specific fiduciary risks associated with repayable contribution arrangements are identified, assessed, and mitigated.

Currently risks are being identified and assessed independently for each repayable contribution initiative. The Department does not have a dedicated risk management framework for repayable contributions at the portfolio level or integrated with the Corporate Risk Profile. However, if the repayable contribution portfolio keeps growing across the Department involving more branches and if a wider range of recipients are envisaged, there may be a need to take a more strategic approach in order to consistently mitigate fiduciary risks associated with repayable contribution initiatives and to minimize exposing the Department to unexpected financial losses.

3.2.2 Development and implementation of risk mitigation strategies

The Department has developed and implemented many measures to manage key risks associated with repayable contribution initiatives. At the corporate level, in SGD, the OIF provides central financial and contractual expertise for repayable contribution programming, which ensures consistency in the application of risk mitigation strategies. While Programs (MSD, WFD) maintain project ownership, the OIF is responsible for supporting the Program’s analysis of the proposal, including by assessing the financial risks and supporting due diligence focussed on blended finance factors and authorities. At the initiative level, these mitigation strategies include OCFO Initiative Assessments (IA), the administrative requirements resulting from the completion of the risk assessment (FRET), and the OIF leading on the financial and various contractual elements of the negotiations for the contribution arrangements.

The IA is the first mitigation measure in the business process and it was performed for the two repayable contribution initiatives signed in 2017, CFPS II and AREI. IAs are conducted by the OCFO to ensure that the Department has exercised due diligence on the financial and contractual management aspects of the repayable contribution initiative prior to the Department seeking the exceptional authorities, on a case by case basis, to provide and negotiate unconditionally repayable contributions. The audit team reviewed the IAs for CFPS II and AREI and found that they had been duly completed in November 2016 before the signature of the repayable contribution arrangements in 2017.

Programs (MSD, WFD) have the responsibility to use the FRET to develop mitigation strategies for each risk that has been previously identified and assessed. The audit team reviewed the risk mitigation measures in the FRET for six (6) repayable contributions and found that three (3) of them (CFPS, CFPS II, and AREI) included measures such as regular monitoring through periodic communication with banks, performing independent audit and evaluation, periodic progress and financial reporting, and mandatory annual meeting. For the other three (3) repayable contributions (CTF, GCF and C2F), the Department did not complete the development of risk mitigation strategies.

If project managers do not systematically develop relevant mitigation strategies, some key risks may not be mitigated and repayable contribution arrangements may not include requirements that would address fiduciary risks specifically identified for the arrangement. This could ultimately mean incomplete protection for the Department from the inherent risks related to repayable contributions.

To ensure that mitigation strategies developed in the FRET were integrated into the arrangements, the audit team reviewed the three (3) repayable contribution arrangements that included complete risk mitigation strategies and found that they were generally incorporated in the arrangements. For example, one of the risk mitigation strategies developed for CFPS II was that GAC will use its due diligence and reporting requirements to ensure that the proper oversight is carried out, both with respect to development impact and repayable amount. In CFPS II, the arrangement reflected the risk mitigation strategy developed in the FRET and included reporting requirements from the MDB to the Department, such as producing annual reports.

In addition to the aforementioned mitigation strategies, from the review of the contribution arrangements, the audit team observed that some exposure limits were defined in various clauses, such as the investment limit on countries, project value, and co-financing. These limitations help minimizing the department's risk exposure in the implementation of the contribution arrangements.

3.2.3 Repayable contribution accounting and financial presentation

It was expected that financial risk (i.e. if repayments are less than expected) would be taken into consideration when recording and presenting repayable contributions in the departmental financial statements, and be in compliance with the applicable accounting standards.

Repayable contributions are contributions where the recipient is expected to repay all or part of the amount according to agreed-upon specific dates or conditions. To date, the Department’s repayable contributions have been largely provided to MDBs who hold, administer, and manage concessional loansFootnote 4 to the private sector in developing countries in order to achieve predetermined development results. MDBs' role is defined in each contribution arrangement and the Department agrees to pay certain amount of service fees to MDBs.

The accounting standards GC 3410 Government Transfers, PS 3050 Loans Receivable and GC 3050 Loans Receivable have various requirements applicable to accounting and presenting the Department’s repayable contributions. The audit team found that although credit risk for each initiative was taken into consideration and its provision was calculated, its accounting, presentation, and disclosure are not always consistent with the applicable accounting standards requirements.

The audit team reviewed the Departmental Financial Statements and the payment made for one repayable contribution arrangement at the end of fiscal year 2016-2017 along with its related transactions and supporting documents. The audit team found that the current terms of the arrangement do not fully and clearly support the department’s position to recognize a financial asset in its financial statements (as required in the public sector accounting standards PS 1000). Based on the wording of the arrangement, there is concern that the department cannot demonstrate it can control the economic resource and access to the future economic benefits (essential characteristics of an asset). Once it has been established that the repayable contribution is indeed a financial asset, the nature of this financial asset will depend on the terms and conditions of the arrangement. Such financial asset can be either a loan receivable or a portfolio investment and as a result the accounting treatment will be different.

Furthermore, the audit team found that administration fees were included in the “Transfer payments receivable”. Whether the repayable contribution meets the definition of a loan receivable or a portfolio investment, the administration fees paid to the MDB should be recorded as a non-financial asset (prepaid expenses) and not be included in the value of the receivable or investment. The cumulative impact of this inclusion over the duration of the financial arrangement overstates the “Financial assets” and understates the “Departmental net debt” in the departmental financial statements by an amount approximately equivalent to the administration fees paid.

The audit team also found that the disclosure for the Department’s “Transfer payments recoverable” had limited details compared to the requirements identified in the applicable accounting standards. Information such as the description of the nature and terms of the contributions, how repayments would be made and contractual obligations associated with one of the arrangements under review was not disclosed.

3.2.4 Managing capacity risk

Given the current size of the departmental repayable contribution portfolio, the special expertise required, which is not readily available among its current grants and contributions program teams, and the increased use of innovative ways to carry out international development assistance, the Department faces the risk that its current specialized capacity may not be sufficient to manage the growing repayable contribution portfolio and ensure that government objectives are achieved. Moreover, in contrast to traditional grants and non-repayable contribution programming (of up to five years in duration), human resource requirements after the arrangement is signed, such as monitoring development results and financial performance, are significant due to the long-term (20-25 years) life span of the contribution arrangements, including expected repayments. The mobility of the Department’s programming branches’ personnel, with routine turnover (every 3 years), creates even more challenges to efficiently transfer essential corporate knowledge to the successive departmental officials over the lifecycle of these arrangements and to build and maintain the related capacity within Programs.

The audit team interviewed responsible managers and all of them expressed difficulties in hiring staff with the required specialized skills and expertise to effectively manage the growing repayable contributions portfolio. To manage the human resources capacity risk effectively, it is essential that Programs involved and the OIF have a coordinated staffing strategy to be able to hire staff with the required skills and expertise in a timely manner to ensure that the Department’s repayable contribution programming is successfully delivered.

Recommendation #2: The Assistant Deputy Minister of Corporate Planning, Finance and Information Technology and Chief Financial Officer, the Assistant Deputy Minister of Global Issues and Development, the Assistant Deputy Minister of Sub-Saharan Africa, and the other Geographic Assistant Deputy Ministers (Europe, Maghreb & Middle East, Americas, and Asia Pacific) should develop a risk management framework tailored to repayable contributions portfolio and integrated to the corporate risk profile to ensure that risks specifically associated with this financial instrument are systematically, strategically, and more thoroughly identified, assessed, and mitigated.

Recommendation #3: The Assistant Deputy Minister of Corporate Planning, Finance and Information Technology and Chief Financial Officer should ensure that the terms of future repayable contribution arrangements clearly support the Department’s accounting of these arrangements, and review the approach for the accounting and presentation of the repayable contributions to ensure consistency with applicable accounting standards.

3.3 Oversight and Performance Monitoring

According to Treasury Board’s Directive on Transfer Payments, the Department should ensure, through the timely assessment of recipient reports and other monitoring activities deemed necessary, that the recipient of a contribution has complied with the obligations and performance objectives in the funding agreement. The Directive also states that in situations where a contribution is repayable, the Department has to ensure that the funding agreement also addresses the timing of repayments among other things.

3.3.1 Departmental oversight over repayable contributions

It was expected that the Department’s oversight role vis-à-vis repayable contributions would be defined and executed to ensure the achievement of predetermined objectives for the use of repayable contributions.

To diversify its international development assistance programming and to achieve different levels of development impact, the Department makes repayable contributions to fund both single contributor and multi-contributor initiatives. When the Department is the only contributor, terms and conditions are negotiated one-on-one with the MDB, which may allow the Department to more easily integrate and advance its international development assistance priorities consistent with the parameters of the funding envelope provided (or the Department’s risk appetite). For multi-donor contributor initiatives, terms and conditions are negotiated among several contributors that may have different development priorities and may also have different risk appetites, which may make it more challenging to obtain consensus on any individual contributor’s priorities. On the other hand, due to the size of the funding and close partnership established among contributors, providing funding to support a multi-contributor initiative may have greater development impact than a smaller initiative funded by a single contributor.

The audit team examined how the Departmental oversight roles were defined in funding agreement and how they were executed under both funding models. In general, the Department exercises its oversight role to influence recipients’ decision-making to support the achievement of predetermined objectives and expected repayments. More specifically, for single contributor initiatives, the Department negotiates eligibility criteria for project selection, organizes and participates in annual meetings with recipients to discuss the project pipeline, activities, outputs, outcomes, results and financial performance. If necessary, the Government of Canada could also advocate Canada’s perspective via its Director position on the MDB Board of Directors.

Therefore, the type of funding model will determine how the Department can exercise its oversight. Since a single contributor initiative involves a bilateral instead of multilateral negotiation with the recipient, the Department may have greater influence to negotiate its preferred oversight mechanisms into the arrangement vis-à-vis a multi-contributor initiative.

The audit team reviewed the definition of the oversight role in six (6) repayable contribution arrangements and found that decisions related to project selection are the responsibility of the recipient. The audit team also found that the Department’s oversight role is better defined and articulated in the four (4) single contributor arrangements (C2F, CFPS, CFPS II, and AREI). These arrangements include eligibility criteria for project selection that are aligned with governmental objectives. They also include a requirement for a mandatory annual meeting with the recipient. These meetings allow the Department and the recipients to discuss the implementation of the repayable contribution arrangements, progress in achieving governmental objectives, and the financial performance of the repayable contribution arrangement. The annual meetings generally took place as required.

Departmental oversight over multi-contributor repayable contribution initiatives (CTF and GCF) is defined and exercised differently. These two (2) multilateral arrangements do not include eligibility criteria for project selection or a requirement for an annual meeting. These requirements are instead set out in other key documents of the relevant funds. Given that the requirements can evolve, the Department relies heavily on the applicable governance body to ensure that the funding will be invested, to the extent possible, in selected projects reflecting both Canadian priorities and the approved risk appetite of the funding envelope. In the case of the GCF, MSD is a member of the GCF’s Board of Directors that meets 3-4 times a year to consider and approve policies and projects as well as set the overall direction of the GCF.

3.3.2 Performance monitoring and reporting

It was expected that the Department had put in place and implemented a performance management framework that includes expected development results and defined performance measures for reporting actual results and achieved progress. It was also expected that the Department had put in place measures and procedures to monitor and track the implementation of repayable contribution arrangements, including repayment schedule.

The audit team found that the Department is monitoring the repayable contribution arrangements through periodic performance report reviews and different internal tools. These tools are used to track information on the projects that the MDBs have selected under each arrangement, such as the source of fund and disbursement timing (both cash and accrual profile) of each arrangement for the climate finance fund, and departmental programming over the next three (3) fiscal years.

The audit team reviewed six (6) repayable contribution arrangements and found that the Department developed a performance management framework for the four (4) single contributor initiatives (C2F, CFPS, CFPS II, and AREI). These performance management frameworks include expected results, indicators, targets, data sources, and data collection methods. The audit team found that the Department included expected results and indicators into the arrangements and recipients are required to report against them. The remaining information listed in the performance management framework is not included into the arrangement since it is the responsibility of the recipient to identify data sources and collection methods to accurately report against expected results and indicators. By embedding the

expected results and the indicators into the arrangements, the Department ensures that the funding is being used in accordance with the stated purpose of the contribution, in support of governmental objectives. For the two (2) multi-contributor repayable contribution arrangements (CTF and GCF), the Department is managing both these arrangements using the performance management framework designed by the recipient and agreed by the relevant governing body.

The four (4) single contributor repayable contribution arrangements (C2F, CFPS, CFPS II, and AREI) include a requirement for the recipient to report performance results annually and/or semi-annually to the Department. Once the reports are received, the relevant Program analyzes and evaluates the information provided by the recipients and feeds the results into the departmental reporting cycle through Annual Project Summary Reports.

The audit team received semi-annual reports for C2F and CFPS as well as the 2017 annual report for C2F and CFPS II. AREI was signed in December 2017, so it is too early for the recipient to have published annual/semi-annual reports. The audit team reviewed the four performance reports received and tried to compare the reported progress and results against the indicators in the performance management framework embedded in the repayable contribution arrangement. The audit team found that for three of these four reports, the reporting format made it difficult to establish the coherence between the reported results and the indicators. However, the audit team noted that the presentation of the last report, the 2017 annual report for CFPS II, facilitated the crosswalk between the results and the indicators. If the Department cannot easily follow the progression of the repayable contribution arrangements, it may not know if the funds invested into the projects are producing the expected results. This may limit the Department’s ability to report on progress and development and climate results achieved on a portfolio basis.

3.3.3 Financial monitoring and repayment tracking

Repayable contributions require significant financial monitoring and repayment tracking once the arrangement is signed. Presently, these responsibilities are shared between Programs (MSD, WFD) and the OIF. Programs are expected to communicate the incoming repayments internally to OCFO, develop and use tracking tools for repayment tracking, and monitor key repayable contributions milestones. On the other hand, the OIF is expected to assess the financial status of each repayable contribution arrangements and the Department's repayable contribution arrangements portfolio to support Programs on the financial management of these arrangements.

The audit team found that Programs (MSD) have developed some tools, such as work spreadsheets for repayment tracking. The OIF is monitoring and assessing the financial aspects of the repayable contribution arrangements, such as annual portfolio reviews of each arrangement, as well as the evergreen Repayables Dashboard providing a financial overview of the Department’s repayables portfolio and a line of sight on its evolving near-term pipeline. The OIF also supports the Department’s repayable contributions more broadly by participating in international meetings at the OECD and other fora, to both represent GAC as well as to partake in knowledge and information exchanges with international colleagues on topics germane to GAC’s innovative/blended finance using repayables.

The examination of the six (6) contribution arrangements showed that only one repayable contribution arrangement (CTF) has a repayment schedule, including payment date and amount, embedded into the arrangement itself. The GCF will also have a repayment schedule once the disbursement is made. For the other four (4) repayable contribution arrangements, the repayments are all reflow-basedFootnote 5 and directly linked to reflows received by the recipients, meaning that the recipients will repay the Department following receipt of repayments from project funding beneficiaries pursuant to the negotiated repayable contribution arrangements. The repayment period of 15 to 20 years can start at any time after the Department has made the first payment to the recipient. The different repayment schedules, along with a long repayment period demonstrate the importance of having formal financial monitoring and repayment tracking processes in place.

With the Financial Models provided by recipients, along with other financial reporting, the Department monitors and tracks the expected repayments under various assumptions. These Financial Models are updated by recipients regularly throughout the lifecycle of the arrangements and may be discussed at the annual meeting between the Department and the recipients. The Financial Models for the reflow-based arrangements also include the recipients’ projections of the expected amount and timing of repayments to Canada, which are not contractually binding.

While it is too soon for GAC to have received repayments for three (3) recently signed repayable contribution arrangements (GCF, CFPS II, and AREI), the Department has received a total of approximately $10 million in interest payments from CTF since 2013 as per agreed upon repayment schedule. Currently the Department is expecting to receive initial repayments for the other two (2) repayable contribution arrangements (C2F and CFPS) whose availability period have ended.

The audit team was informed that the Department has received a first repayment of $6.9 million for C2F in April 2018, including principal and interests, and is awaiting its first repayment for CFPS. The audit team also found that the repayment from the C2F initiative has not been recorded to its appropriate accounts in a timely manner and that it was sitting in a suspense account for more than a month because the cashier division did not know what the money was for. The review of communications between MSD and the OCFO demonstrated that even if MSD were first informed of incoming repayment, it did not forward the information to the OCFO about the details of the transaction, who could have recorded it accordingly.

As the repayment stage for more repayable contribution arrangements has been reached or is approaching, monitoring efforts have to be scaled appropriately to enhance the business process, including communication for repayment tracking and recording.

Recommendation #4: The Assistant Deputy Minister of Global Issues and Development and the Geographic Assistant Deputy Ministers (Sub-Saharan Africa, Europe, Maghreb & Middle East, Americas, and Asia Pacific) should ensure that the recipients of repayable contributions consistently and clearly report results against pre-defined performance indicators.

Recommendation #5: The Assistant Deputy Minister of Global Issues and Development and the Geographic Assistant Deputy Ministers (Sub-Saharan Africa, Europe, Maghreb & Middle East, Americas, and Asia Pacific) and the Assistant Deputy Minister of Corporate Planning, Finance and Information Technology and Chief Financial Officer should formalize repayment tracking process to ensure that repayments are recorded in a timely manner.

4. Conclusion

The Department has put in place key effective measures that, while put together, form most of the expected elements of a management control framework to ensure that it meets governmental priorities and it is generally compliant with the applicable Treasury Board policies, directives and operational standards.

Areas for improvement were identified as establishing a formal governance structure for repayable contributions, including clarifying accountabilities, developing a risk management framework, ensuring full compliance with applicable accounting standards, and formalizing the repayment tracking process.

Appendix A: About the audit

Objective

The objective of this audit was to provide reasonable assurance that a management control framework for repayable contributions programs is adequately designed and effective to support Global Affairs Canada in meeting its priorities, and its compliance with the applicable Treasury Board policies, directives and operational standards.

Scope

The audit focused on key components of a management control framework, such as the governance structure and strategic direction, roles and responsibilities, risk management practice, and monitoring and reporting on results.

The audit covered all eight (8) unconditionally repayable contribution initiatives approved to date by Treasury Board, including six (6) signed unconditionally repayable contribution arrangements and two (2) unconditionally repayable contribution initiatives that had no signed arrangement at the time of the audit. Conditional repayable contributions have been scoped out as none has been negotiated yet.

Criterias

Criteria - C.1. Policy direction and programming strategy for the use of repayable contributions are available to guide the Programs’ operations.

Sub-Criteria

C.1.1. Policy direction and programming strategy have been established;

C.1.2. Policy direction and programming strategy have been clearly communicated and have guided the Programs’ operations and decision-making.

Criteria - C.2. Roles, responsibilities and accountabilities shared by the Programs and supporting branches for the management of repayable contributions are clearly defined, communicated and fulfilled.

Sub-Criteria

C.2.1. The roles, responsibilities and accountabilities shared by the Programs and supporting branches are clearly defined, communicated and fulfilled;

C.2.2. The Department's oversight role is defined and executed to ensure the achievement of predetermined objectives for the use of repayable contributions;

Criteria - C.3. Credit and capacity risks related to repayable contributions are assessed, communicated and responded in a cost-effective manner.

Sub-Criteria

C.3.1. Credit and capacity risks are identified and assessed;

C.3.2. Cost-effective risk mitigation strategies related to identified key risks are developed and implemented;

C.3.3. Accountabilities for implementing risk responses are identified, communicated and executed;

C.3.4. Risk factors are taken into consideration in funding partner selection, funding instrument selection, funding terms negotiation and, accounting and reporting for repayable contribution disbursements and repayments.

Criteria - C.4. The expected results for the use of repayable contributions are monitored, tracked, measured, and reported against predetermined objectives.

Sub-Criteria

C.4.1. The Department has put in place and implemented a performance management framework that includes expected results and defined performance measures for reporting actual results and achieved progress;

C.4.2. Measures and procedures have been put in place and executed to monitor and track the implementation of repayable contribution arrangements (including repayment schedule).

Approach and Methodology

To ensure audit objective can be achieved and concluded, the following methods were used to gather audit evidence:

- Identification and analysis of applicable policies, directives and regulations;

- Identification and analysis of funding authorities;

- Process review and mapping;

- Interviews with external stakeholders and the department's officers involved in the management of repayable contributions;

- Assessment of related risks and internal controls;

- Review and analysis of related documentation;

- Review of contribution arrangements; and

- Other audit tests as deemed necessary.

Appendix B: Repayable contribution arrangements

| Funding Authority | Project Name | Initiative Value up to ($Million) | Recipient | Funding Model SC: single contributor or MC: multi-contributor | Start Date (Arrangement effective date) | CA duration (Years) | Disbursements as of fiscal year end (2017-2018) ($Million) | GAC Responsible Bureau |

|---|---|---|---|---|---|---|---|---|

Canada’s fast-start financing ($1.2 billion envelope) | C2F | 250 | IDB-IIC | SC | 2012-03-30 | 25 | 250 | MSD |

CFPS | 75 | ADB | SC | 2013-03-26 | 24 | 75 | MSD | |

CTF | 200 | IBRD | MC | 2012-03-30 | 25 | 200 | MSD | |

International climate financing ($2.65 billion envelope) | GCF | 110 | GCF | MC | 2015-12-11 | 25 | 0 | MSD |

CFPS II | 200 | ADB | SC | 2017-03-27 | 25 | 148 | MSD | |

AREI | 150 | IFC | SC | 2017-12-21 | 20 | 62 | WFC | |

CCCP II* | 250 | IFC | SC | 2018-03-29 | 25 | 193.5 | MSD | |

C2F II** | 223.5 | IDB-IIC | SC | TBD | TBD | N/A | MSD | |

Total |

| $1,458.5 |

|

|

|

| $928.5 |

See Appendix E for acronym definitions.

*CCCPII is now renamed as “the Canada-IFC Blended Climate Finance Program”

**MSD and the OIF are currently negotiating this arrangement with IDB/IIC

Source: Global Affairs Canada Food Security and Environment Bureau Division (MSD)

Appendix C: Global Affairs Canada repayable contributions business processes

Text version

The flowchart depicts Global Affairs Canada Repayable Contributions Business Processes (as of January 2018)

The different steps of the process are presented below in order:

Start

Initiation: The Programs (Food Security and Environment Bureau or the Pan-Africa Bureau) initiate a repayable contribution project based on the investment plan. The Programs consult the Office of Innovative Finance on the concept.

Work: The repayable contribution project team is created and includes both Program and the Office of Innovative Finance employees.

Design: The Program has advanced talks with prospective partners. The Office of Innovative Finance supports the project team lead on nature and structure of GAC’s involvement with the partner.

Assessment: The Program exercises due diligence on the partner, mostly through the Fiduciary Risk Evaluation Tool. The Program also prepares the Treasury Board Submission, which includes key findings of the Fiduciary Risk Evaluation Tool and a performance management framework. The Office of Innovative Finance provides technical advice to support the assessment of the project as well as due diligence on the partner, reviews and provides input to support the development of the Treasury Board Submission, informs the Chief Financial Officer attestation on the Submission and liaises with Central Agencies on issues as applicable. Various Global Affairs Canada’s specialists, corporate units and Legal Services are consulted by the Program or the Office of Innovative Finance, as applicable throughout the assessment phase.

Arrangement: If Treasury Board decides to give the Minister of International Development an exceptional authority to make a repayable contribution, the Program can conduct the negotiations with the partner in collaboration with the Office of Innovative Finance. The Office of Innovative Finance leads on financial negotiations and contractual aspects. Global Affairs Canada’s specialists, corporate units and Legal Services are consulted by the Program or the Office of Innovative Finance, as applicable. The Program seeks the Corporate Planning, Finance and Information Technology Branch’s concurrence on the final arrangement. Once the contribution arrangement is finalised, it is signed by the Program at Director General-level or the Assistant Deputy Minister and the recipient.

Implementation: Program administers and manages the repayable contributions arrangement/agreement with support from the Office of Innovative Finance (D18). The Office of Innovative Finance provides financial management support, related to monitoring, reporting, and post-signature issues, as well as amendment support, and supports repayment tracking and financial reporting. The Office of Innovative Finance assesses the financial status of Global Affairs Canada’s repayables portfolio, including by preparing periodic reviews of operational Repayable Contributions. The Office of Innovative Finance’s financial management support serves the Corporate Planning, Finance and Information Technology Branch and Programs.

Appendix D: Management action plan

| Audit Recommendation | Management Action | Area Responsible | Expected Completion Date |

|---|---|---|---|

1. The Assistant Deputy Minister of Corporate Planning, Finance and Information Technology and Chief Financial Officer, the Assistant Deputy Minister of Global Issues and Development, the Assistant Deputy Minister of Sub-Saharan Africa, and the other Geographic Assistant Deputy Ministers (Europe, Maghreb & Middle East, Americas, and Asia Pacific) should designate a single accountability point to provide a departmental strategic direction for the use of repayable contributions and to further clarify and formally define roles and responsibilities of all relevant branches. | Agree. The Assistant Deputy Minister of Global Issues and Development, in consultation with the other ADMs noted, will formulate a recommendation to GAC Deputy Minister(s) on a strategic approach to the department’s use of repayable contributions, including appropriate roles and responsibilities. This will incorporate decisions resulting from Cabinet consideration of the MC “Strategy and Vision for Allocating Budget 2018 International Assistance Envelope Resources”, which addresses the new $1.5 billion to support innovation, including new authorities for funding instruments. DPD will support operationalizing the strategic direction through process mapping and the development of guidance and tools. Once the lead has been identified for the department’s new innovative finance program, MFM will work with that person to ensure a responsible and smooth transfer of accountability for this management action. | Assistant Deputy Minister of Global Issues and Development | Expected completion June 30, 2019, based on an estimate of both internal GAC decision processes and the decision process for the MC and the following Treasury Board submission. |

2. The Assistant Deputy Minister of Corporate Planning, Finance and Information Technology and Chief Financial Officer, the Assistant Deputy Minister of Global Issues and Development, the Assistant Deputy Minister of Sub-Saharan Africa, and the other Geographic Assistant Deputy Ministers (Europe, Maghreb & Middle East, Americas, and Asia Pacific) should develop a risk management framework tailored to repayable contributions portfolio and integrated to the corporate risk profile to ensure that risks specifically associated with this financial instrument are systematically, strategically, and more thoroughly identified, assessed, and mitigated. | The Branches involved in the management of repayable contributions will develop a risk management framework tailored to the repayable contributions portfolio and integrate the framework to the corporate risk profile for the risks specifically associated with these financial instruments. | Assistant Deputy Minister of Corporate Planning, Finance and Information Technology and Chief Financial Officer | December 31, 2019 |

3. The Assistant Deputy Minister of Corporate Planning, Finance and Information Technology and Chief Financial Officer should ensure that the terms of future repayable contribution arrangements clearly support the Department’s accounting of these arrangements, and review the approach for the accounting and presentation of the repayable contributions to ensure consistency with applicable accounting standards. | The Assistant Deputy Minister of Corporate Planning, Finance and Information Technology and Chief Financial Officer (SCM) will work with the Branches to review the terms of future arrangements to ensure the accounting treatment can be clearly supported. The ADM of SCM will also review the accounting and presentation of repayable contributions and consult with the Office of the Comptroller General to ensure consistency with applicable accounting standards. | Assistant Deputy Minister of Corporate Planning, Finance and Information Technology and Chief Financial Officer | March 31, 2019 |

4. The Assistant Deputy Minister of Global Issues and Development and the Geographic Assistant Deputy Ministers (Sub-Saharan Africa, Europe, Maghreb & Middle East, Americas, and Asia Pacific) should ensure that the recipients of repayable contributions consistently and clearly report results against pre-defined performance indicators. | Agree As indicated in the audit, the more recent Unconditional Repayable Contribution (URC) Agreements include clearly defined indicators. Noting this is a best practice, moving forward, the department will ensure pre-defined indicators are included in all URC agreements and reported on in a clear and consistent manner. | Director General of International Assistance Operations in consultation with programming branches | July 31, 2018 |

5. The Assistant Deputy Minister of Global Issues and Development and the Geographic Assistant Deputy Ministers (Sub-Saharan Africa, Europe, Maghreb & Middle East, Americas, and Asia Pacific) and the Assistant Deputy Minister of Corporate Planning, Finance and Information Technology and Chief Financial Officer should formalize repayment tracking process to ensure that repayments are recorded in a timely manner.

| Agree. Building on its experience with unconditional repayable contributions, MFM will be accountable for this management action. MFM will work closely with other programming branches, in particular WFM, and corporate services to develop a formalized repayment tracking process. | Assistant Deputy Minister of Global Issues and Development, in collaboration with other branches | March 31, 2019 |

Appendix E: Acronyms and definitions

- ADB

- Asian Development Bank

- AREI

- Africa Renewable Energy Initiative

- CA

- Contribution Arrangement

- CCCP

- Canada Climate Change Program

- CFPS

- Canadian Climate Fund for the Private Sector in Asia

- CTF

- Climate Investment Funds – Clean Technology Fund

- C2F

- Canadian Climate Fund for the Private Sector in the Americas

- DGPC

- Director General Programs Committee

- ECCC

- Environment and Climate Change Canada

- FRET

- Fiduciary Risk Evaluation Tool

- GAC

- Global Affairs Canada

- GCF

- Green Climate Fund

- GHG

- Greenhouse Gas

- IA

- Initiative assessment

- IBRD

- International Bank for Reconstruction and Development

- IDB

- Inter-American Development Bank

- IFC

- International Finance Corporation

- IIC

- Inter-American Investment Corporation

- MDB

- Multilateral Development Bank

- MFM

- Global Issues and Development Branch

- MSD

- Food Security and Environment Bureau

- OCFO

- Office of the Chief Financial Officer

- OIF/SGI

- Office of Innovative Finance

- SCM

- Corporate Planning, Finance and Information Technology

- SGFA

- Financial Risk Assessment Unit

- SGP

- Grants and Contributions Financial Policy

- SMOQ

- Corporate Accounting Unit

- TB

- Treasury Board

- URC

- Unconditional Repayable Contribution

- WFC

- Pan-Africa and Regional Development Division

- WFD

- Pan-Africa Bureau

- WGM

- Sub-Saharan Africa Branch

Availability period: Is the period during which Fund resources may be allocated and committed as concessional financing into eligible projects. Contribution arrangements typically define the length of the availability period, including a beginning and end date.

Blended finance: The strategic use of development finance for the mobilisation of additional finance toward sustainable development in developing countries, with additional finance referring primarily to commercial finance.

Capacity risk: Within the context of this audit, “capacity risk” is used to refer to the risk that the existing human resource capacity, skill set, and a number of allocated employees and their role within the Department may not allow for the effective and efficient management of repayable contributions.

Concessional loans: Loans that are extended on terms substantially more generous than market loans. The concessionality is achieved either through interest rates below those available on the market or by grace periods, or a combination of these. Concessional loans typically have long grace periods. (OECD definition)

Conditionally repayable contributions (CRCs): They are contributions, all or part of which are repayable, if conditions specified in the contribution agreement come into being, e.g. certain level of sales. (Financial Information Strategy Accounting Manual)

Credit risk: The risk that principal and interest payments may not be received in accordance with the terms and conditions of the loan agreement. (PS 3050)

Fiduciary Accountability: In the context of the audit, ‘fiduciary accountability’ refers to the obligation to account for the responsible management of the repayable contributions funds and portfolio, including ensuring funds are used for their intended purpose, are properly recorded and safeguarded, and that the services rendered correspond to the funds disbursed.

Financial risk: An umbrella term for multiple types of risk associated with financing, usually credit risk and market risk. In the context of this audit, the term is mostly used to refer to the likelihood that GAC may not receive the expected repayments from its repayable contribution.

Loan receivable: A loan receivable is a financial asset of a government (the lender) represented by a promise by a borrower to repay a specific amount, at a specified time or times, or on demand, usually with interest but not necessarily. The terms of a loan agreement describe when a loan is due. The terms may specify a calendar date or dates for repayment, or may describe the particular time(s) or circumstance(s) which will determine repayment. (Financial Information Strategy Accounting Manual)

Non-traditional financial instruments: Within the context of this audit, “traditional financial instruments” refer to traditional grants and non-repayable contributions. By contrast, a “non-traditional financial instrument” refers to repayable contributions that are partially or fully repaid. The type of recipients can be the same in both scenarios.

Recipient: Is an individual or entity that either has been authorized to receive a transfer payment or that has received that transfer payment.

Transfer payments: Is a monetary payment, or a transfer of goods, services or assets made, on the basis of an appropriation, to a third party, including a Crown corporation, that does not result in the acquisition by the Government of Canada of any goods, services or assets. Transfer payments are categorized as grants, contributions and other transfer payments. Transfer payments do not include investments, loans or loan guarantees (Policy on Transfer Payments).

Unconditionally Repayable Contributions: Contributions that must be repaid without qualification. The contribution arrangement contains specific repayment terms that set out the time and amount of payment(s) due. They are, in substance, loans. (Financial Information Strategy Accounting Manual)