Evaluation of Canada's International Education Strategy

February 2019

Table of Contents

List of Acronyms, Abbreviations, and Symbols

- AUD

- Australian Dollar

- BBY

- International Education Division (GAC)

- BTB

- Performance Measurement Unit

- CAD

- Canadian Dollar

- CBIE

- Canadian Bureau for International Education

- CMEC

- Council of Ministers of Education Canada

- CNY

- Chinese Yuan

- CRM

- Client Relationship Management

- ELAP

- Emerging Leaders in the Americas Program

- ESDC

- Employment and Social Development Canada

- FPCCERIA

- Federal-Provincial Consultative Committee on Education-Related International Activities

- FPT

- Federal-Provincial-Territorial

- FTE

- Full Time Equivalent

- GAC

- Global Affairs Canada

- GDP

- Gross Domestic Product

- GOC

- Government of Canada

- ICT

- Information and Communications Technology

- IES

- International Education Strategy

- IIE

- Institute of International Education

- IRCC

- Immigration, Refugees, and Citizenship Canada

- ISED

- Innovation, Science, and Economic Development

- ISP

- International Scholarship Program

- KPI

- Key Performance Indicator

- LAC

- Latin America and the Caribbean

- MOU

- Memorandum of Understanding

- OECD

- Organization for Economic Cooperation and Development

- OGD

- Other Government Departments

- PGWP

- Post-Graduate Work Permit

- PR

- Permanent Residency

- PRE

- Diplomacy, Trade, and Corporate Evaluation Division (GAC)

- RETC

- Regional Education Trade Commissioner

- RKA

- Roslyn-Kunin and Associates

- SDGs

- Sustainable Development Goals

- SPALO

- Consulate General of Canada in Sao Paolo, Brazil

- STEM

- Science, Technology, Engineering, and Mathematics

- TB

- Treasury Board

- TC

- Trade Commissioner

- TCS

- Trade Commissioner Service

- UK

- United Kingdom

- UNESCO

- United Nations Educational, Scientific and Cultural Organization

- USA

- United States of America

- USD

- United States Dollar ($)

- £

- British Pound

- €

- Euro

- $ NZ

- New Zealand Dollar

Executive Summary

This report provides the findings, considerations and recommendations of the Evaluation of Canada's International Education Strategy (IES), which was conducted from May to November 2018.

While the IES has contributed to Canada meeting its target of attracting 450,000 international students five years ahead of schedule, favourable external factors, such as Canada's positive reputation, competitive tuition and the reputation of other countries have also contributed to this positive outcome. The evaluation found that the education sector has become one of the most valuable sectors of the Trade Commission Service, reaching $18.7B in 2017 and that it supports a cross-section of GAC and GOC priorities, while simultaneously facilitating coherence across business lines. Canada has achieved this success despite investing less than its main competitors in International Education promotion and digital marketing.

The Department's marketing efforts to raise awareness about Canada as a study destination have been effective. Missions abroad rely on a wide variety of marketing and promotion tools to promote Canada's education sector. Despite the growing importance of web and social media channels, participation in fairs and in-person events remains an important activity in most markets. International students in Canada are strong candidates for immigration and can be an important group to fill Canada's labour market and demographic gaps. To this end, more targeted promotion and marketing would be more effective in aligning student recruitment with Canada's labour market and demographic needs.

While the geographic origins of Canada's international students have diversified slightly during the evaluation reference period, China and India are the two most important markets for Canada and will remain so for the foreseeable future. While this concentration of international students from these two markets is in line with global trends, Canada's education sector remains vulnerable to events that would negatively affect bilateral relations with these two countries. As the number of international students coming to Canada has increased, so has the number of alumni from Canadian institutions in most markets. Regular alumni engagement is an important activity to help Canada reap the medium-term and long-term benefits of welcoming international students.

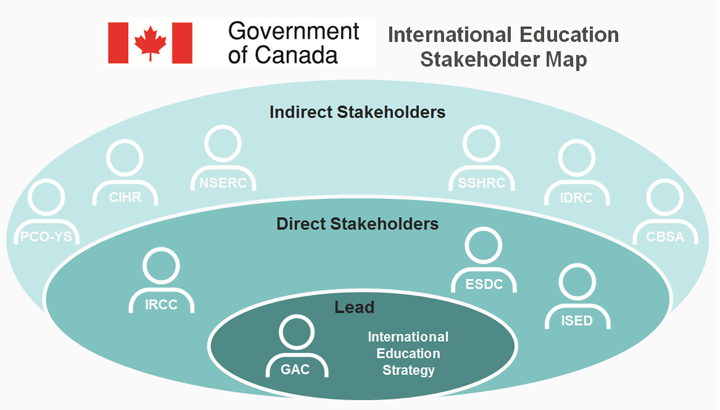

The International Education Division has built a strong working relationship with Provincial and Territorial Stakeholders and consults with them on a regular basis. Coordination on international education efforts between GAC and other federal government departments has improved in recent years. However, clarification on the roles and responsibilities of the various stakeholders would improve the overall effectiveness of the IES. Outbound mobility by Canadian students is important to help Canada's youth acquire the skills, experience, and networks for the 21st century labour market. While the IES includes these elements, this role is misaligned with the mandate of the TCS.

Summary of Recommendations

- A comprehensive digital strategy is needed for Canada to remain competitive and be more targeted and better align recruitment and partnership building with Canada's labour market and immigration needs.

- Adapt the market prioritization tool to reflect the evolving nature of international student mobility and allow more flexibility in resource allocation to support market diversification.

- Pursue efforts to increase coherence with GOC Stakeholders on International Education.

- Develop a comprehensive Alumni Strategy.

- Adapt the current Performance Measurement Strategy to be reflective of broader results of international education.

Context: International Education

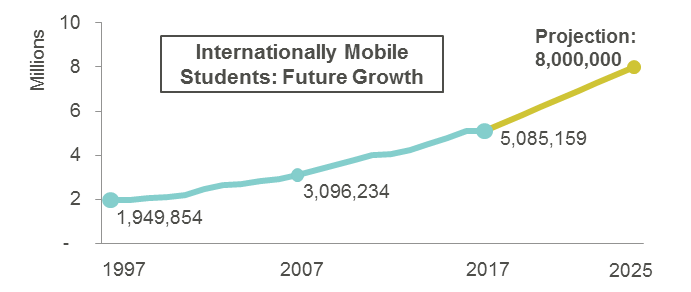

The international education sector has significantly grown over the past few decades, and is expected to continue to grow in the coming years. For host countries and institutions, international students represent an important source of revenue and human capital.

A line chart showing the numbers of Internationally Mobile Students Future Growth broken down by years.

Text version

A line chart showing the numbers of Internationally Mobile Students Future Growth broken down by years:

- In 1997 1,949,854

- In 2007 3,096,234

- In 2017 5,085,159

- In 2025 projected 8,000,000

Students choose to study abroad, enrolling either in short- or long-term programs, for a variety of reasons. These include:

- Proximity (geographic distance, language, historical or political ties)

- Perceived higher quality of education elsewhere, and university rankings

- Economic factors (affordability of education, future employment prospects)

There is also a growing trend for students to choose countries and institutions for their studies that prioritize the student experience as much as the quality of education provided.

China and India currently constitute the largest source of international students worldwide, primarily due to their large population sizes and growing middle classes. It is expected that this trend will continue, and will be supplemented by a growing number of students from emerging economies, changing the composition of the international student profile in terms of geographic place of origin. This is a result of many factors, including a decline in global fertility rates, an increase in life expectancy, a generally aging population in traditional sending countries, and a growing youth population in emerging economies, particularly in Africa.

While the USA is expected to remain the top destination country for students due to the size and reputation of their educational system, other destinations are becoming increasingly popular, such as Australia and Canada. Many traditional source countries are also growing the capacity and quality of their own education systems. Universities in China, Japan, and Singapore now rank among the top universities in the world and are attracting international students of their own. This is projected to lead to a shift in the top destination countries, but also in the number of students choosing to stay in their country of origin rather than going abroad.

The Anglicization of international education, which refers to the increasing number of English language programs in non-Anglophone countries, is also prompting this shift. As more programs become available with English as the language of instruction, particularly in Asia and Europe, this will add to the competition between study destinations. Overall, these changes may result in more reciprocal flows of students globally in the future as there is a trend towards increasing competition between these new and traditional destinations.

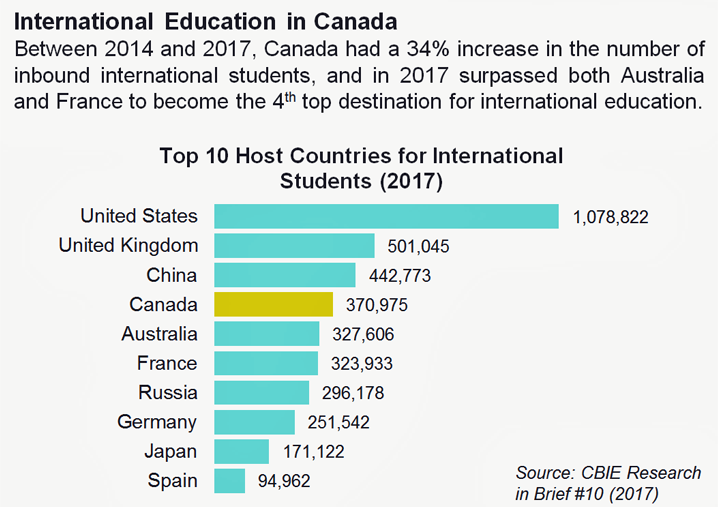

A bar chart showing the Top 10 Host Countries for International Students in 2017 broken down by country.

Text version

A bar chart showing the Top 10 Host Countries for International Students in 2017 broken down by country:

- United States 1,078,822

- United Kingdom 501,045

- China 442,773

- Canada 370,975

- Australia 327,606

- France 323,933

- Russia 296,178

- Germany 251,542

- Japan 171,122

- Spain 94,962

Program Background

The Education Sector

Education is a high-value service export sector for Canada, and is prioritized as one of the key sectors where Canada's expertise provides a strong competitive advantage. International education contributes to Canada's prosperity by promoting exports of educational services and goods, filling labour market gaps, and supporting immigration priorities. Further, international students contribute to improving the competitiveness of the Canadian economy as a result of their contributions to research and development and innovation.

Global Affairs Canada's (GAC) International Education Division (BBY) and the Trade Commissioner Service (TCS) are responsible for the promotion of the Canadian educational sector abroad on behalf of the Government of Canada (GOC). Education promotion includes the recruitment of international students to study in Canada (or to study a Canadian program from outside of Canada), the development of partnerships, and the sale/licensing of Canadian education services abroad.

International Education Strategy

Following the success of the Edu-Canada Pilot Project (2007-2012) and based on recommendations from an independent advisory panel, the International Education Strategy was launched by the Minister of International Trade in January 2014. The International Education Strategy (IES) is the GOC's main vehicle for marketing Canadian education internationally. The Strategy was launched with the primary objectives of doubling Canada's international student base to more than 450,000 by 2022, and promoting Canada as a world-class destination for education and research.

Key elements of the IES include:

- Refreshing Canada's educational brand and enhancing our digital presence

- Targeting key markets

- Coordinating with other GOC entities, provinces and territories

- Managing and supporting promotion activities across Canada's network of diplomatic missions

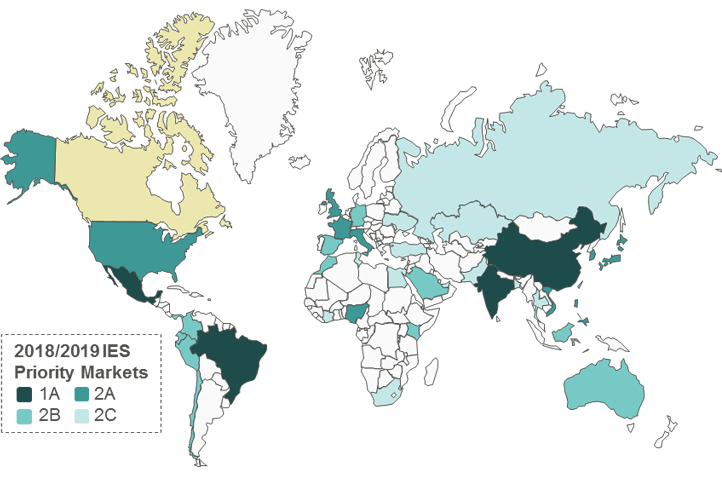

The IES identified Brazil, China, India, Mexico, the Middle East and North Africa as priority markets. In addition, BBY develops and updates a market prioritization tool each fiscal year, outlining current priority markets and funding allocations to missions for promotional activities.

World map highlighting the International Education Strategy’s priority markets

Text version

Text: The map depicts the International Education Strategy’s priority markets, divided them into four categories.

- Category 1A, the highest priority, includes Brazil, China, India, Mexico, the Middle East and North Africa.

- Category 2A, the second highest priority, includes the United States of America, France, the United Kingdom, Italy, Nigeria, Japan, South Korea, Philippines, Vietnam

- Category 2B, the third highest priority, includes Australia, Chile, China (Hong Kong), Colombia, Ecuador, Germany, Indonesia, Kenya, Morocco, Panama, Peru, Saudi Arabia, Singapore, Spain,

- Category 2C, the fourth highest priority, includes Bangladesh, Egypt, Ivory Coast, Jamaica, Taiwan, Kazakhstan, Malaysia, Pakistan, Russia, South Africa, Thailand, Tunisia, Turkey, UAE, Ukraine

International Scholarships Program

The International Scholarships Program (ISP) supports the IES and is managed by BBY. The program provides a variety of scholarships to international students coming to study in Canada, and approximately 750-800 scholarships are awarded per year. Other scholarships programs are also offered by other divisions in the Department. However, scholarships tend to be market specific, targeting students in Asia, Africa, and Latin America & the Caribbean. The largest program offered is the Emerging Leaders in the Americas Program (ELAP), which has awarded over 4,000 scholarships since 2009.

Program Resources

The International Education Division (BBY) is responsible for promoting Canada as a top study and research destination and education partner internationally, as well as for coordinating the educational promotion efforts of Canadian Embassies and Consulates abroad. BBY also manages the International Scholarship Program (ISP), coordinating the promotion and provision of scholarships for international candidates studying in Canada as well as Canadians wishing to study abroad. BBY leads, on behalf of Global Affairs Canada, the federal relationship with Canadian provinces and territories, foreign governments, educational institutions, education associations, multilateral organizations, and other federal government departments regarding engagement on international education. The BBY division is comprised of three main functions, whose teams oversee the coordination of these tasks.

An organizational chart of the International Education Division (BBY) of Global Affairs Canada

Text version

The International Education Division (BBY) is comprises approximately 25 Full Time Equivalent employees.

The International Education Division (BBY) is sub-divided in three units: The Communications, Marketing and Commercial unit, the Mission Support and Training unit and the Policy, Partnerships and Mobility unit.

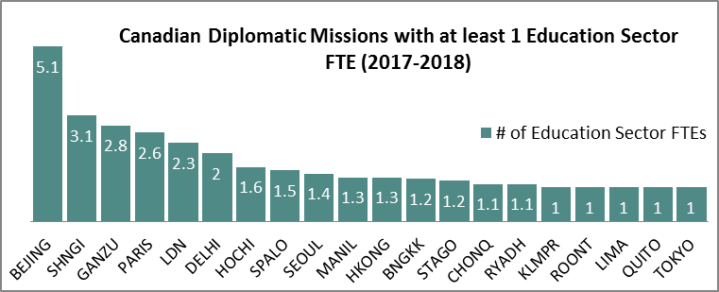

In addition to the BBY unit at GAC headquarters, the IES is supported by Canada's TCS at missions abroad. It is estimated that in 2017-2018, 74.2 FTEs were supporting the education sector at over 120 missions abroad.

A bar chart showing the number of Education Sector Full-Time Equivalents broken down by Canadian Diplomatic Missions

Text version

A bar chart showing the number of Education Sector Full-Time Equivalents broken down by Canadian Diplomatic Missions:

- Beijing 5.1

- Shanghai 3.1

- Guangzhou 2.8

- Paris 2.6

- London 2.3

- Delhi 2

- Ho Chi Minh 1.6

- Sao Paulo 1.5

- Seoul 1.4

- Manilla 1.3

- Hong Kong 1.3

- Bangkok 1.2

- Santiago 1.2

- Chongqing 1.1

- Riyadh 1.1

- Kuala Lumpur 1

- Waterloo 1

- Lima 1

- Quito 1

- Tokyo 1

Financial Resources

The IES Treasury Board submission included a budget of $5 million per year (ongoing) to promote Canada as a top study and research destination. This funding includes resources for new positions at HQ and missions abroad, as well as for increased marketing efforts.

The IES is supported by the International Scholarships Program (ISP). The ISP is a transfer payment program falling under the responsibility of the Minister of Foreign Affairs, and is comprised of both grants and contributions for international education. Scholarships are awarded to eligible recipients through a variety of federal scholarship programs, including to academic institutions and individual students.

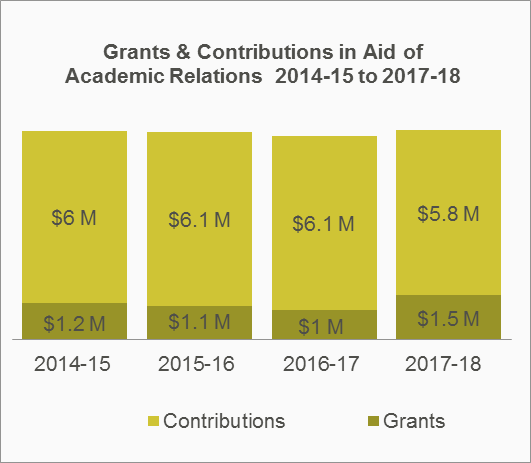

A bar chart showing the dollar value of grants and contributions in aid of Academic Relations broken down by fiscal year from 2014-15 to 2017-18

Text version

A bar chart showing the dollar value of grants and contributions in aid of Academic Relations broken down by fiscal year from 2014-15 to 2017-18:

- 2014-15 1.2 million dollars in grants and 6 million dollars in contributions

- 2015-16 1.1 million dollars in grants and 6.1 million dollars in contributions

- 2016-17 1 million dollars in grants and 6.1 million dollars in contributions

- 2017-18 1.5 million dollars in grants and 5.8 million dollars in contributions

Evaluation Scope

This evaluation provides Departmental senior management with a neutral and evidence-based assessment of the International Education Strategy, including the International Scholarship Program. The focus of this evaluation is on the Program's performance and achievement of results, the Program's alignment and coherence with other Departmental and Government of Canada priorities, and the Program's relevance in terms of the international education sector and Departmental and GOC priorities.

The reference period for the evaluation is from 2014/2015 to 2017/2018, covering the time period since the IES' implementation. This is a mid-term evaluation for the Program, as the time period for the IES runs until 2022, providing the potential for adjustments to be made to the Program if deemed necessary.

This evaluation is a mandatory evaluation, committed to by the IES Treasury Board Submission and required as part of the five-year Departmental plan. The evaluation was carried out in compliance with the 2016 Treasury Board (TB) Policy on Results.

Evaluation Questions

The evaluation was guided by 12 key questions, falling under the themes of relevance, performance, and governance. There was a large focus on program performance, with 8 of the 12 questions focusing on this area.

Relevance

- Does the IES target markets with the highest growth potential for Canada?

- Is Canada's strategy responding to current trends in international student mobility?

- Is the IES taking into consideration emerging Government of Canada priorities, such as: Feminist International Assistance Policy, GBA+ Agenda, GOC Youth Agenda, Progressive Trade and Investment Agenda, Atlantic Growth Strategy, Global Skills Strategy, Departmental Cultural and Public Diplomacy Strategies

Performance

- Has the IES contributed to increased enrollment by international students in Canada?

- To what extent has Canada's TCS contributed to advancing the IES?

- Has the IES contributed to an increase in the number of international students remaining in Canada after graduation from post-secondary education?

- Does the International Education Division communicate effectively with key internal and external stakeholders?

- Have IES marketing activities contributed to increasing awareness of Canada as a study and research destination in target markets?

- To what extent has the resource utilization of the IES and ISP been efficient?

- Have there been any operational constraints affecting the programs' capacity to achieve stated objectives and expected results?

- How does the IES compare, in terms of efficiency and expected results, with similar strategies by other education service exporters?

Governance

- Do current governance and management mechanisms enable effective and efficient delivery of the IES?

Methodology

The evaluation employed a mixed methods approach that consisted of both quantitative and qualitative data to respond to the evaluation questions and enhance the reliability of results. Data was collected from May to October 2018.

Key Stakeholder Interviews (n=122)

Semi-structured interviews were conducted in-person and by phone with key stakeholders at GAC HQ (HQ) and missions abroad (MISSION), relevant other federal and provincial Canadian government departments (OGD), and external stakeholders both Canada- and locally-based (EXTCAN and EXTLOC), including educational institutions at all levels from primary to post-secondary, Program beneficiaries, and representatives from education associations. A total of 122 interviews were conducted as part of this evaluation. Four standard interview protocols were developed to ensure the relevance of questions for different groups of stakeholders.

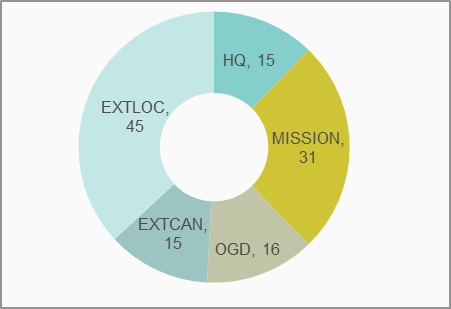

A pie chart showing the number of semi-structured interviews broken down by the categories of respondents.

Text version

A pie chart showing the number of semi-structured interviews broken down by the categories of respondents:

- Global Affairs Canada Headquarters 15

- Missions abroad 31

- Other Government Departments 16

- External Stakeholders in Canada 15

- Locally Based External Stakeholders 45

Online Survey of Mission Staff (n=60)

An electronic survey was developed by the evaluation team and administered to the Education Leads and Managers at 93 missions abroad, with a request to complete one survey per mission. 60 responses from individual missions were collected over a three-week period, providing a response rate of 65%. Respondents had various years of experience working in the education sector at missions abroad, and there was good geographical representation across the responses received.

Survey questions were presented using a variety of formats including multiple choice, ranking, and open text, providing a mixture of qualitative and quantitative responses. The questions covered themes such as the interest of international students to study in Canada, promotional and marketing strategies utilized by the mission, suitability and effectiveness of tools such as the EduCanada.ca website and TRIO, support received from BBY, scholarships, and coherence with other Departmental areas and priorities.

Data Review

A variety of data sources were consulted and reviewed to assess Program performance and determine trends in international student mobility. Departmental reporting tools such as TRIO and Strategia were used to evaluate the performance of the TCS in delivering education results at missions abroad. Data on study permits and permanent residency from Immigration, Refugees, and Citizenship Canada (IRCC) was used to analyze trends in international student mobility to Canada and to assess IES results. Additional statistics and databases from the OECD, the Institute for International Education's (IIE) Project Atlas, UNESCO, and Statistics Canada provided information on foreign students in Canada, including gender disaggregated data, and on international student mobility. These data sets were used to determine national and global education trends.

Document and Literature Review

The evaluation team conducted a comprehensive review of documentation provided by the Program team, including financial documents, statistics, correspondences, reports and other relevant files. Other academic and grey literature, including Canadian and international education reports, competitor international education strategies and documentation, and articles from both news and peer-reviewed sources, were consulted to analyze trends in international student mobility and situate Canada's performance in the education sector globally.

Web and Social Media Analytics

A variety of web and social media statistics were reviewed and analyzed by the evaluation team. BBY provided statistics regarding web traffic of five Canadian international education websites for the period of 2010-2017, as well as statistics on social media presence for the period of 2014-2017. These sources were consulted to evaluate Canada's online presence for international education.

Site Visits (n=13)

Field visits to missions and priority countries were conducted across three separate trips to Latin America, Asia, and Europe. Secondary interviews were also completed in Africa by PRE team members who were there on a field visit for another evaluation. A mixture of in-person and phone interviews were conducted at each site with key stakeholders at the Canadian missions, at local educational organizations, and with Program beneficiaries.

Latin America:

- Brazil

- Panama

- Peru

- Colombia

Asia:

- China

- India

- Indonesia

- Singapore

Europe:

- UK

- France

Africa:

- South Africa

- Mozambique

- Ghana

Limitations & Mitigation Strategies

This evaluation consulted a wide variety of data sources, both qualitative and quantitative in nature. As the education sector is relatively large and open internationally, a wealth of open source data was easily available and accessible to the evaluation team. This allowed for significant triangulation of data across a relatively comprehensive data set, improving the accuracy of findings. The evaluation team also had a good working relationship with the Program team, with willing and open communication, which eased the process of finding key documents and pertinent information.

| Limitations | Mitigation Strategies |

|---|---|

| Availability of Data: TRIO was implemented for education sector reporting in 2013, and there was a learning curve in reporting education sector results in this tool. Therefore, much of the data in the first years of its use is inaccurate – valid TRIO data for the education sector begins in the 2015/2016 fiscal year. | To compensate for the lack of completely accurate data in the first year of the IES' implementation, the evaluation team used the IES strategy baselines as a starting point for TRIO data, and also relied on other key sources to fill in the gaps and triangulate data for findings. |

| Availability of Stakeholders: The data collection phase of the evaluation was primarily conducted over the summer months. Many key stakeholders were therefore on vacation and unavailable for interviews. The late-summer is also rotation time at GAC, and many stakeholders were in the process of transitioning to new positions at this time. This meant that certain stakeholders did not have enough time or experience in a particular market or position to give sufficient comments, or could not be reached altogether. | Interviews were scheduled to accommodate vacations as much as possible, and key stakeholders were offered alternate interview times in order to ensure the evaluation team accommodated and covered a wide range of stakeholders. For stakeholders in the rotation process, the evaluation team reached out to as many staff as possible, and contacted alternate points of contact where applicable. All missions were contacted for the survey to include as broad a range of responses as possible. |

| Consistency of Data: Quantitative data with regard to the volume of international student mobility was somewhat inconsistent across sources, particularly with the total number of students in Canada in 2017 and 2018. This posed data quality and consistency challenges for the evaluation team. | Data sources and numbers were compared to determine the correct data where possible, and where there were issues of inconsistency, the most common numbers were used. The team also relied primarily on Canadian data for Canadian student numbers rather than relying on international sources to count inbound students. Finally, data was triangulated with other sources to ensure consistency and accuracy. |

| Attribution of results: There are a multitude of factors influencing international student mobility. In this context, it is difficult to measure the net impact that activities related to the IES have had on Canada's success in attracting international students. | The evaluation had to rely on qualitative stakeholder perceptions of the program's impact in local markets. Through interviews and the survey, the evaluation team sought stakeholders' opinions on the impact of the IES on interest to study in Canada in a local market. |

Finding #1: The International Education Strategy has contributed to Canada meeting its target of attracting 450,000 international students, five years ahead of schedule.

The international education market has significantly grown over the past several decades, with the number of internationally mobile students nearly quadrupling since 1990 to roughly five million students in 2017.

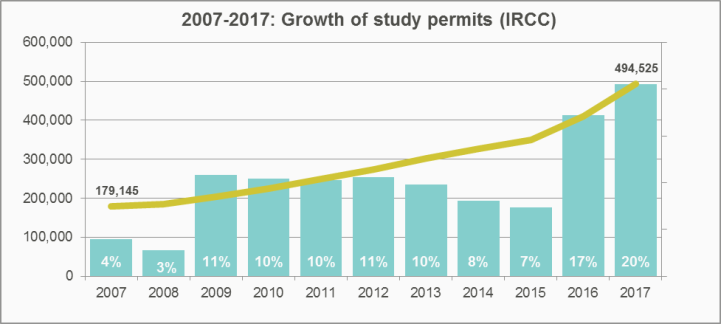

In Canada, the number of international students has increased significantly in the past 10 years, and growth has accelerated since the implementation of the IES began. While launched in January 2014, implementation of the IES effectively began in fiscal year 2014-15. In the following fiscal years, growth reached 17% (2016) and 20% (2017), thus allowing Canada to surpass its objective of attracting 450,000 international students by 2022.

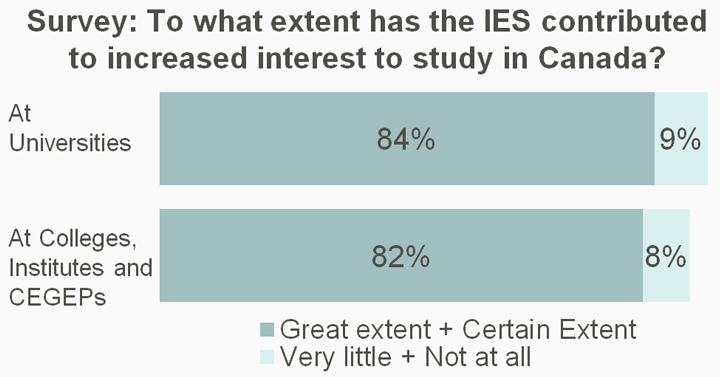

A stacked bar chart showing the extent to which the International Education Strategy contributed to increased interest to study in Canada broken down by academic institution type and degree of influence

Text version

A stacked bar chart showing the extent to which the International Education Strategy contributed to increased interest to study in Canada broken down by academic institution type and degree of influence

At Universities a sum of a great extent and a certain extent 84% a sum of very little and not at all 9%

At Colleges Institutes and CEGEPs a sum of great extent and a certain extent 82% a sum of very little and not at all 8%

While it is challenging to confidently measure the net impact of the IES on the growth of international students in Canada, GAC education sector stakeholders at missions abroad were convinced that the Strategy had contributed to increased interest to study in Canada for post-secondary education.

A combination bar graph and line chart showing the percentage of growth of study permits issued by the department of Immigration Refugees and Citizenship Canada broken down by year.

Text version

A combination bar graph and line chart showing the percentage of growth of study permits issued by the department of Immigration Refugees and Citizenship Canada broken down by year:

- 2007 4% totalling 179,145

- 2008 3%

- 2009 11%

- 2010 10%

- 2011 10%

- 2012 11%

- 2013 10%

- 2014 8%

- 2015 7%

- 2016 17%

- 2017 20% totalling 494,525

Canada's market share of the International Education market

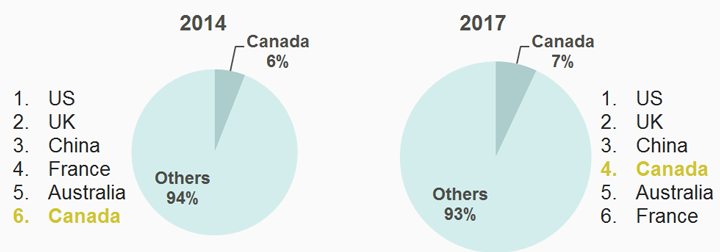

The growth Canada has seen has been reflected in its share of the global international education market. According to research by the Institute of International Education (IIE), Canada's share of the international education market, as defined by the proportion of international students it hosts, grew from 6% at the start of the IES in 2014 to 7% in 2017. According to IIE data, this makes Canada the 4th top destination for international students worldwide, surpassing competitors such as Australia and France.

A pair of pie charts showing Canada's share of the global international education market and Canada's global ranking in the international education market in 2014 and 2017.

Text version

A pair of pie charts showing Canada's share of the global international education market and Canada's global ranking in the international education market in 2014 and 2017.

- In 2014 Canada 6% Others 94% the US is first the UK is second China is third France is fourth Australia is fifth and Canada is sixth.

- In 2017 Canada 7% Others 93% the US is first the UK is second China is third Canada is fourth Australia is fifth and France is sixth.

Finding #1.A: The geographic origins of international student growth in Canada slightly diversified over the evaluation reference period. However, Canada still relies on two major markets for the majority of international students, reflective of global trends.

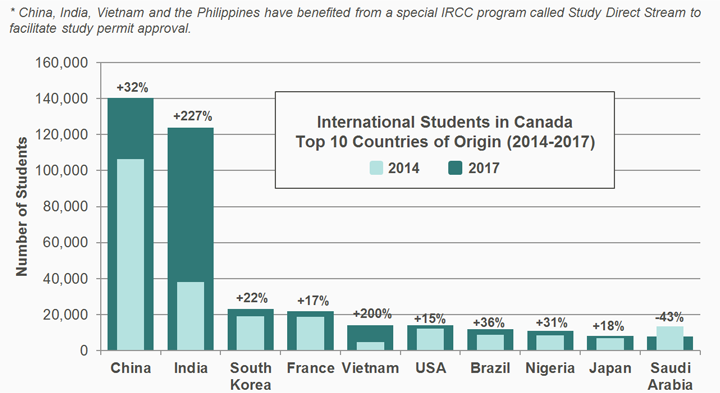

Between 2014-2017, Canada's international student population diversified slightly, although the two primary sources of international students, China and India, continued to dominate the market. This is reflective of global trends, where China* and India remain the largest sending countries of international students worldwide. During the evaluation reference period, India* (227%), Vietnam* (200%), the Philippines* (120%), and Turkey (102%) were the fastest growing countries of origin in Canada in terms of growth rates. However, in terms of the absolute number of students, the largest growing countries of origin were India (86,015), China (34,075), Vietnam (9,400), and South Korea (4,090). Of Canada's top 20 countries of origin, only the number of students from Saudi Arabia declined between 2014-2017.

In 2017, the top 20 countries of origin accounted for 85% of all international students in Canada, with 53% comprised of Chinese and Indian students. The proportion of Chinese and Indian students grew from 44% in 2014, demonstrating an increasing reliance on these two key markets. However, when China and India are excluded from this count, the remaining top 18 countries of origin comprised 32% of the international student population in 2017, which decreased from 39% in 2014. This suggests that the geographic origins of students apart from the top two have diversified over the evaluation reference period, with more students choosing to study in Canada outside of the typical sending countries, and including more emerging markets.

A double bar chart showing the percentage of change of international students in Canada from 2014 to 2017 broken down by the top ten countries of origin.

Text version

A double bar chart showing the percentage of change of international students in Canada from 2014 to 2017 broken down by the top ten countries of origin:

- China + 32%

- India + 227%

- South Korea + 22%

- France + 17%

- Vietnam + 200%

- USA + 15%

- Brazil + 36%

- Nigeria + 31%

- Japan + 18%

- Saudi Arabia – 43%

Compared to the top countries of origin for students studying in the United States, Canada's top countries of origin are relatively similar. Canada has, however, seen faster growth in the number of students from emerging markets such as South Korea, Vietnam, and Nigeria. In general, the top 10 countries of origin for students in Canada are reflective of global and North American trends in the biggest sending countries.

Global future growth of international students is expected to continue to come from China and India as the two largest markets, followed by Germany, South Korea, Saudi Arabia, Nigeria, Nepal, and Pakistan.

Diagram with circles

Text version

Circles showing the growth in international students coming from the top-2 fastest growing countries of origin between 2014 and 2017, India and Vietnam.

India: In 2014, there were 37,925 students from India. That number grew to 123,940 in 2017.

Vietnam: In 2014, there were 4,695 students from Vietnam. That number grew to 14,095 in 2017.

Finding #1.B: Other factors have been very favourable to Canada's attractiveness as a study destination.

Beyond Canada's education promotion efforts and activities through the IES, several other factors have contributed to increasing the number of international students in Canada. According to the survey and interview results, the top three reasons for increased interest to study in Canada are:

Canada's Reputation

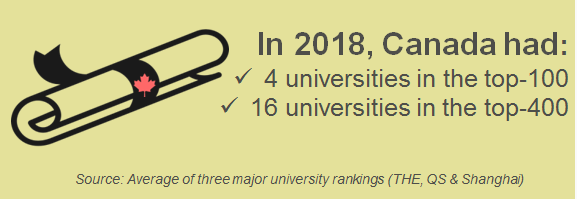

Canada's positive reputation was identified by respondents as one of the top reasons students choose Canada as a study destination. Canada is perceived as a safe, stable, clean and welcoming country with a high quality education system. A large majority of survey respondents (88%) stated that Canada's positive reputation, broadly defined, has contributed to increased interest to study in Canada.

Canada’s Reputation

Text version

In 2018, Canada had:

- 4 universities in the top-100

- 16 universities in the top-400

According to the Reputation Institute's annual Country Reptrak report, which measures the global reputation of the world's 55 largest economies, Canada ranked #1 in 2017 and has ranked first or second every year since 2012. While Canada's ranking scores have remained relatively steady or have grown over the evaluation reference period, its competitors have seen drops in their ranking, particularly the US and UK, showing that Canada's reputation relative to others has been a contributing factor. This favourable perception combined with opportunities for student employment, post-study employment and permanent residency make the country one of the most attractive destinations for international students.

Cost of Studying in Canada

According to 62% of survey respondents, the cost of studying contributed to increased interest to study in Canada. Although tuition fees for international students rose over the evaluation reference period in all English language markets, Canada's fees have remained lower than those of its competitors. The Canadian dollar was also more competitive than other major currencies during the evaluation reference period.

Reputation of Competitor Countries

60% of survey respondents and the majority of interview respondents stated the perceived worsening economic and sociopolitical situations in competitor countries contributed to increased interest to study in Canada. According to these respondents, the 2016 USA presidential elections and the 2016 Brexit referendum were the two most important events to affect international student mobility to English speaking countries.

As of March 2018, there were 0.5% fewer student visas issued in the USA than 12 months earlier. Though slight, this is the first decline since the 2008 recession. While data for the UK has not shown reduced enrollment by international students post-Brexit, recent surveys of prospective international students considering the UK tend to show pessimism about studying in the UK and a greater likelihood to choose another destination due to the uncertainty surrounding Brexit.

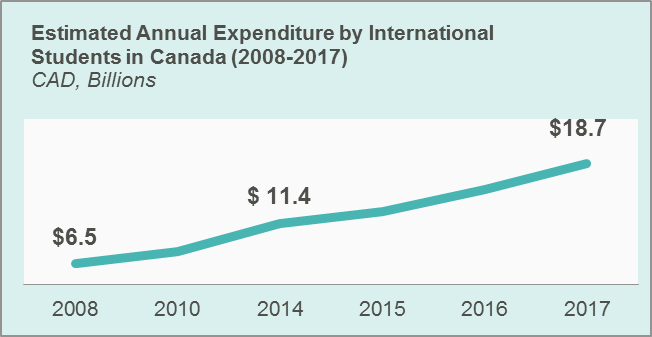

Finding #1.C: The education sector has grown to be one of the most valuable sectors of the TCS.

Economic Benefit of the Education Sector to Canada

Every few years, Global Affairs Canada commissions consulting firm Roslyn-Kunin and Associates (RKA) to measure the direct and indirect economic impact of international students' spending on the Canadian economy. Spending by international students includes tuition fees, living expenses, discretionary spending, and other categories. This number is used to compare the value of education sector exports with other trade sectors. RKA has produced these types of econometric studies for the Department in 2009, 2012, 2016 and 2017. According to these studies, the estimated annual expenditure by international students in Canada has nearly tripled since 2008, and has increased by 39% since the beginning of the IES. When we compare the annual expenditure by international students in Canada to other trade sectors, the Education sector would be Canada's second most valuable service sector (after Personal Travel) accounting for almost 17% of service exports. When compared to a merchandise export, the education sector exports are higher than exports of Wood & Articles (C$ 18.3 B) and Aluminum & Articles (C$ 12.7 B) in 2017.

A line graph showing the Estimated Annual Expenditure by International Students in Canada from 2008 to 2017 broken down by year.

Text version

A line graph showing the Estimated Annual Expenditure by International Students in Canada from 2008 to 2017 broken down by year:

- 2008 6.5 billion dollars

- 2014 11.4 billion dollars

- 2017 18.7 billion dollars

Education as a Trade Sector

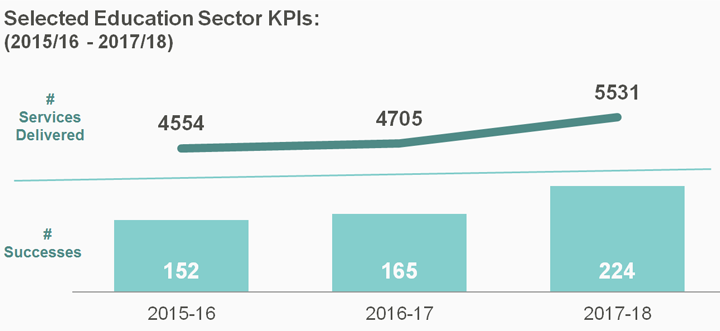

On all traditional TRIO measures, the education sector is one of the most important trade sectors for the TCS. For fiscal year 2017-2018, out of approximately 24 trade sectors, the Education Sector was in the top 5 for most categories of Key Performance Indicators (KPIs). Since the implementation of the IES began in 2014, there has been a steady increase in most categories of KPIs, including services and successes.

Cost of Studying in Canada

Text version

In 2017/2018, the education sector was 2nd for services delivered, 2nd for client satisfaction (94%), 3rd in opportunities pursued and 4th in economic outcomes facilitated.

A line graph and bar chart showing the number of services delivered and number of successes of Selected Education Sector Key Performance Indicators broken down by fiscal year.

Text version

A line graph and bar chart showing the number of services delivered and number of successes of Selected Education Sector Key Performance Indicators broken down by fiscal year:

- 2015-16 4554 services delivered and 152 successes

- 2016-17 4705 services delivered and 165 successes

- 2017-18 5531 services delivered and 224 successes

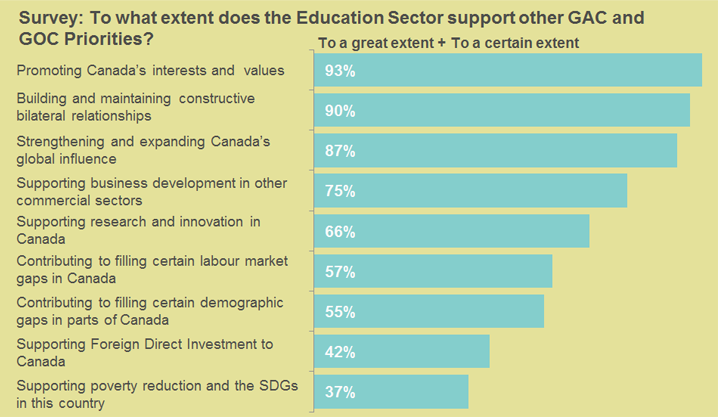

Finding #1.D: The education sector contributes to the achievement of results towards other Departmental objectives and other Government of Canada priorities.

The education sector is seen by various groups of key stakeholders as an enabler for the achievement of results in other Departmental areas and more broadly towards other GOC priorities.

GAC Objectives

The majority of stakeholders stated that the education sector contributed to the achievement of results under GAC's International Advocacy and Diplomacy core responsibility. Positive experiences of studying in Canada by individuals or family members had a deep and lasting influence and predisposed local contacts to speak highly of Canada in their communities and have constructive interactions with Canadian officials and citizens. Education was also seen as enabling success in other commercial sectors. Alumni from Canadian institutions were more likely to look to the Canadian market for sourcing goods or services, and more likely to consider Canada when making investment decisions. In both the survey and through interviews, there was strong evidence that the education sector generated leads for other commercial sectors such as ICT, Life Sciences, Extractives, and Tourism.

A bar chart showing the extent to which the Education Sector supports the priorities of Global Affairs Canada and the Government of Canada summing the totals from the response categories to a great extent and to a certain extent broken down by categories.

Text version

A bar chart showing the extent to which the Education Sector supports the priorities of Global Affairs Canada and the Government of Canada summing the totals from the response categories to a great extent and to a certain extent broken down by categories:

- Promoting Canada's interests and values 93%

- Building and maintaining constructive bilateral relationships 90%

- Strengthening and expanding Canada's global influence 87%

- Supporting business development in other commercial sectors 75%

- Supporting research and innovation in Canada 66%

- Contributing to filling certain labour market gaps in Canada 57%

- Contributing to filling certain demographic gaps in parts of Canada 55%

- Supporting Foreign Direct Investment to Canada 42%

- Supporting poverty reduction and the SDGs in this country 37%

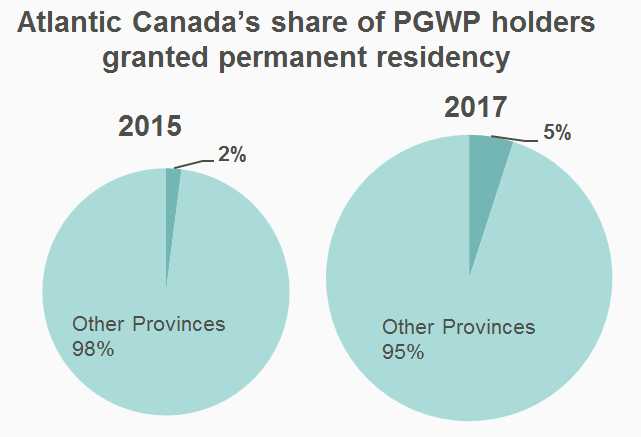

GOC Priorities

The education sector is also widely perceived as supporting other governmental priorities such as immigration and the Innovation and Skills Agenda. International students contribute to filling labour market and demographic gaps in provinces that are experiencing demographic decline (e.g. Atlantic Canada). International students in Canada were a key source of skilled immigration through the prov

incial nomination programs and other fast track immigration programs, such as the Atlantic immigration pilot. Data from IRCC on pathways by international students to permanent residency in Canada is clear: in 2017, 18,730 former post-graduate work permit (PGWP) holders were granted Permanent Residency (PR), an 83% increase from 2015.

Further, because international students are disproportionately represented in graduate-level programs in Canada, they play an important role in research and innovation at Canadian institutions. According to CBIE, up to 55% of international students were enrolled in graduate-level programs in 2017-2018.

Two pie charts showing Atlantic Canada's share of PGWP holders granted permanent residency compared to the other provinces of Canada broken down by year.

Text version

Two pie charts showing Atlantic Canada's share of PGWP holders granted permanent residency compared to the other provinces of Canada broken down by year:

- 2015 Atlantic Canada 2% Other Provinces 98%

- 2017 Atlantic Canada 5% Other Provinces 95%

Finding #2: International Education can be a driver of coherence between the different Departmental business lines.

While the survey results highlight strong linkages between the International Education and trade and diplomacy priorities, the linkages with development objectives are less clear. However, the evaluation team did encounter situations whereby international education has contributed to greater coherence between the trade and development streams.

PM Speech

Text version

Flag of the United Kingdom

Prime Minister’s speech at the University of Edinburgh

In July 2017, during the Prime Minister’s visit to Scotland, the Education sector team at the high commission in London supported the organization of an event at the University of Edinburgh in which the PM received an honorary Ph.D. and delivered remarks to the graduating class. The PM’s speech was widely covered by British and International media and contributed to strengthening and expanding Canada’s global influence.

Education Sector & Diplomacy Coherence

In nearly every country visited by the evaluation team, there were strong examples of coherence between the education sector and the Foreign Policy and Diplomacy Service (FPDS). For example, there were several cases of FPDS engagement in local universities on Canadian perspectives, organized with the help of the education sector team. These joint outreach visits support the recruitment of international students and promote Canadian values.

Education Sector & Development Coherence

A minority of stakeholders expressed concern about the negative impact that international student recruitment activities could have on countries where Canada also invests in development programming. The evaluation team found limited evidence that the education sector is contributing to a "brain drain" effect. Only a small proportion of international students are recruited from countries where Canada has large international assistance investments (with the exception of India, Nigeria and Vietnam). Furthermore, there was no available data on how many of those students immigrate to Canada following completion of their studies. Much of the recent literature on international student mobility from developing countries has emphasized the benefits of the phenomenon, moving from "brain drain" to "brain circulation".

In line with this more nuanced understanding of student mobility from developing countries, the evaluation team found several examples of coherence between the International education sector and Development. For example, following the 2004 tsunami in Indonesia, it became clear that the lack of actuaries in the country was negatively affecting the resilience of low and middle income households to natural disasters. Responding this challenge, the development and education sector teams at the Canadian embassy in Jakarta worked together to fund an initiative to develop the capacity of universities in Indonesia for training in actuarial sciences. The embassy worked with the University of Waterloo to build the capacity of Indonesian actuarial sciences programs.

Finding #3: Alumni engagement allows Canada to reap the longer term benefits of international education, but it can be expensive and time-consuming.

Canadian institutions have alumni all around the world. International alumni are a key group of stakeholders to capture the longer term benefits of study in Canada. Not only can alumni from Canadian institutions support student recruitment in their countries of origin, but they also become ‘ambassadors' for Canada and can be leveraged to advance Canadian diplomatic and commercial interests abroad.

While GAC does not have an official alumni engagement strategy, the International Education Division does provide guidance to trade commissioners abroad on how to engage and leverage local alumni. Canada's diplomatic missions abroad are free to determine the level of effort that they dedicate to alumni engagement. Therefore, there is wide variation in the level of alumni engagement activities at different missions.

Some missions stated that alumni are very helpful as part of student recruitment activities. Alumni can speak about their experience in Canada during fairs, events, or presentations. Further, alumni testimonials can be used for social media and web content.

Quote Bubble

Text version

The image shows a person speaking with a quote bubble.

The person speaking is an Emerging Leaders of the Americas Program Scholarship recipient:

“My positive experience in Canada, from the world-class education I received to the welcoming, peaceful and multicultural society that I discovered, made a deep impression on me.

I regularly speak about my experience in Canada, in my personal and professional life, and it is always positively.”

Competitor Alumni Engagement

The Government of Australia has developed an Australia Global Alumni Engagement Strategy to reach out to their global alumni community, inviting alumni to connect and engage with Australia and the region. The central component of the engagement strategy is the Australia Global Alumni website, a virtual global network to connect, build and invigorate Australian alumni. Other countries such as France, Germany and New Zealand also maintain virtual alumni networks.

Long Term Benefits of International Education

Some of the benefits of international education only take form in the long-term. As former students progress in their careers, reach more senior positions, and gain greater responsibilities, they often retain positive inclinations towards their Alma Mater, the city, the province/territory and country in which they studied.

While it remains difficult to systematically measure the extent to which alumni are supporting the advancement of Canadian Diplomatic and Commercial interests locally, anecdotal evidence suggests that they are of great benefit to Canada. Many interview respondents at missions abroad provided examples of situations where Canada benefited from the fact that an individual had studied at a Canadian institution.

From senior government officials in Latin America being more inclined towards Canada's positions and expertise, to senior business people in Asia considering Canada first in business dealings, the advantage of having a local contact that studied at a Canadian institution was appreciable.

Finding #4: The education sector has adapted to becoming a trade sector, however some results are not adequately captured in TRIO.

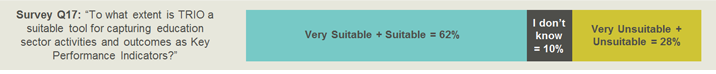

Survey Question:

Text version

This bar graph visually represents the survey responses to the following question.

“To what extent is TRIO a suitable tool for capturing education sector activities and outcomes as Key Performance Indicators?”

- 62% responded “Very Suitable” or “Suitable”

- 10% responded “I don’t know”

- 28% responded “Unsuitable + Very Unsuitable”

TRIO is the Client Relationship Management (CRM) system used by the Trade Commissioner Service (TCS) at missions abroad. TRIO allows the TCS to keep records of all their activities (including outcalls, services, opportunities, and successes), and their relationships with Canadian clients, partners and local contacts. Key Performance Indicators (KPIs) recorded in TRIO demonstrate an economic benefit relayed back to Canada through a direct TCS activity.

Education was included as a trade sector in 2013. However, as international education previously operated differently than other trade sectors, there was a learning curve in terms of performance measurement and reporting on education in TRIO. The Performance Measurement Unit (BTB) and BBY therefore worked together to determine the best way to record education sector KPIs and to clarify through workshops and training sessions what could be considered a KPI. Adjustments have since been made in TRIO to make reporting more sector-specific.

Although education has adapted well to becoming a trade sector, and reporting has improved over the past few years, TRIO is still considered generally, but not wholly, suitable as a reporting tool for activities relating to student recruitment. According to survey respondents, 62% found the tool effective, but 38% considered it ineffective or did not know. Interviewees and survey respondents agreed that this is largely due to the specificities of the education sector which only allow certain activities and successes to be recorded as KPIs. For example, the signing of an MOU between Canadian and international education institutions, and the proof of students attending the Canadian institution as a result, would be considered a KPI success in TRIO.

Two primary issues faced in recording KPI successes are the definition of a "client" for international education, and the fact that education is a horizontal sector. As only institutions or companies, like schools, can be considered clients in TRIO, any interactions with individuals or successes in student recruitment are not captured as KPIs, although these may be considered clients in the diplomatic sense. Further, education sector activities often overlap with activities in other sectors, such as mining or sciences, but cannot be captured under both sectors in TRIO. As a result, TCs may have to choose under which sector to report a KPI, which can lead to a lower number of education KPIs reported if other sectors are chosen in accordance with TCS department objectives and mission KPI targets.

In light of these sector particularities, interviewees and survey respondents highlighted that several activities and outcomes that cannot be captured in TRIO. These discrepancies were noted as a source of frustration, as respondents felt the full scope of their efforts were not being adequately captured or included in performance measurement activities and reporting. To mitigate, missions will instead report on these results in Strategia or in individual reports sent to GAC headquarters. The combination of reporting using these three methods ensures the full scope of TCS work on the education sector is captured and recognized. However, mission and BBY stakeholders noted the burden of having to use three separate systems for reporting.

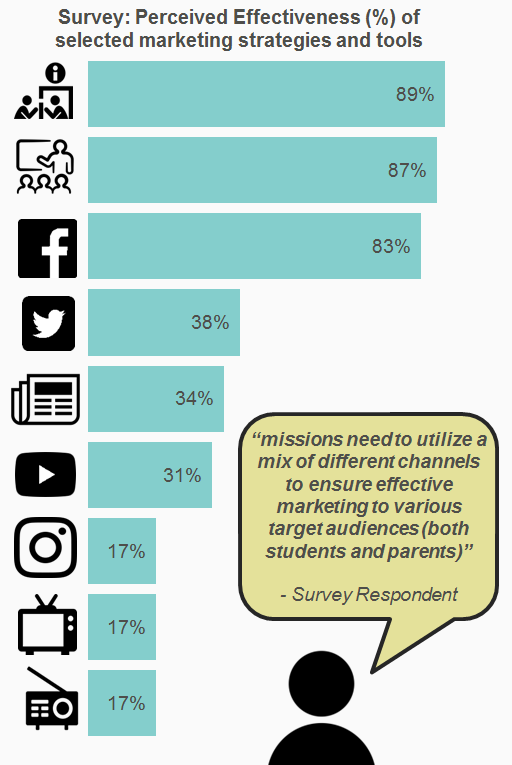

Finding #5: Missions rely on a wide variety of tools to promote Canada as a study destination. Despite the growing importance of web and social media channels, participation in fairs and in-person events remains an important tool in most markets.

Depending on local market conditions, the education sector team at mission can choose different media types to promote Canada's education sector. Different tools are best suited for different audiences (e.g. Parents vs. Students) depending on the market.

Face-to-Face Promotion

97% of survey respondents noted that their mission uses face-to-face marketing strategies. These promotion activities, and particularly fairs and presentations, were considered to be some of the most effective tools to promote Canada as a study destination.

Interviewees noted that while it can be difficult to measure the impact of these types of events, these efforts add a personal touch and enable connections to be made, which cannot necessarily be achieved through other marketing efforts. These events are also particularly useful for answering questions or addressing concerns parents may have.

Web and Social Media

91% of survey respondents noted that their mission uses social media marketing. Internet and social media are often the first point of contact for students in today's digital age. Public opinion research conducted on behalf of BBY in 2016 highlighted that the most important source of information for international students looking to study in Canada is social media and web platforms (59%).

Many interview respondents recognized the increasing importance and effectiveness of Canada's presence on social media platforms such as Facebook, Twitter, YouTube, and Instagram, to reach prospective students. Of these tools, Facebook and Twitter were found to be more effective and widely used by missions.

Traditional Media

38% of survey respondents noted that they their mission uses traditional media marketing. Use of traditional media, such as television, radio, magazines, and newspapers, is diminishing and is perceived by survey respondents as less important than other marketing efforts. However, many missions still use these tools where they continue to prove their success, especially when combined with other marketing efforts, such as attending education fairs.

For example, an annual radio contest organized by the Consulate General of Canada in São Paulo continues to be one of the mission's most important marketing tools for the education sector.

A bar graph showing the percentage of perceived effectiveness of selected marketing strategies and tools broken down by method of communication.

Text version

A bar graph showing the percentage of perceived effectiveness of selected marketing strategies and tools broken down by method of communication:

- Face to face 89%

- Fairs and presentations 87%

- Facebook 83%

- Twitter 38%

- Newspapers and magazines 34%

- YouTube 31%

- Instagram 17%

- Television 17%

- Radio 17%

Finding #6: Marketing efforts to promote Canadian education have effectively contributed to raising awareness about Canada as a study destination.

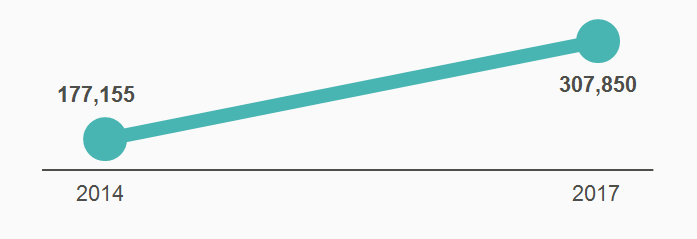

A central component of the IES was to increase awareness of Canada as a study and research destination. Marketing efforts to promote Canada as a study destination have been successful thus far in attracting students from over 185 countries. Several different data sources confirm that there has been an increased interest in studying in Canada over the reference period.

Study Permit Applications

There has been high growth in the total number of study permit applications during the evaluation reference period. Based on IRCC data, the number of total finalized study applications per annum has increased by 173% between 2014 and 2017.

A slope graph showing the growth in the total number of study permits applications broken down by year.

Text version

A slope graph showing the growth in the total number of study permits applications broken down by year:

- 2014 177,155

- 2017 307,850

Google Trends

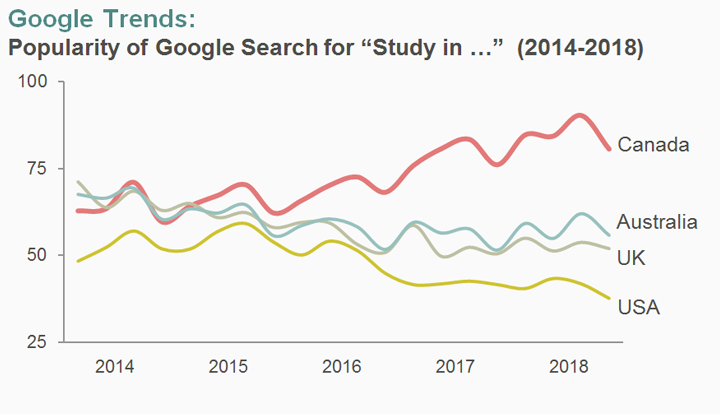

Greater awareness of Canada as a destination of study is also reflected in Google search trends worldwide. The graph below shows the relative popularity of the Google search term "Study in…" followed by the names of major English language educational service exporting countries between 2014 and 2018.

While the popularity of Google searches for major competitors has declined during the reference period, interest in Canada has increased notably.

A line graph showing the popularity of Google search for study in… broken down by country from 2014 to 2018.

Text version

A line graph showing the popularity of Google search for study in… broken down by country from 2014 to 2018.

The trend after 2016 shows Canada in the lead followed by Australia, the UK and the USA

Web Traffic and Social Media Impact

The Canadian international education websites, including EduCanada.ca and scholarships.gc.ca, were found by a majority of stakeholders to provide useful information for students looking to study in Canada.

Overall, during the evaluation reference period there was an increase in web traffic to the IES websites, growing from grown from 7.3 million in 2014 to 8.5 million in 2017. However, while the number of visits to EduCanada.ca has decreased since 2014, the number of visits to scholarships.gc.ca has greatly increased.

Social media engagement by GAC on international education has been inconsistent between 2014 and 2018, making it difficult to identify clear trends. The types of social media used have changed, and the level of effort has varied, leading to challenges in monitoring social media engagement. Data suggests that social media engagement peaked in 2015 with 129 Facebook posts leading to over 13,000 engagements (e.g. likes, shares, comments, clicks) and 574 Tweets leading to over 5,205 engagements and 4,762,187 impressions (number of times appeared). In 2017, 35 Facebook posts generated 2,707 total engagements, 71 Tweets generated 273 total engagements and 755,808 impressions and 22 YouTube videos generated 4,302 total engagements and 41,215 video views. A majority of interview respondents recommended increasing social media engagement on international education, with several suggesting more paid advertisement on social media platforms.

Finding #7: A targeted approach to student recruitment would be more effective in addressing immigration and labour market needs.

As Canada meets the student recruitment objective of the IES five years ahead of schedule, many stakeholders stated that Canada should be more strategic in its activities and better align student recruitment with the country's Labour Market and Immigration needs. It was suggested that an enhanced digital presence would allow more targeted recruitment and help Canada maintain its market share in an increasingly competitive marketplace.

Labour Market Gaps

International students bring skills and experience to Canada that are needed to fill shortages in the labour market. As the Canadian population ages and retires, more candidates are required to fill these gaps, particularly in highly skilled and technologically-based professions, including in research, innovation, and technical fields. Interview respondents noted that targeting international students in STEM, and promoting long term employment possibilities following graduation, can help address some of these labour market shortages while also bringing many benefits to Canadian businesses.

Demographic Gaps

Canada's unique geographical context means that there are a wide variety of educational institutions and lifestyles available for international students to choose from. However, Ontario and British Columbia consistently attract a vast majority of students, and three cities in particular – Toronto, Vancouver, and Montreal – hosted 55% of all international students in Canada in 2017. Many interviewees therefore noted that promoting study at smaller, more regional schools would help address demographic gaps across the country. Atlantic Canada, for example, relies on international students to support a large and diverse population. Interviewees also stated that marketing efforts need to continue to promote more regional locales in order to avoid saturation of international students in the big cities and at the most well-known institutions.

Comprehensive Digital Strategy

While the IES TB-Submission did provide funding for a digital strategy, a Departmental re-allocation of funds has left the digital strategy mostly unfunded.

According to stakeholders, a comprehensive digital strategy is essential for Canada to remain relevant in an increasingly competitive market place. Canada was seen as falling behind its major competitors on web-based marketing and recruitment tools. A digital strategy would allow Canada to collect real-time data on the interests of students, and make content and tools available in different languages.

Interview respondents highlighted the following key components to include in a comprehensive digital strategy:

- Enhancing the EduCanada website and creating a one-stop shop for all information on Canadian education, including scholarships

- EduCanada website content and tools available in multiple languages

- A Customer Relationship Management (CRM) component to better connect with students and collect data

- Creating a more robust social media presence, including HQ-based social media accounts

Finding #8: In some markets, a partnership-focused approach is seen as more effective to support targeted recruitment to meet Canada's labour market and demographic needs and support research and innovation.

Building partnerships between Canada and international educational institutions is a key component of the IES. Partnerships are beneficial to the Canadian education sector in a number of ways. Partnerships promote student, faculty and researcher mobility between institutions and this leads to greater collaboration on research projects between Canadian and foreign institutions. In 2013, it was estimated that 20% of the world's scientific papers were co-authored internationally, and that number is growing rapidly. Further, partnerships also allow Canadian education institutions to gain greater insight of a market, allowing it to adapt its promotion strategy and to be more targeted in its recruitment activities.

Beyond traditional partnerships between education institutions, interviewees and survey respondents emphasized the importance of fostering partnerships with non-traditional institutions, such as local governments and the private sector. With the growing internationalization of higher education, more and more local clients are looking abroad to meet their training and education needs. This is leading to greater opportunities for Canadian institutions to engage in non-traditional partnerships, including offshore and satellite education, corporate training, virtual training and education, and others.

Opportunities such as the contract signed between the University of Alberta and the Mexican Ministry of Energy to collaborate on training and research, or the contract signed by Memorial University to train Indonesian lecturers on aquaculture and marine safety, are examples of these partnerships.

India: From general student recruitment to a partnership-based approach

In some markets visited by the evaluation team, missions are turning away from general student recruitment to focus on partnership building. This is the case in India where very high and unwavering growth in student recruitment led the education sector team focus on matchmaking between Canadian and Indian education institutions. This approach is more targeted as it allows the education sector team to showcase Canadian institutions and programs that are more closely aligned with the country's labour market and demographic needs. Further, focusing on partnerships in the Indian market allows Canada to benefit from the dynamism of Indian innovation and research. Finally, this also responds to issues of overrepresentation of Indian international students in the Greater Toronto Area region by creating partnerships with schools across the country. In short, a partnership-focused approach to promotion allows to focus on recruiting the right students, rather than the most students.

Finding #9: Outbound mobility is important to help Canada's youth acquire the skills, experience, and networks for the 21st century labour market. While the IES does include elements to support outbound mobility by Canadian students, this role is misaligned with the mandate of the Trade Commissioner Service.

While the International Education Strategy is primarily focused on recruiting international students to Canada, there are a few lines in the strategy about supporting outbound mobility of Canadian students. For example, the IES states that "…the Government of Canada will seek to strengthen existing and develop new strategic instruments of cooperation with priority countries to enhance research collaboration, two-way student mobility and knowledge exchange." Additionally, one of the goals of the IES is to "promote two-way student and research mobility”.

Benefits of Outbound Mobility

Outbound mobility is important because it allows Canada's youth to acquire the knowledge, skills and experience to compete and succeed in the 21st century global economy. Beyond acquiring skills, outbound mobility is also important because it contributes to building relationships with emerging countries, which can in turn support trade diversification for Canada.

The academic literature suggests that study-abroad experiences are associated with greater skill development among those who studied abroad, such as problem-solving, communication and teamwork skills, as well as resilience and adaptability. Furthermore, there is a growing body of evidence to suggest that study-abroad programs lead to better employability outcomes.

Challenges

One of the main gaps on outbound mobility by Canadian students is the lack of robust data. Existing data sources give conflicting pictures of Canadian mobility, and currently there is no existing system to collect data on this topic.

Another major challenge with the outbound mobility component of the IES is that this activity is misaligned with the export-oriented mandate of the TCS. If international student enrollment in Canadian universities is considered a service export, then outbound mobility is considered a service import.

Finding #10: While difficult to compare across different models, Canada has had equal or better success than its competitors despite investing less. However, Canada will likely need to increase efforts to maintain and/or increase its market share.

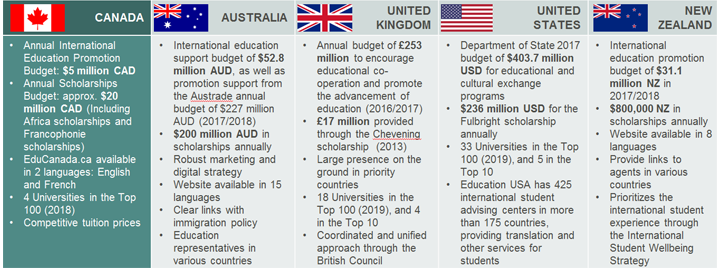

Canada has been successful in recruiting international students, surpassing the IES goal of 450,000 students five years early. This success is impressive considering that Canada has invested comparatively less than its competitors, with a budget of only $5 million CAD per year. However, internal efforts to promote Canada as a study destination have been complemented by a favourable international environment and a variety of external factors which are expected to normalize in the coming years.

Canada's primary competitors, and like-minded countries, are Australia, the United Kingdom, the United States, and New Zealand. Other competitors include European nations such as France and Germany, and emerging competitors, such as China. Interviewees highlighted that these countries have invested far more in their marketing and promotion efforts, and particularly in a digital media presence. Competitors also offer a wide variety of generous scholarships, and in some cases offer free tuition. On the ground, education-specific offices in countries abroad provide students with tailored information and services about international study.

Interview respondents noted the importance of enhancing Canada's international education and promotion efforts to keep up with the top traditional and emerging competitors, especially considering Canada's unique geographic and political situation with provincial and territorial jurisdiction over education. One of the key promotion efforts suggested is a more comprehensive digital strategy, which will allow for more control over digital marketing by BBY, and enhance the current websites and marketing efforts to create a one-stop shop for Canadian international education, scholarships, and events. The risks of not having such a strategy were noted to include an inability to target marketing efforts and recruit quality students, a decline in the number of international students in Canada, and the loss of market share, all leading Canada to fall behind its competitors.

Table comparing strategies by like-minded countries

Text version

Table comparing strategies by like-minded countries

This table compares the international education strategies of 5 countries: Canada, Australia, the United Kingdom, the United States and New Zealand.

CANADA:

Annual International Education Promotion Budget: $5 million CAD

Annual Scholarships Budget: approx. $20 million CAD (Including Africa scholarships and Francophonie scholarships)

EduCanada.ca available in 2 languages: English and French

4 Universities in the Top 100 (2018)

Competitive tuition prices

AUSTRALIA

International education support budget of $52.8 million AUD, as well as promotion support from the Austrade annual budget of $227 million AUD (2017/2018)

$200 million AUD in scholarships annually

Robust marketing and digital strategy

Website available in 15 languages

Clear links with immigration policy

Education representatives in various countries

UNITED KINGDOM

Annual budget of £253 million to encourage educational co-operation and promote the advancement of education (2016/2017)

£17 million provided through the Chevening scholarship (2013)

Large presence on the ground in priority countries

18 Universities in the Top 100 (2019), and 4 in the Top 10

Coordinated and unified approach through the British Council

UNITED STATES

Department of State 2017 budget of $403.7 million USD for educational and cultural exchange programs

$236 million USD for the Fulbright scholarship annually

33 Universities in the Top 100 (2019), and 5 in the Top 10

Education USA has 425 international student advising centers in more than 175 countries, providing translation and other services for students

NEW ZEALAND

International education promotion budget of $31.1 million NZ in 2017/2018

$800,000 NZ in scholarships annually

Website available in 8 languages

Provide links to agents in various countries

Prioritizes the international student experience through the International Student Wellbeing Strategy

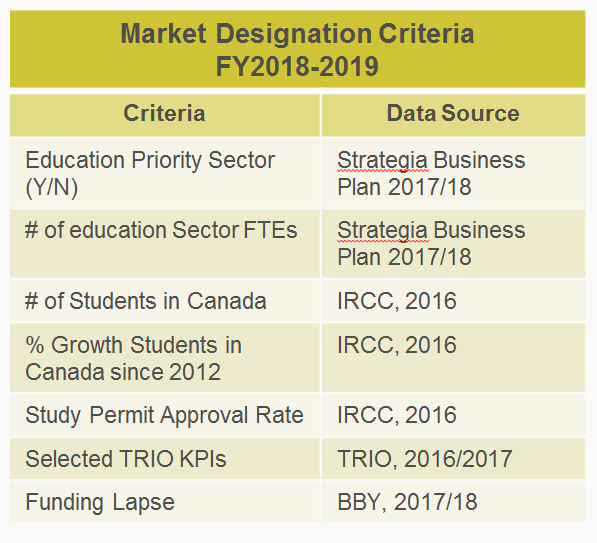

Finding #11: While the market designation exercise is an effective tool to determine the relative importance of markets for the education sector, it does not take into account future growth potential.

The International Education Division has successfully developed and implemented a data-driven market prioritization tool to allocate funds to missions based on relative importance. This tool is flexible and has evolved over the reference period of the evaluation to include different scoring criteria. For example, since 2016/2017 the market designation tool has integrated the IRCC study permit approval rate per country in the equation.

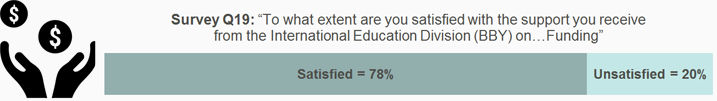

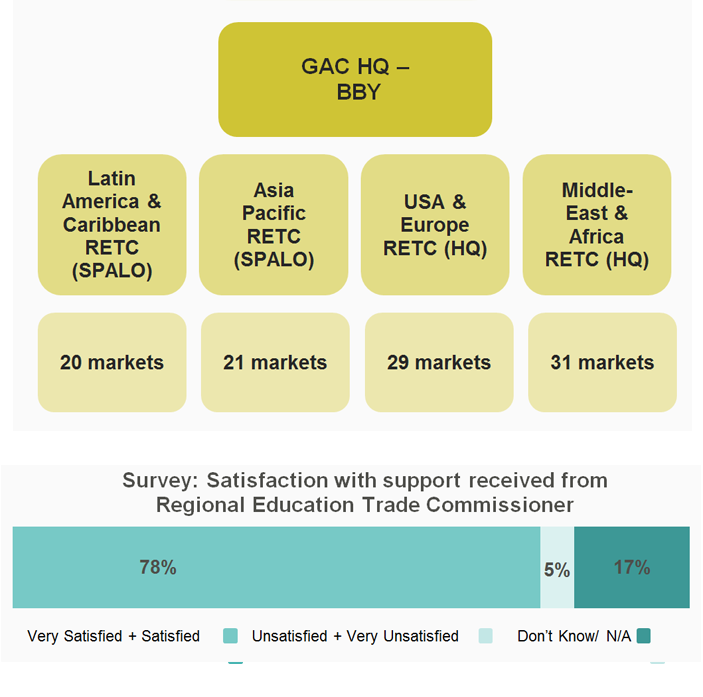

Missions appear to be largely satisfied with the current market prioritization tool and support they receive from the International Education Division on funding. The majority of Global Affairs Canada interview respondents stated that they understood and agreed with the market prioritization tool.

Survey Question 19

Text version

Survey Question 19

This bar graph visually represents answers to survey question 19: “To what extent are you satisfied with the support you receive from the International Education Division (BBY) on…Funding”

- 78% responded satisfied

- 20% responded unsatisfied

While the tool has evolved over time, the criteria it uses are all based on past trends and mission capacity. For example, the market designation exercise for 2018/2019 uses the 2017/2018 mission Strategia plan, TRIO data from 2016/2017, and international student data from 2016. In addition, the majority of the criteria used to determine the market designation are based on GAC's performance in a given market, rather than the actual growth potential of this market. In its current form, there is a risk that the tool will lead to path dependency, and prioritize markets based on historical presence. Other countries, such as the UK's British Council, and academia have integrated projected demographic growth and GDP per capita growth to forecast future growth of international students in key markets and regions. Interviewees noted BBY should consider similar forward-looking criteria in the market designation tool, including elements such as demographic growth and GDP growth. Notwithstanding, the capacity and willingness of missions to work in the education sector remains an important factor in determining funding levels.

This was also important in the context of diversifying target markets. While China and India will continue to be the main sources of international students for Canada in the coming years, many interviewees questioned the effectiveness of continued BBY funding in these markets and noted the need to reduce Canada's dependence on these countries. Instead, it was suggested that BBY funds would be better invested in emerging markets, experiencing higher youth population growth and rapidly improving economic contexts.

Table on Market Designation Criteria

Text version

Table on Market Designation Criteria

This table contains the information that is used to determine priority markets for education sector expenditures.

The Market Designation Criteria that was used in FY2018-2019, includes

Education Priority Sector (Yes or No) from the Strategia Business Plan 2017/18

# of education Sector FTEs from the Strategia Business Plan 2017/18

# of Students in Canada from IRCC, 2016

% Growth Students in Canada since 2012 from IRCC, 2016

Study Permit Approval Rate from IRCC, 2016

Selected TRIO KPIs from TRIO, 2016/2017

Funding Lapse from BBY, 2017/18

Finding #12: The International Education Division has built a strong working relationship with Provincial and Territorial Stakeholders and consults with them on a regular basis.