Growing Canada’s exports to overseas markets by 50% – 2022 Update

April 2023

Key summary

- The Fall 2018 Economic StatementFootnote 1 set a target of increasing by 50% Canada’s overseas exports by 2025, implying that Canadian exports to overseas markets must reach $292billion by 2025, requiring a 5.2% annual growth rate from 2017.

- After the significant disruption to trade caused by the global pandemic, Canadian overseas exports jumped 16.2% to reach $257 billion in 2022. This has not only returned Canadian trade to the path needed to achieve the target, but exceeded it, and as a result, Canadian exports to overseas markets will only need to grow by 4.3% annually from 2022 to reach the target in 2025.

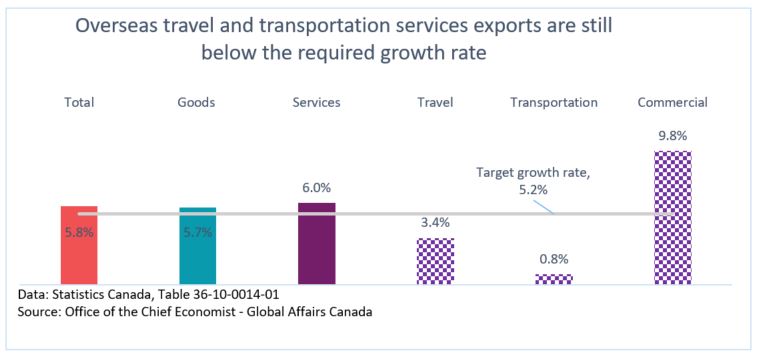

- Travel and transport services exports to overseas markets both rebounded strongly in 2022, but there is room for further growth as both of these services are still underperforming the 5.2% per year target. The negative effects of the pandemic have lingered on these services for longer than elsewhere. Commercial services, of which many can be delivered digitally, continued to build on prior strong performance, growing 9.8% per year between 2017 and 2022.

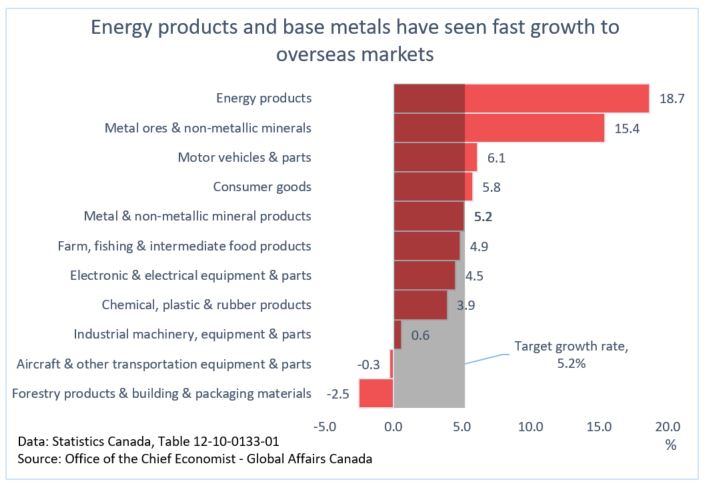

- Elevated commodity prices supported merchandise exports to overseas markets, with strong growth for energy products and metal ores and non-metallic minerals in 2022, resulting in annual growth rates of 18.7% and 15.4%, respectively, from 2017.

- Export performance by overseas partners have varied, but growth to markets that Canada recently established a new free trade relationship with such as the European Union, Japan and South Korea have exceeded the required annual growth rate.

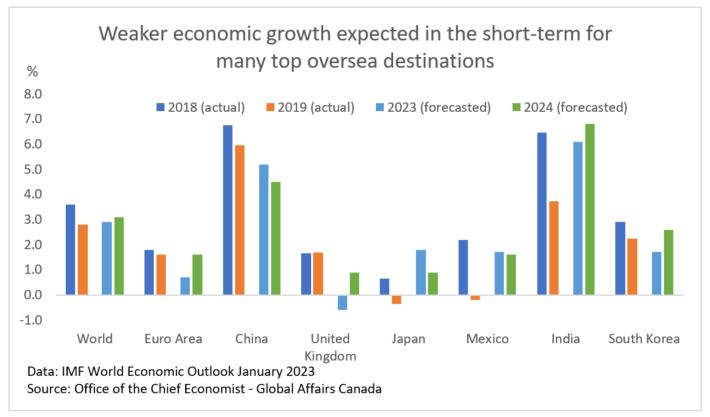

- Going forward, weaker economic growth in the short-term for our top overseas export partners such as the Eurozone, China, and the United Kingdom will be a drag on growth. Higher prices for commodities also played an important role in export growth and could reduce export values if that trends reverses. On the positive side, global supply chain pressure has started to return to normal, and energy and agriculture products should continue to benefit from current market conditions. Additionally, there is still room for recovery for travel and transport services.

Background

The Fall 2018 Economic StatementFootnote 2 set a target of increasing by 50% Canada’s overseas exports by 2025. In 2017, the last full year of available data at the release of the Fall Economic Statement 2018, Canada exported $195billion of goods and services to overseas markets. A 50% increase implies that Canadian exports to overseas markets must reach $292billion by 2025, representing a 5.2% annual growth rate. Canada has struggled to meet the required 5.2% annual growth rate in the past few years due to the pandemic, as border closures, travel restrictions and other containment measures enacted to combat the spread of COVID-19 constrained economic and trade activities.

In 2022, Canadian exports to overseas markets jumped by 16.2% to reach $257 billion (5.8% per year from 2017), which not only made up for the slow growth during the pandemic but exceeded the needed growth. This means that from 2022, Canadian exports to overseas markets will only need to grow by 4.3% annually to reach the target set in the Fall 2018 Economic Statement. In 2022, there was a strong rebound in exports of travel and transport services to overseas markets, with rooms for further growth. Elevated commodity prices supported the export of energy products and metal ores and non-metallic minerals to overseas destinations. Free trade agreements that Canada signed in recent years also provided support, as exports growth were strong to top overseas markets such as the European Union, Japan and South Korea.

Figure 1: Canada's overseas goods and services exports

Text version

| $ Millions | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 | 2025 |

|---|---|---|---|---|---|---|---|---|---|

| 5.2% growth path | 194,507 | 206,664 | 218,820 | 230,977 | 243,134 | 255,290 | 267,447 | 279,604 | 291,761 |

| Overseas Exports | 194,507 | 214,279 | 220,966 | 206,985 | 221,562 | 257472 |

Performance by product categories

Canadian goods exports to overseas markets grew a strong 15.0% in 2022, while, services exports to overseas markets grew 19.3% in 2022. With this strong growth, both goods and services returned to the growth path needed to achieve the trade diversification target. However, some components of services are still below the required target path. Travel services exports to overseas markets grew 49.0% in 2022, but this was not enough to make up for the weaknesses occurred during the pandemic. A similar story occurred for transportation services, strong growth of 36.1% in 2022 did not completely make up for the weaknesses throughout the pandemic. Commercial services did not suffer from the same weaknesses during the pandemic as many had the capabilities to be delivered digitally. Commercial services exports to overseas markets reached $39 billion in 2022, a growth of 9.8% per year from 2017.

Figure 2: Canadian overseas exports growth, 2017 – 2022 average annual growth rate

Text version

| Product group | 2017 – 2022 average annual growth rate for Canadian overseas exports (%) |

|---|---|

| Total | 5.8 |

| Goods | 5.7 |

| Services | 6.0 |

| Travel | 3.4 |

| Transportation | 0.8 |

| Commercial | 9.8 |

| Required Growth rate | 5.2 |

In 2022, the value of Canadian merchandiseFootnote 3 exports to overseas markets grew 15.3%, more than making up for the struggles prior to and throughout the pandemic. The main driver of this growth was energy products, which grew 66.2% to overseas markets in 2022, resulting in an 18.7% per year growth between 2017 and 2022. Energy products is now the 4th largest merchandise product group to overseas markets, overtaking consumer goods in 2022. The 3rd largest product group is metal ores and non-metallic minerals which grew 22.7% in 2022, resulting in a growth rate of 15.4% per year between 2017 and 2022. Metal and non-metallic mineral products, the second largest export product group to overseas markets, grew 11.0% in 2022, resulting in a growth rate of 5.2% per year between 2017 and 2022. These three product groups were supported by elevated commodity prices throughout 2022.

The largest merchandise product group exported to overseas markets was farm, fishing and intermediate food products, which grew 4.9% in 2022 resulting in an average annual growth rate of 4.9% between 2017 and 2022. Exports of this product group to overseas markets declined in 2019, as China imposed trade measures on Canadian food products, and growth was weak in 2021, as widespread drought conditions during the growing season was a drag on crop production and exports, which means better growth in 2020 and 2022 was not sufficient to make up for 2019 and 2021.

Figure 3: Canadian overseas exports growth, 2017 – 2022 average annual growth rate, by type of merchandise exports

Text version

| Mechandise product | 2017 – 2022 average annual growth rate for Canadian overseas exports (%) |

|---|---|

| Forestry products & building & packaging materials | -2.5 |

| Aircraft & other transportation equipment & parts | -0.3 |

| Industrial machinery, equipment & parts | 0.6 |

| Chemical, plastic & rubber products | 3.9 |

| Electronic & electrical equipment & parts | 4.5 |

| Farm, fishing & intermediate food products | 4.9 |

| Metal & non-metallic mineral products | 5.2 |

| Consumer goods | 5.8 |

| Motor vehicles & parts | 6.1 |

| Metal ores & non-metallic minerals | 15.4 |

| Energy products | 18.7 |

| Required Growth rate | 5.2 |

Performance by trade partners

In 2022, Canadian overseas exportsFootnote 4 exceeded the 5.2% per year required growth rate in some markets, while underperformed in others. The European Union (EU 27) is Canada’s largest overseas export market, and exports to this market grew 16.3% to reach $55 billion in 2022, resulting in a growth rate of 7.6% per year from 2017. Both goods and services exports have contributed to the growth in this market, growing 7.8% and 7.1% per year, respectively, from 2017. A 12.7% per year growth in commercial services exports to the EU 27 supported services exports to this market, while travel and transport services are still struggling to attain the 5.2% required growth rate due to weaknesses lingering from the pandemic. The Comprehensive Economic and Trade Agreement, which was provisionally applied in 2017, also supported growth to this market.

China is Canada’s second largest overseas export market, and exports to this market grew 2.8% per year between 2017 and 2022, with goods growing on average 3.2% per year and services growing 1.5% per year. Goods exports to China have witnessed several setbacks in the past few years, including imposed trade measures on Canadian food products in 2019 and long-lasting COVID restrictions. COVID restrictions especially impacted travel services exports, which on average accounted for almost 80% of Canada’s services exports to China. (Note: Travel services include education exports—i.e. when foreign students study in Canada.)

Canadian exports to the United Kingdom, Canada’s third largest overseas market, grew 1.6% per year between 2017 and 2022. Goods grew 0.9% on average per year over this period as gold, which accounts for almost two-thirds of the value of merchandise exports, struggled in 2021 and 2022. Services have performed better, growing 3.7% per year between 2017 and 2022, driven by commercial services which grew 7.7% per year over this same period. Travel and transport services export to the United Kingdom haven’t fully recover from the pandemic, standing at 41.6% and 24.4% below 2019 level, respectively.

Japan is Canada’s fourth largest overseas export destination, and exports to this market have been growing 7.6% per year between 2017 and 2022, with goods growing 8.3% per year and services growing 2.1% per year. Goods exports to Japan have rebounded strongly in 2021 and 2022, supported by the Comprehensive and Progressive Agreement for Trans-Pacific Partnership which came into effect for Canada and Japan in late 2018. Similar to some other overseas markets, services export are stills struggling due to the lingering effect of the pandemic on travel and transport services, even though commercial services exports to Japan have grown on average 11.4% per year since 2017.

Other top overseas markets where Canada has had success in exporting include India (11.7% per year since 2017) and South Korea (7.7% per year since 2017). Exporting to India has been driven by services, 22.4% between 2017 and 2022, while goods has only increased by 4.5% per year. Travel services exports to India experienced extraordinary growth in 2018 (79.2%) and 2019 (47.4%) which overcompensated for the weaknesses throughout the pandemic. Travel services are Canada’s main services export to India, accounting for more than 80% of services exports. Travel services include spending by international students, and the number of students from India studying in Canada has increased by a fast pace of 15.3% per year between 2017 and 2021. Meanwhile, exports to South Korea has been driven by goods exports, 9.4% per year between 2017 and 2022 as services only grew 0.1% per year. The Canada–Korea Free Trade Agreement came into effect in 2015 and eliminated almost all tariff lines for goods exchanged between the two countries.

Figure 4: Canadian overseas exports growth, 2017 – 2022 average annual growth rate, by top overseas export partners

text version

| Export Destinations | 2017 – 2022 average annual growth rate (%) |

|---|---|

| EU 27 | 7.6 |

| China | 2.8 |

| United Kingdom | 1.6 |

| Japan | 7.6 |

| Mexico | 1.8 |

| India | 11.7 |

| South Korea | 7.7 |

| Other | 6.9 |

| Required Growth rate | 5.2 |

Forward looking

While the good news is that Canadian overseas exports will only need to grow 4.3% annually from 2022 to reach the target set in the Fall 2018 Economic Statement, some top overseas export destinations are expected to experience weaker economic growth going forward. Many forecasters are expecting the Euro Area to fall into a mild recession in 2023, as its largest economy, Germany, is heavily exposed to the fallout from the war in Ukraine. Inflation in Germany is higher than that of Canada and the U.S., amid higher gas prices linked to sharply reduced supply from Russia and significantly higher food prices. China’s growth in the short-term is expected to be lower than the years leading up to the COVID pandemic. China is re-opening its economy during the same time that its major export partners are entering a period of weaker growth. Another downside risk is the elevated prices of commodity, which has helped Canadian exports in the past few years, and a large drop in the prices of commodity could reverse this trend.

There are also some positive factors that can potentially boost exports in the short-term. Global supply chain pressure has largely dissipated. According to the Federal Reserve Bank of New York’s Global Supply Chain Pressure Index (GSCPI), supply chain pressure have been steadily falling since April 2022 and is now back to historical norms. Improving supply chains mean exporters will face less logistic hurdles in the process of exporting. Energy and agriculture trends should also continue to benefit Canadian exports. Although energy prices have come down from their peaks, solid output and export growth are still expected from current elevated levels. Wheat and canola exports should also benefit from the shortfall in the global market due to the war in Ukraine. Additionally, there is still room for recovery as travel services exports to overseas markets have not reached 2019 pre-pandemic levels.

Figure 5: Economic growth (actual and forecasted) for top overseas markets

Text version

| GDP growth (%) | World | Euro Area | China | United Kingdom | Japan | Mexico | India | South Korea |

|---|---|---|---|---|---|---|---|---|

| 2018 (actual) | 3.6 | 1.8 | 6.8 | 1.7 | 0.6 | 2.2 | 6.5 | 2.9 |

| 2019 (actual) | 2.8 | 1.6 | 6.0 | 1.7 | -0.4 | -0.2 | 3.7 | 2.2 |

| 2023 (forecasted) | 2.9 | 0.7 | 5.2 | -0.6 | 1.8 | 1.7 | 6.1 | 1.7 |

| 2024 (forecasted) | 3.1 | 1.6 | 4.5 | 0.9 | 0.9 | 1.6 | 6.8 | 2.6 |

The global economic and trade environment have changed significantly since the overseas export target was first set in the Fall 2018 Economic Statement. Even before the COVID-19 pandemic and its tremendous impacts, rising anti-trade sentiments globally and geo-political tensions between the world's largest economies already created uncertainty around the global trading environment. Despite these uncertainty, Canadian overseas exports rebounded strongly in 2022 to put Canada back on track to reaching the target stated in the Fall 2018 Economic Statement, supported by services that can be delivered digitally, elevated commodity prices and the various free trade agreements that Canada has signed in recent years. Trade diversification remains an important strategy, especially in an environment of heightened uncertainty, as it can lessen the impact of external shocks, especially in particular sectors or countries.

- Date modified: