Archived information

Information identified as archived is provided for reference, research or recordkeeping purposes. It is not subject to the Government of Canada Web Standards and has not been altered or updated since it was archived. Please contact us to request a format other than those available.

Impact of FTAs on Canadian Auto Industry

- PDF Version (367 KB)Footnote *

Johannes Van Biesebroeck, Hang Gao and Frank Verboven

June 29, 2012

Prepared for DFAIT Canada

- Executive Summary

- 1.0 Introduction

- 2.0 Trends in the automotive industry

- 3.0 Effects of eliminating preferential tariffs under Canada’s trade agreements

- 4.0 Effect of Korea-U.S. FTA on the Canadian auto industry

- 5.0 Impact of tariff elimination on auto assembly plant investment in Canada

- 6.0 Conclusions

- References

Executive Summary

The views expressed here are the author’s and are not to be attributed to Foreign Affairs and International Trade Canada or to the Government of Canada.

This report consists of four complementary parts. In the first part we provide an overview of the Canadian automotive industry’s position in the global industry and give an overview of important trends. In the second part we conduct counterfactual analyses of several trade liberalization scenarios for Canada. In the third part we conduct a similar simulation to study the expected impact of the recently signed Korea-U.S. FTA on the Canadian automotive sector. In the fourth part we assess the potential impact of Canadian tariff reductions on future FDI in the sector. We next highlight the main findings from each part.

First, the turmoil in the industry over the great 2008-2009 recession has really changed relative positions of firms in the industry. Ford and Hyundai have recorded the largest absolute increases in sales. Total Canadian production has almost recovered to pre-crisis levels, to a large extent due to capacity additions by Toyota and Honda, which now produce around half of their Canadian sales locally. In addition to the recovery from the great recession, important global trends are the emerging auto industries in large developing countries and the growing importance of technologies to boost fuel efficiency.

Second, we find only modest impact on domestic production for different possible trade liberalization scenarios. For example, our preferred estimates suggest that the elimination of the 6.1% import tariff on vehicles assembled in Korea would decrease local production by Canadian plants by 4,482 units. The highest effect we ever find for Canadian trade policy is in the case of full unilateral elimination of tariffs for vehicles from all three trading partners—Korea, Japan, and the E.U.—and assuming a restrictive demand system. Even in this scenario, total loss of local production is estimated to be at most 14,407 vehicles, or 0.70% of total domestic production. Using the average jobs-per-vehicle ratio for the entire Canadian automotive market, this translates into 660 jobs.

Third, a FTA between Canada and Korea is estimated to lead to a decline in sales of 1.47% for vehicles that are produced and sold in Canada. Because 85% of Canadian output is exported, it only amounts to 0.22% of total Canadian new vehicle production. A similar analysis for the recently signed FTA between Korea and the U.S. suggest a decline in Canadian production of 20,175 vehicles in that case or 0.98% of total output. Using the same underlying economic model, we find an effect for U.S. trade policy that is more than twice the size and the difference is even larger under some alternative modeling options.

Fourth, it is unlikely that any new vehicle assembly plants will be announced for North America in the next few years. Moreover, Canadian trade policy has only a marginal influence on this. The three firms that are most likely to find themselves looking for additional regional production capacity are, in order, Hyundai, Mazda, and Nissan.

1. Introduction

With the Doha round of multilateral trade negotiations progressing at a glacial pace, Canada has been actively pursuing bilateral trade liberalization initiatives. It has been negotiating both with South Korea and with the European Union to form Free Trade Agreements (FTA) that would abolish most import tariffs between the two countries or groups of countries. Early in 2011, Canada also launched a joint impact study to investigate the benefits of an Economic Partnership Agreement with Japan.Footnote 1

As one of Canada’s most important manufacturing sectors, it is only natural that the likely impact of these trade initiatives on the automotive sector is considered carefully. Apart from new vehicle imports from the United States and Mexico, which already enter the country duty-free, all new vehicle imports currently come from the three countries mentioned above: the E.U., Japan, and Korea. The most important aspect of these FTAs for the Canadian automotive market is that they would abolish the existing 6.1% preferential import tariff for WTO members on new passenger vehicles.Footnote 2

In the economics literature, the automobile market is usually characterized as a differentiated goods oligopoly. Prices will be set strategically and the margin between prices and marginal costs provides firms with funds to cover fixed costs of operation. These include the establishment of production lines, vehicle development, maintaining a dealership network, advertizing, and other expenditures that allow firms to differentiate their product offerings. Note that it is impossible to observe fixed or variable costs directly. However, we can infer the underlying marginal costs that rationalize the observed prices from the consumers’ estimated price elasticity.

Viewing the industry as a differentiated goods oligopoly has two important consequences for studying the likely impact on the domestic industry of a tariff reduction. First, the pass-through will be incomplete. Abolishing the current 6.1% import tariff on a sub-set of imports will lower the affected firms’ landed marginal cost by 5.75%, but the expected price reduction will surely be less than that.Footnote 3 When a firm with some market power decides on its optimal pricing, it takes the elasticity of demand into account. As most realistic demand models feature a higher consumer price elasticity at higher prices, a firm will tend to choose a lower price-cost markup when faced with an import tariff. As a consequence, when the import tariff is abolished it will increase the optimal price-cost markup.

The second implication of viewing the industry as a differentiated oligopoly is that competing firms are expected to respond to each others’ price changes. In particular, when one firm lowers its price as it benefits from a tariff reduction, its competitors will also adjust their prices—in almost all cases downward as well. This includes firms producing domestically and firms importing from countries that still face the import tariff which do not enjoy any direct benefit of the FTA-motivated tariff reduction.

A further complicating factor is that firms produce multiple products and they will internalize effects on their own products. All of these issues make it complicated to predict the price and quantity responses to tariff reductions. They also guarantee that adjustments will be highly asymmetric as not only the direct effect vary across firms, they also produce different ranges of products, produce products that vary in their substitutability with other products, and they might even face consumers with varying degrees of price elasticity.

The way we obtain estimates for the predicted changes in prices, quantities, and trade flows is by calculating a new industry equilibrium in three steps. First, we estimate a demand system that characterizes the purchase decisions in the Canadian automobile market. Second, we supplement the demand system with a model of firm price setting behavior to uncover the underlying (landed) marginal costs that are consistent with the observed prices. Third, we abolish import tariffs for vehicle models imported from a specific country and we calculate the new equilibrium prices and quantities for all active firms and models.Footnote 4

Of course, Canada is not the only country pursuing bilateral trade deals. Both the E.U. and the U.S. have ratified a FTA with South Korea in 2011. In both cases, issues related to automotive trade have imposed delays between concluding the negotiations and ratifying the agreements.Footnote 5 The agreement with the U.S. in particular is likely to have important repercussions for the Canadian industry because the majority of vehicles produced in Canada are exported to the United States. Using an adjusted version of the methodology outlined above we estimate what the expected effect will be on sales of Canadian vehicles in the U.S. market when Korean firms lower their prices and all competitors are forced to respond.

The remainder of the report is organized as follows. In Section 2 we start with an overview of recent developments in the automotive industry, including the position of Canada in the global industry and important trends that have policy implications. In Section 3, we perform counterfactual simulations for a range of possible FTAs between Canada and one or more of its trading partners. We discuss the expected impact on vehicle sales, imports, domestic production, and employment. In Section 4, we use the same methodology to estimate the expected effect of the KORUS FTA on the Canadian industry. In Section 5, we discuss possible effects of tariff elimination on Foreign Direct Investment in the Canadian auto industry. Section 6 summarizes the conclusions.

2.0 Trends in the automotive industry

2.1 Canadian sales and production

Total sales for the Canadian market in 2010, in units and market share, as well as the growth in sales over the last five years are depicted in the first three columns of Table 1. Total sales are approximately back to the level of 2005, but firms have experienced dramatically different fortunes. The two most eye-catching changes are the collapse in sales by General MotorsFootnote 6 and the spectacular increase in sales by the two marks owned by the Korean Hyundai group, Hyundai and Kia, which even surpassed total sales by Toyota.

As a result, the market has become much more leveled. Sales of the top firm in Canada (Ford) are less than double the sales of the firm in the number six spot (Honda). The combined sales of the top six groups is now over three quarters of the market, with no firm dominating.

Somewhat surprisingly given the overall economic climate, the luxury brands have done extremely well, with large increases in the market shares of Volkswagen (Audi), BMW, Daimler (Mercedes-Benz), and Subaru. Also, Daimler is now again independent from Chrysler. Together with the strong performance of Nissan, it is likely that the market shares of different firms with converge further.

The production breakdown in the last five columns of Table 1 also tells an interesting story. Toyota and Honda are now the most Canadian of all firms. Both produce approximately half of their sales locally. The fraction for GM dropped below 20% and for Ford it even approached 10%, but it will rebound now that the St. Thomas plant has been closed (in September, 2011) which produced mostly for export. Overall, exactly 20% of all vehicles sold in Canada are produced domestically. Given that total Canadian sales only make up 11% of the entire integrated NAFTA market this is still a higher than proportional fraction.

| Units | Share | Growth 2005-2010 | |

|---|---|---|---|

| Ford | 262,200 | 17.1% | 25.4% |

| GM | 237,487 | 15.5% | -45.5% |

| Chrysler | 203,937 | 13.3% | -5.1% |

| Hyundai | 172,389 | 11.3% | 84.8% |

| Toyota | 171,200 | 11.2% | -2.9% |

| Honda | 141,070 | 9.2% | -8.7% |

| Nissan | 82,993 | 5.4% | 17.0% |

| Mazda | 78,662 | 5.1% | 1.0% |

| Volkswagen | 59,584 | 3.9% | 53.2% |

| BMW | 31,703 | 2.1% | 47.1% |

| Daimler | 30,081 | 2.0% | 90.8% |

| Subaru | 27,805 | 1.8% | 74.2% |

| Mitsubishi | 19,504 | 1.3% | 87.7% |

| Suzuki | 9,128 | 0.6% | 3.6% |

| Tata | 3,302 | 0.2% | 1.7% |

| Total | 1,531,045 | 100% | -1.0% |

| Canada | U.S. & Mexico | Japan | Korea | E.U. | |

|---|---|---|---|---|---|

| Ford | 11.3% | 86.2% | N/A | N/A | 2.5% |

| GM | 19.3% | 80.7% | N/A | N/A | 0.0% |

| Chrysler | 35.0% | 65.0% | N/A | N/A | N/A |

| Hyundai | N/A | 30.1% | N/A | 69.9% | N/A |

| Toyota | 51.4% | 32.7% | 15.9% | N/A | N/A |

| Honda | 49.4% | 42.3% | 8.3% | N/A | N/A |

| Nissan | N/A | 64.3% | 35.7% | N/A | N/A |

| Mazda | N/A | 17.7% | 82.3% | N/A | N/A |

| Volkswagen | 1.7% | 26.1% | N/A | N/A | 72.2% |

| BMW | N/A | 24.8% | N/A | N/A | 75.2% |

| Daimler | N/A | 14.2% | N/A | N/A | 85.8% |

| Subaru | N/A | 36.7% | 63.3% | N/A | N/A |

| Mitsubishi | N/A | 8.2% | 91.8% | N/A | N/A |

| Suzuki | N/A | 6.9% | 93.1% | N/A | N/A |

| Tata | N/A | N/A | N/A | N/A | 100.0% |

| Total | 20.0% | 53.9% | 11.6% | 7.9% | 6.7% |

Notes: Based on 2010 sales statistics. Tata is counted as a European manufacturer (Land Rover/Jaguar)

Even though the two Japanese firms dominate the sales of vehicles that are produced domestically, accounting for 51.6% of all these vehicles, Table 2 shows that the picture is still different if production for export is included. When looking at total Canadian production for 2010, GM is still the largest producer. It just happens to produce vehicles that are more popular south of the border, exporting 91.4% of output. Its market share in Canada is also lower than in the United States. The production statistics also show a leveling in this respect with GM, Chrysler, and Toyota each producing between 460,000 and 530,000 vehicles in Canada. Furthermore, it is likely that Honda will have passed Ford in Canadian production in 2011.

| Plant | Production | Total production | Sold domestically | Fraction exported | |

|---|---|---|---|---|---|

| GM | Ingersoll (CAMI) | 242,929 | 529,568 | 45,776 | 91.4% |

| Oshawa | 286,639 | ||||

| Chrysler | Brampton | 163,257 | 475,382 | 72,520 | 84.7% |

| Windsor | 312,125 | ||||

| Toyota | Cambridge | 307,698 | 458,729 | 87,966 | 80.8% |

| Woodstock | 151,031 | ||||

| Ford | Oakville | 224,607 | 320,608 | 29,747 | 90.7% |

| St. Thomas | 96,001 | ||||

| Honda | Alliston | 278,272 | 278,272 | 69,622 | 75.0% |

| Total | All plants | 2,062,559 | 2,062,559 | 305,631 | 85.2% |

Notes: In 2011, the CAMI plant that was started as a joint venture between GM and Suzuki became fully owned by GM. Ford closed the St. Thomas plant in September 2011.

The statistics in Table 1 and Table 2 together imply that Canada is still running a sizeable trade surplus in new vehicles. In 2010, vehicle exports totaled 1,756,928 and imports 1,222,504. Its net exports are thus 531,514 vehicles, more than one quarter of total production. We can thus characterize the Canadian automotive industry as highly integrated with the rest of the world. 80% of sales are vehicles assembled abroad; 26% even originates from another continent. 85% of production is exported—almost all to other NAFTA countries—and this share is lower for Japanese plants.

2.2 Major trends in the industry

The most important trends that are worth highlighting are the recovery in the aftermath of the great recession, the growth of the industry in large developing countries, and the growing importance of alternative fuel vehicles.

The recession of 2008-09 caused a tremendous crisis in the automotive industry as sales plummeted when consumers cut back on consumption of durables, in particular motor vehicles. The sales decline together with large legacy costs bankrupted GM and Chrysler, both of which emerged quickly from Chapter 11 restructuring under partial government ownership—jointly by the U.S. and Canadian governments. Fiat bought out the government stake from Chrysler in July 2011 and following an initial public offering on November 18, 2011, the government stake in GM was substantially reduced. For further details on the travails of the industry over the recession, we refer to Sturgeon and Van Biesebroeck (2009).Footnote 7

The former Big 3 are looking a lot healthier today, but they have trimmed production capacity aggressively in North America, making it a much more leveled industry. The same has happened at the global level with GM, Ford, Toyota, Volkswagen, and Hyundai emerging as the five dominant groups. All indications are that global competition is getting stronger, also driven by the emerging auto sectors in large developing countries, which is discussed next.

Impact of the crisis on quality initiatives of second-tier Canadian suppliers (2009 survey; percentage of responses)

Is the area of … in your company affected by the recession?

- Quality control: 6% answering "yes"

- Human resources (top answer): 25% answering "yes"

- Answered “all of the above”: 37%

Over the past 6 months, which of the following events have you noticed in your company?

- Cut in quality program: 13%

- Cost reduction, layoffs, reduced working hours, waste reduction (top answers): 100%

| Before the recession | During the recession | |

|---|---|---|

| Cost reduction activities | 50% | 100% |

| Customer satisfaction | 100% | 100% |

| Supplier development | 37% | 24% |

| Continuous improvement | 69% | 37% |

| New product development | 13% | 6% |

| Process/product innovation | 63% | 25% |

Source: Facey (2009)

In this respect, quality improvement and innovation is likely to become ever more important. A survey by Facey (2009) finds that second-tier Canadian suppliers have taken pains to avoid cuts in the quality control departments over the recession, which bodes well for the future. On the other hand, many aspects of company development and product improvement have been put on hold. Table 3 contains some highlights of her survey. The responses indicate that over the crisis, the fraction of firms that were active or very active in continuous improvement dropped from 69% to 37%. The fraction of firms that state being active or very active in new product development was low to begin with (13%), but even declined further over the recession (to 6%). Finally, process or product innovation was also scaled back substantially.

The second important trend in the global automotive industry is the growing importance of emerging markets. Large developing countries have now clearly become the engine of growth for the industry. This does not include Mexico, which in 2010 still recorded sales 28% below its pre-crisis level. The largest growth markets are China, India, and Brazil. China has now become the largest automobile market and this is likely to remain the case for a long time. Sturgeon and Van Biesebroeck (2010) discuss this evolution in detail and summarize policy options for developing countries.Footnote 8

| Canada | United States | Europe | Latin America | Asia | |

|---|---|---|---|---|---|

| Fraction of your firm’s production taking place in facilities located in… | 69.4% | 17.1% | 11.9% | 1.4% | 0.3% |

| Fraction of supply needs that were sourced from… | 51.1% | 33.3% | 9.0% | 1.9% | 4.7% |

| Fraction of Greenfield investments (past 5 years) made in… | 49.0% | 18.0% | 4.0% | 1.0% | 28.0% |

- In the last three years, has one or more of your major customers ever threatened to switch to overseas suppliers? Yes: 71%

- In the last three years, has one or more of your major customers asked your firm to initiate or expand activities in new geographical markets in order to facilitate its own expansion agenda? Yes: 64%

- Countries mentioned most frequently: United States (33), Korea (33), China (33), Mexico (22)

Source: Asia Pacific Foundation of Canada (2005)

As a result, automotive suppliers in developed countries, like Canada, are often pressured by their clients to follow them overseas. We find some evidence for this from a survey by the Asia Pacific Foundation of Canada (2005). Table 4 groups the answers to five survey questions that probe the firms about their own production activities, sourcing, investments, and customer demands. These responses illustrate that activities of Canadian supplier firms already started to spread geographically long before the crisis.

If we compare the geographical distribution of three activities—production, sourcing, and investment—we see a clear trend away from Canada toward Asia. While almost 70 percent of the supplier firms’ production takes place in Canada, only 51 percent of inputs are currently sourced domestically and only 49 percent of greenfield investment occurs in Canada. In contrast, Asia is the production location for only 0.3 percent of current output, but the source of 4.7 percent of inputs. Most importantly for the future, 28 percent of all greenfield investment by Canadian automotive parts suppliers are being made in Asia, ahead of even the United States.

An important impetus for Canadian suppliers to invest overseas is the explicit requests from current customers: 64 percent of suppliers report that they have received a request in the last three years to aid the overseas expansion of their customers by setting up overseas operations of their own. Some suppliers also indicated that they believe serving Japanese-owned firms in other countries will increase their chances of gaining new business to supply Japanese assembly in Canada.

The third global trend we highlight is the rising importance of alternative fuel vehicles, such as hybrid and electric vehicles. In Japan, the Toyota Prius already is the best-selling model and under the 20/20/20 strategy the E.U. has passed extremely ambitious regulations to increase fuel efficiency of the new vehicle fleet. The new CAFE standards that the Obama administration announced on August 1, 2011 intend to raise the average fuel efficiency of the new vehicle fleet in the U.S. to 54.5 mpg by 2025. While less ambitious than the European program, these standards will affect all plants producing for the NAFTA market, including Canadian plants.

Vehicles that use new technology to boost fuel efficiency are largely absent from Canada’s production plants. The Honda Civic GX, which runs on compressed natural gas, is not produce in Alliston anymore, but in Honda’s Greensburg, IA plant. The fact that it was not certified for use on Canadian roads did not help to keep production in Canada. GM still produces flex-fuel vehicles that run on a mixture of 85% of ethanol in Oshawa, but the latest calculations of CO2 emissions over the full life-cycle have not been positive for ethanol as a fuel for the future. Finally, while Canada is still at the frontier of developments in fuel-cell technology, its applicability to motor vehicles is still as far out as ever.

3.0 Effects of eliminating preferential tariffs under Canada’s trade agreements

3.1 The nature of the counterfactual analysis

The methodology to estimate the expected effect of a change in trade policy consists of the following three steps.

First, we estimate a demand model that characterizes the vehicle purchase decisions of Canadian consumers. In particular, using the observed vehicle characteristics, including prices, and market shares for the years 1998 to 2010, we estimate the parameters that determine consumer preferences. The key outputs from this step are estimates of the sales responsiveness of each model to a change in its own price and to price changes of all competing models, i.e. the full set of own and cross-price elasticities.

Second, we infer what the underlying (landed) marginal cost for each model must be for the observed prices to be the optimal choices of profit maximizing firms. In particular, we assume that firms compete by choosing prices (not quantities) for all their models, taking the pricing decisions of competitors into account. The observed prices are assumed to be the outcome of a differentiated products Bertrand-Nash equilibrium, which means that no firm should be able to increase its profits by unilaterally changing its price.

Third, we start from the observed market situation in 2010 and calculate what prices and quantities would have been if a different trade policy had been in place in that year. We assume that consumers still behave according to the demand function estimated in step 1 and that firms choose prices to maximize profits starting from the marginal costs calculated in step 2. We only change one primitive in the model—namely the import tariff applied to imports from one or more countries—and calculate the counterfactual equilibrium situation for the industry.

Note that in these calculations, all participants are allowed to adjust their behavior. All firms can change their prices to adjust to competitors and all consumers can change their purchase decisions to adjust to the changed prices. For each model sold in the Canadian market in 2010 our calculations will generate a new equilibrium prices and market share.Footnote 9

In particular, if a FTA with South Korea had been in effect in 2010, the landed variable cost of all models imported from Korea would have been 5.75% lower than the marginal costs that the model has generated from the actual data that includes an effective import tariff of 6.1%. Our estimate of the consumers’ price sensitivity will indicate how much of the tariff reduction will be passed on to Canadian consumers by a profit maximizing Korean firm. In addition, our pricing model together with the cross-price elasticities of the demand model will indicate to what extent competing firms will want to respond to price cuts on Korean vehicles.

In the new price equilibrium all models will be cheaper, but vehicles imported from Korea will see the largest price decline. Models that are close substitutes will still see a noticeable price decline as firms will sacrifice some profits to limit the impact on their sales. Models that are poor substitutes for Korean imports will hardly see any price change. The demand model will further reveal the new market shares for all models implied by these new equilibrium prices.

In terms of interpretation, a few important caveats should be pointed out:

- One should not interpret the results as a prediction of the likely future effects of trade policy changes. Rather, we calculate what the market equilibrium would have looked like in 2010 if an alternative trade regime would have been in effect.

- The calculated effects should be interpreted as medium-term. The results take responses of directly and indirectly affected firms into account. All market participants have adjusted their price setting to the new tariff situation. However, we consider the location of production of each model and the firms’ product portfolio as unchanged.

- Because transaction prices are not observed, we have to work with manufacturer suggested retail prices (MSRPs). If the gaps between listed and actual prices are similar for different firms or if the gaps in percentage terms remain the same before and after the trade policy change, the results would be the same using transaction prices.

- The estimated demand model plays an important role in the analysis. The specification we rely on is very flexible, incorporating observed and unobserved vehicle characteristics, market segmentation by vehicle type and ownership, and consumers that are heterogeneous with respect to their price elasticity. Nevertheless, one has to keep in mind that estimating the model over a different time period or including different characteristics or random effects would have an impact on the results. To verify robustness, we have included an alternative analysis using a more restrictive demand model.

- A final caveat is that the demand model and equilibrium calculations are inherently static. Firms do not consider spillover effects on subsequent years when setting prices and consumers are not forward-looking regarding price changes or take durability of vehicles into account.

There are two factors that explain the differences between the results in this report and those in Van Biesebroeck (2007). First, the benchmark year for the counterfactual analysis is now 2010, instead of 2005 before. Hyundai-Kia now operates two plants in North AmericaFootnote 10 and the fraction of sales by foreign-owned firms that is produced within NAFTA has generally increased. Moreover, the recent recession combined with the increase in fuel price and greater awareness of global warming has tilted demand towards smaller size segments.

Second, the demand model that the analysis relies on has been improved greatly and is now estimated more robustly using 13 years of data instead of only 2 years of data in the previous report. Consumer preferences are now modeled much more flexibly with price elasticities allowed to vary by income level and the closeness of substitution within segments to differ across segments.

3.2 Data set

We assembled annual information on each passenger vehicle model for sale in the Canadian market between 1998 and 2010. Models that sell less than 50 units per year are dropped, as well as pure luxury brands such as Ferrari or Porsche. We further dropped commercial vehicles and full size vans, which gives us a sample of 2,751 observations, growing from 153 in 1998 to 244 in 2010. Average annual sales for Canada total 1.54 million units, growing from 1.34 million in 1998 to 1.56 million in 2010 with a high of 1.67 million in 2002.

We observe the specifications and prices for several varieties of each model, but only the sales information at the model level. Therefore the entire analysis has to be conducted at the model level. We use the specifications, including the price, of the cheapest variety of each model available for sale in a given year—the ‘base’ model.

The most important characteristic for the trade policy simulations is the assembly location and we also use that of the cheapest version. In most cases where different varieties of a model are assembled in different countries, this is immaterial for the trade analysis as they come from different NAFTA countries, e.g. the Nissan Sentra is assembled in the U.S. and Mexico. In a few cases, the multiple origins are a temporary situation as production has switched, e.g. from Japan or South Korea to North America, but there were still imports from the old production location in the start-up year.

In 2010, several models are affected by this problem, i.e. they are assembled in two different countries and at least one is not in the NAFTA free trade area. Most importantly, the following models are all treated as assembled in the country where the majority of production takes place: BMW X3 in the U.S. (85% of its Canadian sales come from the U.S.), Honda Civic in Canada (99.4%), Honda Ridgeline in Canada (57%), Hyundai Sonata in the U.S.(99%), Hyundai Elentra in Korea (99%), Lexus RX in Canada (63%), Nissan Juke in Japan, Volkswagen Golf/Rabbit in the E.U. (81%), Toyota Highlander in U.S.(80%), and Toyota RAV4 in Canada (97%).

The sourcing location for a few other models deserves some further comments. The Mercedes-Benz G-class is mostly assembled in the U.S. (97%), but its sales numbers are only reported together with the GLK model which is produced in Europe. Given that the latter is sold in larger quantities, we assigned the combined G-class/GLK model to the E.U. Finally, GM has gradually switched most of the production of the Chevrolet Aveo and Pontiac Wave from Korea to Mexico. Given that the successor 2011 model, the Chevrolet Sonic, went in produced in Michigan in 2010, we assign both the Aveo and the Wave to U.S./Mexico. For the Suzuki Swift+, which is basically the same model as well, we could not find a reliable sourcing location (it was only sold in Canada and has already been discontinued) and we assigned it to the same location as the Aveo/Wave on which platform it stands.

In order to incorporate consumers that did not purchase a vehicle at prevailing prices in 2010, but which might be enticed to enter the new vehicle market at lower prices, it is customary to include an “outside good”. This requires an estimate for the potential market size, which we take to be the total number of households—12.58 million in 2010. As such, in an average year we find that 87% of households choose not to buy a new vehicle.

The dependent variable in the demand estimation is the market share of each model. As explanatory variables, we follow most closely the papers by Berry et al. (1995) and Petrin (2002). The following variables are included: price (in thousands of dollars), power per weight (maximum power in kw divided by weight), size (length x width x height), and fuel efficiency (liters of gasoline per 100 km). In addition, we include a dummy variable whether the brand has traditionally been owned by an American firm to capture the historical reach of the dealership system.

Summary statistics for 2010—the year for which we do the trade policy simulations—are in Table 5. Vehicles are assigned into one of 5 segments, listed at the bottom, which will play an important role in the demand estimation.

| Average | Standard deviation | |

|---|---|---|

| Sales (units) | 6,275 | 12,087 |

| Model characteristics | ||

| Price (thousands of dollars) | 37.542 | 19.759 |

| Power/weight | 9.670 | 2.697 |

| Size | 14.224 | 3.015 |

| Liter/100 km | 10.526 | 2.485 |

| Domestic brand | 0.336 | 0.473 |

| Fraction of models | Fraction of sales | |

|---|---|---|

| Production locations | ||

| Canada | 11.1% | 20.0% |

| U.S. & Mexico | 45.5% | 53.9% |

| E.U. | 18.4% | 6.7% |

| Japan | 17.6% | 11.6% |

| South Korea | 7.4% | 7.9% |

| Segments | ||

| Regular cars (all sizes) | 30.7% | 39.5% |

| Luxury or sporty cars | 23.0% | 5.8% |

| SUVs | 34.8% | 28.6% |

| Pickups | 7.0% | 19.7% |

| Minivan | 4.5% | 6.4% |

3.3 Demand estimation

The automobile industry has been a popular proving ground for discrete choice models to estimate demand for differentiated products. The state-of-the-art in estimating aggregate demand is the random coefficient model discussed in Berry (1994) and first taken to the data in Berry, Levinsohn, and Pakes (1995) to estimate the U.S. demand for automobiles. Several studies have used this general class of models to evaluate trade policies. For the automobile industry in particular, we can mention Goldberg (1994), Fehrstman and Gandal (1998), Berry, Levinsohn, and Pakes (1999), Brambilla (2005), and Brenkers and Verboven (2006). The only previous estimates for the Canadian automobile market are in Van Biesebroeck (2007).

The advantage of this modeling strategy instead of specifying a traditional demand system at the product level is that only a few parameters can generate very general cross-price substitution patterns between all models. This is an important feature, given that in each year 200 to 250 different models are sold in the Canadian market. Specifying the demand directly would require an extraordinary amount of parameters to allow for flexible substitution patterns. As a result, the discrete choice approach has become the dominant way to study differentiated goods markets.

In this study we use a nested logit model, see Anderson and De Palma (1992) and Verboven (1996) for details. It can be interpreted as a random coefficients model where consumers share the valuation on all observable characteristics, except on a set of nesting dummies that segment the market (Cardell 1998). The same model was used in Van Biesebroeck (2007), but we include two modifications to allow for more flexible price elasticities. We now estimate different parameters for each segment (σg) and we incorporate a random price coefficient (αi) in the model.

Consider the Canadian automobile market where I consumers are considering to purchase a car or light truck. They can choose between J available models, one of which is the outside good, i.e. purchasing a second hand vehicle or postponing the purchase to a future year. The utility of the outside good purchase will be normalized to zero. Each consumer chooses one model to maximize her utility. The conditional indirect utility function for consumer i from purchasing product j that belongs to nest/segment g is given by:

The first term combines the effect of K observable product characteristics, such as fuel-efficiency, horsepower, size, etc., on product demand. The second term is an additional product characteristic that consumers and all other firms observe, but is unobservable to the econometrician. It includes the effect of style, advertising, etc. These first two terms in the random utility function are valued the same by all consumers. The next three terms are consumer specific.

The effect of price on utility is expected to be negative and to vary across consumers inversely with their income (yi). To incorporate in the model that consumers with higher income are likely to be less price sensitive than low-income consumers, we model the αi parameter as α/yi. In the estimation we use a frequency estimator to simulate market shares using the observed Canadian income distribution over ten deciles to generate hypothetical consumers.

The next term (ζig) is a random taste shock of consumer i for vehicles in segment g, which can be positive or negative. We partition the market into 5 exclusive and exhaustive segments: regular cars, luxury and sporty cars, SUVs, pickup trucks, and minivans. The final term is an individual-model specific random utility draw (εij), which is assumed to follow the extreme value distribution.

The nested logit model generates higher elasticities of substitution between models in the same segment than across segments if the σ coefficients are estimated positively. A high estimate would indicate that the likelihood that substitution in response to price changes remains within the segment is high. As a result, competition within the segment will be fiercer and price-cost markups lower. The segment with the highest σg parameter will have strongest substitution between the vehicles it contains and the highest own and cross-model price elasticities. Brenkers and Verboven (2006) find in their application to the European car market that vehicles in the ‘small car’ segment are the closest substitutes, which is intuitive.

The standard transformation of the model yields the following log-odds ratio that consumer i purchases model j rather than the outside good:

It is a linear function of the K characteristics, the price, the conditional market share of vehicle j within its segment g, and the term for the unobserved quality of the good, which takes the role of the error term in the equation. The difficulty for estimation is that we only observe aggregate quantities, while some of the terms on the right-hand side vary across consumers. This makes it impossible to obtain closed form solutions for aggregate market shares and requires a simulation estimator.

A simple logit model would have two unattractive features for our purpose: (i) all cross-model substitution is proportional to market shares and (ii) own-price elasticities are increasing in the price of each model. The nested logit eliminates the first drawback and the introduction of segment-specific σg parameters eliminates the second. However, they do so only in a very limited way. To allow for more flexible own- and cross-elasticities it is crucial to incorporate the heterogeneous price coefficients.

In a robustness check to the model, we do impose a constant price coefficient α on all consumers. With this modification, the model simplifies to a simple nested logit model and we can derive market shares in analytical form. In the equation above, the left hand side simply becomes ln(sj/s0), the normalized market share for vehicle j, and the i subscripts on the right hand side can simply be dropped. The demand equation can then straightforwardly be estimated using least squares.

However, to obtain consistent parameter estimates, we still need to take into account that firms will set prices knowing the value for ξj. Vehicles that are very desirable, e.g. because of attractive styling or reliability, will attract more consumers and firms can raise the price. To break this link between the error term and the price variable, we use the standard instruments, see Berry, Levinsohn, and Pakes (1995). In the specific context of a nested logit model with nest-specific market shares, the endogeneity problem carries over to the within-nest market share variable, and we use the optimal instruments proposed by Brenkers and Verboven (2006).Footnote 11

For details on the econometrics, we refer to Grigolon and Verboven (2011). The estimation algorithm involves the following steps:

- The observed sales are set equal to the predicted relative sales, which are obtained using the above formula and starting values for all coefficients. The difference between the two gives the error term ξj, now a function of the model parameters.

- Because consumer tastes are heterogeneous and the ξj term is constant for all consumer types i, an analytic solution is not available. Instead, we use the contraction mapping suggested by Berry, Levinsohn, and Pakes (1995).

- The error term ξj is then interacted with the instruments to obtain a GMM estimator. Each time the estimation converges and produces new parameter estimates, we resolve the contraction mapping for ξj and re-optimize the GMM objective, until the estimates do not change anymore.

In Table 6 we present two sets of estimates. Both use all model-year observations over the 1998–2010 period and include year and year-squared and model-fixed effects as controls in the equation. This reduces the endogeneity problem in estimation. In the first column, we use heterogeneous price effects and two-level nesting of models—at the first level there are five market segments and below that two levels for the nationality of the firm (domestic or foreign). In the second column, we assume a homogenous price effect and use just one level market segment nests. This last model is almost as in Van Biesebroeck (2007), but allows the substitution parameters to vary across nests.

All coefficient estimates, except for one, have the predicted signs. Consumers dislike high prices and low fuel efficiency. They prefer vehicles with a higher power to weight ratio and a larger size. Only for Model 2 do we find a negative coefficient on the power/weight coefficient. The reason is that high performance, which consumers like, tends to go together with a higher price, lower fuel efficiency, and smaller size, all of which consumers dislike. The simple linear specification does not do a good job at disentangling the partial effects of the severely multi-collinear variables. Notice for example that the negative coefficient on the power/weight variable is accompanied by a much lower estimate on the size coefficient. Given that we are not interested in these point estimates per se, we leave it at this.

| Model 1 | Model 2 | |

|---|---|---|

| Price | -1.565 (.344)*** | -0.586 (.335)* |

| Power/weight | 0.010 (.008) | -0.015 (.010) |

| Fuel efficiency (l/100 km) | -0.010 (.008) | -0.014 (.007)** |

| Size | 0.081 (.014)*** | 0.039 (.020)** |

| σ1 (regular cars) | 0.836 (.031)*** | 0.943 (.065)*** |

| σ2 (luxury & sports cars) | 0.727 (.064)*** | 0.847 (.076)*** |

| σ3 (SUVs) | 0.189 (.224) | 0.225 (.047)*** |

| σ4 (pickup trucks) | 0.798 (.051)*** | 0.734 (.169)*** |

| σ5 (minivans) | 0.068 (.117) | 0.309 (.131)*** |

| Sub_σ1 (domestic/foreign) | 0.836 (.031)*** | N/A |

| Sub_σ2 (domestic/foreign) | 0.754 (.040)*** | N/A |

| Sub_σ3 (domestic/foreign) | 0.399 (.067)*** | N/A |

| Sub_σ4 (domestic/foreign) | 0.798 (.051)*** | N/A |

| Sub_σ5 (domestic/foreign) | 0.518 (.108)*** | N/A |

| Observations | 2752 | 2752 |

| Adjusted R² | 0.822 | 0.806 |

Notes: Model (1): two-level nested logit (first level are 5 market segments, second level is domestic/foreign firm) with heterogeneous price effect by income estimated by simulated GMM. Model (2): one-level nested logit with 5 market segments and homogenous price effect estimated by IV. Instruments are average rival characteristics for price and number of rival products in same segment for the segment variables. The price variable is normalized by the average income level ($28,300). Regression includes year, year-squared and model-fixed effects as controls. ***, **, * indicates significance at the 1%, 5%, and 10% level.

All the nesting parameters are estimated positive and between zero and one, in line with economic theory. The higher the nesting parameter, the more likely it is that consumers will substitute between models in the same nest, rather than across nests. The estimates suggest that substitution for models in the “SUV” or the “minivan” segments is barely higher within the same nest as towards models in other nests. On the other hand, “regular cars” tend to be rather close substitutes. However, to satisfy economic theory, the sub-nest parameters should be larger than the basic nesting parameters. This was violated for the regular cars and the pickup segment and we enforced equality of σ1 and Sub_σ1, and between σ4 and Sub_σ4.

The crucial take away from the demand estimation are not the coefficients directly, but the own- and cross-price elasticities that they imply. They measure the sales response associated with own price changes or price changes of competing vehicles. They determine the optimal price-cost markup that a firm will charge as well as the optimal response to a price change of a competitor. In the one-level nested logit model, the demand elasticities are given by a simple formula containing only the α and σ parameters, own market share, and the relevant price, see Van Biesebroeck (2007). However, with a heterogeneous price effect in the utility function, the formulas need to integrate over the income distribution.

While elasticities are increasing in the (absolute value of the) price coefficient, it is important to point out that the much lower price coefficient estimate for Model 2 does not automatically imply that the model will feature uniformly lower price elasticities. The elasticities also depend on the σ estimates, and these are estimated higher in four of the five cases in Model 2. It implies that substitution between models in the same nest is stronger, which raises the elasticities above what is implied solely by the price coefficient estimate. Moreover, in Model 1 the actual price coefficient varies across consumers with their income level. Consumers with an above average income level, will be imputed to have a lower absolute value of the price coefficient in their demand equation.

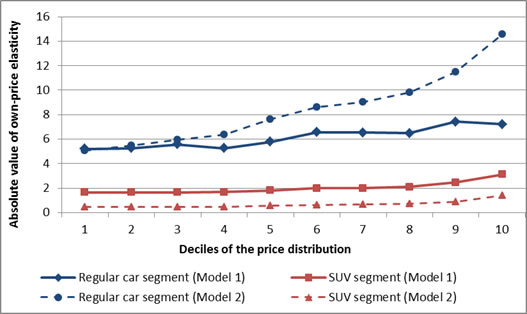

We calculated the own price elasticities for all models and the cross-price elasticities for all model-pairs. In Figure 1 we illustrate how own-price elasticities evolve with price for both demand models for vehicles in the first and third segments, respectively regular cars and SUVs. The absolute value of the elasticities are plotted against the deciles of the price distribution, which rise relatively smoothly from $15,000 (p1) to $38,000 (p9), with a much larger jump for the 10th percentile (to $90,000).

Figure 1: Own-price elasticities for two segments (absolute values)

All elasticities are increasing in price, which is a general feature of the logit model or of the nested logit within a segment. Note that this increase is tempered in Model 1, due to the lower price coefficient for high-income consumers. This is especially vivid in the first segment. The much higher estimate of the nesting parameter in the regular car segment uniformly raises all elasticities. Finally, the extra second-level nesting of domestic and foreign models (based on the nationality of the owning firm) introduces some variation in the elasticities for Model 1, which makes the curve less smooth.

The cross-model elasticities of substitution are higher for models in the same nest and this feature is much more pronounced for segment with high σg estimates. Competition within these segments is fiercer. The high σg estimates combined with offsetting low α estimates makes substitution towards vehicles in other nests rather low. A final factor that influences the cross-model elasticities is the number of vehicles offered in a segment. In more crowded segments, in particular the luxury and sporty cars segment, will have higher cross-price elasticities, as a price increase of one model leaves consumers with a lot of choices within the segment to substitute towards.

3.4 Counterfactual simulation

When we augment the substitution patterns that the estimated demand system generates with a model of optimal price setting behavior it is possible to uncover the marginal costs that make the observed prices optimal for profit maximizing firms. The standard approach in the literature is to assume differentiated products Bertrand-Nash pricing. It means that firms strategically set prices (rather than quantities) taking into account (i) the above substitution patterns from the demand system and (ii) that their competitors are also setting prices optimally. The Nash equilibrium assumption implies that no firm will be able to raise its profits by unilaterally changing its price. The evidence in Bresnahan (1987) suggests that this is an appropriate assumption for the automobile market.

Firms are explicitly modeled as multi-product firms, which take the effect of the price of each model on all the other models in their own portfolio into account.Footnote 12 For a derivation of the first order condition, we refer the interested reader to Berry (1994) or Berry, Levinsohn, and Pakes (1995). For vehicle model j it takes the following form:

The first term captures that the firm producing model j takes into account that raising pj raises profits in proportion to the market share of model j. It also takes into account that it lowers the sales of model j and leads to a loss of profits in proportion to the own-price elasticity, ∂sj/∂pj, and the mark-up on model j. Finally, the firm also takes into account the spillover effects on all other products it sells, i.e. models in the set Fj, which will see increased sales when pj rises, i.e. ∂sk/∂pj>0 if k≠j.

In total there are J first order condition of this form and each depends on the entire price vector p. Once the demand equation is estimated and all the derivates can be calculated, all elements of these equations are observable except for the marginal costs, mcj, for all j. This is now a system of J equations in J unknowns and we can use it to calculate the marginal costs that are consistent with observed pricing behavior.

One should bear in mind that the economic concept of marginal cost differs from the accounting cost concept. A large number of costs which accountants treat as variable tend to be fixed from a firm’s perspective in the medium to short run. As a result they will not enter optimal pricing decisions. For example, labor contracts in the automotive industry make most of the labor costs fixed rather than variable. Therefore we expect that our demand estimation will impute relatively low level of marginal cost. These only include the expenditures that can be saved if the marginal vehicle is not produced. It excludes most labor costs, marketing and advertising expenditures, tooling and maintaining an assembly plant, design and engineering costs, costs of the dealership network, etc. All of these are largely independent of the number of vehicles sold, at least in the short run.

We now have all the ingredients to conduct the counterfactual analysis, i.e. (i) estimates of substitution patterns generated by a demand system, (ii) imputed marginal costs, and (iii) a market equilibrium assumption. The algorithm for this exercise consists of the following three steps:

- For each vehicle model that benefits from a FTA, the landed marginal cost in Canada is reduced by 5.75%. Marginal costs of all other models are unchanged.

- Given the new vector of marginal costs, the system of first order conditions above will not hold anymore with equality at the observed prices. We calculate the new equilibrium price vector using a contraction mapping and the estimated derivatives (which are themselves a function of all prices). The directly affected firms will again take into account not only the direct effect on the models that benefit from an FTA, but also the cross-price elasticities on their other products. The indirectly affected firms will also adjust their prices as the derivatives of their market shares with respect to their own price ∂sj(p)/∂pj are a function of the entire price vector. Hence, their original first order conditions will not hold anymore even if their own marginal cost is unchanged.

- When we use the new equilibrium price vector in the estimated demand system holding all vehicle characteristics constant, including the ξj vector, we calculate new equilibrium market shares for all models. The market share for the outside good is also updated and given the overall price decline it will translate into higher overall sales.

For each model, we have thus calculated a new marginal cost (if it is directly affected by the FTA), a new price, and a new sales quantity. We can aggregate this over all models by import status to calculate new import volumes, new average prices, new price-cost margins, etc. These results will be discussed in the next section.

3.5 Effects for different trade agreements

We compare the expected outcome for each trade policy simulation with the actual situation in 2010. In that year, total new passenger vehicles sold in Canada stood at 1.52 million for the models included in our sample, cars and light trucks combined. Only 305,631 vehicles, exactly 20.0% of the total, were assembled domestically and the rest are imported. The primary sources of imports are the NAFTA trading partners, the U.S. and Mexico, responsible for 53.9% of total sales. All of these vehicles are assumed to enter the country duty free.Footnote 13

The remainder of the vehicles sold in Canada are imported from Japan (11.6%), South Korea (7.9%), and the E.U. (6.7% in quantity, but much higher in value). Currently, Canada imposes a 6.1% import duty on finished vehicles. In the different trade liberalization scenarios that we consider, we calculate how the market equilibrium would have changed if vehicles imported from one or more of these countries would have been exempt from import tariffs.

A first thing to note is that Canada produces many more vehicles than those that are sold domestically. Total new vehicle production in 2010 stood at 2.06 million and the vast majority of them (85.2%) are sold abroad. There is no reason to expect these Canadian exports to be affected by any of the Canadian trade policy changes we consider here. However, in the next section we look at the expected effects of the FTA between Korea and the U.S., which is likely to exceed the impact on the domestic industry of a possible FTA between Korea and Canada.

For models that are affected by one of the trade policy simulations, their landed marginal cost in Canada is reduced by 5.75%, which is the fraction of costs that the importing firm saves. The firm will split this into a higher profit margin and a lower price for consumers. Competitors will respond, also lowering their prices slightly, at the expense of profit margins and a new market equilibrium will result. We keep model offerings and production locations constant in this analysis, but allow prices to adjust fully. The results should thus be interpreted as medium-term effects.

The results of the different simulations are reported in Table 7 in absolute changes from the 2010 benchmark and in Table 8 in percentage changes. These results rely on the demand estimates from Model 1, assuming a two-level nested logit model with heterogeneous price effects.

In panel (a) of Table 9 we include a robustness check using the demand estimates from Model 1, i.e. one-level nested logit with homogenous price effect. In panel (b) of Table 9 we use an alternative assumption of firm behavior. Rather than assuming that firms set prices to maximize profits, we assume here that they choose prices to maximize sales. This assumption might for example be relevant for the entry-level segment of vehicles, as firms have an incentive to tie new customers to their brands, hoping that loyalty will bind new customers in subsequent years. The potential of repeat purchases by customers that first enter the car market can make firms compete extremely aggressively in this segment.

To pin down prices under the sales maximization assumption, we assume that firms apply a fixed mark-up of 20% to cover fixed costs. If we express the results in percentages, all changes would be identical for any mark-up we apply, as long as it is a fixed percentage of the underlying costs. Note that firms that maximize sales will choose to pass on the entire tariff cut to consumers. This holds their profit margins constant and the only source of increased profits are the increased sales. On the other hand, firms that are only indirectly affected will not be able to respond to a price change of their competitors. As a result, this behavioral assumption yields maximum changes in market shares and those results should be considered as upper bounds on the possible effects of any trade policy change.

Before we turn to a detailed discussion of the results, we summarize the different forces that are at play in all the trade policy scenarios:

- Prices for models affected by a FTA will fall, but by less than 5.75% as some of the cost decline is taken as higher profit margin, i.e. not passed on to consumers.

- The extent of tariff pass-through is increasing in the elasticity of the model. Holding all else fixed, models with higher prices and in segments with higher nesting parameters will see larger price declines.

- A FTA will make firms that are affected directly more competitive in all segments, but they will be particularly prone to lower their prices in segments where they are not well represented as they do not need to worry about cannibalizing their own profits.

- Producers that are only indirectly affected will tend to lower their prices. These competitive responses are relatively minor, but most pronounced for firms that produce many vehicles in the same segments as those affected by the FTA.

- Price responses will translate directly into market share changes according to the estimated demand models.

Trade policy simulations for the preferred demand model

| FTA of Canada with… | E.U. | Korea* | Japan | EU, Korea, & Japan | EU & Japan | EU & Korea |

|---|---|---|---|---|---|---|

| Canadian consumption (unit) | +7,527 | +5,730 | +9,796 | +21,249 | +17,050 | +11,795 |

| Total imports | +10,917 | +10,211 | +16,792 | +35,656 | +27,241 | +19,790 |

| Imports from US/Mexico | -5,602 | -6,221 | -12,577 | -23,895 | -17,715 | -12,395 |

| Imports from EU | +21,829 | -898 | -3,603 | +16,484 | +17,801 | +20,370 |

| Imports from Japan | -3,820 | -4,553 | +37,936 | +27,938 | +33,479 | -8,425 |

| Imports from Korea | -1,491 | +21,883 | -4,964 | +15,130 | -6,325 | +20,240 |

| Domestic production | -3,390 | -4,482 | -6,996 | -14,407 | -10,191 | -7,995 |

Notes: *FTA Korea includes GDP effect.

| FTA of Canada with… | E.U. | Korea* | Japan | EU, Korea, & Japan | EU & Japan | EU & Korea |

|---|---|---|---|---|---|---|

| Canadian consumption | +0.49% | +0.37% | +0.64% | +1.39% | +1.11% | +0.77% |

| Total imports | +0.89% | +0.83% | +1.37% | +2.91% | +2.22% | +1.61% |

| Imports from US/Mexico | -0.68% | -0.75% | -1.52% | -2.90% | -2.15% | -1.50% |

| Imports from EU | +21.30% | -0.88% | -3.52% | +16.08% | +17.37% | +19.87% |

| Imports from Japan | -2.15% | -2.57% | +21.39% | +15.75% | +18.88% | -4.75% |

| Imports from Korea | -1.24% | +18.17% | -4.12% | +12.56% | -5.25% | +16.81% |

| Domestic production sold in Canada | -1.11% | -1.47% | -2.29% | -4.71% | -3.33% | -2.62% |

| Total domestic production | -0.16% | -0.22% | -0.34% | -0.70% | -0.49% | -0.39% |

The results for the different trade policy simulations are discussed below in separate sections while the tables contain the estimates for all simulations in different columns. We focus on the quantity responses—domestically produced and imported—and discuss the effects on other variables in Section 3.5.5 at the end.

3.5.1 European Union

The simulations for a FTA between Canada and the European Union are reported in the first column of the three tables with results. For this first set of results, we will describe the changes in some detail.

The price declines that the FTA would set in motion are estimated to lead to higher total sales in Canada of 7,527 additional vehicles. This implies that market share is taken away from the outside good. Among active firms, the FTA would also reshuffle market shares quite a bit. Total imports are estimated to increase by 10,917 and domestic production to decline by 3,390 units. The import changes would be very asymmetric as well, imports from the E.U. are estimated to increase by 21,829 vehicles, while all other trading partners would see their sales decline. The NAFTA trading partners would bear the brunt of the adjustment, selling 5,602 fewer vehicles in Canada, followed by lower imports from Japan of 3,820 vehicles and 1,491 fewer imports from Korea.

Note that the statistics in the table are not the firm totals, but the totals by country of assembly. E.U. firms will also see their sales decline for models that they currently produce within the NAFTA area and these effects are included in the US/Mexico total. Japanese and Korean firms will have also loose sales on the vehicles they produce in North America, in addition to those on models shipped from their home countries that are listed separately in Table 7.

In Table 8, these same changes are expressed as a fraction of total observed output in 2010. While imports from US/Mexico saw the largest decline in absolute terms, the percentage decline is the smallest of the four regions that lose sales. There are several reasons for this.

First, given that the firms that sell the bulk of the vehicles made in the E.U.—Volkswagen, BMW, and Daimler—also operate assembly plants in the U.S. or Mexico, they will not benefit from the FTA for these models. They will be especially reluctant to lower prices and start a downward price spiral in the segments where they sell the vehicles that they assemble in North American vehicles. This is a standard effect for multi-product firms and strongly favors other producers in the US/Mexico area which tend to produce similar vehicles (e.g. SUVs).

Second, the price decline is extremely high, on averaging -5.06%, as many of the models imported from the E.U. are in the luxury and sporty vehicle segment where prices are higher and the number of vehicle offerings is larger. These same factors also make the price response of other firms larger as they raise the cross-price elasticity. As a result, market share changes are muted, but variable profits decline to a greater extent.

Third, the price decline will be highest in segments where vehicles imported from the E.U. are most prominent and this is by far the luxury and sporty cars segment. The Japanese firms own most of the competing vehicles in this segment and they see a market share decline for models imported from Japan that is three times as high as for models produced in US/Mexico.

The estimated decline of domestic production for Canada of 3,390 vehicles, amounts to a 1.11% decline in the number of vehicles that are produced and sold in Canada. Given that only 15% of domestic output is also sold in Canada, it means a decline in total domestic production of only 0.16%. The first statistic is comparable to the import declines reported for the other countries and is relevant to gauge the change in market equilibrium. The second statistic is the most relevant one for the domestic industry.

For an idea what the potential employment impact of this decline would be, we can multiply the percentage change with total employment in the Canadian assembly industry of 32,406 (NAICS industry 3361 “Motor Vehicle Manufacturing). For a more pessimistic scenario, we could even multiply it with total employment in the entire Canadian automotive production sector, including parts production, which would add 61,771 more jobs at stake (adding NAICS industry 3362 “Motor Vehicle Body and Trailer Manufacturing” and 3363 “Motor Vehicle Parts Manufacturing”).Footnote 14 These calculations suggests a possible impact of 52 or at most 151 jobs.

Of course, total employment at an automobile plant does not fluctuate smoothly with the production level. Most employment is relatively fixed, especially in the short run, and employment only really declines when a plant is eventually closed down. These numbers are only intended to express the production decline in terms of employment, using the average worker-per-vehicle conversion factor for the industry.

In Table 9 we provide two alternative simulations to verify the robustness of the earlier estimates. In panel (a) we use a more restrictive demand model that is only slightly more flexible than the one used in Van Biesebroeck (2007). It predicts a smaller increase in total vehicle purchases and a smaller increase in imports, but a slightly larger decline in the domestic production. In this demand model, the cross-price elasticities vary much less across different vehicle models. In particular, the models produced in Canada are still considered relatively good substitutes for the E.U. models, which was not the case in the preferred model. In each of the subsequent trade simulations that involve the E.U., we estimate larger effects on Canadian production with this more restrictive model. At the same time, the more restrictive model predicts a smaller decline in sales by Japanese luxury models, as they are now also only average substitutes.

| FTA of Canada with… | E.U. | Korea | Japan | E.U., Korea, & Japan | EU & Japan | EU & Korea |

|---|---|---|---|---|---|---|

| (a) Alternative demand model | ||||||

| Canadian consumption | +0.19% | +0.13% | +0.21% | +0.50% | +0.39% | +0.30% |

| Total imports | +0.56% | +0.53% | +0.95% | +1.94% | +1.47% | +1.06% |

| Domestic production sold in Canada | -1.32% | -1.51% | -2.76% | -5.27% | -3.95% | -2.77% |

| Total domestic production | -0.20% | -0.22% | -0.41% | -0.78% | -0.59% | -0.41% |

| (b) Assuming sales maximizing behavior | ||||||

| Canadian consumption | +0.45% | +0.47% | +0.60% | +1.38% | +1.03% | +0.81% |

| Total imports | +0.86% | +0.94% | +1.29% | +2.91% | +2.12% | +1.72% |

| Domestic production sold in Canada | -1.23% | -1.42% | -2.17% | -4.76% | -3.34% | -2.83% |

| Total domestic production | -0.18% | -0.21% | -0.32% | -0.71% | -0.50% | -0.42% |

In panel (b) of Table 9 we make the extreme assumption that firms are maximizing sales rather than profits, but use again the more flexible demand Model 1. As discussed before, this will lead to full pass-through of the tariff cut to consumer prices for affected vehicles, while indirectly affected models will not see a price change anymore. This will unambiguously lead to the maximum gain in sales for the benefitting country and the maximum reduction in Canadian production. We see that in this case the decline in domestic production for Canada is only slightly higher than in Table 8, at 1.23%, or 0.18% of total production of the sector.

The benchmark effects in Table 8 tend to be in between the results for the two more extreme models in Table 9. The underlying reason is that the estimated pass-through of tariff cuts in the benchmark model is not as large as in the case of sales maximizing behavior, but stronger than in the more restrictive demand model without random coefficients.

3.5.2 South Korea

Given the above explanations for the nature of the effects and the detailed discussion of the changes in the case of a FTA with the E.U., we can let the results speak for themselves in the following simulations. One thing that is different in the calculation of a FTA with Korea is that we include the predicted increase to Canadian GNP from the FTA in the counterfactual calculation. This was estimated to be a 0.15% boost to Canadian GNP by Ciuriak and Chen (2008) and this raises overall vehicle sales slightly.

Given that total initial imports from Korea are more than one third larger than imports from the E.U., it is not surprising that the impact of this FTA is estimated to be larger. The impact on Canadian production is estimated at 4,482 units or 0.22% of the total, which is less than proportional to the initial level of Korean imports. Estimated own-price elasticities for vehicles imported from Korea are slightly lower than for E.U. imports which leads to smaller pass-through and a smaller gain in market share. This is driven by the presence of some SUVs and minivan imports, which have markedly lower σg estimates, and the lower prices of Korean vehicles, while price elasticity is slightly increasing in price. Imports from Japan are estimated to be particularly affected by a FTA between Canada and Korea. In the more restrictive demand model, the decline of Canadian production is more pronounced.

It is instructive to compare the results in this case with those obtained in Van Biesebroeck (2007), where the focus was on a FTA with Korea. The absolute impact on Canadian production was estimated at 2.137 in the earlier calculations, while the increase in Korean imports was estimated at 13,160.

Much of the difference can be explained by the different base year, 2005 before against 2010 now. In the earlier study, total Korean imports stood at 124,135. While sales by Hyundai and Kia increased markedly in the following five years, their opening of assembly plants in North America as well as the production shift of several GM vehicles to North America, left total Korean imports virtually unchanged at 120,437 vehicles five years later. Moreover, in 2005 almost 30% of vehicles imported from Korea were sold by GM, which as market leader had much less of an incentive to lower prices. GM had a total Canadian market share of 28.1% at the time. In 2010, all of the imports from Korea were sold by Hyundai-Kia. A final factor to explain the difference is that the more flexible and more robustly estimated demand system has produced higher total elasticities in general. This can be seen by comparing the predicted overall increase in vehicle consumption due to a FTA with Korea, which was estimated at +3,927 for 2005 and at +5,730 for 2010 now.

3.5.3 Japan

The last FTA we simulate is between Canada and Japan. The results indicate that this would have by far the largest impact on all of the market participants. It would lead to a decline in Canadian production of 6,996 vehicles or 0.34% of total domestic production (2.29% of current output destined for the domestic market). The increased imports from Japan would be also far larger than in the case of the other two FTAs, estimated at an additional 37,936 vehicles. However, this is mostly the result of the much larger market share of Japanese vehicles as the percentage increase in imports would be smaller than for E.U. models under a FTA with the E.U.

It is instructive to compare the differential impact of the various FTAs on each country group. Looking horizontally in the first three columns for the domestic production line in Table 8 shows that the percentage impact on the Canadian industry is gradually increasing for FTAs with the E.U., Korea, and Japan, in this order. However, we have to keep in mind that initial import levels also differ. While imports from Japan are 73% higher than from the E.U. and 47% higher than from Korea, the effect of an FTA with Japan is fully 106% larger than with the E.U. and 56% larger than with Korea. Controlling for these initial differences, Canadian plants seem to compete most closely with imports from Japan.

This differs from the effects on plants in the U.S. and Mexico, which would suffer far more from a Canadian FTA with Japan, both in absolute numbers and proportionately. Japanese imports would decline more from an FTA with Korea than with the E.U. The largest difference would be for E.U. imports. A Canadian FTA with Korea would cost them only 898 unit sales, while one with Japan 3,603. Even though Korea attains more than two thirds of the Japanese import volume, the effect on E.U. imports from a Korean FTA would be only one quarter of the effect of a Japanese FTA.

These last results are not surprising for anybody familiar with the product offerings of the different firms, but it highlights the importance of working with a rich and flexible demand model. This can also be seen from the results with the alternative demand model and alternative behavioral assumption in Table 9. The estimated effects tend to differ a lot less over the first three FTAs.

3.5.4 Simultaneous FTAs with several trading partners

In the final three columns of the different tables we also report results for simultaneous FTAs with several trading partners: E.U., Korea, and Japan in columns (4), E.U. and Japan in columns (5), and E.U. and Korea in columns (6).

The one general finding is that the effect of simultaneous FTAs are slightly lower than the sum of the individual FTAs. This is reasonable as firms that do not benefit from a FTA will already strategically respond to the price declines of other firms by lowering their own prices somewhat as well. The benefit of an additional FTA for these firms will not have full impact on their prices anymore as they already start from a lower level. Note that under the sales-maximizing assumption, the sum of the effect on domestic production is very close to the effect of simultaneous FTAs.

In addition, given that other firms are now responding more aggressively to price declines, each firm that benefits from a FTA will experience a smaller boost to its import sales. Especially Korean firms are estimated to only increase their imports by 12.6% if Canada would form FTAs with all three trading partners. This is a lot lower than the 18.2% higher sales estimate in the case of an exclusive FTA.

3.5.5 Effects of FTAs on tariff revenue, consumer surplus, and prices

The effects of the different FTAs on quantities—domestically produced or imported—have been discussed extensively in the previous sections. We already alluded to pricing effects in some instances, but in Table 10 we bring together all effects on prices, consumer surplus, and government revenue. We use the benchmark model throughout and break down the effects by production region, as before.

The first line of statistics illustrates how much tariff revenue would fall as a result of the different FTAs. The total revenue for 2010 of $424m is based on the imputed marginal costs by the model. The results indicate that a FTA with the E.U. would have a disproportionately large effect on tariff revenue. The predicted reduction in revenue of $167 million (40%) is almost as large as for a FTA with Japan even though the number of vehicles imported is only slightly more than half as large. It is, of course, the result of the high price of the vehicles imported from the E.U.

Calculating the tariff revenue as 5.75% of the marginal cost is not entirely correct as the tariff rate should be applied to the market value of the imported vehicles. This should include the firm’s mark-up, but not the distribution costs that will be incurred in Canada. The exact base cannot be known without detailed information on distribution costs, but the second line in Table 10 shows an alternative calculation applying the tariff rate to the consumer price. This produces higher numbers and the true amount should be somewhere in between.

At this point it is useful to point out that we did not consider changes in indirect tax revenues. For example, the results in Table 7 indicated that a FTA with the E.U. would boost total Canadian vehicle sales by 7,527 units. At an average price of $25,376, a 13% HST on these sales would result in a tax revenue $24.8m. Of course, this does not represent a net gain for Canada, but merely redistribute money from consumers to the government. It does highlight that the budgetary impact of any change in trade policy would be not as severe as the statistics in the first line of Table 10 suggest.Footnote 15

The following statistics in Table 10 show the average price change by model, using the ex post sales quantities as weights. In the first FTA, E.U. firms are predicted to lower the prices on the models that are directly affected by the tariff reduction by 5.06%. Given that their landed marginal cost in Canada would go down by 5.75%, this amounts to a pass-through rate of 88% of the tariff cut. Korean and Japanese firms are predicted to lower prices by respectively 4.44% and 4.90% when they benefit from a FTA, but Korean producers would increase the pass-through rate when there is a simultaneous FTA with the E.U. or Japan.

| FTA of Canada with… | E.U. | Korea | Japan | EU, Korea, & Japan | EU & Japan | EU & Korea |

|---|---|---|---|---|---|---|

| Tariff revenue (based on MC) | -$167,000,000 (‑39.5%) | -$87,000,000 (‑20.6%) | -$169,000,000 (‑39.9%) | -$424,000,000 (‑100%) | -$336,000,000 (‑79.4%) | -$255,000,000 (‑60.1%) |

| Tariff revenue (based on price) | -$218,000,000 | -$127,000,000 | -$238,000,000 | -$584,000,000 | -$456,000,000 | -$345,000,000 |

| Consumer surplus | $215,000,000 (0.50%) | $170,000,000 (0.40%) | $231,000,000 (0.54%) | $526,000,000 (1.24%) | $440,000,000 (1.03%) | $302,000,000 (0.71%) |

| Average price change by model | ||||||

| Canada | -0.07% | 0.03% | -0.01% | -0.07% | -0.07% | -0.06% |

| US/Mexico | -0.01% | 0.04% | 0.00% | 0.01% | -0.01% | 0.01% |

| E.U. | -5.06% | 0.05% | 0.01% | -5.02% | -5.05% | -5.03% |

| Japan | -0.06% | 0.06% | -4.90% | -4.96% | -4.99% | -0.02% |