Quarterly economic and trade report – Q3 2022

Highlights

- Driven, in part, by a temporary easing of the ongoing lockdown restrictions in China during summer 2022 (prior to China's removal of most COVID restrictions in December 2022) and stronger than expected consumer spending in the United States, global real GDP increased at a faster pace in the third quarter (3.9%) compared to Q2 2022 (0.6%). World merchandise trade (1.2%) and production (1.3%) volumes also increased in Q3.

- Nonetheless, the International Monetary Fund's outlook for global economic growth in 2023 was further downgraded to 2.7% in October from 2.9% in July, as persistent inflation, increases in the cost of living, and the war in Ukraine impact global growth.

- The Canadian economy posted surprisingly strong GDP growth in Q3 (2.9%), driven by net trade and inventory accumulation. However, household spending (-1.0%) and final domestic demand (-0.6%) contracted, suggesting the economy is starting to cool.

- The value of Canada's goods and services exports contracted by 2.6% in Q3 due to a decline in prices while volumes actually increased (due to energy exports). Goods and services imports increased by 1.5%, leading to Canada's first goods and services trade deficit in over a year.

- As interest rates rise, with the Bank of Canada working to reign in inflation, Canadian economic growth is expected to slow to 0.9% in 2023, with a modest contraction expected for the first half of the year.

Table 1: Highlights - second quarter 2022

| % change, Q3 2022 vs Q2 2022 | % change, YTD | |

|---|---|---|

| Global real GDP* | 3.9 | 3.5 |

| Global merchandise trade volume | 1.2 | 4.6 |

| Canadian real GDP* | 2.9 | 3.9 |

| Canadian exports (goods & services) | -2.6 | 23.9 |

| Canadian imports (goods & services) | 1.5 | 22.2 |

Notes: *Throughout the report, GDP is quarterly changes at annualized rates. "YTD %" is the year-to-date change compared to the same period in the previous year, at annualized rates.

Source: Oxford Economics, Netherland Bureau for Economic Analysis, Statistics Canada.

Global economic growth rebounded in Q3

After posting very slow growth in Q2 (0.6%), the global economy grew 3.9% in Q3. Emerging markets grew by a robust 7.4% in Q3, following a 0.6% contraction in Q2. Growth in advanced economies picked up pace slightly compared to Q3, increasing by 1.8% in Q3.

A sharp rebound in activity in China drove emerging market growth. While China's Q3 growth was strong, economic data from October show signs of weakening, with retail sales contracting, investment slowing, and exports continuing to contract. Recent announcements by the Chinese government to lower some COVID-19 restrictions and provide support for the property market will help ease the slowdown but 2022 and 2023 economic growth could remain weak by historical standards.

After experiencing a mild technical recession in the first half of 2022, growth in the United States (U.S.) increased to 2.9% in Q3. An increase in exports, consumer and government spending, and non-residential investment drove Q3 growth. Housing investment continued to subtract from growth.

High inflation and the energy crisis in the Eurozone subdued growth in Q3 as the region grew 0.8%, although this remains more robust than many had feared. The war in Ukraine has led to a significant cost of living crisis that may worsen as Europeans look to heat their homes during the winter season.

Source: Oxford Economics, Statistics Canada. Seasonally adjusted. Retrieved on 2022-11-29.

Text version

Real GDP growth, top economies

(quarterly % change, annualized)

| 2022 - Q2 | 2022 - Q3 | |

|---|---|---|

| Advanced economies | 1.4 | 1.8 |

| Emerging markets | -0.6 | 7.4 |

| Canada | 3.22 | 2.94 |

| China | -6.67 | 15.59 |

| France | 1.94 | 0.7 |

| Germany | 0.41 | 1.61 |

| Italy | 4.61 | 1.86 |

| Japan | 4.62 | -1.22 |

| United Kingdom | 0.94 | -0.66 |

| United States | -0.58 | 2.93 |

World merchandise trade volumes picked up modestly in Q3

World merchandise trade volume growth picked up slightly (1.2%) in the third quarter of 2022, up from 0.7% growth in the second quarter. Export volume growth was widespread across the major advanced economies, with the United Kingdom posting exceptionally strong growth in Q3 (14.7%), albeit due to an increase in exports of non-monetary gold.

Meanwhile, export volumes in emerging economies contracted by 0.2% in Q3. Declining export volumes from China (-0.6%) and Emerging Europe (-9.0%) drove the emerging market contraction, reflecting the impacts of the COVID-19 lockdowns and property market declines in China and the continued fallout stemming from Russia's aggression toward Ukraine. Both of these factors pose a risk to global trade going forward.

World industrial production volumes increased by 1.3% in Q3 of 2022 after decreasing by 1.6% in the previous quarter. Despite challenges and real estate weakness, China's production rebounded, increasing 3.4% in Q3 after contracting 6.8% in Q2. Production in advanced economies marginally increased (0.7%) in Q3 compared to Q2 (0.2%), driven by a rebound in production in Japan (5.1%) and a slight improvement in Euro Area (0.3%) production growth.

Source: IMF World Economic Outlook, October 2022, retrieved on 2022-11-24.

Text version

World merchandise trade and

industrial production volume

(Index 2010 = 100)

| Date | World merchandise trade volume | World industrial production volume |

|---|---|---|

| Dec-19 | 123.7 | 125.9 |

| Jan-20 | 120.9 | 120.1 |

| Feb-20 | 121.0 | 120.7 |

| Mar-20 | 118.2 | 120.3 |

| Apr-20 | 104.5 | 109.8 |

| May-20 | 104.3 | 110.6 |

| Jun-20 | 112.0 | 116.0 |

| Jul-20 | 117.7 | 119.9 |

| Aug-20 | 119.7 | 121.4 |

| Sep-20 | 123.2 | 123.2 |

| Oct-20 | 123.7 | 124.3 |

| Nov-20 | 125.3 | 125.6 |

| Dec-20 | 126.1 | 127.0 |

| Jan-21 | 127.0 | 128.5 |

| Feb-21 | 126.8 | 128.3 |

| Mar-21 | 130.9 | 128.7 |

| Avr-21 | 130.2 | 129.3 |

| Mai-21 | 128.9 | 127.9 |

| Jun-21 | 129.7 | 129.4 |

| Jul-21 | 129.0 | 129.7 |

| Aug-21 | 129.7 | 129.3 |

| Sep-21 | 129.5 | 128.3 |

| Oct-21 | 130.4 | 129.3 |

| Nov-21 | 133.4 | 130.9 |

| Dec-21 | 135.1 | 132.3 |

| Jan-22 | 134.0 | 133.9 |

| Feb-22 | 134.6 | 135.2 |

| Mar-22 | 132.8 | 133.8 |

| Apr-22 | 132.7 | 130.9 |

| May-22 | 136.1 | 131.9 |

| Jun-22 | 135.6 | 133.8 |

| Jul-22 | 135.6 | 133.3 |

| Aug-22 | 136.6 | 134.1 |

| Sep-22 | 136.8 | 134.4 |

Global economic outlook edges further down

High worldwide inflation and rapid and synchronized monetary tightening have led to a cost of living crisis that poses a threat to global economic growth. While the International Monetary Fund's (IMF) forecast for 2022 global economic growth remains at 3.2%, unchanged from its July 2022 forecast, it further downgraded its economic growth expectations for 2023 from 2.9% to 2.7%. This forecast represents the weakest growth since 2001, excluding the 2008/09 Great Recession and brief contraction in 2020 that was brought on by the COVID-19 pandemic.

While labour markets remain tight in many economies and supply bottlenecks have eased, several downside risks outweigh these positive indicators. Downside risks include the potential for a miscalibration in monetary, fiscal, or financial policy, further restrictions of gas supply to Europe brought on by the war in Ukraine, a resurgence of COVID-19, and slower growth in China that may result from a worse than expected property market performance.

Source: IMF World Economic Outlook, October 2022, retrieved on 2022-11-24.

Text version

| 2022 | 2023 | 2024 | |

|---|---|---|---|

| Global forecasted GDP growth (annual % change) | 3.2 | 2.7 | 3.2 |

Canadian Q3 economic growth surprised on the upside but headwinds remain

The Canadian economy grew 2.9% in Q3, down slightly from 3.2% growth in Q2. Net trade was the biggest contributor to growth in Q3, adding 3.4 percentage points to annualized growth. Led by oil products, export volumes increased for the second consecutive quarter (8.6%) while imports contracted by 1.5% as energy product imports declined. Accumulation of inventories also contributed to growth in Q3 (0.2 percentage points), with non-farm inventories reaching a historic high.

While Q3 growth was stronger than expected, there are signs of weakness in the economy. Consumption contributed 0.6 percentage points to GDP growth in Q3, substantially less than its 4.4 percentage point contribution in Q2. Moreover, consumption growth in Q3 was entirely supported by the government and non-profit sectors, while household spending contracted by 1.0%. Household spending patterns continued to shift towards services; spending on durable and semi-durable goods contracted in Q3 while services spending growth was strong (3.8%). The contraction in household spending overall could suggest that increased interest rates and high inflation are starting to take hold.

Furthermore, the housing market continued to drag down growth in Q3, with investment in residential structures contracting by approximately 15.4%, following a 31.5% contraction in Q2. Overall, final domestic demand contracted by 0.6% in the third quarter.

Source: Statistics Canada Table 36-10-0104-01, retrieved on 2022-11-29.

Text version

| Q2 2021 | Q3 2021 | Q4 2021 | Q1 2022 | Q2 2022 | Q3 2022 | |

|---|---|---|---|---|---|---|

| GDP growth (%) | -2.3 | 5.8 | 6.9 | 2.8 | 3.2 | 3.0 |

| Consumption (percentage points contribution) | -0.3 | 10.8 | 1.4 | 1.3 | 4.4 | 0.6 |

| Investment (percentage points contribution) | -0.2 | -3.5 | 2.3 | 1.6 | -2.1 | -1.2 |

| Inventories (percentage points contribution) | 4.2 | -3.3 | 4.2 | 2.6 | 6.5 | 0.2 |

| Net Trade (percentage points contribution) | -6.5 | 2.1 | -1.1 | -2.6 | -5.9 | 3.4 |

Energy and agriculture products led growth in Q3

Real GDP by industry expanded 0.7% in Q3, as goods-producing industries expanded 1.0% and services industries expanded 0.6%. Third-quarter growth was broad-based, with 15 of 20 major goods and services industries posting positive growth.

Goods-producing industries led growth in Q3 as mining, quarrying, and oil and gas sector increased 2.0% on crude bitumen production, which reached a record high in September 2022. Growth in agricultural production (8.8%) also supported Q3 performance, as crop yields were higher than expected. Manufacturing activity continued to decline, posting its fourth decline in five months in September and negative growth in Q3 (-0.9%). The contraction was due to a widespread decline in non-durable goods manufacturing, including food product manufacturing. Gains in machinery manufacturing helped partially offset losses.

Services growth was modest in Q3, supported by growth in professional and technical services (1.7%) and many social service industries, including public administration (1.2%), education (1.1%), and health care and social assistance (0.9%). Growth continued in several service client-facing industries including arts and entertainment industries (4.7%) and accommodation and food services (1.8%). Meanwhile, finance and insurance and real estate continued to struggle, contracting 0.2% and 0.05%, respectively.

Source: Statistics Canada Table 36-10-0449-01 . Retrieved 2022-11-29.

Text version

| Sector | Quarterly % GDP growth in Q3 |

|---|---|

| Manufacturing | -0.9 |

| Retail trade | -0.7 |

| Finance & insurance | -0.2 |

| Real estate & rental & leasing | 0.0 |

| Administrative & waste management | 0.1 |

| Transportation & warehousing | 0.3 |

| Wholesale trade | 0.4 |

| Construction | 0.7 |

| All Industries | 0.7 |

| Information & cultural industries | 0.9 |

| Health care & social assistance | 0.9 |

| Educational services | 1.1 |

| Public administration | 1.2 |

| Utilities | 1.6 |

| Professional, scientific & technical services | 1.7 |

| Accommodation & food services | 1.8 |

| Mining, quarrying, & oil & gas extraction | 2.0 |

| Other services (except public administration) | 2.2 |

| Arts, entertainment & recreation | 4.7 |

| Agriculture, forestry, fishing & hunting | 8.8 |

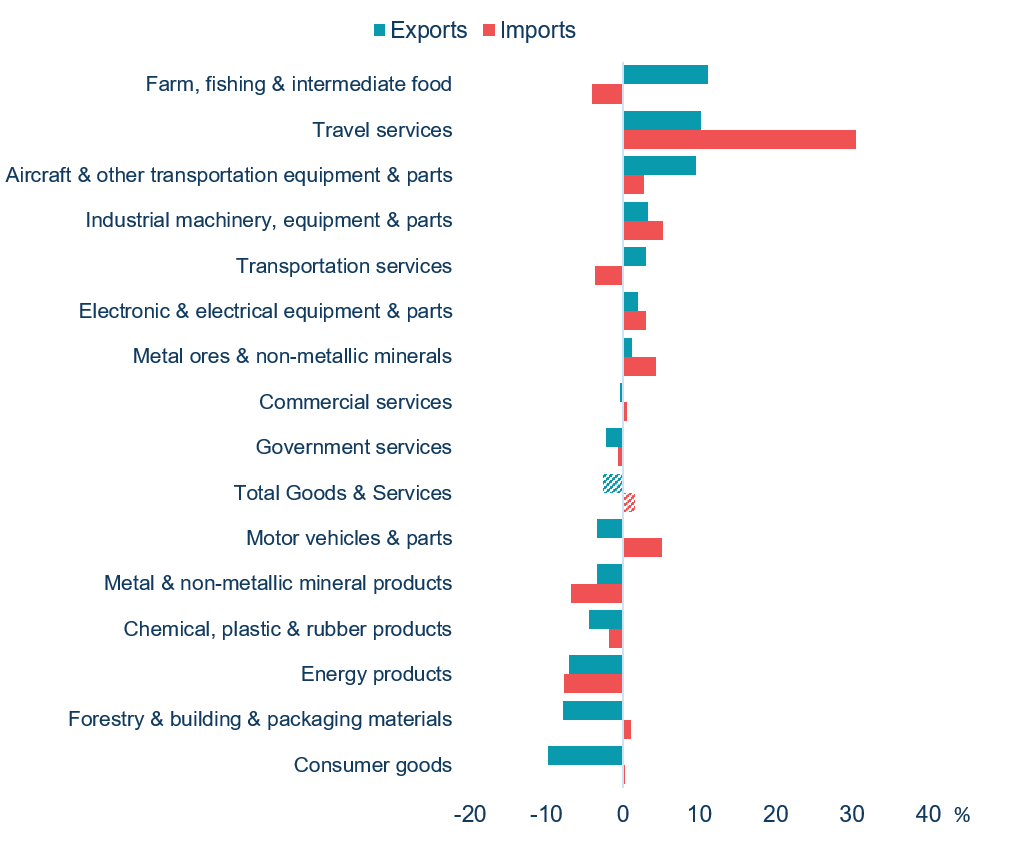

Exports contracted in Q3 driven by widespread declines of goods exports

Following 4 consecutive quarters of growth, the value of exports contracted by 2.6% in the third quarter of 2022, driven entirely by a contraction in goods exports (-3.5%) as service exports increased by 2.0%. Despite a contraction in the value of exports, export volumes were up. At the same time, imports rose 1.5% in Q3, driven by services imports (+4.5%) as goods imports edged up only 0.9%. As such, Canada's goods and services balance went from a surplus in Q2 to a deficit in Q3 – the first trade deficit in a year.

Six of 11 goods export product categories contracted in Q3, including significant contractions in consumer goods (-9.8%), forestry and related products (-7.8%), and energy products (-7.0%). Overall, energy export declines were the largest contributor to the Q3 export contraction as energy prices fell significantly. Meanwhile, a small contraction in commercial service exports (-0.4%) was outweighed by continued robust growth in travel services exports (10.2%) and growth in transportation services (3.1%).

Half of the 4 major service import categories increased in Q3. Third-quarter services import growth was primarily driven by travel services growth (30.5%) as Canadians continued to take advantage of fewer COVID-19 restrictions abroad. Commercial services imports struggled (0.5%) while both transportation (-3.6%) and government services (-0.7%) imports contracted. Services imports overall are now roughly 7.8% above their pre-2020 peak, but travel services have not recovered fully and Q3 travel imports were 25.0% below their Q4 2019 level. Goods imports edged up 0.9% in Q3 as increases in motor vehicles and parts (5.1%) and industrial machinery (5.3%) imports were pulled down by declines in metallic and non-metallic mineral products (-6.8%) and energy products (-7.7%).

Source: Statistics Canada Table 36-10-0019-01 & Table 36-10-0021-01. Balance of payments basis, seasonally adjusted.

Text version

Quarterly % growth in Q3

| Sector | Exports | Imports |

|---|---|---|

| Farm, fishing & intermediate food | 11.2 | -4.1 |

| Travel services | 10.2 | 30.5 |

| Aircraft & other transportation equipment & parts | 9.6 | 2.7 |

| Industrial machinery, equipment & parts | 3.3 | 5.3 |

| Transportation services | 3.1 | -3.6 |

| Electronic & electrical equipment & parts | 1.9 | 3.0 |

| Metal ores & non-metallic minerals | 1.1 | 4.3 |

| Commercial services | -0.4 | 0.5 |

| Government services | -2.2 | -0.7 |

| Total Goods & Services | -2.6 | 1.5 |

| Motor vehicles & parts | -3.4 | 5.1 |

| Metal & non-metallic mineral products | -3.4 | -6.8 |

| Chemical, plastic & rubber products | -4.5 | -1.8 |

| Energy products | -7.0 | -7.7 |

| Forestry & building & packaging materials | -7.8 | 1.0 |

| Consumer goods | -9.8 | 0.3 |

Goods exports decline driven by resource exports to the U.S.

Canadian goods exports to the U.S. contracted 4.6% in Q3, as energy exports declined due to price decreases. Declines in exports of potash and softwood lumber also contributed to the contraction. Meanwhile, imports increased by 2.1%, causing Canada's trade surplus with the U.S. to contract by $9.8 billion, dropping to $28.8 billion in Q3.

Exports to the rest of the world eked out growth in Q3 (0.5%), led by goods exports to Hong Kong, which increased more than fourfold on gold and crude oil exports. After struggling in the first half of 2022, Canadian exports to China (pulse, crops, potash and grains) grew at a robust pace of 13.0% in Q3. Goods exports to the European Union also increased (1.5%) in Q3, with declines in exports to the Netherlands (pharmaceutical products and iron ore) offset by an increase in exports to Germany.

Goods imports from non-U.S. destinations contracted by approximately 1.2% in Q3, reflecting cooling domestic demand. Imports from the United Kingdom (gold), the Netherlands (motor gasoline), Hong Kong, and Switzerland (copper) posted the largest declines in Q3, which were partially offset by increases in imports from China (various products) and Mexico (various products). The goods trade deficit with non-U.S. economies narrowed to $27.1 billion in Q3.

Overall, Canada's goods trade surplus with the world contracted by roughly $8.7 billion in Q3 to hit $1.7 billion. Looking forward, challenges to export growth remain as foreign demand slows, and many countries are facing possible contractions in early 2023.

Source: Statistics Canada Table 36-10-0023-01, balance of payments basis, seasonally adjusted. European Union does not include the United Kingdom.

Text version

Quarterly % growth in Q3

| Country | Exports | Imports |

|---|---|---|

| United States | -4.6 | 2.1 |

| China | 13.0 | 2.8 |

| European Union | 1.5 | 1.6 |

| Rest of the world | -2.4 | -4.3 |

U.S. travel drives services trade growth in Q3

Services import growth (4.5%) outpaced export growth (2.0%) again in Q3, leading to a services deficit of $5.7 billion. Services export growth was led by China (8.2%) and the U.S. (0.7%). Services exports to non-U.S. economies also contributed to growth, increasing by 3.6%, with exports to nearly all major economies increasing.

Services imports from the U.S. increased 7.7% in Q3, fuelled by Canadians travelling south. Services imports from non-U.S. destinations edged up 0.5% in Q3, as declines across several markets in Asia, as well as Mexico, were offset by increased services imports from the European Union (1.5%).

After commercial services, travel is the largest services trade category. Services trade was significantly impacted by COVID-19 due to the physical restrictions on travel imposed by many countries, including Canada. International travel has started to come back in 2022, but the number of travellers (coming into Canada and Canadians travelling abroad) is still significantly below 2019 levels. Travel services imports (i.e., Canadians travelling abroad) increased by 5.7% in Q3, driven by Canadians travelling to the U.S. Roughly 2.4 million Canadians travelled to the U.S. each month on average in Q3, up 13.3% but growth slowed from Q2. Travel exports increased by 18.0% in Q3, significantly slower than the pace of growth in Q2. Indeed, visits from U.S. and non-U.S. travellers increased overall in Q3, but most of these gains were seen in July as travel to Canada increased slowly in August and contracted in September.

Source: Statistics Canada Table 12-10-0157-01, balance of payments basis, seasonally adjusted. European Union does not include the United Kingdom.

Text version

Quarterly % growth in Q3

| Country | Exports | Imports |

|---|---|---|

| United States | 0.7 | 7.7 |

| China | 8.2 | 0.1 |

| European Union | 1.2 | 1.5 |

| Rest of the world | 3.8 | 0.2 |

Canadian economic growth forecast further downgraded amidst persistent inflation

The Bank of Canada expects economic growth to be 3.3% in 2022, down from 3.5% in its July forecast. Furthermore, the Bank of Canada downgraded its 2023 economic growth forecast by nearly a percentage point, from 1.8% in its July forecast to 0.9% in the October Monetary Policy Report.

Persistently high inflation is the primary reason for the Bank of Canada downgrading the 2023 economic outlook. While inflation has come down since its 8.1% peak in June, largely because of declining gas prices, it is still high (6.9% in October, the latest available data at the time of writing) and broad-based. Domestic demand is expected to remain weak throughout 2023, while a weaker Canadian dollar is expected to partially offset a slowdown in export growth caused by slowing global demand.

Alternative perspectives on the Canadian economy are more pessimistic about 2023 economic growth. Oxford Economics, a private sector forecaster, forecasts that the Canadian economy will contract by 1.3% in 2023. Oxford Economics forecasts a contraction in consumer spending and the housing market that is worse than what the Bank of Canada predicts, driving the difference in the two 2023 forecasts. A major source of uncertainty in these forecasts is whether or not the Bank of Canada can successfully reduce inflation through interest rate hikes without causing a deep recession.

Despite persistently high inflation and the risks of interest rate increases, the Bank of Canada continues to estimate that inflation will return to its targeted range by the end of 2024. As inflation returns to near the 2% target, potential output growth picks up, and foreign demand returns, the Bank of Canada forecasts economic growth to increase by 2.0% in 2024.

Source: Bank of Canada, Monetary Policy Report, October 2022.

Text version

| 2022 | 2023 | 2024 | |

|---|---|---|---|

| Canadian forecasted GDP growth (%) | 3.3% | 0.9% | 2.0% |

Special focus on labour markets

Labour markets are historically tight but starting to cool

The Canadian labour market has been historically tight throughout 2022. In June and July, the unemployment rate reached an all-time low of 4.9%, and there was a record-setting million job vacancies (i.e., unmet demand for labour) across the country from April to June. Labour demand has rapidly outpaced supply since the initial shocks of the pandemic in 2020. Canada is not alone in this trend, with most advanced economies, including the U.S., experiencing tight labour markets throughout 2022.

Moreover, Canada's labour force participation rate (i.e., the number of working-age individuals working or looking for work) remains high, at 64.8% in November. This suggests that low unemployment is not driven by workers dropping out of the labour force but by high demand for workers. These conditions are one factor causing most forecasters to predict that Canada will avoid a deep recession in 2023.

However, the Bank of Canada interprets the tightness in the labour market as a symptom of excess demand in the economy. Hence, it is looking for signs of a labour market slowdown as one indicator that the economy is cooling and high interest rates are starting to take hold. In recent months, the number of jobs added to the economy has remained relatively flat, the unemployment rate is up slightly from its lowest level, and job vacancies have come down marginally from their peak. These movements suggest the labour market is cooling. As it seeks to tame inflation, the Bank of Canada will continue to watch these indicators closely over the coming months.

Source: Statistics Canada Table 14-10-0287-01 & custom tabulation from Statistics Canada for seasonally adjusted job vacancies (only available to September 2022).

Text version

Canadian Unemployment and Job Vacancies

| Date | Unemployment Rate (%, seasonally adjusted) | Job Vacancies (thousands of jobs, seasonally adjusted) |

|---|---|---|

| Oct-20 | 9.2 | 573.1 |

| Nov-20 | 8.7 | 567.1 |

| Dec-20 | 8.9 | 562.4 |

| Jan-21 | 9.4 | 564.9 |

| Feb-21 | 8.3 | 615.9 |

| Mar-21 | 7.5 | 640.7 |

| Apr-21 | 8 | 649.6 |

| May-21 | 8 | 671 |

| Jun-21 | 7.6 | 766.5 |

| Jul-21 | 7.4 | 819.6 |

| Aug-21 | 7.1 | 888.2 |

| Sep-21 | 7 | 922.4 |

| Oct-21 | 6.8 | 918.2 |

| Nov-21 | 6.1 | 910 |

| Dec-21 | 6 | 963.8 |

| Jan-22 | 6.5 | 926.7 |

| Feb-22 | 5.5 | 917.9 |

| Mar-22 | 5.3 | 986.2 |

| Apr-22 | 5.2 | 990.1 |

| May-22 | 5.1 | 1001.3 |

| Jun-22 | 4.9 | 986.1 |

| Jul-22 | 4.9 | 953.5 |

| Aug-22 | 5.4 | 925.4 |

| Sep-22 | 5.2 | 928.7 |

| Oct-22 | 5.2 | |

| Nov-22 | 5.1 |

Annex: Tables

Table 1: Canadian trade by industry sector ($ millions)

| Exports | Imports | |||||

|---|---|---|---|---|---|---|

| Q3 – 2022 | Q/Q % | YTD % | Q3 - 2022 | Q/Q % | YTD % | |

| Goods | 197,008 | -3.5 | 25.8 | 195,329 | 0.9 | 22.0 |

| Resource products | 124,827 | -4.0 | 34.7 | 67,235 | -3.7 | 28.8 |

| Energy products | 55,438 | -7.0 | 76.8 | 12,992 | -7.7 | 67.7 |

| Non-resource products | 67,035 | -2.8 | 12.9 | 120,120 | 3.0 | 18.7 |

| Industrial machinery & equipment | 11,546 | 3.3 | 18.5 | 22,288 | 5.3 | 22.8 |

| Electronic machinery & equipment | 8,023 | 1.9 | 17.8 | 21,834 | 3.0 | 16.1 |

| Motor vehicles and parts | 20,364 | -3.4 | 14.6 | 29,608 | 5.1 | 19.7 |

| Aircraft & other transportation equipment | 6,125 | 9.6 | -10.2 | 6,172 | 2.7 | 19.0 |

| Consumer goods | 20,977 | -9.8 | 14.6 | 40,218 | 0.3 | 17.4 |

| Services | 40,417 | 2.0 | 15.3 | 46,085 | 4.5 | 23.4 |

| Travel | 8,209 | 10.2 | 81.3 | 9,372 | 30.5 | 298.5 |

| Transportation | 4,932 | 3.1 | 29.3 | 9,007 | -3.6 | 38.4 |

| Commercial | 26,915 | -0.4 | 3.4 | 27,261 | 0.5 | 1.6 |

| Government | 361 | -2.2 | 6.3 | 445 | -0.7 | 5.9 |

| Total Goods and Services | 237,425 | -2.6 | 23.9 | 241,414 | 1.5 | 22.2 |

Note: "Q/Q %" is the change from the previous quarter; "YTD %" is the year-to-date (Q1 to recent quarter) cumulative change compared to the same period in the previous year.

Source: Statistics Canada Table 36-10-0019-01 & 36-10-0021-01. Balance of payments basis, seasonally adjusted.

Table 2: Canadian goods trade by trading partner ($ millions)

| Exports | Imports | |||||

|---|---|---|---|---|---|---|

| Q3 – 2022 | Q/Q % | YTD % | Q3 – 2022 | Q/Q % | YTD % | |

| United States | 150,563 | -4.6 | 30.3 | 121,793 | 2.1 | 21.8 |

| Mexico | 2,338 | -2.7 | 8.8 | 6,468 | 7.7 | 25.6 |

| European Union | 9,169 | 1.5 | 15.9 | 17,969 | 1.6 | 21.7 |

| France | 989 | -2.6 | 0.4 | 1,465 | 0.3 | 9.1 |

| Germany | 2,114 | 13.8 | 4.1 | 4,904 | 4.3 | 18.0 |

| United Kingdom | 4,802 | -13.2 | 12.5 | 2,219 | -25.6 | -0.4 |

| India | 1,134 | -12.0 | 68.3 | 1,714 | 0.2 | 41.7 |

| China | 7,232 | 13.0 | -7.1 | 18,559 | 2.8 | 27.7 |

| Japan | 4,485 | -6.6 | 25.9 | 3,006 | 1.3 | 3.5 |

| South Korea | 2,131 | -11.8 | 47.3 | 2,738 | -2.9 | 29.9 |

| Rest of the world | 15,154 | 5.7 | 11.9 | 20,863 | -5.9 | 21.5 |

| Total Goods Trade | 197,008 | -3.5 | 25.8 | 195,329 | 0.9 | 22.0 |

Note: "Q/Q %" is the change from the previous quarter; "YTD %" is the year-to-date (Q1 to recent quarter) cumulative change compared to the same period in the previous year.

Source: Statistics Canada Table 36-10-0023-01. Balance of payments basis, seasonally adjusted.

Table 3: Canadian services trade by trading partner ($ millions)

| Exports | Imports | |||||

|---|---|---|---|---|---|---|

| Q3 – 2022 | Q/Q % | YTD % | Q3 – 2022 | Q/Q % | YTD % | |

| United States | 21,716 | 0.7 | 11.8 | 26,296 | 7.7 | 21.0 |

| Mexico | 442 | 0.9 | 29.3 | 637 | -7.3 | 88.3 |

| European Union | 4,558 | 1.2 | 14.3 | 5,662 | 1.5 | 19.0 |

| France | 1,112 | 0 | 29.5 | 886 | -0.7 | 30.0 |

| Germany | 759 | 2.4 | 2.2 | 1,007 | 0.7 | 19.3 |

| United Kingdom | 1,845 | 0.3 | 9.4 | 2,320 | -0.2 | 16.2 |

| India | 1,564 | 7.8 | 21.4 | 740 | 3.4 | 20.4 |

| China | 2,185 | 8.2 | 43.9 | 1,117 | 0.1 | 36.0 |

| Japan | 480 | -0.6 | 21.1 | 808 | -0.2 | 36.5 |

| South Korea | 363 | 0.6 | 35.8 | 151 | -7.9 | 38.3 |

| Rest of the world | 7,264 | 4.5 | 19.3 | 8,354 | 0.9 | 30.6 |

| Total Services Trade | 40,417 | 2.0 | 15.3 | 46,085 | 4.5 | 23.4 |

Note: "Q/Q %" is the change from the previous quarter; "YTD %" is the year-to-date (Q1 to recent quarter) cumulative change compared to the same period in the previous year.

Source: Statistics Canada, Table 12-10-0157-01. Balance of payments basis, seasonally unadjusted.

- Date modified: