Atāmitowin: Identifying and overcoming challenges facing Indigenous exporters

A joint report by the Canadian Council for Indigenous Business and Global Affairs Canada

September 2024

Table of contents

- About the title

- Acknowledgments

- Key messages

- Executive summary

- Chapter 1: Introduction

- Chapter 2: Obstacles to growth

- Chapter 3: Export activity of Indigenous SMEs–motivations and challenges

- Chapter 4: Trade supports and policies to support exporters

- Chapter 5: Case Studies in 3 First Nations communities

- Chapter 6: Conclusion

- Bibliography

- Appendix: Econometric analysis

About the title

Our second report title celebrates the significance of Cree languages—the most widely spoken Indigenous languages in Canada, with over 86,000 speakers in 2021. These languages thrive among First Nations people in the Prairies (Manitoba, Saskatchewan, and Alberta). Cree connects these communities and has facilitated trade and commerce for generations, including trade connections during and after the first contact. Our team explored various English words and phrases—including “relationships,” “reciprocity,” “expansion,” “growth,” and “exchange (over great distances)”—but ultimately, we settled on “trade.” The Cree translation, “Atāmitowin,” captures the essence of this report series, emphasizing the crucial role of language and cultural preservation in economic rejuvenation.

About the cover

The cover design is by Angie Saltman, an Red River Métis artist, who aimed to capture the essence of the Indigenous trade on Turtle Island.

The foundation of the design is a Loon—one of the original clans in Anishinaabe governance.

The Loon represents the diplomat who travels to build working relationships. Similarly, modern entrepreneurs often travel when exporting their goods and services.

Turtle Island includes Canada, the US, and Mexico. It sits at the centre of the design, ready to go in any of the four directions, because they are all a part of the Indigenous economy.

The Killer Whale (Orca) symbolizes family, community, protection, and power and is often used to represent the Pacific Northwest. It is a reminder of the importance of kinship and the history of Indigenous people, even as they move across the land and seas.

On the right of the design, the Caribou represents the Eastern areas of Turtle Island. Caribou travel large distances while remaining together as a group for community, safety, and raising their young. This community reflects the importance of people-to-people connections in Indigenous trade.

The Medicine Wheel central to the design shows the interconnectedness of all our relations. It emphasizes balance, harmony, and respecting all living things while understanding our place in the universe. In this design, black represents water, red is for the land, yellow is for fire, and white (pointing North) is for air.

There’s an Anishinaabe saying that when all nations of the world drum together, we’ll connect as one race and find peace. The artist believes that as Indigenous economies expand through trade and growth, we’ll shift business philosophies globally to the sustainability first mindset and realize we must live in reciprocity with mother earth to sustain a safe place for our children and future generations to enjoy.

Acknowledgments

This study was co-authored by the Canadian Council for Indigenous Business (CCIB) and the Office of the Chief Economist of Global Affairs Canada (GAC). It was also funded by Global Affairs Canada.

The authors are indebted to all the Indigenous entrepreneurs, communities, and councils who have invested valuable time in sharing their experiences with us. We hope the products of our collaborative work will allow them to view these investments as beneficial to Indigenous economies.

The authors thank the project’s Indigenous advisory committee, comprised of First Nations, Métis, and Inuit leaders who provided guidance, advice, and feedback at every stage of the project.

This report was authored by Lucas Alexiou, Cody Lewis, and Andy Avgerinos from CCIB and Jacqueline Palladini and Michelle Zilbergerts from Global Affairs Canada. The authors would like to thank those who reviewed the report, including officials from Crown-Indigenous Relations and Northern Affairs Canada, Indigenous Services Canada, and Global Affairs Canada. Any errors or omissions are those of the authors.

We are thankful for contributions from Big River Analytics and their expertise in weighting the national survey data and their feedback on the survey design, Environics Research Group, who administered the national survey, and the Bank of Canada for their contributions to the survey questionnaire and project funding.

Graphic design and layout were developed by Saltmedia, and copy editing was completed by Kaitlin Littlechild.

As nationwide organizations, both Global Affairs Canada and the CCIB acknowledge that our project was undertaken on many Indigenous lands. We hope to honour this through our work to support the Indigenous Peoples who live, work, and do business on this land.

This work is published under the joint responsibility of Global Affairs Canada and the CCIB. The opinions and arguments expressed do not necessarily reflect the official views of the Government of Canada.

Canadian Council for Indigenous Business

Canadian Council for Indigenous Business (CCIB) is committed to the full participation of Indigenous Peoples in Canada’s economy. As a national, non-partisan association, CCIB has a mission to promote, strengthen, and enhance a prosperous Indigenous economy through the fostering of business relationships, opportunities, and awareness. CCIB offers knowledge, resources, and programs to its members to foster economic opportunities for Indigenous Peoples and businesses across Canada.

CCIB’s work is dedicated to supporting Indigenous economies across Canada and bolstering meaningful and mutually beneficial relationships between Indigenous and non-Indigenous peoples, businesses, and communities. CCIB does this through diverse programming, providing tools, training, network building, major business awards, and national events.

CCIB’s research shows that Indigenous entrepreneurs are motivated by a desire to innovate, expand, and profit from their businesses, with many giving back to their communities. However, they also face unique challenges to their growth and development. A better understanding of these realities by businesses and governments, combined with the skills of Indigenous business owners, creates opportunities for everyone.

For more information, visit www.CCIB.com

Office of the Chief Economist, Global Affairs Canada

The Office of the Chief Economist at Global Affairs Canada (GAC) consists of a team of economists who research and advise on international commerce topics for the benefit of Canadians.

The team provides advice to policymakers and research on current issues, including:

- supply chains

- inclusive trade

- impacts of trade agreements

- foreign direct investment

- performance of Canadian exporting firms

The Office of the Chief Economist supports Global Affairs Canada’s inclusive trade mandate to ensure that the benefits of trade flow to all segments of society. Our inclusive trade research evaluates the impacts of trade on traditionally underrepresented groups such as women, Indigenous Peoples, and racialized people. This includes understanding the export activities of Indigenous entrepreneurs and the challenges they face.

Our work informs Global Affairs Canada trade policies, including the negotiations of free trade agreements and our Trade Commissioner Service programs, which help Canadian businesses succeed in international markets.

Key messages

- The Canadian Council for Indigenous Business (CCIB) and Global Affairs Canada (GAC) partnered to better understand the experiences of Indigenous exporters and the challenges they face using a novel national survey of 2,603 Indigenous businesses, case studies in 3 First Nations communities, and discussions with community economic development officers. The survey and interviews focused on business activity in 2020.

- We co-published a report in September 2023, Adàwe: Export Experiences of Indigenous Entrepreneurs, which found a sizable gap in export propensity in 2020 between Indigenous small and medium-sized enterprises (SMEs) (7.2%) and the average Canadian SME (12.1%).

- Recognizing the benefits of trade, this report investigates the barriers to firm growth and exporting while exploring the supports and policies reported by Indigenous SMEs as being helpful.

- We find that Indigenous SMEs are more likely to report several obstacles to firm growth compared to the average Canadian SME, including labour attraction, regulation, and access to financing.

- Economic conditions were a leading hurdle to firm growth, reported by nearly 2 out of 3 Indigenous SMEs in 2020. More than two-thirds of Indigenous SMEs who reported that they stopped exporting cited the pandemic as their main reason for doing so.

- Geographic factors played a role in determining or exacerbating the most pertinent obstacles to firm growth. Physical and digital infrastructure, access to business advisory, and financing were more prominently reported as obstacles by Indigenous SMEs located in remote regions and those located within Indigenous communities.Footnote 1

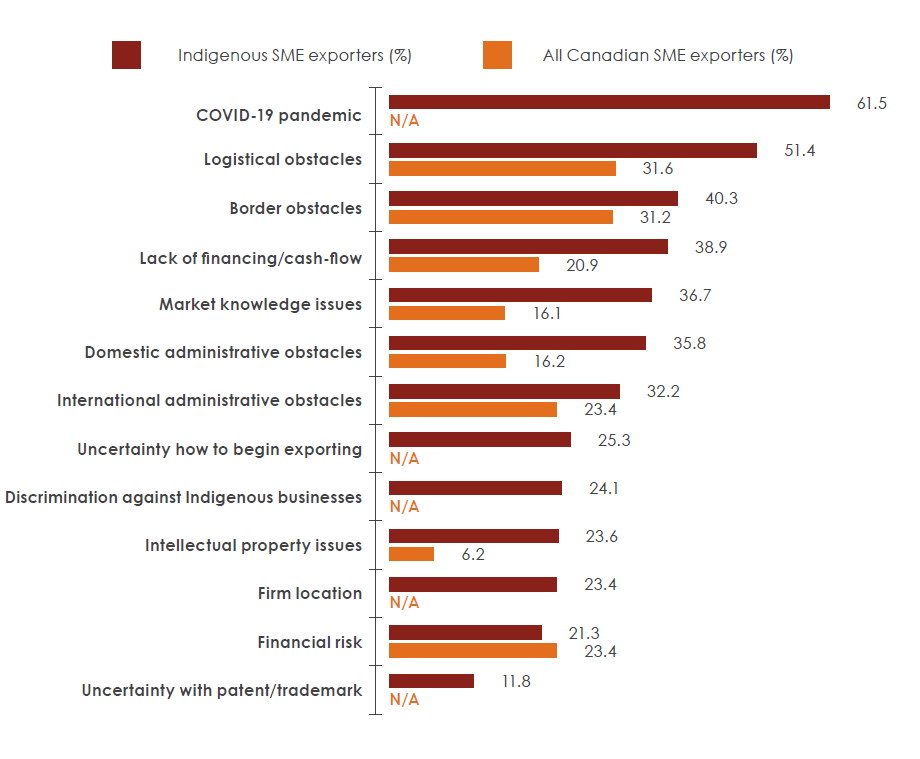

- Regarding export obstacles, intellectual property protections, market knowledge, administrative barriers in Canada, financing, and logistics were more pronounced for Indigenous SME exporters than the national average. Border obstacles were also more pronounced challenges for Indigenous SME exporters (40.3%) compared to the national average (31.2%).

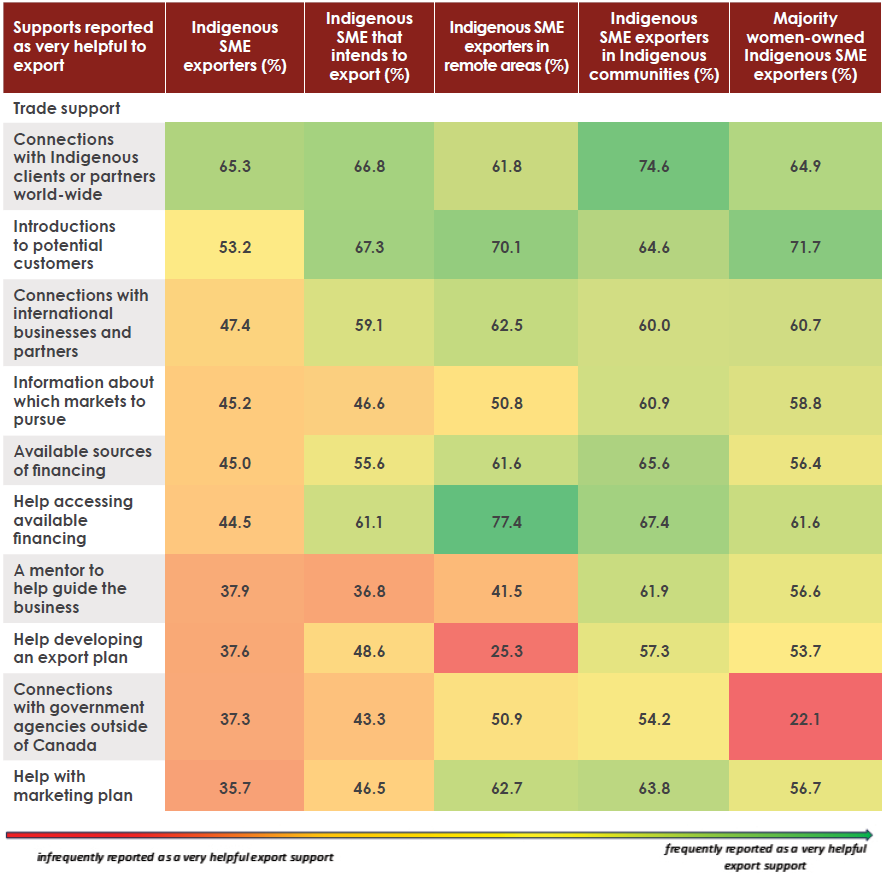

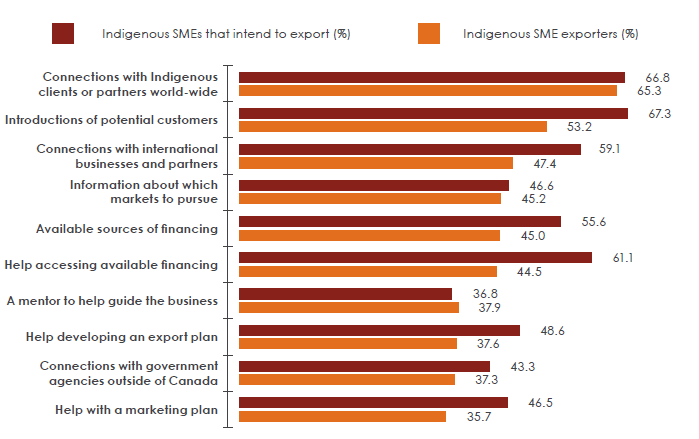

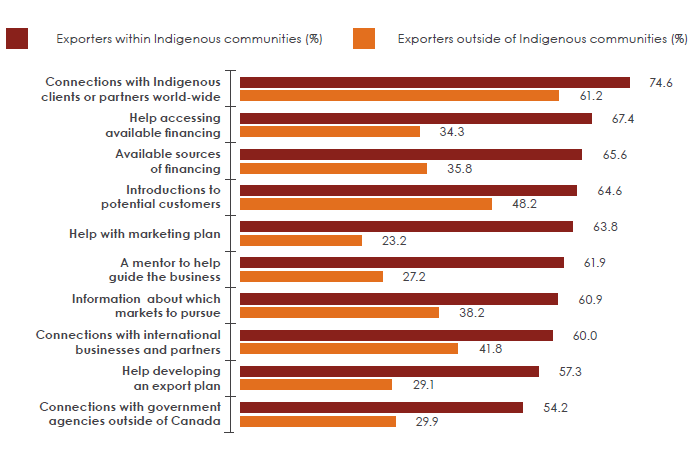

- When asked which program supports would be most helpful for exporting, Indigenous SMEs put people-to-people connections—particularly Indigenous-to-Indigenous connections—at the top of the list.

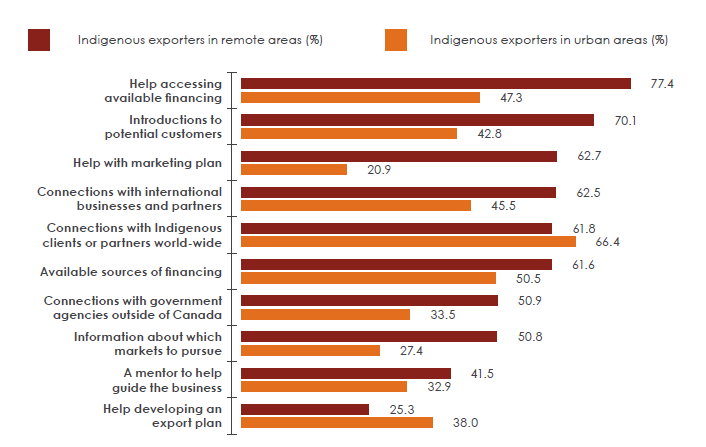

- Indigenous exporters in remote areas and those within Indigenous communities identify help accessing financing as an important tool to support exporting, with 77.4% and 67.4% of Indigenous SME exporters, respectively, identifying financing as very helpful.

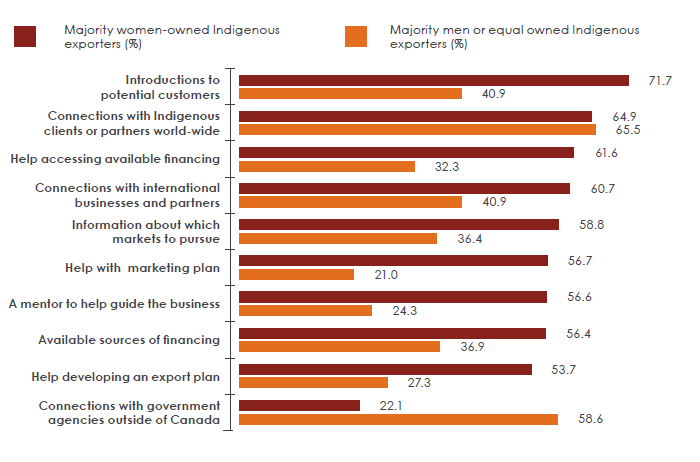

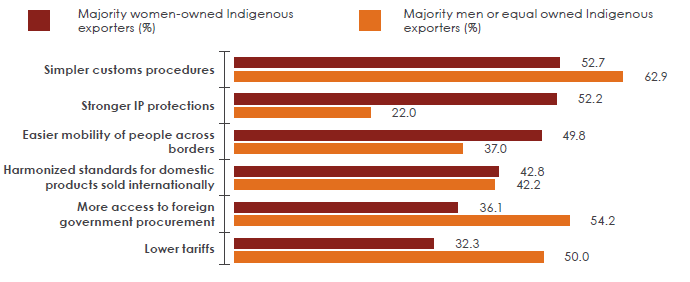

- Policies specifically related to bolstering intellectual property protections for businesses incorporating Indigenous Traditional Knowledge into their products or services were among the most significant policy supports cited, particularly among exporters in remote locations, within Indigenous communities, and those that are majority women-owned.

Executive summary

Atāmitowin aims to enhance our understanding of the obstacles facing Indigenous entrepreneurs and exporters. This is the second and final report resulting from a recent partnership between the Canadian Council for Indigenous Business (CCIB) and Global Affairs Canada (GAC).

Our previous report, Adàwe, sought to illuminate the exporting and business activities of Indigenous-owned small and medium-sized enterprises (SMEs). Using a novel national survey of 2,603 Indigenous-owned businesses, Adàwe uncovered an export gap: 7.2% of Indigenous SMEs export compared to the Canadian SME average of 12.1%.Footnote 2

Atāmitowin builds on this work by examining the growth and exporting obstacles that might explain this gap and explores what we heard from Indigenous entrepreneurs themselves about possible supports. A better understanding of obstacles and supports can inform governments and communities serving these businesses, ultimately helping them find international success that benefits Indigenous and non-Indigenous communities at home.

Recognizing the unique business operating environments and challenges that come with locations in remote regions or within Indigenous communities, we enrich our national survey analysis with case studies from 3 First Nations communities, including extensive interviews with businesses and economic development officers (EDOs). Acknowledging that these voices are not always well captured in traditional surveys, special attention is paid to these businesses.

Growth and exporting obstacles

Our national survey and case studies on First Nations reserves investigate challenges and obstacles to business growth for exporters and non-exporters alike, using 2020 as the reference year. Overall, the top 3 obstacles were economic conditions, attracting employees with the right skills or qualifications, and the costs of doing business.

While these 3 obstacles were also reported by Indigenous SMEs located in remote or Indigenous communities, those businesses were relatively more likely to report physical and digital infrastructure gaps, with 30 to 50% of these businesses naming these obstacles, respectively. Furthermore, we found that even when the effects of remoteness are controlled for in the econometric analysis, firms located within Indigenous communities are associated with higher odds of reporting physical and digital infrastructure barriers to growth.

An analysis of export obstacles emphasized the severe impacts of the COVID-19 pandemic on export activity, with 61.5% of Indigenous SME exporters reporting it as a moderate or major obstacle to exporting. Logistical and border obstacles rounded out the top three. While COVID-19 exacerbated these obstacles, logistics and border challenges were also highly reported as export obstacles by Indigenous exporters before the pandemic.

A lack of financing or cash flow was the fourth most reported export obstacle (38.9% of Indigenous SME exporters). It was very highly reported by Indigenous SMEs located in Indigenous communities (59.5%) and by those in remote regions (56.3%). The econometric analysis finds that this challenge is especially pertinent for SMEs in Indigenous communities, which are associated with 1.9 times higher odds of reporting the difficulty as a barrier to export.

Trade programs and policy supports

Our survey and interviews heard from Indigenous entrepreneurs about what trade program and policy supports they would find most beneficial. Businesses overwhelmingly reported people-to-people connections as the leading trade program support. Connections with Indigenous clients and partners topped the list, with around two-thirds of Indigenous SMEs who export or plan to start exporting reporting them as being “very helpful.”

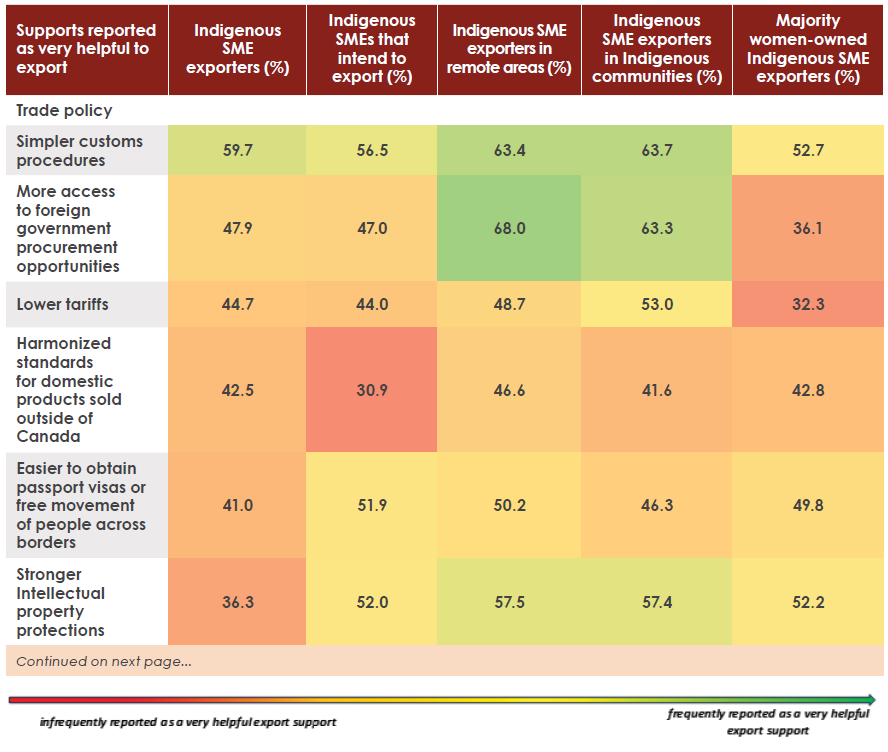

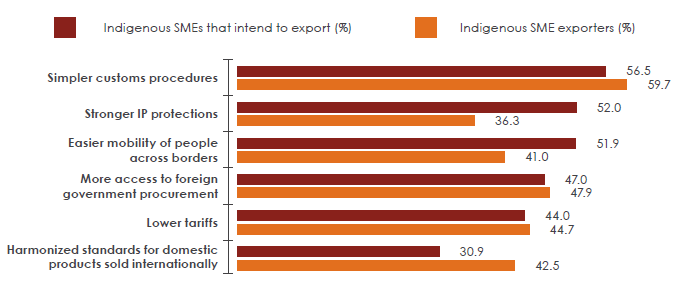

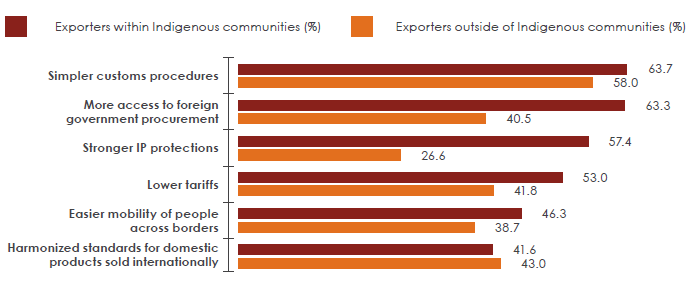

Regarding trade policy, simpler customs procedures topped the list of most helpful supports for current exporters (59.7%) and SMEs that intend to export (56.5%).

Indigenous SMEs in remote regions, Indigenous communities, or those majority-owned by women prioritized supports differently. In general, these businesses put relatively more emphasis on intellectual property protections, help accessing sources of financing, mentorship, and help with marketing plans, among others.

While acknowledging the diversity of experiences among Indigenous-owned SMEs, Atāmitowin proposes 5 general priority areas in supporting Indigenous SMEs on their export journeys:

- Building a skilled workforce:8% of Indigenous SMEs face substantial challenges in finding employees with the right skills and qualifications, and they report this as a challenge at a much higher rate than the average Canadian SME (50.3%).

- Financing and capital: Indigenous SMEs experienced obstacles to accessing financing when growing a business or exporting, and this was particularly pronounced for Indigenous businesses operating within Indigenous communities.

- Physical and digital infrastructure: These obstacles were more pronounced for Indigenous SMEs operating from remote areas or those in Indigenous communities. From road access to reliable internet, many businesses in the First Nations case studies also emphasized the criticality of these needs.

- Intellectual property (IP) protections: Indigenous SME exporters are almost 4 times more likely to report IP protections as a barrier to exporting than the Canadian average. These barriers were reported more prevalently by Indigenous businesses in remote areas, in Indigenous communities, or owned by women.

- People-to-people connections: Indigenous SMEs strongly value supports that help them connect with partners, clients, and customers. Organizations offering supports to exporters should take note of the recommendation for Indigenous-to-Indigenous connections and the importance placed on them.

The research and findings in both Adàwe and Atāmitowin establish an understanding of Indigenous export activity, identify and quantify challenges, and explore important business and policy supports. This work, completed by Global Affairs Canada and CCIB, aims to support Indigenous Peoples’ leadership in growing the Indigenous economy and contributing more broadly to the Canadian economy.

Chapter 1: Introduction

Global Affairs Canada (GAC) and the Canadian Council for Indigenous Business’s (CCIB) Adàwe report highlighted the remarkable achievements of Indigenous SME exporters.

Indigenous SMEs operate across diverse industries, with their products and services reaching markets worldwide, including the United States, the United Kingdom, Australia, and many others. Adàwe also highlighted the role of Indigenous women in narrowing gender gaps within exporting, with Indigenous SME exporters being nearly twice as likely to be majority women-owned compared to the national average.Footnote 3

Despite these achievements, Indigenous businesses continue to face barriers hindering their full potential for export expansion. Adàwe estimated that 7.2% of Indigenous SMEs currently export, which is significantly lower than the national average of 12.1%. This disparity is even more pronounced for firms situated in remote areas or within Indigenous communities.Footnote 4 This gap underscores the need to identify and address the challenges faced by Indigenous SMEs in fully participating in and reaping the benefits of trade.

In this report, we deepen our understanding of the obstacles experienced by Indigenous businesses and the supports they deem important. Building on the findings in Adàwe, we pay special attention to obstacles reported by firms located in remote regions or within Indigenous communities.

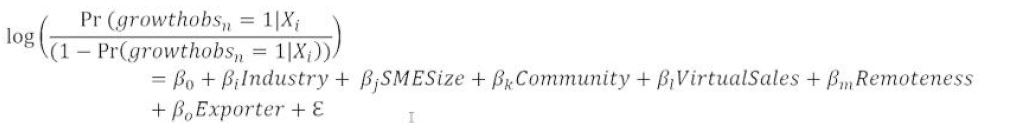

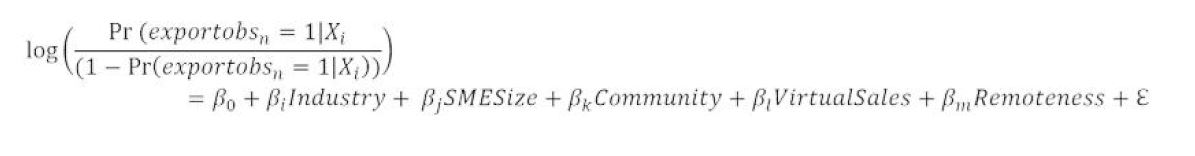

This report focuses on several distinct areas of study. Following this introduction, Chapter 2 assesses barriers to business growth for Indigenous exporters and non-exporters alike. In Chapter 3, we explore the barriers Indigenous exporters face in international expansion and what drives firms to begin or stop exporting. Throughout this analysis, we employ both descriptive analyses using survey data as well as econometric analysis to quantify which firm characteristics are statistically associated with obstacles to growth and export. In Chapter 4, we shift our focus from obstacles to supports as we draw on insights from Indigenous firms about which supports they report as useful for exporting.

Recognizing the unique conditions affecting First Nations businesses located on reserve, Chapter 5 features case studies in 3 First Nations communities. This inclusion aims to amplify voices that typical national surveys may not fully capture. Drawing upon insights from interviews, we explore the business environment and challenges facing these firms. We conclude by summarizing the main findings in Chapter 6.

As Indigenous firms contribute to job creation, economic diversification, community development, and the strength of the Canadian economy, our findings carry implications for broader societal well-being. We hope this report offers meaningful insights that can guide the formulation of policies and initiatives aimed at cultivating a more inclusive and equitable economic landscape in Canada, particularly through economic reconciliation.

1.1 Project approach

Our inaugural 2019 co-published report, Indigenous-Owned Exporting Small and Medium Enterprises in Canada, investigated the export experiences of Indigenous SMEs.Footnote 5 This report provided an initial glimpse into the characteristics and challenges faced by Indigenous exporters. However, the constraints of a small sample size limited the depth of the findings, and the inherent diversity within Indigenous enterprises underscored the need for ongoing and more comprehensive studies.Footnote 6

Following this first report, CCIB and Global Affairs Canada partnered again to build on earlier work with 2 additional studies—Adàwe (2023) and Atāmitowin (2024).Footnote 7Footnote 8 Each iterative report builds on previous findings to strengthen the understanding of the complex conditions and experiences of Indigenous SMEs.

The survey methodology has been significantly enhanced in the current CCIB-GAC partnership. In 2021, the CCIB and Global Affairs Canada’s survey captured 2,603 Indigenous firms in Canada. This marks a notable increase in sample size, more than double the number of respondents compared to the 2019 study.Footnote 9 Furthermore, this latest partnership includes in-depth interviews and case studies of 3 First Nations communities and interviews with several economic development officers (EDO) to ensure that these unique challenges are captured. These special qualitative and quantitative data sets form the basis for our present report and its precursor, Adàwe.

As we investigate the business obstacles and supports for Indigenous SMEs in this report, special attention is paid to the factors Adàwe found to be significant in exporting. Notably, Adàwe found that firms in remote areas or within Indigenous communities were associated with lower odds of exporting. In comparison, certain industries and e-commerce were factors that were associated with higher odds of exporting. Some factors didn’t have statistically significant effects, such as the owner’s gender or firm size.

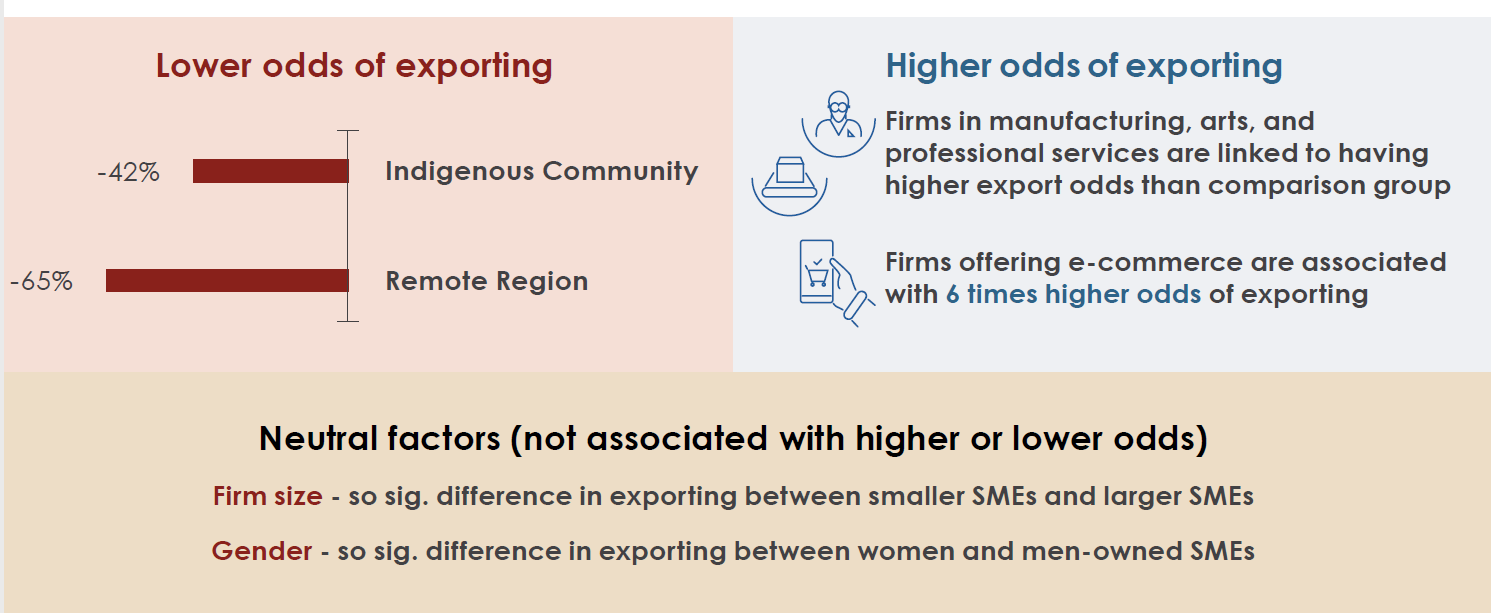

Figure 1: Key findings of econometric analysis from Adàwe report

Text version - Figure 1

| Lower odds of exporting | Higher odds of exporting | Neutral factors (not associated with higher or lower odds) |

|---|---|---|

| Location within Indigenous community (-42%) | Firms in manufacturing, arts, and professional services are linked to having higher export odds than comparison group | Firm size — no significant difference in exporting between smaller SMEs and larger SMEs |

| Remote region (-65%) | Firms offering e-commerce are associated with 6 times higher odds of exporting | Gender — no significant difference in exporting between women and men-owned SMEs |

Source: Canadian Council for Indigenous Business & Global Affairs Canada (2023), adapted from regression results

Note: Statistical significance levels: Indigenous community (5% level), remote region (1% level), virtual sales (0.1% level)

In this report, we build on these findings to understand what mechanisms underpin the relationship between exporting and Indigenous firm characteristics. Namely, we employ comparative analysis to understand how barriers to growth and supports differ among firms based on geographic characteristics of interest. Furthermore, we enrich the descriptive work with econometric analysis to further discern which factors have a statistically significant association with obstacles to firm growth and export.Footnote 10 Detailed econometric results are provided in the appendix.

1.2 About the data

This report includes several components that capture as many Indigenous business voices as possible. It consists of an in-depth national telephone survey of 2,600 Indigenous majority-owned businesses. Statistics Canada estimates that 11,900 Indigenous-owned businesses had employees in Canada in 2018. Based on this estimate, the CCIB-GAC survey heard from more than 14% of the Indigenous-owned employer business population. A large majority (91.1%) of respondents choose to participate in the interview in English, while the remaining 8.9% of respondents elected to participate in French.Footnote 11

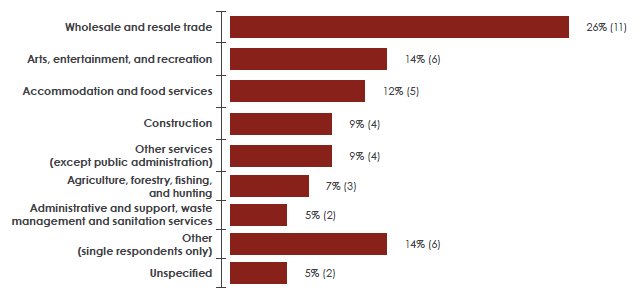

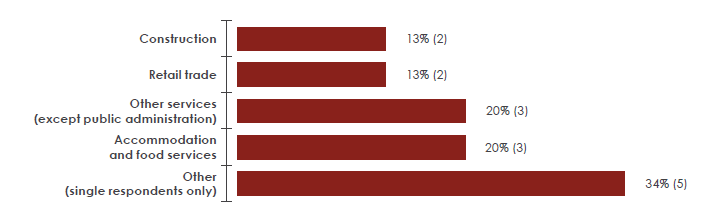

The work also included case studies in 3 First Nations communities, business surveys with 64 firms, and interviews with 3 EDOs. Interviews were conducted in the participants' official language of choice.

This report and the Adàwe report use a novel national data set that asked majority Indigenous-owned firms about their business experiences in 2020. The questionnaire and timeframe were designed to allow for comparison with national averages using Statistics Canada’s Survey of Financing and Growth of Small and Medium Enterprises (SFGSME).

To more accurately represent the true Indigenous business population, Big River Analytics weighted the national survey data. Weighted results are presented throughout this report, unless otherwise specified.

For further details about the data set, weighting method, and research ethics employed in this work, please see Adàwe.Footnote 12

Definitions

Indigenous SMEs: Firms that are self-identified Indigenous majority-owned (i.e., 51% or higher ownership) and have 1–499 employees. There were 1,537 Indigenous SMEs included in the national survey.

Exporters: Indigenous SMEs that exported in 2020. In the national survey, we spoke with 111 Indigenous SME exporters.

Previous exporters: Indigenous SMEs that did not export in 2020 but did export in a previous year. The national survey included 92 previous exporters.

SMEs with export experience: Indigenous SMEs that exported at any time, whether past or present. The number of experienced exporters is equivalent to the sum of exporters and previous exporters, totalling 203 Indigenous SMEs in our national survey.

SMEs that intend to export: Indigenous SMEs that were not exporting in 2020 but indicated plans to expand internationally. Our national survey captured 214 Indigenous SMEs in this definition.

Chapter 2: Obstacles to growth

Key messages

- Compared to the national average, Indigenous SMEs were significantly more likely to report several obstacles to growth. They were 1.9 times as likely to report that access to financing is a barrier to growth and 1.2 times as likely to report barriers with labour attraction. Government regulation was also more pronounced for Indigenous SMEs than the national average.

- Skilled labour attraction and economic conditions were the top obstacles for Indigenous SMEs, affecting over 60% of firms.

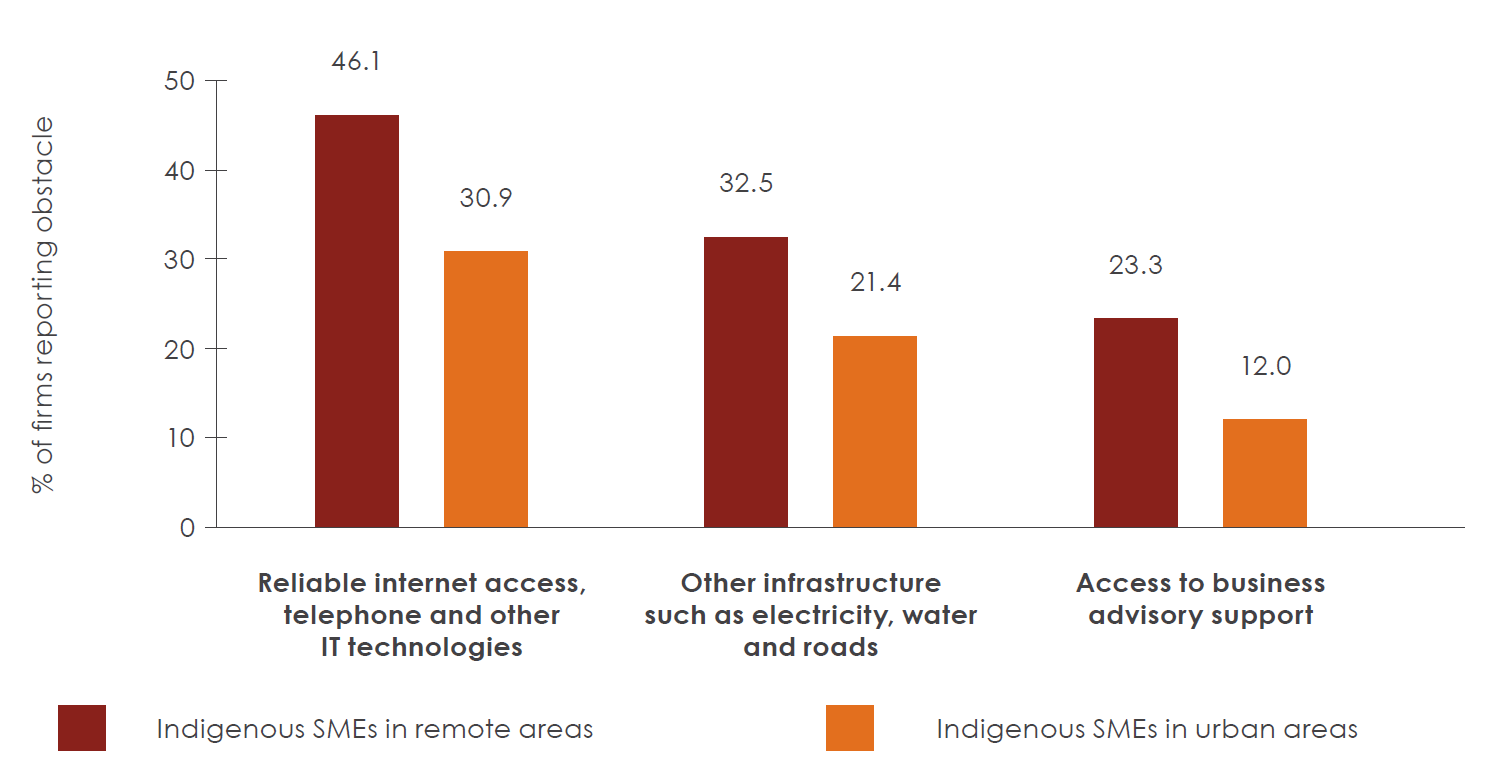

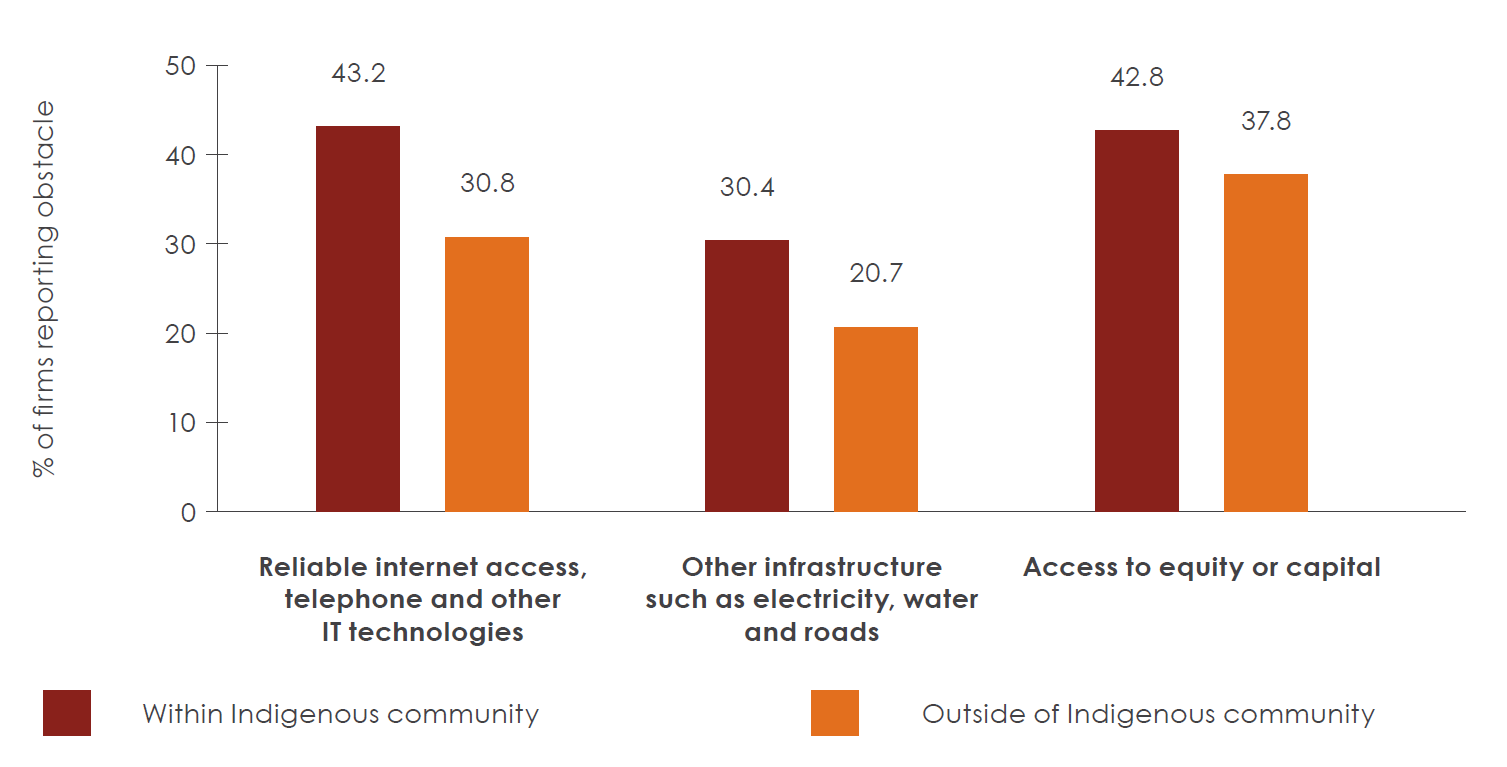

- Firms in Indigenous communities report physical and digital infrastructure barriers to growth at higher rates than Indigenous firms outside of Indigenous communities (9.6 and 12.3 percentage points higher, respectively).

- Indigenous SMEs in remote areas also report physical and digital infrastructure barriers at higher rates than those in urban areas (11.1 and 15.1 percentage points higher, respectively).

- More than 2 out of 5 Indigenous SMEs in Indigenous communities report that finance or access to equity or capital are significant hindrances to growth.

- In general, Indigenous exporting firms faced similar challenges to business growth as non-exporters, with some exceptions: notably, they experienced a higher incidence of challenges in accessing equity and capital, reliable internet, and higher business costs.

2.1 Obstacles to firm growth

Indigenous businesses across Canada are diverse, and unique cultural, historical, and geographic contexts shape their experiences. In Adàwe, we explored some of these distinctions, such as variations in industry, ownership, and targeted markets. Building upon this foundation, this report focuses on how these differences can exacerbate barriers within the business landscape, specifically regarding firm growth obstacles.

The connection between exporting and firm growth has been well-established in the literature. Numerous studies find a positive correlation between exporting activities, productivity improvements, and overall firm growth.Footnote 13Footnote 14 Firm size, in particular, been positively related to export propensity in the literature.Footnote 15 Considering this relationship, identifying barriers to growth is a natural starting point for empowering the success of Indigenous firms as they venture into international markets.

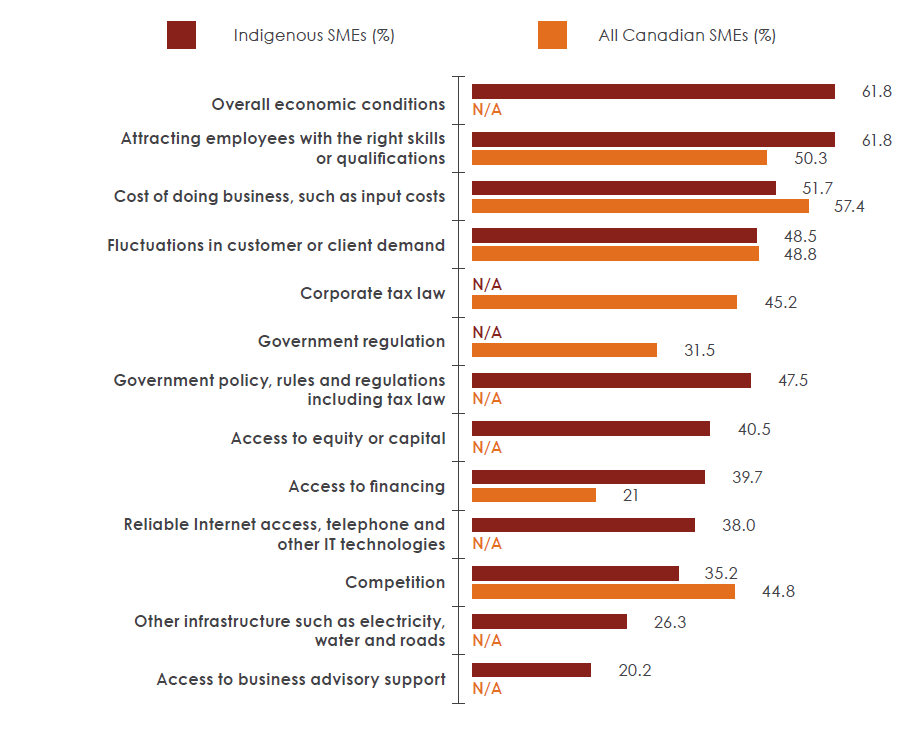

Figure 2: Comparison of obstacles to business growth between Indigenous and all Canadian SMEs

Text version - Figure 2

| Significant challenge to business growth | Indigenous SMEs (%) | All Canadian SMEs (%) |

|---|---|---|

| Overall economic conditions | 61.8 | - |

| Attracting employees with the right skills or qualifications | 61.8 | 50.3 |

| Cost of doing business, such as input costs | 51.7 | 57.4 |

| Fluctuations in customer or client demand | 48.5 | 48.8 |

| Corporate tax law | - | 45.2 |

| Government regulation | - | 31.5 |

| Government policy, rules and regulations including tax law | 47.5 | - |

| Access to equity or capital | 40.5 | - |

| Access to financing | 39.7 | 21.0 |

| Reliable Internet access, telephone, and other IT technologies | 38.0 | - |

| Competition | 35.2 | 44.8 |

| Other infrastructure such as electricity, water, and roads | 26.3 | - |

| Access to business advisory support | 20.2 | - |

Source: Canadian Council for Indigenous Business & Global Affairs Canada’s Survey of Indigenous Firms, 2021; Statistics Canada. Table 33-10-0447-01 Obstacles to business growth for small and medium-sized enterprises.

Notes: There are variances in obstacle descriptions between the SFGSMEs and the CCIB-GAC survey. Notable examples include: 1) the SFGSME identifies “recruiting and retaining skilled employees," while the CCIB-GAC survey identifies “attracting employees with the right skills or qualifications regulations”; 2) the SFGSME identifies “rising input costs,” while the CCIB-GAC survey identifies “cost of doing business such as input costs”; 3) the SFGSME identifies “government regulations,” while the CCIB-GAC survey identifies “government policy, rules, and regulations such as tax law”; and 4) the SFGSME identifies “obtaining financing,” while the CCIB-GAC survey identifies “access to financing.” For instance, where data is not comparable, “N/A” is indicated on the graph.

Economic conditions

Indigenous SMEs report a myriad of obstacles to growth, but overall economic conditions were reported as one of the most pressing. This finding is unsurprising, considering that the survey asked respondents about their experiences in 2020.

The COVID-19 pandemic resulted in exceptional disruptions to the Canadian and world economy. Businesses faced many challenges, from supply chain interruptions to enforced closures and remote work mandates. Many firms encountered financial strains due to fluctuating markets, regulatory barriers, cash flow constraints, and uncertain economic conditions.Footnote 16

Moreover, travel restrictions and social-distancing measures hampered traditional networking and business development avenues, impacting firms’ ability to engage with clients, partners, and markets.Footnote 17 At the same time, the shift to remote work necessitated rapid adaptations in operational models, technological investments, and new cybersecurity measures.

While the pandemic impacted firms of all sizes, there is evidence that smaller firms in Canada and the world were more likely to cease operations and experience more significant reductions in sales than larger firms.Footnote 18Footnote 19 Thus, the high rate of Indigenous SMEs that reported that economic barriers restricted growth generally mirrors the experiences of SMEs domestically and in other economies.

Even though pandemic-related challenges were not exclusive to Indigenous firms, evidence suggests that Indigenous firms may have been disproportionately affected by negative economic expectations during the pandemic. A 2024 study by the Bank of Canada that used the CCIB-GAC survey data set revealed that Indigenous firms exhibited stronger inflation expectations and weaker wage growth forecasts in 2021 than the average private sector firm in Canada.Footnote 20

While it is crucial to consider the pandemic when interpreting the survey results, it is equally important to recognize the extensive body of literature that highlights pre-existing obstacles for Indigenous businesses.Footnote 21Footnote 22 Consequently, one difficulty in this analysis is disentangling barriers that emerged due to the pandemic from those that already existed within Indigenous communities (and were potentially exacerbated by the ongoing crisis). For example, during the COVID-19 pandemic, various Indigenous communities implemented shutdown measures to safeguard the health of their members.Footnote 23 While these actions were taken to ensure community well-being, they also restricted access to external visitors and services, which had ramifications on commerce. Thus, when interpreting the survey results, it is essential to consider the interplay between documented challenges within Indigenous communities, such as infrastructure and socioeconomic barriers, and pandemic-related factors.

Labour needs

Labour attraction was reported to be just as significant as barriers stemming from economic conditions. More than 3 out of 5 Indigenous SMEs indicated that attracting employees with the necessary skills or qualifications is a barrier to growing their business—a figure that is above the national average of 50.3%.

Indigenous SMEs that report labour as an obstacle to growth are more likely to be in the services industries. More than 70% of Indigenous SMEs in each of the following industries reported that labour attraction poses a significant obstacle to growth:

- transportation and warehousing

- arts, entertainment, and recreation

- health care

- accommodation and food service

Once again, the context of the pandemic is front of mind when thinking about the high proportion of firms in the service industries that report labour as a growth barrier. Notably, social-distancing measures and lockdown restrictions during the COVID-19 pandemic impacted high-contact service industries severely.Footnote 24

While firms’ expectations about labour availability appear to be improving according to the 2024 first quarter results of Statistic’s Canada Canadian Survey on Business Conditions, some challenges persist, especially among select industries. Notably, entrepreneurs in accommodation and food services, construction and healthcare expected labour challenges into 2024.Footnote 25

Skills growth, training, and funding opportunities are critical for Indigenous Peoples to advance their careers, improve Indigenous labour-market and entrepreneurship results, and further economic reconciliation in Canada, as detailed in research by the CCIB.Footnote 26 Thus, increased access to education and other capacity-building resources are critical avenues to consider when working towards a truly inclusive economy, especially one that enables opportunities for growth and success for marginalized groups.

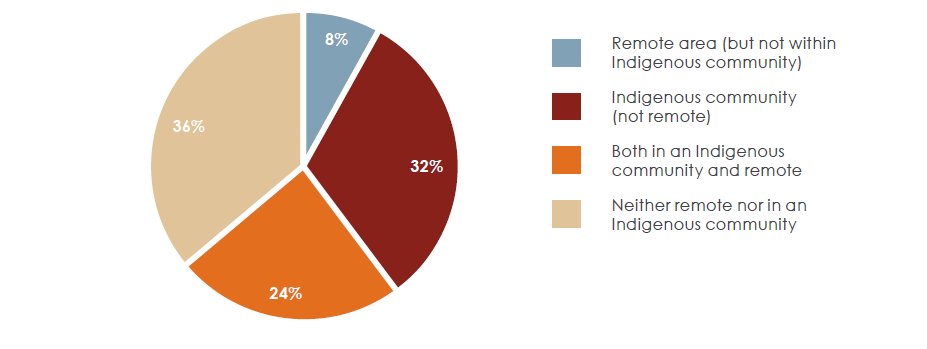

Geographic characteristics can constrain recruitment for Indigenous SMEs. We use Statistics Canada’s Index of Remoteness and postal code information to classify firms as either urban (for example, Toronto, Vancouver, Edmonton, Winnipeg), semi-connected (for example, Belleville, Thunder Bay, Whitehorse, Nanaimo) or remote (for example, Igloolik, Yellowknife, Iqaluit, Arctic Bay). For a full explanation of the remoteness indicator, please see Adàwe. Using our definitions, 32% of all Indigenous SMEs in our survey are in remote areas, 57% of all Indigenous SMEs are located within Indigenous communities, and 24% of all Indigenous SMEs are in both remote areas and Indigenous communities.Footnote 27

Figure 3: Firm location of Indigenous SMEs

Text version - Figure 3

| Firm location of Indigenous SMEs | % of Indigenous SMEs |

|---|---|

| Neither remote nor in an Indigenous community | 36 |

| Both in an Indigenous community and remote | 24 |

| Remote area (but not within Indigenous community) | 8 |

| Indigenous community (not remote) | 32 |

Source: Canadian Council for Indigenous Business & Global Affairs Canada’s Survey of Indigenous Firms, 2021; Statistics Canada’s Index of Remoteness

Firms that operate outside of urban areas can be exposed to unique challenges. Notably, lower population densities, vast distances, and limited transit infrastructure can restrict access to sizable labour pools.Footnote 28

One First Nations business owner who participated in our case studies highlighted the difficulty in attracting labour due to the community’s considerable distance from urban centres, stating:

“A major hurdle is attracting employees. My community is uniquely challenged by geography, being two hours away from the nearest major city center and lacking accommodations for employees and their families.”

- Firm owner from First Nations Community #2

Many labour-related barriers also stem from inadequate infrastructure. Another case study interview participant remarked:

“There is a lack of accommodations [housing] to draw in and keep talent. It’s difficult for single applicants and the applicants who have families.”

- First Nations business owner in Community #2

Labour challenges can also stem from a lack of qualified workforce to draw from, particularly for businesses that want to hire Indigenous workers. When asked what would help international expansion efforts, one Indigenous firm owner noted they “have the cash flow to hire someone, but it is very difficult for a small business to find qualified people, especially wanting to hire an Indigenous person.”

Another firm owner remarked that they wish to have guidance on “where to find staff,” specifically “Métis/Indigenous employees,” while another noted that they are looking for “Indigenous technical employees.”

Government regulation

Nearly half (47.5%) of Indigenous SMEs cite government policy, rules, and regulations (including tax law) as significant barriers to growth. The SFGSME covering the national average posed a slightly different question, making comparisons difficult as it separates rules and regulations from taxes and finds that 31.5% of all Canadian SMEs cited the former as an obstacle, while 45.2% cited corporate tax rates. Thus, it is unclear whether government regulation is identified as a more important barrier to growth by Indigenous SMEs and if this finding relates to legislation specific to Indigenous Peoples, such as the Indian Act.

Business financing

The most pronounced barrier for Indigenous SMEs compared to the national average is access to finance. Some 39.7% of Indigenous SMEs indicated that access to financing is a barrier to firm growth compared to only 21.0% of all Canadian SMEs. Indigenous SMEs have lower rates of credit use: in 2020, only 10.9% of Indigenous SMEs indicated that private lending sources, such as bank loans, are the main sources of financing for their business.Footnote 29 In contrast, 34.6% of all Canadian SMEs used credit from financial institutions to start their business.Footnote 30

Several factors complicate access to finance for Indigenous businesses. A study by the Bank of Canada finds that a sizeable percentage of First Nations communities are far from financial institutions. The research found that the median travel distance between a band office and a financial institution branch is 24 kilometres.Footnote 31 Thus, for the 45.7% of SMEs in our study that are both First Nations-owned and located within Indigenous communities, large distances to banking institutions may be one of the factors at play when it comes to challenges with accessing financing.Footnote 32

Furthermore, the Indian Act could limit credit opportunities for firms within First Nations reserves. Restrictions to property rights under the Indian Act, such as the inability to use reserve land as collateral, may limit access to low-cost, secured loans.Footnote 33 As a result, First Nations-owned firms located on reserves may face larger hurdles in securing financing from banking institutions. Adàwe explores the impacts of the Indian Act on company financing in greater detail. Namely, our econometric analysis finds that Indigenous SMEs in Indigenous communities are associated with 1.3 times higher odds of reporting financing as a significant barrier to growth, when compared to their counterparts.Footnote 34

Furthermore, the experience of a First Nations business owner offers a firsthand perspective into the challenges businesses on reserves face when seeking equity. They remarked the following:

“As an Indigenous person, it is a fact that I do not have equity; I cannot use my home as equity on reserve lands, so there is a huge lack of equity. How are you supposed to get equity?”

- First Nations business owner in Community #1

Other studies have highlighted sentiments of mistrust and alienation from mainstream banking institutions that Indigenous Peoples have experienced.Footnote 35 Thus, accessibility barriers to finance may also stem from the discomfort of interacting with banking institutions, in addition to geographical distances, limitations stemming from the Indian Act, and collateral requirements.

There is an Indigenous business financing ecosystem in Canada. It is made up of government institutions such as Export Development Canada and Business Development Bank of Canada, as well as Indigenous and non-Indigenous financial institutions. The National Aboriginal Capital Corporations Association, for example, is a network of over 50 Indigenous financial institutions. They have provided over $3 billion in loans to businesses owned by First Nations, Métis and Inuit people, with the goal of supporting Indigenous economic growth.Footnote 36

Digital and physical infrastructure

From reliable internet access to water and roads, many Indigenous SMEs report digital (38.0%) and physical (26.3%) infrastructure as obstacles to growth. Given the importance of e-commerce, with Adàwe finding that e-commerce was associated with 6 times higher odds of exporting, it is concerning that so many Indigenous SMEs don’t have reliable access. Research by CCIB and Google Canada has shown that, when available, Indigenous businesses are making use of online tools, such as online search (75%), online advertising (61%), and other marketing tools like social media to reach new customers at higher rates than the average Canadian business.Footnote 37 These findings indicate that Indigenous businesses are interested in leveraging technology to access new markets both domestically and internationally.

Digital infrastructure is the top growth obstacle, with the biggest difference between Indigenous firms in remote regions and urban areas. Our national survey reveals that 46.1% of Indigenous SMEs in remote areas report IT-related barriers to growth, compared to just 30.9% of Indigenous SMEs in urban areas. When business characteristics such as size and industry are controlled for, our econometric analysis finds that Indigenous SMEs in remote communities are associated with having 1.7 times higher odds of reporting information technology (IT) obstacles to growth compared to their urban counterparts.

Figure 4: Top 3 disparities in growth obstacles between Indigenous SMEs in urban and remote areas

Text version - Figure 4

| Significant challenge to business growth | Indigenous SMEs in remote areas (% of firms reporting obstacle) | Indigenous SMEs in urban areas (% of firms reporting obstacle) |

|---|---|---|

| Reliable internet access, telephone, and other IT technologies | 46.1 | 30.9 |

| Other infrastructure such as electricity, water, and roads | 32.5 | 21.4 |

| Access to business advisory support | 23.3 | 12.0 |

Source: Canadian Council for Indigenous Business & Global Affairs Canada’s Survey of Indigenous Firms, 2021

Remote communities in Canada often lack the same access to high-speed internet as their urban counterparts. In 2021, only 59.5% of rural and remote households had access to minimum connection speeds—a figure far below the national average of 90.9%.Footnote 38 Furthermore, internet connectivity often comes at a higher cost for remote clients. However, through a 10-year spending plan, the federal government promises to connect 95% of Canadians to high-speed internet capabilities by 2026 and 100% of Canadians by 2030.Footnote 39

Figure 5: Top 3 disparities in growth obstacles between SMEs in and outside of Indigenous communities

Text version - Figure 5

| Significant challenge to business growth | Within Indigenous community (% of firms reporting obstacle) | Outside of Indigenous community (% of firms reporting obstacle) |

|---|---|---|

| Reliable Internet access, telephone, and other IT technologies | 43.2 | 30.8 |

| Other infrastructure such as electricity, water, and roads | 30.4 | 20.7 |

| Access to equity or capital | 42.8 | 37.8 |

Source: Canadian Council for Indigenous Business & Global Affairs Canada’s Survey of Indigenous Firms, 2021

Reliable digital infrastructure is also an obstacle, with the biggest difference between Indigenous firms in Indigenous communities compared to those located outside of Indigenous communities. Our econometric analysis reveals that Indigenous SMEs within Indigenous communities are associated with having 1.8 times the odds of reporting digital infrastructure as a barrier to growth.

Studies have consistently highlighted that Indigenous communities grapple with distinct digital infrastructure-related challenges, particularly within First Nations reserves.Footnote 40 A report by the Auditor General of Canada highlights that households in First Nations reserves can experience more severe connectivity gaps than households that are merely in remote regions. Namely, the report finds that only 42.9% of households in First Nations reserves have access to minimum connectivity speeds (a figure markedly below the 59.5% of remote households that have access to the same speeds).Footnote 41

We heard firsthand accounts of the struggles that firm owners experience with reliable internet access:

“Access to internet can be an issue depending on where you are. The internet in our city is very slow and can cause significant issues when running an online business. It slows everything down.”

- First Nations business owner in Community #3

“Internet and phone access pose significant obstacles as my network provider doesn't cover the area where I market my goods. This strains my ability to communicate effectively with customers.”

- Firm owner from First Nations Community #1

Physical infrastructure, such as roads, electricity, and water, was reported as a growth barrier by more than a quarter of Indigenous SMEs in our national survey. Like digital infrastructure, physical infrastructure challenges were more prevalent among Indigenous firms in remote regions and those located in Indigenous communities.

Some 32.5% of firms in remote areas reported that inadequate physical infrastructure, including roads, electricity, and water, is a barrier to growth. Econometric analysis also finds that Indigenous firms in remote areas are linked to having 1.4 times higher odds of reporting physical infrastructure barriers to growth than Indigenous SMEs in urban areas.

A First Nations business owner shares one poignant example of challenges related to infrastructure:

“I think that the electricity rates are the main issue if I open up a storefront.”

- First Nations business owner in Community #2

While the degree of remoteness is evidently important for infrastructure obstacles, so too is the location of a firm either within or outside of Indigenous communities, such as First Nations reserves. Econometric analysis finds that Indigenous SMEs in Indigenous communities are associated with 1.6 higher odds of reporting physical infrastructure barriers to growth, even when the effects of remoteness are controlled for.

Competition

Competition is reported as a barrier by over one-third (35.2%) of Indigenous SMEs, making it a sizeable, though one of the lowest-ranked, barrier to growth.

Industry-related differences, such as a high degree of specialization for Indigenous firms, could explain why competition is perceived as less of a barrier than for national averages. For example, the econometric analysis reveals that firms in select industries, such as retail trade, are linked to higher odds of reporting competition as a barrier to growth than accommodation and food services. According to one estimate, the Indigenous art market in the United States was valued at US$1.5 billion in 2020, with a projected annual growth rate of 8%.Footnote 42 Thus, Indigenous SMEs that specialize in producing traditional and cultural products could produce highly differentiated products, which would contextualize why competition is perceived as a less significant barrier to growth.

However, this indicates a need to prevent the misappropriation and copying of Indigenous traditional and cultural products to ensure that they are not forced to compete with non-Indigenous entities in this space. The United States currently has the Indian Arts and Crafts Act (1990), which makes it illegal to “offer or display for sale, or sell, any art or craft product in a manner that falsely suggests it is Indian produced, an Indian product, or the product of a particular Indian or Indian tribe or Indian arts and crafts organization, resident within the United States,” but no similar legislation currently exists in Canada, which has led to a rise in counterfeiting issues.Footnote 43 For example, an investigative journalist found that 75% of the 40 shops in Gastown, Vancouver, were selling fake Indigenous art.Footnote 44

Geographic factors may reduce the challenging effects of competition for the 74.8% of Indigenous SMEs located outside of urban areas. Research indicates that rural areas tend to foster more start-up firms per capita, which are often born out of demand to fill a necessity.Footnote 45 In remote areas, consumers contend with significant distances to access goods and services, which creates a demand for local entrepreneurs to cater to these needs. Consequently, rural regions may be somewhat shielded from urban competition, allowing businesses to operate within less saturated markets.Footnote 46 A lower share of remote Indigenous SMEs reported market competition as a moderate or major barrier (31.0%) than the Indigenous SME average (35.2%).

2.2 Obstacles to growth for exporters

In general, Indigenous SME exporters report barriers to growth at similar rates to non-exporters. For instance, economic conditions and attracting employees with the right skills are the top 2 business challenges for both groups.

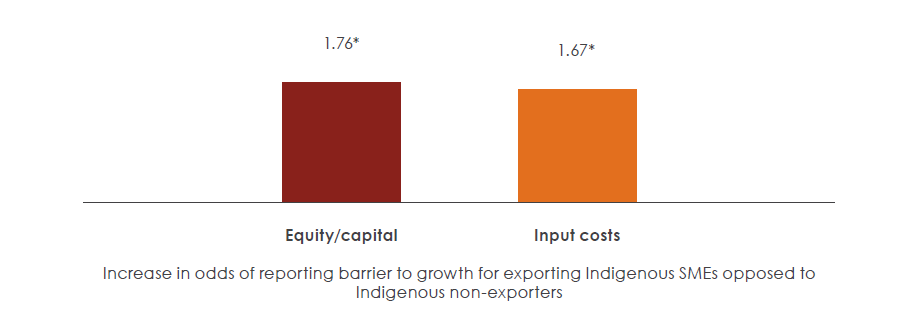

However, equity, capital, and input costs are barriers that are statistically more pronounced for Indigenous exporters. When firm characteristics are controlled for, Indigenous SME exporters are associated with having 1.8 times higher odds of reporting that access to equity or capital is a barrier to growth than non-exporting firms, according to our econometric analysis. Furthermore, Indigenous SME exporters have 1.7 times higher odds of reporting rising input costs as a barrier to growth than non-exporters—even after industry-related differences are controlled for.

Figure 6: Statistically significant obstacles to growth for Indigenous SME exporters

Text version - Figure 6

| Statistically significant obstacles to growth | Equity/capital | Business/input costs |

|---|---|---|

| Increase in odds of reporting barrier to growth for exporting Indigenous SMEs opposed to Indigenous non-exporters | 1.76* | 1.67* |

Notes: * represents 5% significance level. Result obtained when other factors are controlled for, such as industry, size, use of virtual sales, and geographic characteristics. Please see Table 1.1A for complete regression.

Source: Canadian Council for Indigenous Business & Global Affairs Canada’s Survey of Indigenous Firms, 2021

Our previous report, Adàwe, found that exporters are more likely to use virtual sales than non-exporters. We now find that reliable communications infrastructure is a notable challenge for Indigenous SMEs exporters. Some 4.8 percentage points more Indigenous exporters than non-exporters highlighted that reliable internet and IT tools are noteworthy obstacles to firm growth.

In 2020, Indigenous exporters’ profits were slightly harder hit than those of non-exporters, with a smaller share reporting a net profit (41.3% vs. 46.3%). Most Indigenous exporters either broke even or incurred a net loss, underscoring their strained financial position in 2020. A sizable number of the Indigenous SME exporters who reported a net loss were in service-related industries, such as accommodation and food services, as well as transportation and warehousing. This disparity in financial standing between exporting and non-exporting firms during that period emphasizes the heightened vulnerability of exporters to economic turbulence and increased prices. It could also be indicative of pandemic-related challenges for firms in service industries.

Figure 7: Revenues in 2020 for Indigenous SMEs by export status

Text version - Figure 7

| Revenues in 2020 | Indigenous exporter (%) | Indigenous non-exporter (%) |

|---|---|---|

| Net profit | 41.3 | 46.3 |

| Break even | 33.5 | 29.2 |

| Net loss | 25.2 | 24.5 |

Source: Canadian Council for Indigenous Business & Global Affairs Canada’s Survey of Indigenous Firms, 2021

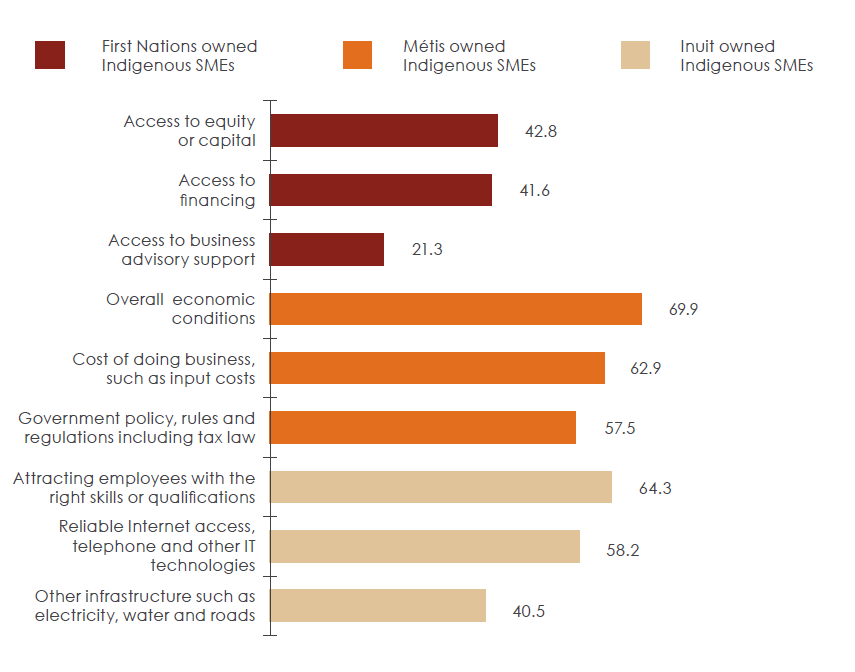

Business challenges for First Nations, Métis, and Inuit firms

There is much diversity among Indigenous Peoples in Canada, including within First Nations, Métis, and Inuit identities. Geographical locations, spiritual and cultural practices, and historical and modern contexts are all factors that may differentiate the experiences of Indigenous entrepreneurs.

Compared to the Indigenous SME average, First Nations-owned Indigenous SMEs are slightly more likely to report challenges related to access to equity (+2.3 percentage points), access to financing (+1.9 percentage points), and access to business support (+0.8 percentage points). These statistics likely reflect systemic barriers within financial and support ecosystems, as discussed throughout this report. Furthermore, given that a majority of First Nations firms in our study are based within reserves, it is important to consider the ramifications of the Indian Act on access to finance and equity.

Métis-owned firms, conversely, are significantly more impacted by obstacles stemming from government policy and regulations (such as tax law) (+13.0 percentage points), business costs (+11.2 percentage points), and overall economic conditions (+8.1 percentage points). Industry composition may partly explain some of these challenges. Notably, a significant portion of Métis-owned firms are in the construction industry and are thus likely to be exposed to volatile input costs such as commodity price fluctuations.

Inuit-owned firms starkly deviate from the Indigenous SME average and are more likely to face challenges related to IT (+20.2 percentage points), infrastructure (+14.2 percentage points), and labour attraction (+2.5 percentage points). As Inuit tend to inhabit remote parts of Canada, these figures likely showcase the impacts of remoteness on access to labour and infrastructure.

Figure 8: Largest discrepancies in obstacles to growth among First Nations, Métis, and Inuit-owned firms when compared to Indigenous average

Text version - Figure 8

| Obstacle to growth | First Nations owned Indigenous SMEs |

|---|---|

| Access to equity or capital | 42.8 |

| Access to financing | 41.6 |

| Access to business advisory support | 21.3 |

| Obstacle to growth | Métis owned Indigenous SMEs |

|---|---|

| Overall economic conditions | 69.9 |

| Cost of doing business, such as input costs | 62.9 |

| Government policy, rules and regulations including tax law | 57.5 |

| Obstacle to growth | Inuit owned Indigenous SMEs |

|---|---|

| Attracting employees with the right skills or qualifications | 64.3 |

| Reliable Internet access, telephone and other IT technologies | 58.2 |

| Other infrastructure such as electricity, water and roads | 40.5 |

Source: Canadian Council for Indigenous Business & Global Affairs Canada’s Survey of Indigenous Firms, 2021.

For more information on obstacles to firm growth by identity of ownership, please see Table 2.4A in the appendix.

Chapter 3: Export activity of Indigenous SMEs–motivations and challenges

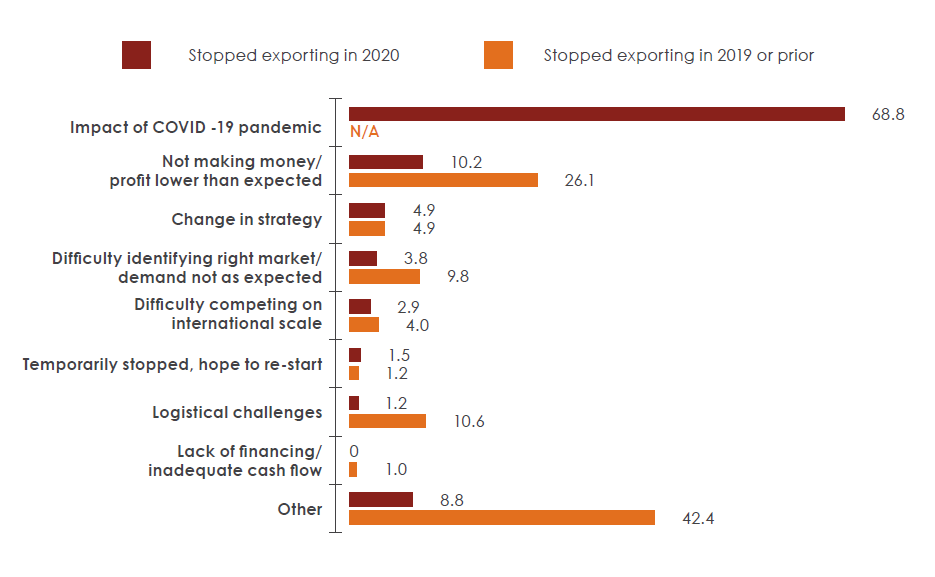

Key messages

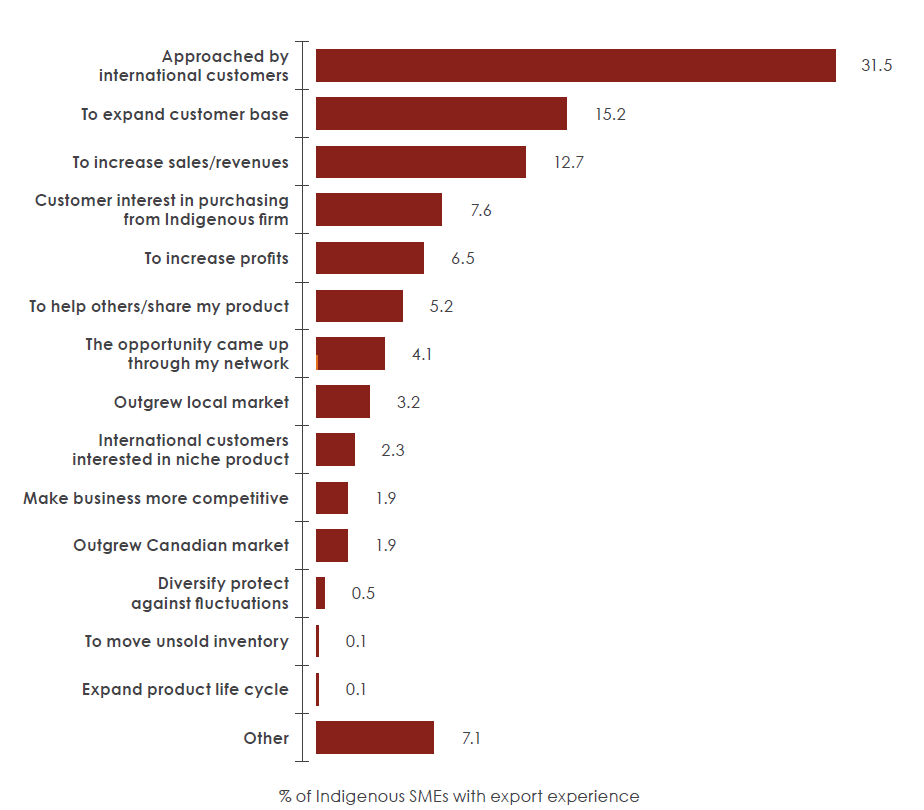

- Indigenous SMEs begin exporting for various reasons, with interest from international customers being the most common (reported by nearly one-third of firms).

- For nearly every barrier, Indigenous SMEs are more likely to report facing moderate or major export obstacles than the average SME in Canada.

- The pandemic was the most reported export obstacle for Indigenous SMEs, with 61.5% reporting it as a moderate or major obstacle.

- More than two-thirds of Indigenous SMEs who stopped exporting in 2020 reported that the pandemic was the main factor behind their decision. For SMEs who stopped exporting in the previous year, a lack of profits (26.0%) was the main motivator.

- Intellectual property protection and market knowledge stand out as export obstacles reported at significantly higher rates by Indigenous SME exporters than the national average, 3.8 times higher and 2.3 times higher, respectively.

- Remotely located Indigenous SMEs are associated with nearly 4 times higher odds of reporting that location is a moderate or major obstacle to exporting compared to firms in urban areas.

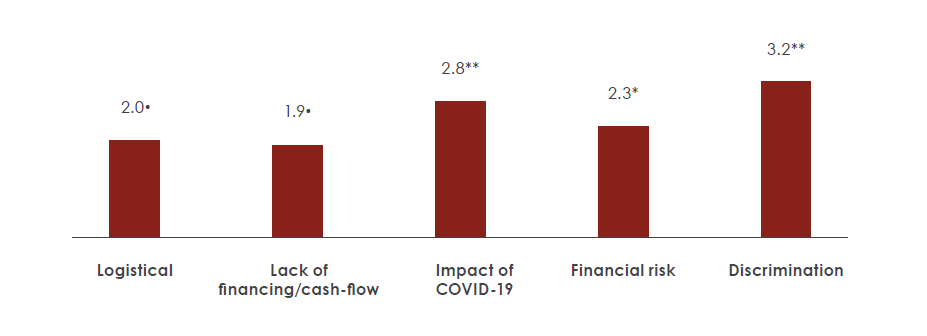

- Firms in Indigenous communities are associated with magnified odds of experiencing export barriers related to financing, financial risk, discrimination, logistics, and the effects of the pandemic.

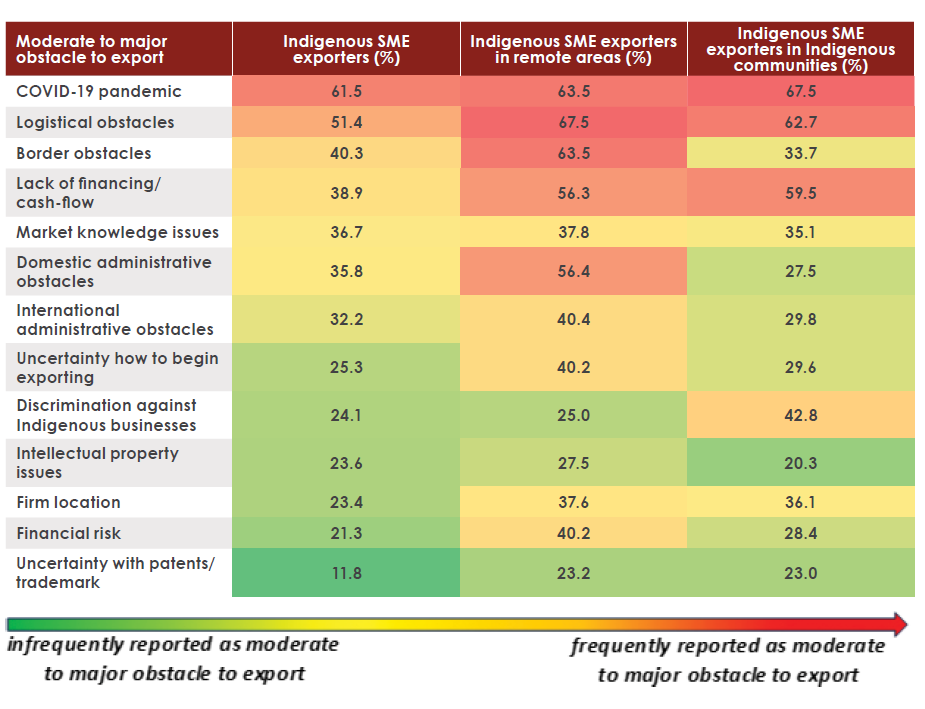

Figure 9: Heatmap of obstacles to export for various segments of Indigenous SME exporters

Text version - Figure 9

| Moderate to major obstacle to export | Indigenous SME exporters (%) | Indigenous SME exporters in remote areas (%) | Indigenous SME exporters in Indigenous communities (%) |

|---|---|---|---|

| COVID-19 pandemic | 61.5 | 63.5 | 67.5 |

| Logistical obstacles | 51.4 | 67.5 | 62.7 |

| Border obstacles | 40.3 | 63.5 | 33.7 |

| Lack of financing/cash-flow | 38.9 | 56.3 | 59.5 |

| Market knowledge issues | 36.7 | 37.8 | 35.1 |

| Domestic administrative obstacles | 35.8 | 56.4 | 27.5 |

| International administrative obstacles | 32.2 | 40.4 | 29.8 |

| Uncertainty how to begin exporting | 25.3 | 40.2 | 29.6 |

| Discrimination against Indigenous businesses | 24.1 | 25.0 | 42.8 |

| Intellectual property issues | 23.6 | 27.5 | 20.3 |

| Firm location | 23.4 | 37.6 | 36.1 |

| Financial risk | 21.3 | 40.2 | 28.4 |

| Uncertainty with patent/trademark | 11.8 | 23.2 | 23.0 |

Source: Canadian Council for Indigenous Business & Global Affairs Canada’s Survey of Indigenous Firms, 2021

Note: Percentages reflect % of firms (of each segment) that reported the export obstacle as moderate to significant.

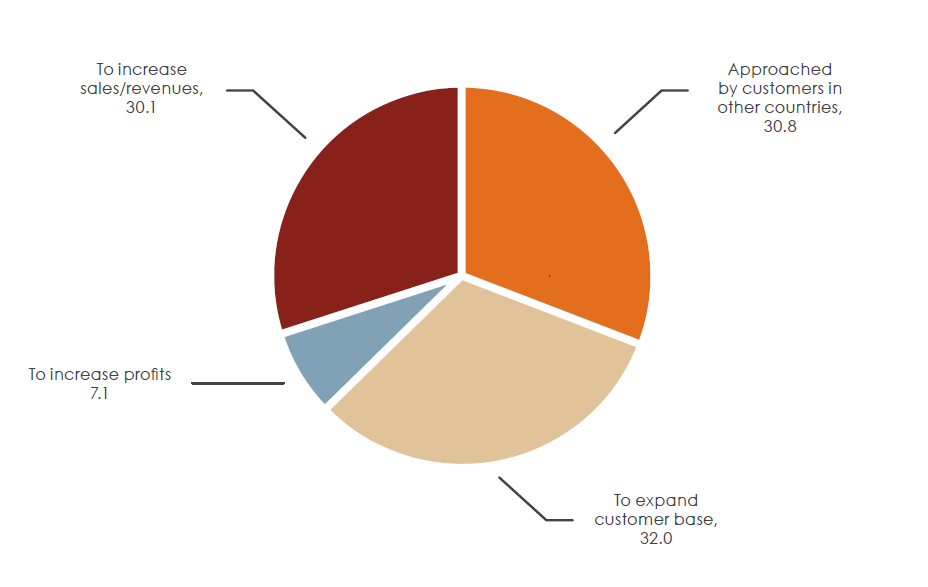

3.1 Reasons to export for Indigenous firms

Most Indigenous firms do not start their business with the intention of exporting. In fact, the CCIB-GAC national survey estimates that only 24.9% of Indigenous SMEs with export experience started their business with exporting in mind, suggesting that the choice to venture into international markets typically happens later.

The decision to enter international markets often stems from a combination of factors. “Push” factors like market saturation, excess production capacity, or the need for diversification can motivate companies to overcome domestic limitations and seek growth opportunities abroad. For instance, companies might seek international markets to sustain growth when facing limited domestic growth potential due to saturation or intense competition. Similarly, having surplus production capacity can drive companies to explore export opportunities to achieve economies of scale and improve efficiency.

“Pull” factors such as high demand in foreign markets, attractive profit margins, or favourable trade conditions may entice companies to enter international markets. This offers not only increased sales potential via a broader customer base, but increased production can lower per unit production costs and enable greater productivity. Competitive advantages like unique products, expertise, or technological advancements may also pull companies to markets where their offerings are valued.Footnote 47

Trade agreements can support companies with international expansion. Canada has 15 free trade agreements that cover 60% of global GDP, giving SMEs access to 1.5 billion customers. Canada has also been advancing Trade and Indigenous Peoples chapters in its ongoing trade agreement negotiations. These chapters seek to enhance the ability of Indigenous Peoples and businesses to benefit from the opportunities created under the agreement.

Figure 10: Top reasons to start exporting for Indigenous SMEs

Text version - Figure 10

| Top reason to start exporting | % of Indigenous SMEs with export experience |

|---|---|

| Approached by customers in other countries | 31.5 |

| To expand customer base | 15.2 |

| To increase sales/revenues | 12.7 |

| Customers interested in purchasing from Indigenous firm | 7.6 |

| To increase profits | 6.5 |

| To help others/share my product | 5.2 |

| The opportunity came up through my network | 4.1 |

| Outgrew local market | 3.2 |

| International customers interested in niche product | 2.3 |

| Make business more competitive | 1.9 |

| Outgrew Canadian market | 1.9 |

| Diversify/protect against fluctuations | 0.5 |

| To move unsold inventory | 0.1 |

| Expand product life cycle | 0.1 |

| Other | 7.1 |

Source: Canadian Council for Indigenous Business & Global Affairs Canada’s Survey of Indigenous Firms, 2021.

Note: This was an open-ended question. Respondents were asked the main reason they began to export and other reasons that motivated this decision. This chart shows the main reasons for exporting.

International clients and demand for Indigenous products

The primary driver behind why Indigenous firms start exporting is international demand: 31.5% report starting because they were approached by customers in other countries. Almost half of these firms are in the professional, scientific, and technical services industry.

An additional 7.6% of Indigenous SMEs said they were approached by customers interested in buying from an Indigenous firm specifically. These firms were primarily in arts, entertainment, and recreation as well as manufacturing sectors.

A strong customer base can also be enticing. Some 15.2% of Indigenous SMEs with export experience pinpoint the expansion of their customer base as a factor fueling their decision to export.

Financial motivators

Indigenous firms also cite financial reasons as pivotal drivers that draw them towards exporting, with 12.7% of Indigenous SMEs with export experience indicating that growth in sales or revenues was their primary motivation to export. Profits were also a large motivating factor for 6.5% of Indigenous SMEs with export experience.

3.2 Obstacles to exporting

Indigenous SME exporters consistently report barriers to exporting at higher rates than the average Canadian SME exporter. This section uses 2 approaches to explore obstacles in greater depth. First, we compare Indigenous responses to questions on challenges in 2020 to the national average. Second, we conduct econometric analysis to identify which business characteristics, such as location in remote or Indigenous communities, are associated with statistically higher or lower odds of reporting each obstacle.Footnote 48

COVID-19 pandemic

From border closures and widespread labour shortages to skyrocketing input costs and supply chain disruptions, Canadian businesses had to weather many new challenges to stay afloat, let alone export to global markets in 2020. Some 61.5% of Indigenous SMEs reported that the pandemic presented a moderate or major obstacle to exporting.

Pandemic-related research conducted by the CCIB finds further evidence of the immense pressures COVID-19 placed on Indigenous firms; by January 2021, 58% of Indigenous firms surveyed by the CCIB had applied for government financial assistance due to the pandemic, and 52% received funding.Footnote 49 In a separate survey, Statistics Canada’s Canadian Survey on Business Conditions (2021 Q1) indicated that Indigenous businesses were 12.2 percentage points more likely to access the Canada Emergency Business Account (CEBA) than the national average.Footnote 50

Figure 11: Moderate and major obstacles to export

Text version - Figure 11

| Obstacle to export | Indigenous SME exporters (%) | All Canadian SME exporters (%) |

|---|---|---|

| COVID-19 pandemic | 61.5 | - |

| Logistical obstacles | 51.4 | 31.6 |

| Border obstacles | 40.3 | 31.2 |

| Lack of financing/cash-flow | 38.9 | 20.9 |

| Market knowledge issues | 36.7 | 16.1 |

| Domestic administrative obstacles | 35.8 | 16.2 |

| International administrative obstacles | 32.2 | 23.4 |

| Uncertainty how to begin exporting | 25.3 | - |

| Discrimination against Indigenous businesses | 24.1 | - |

| Intellectual property issues | 23.6 | 6.2 |

| Firm location | 23.4 | - |

| Financial risk | 21.3 | 23.4 |

| Uncertainty with patent/trademark | 11.8 | - |

Source: Canadian Council for Indigenous Business & Global Affairs Canada’s Survey of Indigenous Firms, 2021; Statistics Canada. Table 33-10-0451-01 Obstacles to exporting for small and medium-sized enterprises, 2022.

Note: The CCIB-GAC survey asked more extensive questions on export obstacles than the SFGSMEs. As a result, some categories cannot be compared to the national average. This is indicated with “N/A.”

Our econometric analysis reveals that the COVID-19 pandemic stood out as one of the most significant obstacles for firms within Indigenous communities. Indigenous SMEs with export experience that were based in Indigenous communities were linked to 2.8 times higher odds of reporting pandemic-related obstacles to exporting—even after other characteristics, such as remoteness, are controlled for.

Figure 12: SMEs in Indigenous communities: Statistically significant obstacles to exporting

Text version - Figure 12

| Statistically significant obstacles to exporting | Logistical | Lack of financing/cash-flow | Impact of COVID-19 | Financial risk | Discrimination |

|---|---|---|---|---|---|

| Increase in odds of reporting barrier to exporting for Indigenous SME with export experience in Indigenous community, as opposed to Indigenous SME with export experience outside of Indigenous community. | 2.0• | 1.9• | 2.8** | 2.3* | 3.2** |

Notes: ** represents 1% significance level, * represents 5% significance level, and represents 10% significance level. Result obtained when other factors are controlled for, such as industry, size, use of virtual sales, and remoteness. Please see Table 1.2A for complete regression.

Source: Canadian Council for Indigenous Business & Global Affairs Canada’s Survey of Indigenous Firms, 2021.

In our community case studies, we heard from a First Nations firm owner who shared how challenges during the pandemic “became too difficult to overcome,” especially considering that the owner had “invested so much savings into it to try to make this business beneficial for family.” Another First Nations business owner remarked how sales plummeted during the lockdown and became a significant obstacle to exporting.

Logistical obstacles

Logistical obstacles, including distance to customers, transportation costs, and brokerage fees, are reported as a moderate or major obstacle by 51.4% of Indigenous exporters, compared to 31.6% of all Canadian SME exporters.

While the high prevalence of logistical obstacles could reflect pandemic-related supply chain challenges that were occurring at the time of the survey, logistical obstacles and infrastructure gaps have been well-documented challenges affecting Indigenous populations for many years.Footnote 51Footnote 52

Our national survey asked Indigenous SMEs who had already stopped exporting before the pandemic about obstacles, and a stark 45.0% reported that logistics were a barrier to export. Thus, there is significant evidence that factors unrelated to the pandemic play a key role in driving logistical obstacles to export.

Logistical barriers are particularly relevant for remotely located Indigenous SMEs. Nearly 68% of Indigenous SME exporters located in remote regions reported that logistics were a moderate or major obstacle to exporting, making it their number one challenge. In fact, the percentage of Indigenous SME exporters in remote locations who report this obstacle is 23.6 percentage points higher than that of urban Indigenous exporters (see Figure 13).

The amplified logistical obstacles remote Indigenous exporters face might signify broader challenges in accessing trade infrastructure. Due to the vast distances and intricate geographical terrain, transportation costs tend to soar for remote communities, contributing to the overall complexity of logistics. In some cases, carriers may charge higher prices to ship items outside typical pickup areas.Footnote 53

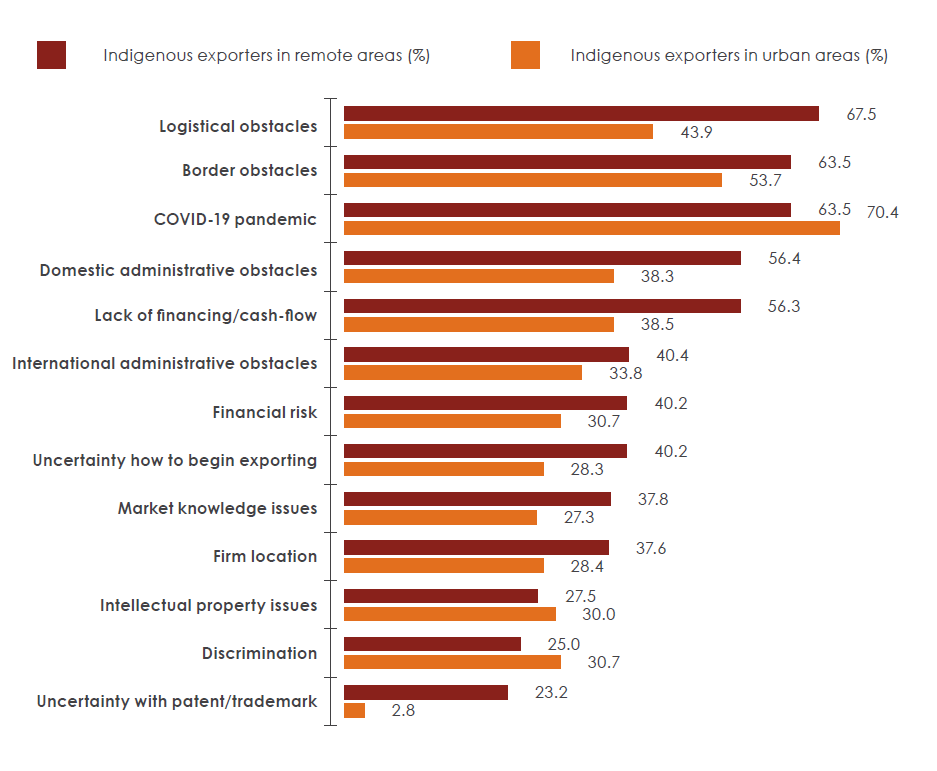

Figure 13: Moderate and major obstacles to export for Indigenous firms in remote and urban areas

Text version - Figure 13

| Moderate and major obstacles to export | Indigenous exporters in remote areas (%) | Indigenous exporters in urban areas (%) |

|---|---|---|

| Logistical obstacles | 67.5 | 43.9 |

| Border obstacles | 63.5 | 53.7 |

| Impacts of the COVID-19 pandemic | 63.5 | 70.4 |

| Domestic administrative obstacles | 56.4 | 38.3 |

| Lack of financing/cash-flow | 56.3 | 38.5 |

| International administrative obstacles | 40.4 | 33.8 |

| Financial risk | 40.2 | 30.7 |

| Uncertainty how to begin exporting | 40.2 | 28.3 |

| Market knowledge issues | 37.8 | 27.3 |

| Firm location | 37.6 | 28.4 |

| Intellectual property issues | 27.5 | 30.0 |

| Discrimination | 25.0 | 30.7 |

| Uncertainty with patent/trademark | 23.2 | 2.8 |

Source: Canadian Council for Indigenous Business & Global Affairs Canada’s Survey of Indigenous Firms, 2021

Note: Values are from a smaller data set that includes firm location.

Border obstacles

The third most pressing obstacle to exporting for Indigenous SMEs is border obstacles. For some 40.3% of Indigenous SME exporters, border issues, such as tariffs, import quotas, customs duties, or border security, posed a moderate or major obstacle to exporting. Comparatively, border obstacles are also a key challenge to exporting for all Canadian SMEs, albeit to a slightly lesser extent (reported by 31.2% of exporters). Given the closure of borders during the pandemic, it is likely that COVID-19 also exacerbated this challenge. However, 41.6% of Indigenous firms that exported before 2020 also reported that border obstacles are an obstacle to export, which signifies that pre-existing factors are also at play.

Access to finance

Another notable obstacle is access to finance or cash flow, which was reported as a moderate or major obstacle to exporting by 38.9% of Indigenous SME exporters, compared to 20.9% of all Canadian SME exporters.

Empirical studies show that businesses with fewer credit constraints are more likely to export.Footnote 54Footnote 55 Several factors explain the importance of credit access in exporting, such as the initial costs to begin exporting.Footnote 56 These entry costs are incurred before any revenues from exporting are earned, which can pose a barrier for firms (especially smaller ones) that do not have adequate savings to fund entry into new markets.Footnote 57 Furthermore, a study by the Bank of Canada estimates that alleviating credit constraints for exporters could increase aggregate productivity.Footnote 58

Compared to sales in domestic markets, there can be larger delays between production and payment for sales in international markets. When coupled with other risks, such as exchange rate fluctuations and the possibility of non-payment from international sales, financial products such as financing and/or insurance can be essential factors that allow firms to hedge the financial risks and costs associated with exporting.Footnote 59

One First Nations firm owner shared:

“I find it difficult to receive financing to help build my business. With no financing for the business, I’m struggling to be able to hire any employees so that I can produce larger orders and generate more revenue.”

- Firm owner from First Nations Community #1

In the words of this First Nations firm owner, barriers to financing can be a precursor to other obstacles. Without proper funds to ensure competitive wages and hire new employees, labour can limit firm expansion by hindering production, future revenues, and the potential for international growth.

For another First Nations firm owner, barriers to accessing finance boiled down to not being aware of how to access it. They remarked the following:

“I need help gaining knowledge on accessing financial support for my small business.”

- Firm owner from First Nations Community #1

Firms in Indigenous communities are almost twice as likely to report the lack of financing or adequate cash flow as a moderate or major obstacle (59.5% vs. 29.8% of exporters located outside of Indigenous communities). Moreover, these higher odds are statistically significant (see Figure 12). Higher prevalence could again indicate negative repercussions from the Indian Act. See Adàwe for a deeper discussion.

While more work remains to ensure financing challenges for Indigenous firms are better understood and addressed, there are supports available to Indigenous entrepreneurs seeking financing for international expansion. For example, Export Development Canada recognizes that lack of collateral is an issue for many Indigenous businesses and works with banks to provide guarantees on behalf of the businesses to absorb the risk in situations where collateral is lacking or absent.Footnote 60

Intellectual property

As demonstrated in Figure 11, intellectual property (IP) issues are cited as a moderate or major obstacle by 23.6% of Indigenous SME exporters, a rate 3.8 times higher than the national average. The CCIB found that unauthorized use of Traditional Knowledge (TK) and Cultural Expressions (CE) is more widely reported by businesses with clients outside Canada than those with domestic clients (13% vs. 2% with clients only within Canada).Footnote 61

Indigenous IP can encompass a wide range of TK, practices, and cultural wisdom that has been developed and passed down through generations. Even though Indigenous TK far predates the development of Western IP systems, TK has not always been eligible for protection by the current IP system. This is largely because current Western IP systems do not recognize Indigenous TK if it does not fit within the criteria deemed necessary for protection, such as the requirements of originality, identifiable authors for copyright protection, and the need for novelty and inventive steps for patent protection.Footnote 62

While 2.8% of Indigenous SME exporters in urban regions identified uncertainty surrounding patents or trademarks as a moderate or major hurdle to exporting, 23.2% of Indigenous exporters in remote areas reported this challenge, marking an eight-fold difference (Figure 13). This disparity might stem from product differences; however, the survey also found that remote Indigenous SMEs highlighted limited access to business supports as a barrier to firm growth at higher rates than their urban counterparts. Thus, restricted availability or access to business advisory services, which could assist firms in understanding and navigating patent or trademark processes, might contribute to this relationship.

Administrative obstacles

Domestic administrative barriers, which include rules, regulations, and legal requirements, were reported as moderate or major challenges to exporting by 35.8% of Indigenous SME exporters—a much higher figure than the share of Canadian SME exporters (16.2%). Administrative obstacles appear more prevalent among Indigenous SME exporters in remote regions.

Administrative barriers outside of Canada were also mentioned as a challenge to exporting, albeit by a smaller percentage of Indigenous SME exporters (32.2%). A recent trade policy report by the CCIB finds that Indigenous businesses can face numerous regulatory barriers that may hinder international expansion, such as adhering to country-specific technical regulations and standards, acquiring necessary certifications, navigating labelling requirements like country-of-origin labelling, working with numerous authorities like the U.S. Food and Drug Administration, and facing insufficient recognition of Indigenous companies and harvesting rights.Footnote 63

Firm location

Firm location is an export obstacle that also stands out more for remote exporters than urban exporters (Figure 13). This export obstacle holds unique significance as econometric analysis finds that Indigenous SMEs with export experience in remote areas are associated with 4 times higher odds of reporting location as an export obstacle, even when other factors are controlled for.

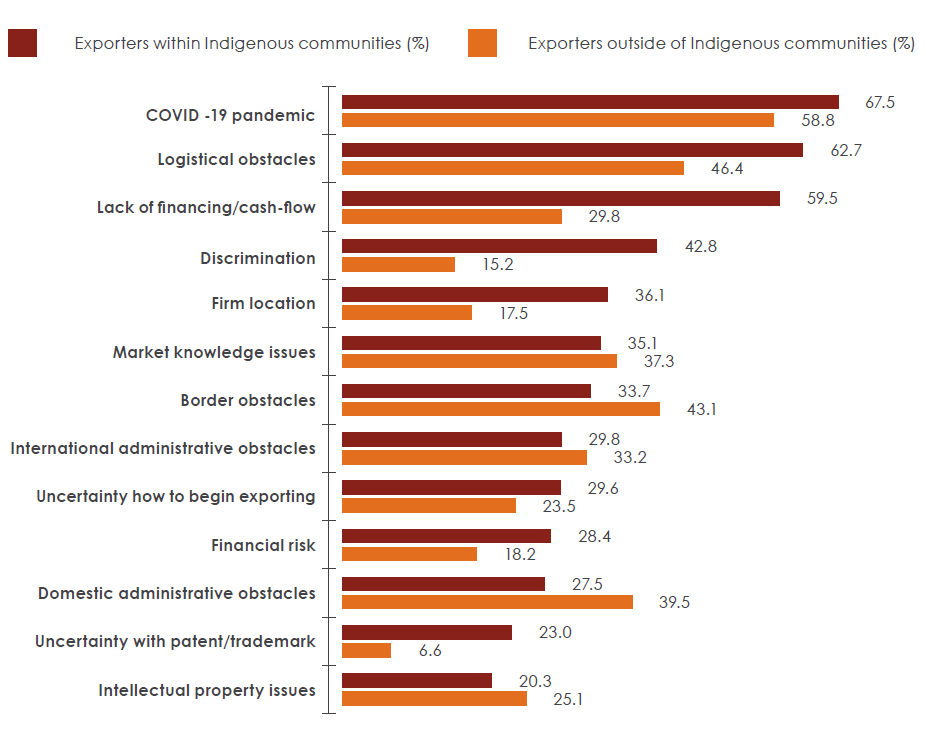

Figure 14: Moderate and major obstacles to export based on firm location within Indigenous communities

Text version - Figure 14

| Moderate and major obstacles to export | Exporters within Indigenous communities (%) | Exporters outside of Indigenous communities (%) |

|---|---|---|

| COVID-19 pandemic | 67.5 | 58.8 |

| Logistical obstacles | 62.7 | 46.4 |

| Lack of financing/cash-flow | 59.5 | 29.8 |

| Discrimination | 42.8 | 15.2 |

| Firm location | 36.1 | 17.5 |

| Market knowledge issues | 35.1 | 37.3 |

| Border obstacles | 33.7 | 43.1 |

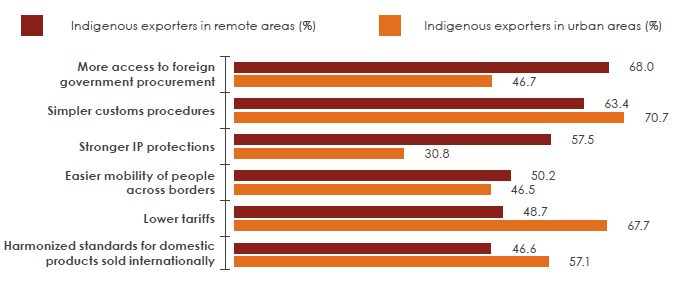

| International administrative obstacles | 29.8 | 33.2 |