Joint Progress Report - Outcome of the review process in Annex 30-C of CETA

Table of contents

- Objective of the Joint Progress Report

- Background

- Post-CETA growth in trade

- Progress made in the CETA Committee on Wines and Spirits

- EU measures

- Canadian measures

- Repeal of Excise Duty exemption for Canadian wines

- Ontario - wine taxation in off-site stores

- Ontario – restricted authorizations

- Ontario - bag-in-box products

- Nova Scotia - emerging wine regions policy

- British Columbia - access to imported wines on grocery store shelves

- Quebec - equivalent markup for small producers in grocery / convenience channel

- Transparency

- Importation of Intoxicating Liquors Act and personal exemption limits

- Geographical Indications

- Ongoing work

Objective of the Joint Progress Report

The Parties reaffirm their commitment to the bilateral trade in wines and spirits as an important economic driver in their respective jurisdictions. As part of this commitment, the Parties further affirm the importance of reviewing the progress achieved in the first five years since the provisional application of the Comprehensive Economic and Trade Agreement (CETA), in accordance with the commitments undertaken in Annex 30-C (Joint Declaration on Wines and Spirits).

This Joint Progress Report reflects the outcome of that progress review. The report is presented to the CETA Joint Committee pursuant to Article 26.2(6) of CETA.

Background

Trade environment pre-CETA

The Parties laid the legal framework for the bilateral trade in alcoholic beverages in 1989 when a first bilateral agreement was reached, the Agreement between Canada and the European Economic Community Concerning Trade and Commerce in Alcoholic Beverages. That agreement set down mutually recognised principles with regards to practices of the Parties, and in essence, set the tone for future trade in alcoholic beverages between Canada and the EU.

Following further evolution in the sector, the Parties negotiated a second agreement, namely the Agreement between the European Community and Canada on Trade in Wines and Spirit Drinks ('the 2003 Agreement') which entered into force in 2004. That new agreement was much more ambitious and far-reaching in terms of impact and scope. While it built upon the 1989 provisions, it also incorporated winemaking practices, geographical indications, certification, cost-of-service differential charges, customary terms and allowed for certain provincial practices to be maintained.

Finally, the 2003 Agreement established a Joint Committee on Wines and Spirits (the Committee) consisting of representatives of the European Commission and Canada. The Committee is charged with the proper functioning of the Agreement, making recommendations which would contribute to the attainment of the objectives of these Agreements, exchanging information, and recommending proposals on issues of mutual interest.

Trade of wines and spirits before CETA

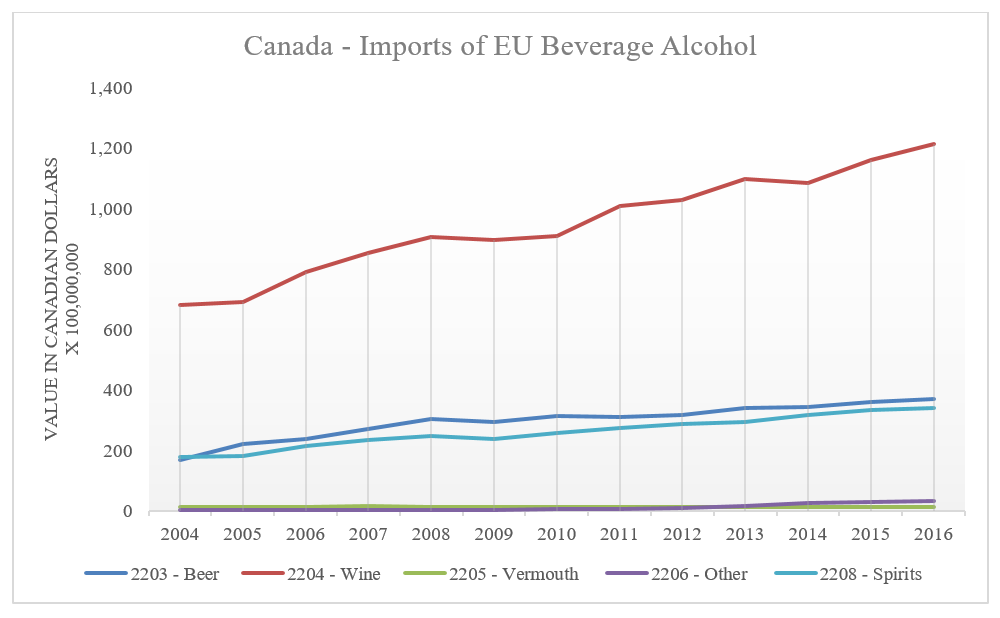

The trade in wine and spirits between the Parties grew significantly in the years following the implementation of these Agreements. Prior to the implementation of CETA, over the period of 2004-2016, imports of Canadian spirits into the European Union increased by over 20% between 2004-2016 from €17.5 million in 2004 to €21.0 million in 2016, and imports of spirits from the EU into the Canadian market increased by 89%, from $178.6 million to $338.2 million over the same periodFootnote 1 . Canadian imports of European wines also grew by 78%, from $681.5 million in 2004 to $1.21 billion in 2016.

Source: Statistics Canada. UK excluded

Text version

| Product | 2004 | 2005 | 2006 | 2007 | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 2203 – Beer | 168,786,114 | 219,953,453 | 237,348,534 | 271,805,254 | 302,601,001 | 293,262,528 | 312,205,095 | 310,278,150 | 317,744,235 | 338,858,942 | 343,173,098 | 358,043,162 | 368,188,603 |

| 2204 – Wine | 681,521,616 | 691,136,635 | 790,031,187 | 851,338,179 | 903,590,535 | 895,497,859 | 908,625,570 | 1,007,751,392 | 1,028,269,276 | 1,095,167,346 | 1,084,678,317 | 1,159,938,966 | 1,211,363,095 |

| 2205 – Vermouth | 13,792,978 | 13,428,555 | 13,726,185 | 15,058,892 | 13,097,810 | 12,420,577 | 11,212,628 | 11,540,319 | 11,095,331 | 11,666,786 | 11,232,791 | 11,745,475 | 12,385,618 |

| 2206 – Other | 1,034,151 | 1,417,543 | 1,858,282 | 1,369,529 | 2,977,117 | 3,412,121 | 4,265,163 | 4,595,911 | 9,468,844 | 17,149,668 | 24,122,800 | 29,420,471 | 33,154,105 |

| 2208 – Spirits | 178,624,922 | 181,781,497 | 213,966,492 | 234,023,507 | 247,455,131 | 235,877,928 | 257,686,028 | 272,852,325 | 285,578,456 | 292,105,543 | 317,161,348 | 332,633,713 | 338,258,808 |

Source: Eurostat. UK excluded

Text version

| Product | 2004 | 2005 | 2006 | 2007 | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 2203 – Beer | 1,083,160 | 1,025,795 | 923,468 | 716,117 | 848,554 | 668,686 | 709,878 | 649,310 | 857,537 | 943,629 | 1,085,034 | 1,722,574 | 2,469,332 |

| 2204 – Wine | 1,694,583 | 1,526,455 | 1,047,493 | 1,067,064 | 877,574 | 528,980 | 598,887 | 1,012,995 | 562,339 | 682,518 | 982,163 | 1,096,268 | 1,601,663 |

| 2205 – Vermouth | 146 | 72 | 1,457 | 3,002 | 24 | 47,549 | 60 | 675 | |||||

| 2206 – Other | 61,266 | 337,698 | 314,558 | 649,672 | 350,638 | 342,476 | 659,631 | 444,700 | 810,141 | 362,527 | 351,129 | 302,524 | 237,631 |

| 2208 – Spirits | 17,509,217 | 11,978,038 | 14,891,464 | 13,958,617 | 17,704,082 | 15,614,415 | 15,511,063 | 15,414,153 | 15,410,148 | 14,949,894 | 17,271,788 | 17,529,141 | 21,081,033 |

Summary of CETA negotiations

In 2009, the Parties sought to further modernize the bilateral texts, and discussions on alcohol were soon launched as part of the CETA negotiations. The outcome of these discussions intended to further facilitate bilateral trade between the Parties. One immediate benefit CETA had on the sector was preferential market access to both Parties through the elimination of tariffs. Upon entry into force of CETA, Canada eliminated its tariffs on wine and spirits, ranging from 1.87 to 4.68 cents per litre of wine, and 0.92 to 12.28 cents per litre of absolute ethyl alcohol. The EU eliminated its tariffs on wine immediately upon entry into force of CETA, ranging from 5.76 to 32 Euros per 100 litres. While most of EU imports of spirits were already duty-free on a most-favoured-nation (MFN) basis, the EU also eliminated immediately its tariff for the MFN non-duty-free spirit drinks.

Another key achievement was the incorporation of the two existing wine and spirit agreements into CETA, while simultaneously updating those agreements. The modernized language introduced new provisions which more accurately reflected market conditions and solidified the Parties' commitments.

Finally, the CETA outcome included the establishment of the Committee on Wines and Spirits, which provides an institutional structure for the Parties to maintain an open, frank and productive dialogue and to advance issues of mutual interest.

CETA Joint Declaration on Wines and Spirits (Annex 30-C)

The CETA Joint Declaration on Wines and Spirits, Annex 30-CFootnote 2 , is the result of the recognition that certain issues required additional time for deliberation and discussion between the Parties. As such, "the Parties agreed to discuss, through the appropriate mechanisms, without delay and in view to find mutually agreed solutions, any other issues of concern related to Wines and Spirits, and notably the desire of the European Union to seek the elimination of the differentiation of provincial mark-ups applied on domestic wines and wines bottled in Canada in private wine outlets."

As part of the declaration, the Parties agreed that "[a]t the end of the fifth year following the entry into force of this Agreement, the Parties agree to review the progress made on the elimination of the differentiation referred to in the previous paragraph, based on the examination of all developments in the sector, including the consequences of any granting to third countries of a more favourable treatment in the framework of other trade negotiations involving Canada." To implement that commitment, the Parties have undertaken a stocktaking of the progress made to date and the remaining concerns in the form of this Joint Progress Report.

Post-CETA growth in trade

The CETA has enabled strong growth and resilience in the trade of alcoholic beverages between the Parties, even in the face of global uncertainty and shifting market trends, such as those seen throughout the COVID-19 pandemic.

In 2021, wine and spirits were among the top 20 product categories of exports by value from the EU to Canada, with wine finishing 5th and spirits, 20th. Canada continues to be a very important market for European wines and spirits, with imports valued at $2.0 billion CAD in 2021. In the past 5 years, over the period of 2017-2021, imports of EU beverage alcohol in Canada grew by 18%, from $2.1 billion in 2017 to $2.5 billion in 2021.

In Canada, approximately $25.5 billion worth of alcoholic beverages were sold in the fiscal year ending March 31, 2021, up 4.2% from a year earlier. This was the largest sales increase in over a decadeFootnote 3.

The European market continues to be an important market for Canadian wines and spirits. Imports of Canadian wine and spirits, including high value and specialized alcohol products, such as Canadian Rye Whisky and Icewine, to the European market increased to over €20 million in 2021Footnote 4.

EU wines and spirits

Imports of European spirits in the Canadian market increased by 25% over the period of 2017-2021, from $356.4 million in 2017, to $ 446.6 million in 2021. Despite the market volatility brought on during the pandemic, which has significantly impacted consumers purchasing habits, imports continued to grow in 2020 and 2021.

European wine producers have improved their position as suppliers of the majority of Canada's imported wine, representing 58% of wine imports in 2021, compared to 52% in 2016. From 2017 to 2021 imports of EU wine into Canada grew by 26%, or an average of 5.2% per year, significantly outpacing imports from other wine producing countries such as the US (17%), Australia (-14%) and New Zealand (1%).

Source: Statistics Canada. UK excluded

Text version

| Product | 2017 | 2018 | 2019 | 2020 | 2021 |

|---|---|---|---|---|---|

| 2203 – Beer | 373,412,528 | 413,700,459 | 397,278,523 | 385,726,582 | 328,872,631 |

| 2204 – Wine | 1,308,889,718 | 1,393,859,152 | 1,427,673,005 | 1,453,679,659 | 1,647,570,835 |

| 2205 – Vermouth | 12,788,668 | 13,151,017 | 12,666,142 | 14,726,099 | 14,176,471 |

| 2206 – Other | 39,732,735 | 41,810,739 | 37,718,226 | 22,858,888 | 23,981,231 |

| 2208 – Spirits | 356,482,581 | 367,551,116 | 396,692,385 | 408,762,147 | 446,661,843 |

Canadian wines and spirits

EU imports of Canadian spirits peaked following the provisional implementation of CETA in 2017. However, compared to 2017, imports have significantly increased into Belgium (+178%), the Netherlands (+58%) and Ireland (+7358%). Since 2019, Canadian spirits exporters are seeing an uptake in their exports, with the EU reporting an increase to €19.2 million in 2021.

Imports of Canadian wines have remained mostly stable since the provisional implementation of CETA.

Source: Eurostat. UK excluded

Text version

| Product | 2017 | 2018 | 2019 | 2020 | 2021 |

|---|---|---|---|---|---|

| 2203 – Beer | 3,078,247 | 2,984,179 | 2,509,574 | 2,307,180 | 2,396,924 |

| 2204 – Wine | 1,732,847 | 1,521,797 | 1,821,718 | 1,480,418 | 1,476,053 |

| 2205 – Vermouth | 304 | 357 | 3,590 | 124 | |

| 2206 – Other | 182,121 | 117,639 | 209,970 | 132,816 | 148,104 |

| 2208 – Spirits | 23,375,851 | 20,223,032 | 15,744,480 | 16,147,442 | 19,269,634 |

Progress made in the CETA Committee on Wines and Spirits

As is evident by trade statistics from both Parties, bilateral trade in wines and spirits has increased since the provisional application of CETA. This success can be attributed to many contributing factors, such as tariff elimination, increased transparency, and the reduction of trade barriers. Indeed, CETA solidified the institutional structure by which the Parties can address systemic issues that may impact trade, through the Committee on Wines and Spirits ('the Committee').

The Committee allows the Parties to exchange information and makes recommendations which contribute to the attainment of the objectives of CETA and the Agreements incorporated into it and on issues of mutual interest. The issues identified below have been the subject of discussion between the Parties, conducted within the spirit of the agreement, and with the objective of finding common ground. Since its inception, the Committee has had several successes in this regard, some of which are discussed in the sections below.

Plan to address Annexes to the 2003 Agreement

Canada and the EU both expressed their willingness to seek approval to amend the annexes of the 2003 Agreement between the European Community and Canada on trade in wines and spirits drinks (hereinafter the 2003 Agreement), incorporated into CETA, with regard to geographical indications (GIs) and oenological practices. The amendment would be pursued by way of a Decision of the Joint Committee established under the 2003 Agreement. Following approval of that amendment, the Parties intend, inter alia, to add to the relevant annexes the GIs from the European Union where a request has been made directly with the Canadian Intellectual Property Office (CIPO) and protected in Canada by the date indicated below. More specifically, for EU GI terms that are not currently protected in Canada, the amendment will be undertaken following this process:

- Interested EU wine and spirit GI rights holders will need to submit a request for their desired GIs to CIPO for review.

- Upon receipt of a complete application, which includes all supporting documentation and the associated fee, the GIs are reviewed on a first-come, first-serve basis by CIPO. The terms will be granted protection only if and when they have passed all stages of Canada's domestic review process.

- The Canada-EU Joint Wine and Spirits Committee will add the relevant GIs that have received protection in Canada by 28 February 2023 to the draft Joint Committee Decision.

- Upon completion of the above process, the Parties take the steps necessary to pursue the adoption of the amending Joint Committee Decision to amend the agreement to include the CIPO-approved GIs in Annexes III and IV.

Should that approach be successfully implemented, the Parties may consider subsequent updates following a similar approach.

EU measures

List of competent bodies authorised to establish the V.I.1 certificate

The EU requires that a document known as the "V.I.1" be used to export wine to the EU. The V.I.1 form serves as a certificate of analysis and compliance with EU rules on oenological practices. In 2020, Canada notified some updates with regards to the competent bodies authorised to establish the V.I.1 certificate. The European Commission immediately implemented the changes by amending the relevant list. On several occasions, Canada also informed the Committee about its intention to authorise new bodies to establish the V.I.1 certificate.

Icewine

In 2018, Canada drew the attention of the Committee to the need to amend EU wine rules in regards to icewine from Canada, to implement a specific provision of the 2003 agreement on trade in wine and spirit drinks. The EU accepted this request and, on 7 December 2019, removed the distinction in treatment between red and white Canadian icewine with respect to maximum levels of permitted sulphur dioxide.

Transparency

The European Commission maintains the Access2Markets portal to help businesses make the most of EU trade agreements. The portal includes "My Trade Assistant", a tool that provides, including for alcoholic beverages, product-by-product information on tariffs & taxes, customs procedures, rules of origin and product requirements for all EU countries. It also provides access to the Rules of Origin Self-Assessment tool (ROSA), which offers guidance in simple steps to determine the rules of origin for specific products. Besides, the Commission maintains a detailed list of the excise duty rates applicable to alcoholic beverages in each EU country.

Canadian measures

Repeal of Excise Duty exemption for Canadian wines

The excise duty exemption on Canadian wines was a persistent issue between the Parties. On June 23, 2022, Canada amended the Excise Act, 2001, and repealed the federal excise duty exemption for wine made exclusively from Canadian content, effective as of June 30, 2022.

Ontario - wine taxation in off-site stores

Ontario imposes a Wine Basic Tax (WBT) on all owner-produced wine sold in Winery Retail Stores and on all wine sold in Wine Boutiques that was produced by the owner of the Wine Boutique, as per s.27 of the Liquor Tax Act, 1996. In July 2020, Ontario announced its commitment to phase out the tax difference between Ontario wine and non-Ontario wine sold in off-site winery retail stores, including wine boutiques by 20 July 2023 by introducing legislation in Ontario's Legislative Assembly to eliminate the tax difference and fully supporting its passage.

Ontario – restricted authorizations

In 2016 Ontario announced the creation of beer and wine authorization to allow for those products to be sold in grocery stores. In July 2020, Ontario agreed it would not issue any new restricted beer and wine authorizations under Ontario Regulation 232/16. All restricted beer and wine authorizations authorized under Ontario Regulation 232/16 were converted to unrestricted beer and wine authorizations by August 2020. Ontario's liquor legislation was revised between 2019 and 2021. During that process, grocery store authorizations were converted into grocery store licences under the new Liquor Licence and Control Act, 2019. All grocery licences that permit the sale of wine are unrestricted.

Ontario - bag-in-box products

Ontario continues to expand its assortment of imported bag-in-box products and has recently confirmed that the Liquor Control Board of Ontario will manage bag-in-box products according to its usual methodology as it would for other product formats. This includes delisting under-performing stock keeping units in retail.

Nova Scotia - emerging wine regions policy

Nova Scotia's Emerging Wine Regions Policy (EWRP) applies a reduced mark-up to wines produced in distinct wine making regions (viticultural area) that produce less than 50,000 HL of wine per annum. Nova Scotia is preparing to discontinue the EWRP, with final elimination to be completed no later than June 30, 2024.

British Columbia - access to imported wines on grocery store shelves

In 2015, British Columbia (B.C.) amended its liquor distribution policies to permit the sale of only B.C. wine on grocery store shelves. In 2019, B.C. amended the Liquor Control and Licensing Regulation to eliminate the regulatory measures that only allowed sales of B.C. wine on grocery store shelves. The amendment enables licensees who are permitted to sell wine on grocery store shelves to sell all domestic and imported wine.

Quebec - equivalent markup for small producers in grocery / convenience channel

Bill 88, An Act respecting development of the small-scale alcoholic beverages industry, was adopted by the Québec National Assembly on May 26, 2016, and entered into force on December 14, 2016. With the implementation of this Act, wine sold directly and personally delivered by a small-scale wine producer to the holder of a grocery permit was not subject to the standard Société des Alcools du Québec (SAQ) mark-up. In April 2021, Quebec issued a decree in the Gazette Officielle du Quebec, indicating that it would implement, by December 1, 2023, a charge equivalent to the SAQ mark-up on wines produced by small-scale wine producers and directly delivered to the grocery or convenience store channel.

Transparency

Since the provisional implementation of CETA, Canada and the EU continue to have exchanges on various measures, including, among others, light glass policies, tied houses, tendering processes, beer distribution, and production requirements.

Notwithstanding CETA, Canada is actively working to remove internal trade barriers and increase the transparency of its alcohol system. One way it is doing this is through the Trade in Alcoholic Beverages Working Group, established under the Canadian Free Trade Agreement (CFTA). In that context, in 2020, Canada designed and published a new website (alcohollaws.ca) to help alcohol manufacturers, agents, and other related businesses find regulatory information related to Canadian alcohol retail and distribution systems. That website is jointly maintained by the provincial, territorial and federal governments of Canada to improve transparency and helps businesses, including from the EU, better understand how to sell their alcoholic beverage products in multiple Canadian jurisdictions.

Cost of services differentials

In 2018, Canada phased in new disciplines introduced by CETA on cost of services differentials (COSD). Specifically, the Société des Alcools du Québec (SAQ) removed the ad-valorem component of cost-of-service fees, and the Liquor Control Board of Ontario (LCBO) replaced the ad valorem COSD by a volume-based COSD.

On 7 November 2018, the EU requested Canada to carry out new audits on the COSD rates applied to EU wines in Ontario and Quebec by the end 2019. Canada provided a copy of the audit reports to the EU in February 2020 and December 2019, respectively. In an effort to improve transparency in this area, the SAQ provided an overview of the general principles of the cost-of-service audits in March 2019, and the Ontario report was accompanied by a non-confidential summary. Between 2015-2019, audit results reflected a decrease in the costs of service associated with the marketing of EU alcoholic beverages in those two provinces, taking into account additional costs resulting from, inter alia, delivery methods and frequency. In 2021, Ontario and Quebec updated the cost-of-service differential rates to reflect those results.

Importation of Intoxicating Liquors Act and personal exemption limits

In Canada, the importation of and inter-provincial/territorial trade in alcoholic beverages is governed by the federal Importation of Intoxicating Liquors Act (IILA). The objective of the IILA relates to the control of the consumption of alcoholic beverages in Canada for the purpose of protecting public health and morals. The IILA provides the provinces and territories, within their respective jurisdictions, with control over the sale of intoxicating liquor, and over the importation. The provinces and territories have delegated this activity to the provincial/territorial liquor control authorities. In 2019, the IILA was amended to remove all remaining federal barriers to interprovincial trade of alcohol and permit direct-to-consumer shipping of alcohol across provincial borders to the extent that the receiving province also permits such transactions.

Additionally, many Canadian Provinces have moved to increase or eliminate personal exemption limits for consumers moving alcohol (for personal consumption) inter-provincially, a benefit not only to Canadian producers, but also to EU producers who sell into the Canadian market. To date, the provinces of Alberta, British Columbia, Manitoba, Nova Scotia, Ontario, Prince Edward Island, Quebec, and Saskatchewan, have undertaken the regulatory amendments required to eliminate their personal exemption limits, and the province of Newfoundland and Labrador has increased its limits. Additionally, The Legislative Assembly of the Government of the Northwest Territories is in final consideration of Bill 53 that includes provisions for increasing personal exemption limits.

Geographical Indications

Since the entry into force of CETA in 2017, four additional EU wine geographical indications (GIs) and one EU spirit GI have been successfully registered with the Canadian Intellectual Property Office (CIPO). Canada encourages more EU wines and spirits GI stakeholders to request protection for their GIs with CIPO. Canada and the EU have held in-depth exchanges on the provisions of the 2003 Agreement, related to the protection of GIs as they pertain to wine and distilled spirits. In 2019 and 2020, Canada held meetings with several EU Member States to explain the Canadian GI system and its enforcement mechanisms to EU stakeholders. The Parties discussed cases of alleged breaches of protected geographical indications in Canada. The Parties noted positive outcomes on certain individual cases, with the EU stressing what in their view are remaining challenges on the enforcement and protection of GIs, and Canada stressing that EU GI right holders must take proactive action to assert their rights in the Canadian marketplace.

Ongoing work

Looking ahead, the Parties will continue to follow the implementation of the commitments described in the section "Progress made in the CETA Committee on Wines and Spirits". This will include preparatory works for the envisaged update of annexes to the 2003 agreement.

Moreover, recognising the success of the provisional application of CETA and the work of the Committee over the last five years, the Parties reaffirm their intent to discuss and address ongoing concerns, as they arise, through the Committee. Canada has noted remaining concerns from the EU notably regarding differential taxes and mark ups giving preference to local producers or measures that allow for direct delivery exclusively by local producers. The EU perceives that certain measures are at odds with the letter and spirit of the CETA. For its part, the EU has noted Canada's concerns over specific examples of differing labelling requirements across EU Member States, including health warnings, environmental and green initiatives, as well as nutritional and energy labelling for wines and spirits. The Parties will continue to exchange information on developments and seek mutually agreed solutions on the Parties' remaining concerns, which the Committee should address as a matter of priority. This is without prejudice to the Parties' right to take action in response to CETA-incompatible measures, including under the applicable dispute resolution arrangements.

In that context, the Parties will pay particular attention to the work of the Alcoholic Beverages Working Group under the Canadian Free Trade Agreement. The working group was tasked with identifying specific opportunities and recommendations to further enhance trade in alcoholic beverages within Canada, while being mindful of social responsibility and international trade obligations. Within the working group, several Canadian jurisdictions have formed a taskforce and are assessing implementation options and issues for a direct-to-consumer (DTC) model. Canada has noted the EU's call to all Provinces and Territories to take this opportunity to ensure full compliance with Canada's international obligations and, in particular, to align their approaches to the National Treatment principle.

The Parties will also continue their exchanges on the provisions of the agreement regarding the protection of wine and spirits geographical indications, with a view notably to provide additional clarity and information to facilitate stakeholders' understanding of GI rights in the Canadian marketplace.

Finally, at the end of the fifth year following the publication of this Joint Progress Report, the Parties agree to review once more the progress achieved by the Committee towards addressing issues of concern, including the consequences of any granting to third countries of more favourable treatment in the framework of other trade negotiations.

- Date modified: