How the CPTPP can help your business grow in the Indo-Pacific

A high-standard free trade agreement

The Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP) offers Canadian businesses a number of advantages to help them compete in the -Pacific region.

The CPTPP creates a trading bloc of 11 countries that together represent 15.6% of global GDP and over 580 million consumers. It’s an ambitious and high-standard free trade agreement that strengthens the rules-based international trading system.

To learn more about the resources and tools that will help your business to benefit from the CPTPP, visit Canada.ca/CPTPP.

Alternative text

Bracket groupings:

- Active explanatory discussions: ASEAN†, China

- Negotiations commenced: Ongoing negotiations**, India, MERCOSUR

- Existing FTA’s: United States, Mexico, Korea, CETA, Other existing free trade agreements**

Source information:

- * World GDP excluding Canada

- ** Other existing free trade agreements: Chile, Colombia, Costa Rica, Honduras, Israel, Jordan, Panama, Peru, Ukraine, European Free Trade Association (EFTA); Other (negotiations commenced): CARICOM, Dominican Republic, El Salvador, Guatemala, Nicaragua, Morocco.

- † Excluding existing FTA partners

- †† No free trade agreements or FTA initiatives

- Data: IMF World Economic Outlook

- Source: Office of the Chief Economist, Global Affairs Canada

- Effective April 9, 2019

Exporting goods under the CPTPP

With the CPTPP now in force in Canada, tariffs on 99% of all tariff lines covering 98% of Canada’s current exports to CPTPP markets will be fully eliminated or drop through a series of scheduled tariff cuts. This makes Canadian exports more competitive than those from countries that do not have free trade agreements with CPTPP countries, including the United States.

The CPTPP has now entered into force for all eleven original signatories. The United Kingdom is the first country to accede to the CPTPP, and the only economy with whom an accession process has been commenced and concluded. The U.K. became a signatory to the CPTPP and the 12th member of the Agreement on July 16, 2023; once the CPTPP enters into force for the U.K., it will become a Party to the Agreement. For the Agreement to enter into force for the U.K., all members must ratify the United Kingdom accession protocol. If all members do not ratify within the first fifteen months from signature, the Agreement will enter into force for the U.K. once six members and the U.K. ratify.

Alternative text

Bracket groupings:

- Active explanatory discussions: ASEAN†, China

- Negotiations commenced: Ongoing negotiations**, India, MERCOSUR

- Existing FTA’s: United States, Mexico, Korea, CETA, Other existing free trade agreements**

- Concluded negotiations: CPTPP†

Source information:

- ** Other existing free trade agreements: Chile, Colombia, Costa Rica, Honduras, Israel, Jordan, Panama, Peru, Ukraine, European Free Trade Association (EFTA); Other (negotiations commenced): CARICOM, Dominican Republic, El Salvador, Guatemala, Nicaragua, Morocco.

- † Excluding existing FTA partners

- †† No free trade agreements or FTA initiatives

- Data: IMF World Economic Outlook

- Source: Office of the Chief Economist, Global Affairs Canada

- Effective April 9, 2019

Does your product benefit from tariff reduction or elimination?

Use your product’s Harmonised System (HS) code to find out if it benefits from preferential tariff treatment.

- Use the Canada Tariff Finder to see what tariffs apply to your products.

- Learn about tariff elimination for each CPTPP country.

Unsure what tariffs correspond to the HS codes of your specific goods? Producers, importers or exporters can request an advance ruling from the customs authorities of an importing CPTPP country to obtain a binding decision on the tariff classification of a good. These rulings are valid for a minimum of three years.

Does your product meet the applicable rule of origin?

To qualify for preferential tariff treatment, your product must meet the CPTPP rules of origin. These vary by product.

- In general, there are three types of originating goods:

- Wholly obtained (made from material sourced entirely from Canada)

- All originating materials (assembled from material sourced from countries where the CPTPP has entered into force)

- Goods containing ingredients/components from other countries that meet the CPTPP’s product-specific rules of origin

You can also obtain an advance ruling to ensure that your product satisfies the rules of origin of the importing CPTPP country.

How do I obtain an advance ruling?

Each CPTPP country has its own procedure to apply for an advance ruling. The Trade Commissioner Service recommends that any business looking to export to foreign markets should consult the country’s official customs websites. These resources provide general information on import procedures, acquiring advance rulings on origin, and advance rulings on tariff classification.

Please note that these websites are neither owned nor controlled by the Government of Canada and may therefore only be available in English and/or the local official language of the CPTPP partner country.

Please also note that these countries have all signed the Agreement, but have not all ratified it.

How do I claim origin?

Remember! Preferential tariffs do not automatically apply to a shipment of goods. The importer must claim preferential tariff treatment for the good to benefit from CPTPP tariff elimination or reduction. This requires a completed certification of origin.

Under the CPTPP, a producer, exporter or importer may complete the certification of origin. There is no template for the CPTPP certification of origin. As long as you provide certification that satisfies the minimum data requirements, you may submit the certification electronically. It will remain valid for up to 12 months.

You must indicate who is certifying the product from the following list. Once the certifier has been identified, you must provide their name, address (including country), telephone number, and e-mail address.

- Exporter

- Producer

- Importer

You must also provide other information such as:

- Description and HS Tariff Classification of the Good

- Origin Criterion

- Blanket Period of validity of up to 12 months (for multiple shipments of identical goods)

- Authorised Signature and Date

To ensure you are sufficiently meeting these minimum data requirements and aware of all exceptions, please consult Article 3 Section B, Annex 3-B, of the CPTPP agreement.

The Trade Commissioner Service works closely with other governmental departments and organizations with the common interest of helping Canadian businesses reach new markets. If you are interested in pursuing new opportunities in the Asia Pacific, make sure to review these resources:

- Trade Commissioner Service (TCS) Resources:

- Export Development Canada (EDC) Resources:

- Business Development Canada (BDC) Resources:

- Innovation, Science and Economic Development (ISED) Resources:

- Innovation, Science and Economic Development Canada

- International trade and investment – tools for exporting, importing and investing

- Investing abroad

- Canadian Border Services Agency (CBSA) Resources:

- Canadian Border Services Agency Import and Export

- Exporting goods from Canada: A handy guide

- Step-by-step guide to importing commercial goods into Canada

- Agriculture and Agri-Food Canada (AAFC) Resources:

Cross-border trade in services

The CPTPP secures enhanced market access, predictability and transparency for Canadian service suppliers in the dynamic CPTPP region.

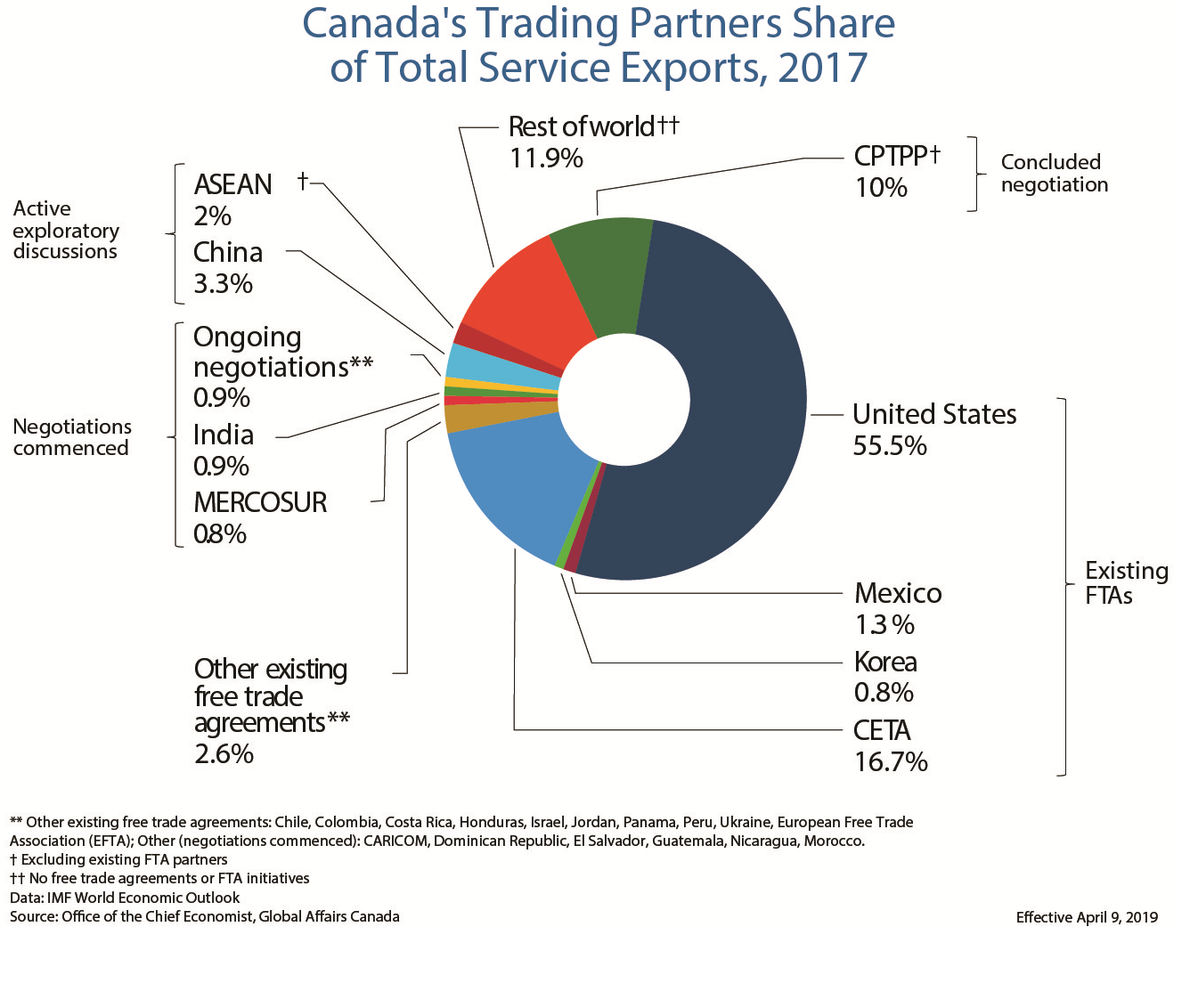

Alternative text

Bracket groupings:

- Active explanatory discussions: ASEAN†, China

- Negotiations commenced: Ongoing negotiations**, India, MERCOSUR

- Existing FTA’s: United States, Mexico, Korea, CETA, Other existing free trade agreements**

- Concluded negotiations: CPTPP†

Source information:

- ** Other existing free trade agreements: Chile, Colombia, Costa Rica, Honduras, Israel, Jordan, Panama, Peru, Ukraine, European Free Trade Association (EFTA); Other (negotiations commenced): CARICOM, Dominican Republic, El Salvador, Guatemala, Nicaragua, Morocco.

- † Excluding existing FTA partners

- †† No free trade agreements or FTA initiatives

- Data: IMF World Economic Outlook

- Source: Office of the Chief Economist, Global Affairs Canada

- Effective April 9, 2019

Core obligations of CPTPP countries on cross-border trade in services

Under the CPTPP, your company may benefit from commitments made by the governments of CPTPP countries that ensure transparent and stable business environments within the countries:

- Most-favoured nation (MFN) treatment:

- You can operate in CPTPP countries knowing that the partner governments will provide you with the same treatment as other foreign competitors.

- Market access:

- You will not face quantitative restrictions on the supply of your services or on the types of legal entity or joint venture through which you may provide a service.

- National treatment:

- You can operate under the same rules as domestic competitors.

- Local presence:

- A partner government will not require you to establish or maintain a representative office or any form of enterprise, or to be resident, in its territory.

You will need to refer to each country’s unique schedule of reservations (see Annex I and Annex II of the Agreement) to determine if any country-specific limitations apply.

- In Annex I, each CPTPP country lists its non-conforming measures (i.e. local laws and regulations) affecting services and investment that existed at the time the CPTPP was concluded and that the country intends to maintain. These measures do not need to be changed even if they are inconsistent with certain obligations in the Agreement. CPTPP countries also committed to ensuring that the non-conforming measures listed in Annex I would not become more restrictive in the future.

- In Annex II, each CPTPP country describes reservations for sectors or activities where it wishes to retain complete policy flexibility, now and in the future. These reservations allow CPTPP countries to introduce new measures in these areas based on domestic priorities, and exempt them from certain CPTPP obligations.

What services are covered under the CPTPP?

Service commitments vary by CPTPP country. Canadian companies benefit from improved transparency and predictability in these markets, specifically in sectors such as:

Alternative text

- Professional Services (e.g., accounting, architectural, legal, engineering):

- Australia, Brunei, Chile, Japan, Malaysia, Mexico, New Zealand, Peru, Singapore, Vietnam

- Computer-related services:

- Australia, Chile, Malaysia, Mexico

- Research and development services:

- Brunei, Chile, Japan, Malaysia, Singapore

- Construction services:

- Mexico, New Zealand, Vietnam

- Education services:

- New Zealand, Singapore

- Environmental services:

- Australia, Brunei, Japan, Malaysia, Mexico, New Zealand Peru, Vietnam

- Mining-related services:

- Australia, Brunei, Chile, Malaysia, Mexico, Singapore

- Energy-distribution services:

- Brunei, Japan

- Transportation services:

- Brunei, Chile, Japan, New Zealand, Peru, Singapore, Vietnam

Financial services

For Canadian financial services institutions, the CPTPP provides legal certainty and locks-in current levels of market access in all CPTPP countries. The most important outcomes for these institutions include transparency, protection against discriminatory regulatory treatment, and protection of investments. Under the CPTPP, financial institutions can:

- manage funds on behalf of foreign clients

- process their information in Canada or at regional hubs

- benefit from a level playing field with postal entities

- assure their clients that electronic payment services will operate across borders

Note: Under the CPTPP, the ability for financial institutions to initiate an Investor-State dispute settlement claim has been suspended. These claims can still be brought forward via a state-to-state dispute settlement mechanism

Exceptions for financial services covered under the CPTPP are largely contained in Annex III.

Investment

Canadian investors seeking new opportunities in CPTPP markets abroad benefit directly from the CPTPP Investment Chapter, which establishes a framework of transparent rules designed to reduce risk.

Core obligations on investment under the CPTPP

Subject to exceptions, the CPTPP contains several core obligations that protect investors in foreign markets.

These include:

- National treatment:

- You can operate under the same rules as domestic competitors.

- Most-favoured nation (MFN):

- You can operate in CPTPP countries knowing that the partner governments will provide you with the same treatment as other foreign competitors.

- Expropriation:

- Your investments will not be expropriated or nationalized, except if done for a public purpose and accompanied by adequate compensation.

- Transfers:

- You will not be prohibited from the free transfer of capital and profits in or out of CPTPP countries, with some exceptions (e.g., during a financial crisis).

- Performance requirements:

- You will not be subject to specific conditions that otherwise restrict your operations. (e.g. buy local requirements).

- Minimum standard of treatment (MST):

- You will be provided a baseline of treatment founded in customary international law.

Exceptions

There are reservations and exceptions in the CPTPP Investment Chapter to give CPTPP countries flexibility. These exceptions are found in the same Annexes I and II as those restricting Cross-Border Trade in Services.

- Annex I provides a list of existing measures that do not comply with certain CPTPP investment obligations.

- Annex II provides a list of future areas and sectors that will be exempt from specific CPTPP obligations.

Investor-State dispute settlement

If you believe a CPTPP government discriminated against you or your investments, the Agreement provides for an ad hoc dispute resolution mechanism. If an investment dispute is not resolved within six months of a written request for consultations, you may submit the case to arbitration.

Temporary entry of business persons

In an increasingly integrated global economy, it is important for business persons to be able to cross borders to facilitate trade in goods and services as well as investment and government procurement. There is no substitute for being on-site where clients and operations are located.

The temporary entry obligations in the CPTPP are intended to reduce border-crossing delays, thereby facilitating the entry of certain types of business persons.

Temporary entry commitments apply exclusively to obtaining the necessary work authorization in a CPTPP country. Any formalities related to immigration, such as needing a visa or proof of local licensing and qualifications, still apply.

Business persons may face obstacles at the border that affect their ability to enter overseas markets. The CPTPP commitments ensure that, for certain types of business persons, the following barriers are not applied:

- economic needs tests, used to limit entry when a local supplier is available to do the job

- quotas, such as restrictions on the number of foreign nationals permitted to enter a market

- proportionality requirements, such as restrictions that limit the percentage of foreign nationals permitted to work within an organization.

While the specific coverage varies by CPTPP country, commonly covered categories include:

- business visitors

- investors

- intra-corporate transferees

- professionals and technicians

In addition, certain CPTPP countries, including Canada provide coverage that extends temporary entry privileges (including the right to work) to spouses of certain covered business persons. Recognizing that many households rely on two incomes, these commitments help business persons and their families temporarily relocate to these countries.

Government procurement

Government procurement refers to the purchase by governments of a wide range of goods and services. This includes anything from office supplies to services for large construction projects.

The CPTPP Government Procurement Chapter sets out common rules and procedures regarding covered government procurement activities, which reflect the principles of non-discrimination, transparency, impartiality and fairness. This chapter also provides guaranteed access to covered contracts for goods, services and construction services in CPTPP countries for Canadian suppliers, as well as access to bid challenge mechanisms in the case of suspected violations of the obligations contained in the chapter.

Increased opportunities

The CPTPP creates greater access to procurement opportunities for Canadian suppliers:

- Vietnam & Malaysia:

- First ever access to procurement opportunities as foreign suppliers

- Australia & Brunei:

- New guaranteed access to procurement opportunities

- Peru & Chile:

- New access to existing partners’ sub-central procurement opportunities

Taking advantage of opportunities

CPTPP partner countries have committed to make information on government procurement opportunities readily available to the public through paper or electronic means. Opportunities will be published in the Government Procurement Chapter annex for each country. CPTPP parties have also committed to indicate in tender documentation whether a given procurement opportunity is covered under the CPTPP.

The CPTPP Government Procurement Chapter does not automatically apply to all procurement activities of CPTPP countries. Coverage varies by country and is specified in each country’s annex to the chapter.

In order to be covered, a procurement must:

- Be undertaken by a covered entity:

- central

- sub-central level

- other (e.g. Crown corporations)

- Involve covered:

- goods

- services

- construction services

- Not be subject to any of the listed exceptions, such as:

- certain defence procurement contracts

- contracts related to cultural industries

- contracts that are set-asides for Aboriginal businesses

Do you want to learn more about doing business in CPTPP markets?

The Trade Commissioner Service (TCS) has programs and services to help you pursue new opportunities abroad, including with CPTPP countries.

Free of charge, the TCS can:

- Match your business with potential foreign partners

- help you pursue partnerships and commercialization opportunities in new markets

- offer financial support through programs such as CanExport

- provide practical advice to help you do business abroad

The TCS has trade offices located across Canada and in 161 locations around the world, including in all 10 of Canada’s CPTPP partner countries.

Contact a Canadian trade commissioner today and start growing your business in the CPTPP region.

Useful contacts

| Temporary Entry for Business People | enquiry-demande.TE@international.gc.ca |

| Free Trade Agreement Promotion | FTA-ALE@international.gc.ca |

| Agriculture and Agri-food Tariff Rate Quotas (TRQ) and Safeguards | aafc.mas-sam.aac@canada.ca |

- Date modified: