What does the CPTPP mean for industrial goods?

Summary/overview

- Under the CPTPP, all countries will eliminate their remaining tariffs on industrial goods.

Tariff elimination

Tariff elimination on industrial goods will be wide-ranging, covering a variety of key Canadian export sectors, including:

- metals and minerals (including iron and steel, aluminium, nickel and petroleum products);

- chemicals and plastics (including ethylene polymers, plastic bags, plastic tubes, pipes and hoses, plastic plates and sheets, and sodium chlorate);

- information and communications technology;

- aerospace;

- life sciences (such as medical devices and pharmaceuticals products);

- industrial machinery;

- agricultural equipment;

- construction equipment; and

- cosmetic and hygiene products.

How the CPTPP benefits exporters

By removing tariffs, the CPTPP will create new export opportunities for Canadian businesses to key markets such as Japan, Malaysia and Vietnam, allowing Canadian businesses to capitalize on growing demand in the region.

More coherent technical requirements will make it easier for Canadian producers in all manufacturing sectors to trade across borders. The CPTPP Technical Barriers to Trade (TBT) chapter complements the elimination and ambitious reduction of tariffs, to create a more predictable trading environment for partners in the CPTPP. It will give manufacturers and exporters a leg-up in prospective markets. Minimizing the impact of technical barriers will help maximize market access for Canadian exports.

Annexes to the TBT chapter of the agreement deal with specific challenges that face Canadian exporters of pharmaceuticals, medical devices, cosmetics, and information and communications technology products. The provisions contained in these annexes will help to streamline regulatory approvals, make the regulations more clear and enhance proprietary protection.

By generating opportunities for Canadian industrial goods exports, the CPTPP will bring benefits for both Canadian businesses and workers.

Trade snapshot

Key facts and figures

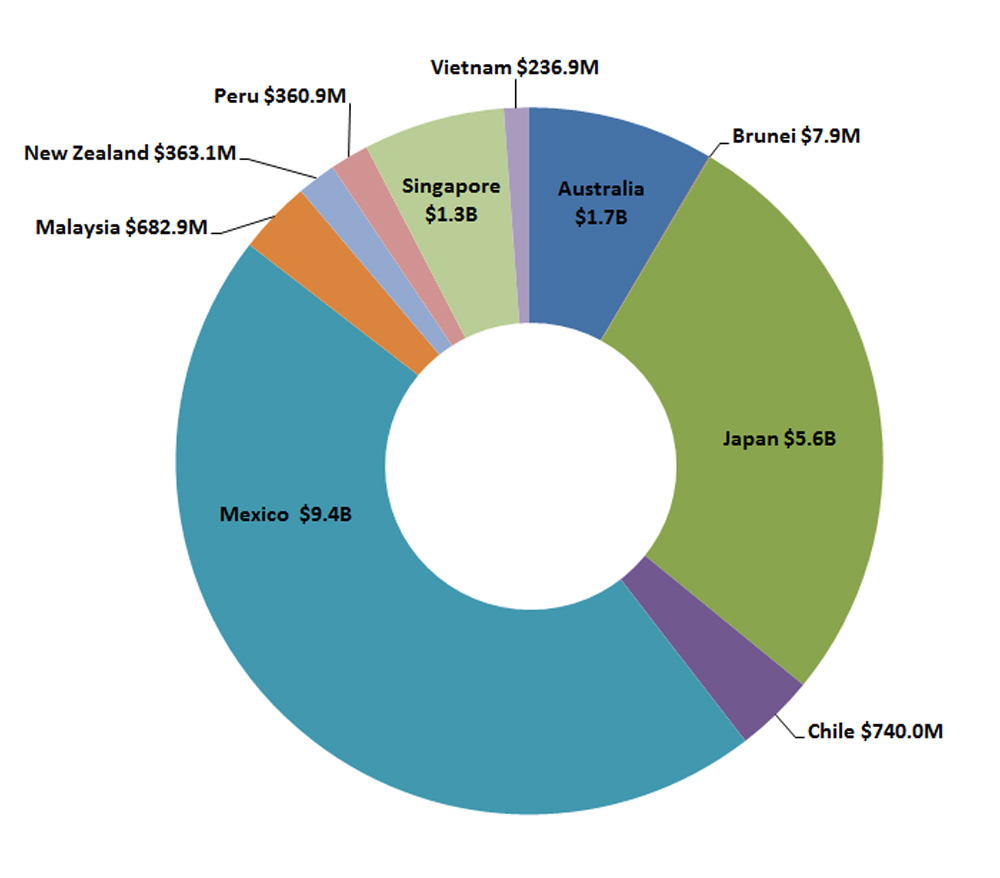

- From 2014 to 2016, Canadian exports of industrial goods to CPTPP countries were worth, on average, $20.4 billion per year.

Annual Canadian Industrial Goods Exports to CPTPP Countries

(2014-16 average in $CAD)

Text version

| Partner Countries | 2014-16 average ($CAD) |

|---|---|

| CPTPP-11 (minus Canada) | $20,366,922,099 |

| Australia | $1,729,666,914 |

| Brunei Darussalam | $7,922,758 |

| Chile | $739,956,559 |

| Japan | $5,576,338,364 |

| Malaysia | $682,870,781 |

| Mexico | $9,353,974,199 |

| New Zealand | $363,060,451 |

| Peru | $360,877,162 |

| Singapore | $1,315,332,758 |

| Vietnam | $236,922,153 |

Trade Snapshot: Metals and Minerals

Key facts and figures

- From 2014 to 2016, Canada’s exports of metals and minerals to CPTPP countries were worth, on average, $6.8 billion per year.

- Japan is a key market for Canadian metals and minerals, being the fourth largest importer from 2014 to 2016, importing an annual average of $3.1 billion.

- Canadian exports in this sector included petroleum products, potash, and precious metals - such as gold and silver - as well as other metals such as iron and steel, aluminum and nickel.

- In 2016, the metals and minerals sector contributed to 596,000 jobs (direct and indirect) across Canada, with two-thirds of employment concentrated in Ontario and Québec.

Tariff elimination

Metals and minerals exports currently face tariffs in a number of CPTPP markets, including Australia (up to 5%), Japan (up to 11.7%), Malaysia (up to 50%), New Zealand (up to 10%) and Vietnam (up to 40%). These tariffs will be fully eliminated under the CPTPP.

Below are some examples of Canadian metals and minerals products that will gain duty-free access under the CPTPP.

| Country | Current Maximum MFN Tariff Rate | Length of Tariff Phase-out |

|---|---|---|

| Iron and steel products | ||

| Australia | 5% | 4 years |

| Japan | 6.3% | 10 years |

| Malaysia | 20% | 10 years |

| Vietnam | 40% | 10 years |

| Aluminium products | ||

| Australia | 5% | Duty-free upon entry into force |

| Japan | 7.5% | Duty-free upon entry into force |

| Malaysia | 30% | 10 years |

| Vietnam | 27% | 3 years |

| Nickel products | ||

| Japan | 11.7% | 10 years |

| Petroleum products | ||

| Japan | 7.9% | 10 years |

| Vietnam | 30% | 10 years |

*Most Favoured Nation

Trade Snapshot: Chemicals and Plastics

Key facts and figures

- From 2014 to 2016, Canada’s exports of chemicals and plastics to CPTPP countries were worth, on average, $1 billion annually.

- Japan and Australia are key markets for Canada’s producers of chemical and plastic products.

- From 2014 to 2016, Japan imported an annual average of $175 million from Canada, while Australia imported an annual average of $118 million.

- The CPTPP Agreement will provide Canada’s chemical and plastic industry with the opportunity to maintain and grow market share in these markets and to expand in new markets such as Malaysia and Vietnam, which together imported over $65 million per year, on average, from 2014 to 2016.

- In 2016, the chemicals industry contributed close to 88,000 jobs across Canada, while the plastics industry contributed over 90,000 jobs. Employment in these sectors is concentrated in Ontario, Alberta, and Québec.

Tariff elimination

Chemicals and plastics exports currently face tariffs imposed by certain CPTPP countries, including Australia (up to 10%), Japan (up to 6.5%), Malaysia (up to 50%), New Zealand (up to 10%) and Vietnam (up to 31%). These tariffs will all be eliminated under the CPTPP.

Below are some examples of Canadian chemicals and plastics products that will gain duty-free access under the CPTPP.

| Country | Current Maximum MFN* Tariff Rate | Length of Tariff Phase-out |

|---|---|---|

| Ethylene polymers | ||

| Japan | 6.5% | Duty-free upon entry into force |

| Malaysia | 15% | 5 years |

| Plastic tubes, pipes, and hoses | ||

| Japan | 4.8% | Duty-free upon entry into force |

| Malaysia | 20% | Duty-free upon entry into force |

| Vietnam | 17% | 3 years |

| Plastic plates and sheets | ||

| Australia | 5% | 4 years |

| Japan | 5.2% | Duty-free upon entry into force |

| Malaysia | 25% | Duty-free upon entry into force |

| New Zealand | 5% | 7 years |

| Vietnam | 17% | 3 years |

| Sodium chlorate | ||

| Japan | 3.3% | Duty-free upon entry into force |

*Most Favoured Nation

Trade snapshot: Information and communications technology

Key facts and figures

- From 2014 to 2016, Canada’s exports of information and communications technology (ICT) to CPTPP countries averaged $1.8 billion annually.

- Roughly 80% of ICT products manufactured in Canada were exported in 2016, with over 10% destined for Asia-Pacific markets.

- Japan, Australia and Malaysia are key markets for Canada’s ICT exporters, together importing an annual average of nearly $450 million from 2014 to 2016. Canada’s industry is well positioned under the CPTPP to meet growing needs in these markets.

- In 2016, the ICT sector contributed 35,000 jobs to the economy in major urban centres across Canada, including Toronto, Montréal, Vancouver, Ottawa, Waterloo, Calgary, Edmonton and Québec.

Tariff elimination

With the exception of Brunei, Chile, and Mexico, CPTPP member countries are part of the Information Technology Agreement (ITA) under the World Trade Organization, and therefore, have already eliminated tariffs on many ICT products.

The CPTPP will widen the scope of ICT products benefiting from duty-free market access across all CPTPP countries.

Below are some examples of Canadian ICT products that will gain duty-free access under the CPTPP.

| Country | Current maximum MFN tariff rate | Length of tariff phase-out |

|---|---|---|

| Certain types of headphones, loudspeakers and microphones | ||

| Australia | 5% | Duty-free upon entry into force |

| Brunei | 5% | 7 years |

| Malaysia | 15% | Duty-free upon entry into force |

| New Zealand | 5% | 7 years |

| Vietnam | 24% | 3 years |

| Certain types of monitors and projectors | ||

| Malaysia | 30% | 2 years |

| Vietnam | 37% | 3 years |

*Most favoured nation

In addition, the ICT annex to the Technical Barriers to Trade chapter addresses particular challenges faced by Canadian exporters. Specifically, CPTPP Parties are prevented from requiring ICT product manufacturers to transfer or provide access to their proprietary information for cryptographic technology as they seek approval to sell in CPTPP markets.

Trade snapshot: Aerospace

Key facts and figures

- From 2014 to 2016, Canada’s aerospace exports to CPTPP markets were worth an average of $1 billion annually.

- In 2016, the aerospace industry contributed to close to 208,000 jobs (direct, indirect and induced) across Canada:

- Among manufacturing jobs, 25% were in Ontario, 55% in Quebec, 15% in Western Canada and 5% in Atlantic Canada.

- Among aerospace maintenance, repair and overhaul jobs, 24% were in Ontario, 18% in Québec, 44% in Western Canada and 14% in Atlantic Canada.

Tariff elimination

Below are some examples of Canadian aerospace products that will gain duty-free access under the CPTPP.

| Country | Current maximum MFN* tariff rate | Length of tariff phase-out |

|---|---|---|

| Aircraft engine parts | ||

| Australia | 5% | Duty-free upon entry into force |

| Aircraft seats | ||

| New Zealand | 5% | Duty-free upon entry into force |

* Most favoured nation

In addition, the CPTPP will offer new opportunities for Canada’s aerospace sector by providing greater certainty and predictability for Canadian exports of aerospace-related goods and services, through:

- streamlined customs procedures;

- rules of origin that reflect Canadian production realities and methods;

- clear origin procedures;

- more transparent and predictable cross-border trade in services;

- enhanced temporary entry of business people;

- robust rules promoting non-discrimination, transparency and procedural fairness for government procurement; and

- a framework conducive to investments in the sector, among others.

Trade snapshot: Life sciences

Key facts and figures

- From 2014 to 2016, Canada’s exports of life sciences products (medical devices and pharmaceuticals products) to CPTPP countries were worth, on average, $1.2 billion per year.

- Japan, Australia and New Zealand are key markets for Canada’s life sciences sector.

- From 2014 to 2016, Japan imported an annual average of $637.9 million in life sciences products.

- Over the same period, Australia and New Zealand together imported an annual average of more than $206 million from Canada.

- In 2016, the life sciences sector contributed about 90,000 jobs across Canada, with the majority of them located in Ontario, Quebec and British Columbia.

Tariff elimination

Exports of life sciences products currently face tariffs imposed by certain CPTPP countries, including Australia (up to 5%), Brunei (up to 20%), Japan (up to 10%), Malaysia (up to 30%), New Zealand (up to 5%) and Vietnam (up to 25%). These tariffs will be fully eliminated under the CPTPP.

Below are some examples of Canadian life sciences products that will gain duty-free access under the CPTPP.

| Country | Current maximum MFN* tariff rate | Length of tariff phase-out |

|---|---|---|

| Medical, surgical, dental or veterinary equipment | ||

| Australia | 5% | Duty-free upon entry into force |

| Medicines in doses for retail sale | ||

| Vietnam | 7% | Duty-free upon entry into force |

| Laboratory machinery for heating, distilling, sterilizing and drying | ||

| Australia | 5% | 3 years |

| New Zealand | 5% | Duty-free upon entry into force |

| Frames and mountings for glasses | ||

| Australia | 5% | Duty-free upon entry into force |

| Japan | 4.7% | Duty-free upon entry into force |

| New Zealand | 5% | Duty-free upon entry into force |

*Most favoured nation

In addition, the Medical Device and Pharmaceutical annexes to the Technical Barriers to Trade chapter address specific challenges faced by exporters by:

- allowing pharmaceutical and medical device companies to better track the marketing authorization process of their products;

- helping ensure timely mitigation measures if a product application is not approved or is deemed deficient; and

- allowing CPTPP parties to make authorization decisions based on clear, established risk-based criteria.

Trade snapshot: Industrial machinery

Key facts and figures

- From 2014 to 2016, Canada’s exports of industrial machinery to CPTPP countries were worth, on average, $1.7 billion annually.

- Japan and Australia are key markets for Canada’s industrial machinery producers, together importing an annual average of more than $330 million from 2014 to 2016.

- In 2016, the industrial machinery sector contributed to over 116,000 jobs across Canada. In total, 45% of machinery jobs were in Ontario, 25% in Quebec, 27% in Western Canada and 2.5% in Atlantic Canada.

Tariff elimination

Industrial machinery exports currently face tariffs imposed by certain CPTPP countries, including Australia (up to 5%), Malaysia (up to 30%), New Zealand (up to 5%) and Vietnam (up to 25%). These tariffs will be fully eliminated under the CPTPP.

Below are some examples of Canadian industrial machinery products that will gain duty-free access under the CPTPP.

| Country | Current maximum MFN* tariff rate | Length of tariff phase-out |

|---|---|---|

| Pumps for liquids | ||

| Australia | 5% | Duty-free upon entry into force |

| Malaysia | 25% | 5 years |

| New Zealand | 5% | Duty-free upon entry into force |

| Vietnam | 24% | 3 years |

| Taps, cocks and valves for pipes and boilers | ||

| Australia | 5% | 3 years |

| Malaysia | 25% | 5 years |

| New Zealand | 5% | 7 years |

| Vietnam | 20% | 3 years |

| Air or vacuum pumps and compressors | ||

| Australia | 5% | 3 years |

| Malaysia | 35% | 5 years |

| New Zealand | 5% | 7 years |

| Vietnam | 31% | 3 years |

| Moulds and machinery for manufacturing rubber or plastics | ||

| Australia | 5% | Duty-free upon entry into force |

| New Zealand | 5% | Duty-free upon entry into force |

* Most favoured nation

Trade Snapshot: Agricultural Equipment

Key facts and figures

- From 2014 to 2016, Canada’s exports of agricultural equipment to CPTPP countries were worth, on average, $169.4 million annually.

- Australia and New Zealand are key markets for Canada’s agricultural equipment.

- Australia was the second largest importer of Canadian agricultural equipment from 2014 to 2016, importing an annual average of $113 million.

- In the same period, New Zealand imported an annual average of $15 million, as the seventh largest importer of Canadian agricultural equipment.

- In 2016, the agricultural equipment sector contributed to over 10,000 jobs across Canada, with 78% of those jobs concentrated in Ontario and Western Canada.

Tariff elimination

Agricultural equipment exports currently face tariffs in a number CPTPP markets, including Australia (up to 5%), Malaysia (up to 30%), New Zealand (up to 5%), and Vietnam (up to 20%). These tariffs will be fully eliminated under the CPTPP.

Below are some examples of Canadian agricultural equipment exports that will gain duty-free access under the CPTPP.

| Country | Current Maximum MFN Tariff Rate | Length of Tariff Phase-out |

|---|---|---|

| Harvesters and mowers | ||

| Australia | 5% | Duty-free upon entry into force |

| Malaysia | 30% | 2 years |

| New Zealand | 5% | Duty-free upon entry into force |

| Vietnam | 5% | 3 years |

| Agricultural machinery | ||

| Australia | 5% | Duty-free upon entry into force |

| Vietnam | 20% | 3 years |

*Most favoured nation

Trade snapshot: Construction equipment

Key facts and figures

- From 2014 to 2016, Canada’s exports of construction equipment to CPTPP countries were worth, on average, $465 million per year.

- Australia, New Zealand and Malaysia are key markets for Canada’s construction equipment products. Together, Australia, New Zealand and Malaysia imported an annual average of $124.6 million from 2014 to 2016.

- In 2016, over 400 companies operated in the construction equipment sector, with 37% based in Ontario, 19% in Quebec, 18% in Alberta and 14% in British Columbia.

Tariff elimination

Construction equipment exports currently face tariffs in a number of CPTPP markets, including Australia (up to 5%), Brunei (up to 20%), Malaysia (up to 30%), New Zealand (up to 5%) and Vietnam (up to 50%). These tariffs will be fully eliminated under the CPTPP.

Below are some examples of Canadian construction equipment products that will gain duty-free access under the CPTPP.

| Country | Current maximum MFN* tariff rate | Length of tariff phase-out |

|---|---|---|

| Parts for construction equipment | ||

| Australia | 5% | Duty-free upon entry into force |

| Brunei | 20% | 7 years |

| Malaysia | 10% | 2 years |

| New Zealand | 5% | Duty-free upon entry into force |

| Vietnam | 10% | Duty-free upon entry into force |

| Lifting, handling, loading or unloading machinery | ||

| Australia | 5% | 4 years |

| Malaysia | 5% | Duty-free upon entry into force |

| New Zealand | 5% | Duty-free upon entry into force |

| Vietnam | 10% | Duty-free upon entry into force |

| Moving, grading and levelling machinery | ||

| Australia | 5% | Duty-free upon entry into force |

| Malaysia | 20% | 5 years |

| New Zealand | 5% | Duty-free upon entry into force |

| Self-propelled bulldozers and other graders | ||

| Australia | 5% | Duty-free upon entry into force |

| Malaysia | 25% | 5 years |

| New Zealand | 5% | 7 years |

| Vietnam | 5% | Duty-free upon entry into force |

* Most favoured nation

Trade Snapshot: Cosmetic and Hygiene Products

Key facts and figures

- From 2014 to 2016, Canada’s exports of cosmetic and hygiene products to CPTPP countries amounted to an average of $104.3 million annually.

- Australia, Japan and Singapore are key markets for Canada’s cosmetic products.

- From 2014 to 2016, Australia imported an annual average of $23 million in Canadian cosmetic products, Japan an average of $21 million, and Singapore an average of $26.3 million.

- In 2015, the cosmetics and hygiene products sector contributed to about 15,900 jobs across Canada, with 40% based in Ontario, 30% in Quebec, and 12% in Western Canada.

Tariff elimination

Canadian cosmetic and hygiene product exports currently face tariffs imposed by certain CPTPP countries, including Australia (up to 5%), Brunei (up to 30%), Japan (up to 5.4%), Malaysia (up to 20%), and New Zealand (up to 5%). These tariffs will be fully eliminated under the CPTPP.

The Cosmetics Annex to the TBT Chapter also addresses specific challenges faced by Canadian exporters, specifically:

- Preventing separate marketing authorization processes for cosmetic products that differ only with respect to shade extensions or fragrance variants; and

- Requiring CPTPP parties to regulate based on the recognition that cosmetic products are generally less of a risk to human health than certain other products, such as medical devices or pharmaceuticals.

Below are some examples of Canadian cosmetic and hygiene products that will gain duty-free access under the CPTPP.

| Country | Current Maximum MFN Tariff Rate | Length of Tariff Phase-out |

|---|---|---|

| Makeup and skincare products | ||

| Australia | 5% | Duty-free upon entry into force |

| Brunei | 5% | 7 years |

| New Zealand | 5% | 2 years |

| Vietnam | 24% | 3 years |

| Shampoos and other hair products | ||

| Australia | 5% | Duty-free upon entry into force |

| New Zealand | 5% | Duty-free upon entry into force |

| Vietnam | 24% | 3 years |

| Soap and other cleansers | ||

| Australia | 5% | Duty-free upon entry into force |

| New Zealand | 5% | 7 years |

| Shaving preparations, deodorants, and other perfumes | ||

| Australia | 5% | Duty-free upon entry into force |

| Japan | 5.4% | Duty-free upon entry into force |

| New Zealand | 5% | Duty-free upon entry into force |

| Vietnam | 30% | 3 years |

* Most favoured nation

- Date modified: