This consolidation is for information purposes only, and should not be relied upon as authoritative. For authoritative texts, please refer to the CUSMA and the Protocol of Amendment.

Canada-United States-Mexico Agreement (CUSMA) – Chapter 22 – State-owned enterprises and designated monopolies

Article 22.1: Definitions

For the purposes of this Chapter:

Arrangement means the Arrangement on Officially Supported Export Credits, developed within the framework of the Organization for Economic Co-operation and Development (OECD), or a successor undertaking, whether developed within or outside of the OECD framework, that has been adopted by at least 12 original WTO Members that were Participants to the Arrangement as of January 1, 1979;

commercial activities means activities that an enterprise undertakes with an orientation toward profit-making Footnote 1 and that result in the production of a good or supply of a service that will be sold to a consumer in the relevant market in quantities and at prices determined by the enterprise; Footnote 2

commercial considerations means price, quality, availability, marketability, transportation, and other terms and conditions of purchase or sale, or other factors that would normally be taken into account in the commercial decisions of a privately owned enterprise in the relevant business or industry;

designate means to establish, name, or authorize a monopoly, or to expand the scope of a monopoly to cover an additional good or service;

designated monopoly means a privately owned monopoly that is designated after the date of entry into force of this Agreement and a government monopoly that a Party designates or has designated;

financial services supplier, financial institution, and financial services have the same meaning as in Article 17.1 (Definitions);

government monopoly means a monopoly that is owned, or controlled through ownership interests, by a Party or by another government monopoly;

independent pension fund means an enterprise that is owned, or controlled through ownership interests, by a Party that:

- (a) is engaged exclusively in the following activities:

- (i) administering or providing a plan for pension, retirement, social security, disability, death, or employee benefits, or any combination thereof solely for the benefit of natural persons who are contributors to such a plan or their beneficiaries, or

- (ii) investing the assets of these plans;

- (b) has a fiduciary duty to the natural persons referred to in subparagraph (a)(i); and

- (c) is not subject to investment direction by the government of the Party; Footnote 3

market means the geographical and commercial market for a good or service;

monopoly means an entity, including a consortium or government agency that, in a relevant market in the territory of a Party, is designated as the sole provider or purchaser of a good or service, but does not include an entity that has been granted an exclusive intellectual property right solely by reason of the grant;

non-commercial assistance Footnote 4 means assistance that is limited to certain enterprises, and:

- (a) “assistance” means the following forms of assistance:

- (i) direct transfers of funds or potential direct transfers of funds or liabilities, such as:

- (A) grants or debt forgiveness,

- (B) loans, loan guarantees, or other types of financing on terms more favorable than those commercially available to that enterprise, or

- (C) equity capital inconsistent with the usual investment practice (including for the provision of risk capital) of private investors,

- (ii) the provision of goods or the supply of services other than general infrastructure, on terms more favorable than those commercially available to the enterprise, or

- (iii) the purchase of goods on terms more favorable than those commercially available to the enterprise;

- (i) direct transfers of funds or potential direct transfers of funds or liabilities, such as:

- (b) “certain enterprises” means an enterprise or industry or group of enterprises or industries;

- (c) “limited to certain enterprises” means that the Party or any of the Party’s state enterprises or state-owned enterprises, or a combination thereof:

- (i) explicitly limits access to the assistance to certain enterprises,

- (ii) provides assistance to a limited number of certain enterprises,

- (iii) provides assistance which is predominantly used by certain enterprises,

- (iv) provides a disproportionately large amount of the assistance to certain enterprises, or

- (v) otherwise favors certain enterprises through the use of its discretion in the provision of assistance;Footnote 5 and

- (d) assistance that falls under Article 22.6.1, Article 22.6.2, or Article 22.6.3 (Non-Commercial Assistance) shall be deemed to be “limited to certain enterprises”;

public service mandate means a government mandate pursuant to which a state-owned enterprise makes available a service, directly or indirectly, to the general public in its territory;Footnote 6

state-owned enterprise means an enterprise that is principally engaged in commercial activities, and in which a Party:

- (a) directly or indirectlyFootnote 7 owns more than 50 percent of the share capital;

- (b) controls, through direct or indirect ownership interests, the exercise of more than 50 percent of the voting rights;

- (c) holds the power to control the enterprise through any other ownership interest, including indirect or minority ownership;Footnote 8 or

- (d) holds the power to appoint a majority of members of the board of directors or any other equivalent management body.

Article 22.2: Scope

1. This Chapter applies to the activities of state-owned enterprises, state enterprises, or designated monopolies of a Party that affect or could affect trade or investment between Parties within the free trade area. This Chapter also applies to the activities of state-owned enterprises of a Party that cause adverse effects in the market of a non-Party as provided in Article 22.7 (Adverse Effects).

2. This Chapter does not apply to:

- (a) the regulatory or supervisory activities, or monetary and related credit policy and exchange rate policy, of a central bank or monetary authority of a Party;

- (b) the regulatory or supervisory activities of a financial regulatory body of a Party, including a non-governmental body, such as a securities or futures exchange or market, clearing agency, or other organization or association, that exercises regulatory or supervisory authority over financial services suppliers; or

- (c) activities undertaken by a Party or one of its state enterprises or state-owned enterprises for the purpose of the resolution of a failing or failed financial institution or any other failing or failed enterprise principally engaged in the supply of financial services.

3. This Chapter does not apply to:

- (a) an independent pension fund of a Party; or

- (b) an enterprise owned or controlled by an independent pension fund of a Party, except:

- (i) Article 22.6.1, Article 22.6.2, Article 22.6.4, and Article 22.6.6 (Non-Commercial Assistance) apply only to a Party’s direct or indirect provision of non-commercial assistance to an enterprise owned or controlled by an independent pension fund, and

- (ii) Article 22.6.1, Article 22.6.2, Article 22.6.4, and Article 22.6.6 (Non-Commercial Assistance) apply only to a Party’s indirect provision of non-commercial assistance through an enterprise owned or controlled by an independent pension fund.

4. This Chapter does not apply to government procurement.

5. Nothing in this Chapter shall be construed to prevent a Party from:

- (a) establishing or maintaining a state enterprise or a state-owned enterprise; or

- (b) designating a monopoly.

6. Article 22.4 (Non-Discriminatory Treatment and Commercial Considerations), Article 22.6 (Non-Commercial Assistance), and Article 22.10 (Transparency) do not apply to a service supplied in the exercise of governmental authority.Footnote 9

7. Article 22.4.l(b), Article 22.4.l(c), Article 22.4.2(b), and Article 22.4.2(c) (Non-Discriminatory Treatment and Commercial Considerations) do not apply to the extent that a Party’s state-owned enterprise or designated monopoly makes purchases and sales of goods or services pursuant to:

- (a) an existing non-conforming measure that the Party maintains, continues, renews or amends in accordance with Article 14.12.1 (Non-Conforming Measures), Article 15.7.1 (Non-Conforming Measures) or Article 17.10.1 (Non-Conforming Measures), as set out in its Schedule to Annex I or in Section A of its Schedule to Annex III; or

- (b) a non-conforming measure that the Party adopts or maintains with respect to sectors, subsectors, or activities in accordance with Article 14.12.2 (Non-Conforming Measures), Article 15.7.2 (Non-Conforming Measures) or Article 17.10.2 (Non-Conforming Measures), as set out in its Schedule to Annex II or in Section B of its Schedule to Annex III.

Article 22.3: Delegated Authority

Consistent with Article 1.4 (Persons Exercising Delegated Governmental Authority), each Party shall ensure that if its state-owned enterprises, state enterprises, or designated monopolies exercise regulatory, administrative, or other governmental authority that the Party has directed or delegated to those entities to carry out, those entities act in a manner that is not inconsistent with that Party’s obligations under this Agreement.Footnote 10

Article 22.4: Non-Discriminatory Treatment and Commercial Considerations

1. Each Party shall ensure that each of its state-owned enterprises, when engaging in commercial activities:

- (a) acts in accordance with commercial considerations in its purchase or sale of a good or service, except to fulfil the terms of its public service mandate that are not inconsistent with subparagraphs (b) or (c)(ii);

- (b) in its purchase of a good or service:

- (i) accords to a good or service supplied by an enterprise of another Party treatment no less favorable than it accords to a like good or a like service supplied by enterprises of the Party, of any other Party or of a non-Party, and

- (ii) accords to a good or service supplied by an enterprise that is a covered investment in the Party's territory treatment no less favorable than it accords to a like good or a like service supplied by enterprises in the relevant market in the Party's territory that are investments of investors of the Party, of another Party or of a non-Party; and

- (c) in its sale of a good or service:

- (i) accords to an enterprise of another Party treatment no less favorable than it accords to enterprises of the Party, of any other Party or of a non-Party, and

- (ii) accords to an enterprise that is a covered investment in the Party’s territory treatment no less favorable than it accords to enterprises in the relevant market in the Party’s territory that are investments of investors of the Party, of another Party or of a non-Party.Footnote 11

2. Each Party shall ensure that each of its designated monopolies:

- (a) acts in accordance with commercial considerations in its purchase or sale of the monopoly good or service in the relevant market, except to fulfil any terms of its designation that are not inconsistent with subparagraphs (b), (c), or (d);

- (b) in its purchase of the monopoly good or service:

- (i) accords to a good or service supplied by an enterprise of another Party treatment no less favorable than it accords to a like good or a like service supplied by enterprises of the Party, of any other Party or of a non-Party, and

- (ii) accords to a good or service supplied by an enterprise that is a covered investment in the Party's territory treatment no less favorable than it accords to a like good or a like service supplied by enterprises in the relevant market in the Party's territory that are investments of investors of the Party, of another Party or of a non-Party; and

- (c) in its sale of the monopoly good or service:

- (i) accords to an enterprise of another Party treatment no less favorable than it accords to enterprises of the Party, of any other Party or of a non-Party, and

- (ii) accords to an enterprise that is a covered investment in the Party's territory treatment no less favorable than it accords to enterprises in the relevant market in the Party's territory that are investments of investors of the Party, of another Party or of a non-Party; and

- (d) does not use its monopoly position to engage in, either directly or indirectly, including through its dealings with its parent, subsidiaries, or other entities the Party or the designated monopoly owns, anticompetitive practices in a non-monopolized market in its territory that negatively affect trade or investment between the Parties.

3. Paragraphs 1(b) and 1(c) and paragraphs 2(b) and 2(c) do not preclude a state-owned enterprise or designated monopoly from:

- (a) purchasing or selling goods or services on different terms or conditions including those relating to price; or

- (b) refusing to purchase or sell goods or services,

provided that this differential treatment or refusal is undertaken in accordance with commercial considerations.

Article 22.5: Courts and Administrative Bodies

1. Each Party shall provide its courts with jurisdiction over civil claims against an enterprise owned or controlled through ownership interests by a foreign government based on a commercial activity carried on in its territory.Footnote 12 This shall not be construed to require a Party to provide jurisdiction over those claims if it does not provide jurisdiction over similar claims against enterprises that are not owned or controlled through ownership interests by a foreign government.

2. Each Party shall ensure that any administrative body that the Party establishes or maintains that regulates a state-owned enterprise exercises its regulatory discretion in an impartial manner with respect to enterprises that it regulates, including enterprises that are not state-owned enterprises.

Article 22.6: Non-Commercial Assistance

1. The following forms of non-commercial assistance, if provided to a state-owned enterprise primarily engaged in the production or sale of goods other than electricity, are prohibited:Footnote 13

- (a) loans or loan guarantees provided by a state enterprise or state-owned enterprise of a Party to an uncreditworthy state-owned enterprise of that Party;Footnote 14

- (b) non-commercial assistance provided by a Party or a state enterprise or state-owned enterprise of a Party to a state-owned enterprise of that Party, in circumstances where the recipient is insolventFootnote 15 or on the brink of insolvency,Footnote 16 without a credible restructuring plan designed to return the state-owned enterprise within a reasonable period of time to long-term viability; or

- (c) conversion by a Party or a state enterprise or state-owned enterprise of a Party of the outstanding debt of a state-owned enterprise of that Party to equity, in circumstances where this would be inconsistent with the usual investment practice of a private investor.Footnote 17

2. No Party shall provide, either directly or indirectly,Footnote 18 non-commercial assistance referred to in paragraphs 1(b) and 1(c).

3. Each Party shall ensure that its state enterprises and state-owned enterprises do not provide, either directly or indirectly, non-commercial assistance referred to in paragraphs 1(a), 1(b), and 1(c).

4. No Party shall causeFootnote 19adverse effects to the interests of another Party through the use of non-commercial assistance that it provides, either directly or indirectly, to its state-owned enterprises with respect to:

- (a) the production and sale of a good by the state-owned enterprise;

- (b) the supply of a service by the state-owned enterprise from the territory of the Party into the territory of another Party; or

- (c) the supply of a service in the territory of another Party through an enterprise that is a covered investment in the territory of that other Party or any other Party.

5. Each Party shall ensure that its state enterprises and state-owned enterprises do not cause adverse effects to the interests of another Party through the use of non-commercial assistance that the state enterprise or state-owned enterprise provides to a state-owned enterprise of the Party with respect to:

- (a) the production and sale of a good by the state-owned enterprise;

- (b) the supply of a service by the state-owned enterprise from the territory of the Party into the territory of another Party; or

- (c) the supply of a service in the territory of another Party through an enterprise that is a covered investment in the territory of that other Party or any other Party.

6. No Party shall cause injury to a domestic industryFootnote 20 of another Party through the use of non-commercial assistance that it provides, either directly or indirectly, to any of its state-owned enterprises that is a covered investment in the territory of that other Party in circumstances in which:

- (a) the non-commercial assistance is provided with respect to the production and sale of a good by the state-owned enterprise in the territory of the other Party; and

- (b) a like good is produced and sold in the territory of the other Party by the domestic industry of that other Party.Footnote 21

7. A service supplied by a state-owned enterprise of a Party within that Party’s territory shall be deemed not to cause adverse effects.Footnote 22

Article 22.7: Adverse Effects

1. For the purposes of Article 22.6.4 and Article 22.6.5 (Non-Commercial Assistance), adverse effects arise if the effect of the non-commercial assistance is:

- (a) that the production and sale of a good by a Party’s state-owned enterprise that has received the non-commercial assistance displaces or impedes from the Party’s market imports of a like good of another Party or sales of a like good produced by an enterprise that is a covered investment in the territory of the Party;

- (b) that the production and sale of a good by a Party’s state-owned enterprise that has received the non-commercial assistance displaces or impedes from:

- (i) the market of another Party sales of a like good produced by an enterprise that is a covered investment in the territory of that other Party, or imports of a like good of any other Party, or

- (ii) the market of a non-Party imports of a like good of another Party;

- (c) a significant price undercutting by a good produced by a Party’s state-owned enterprise that has received the non-commercial assistance and sold by the enterprise in:

- (i) the market of a Party as compared with the price in the same market of imports of a like good of another Party or a like good that is produced by an enterprise that is a covered investment in the territory of the Party, or significant price suppression, price depression or lost sales in the same market, or

- (ii) the market of a non-Party as compared with the price in the same market of imports of a like good of another Party, or significant price suppression, price depression or lost sales in the same market.

- (d) that services supplied by a Party’s state-owned enterprise that has received the non-commercial assistance displace or impede from the market of another Party a like service supplied by a service supplier of that other Party or any other Party; or

- (e) a significant price undercutting by a service supplied in the market of another Party by a Party's state-owned enterprise that has received the non-commercial assistance as compared with the price in the same market of a like service supplied by a service supplier of that other Party or any other Party, or significant price suppression, price depression or lost sales in the same market.Footnote 23

2. For the purposes of paragraphs l(a), l(b), and l (d), the displacing or impeding of a good or service includes a case in which it has been demonstrated that there has been a significant change in relative shares of the market to the disadvantage of the like good or like service. “Significant change in relative shares of the market” includes the following situations:

- (a) there is a significant increase in the market share of the good or service of the Party’s state-owned enterprise;

- (b) the market share of the good or service of the Party’s state-owned enterprise remains constant in circumstances in which, in the absence of the non-commercial assistance, it would have declined significantly; or

- (c) the market share of the good or service of the Party’s state-owned enterprise declines, but at a significantly slower rate than would have been the case in the absence of the non-commercial assistance.

The change must manifest itself over an appropriately representative period sufficient to demonstrate clear trends in the development of the market for the good or service concerned, which, in normal circumstances, is at least one year.

3. For the purposes of paragraphs l(c) and l(e), price undercutting includes a case in which such price undercutting has been demonstrated through a comparison of the prices of the good or service of the state-owned enterprise with the prices of the like good or service.

4. Comparisons of the prices in paragraph 3 must be made at the same level of trade and at comparable times, and due account must be taken for factors affecting price comparability. If a direct comparison of transactions is not possible, the existence of price undercutting may be demonstrated on some other reasonable basis, such as, in the case of goods, a comparison of unit values.

5. Non-commercial assistance that a Party provides before the signing of this Agreement shall be deemed not to cause adverse effects.

Article 22.8: Injury

1. For the purposes of Article 22.6.6 (Non-Commercial Assistance), the term “injury” means material injury to a domestic industry, threat of material injury to a domestic industry, or material retardation of the establishment of such an industry. A determination of material injury shall be based on positive evidence and involve an objective examination of the relevant factors, including the volume of production by the covered investment that has received non-commercial assistance, the effect of that production on prices for like goods produced and sold by the domestic industry, and the effect of that production on the domestic industry producing like goods.Footnote 24

2. With regard to the volume of production by the covered investment that has received non-commercial assistance, consideration shall be given as to whether there has been a significant increase in the volume of production, either in absolute terms or relative to production or consumption in the territory of the Party in which injury is alleged to have occurred. With regard to the effect of the production by the covered investment on prices, consideration shall be given as to whether there has been a significant price undercutting by the goods produced and sold by the covered investment as compared with the price of like goods produced and sold by the domestic industry, or whether the effect of production by the covered investment is otherwise to depress prices to a significant degree or to prevent price increases, which otherwise would have occurred, to a significant degree. No one or several of these factors can necessarily give decisive guidance.

3. The examination of the impact on the domestic industry of the goods produced and sold by the covered investment that received the non-commercial assistance must include an evaluation of all relevant economic factors and indices having a bearing on the state of the industry, such as actual and potential decline in output, sales, market share, profits, productivity, return on investments, or utilization of capacity; factors affecting domestic prices; actual and potential negative effects on cash flow, inventories, employment, wages, growth, ability to raise capital or investments and, in the case of agriculture, whether there has been an increased burden on government support programs. This list is not exhaustive, nor can one or several of these factors necessarily give decisive guidance.

4. It must be demonstrated that the goods produced and sold by the covered investment are, through the effects of the non-commercial assistance, set out in paragraphs 2 and 3, causing injury within the meaning of this Article. The demonstration of a causal relationship between the goods produced and sold by the covered investment and the injury to the domestic industry shall be based on an examination of all relevant evidence. Any known factors other than the goods produced by the covered investment which at the same time are injuring the domestic industry must be examined, and the injuries caused by these other factors must not be attributed to the goods produced and sold by the covered investment that has received non-commercial assistance. Factors that may be relevant in this respect include the volumes and prices of other like goods in the market in question, contraction in demand or changes in the patterns of consumption, and developments in technology and the export performance and productivity of the domestic industry.

5. A determination of a threat of material injury shall be based on facts and not merely on allegation, conjecture or remote possibility and shall be considered with special care. The change in circumstances that would create a situation in which non-commercial assistance to the covered investment would cause injury must be clearly foreseen and imminent. In making a determination regarding the existence of a threat of material injury, there should be consideration of relevant factorsFootnote 25 and of whether the totality of the factors considered lead to the conclusion that further availability of goods produced by the covered investment is imminent and that, unless protective action is taken, material injury would occur.

Article 22.9: Party-Specific Annexes

1. Article 22.4 (Non-Discriminatory Treatment and Commercial Considerations) and Article 22.6 (Non-Commercial Assistance) do not apply with respect to the non-conforming activities of state-owned enterprises or designated monopolies that a Party lists in its Schedule to Annex IV in accordance with the terms of the Party’s Schedule.

2. Article 22.4 (Non-Discriminatory Treatment and Commercial Considerations), Article 22.5 (Courts and Administrative Bodies), Article 22.6 (Non-Commercial Assistance), and Article 22.10 (Transparency) do not apply to a Party’s state-owned enterprises or designated monopolies as set out in Annex 22-D (Application to Sub-Central State-Owned Enterprises and Designated Monopolies).

Article 22.10: Transparency

1. Each Party shall provide to the other Parties or publish on an official website a list of its state-owned enterprises no later than six months after the date of entry into force of this Agreement, and thereafter shall update the list annually.

2. Each Party shall promptly notify the other Parties or publish on an official website the designation of a monopoly or expansion of the scope of an existing monopoly and the terms of its designation.

3. On the written request of another Party, a Party shall promptly provide the following information in writing concerning a state-owned enterprise or a government monopoly, provided that the request includes a reasoned explanation of how the activites of the entity affect or could affect trade or investment between the Parties:

- (a) the percentage of shares that the Party, its state enterprises, state-owned enterprises, or designated monopolies cumulatively own, and the percentage of votes that they cumulatively hold, in the entity;

- (b) a description of any special shares or special voting or other rights that the Party, its state enterprises, state-owned enterprises, or designated monopolies hold, to the extent these rights are different from the rights attached to the general common shares of the entity;

- (c) the government titles of any government official serving as an officer or member of the entity’s board of directors;

- (d) the entity’s annual revenue and total assets over the most recent three year period for which information is available;

- (e) any exemptions and immunities from which the entity benefits under the Party’s law; and

- (f) any additional information regarding the entity that is publicly available, including annual financial reports and third-party audits, and that is sought in the written request.

4. On the written request of another Party, a Party shall promptly provide, in writing, information regarding any policy or program that the Party has adopted or maintains that provides for the provision of either non-commercial assistance or any equity capital (regardless of whether the equity infusion also constitutes non-commercial assistance) to its state-owned enterprises.

5. When a Party provides a response pursuant to paragraph 4, the information it provides must be sufficiently specific to enable the requesting Party to understand the operation of the policy or program and evaluate its effects or potential effects on trade or investment between the Parties. The Party responding to a request shall ensure that the response that it provides contains the following information:

- (a) the form of the non-commercial assistance provided under the policy or program, for example, grant or loan;

- (b) the names of the government agencies, state enterprises, or state-owned enterprises providing the non-commercial assistance or equity capital and the names of the state-owned enterprises that have received or are eligible to receive the non-commercial assistance;

- (c) the legal basis and policy objective of the policy or program providing for the non-commercial assistance or equity infusion;

- (d) with respect to goods, the amount per unit of the non-commercial assistance or, in cases if it is not possible to provide a per unit amount, the total amount of or the annual amount budgeted for the non-commercial assistance, indicating, if possible, the average amount per unit in the previous year;

- (e) with respect to services, the total amount of or the annual amount budgeted for the non-commercial assistance, indicating, if possible, the total amount in the previous year;

- (f) with respect to policies or programs providing for non-commercial assistance in the form of loans or loan guarantees, the amount of the loan or amount of the loan guaranteed, interest rates, and fees charged;

- (g) with respect to policies or programs providing for non-commercial assistance in the form of the provision of goods or the supply of services, the prices charged, if any, for those goods and services;

- (h) with respect to policies or programs for the provision of equity capital, the amount invested, the number and a description of the shares received, and any assessment of the enterprise’s financial health and prospects that is conducted with respect to the underlying investment decision;

- (i) duration of the policy or program or any other time-limits attached to it; and

- (j) statistical data permitting an assessment of the effects of the non-commercial assistance on trade or investment between the Parties.

6. In response to a request made pursuant to paragraph 4, if a Party considers that it has not adopted or does not maintain any policies or programs referred to in paragraph 4, it shall promptly provide a reasoned explanation of this in writing to the requesting Party.

7. If any relevant points in paragraph 5 have not been addressed in the written response, that Party shall provide a reasoned explanation of this in the written response.

8. The Parties recognize that the provision of information under paragraphs 5 and 7 does not prejudge the legal status of the assistance that was the subject of the request under paragraph 4 or the effects of that assistance under this Agreement.

9. When a Party responds to a request for information under this Article, and informs the requesting Party that it considers certain information to be confidential, the Party shall provide a reasoned explanation for its determination. The requesting Party shall not disclose this information without the prior consent of the Party that provided it. To the maximum extent possible under its law, the Party should not consider the amount of the financial contribution associated with the non-commercial assistance or equity capital to be confidential.

Article 22.11: Technical Cooperation

The Parties shall, if appropriate and subject to available resources, engage in mutually decided upon technical cooperation activities, including:

- (a) exchanging information regarding Parties’ experiences in improving the corporate governance and operation of their state-owned enterprises;

- (b) sharing best practices on policy approaches to ensure a level playing field between state-owned and privately owned enterprises, including policies related to competitive neutrality; and

- (c) organizing international seminars, workshops or any other appropriate forum for sharing technical information and expertise related to the governance and operations of state-owned enterprises.

Article 22.12: Committee on State-Owned Enterprises and Designated Monopolies

1. The Parties hereby establish a Committee on State-owned Enterprises and Designated Monopolies (SOE Committee), composed of government representatives of each Party.

2. The SOE Committee’s functions include:

- (a) reviewing and considering the operation and implementation of this Chapter;

- (b) at a Party’s request, consulting on a matter arising under this Chapter;

- (c) developing cooperative efforts, as appropriate, to promote the principles underlying the disciplines contained in this Chapter in the free trade area and to contribute to the development of similar disciplines in other regional and multilateral institutions in which two or more Parties participate; and

- (d) undertaking other activities as the SOE Committee may decide.

3. The SOE Committee shall meet within one year after the date of entry into force of this Agreement, and at least annually thereafter, unless the Parties decide otherwise.

Article 22.13: Exceptions

1. Nothing in Article 22.4 (Non-Discriminatory Treatment and Commercial Considerations) or Article 22.6 (Non-Commercial Assistance) shall be construed to:

- (a) prevent the adoption or enforcement by a Party of measures to respond temporarily to a national or global economic emergency; or

- (b) apply to a state-owned enterprise with respect to which a Party has adopted or enforced measures on a temporary basis in response to a national or global economic emergency, for the duration of that emergency.

2. Article 22.4.l (Non-Discriminatory Treatment and Commercial Considerations) does not apply to the supply of financial services by a state-owned enterprise pursuant to a government mandate if that supply of financial services:

- (a) supports exports or imports, provided that these services are:

- (i) not intended to displace commercial financing, or

- (ii) offered on terms no more favorable than those that could be obtained for comparable financial services in the commercial market;Footnote 26

- (b) supports private investment outside the territory of the Party, provided that these services are:

- (i) not intended to displace commercial financing, or

- (ii) offered on terms no more favorable than those that could be obtained for comparable financial services in the commercial market; or

- (c) is offered on terms consistent with the Arrangement, provided that it falls within the scope of the Arrangement.

3. The supply of financial services by a state-owned enterprise pursuant to a government mandate shall be deemed not to give rise to adverse effects under Article 22.6.4(b) (Non-Commercial Assistance) or Article 22.6.5(b), or under Article 22.6.4(c) or Article 22.6.5(c) if the Party in which the financial service is supplied requires a local presence in order to supply those services, if that supply of financial services:Footnote 27

- (a) supports exports or imports, provided that these services are:

- (i) not intended to displace commercial financing, or

- (ii) offered on terms no more favorable than those that could be obtained for comparable financial services in the commercial market;

- (b) supports private investment outside the territory of the Party, provided that these services are:

- (i) not intended to displace commercial financing, or

- (ii) offered on terms no more favorable than those that could be obtained for comparable financial services in the commercial market; or

- (c) is offered on terms consistent with the Arrangement, provided that it falls within the scope of the Arrangement.

4. Article 22.6 (Non-Commercial Assistance) does not apply with respect to an enterprise located outside the territory of a Party over which a state-owned enterprise of that Party has assumed temporary ownership as a consequence of foreclosure or a similar action in connection with defaulted debt, or payment of an insurance claim by the state-owned enterprise, associated with the supply of the financial services referred to in paragraphs 2 and 3, provided that any support the Party, a state enterprise, or state-owned enterprise of the Party provides to the enterprise during the period of temporary ownership is provided in order to recoup the state-owned enterprise's investment in accordance with a restructuring or liquidation plan that will result in the ultimate divestiture from the enterprise.

5. Article 22.4 (Non-Discriminatory Treatment and Commercial Considerations), Article 22.6 (Non-Commercial Assistance), Article 22.10 (Transparency), and Article 22.12 (Committee on State-Owned Enterprises and Designated Monopolies) do not apply with respect to a state-owned enterprise or designated monopoly if in any one of the three previous consecutive fiscal years, the annual revenue derived from the commercial activities of the state-owned enterprise or designated monopoly was less than a threshold amount which shall be calculated in accordance with Annex 22-A (Threshold Calculation).Footnote 28

Article 22.14: Further Negotiations

Within six months of the date of entry into force of this Agreement, the Parties shall begin further negotiations so as to extend the application of the disciplines in this Chapter in accordance with Annex 22-C (Further Negotiations).

Article 22.15: Process for Developing Information

Annex 22-B (Process for Developing Information Concerning State-Owned Enterprises and Designated Monopolies) applies in any dispute under Chapter 31 (Dispute Settlement) regarding a Party’s conformity with Article 22.4 (Non-Discriminatory Treatment and Commercial Considerations) or Article 22.6 (Non-Commercial Assistance).

ANNEX 22-A

THRESHOLD CALCULATION

1. On the date of entry into force of this Agreement, the threshold referred to in Article 22.13.5 (Exceptions) shall be 175 million Special Drawing Rights (SDRs).

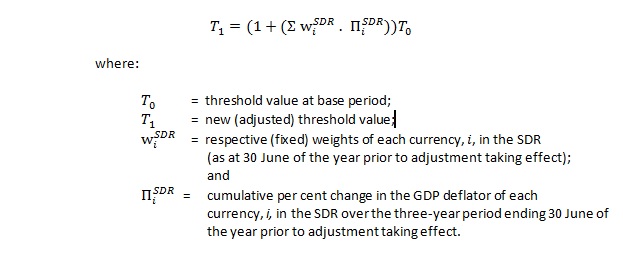

2. The amount of the threshold shall be adjusted at three-year intervals with each adjustment taking effect on 1 January. The first adjustment must take place on the first 1 January following the entry into force of this Agreement, in accordance with the formula set out in this Annex.

3. The threshold shall be adjusted for changes in general price levels using a composite SDR inflation rate, calculated as a weighted sum of cumulative per cent changes in the Gross Domestic Product (GDP) deflators of SDR component currencies over the three-year period ending 30 June of the year prior to the adjustment taking effect, and using the following formula:

4. Each Party shall convert the threshold into national currency terms where the conversion rates are the average of monthly values of that Party’s national currency in SDR terms over the three-year period to 30 June of the year before the threshold is to take effect. Each Party shall notify the other Parties of their applicable threshold in their respective national currencies.

5. For the purposes of this Chapter, all data shall be drawn from the International Monetary Fund's International Financial Statistics database.

6. The Parties shall consult if a major change in a national currency vis-à-vis the SDR were to create a significant problem with regard to the application of this Chapter.

ANNEX 22-B

PROCESS FOR DEVELOPING INFORMATION CONCERNING STATE- OWNED ENTERPRISES AND DESIGNATED MONOPOLIES

1. If a panel has been established pursuant to Chapter 31 (Dispute Settlement) to examine a complaint arising under Article 22.4 (Non-Discriminatory Treatment and Commercial Considerations) or Article 22.6 (Non-Commercial Assistance), the disputing Parties may exchange written questions and responses, as set forth in paragraphs 2, 3, and 4, to obtain information relevant to the complaint that is not otherwise readily available.

2. A disputing Party (questioning Party) may provide written questions to another disputing Party (answering Party) within 15 days of the date the panel is established. The answering Party shall provide its responses to the questions to the questioning Party within 30 days of the date it receives the questions.

3. The questioning Party may provide any follow-up written questions to the answering Party within 15 days of the date it receives the responses to the initial questions. The answering Party shall provide its responses to the follow-up questions to the questioning Party within 30 days of the date it receives the follow-up questions.

4. If the questioning Party considers that the answering Party has failed to cooperate in the information-gathering process under this Annex, the questioning Party shall inform the panel and the answering Party in writing within 30 days of the date the responses to the questioning Party’s final questions are due, and provide the basis for its view. The panel shall afford the answering Party an opportunity to reply in writing.

5. A disputing Party that provides written questions or responses to another disputing Party pursuant to the procedures set out in this Annex shall, on the same day, provide the questions or answers to the panel. In the event that a panel has not yet been composed, each disputing Party shall, upon the composition of the panel, promptly provide the panel with any questions or responses it has provided to the other disputing Party.

6. The answering Party may designate information in its responses as confidential information in accordance with the procedures set out in the Rules of Procedure established under Article 30.2. l (e) (Functions of the Commission) or other rules of procedure agreed to by the disputing Parties.

7. The time periods in paragraphs 2, 3, and 4 may be modified upon agreement of the disputing Parties or approval by the panel.

8. In determining whether a disputing Party has failed to cooperate in the information-gathering process, the panel shall take into account the reasonableness of the questions and the efforts the answering Party has made to respond to the questions in a cooperative and timely manner.

9. In making findings of fact and its initial report, the panel should draw adverse inferences from instances of non-cooperation by a disputing Party in the information-gathering process.

10. The panel may deviate from the time period set out in Chapter 31 (Dispute Settlement) for the issuance of the initial report if necessary to accommodate the information-gathering process.

11. The panel may seek additional information from a disputing Party that was not provided to the panel through the information-gathering process if the panel considers the information necessary to resolve the dispute. However, the panel shall not request additional information to complete the record if the information would support a Party’s position and the absence of that information in the record is the result of that Party’s non-cooperation in the information-gathering process.

ANNEX 22-C

FURTHER NEGOTIATIONS

Within six months of the date of entry into force of this Agreement, the Parties shall begin further negotiations so as to extend the application of:

- (a) the obligations in this Chapter to the activities of state-owned enterprises that are owned or controlled by a sub-central level of government, and designated monopolies designated by a sub-central level of government, if these obligations are listed in Annex 22-D (Application to Sub-Central State-Owned Enterprises and Designated Monopolies); and

- (b) the disciplines of Article 22.6 (Non-Commercial Assistance) and Article 22.7 (Adverse Effects) to address effects caused in a market of a non-Party through the supply of services by a state-owned enterprise.

The Parties shall meet on a quarterly basis, and shall endeavor to conclude these further negotiations within three years after entry into force of this Agreement.

ANNEX 22-D

APPLICATION TO SUB-CENTRAL STATE-OWNED ENTERPRISES AND DESIGNATED MONOPOLIES

Pursuant to Article 22.9.2 (Party-Specific Annexes), the following provisions do not apply with respect to a state-owned enterprise owned or controlled by a sub-central level of government or a designated monopoly designated by a sub-central level of government:Footnote 29

- (a) For Canada:

- (i) Article 22.4.1(a) (Non-Discriminatory Treatment and Commercial Considerations),

- (ii) Article 22.4.1(b) (Non-Discriminatory Treatment and Commercial Considerations), with respect to purchases of a good or service,

- (iii) Article 22.4.1(c)(i) (Non-Discriminatory Treatment and Commercial Considerations),

- (iv) Article 22.4.2 (Non-Discriminatory Treatment and Commercial Considerations), with respect to designated monopolies designated by a sub-central level of government,

- (v) Article 22.5.2 (Courts and Administrative Bodies), with respect to administrative regulatory bodies established or maintained by a sub-central level of government,

- (vi) Article 22.6.1, Article 22.6.2, and Article 22.6.3 (Non-commercial Assistance),

- (vii) Article 22.6.4(a) (Non-commercial Assistance) and Article 22.6.5(a) (Non-commercial Assistance), with respect to the production and sale of a good in competition with a like good produced and sold by a covered investment,

- (viii) Article 22.6.4(b) and (c) (Non-commercial Assistance) and Article 22.6.5(b) and (c) (Non-commercial Assistance),

- (ix) Article 22.6.6 (Non-Commercial Assistance),

- (x) Article 22.10.1 (Transparency), and

- (xi) Article 22.10.4 (Transparency) with respect to a policy or program adopted or maintained by a sub-central level of government.

- (b) For Mexico:

- (i) Article 22.4.1(a) (Non-Discriminatory Treatment and Commercial Considerations),

- (ii) Article 22.4.1(b) (Non-Discriminatory Treatment and Commercial Considerations), with respect to purchases of a good or service,

- (iii) Article 22.4.1(c)(i) (Non-Discriminatory Treatment and Commercial Considerations),

- (iv) Article 22.4.2 (Non-Discriminatory Treatment and Commercial Considerations), with respect to designated monopolies designated by a sub-central level of government,

- (v) Article 22.5.2 (Courts and Administrative Bodies), with respect to administrative regulatory bodies established or maintained by a sub-central level of government,

- (vi) Article 22.6.1, Article 22.6.2, and Article 22.6.3 (Non-Commercial Assistance),

- (vii) Article 22.6.4(a) (Non-Commercial Assistance) and Article 22.6.5(a) (Non-Commercial Assistance), with respect to the production and sale of a good in competition with a like good produced and sold by a covered investment in the territory of Mexico,

- (viii) Article 22.6.4(b) and (c) (Non-Commercial Assistance) and Article 22.6.5(b) and (c) (Non-Commercial Assistance), and

- (ix) Article 22.10.1 (Transparency).

- (c) For the United States:

- (i) Article 22.4.1(a) (Non-Discriminatory Treatment and Commercial Considerations),

- (ii) Article 22.4.1(b) (Non-Discriminatory Treatment and Commercial Considerations), with respect to purchases of a good or service,

- (iii) Article 22.4.1(c)(i) (Non-Discriminatory Treatment and Commercial Considerations),

- (iv) Article 22.4.2 (Non-Discriminatory Treatment and Commercial Considerations), with respect to designated monopolies designated by a sub-central level of government,

- (v) Article 22.5.2 (Courts and Administrative Bodies), with respect to administrative regulatory bodies established or maintained by a sub-central level of government,

- (vi) Article 22.6.1, Article 22.6.2, and Article 22.6.3 (Non-Commercial Assistance),

- (vii) Article 22.6.4(a) (Non-Commercial Assistance) and Article 22.6.5(a) (Non-Commercial Assistance), with respect to the production and sale of a good in competition with a like good produced and sold by a covered investment in the territory of the United States,

- (viii) Article 22.6.4(b) and (c) (Non-Commercial Assistance) and Article 22.6.5(b) and (c) (Non-Commercial Assistance), and

- (ix) Article 22.10.1 (Transparency).

ANNEX 22-E

SPECIAL PURPOSE VEHICLES OF STATE PRODUCTIVE ENTERPRISES

1. This Chapter applies to the State Productive Enterprises (“SPEs”) referred to in the Decree amending the Political Constitution of the United Mexican States on December 20, 2013 as published in the Official Gazette (“the Decree”), and to the subsidiaries and affiliates of the SPEs.

2. This Chapter does not apply to Special Purpose Vehicles, with the exception of paragraphs 3 and 4 of this Annex. For the purposes of this Annex, the term “Special Purpose Vehicle” means a private legal entity established by the SPEs, their subsidiaries and affiliates, as a result of a venture with private investors, created to perform, develop, own, or operate a specific project.Footnote 30

3. Mexico shall ensure that Special Purpose Vehicles:

- (a) be established as a result of competitive processes under the laws and regulations of Mexico applicable to the SPE;

- (b) pursue the performance of commercial activities on equal circumstances and conditions available to competitors on a level playing field, with no intention of displacing or impeding competitors from the relevant market;

- (c) be aimed at generating economic value and profitability under commercial conditions;

- (d) follow generally accepted accounting principles and generally accepted international corporate governance rules such as the G20/OECD Principles of Corporate Governance;

- (e) act in accordance with Article 22.4 (Non-Discriminatory Treatment and Commercial Considerations), Article 22.5 (Courts and Administrative Bodies), and Article 22.6 (Non-Commercial Assistance).

4. Mexico shall provide information concerning the SPV and any assistance provided to it, to the extent reasonably available, if it is requested in accordance with the relevant provisions of Article 22.10 (Transparency).

ANNEX 22-F

NON-COMMERCIAL ASSISTANCE TO CERTAIN STATE PRODUCTIVE ENTERPRISES

1. With respect to Article 22.6.1, Article 22.6.2, and Article 22.6.3 (Non-Commercial Assistance), Mexico or its state enterprises or state-owned enterprises may provide non-commercial assistance to an SPE referred to in Annex 22-E (Special Purpose Vehicles of State Productive Enterprises) (including the SPE’s affiliates and subsidiaries) that is primarily engaged in oil and gas activities, in circumstances that jeopardize the continued viability of the recipient enterprise, and for the sole purpose of enabling the enterprise to return to viability and fulfil its mandate under the Decree and Article 25 of Mexico’s Constitution (Constitución Política de los Estados Unidos Mexicanos).

2. At the request of a Party, the Parties may consult regarding whether this Annex should be amended or eliminated. This Annex should only be maintained if Mexico considers that circumstances continue to require the possibility of providing non-commercial assistance to an SPE to ensure its continued viability.

- Date modified: