Minister of International Trade - Briefing book

2019-11

Table of contents

- A. Global Overview

- B. The Department

- C. First 100 Days

- D. Key Portfolio Responsibilities

- E. Top Issues

- F. Trade Investment Overview

- G. Geographic – Integrated Regional Overview

- H. Multilateral/Global Institutions

- The United Nations

- NATO

- Five Eyes Intelligence Partnership

- Canada and the G7

- Canada and the G20

- World Trade Organization

- International Financial Institutions

- Organisation for Economic Co-operation and Development

- Asia-Pacific Economic Cooperation

- Inter-American Multilateralism

- La Francophonie

- Commonwealth

- The World Economic Forum

- Association of Southeast Asian Nations

- Canada and the African Union

Strategic Overview

Issue

- The free flow of goods, services, capital, technology and people is critical to Canada’s growth and improved living standards. Canada must seize opportunities to expand and diversify its trade while navigating rising global trade tensions and challenges to the rules-based global trading system.

Context

As Minister of International Trade, your key responsibilities will include: building and safeguarding an open and inclusive rules-based global trading system; support for Canadian exporters and innovators in their international business development efforts; negotiation of bilateral, plurilateral and multilateral trade agreements; administration of export and import controls; management of international trade disputes; facilitation and expansion of foreign direct investment; and support to international innovation, science and technology. This is done in support of the Minister of Foreign Affairs, who oversees all matters relating to Canada’s external affairs, including trade and commerce.

Your portfolio is complemented by the work of the Minister for International Development, whose focus on sustainable development and poverty reduction contributes to strengthening and stabilizing the economies of developing countries, creating opportunities for mutually beneficial trading partnerships.

To advance your portfolio you are supported by the Deputy Minister of International Trade. You can also rely on the Deputy Ministers of Foreign Affairs and of International Development, who directly support your colleagues. As a team, the Deputies and the wider Global Affairs senior leadership work to ensure that the department’s 10,707 employees in Canada and 110 countries around the world are delivering an integrated and coherent approach to Canada’s advantage.

Disrupted global trade context

As a trading nation, Canada is endowed with an impressive range of comparative advantages including our diverse, highly-skilled population; abundant natural resources; strong public institutions; world-leading companies; and a shared commitment to the fundamental values of a free, open and democratic society. Canada also benefits from strong trade rules and market access with most of its major trading partners, with 14 bilateral and regional free trade agreements (FTAs) in force, covering 51 countries and two-thirds of global GDP.

However, the global trading environment is facing increased turbulence in major trading relationships, juxtaposed with deepening challenges to the rules-based trading system. In this context, Canada must adapt and pursue new and emerging opportunities.

Over the last few years, the increase in trade tensions, [REDACTED] are hampering global economic growth rates for advanced economies and developing economies alike.

While Canada’s economy has grown, there is increasing concern about the potential for a global recession in the not-too-distant future. Canadian exporters and investors have been harmed by these developments, which in some instances have been motivated by non-trade considerations.

International observers continue to expect global growth to rebound in 2020, albeit at lower levels, and recent outlooks have been revised downward.

[REDACTED due to copyright]

New technologies and trans-boundary threats like climate change will also affect Canada’s prosperity. They promise to alter modes and patterns of trade, impact domestic policies, and will in some cases require new international frameworks for collective action, at a time when finding common ground is more challenging.

Multilateral, plurilateral, and regional trade

The WTO remains the pre-eminent international institution supporting the rules-based trading system. The WTO and the General Agreement on Tariffs and Trade (GATT) before it, has underpinned global trade during the postwar period. Active participation at the WTO has proven to be of strategic interest to Canada for its ability to protect Canada’s interests and allowing it to influence discussions in a way that would not otherwise be possible [REDACTED].

Early attention will be required due to a number of developments and upcoming events.

Canada has an established position in leading a group of diverse and representative WTO members (the “Ottawa Group”) committed to supporting and strengthening the WTO. This grouping will remain important for advancing discussions to strengthen and modernize the organization although we will need to reassess how we can play an even broader leadership role at the WTO.

[REDACTED]

This issue is expected to come to a head if not resolved by December 10, when the terms of two of the last three members end. The absence of a functional appeal system would permit Members to evade binding dispute settlement, which runs counter to Canada’s interests. Canada will need to remain particularly focused on this issue, and in particular, with respect to building broader alliances in support of our objectives. If an effective dispute settlement mechanism ceases to exist at the WTO, the overall legitimacy of the institution itself could be brought into question.

More broadly, Canada cannot take for granted that the multilateral system anchored by the WTO will continue to evolve as the world economy grows. As countries navigate a global economy caught between difficult multilateral discussions and bilateral deals-based approaches based on spheres of influence, regional relationships are taking on increasing importance. Canada needs to strengthen its regional alliances as well. Although we have a broad network of FTAs, further work is required to ensure shared views on the value of rule-based trade, along with a willingness to be prepared to do something to advance and strengthen those rules.

Canada is well-placed to leverage regional and other groupings e.g. APEC Comprehensive and Progressive Trans-Pacific Partnership Agreement (CPTPP) expansion, Association of South-East Asian Nations (ASEAN), the Organization for Economic Cooperation and Development (OECD), and various standard-setting bodiesto enhance its influence to shape new rules, counter-balance asymmetric relationships, and foster further trade opportunities.

Key bilateral relationships

Canada’s proximity and economic integration with the United States dictates that access to the U.S. market will remain paramount. Improved stability and predictability in this commercial relationship has been a key priority. [REDACTED]

This should be advanced through the ratification and implementation of the Canada-United States-Mexico Agreement (CUSMA), which on the Canadian side will require the passage of implementing legislation in Parliament.

[REDACTED]

China is Canada’s second-largest trading partner, [REDACTED]

Growing trade in other markets

Notwithstanding global trade challenges, the past decade has seen historic advances in some of our most important trade relations. In addition to CUSMA, Canada has successfully negotiated both the Canada-European Union Comprehensive Economic and Trade Agreement (CETA), and CPTPP. Together these agreements afford us preferential market access to all of the other members of the G7. For both CETA and CPTPP, efforts will be needed to encourage the remaining Parties to ratify as soon as possible. Furthermore, expansion of the CPTPP to include new members [REDACTED] also represents a key opportunity to secure access to new markets in Asia.

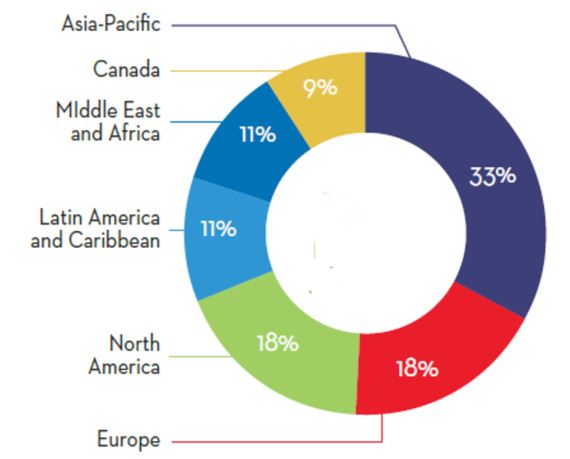

A focus for the Government of Canada has been to create an enabling environment for firms and businesses to fully capitalize on the opportunities arising from these significant trade agreements, as well as from economic growth in a wider range of overseas markets more generally. Canada can also look to continuously improve the international competitiveness of its businesses by supporting robust trade promotion services and programs through the Trade Commissioner Service (TCS). Every day, some 945 Trade Commissioners located in 160 missions aboard, and 95 located in six regional offices across Canada, work to help Canadian businesses compete and win in global markets by providing customized market intelligence, advice and contacts.

Trade Commissioners serve clients from locations across Canada and around the world.

Asia is one of the fastest growing regions in the world; many countries are aggressively positioning themselves to tap into the region’s growth, [REDACTED] Canada has recently completed exploratory discussions for a potential Canada-ASEAN FTA [REDACTED]

In the Americas, Canada has been negotiating a comprehensive trade agreement with Mercosur (Argentina, Brazil, Paraguay, and Uruguay) since 2018. As well, a final Agreement with the Pacific Alliance (Chile, Colombia, Mexico and Peru) may be reachable in the coming months.

The United Kingdom’s departure from the EU would mean that Canada’s most significant trade partner in Europe would no longer be party to the CETA

[REDACTED]

Canada is also considering modernization of several of its existing FTAs to meet the ambition of its most recent agreements and maximize benefits for Canadians, e.g. the Canada-European Free Trade Association (Switzerland, Norway, Iceland, and Lichtenstein), and Canada-Ukraine FTAs.

Finally, with respect to developing countries, Canada has been investing in initiatives that support their engagement and success in regional and global trade. This includes providing support for the establishment of the African Continental Free Trade Area to boost intra-African trade; and funding technical expertise and targeted interventions through the Global Alliance on Trade Facilitation and the Canadian Trade and Investment Facility for Development.

Controlling trade in sensitive sectors

Import and export permits are required when there are important and sensitive political, security and/or economic concerns about trade (e.g. foreign policy or national security consideration, trade liberalization for agricultural goods). The economic impact to Canada and the volume of transactions is significant, attracting extensive stakeholder interest. The Minister of Foreign Affairs traditionally gives responsibility for all trade-related policy and operational issues (e.g. agriculture, softwood lumber, steel, and aluminum) that do not have security or defence implications to the Minister of International Trade. You will be called on, including in the early days of your tenure, to make a number of time-sensitive operational and policy decisions.

Investment, talent, and the changing nature of trade

Just as the growth of developing economies is re-shaping global trade patterns, fast-emerging technologies (e.g. digitalization, artificial intelligence, and advanced manufacturing) as well as responses to global issues such as sustainability and climate change portend transformative effects on Canada’s economy and trade. In addition, Canada’s North and Arctic is a region of global interest, at once becoming more connected through technology and transportation links while also facing unique challenges. Such changes are likely to affect what we trade; how we produce and deliver it; who we trade with; and which Canadians and firms participate in international trade.

Simultaneously, many relevant policies and regulations (e.g. on data flows, infrastructure, the investment climate, and promoting innovation) that shape the global competitiveness of Canadian firms and Canada’s standing as a destination for foreign direct investment and talent will be developed in a domestic context. The challenge in this regard is to ensure that international implications are kept in mind during that process as strong international competition is to be expected in all these areas.

To reconcile these trends, Canada will need to have a well-developed and coordinated approach between Global Affairs and domestic line departments on trade-related matters in order to take a leadership position.

Global Trends

Issue

International relations have entered a period of heightened uncertainty and instability, with established institutions, alliances, and practices being challenged by a shifting balance of power, new economic and social forces, and renewed ideological competition.

Context

An historic shift of geopolitical and economic power from the Atlantic to the Pacific is underway, and as a multi-node world emerges, new and established powers, as well as non-state actors, are seeking to recast the international system to their benefit. Innovations and globalization over the past 25 years helped to bring millions of people out of poverty. But the optimism that accompanied these developments has been tempered more recently by growing inequality, a resurgence of ethno-nationalism, and a return to great power rivalries and proxy warfare.

The consequences of this dynamic evolution impose strategic choices on Canada’s foreign policy.

In promoting its interests abroad, Canada has contributed to developing and strengthening an evolving international system based on rules in which parameters for inter-state behaviour were largely collectively shaped and mutual accountability was expected. In this context, Canada has benefitted from U.S. support and Washington’s position as the world’s leading power, with its vast network of alliances and partners, including NATO and NORAD, which underpin Canada-U.S. security and defence cooperation. [REDACTED] International development and economics have also emerged as domains for geopolitical influence and competition. [REDACTED]

Not surprisingly, these shifting geopolitical realities are straining the existing system of international laws, norms, alliances and institutions. [REDACTED] and in cyberspace, which has become an active domain for geopolitical rivalry and the nefarious activities of non-state actors. [REDACTED]

This shift is increasingly apparent with regards to debt financing. The composition of public debt in Low Income developing Countries (LICs) continues to shift from traditional sources (largely the Paris Club, including Canada) towards non-traditional bilateral lenders [REDACTED] In 2007, 66 percent of public external debt in LICs was held by multilateral development banks or Paris Club members, with just 19 percent held by Non-Paris Club lenders. By 2016 fully 37 percent of public debt in LICs was held by Non-Paris Club, with combined MDB and Paris Club debt down to just 33 percent. Moreover, this presents an incomplete picture of the global debt shift since it only focusses on LICs, and does not account for other forms of financing, including non-governmental foreign direct investment, public funding through non-governmental organizations, or investments through state-owned enterprises with close links to the central government, [REDACTED]

On the security front, several pressures are apparent. Nuclear non-proliferation faces sustained challenges, particularly from Iran, North Korea, [REDACTED] Violent extremism, including in the form of pernicious terrorist groups (e.g. Daesh, Boko Haram, Al-Qaida), white supremacists, and anti-immigrant movements, threaten people around the world. And protracted crises, such as Syria, are extremely costly in terms of lives and livelihoods, and for their regional and international implications.

Change in Creditor Composition of LIDC's Public External Debt 2007 to 2016

Text version

Change in Creditor Composition of LIDCs' Public External Debt

| Creditor Composition | 2007 | 2016 |

|---|---|---|

| Multilateral | 46% | 27% |

| Paris Club | 20% | 6% |

| Plurilateral | 8% | 16% |

| Commercial | 7% | 15% |

| Non-Paris Club | 19% | 37% |

In parallel to these specific preoccupations, globalization continues to reshape economic and social life and has contributed to the shifting balance of power. Freer trade, technological innovation and transnational value chains have raised global standards of living. Between 2000 and 2017, emerging Asian countries (including China and India) increased their share of world GDP from approximately 7 percent to 22 percent and are projected to grow at a much faster rate than advanced economies – [REDACTED] Developing countries are also increasingly urbanized, and some face demographic “youth bulges” in their fast-growing populations – offering the potential for continued growth, especially if jobs can match success in extending life expectancy, but also threatening social stability if they cannot. This speaks to the urgent need to accelerate the achievement of the sustainable development goals.

While increased growth and interconnectedness have created a growing global middle class, the momentum to liberalize international trade has stalled, as evidenced by protracted disagreements over the WTO and rising protectionism. This stems partly from the recognition that the benefits of globalization have been unevenly shared. From 2005 to 2014, 65-70 percent of households in advanced economies, on average, were in income segments whose real market incomes were flat or falling (McKinsey).

International migration, regular and irregular, is expected to increase, with competition for jobs and resources in less-developed regions and labour shortages in developed economies.

Emerging markets, including countries where Canada currently invests significant development assistance, present new economic opportunities, although geopolitical, security and governance-related concerns can limit the scope for engagement in the very near term. These and other complex transnational challenges – including climate change and pandemic diseases – affect Canada directly, and Canada can most effectively protect its prosperity and stability by working alongside new and traditional allies and partners.

Canada faces an international environment of growing great power competition, rising trade protectionism, complex transnational challenges, traditional partners who are distracted or disengaged, and resurgent authoritarianism. Yet amid these challenges are opportunities to shape the evolving international system, embrace new markets and non-traditional partners, regroup with like-minded countries and leverage Canada’s deep people-to-people ties around the world. [REDACTED]

In the context of growing international volatility, Canada’s efforts will require close collaboration between Global Affairs Canada and other government departments and agencies to coordinate a whole-of-government approach. But Canada is equipped with an international policy toolkit to meet many of these challenges: its membership in key institutions such as the UN, G7, G20, NATO, NORAD, APEC, the OECD, the Commonwealth and La Francophonie offers comparative leverage; it sustains a positive global reputation for freedom, tolerance, diversity, gender equality, and good governance, including through our leadership of issue-based alliances; it has trade agreements with all G7 members and has solidified the Comprehensive Economic and Trade Agreement (CETA) with the EU, as well as the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP); and Canada still possesses hard-won, though transient, credibility on issues of peace and security and international development. In this new era of international relations, Canada will need all the tools at its disposal to navigate difficult strategic terrain ahead.

State of the Global Economy / Trade

Issue

- Global growth is softening as geopolitical and trade tensions are disrupting supply chains and have led to a worsening of business sentiment.

- Despite rising concerns of the risk of recession, most projections call for global growth to rebound in 2020, due to stronger performance by emerging markets and developing economies.

- The Canadian economy is expected to grow by 1.5 percent in 2019 and 1.8 in 2020, but weak global trade is expected to moderate business investment and exports.

Context

Global growth is expected to be weak in 2019 in both advanced and emerging economies. Several factors have contributed to this slowdown:

(1) the ongoing trade and technology conflict between the world’s two largest economies (United States and China); (2) Brexit-related uncertainty; (3) rising geopolitical tensions; and (4) business conditions decelerating after years of steady expansion.

Chart 1: Real GDP Growth projections

[REDACTED due to copyright]

The global economy has experienced a long period of growth since the 2008 financial crisis, but this growth is decelerating in 2019. While the global services sector has held up, manufacturing activities have either contracted or decelerated in many major economies in the first half of 2019, as indicated by manufacturing industrial production.

Given the uncertain outlook, it appears that firms and households continue to hold back on long-range spending as shown by weak business spending (machinery and equipment) and consumer purchases of durable goods, such as cars and appliances. The IMF and OECD project global growth to rebound in 2020 due to stronger performances by emerging markets and developing economies, but these projections are for modest growth, and outlooks have been revised downward repeatedly over the last 18 months.

Trade Tensions

[REDACTED]

Global trade growth in volume terms has declined sharply in recent quarters. Escalating trade conflicts and related uncertainty have given rise to concerns about a potential recession, reflecting unease in the global economy.

Uncertain Growth

The U.S. economy is steady for the moment but is sending increasingly mixed signals. Europe is losing momentum as its largest economy, Germany, has contracted in two of the last four quarters. At the same time, China is showing its weakest growth since 1992, a situation that is set to worsen unless the United States and China resolve their trade conflict. There are also concerns about debt sustainability in developing economies, as growing debt burdens, particularly in Latin America and East Asia, have the potential to quickly become unsustainable.

In response to uncertain growth prospects, many central banks, including the United States Federal Reserve, have cut interest rates to provide economic support, but the lower interest rates can also foster financial vulnerabilities as financial markets move to riskier assets. For its part, the Bank of Canada has maintained its rate unchanged since October 2018 (1.75 percent) as core inflation remained around its 2 percent target, but it has flagged that it will continue to watch developments closely.

Regional Update

Canada

In 2018, Canada’s exports of goods and services increased 6.2 percent to $706 billion, while imports rose 5.4 percent. The total value of trade in goods and services reached a record high of $1.5 trillion. However, GDP growth for 2018 as a whole was 1.9 percent, down from three percent in 2017. The slower rate of growth in late 2018 and early 2019 has been attributed to weakness from the goods producing sectors, uncertainties generated by trade tensions between the United States and China and by American tariffs on steel and aluminum (lifted in May 2019). Despite a frail start in 2019 and ongoing weaknesses in the oil-producing sector and corresponding regions, economic growth rebounded to 3.7 percent in Q2 after growing only 0.5 percent in Q1, driven by strong performance in goods exports, although domestic demand was weak. Canada has seen a trade deficit since the global financial crisis. The IMF projects that Canada’s GDP growth will be at 1. 5 percent in 2019 and 1.8 percent in 2020 – both below the 2018 level.

Overall, the Canadian economy remains sound. The strong national labour market, with close to record low unemployment (5.5. percent in September), should bolster household income and support steady growth in household consumption.

Key factors that could affect the short-term outlook are global trade and geo-political tensions, persistent transportation and production constraints in the oil and gas sector, and an elevated level of household indebtedness. Given interconnectedness with the U.S. economy, economic trends in the United States will also impact the Canadian economy.

United States

The current U.S. economic expansion is the longest on record, though talk of a U.S. recession in the next 18 months has risen following the publication of a string of weak leading economic indicators over the summer.

In response, the United States Federal Reserve has cut its interest rate three times this year, the first cuts since the 2008 financial crisis. U.S. GDP is projected by the IMF to continue growing next year but growth is expected to fall from 2.9 percent in 2018 to 2.4 percent in 2019 and 2.1 percent in 2020, as the effects of past fiscal stimulus unwinds and the impacts of tariffs counter measures by other countries make their mark.

Europe

Euro area growth declined to 1.9 percent in 2018 and is projected to further decline to 1.2 percent in 2019, before rebounding to 1.4 percent in 2020. Export-reliant Germany, Europe’s largest economy, has contracted in two of the last four quarters. Growth in the Italian economy has been tepid since the recession that occurred last year, due to business and political uncertainty. In the second quarter of 2019, the U.K. economy contracted for the first time since 2012, as the U.K. ’s stockpiling for Brexit reached a peak and the car industry implemented shutdowns. Going forward, the IMF expects the U.K. economy to grow at 1.2 percent in 2019 and 1.4 percent in 2020. Uncertainties from Brexit continue to weigh on economic prospects in the United Kingdom and the Eurozone.

Emerging and developing Asia

GDP is expected to grow at 5.9 percent in 2019 and 6.0 percent in 2020, lower than previous forecasts, largely reflecting the impact of tariffs on trade and investment. Chinas growth (year over year) dipped to 6 percent in the third quarter of 2019, the lowest on record since 1992. Escalating tariffs have added downward pressure on an economy already in the process of a structural slowdown and regulatory tightening to rein in debt. Chinas slowing growth is expected to spill over to other emerging Asian economies that are integrated in its supply chains. Elsewhere, Indias economy is set to grow at 6.1 percent in 2019, due to weaker-than-expected domestic demand, and by 7 percent in 2020, as fiscal and monetary stimulus start to have an impact. Indias economy has decelerated in the past few quarters, fueling concerns of a structural slowdown. [REDACTED]

Other emerging markets and developing economies

As indicated in Chart 1, economic growth projections are higher for emerging markets and developing economies. For example, the IMF projects that Sub-Saharan Africa as a region will grow at 3.2 percent in 2019 and 3.6 percent in 2020. However, the regionwide numbers mask considerable differences in the growth performance and prospects of their constituent countries. Also, while growth rates can be high, it is often from a smaller base, which means that it will take some time for these countries to play a bigger role in the global economy and global trade.

In the meantime, there are opportunities to leverage Canada`s diplomatic and international assistance relationships to position us for the future, as other countries are already doing.

International Horizon Issues (November 2019 - March 2020)

North America

Relations with U.S.:

- CUSMA ratification (timelines TBD)

- [REDACTED]

- [REDACTED]

- [REDACTED]

- [REDACTED]

- [REDACTED]

Mexico:

- [REDACTED]

- Central American migration

Europe

Regional:

- [REDACTED] Middle East and African migration

- Developments [REDACTED]

EU/United Kingdom:

- Brexit negotiations (new bilateral trade agreement)

- CETA ratification by all EU member states

- Follow-up from 17th Canada-EU Summit (June 2019)

Ukraine:

- Military training mission (Op UNIFIER) and other security cooperation

- Ongoing political reforms

Russia:

- Crimea and Eastern Ukraine

- [REDACTED]

- [REDACTED]

- Intermediate-range Nuclear Forces (INF) Treaty

- [REDACTED]

- [REDACTED]

Romania:

- [REDACTED]

Latin America and the Caribbean

- Migration flows and impact [REDACTED]

- Venezuela: ongoing political crisis, LIMA group engagement/leadership

- Caribbean: managing hurricane season

- Latin America: [REDACTED]

Africa

- African Continental Free Trade Agreement and growth opportunities

- Political transitions [REDACTED]

- Security situation [REDACTED]

- Sahel: mitigate terrorism, [REDACTED] G7 and broader coordination of international efforts

- Piracy in the Gulf of Guinea and migration to Europe

Global themes/trends to watch

- [REDACTED]

- [REDACTED]

- [REDACTED]

- Democratic institutions, processes, and freedoms under threat

- [REDACTED] and violent extremism

- Peace, stability and climate change

- Scale and drivers of migration

- Diverging approaches to cyberspace, online platforms, new digital technologies and regulations

Multilateral

G7/G20:

- Signature initiatives from Canada's 2018 G7 Presidency – implementation & follow-up

- G7 transition from France to U.S.

- G20 transition from Japan to Saudi Arabia

UN:

- Canada's UN Security Council campaign (vote in June 2020), related events/interactions

- Secretary General Guterres' vision for UN Reform

- Implementation of Agenda 2030 for Sustainable Development (Decade of Action 2020-2030)

- UN Framework Convention on Climate Change – (COP25, December 2019)

WTO:

- Appellate Body appointment stalemate (December 10 deadline)

- WTO reform initiatives (Ottawa Group: transparency, dispute settlement, rule-making)

- [REDACTED]

NATO:

- Foreign Ministers' Meeting (Nov. 2019) and Leaders Summit (Dec. 2019)

- [REDACTED]

- Contributions to NATO missions in Iraq and Latvia

- [REDACTED]

Plurilateral trade agreements:

- CPTPP (Canada ratified Dec 2018)

- [REDACTED]

- [REDACTED]

Treaty on the Non-proliferation of Nuclear Weapons (NPT):

- 2020 Review Conference

Global Replenishments:

- Global Fund (October 2019)

- Green Climate Fund (October 2019)

International Development:

- Nairobi Summit (Nov 2019): 25th anniversary of Int'l Conference on Population and Development

- "Beijing 25+" (March 2020, New York): 25th anniversary of Fourth World Conference on Women

Legal/Regulatory

- [REDACTED]

- [REDACTED]

- [REDACTED]

High profile consular cases

- [REDACTED]

- [REDACTED]

- [REDACTED]

- [REDACTED]

Middle East

Turkey/Syria:

- [REDACTED]

- White Helmets (civilian volunteer group), government as gatekeeper of aid operations

Regional:

- Instability in the Strait of Hormuz

- Regional spillover [REDACTED]

- Global Coalition against Daesh

- Political transitions [REDACTED]

Israel/ Middle East Peace Process (MEPP):

- [REDACTED]

- [REDACTED]

- [REDACTED]

Gulf States:

- Bilateral relations with [REDACTED]

- [REDACTED] humanitarian situation, peace talks

- Human rights concerns [REDACTED]

- [REDACTED]

Iran:

- [REDACTED]

Libya:

- Escalating civil conflict, political and institutional backsliding

Asia

Regional:

- [REDACTED]

- [REDACTED]

China:

- [REDACTED]

- [REDACTED]

- [REDACTED]

- [REDACTED]

- [REDACTED]

- [REDACTED]

Northeast Asia:

- [REDACTED]

North Korea:

- Nuclear negotiations [REDACTED]

- Multilateral efforts [REDACTED]

- Human rights and humanitarian situation

South Asia:

- Situation [REDACTED]

- [REDACTED]

Afghanistan:

- [REDACTED]

- Peace process

Myanmar:

- Rohingya crisis [REDACTED]

- Reinforce democratic transition

The Department at a Glance

Issue

Global Affairs Canada is responsible for shaping and advancing Canada’s integrated foreign policy, international trade and international assistance objectives, and supporting Canadian consular and business interests. We have 10,707 employees working in Canada and in 178 missions in 110 countries around the world with a total budget of $6.7 billion.

Who We Are

Canada’s first foreign ministry was established in June 1909. Since then, the department has progressively transformed itself to reflect the changing international environment. The most significant transformations include its amalgamation with the Department of Trade and Commerce in 1982 and with the Canadian International Development Agency in 2013.

While the legal name of the department (pursuant to the Department of Foreign Affairs, Trade and Development Act of June 26, 2013) remains the Department of Foreign Affairs, Trade and Development, its public designation under the Federal Identity Program is Global Affairs Canada.

What We Do

Global Affairs Canada manages Canada’s diplomatic and consular relations with foreign governments and international organizations, engaging and influencing international players to advance Canada’s security and prosperity in a dynamic global context.

The department develops and implements Canada’s political, trade and international assistance policy and programming priorities based on astute analysis, consultation and engagement with other government departments, Canadians and international stakeholders.

The department’s work is focused on five core responsibilities:

1) International Advocacy and Diplomacy:

Promote Canada’s interests and values through policy development, diplomacy, advocacy, and engagement with diverse stakeholders. This includes building and maintaining constructive relationships to Canada’s advantage, primarily through our network of missions; taking leadership on select global issues; and efforts to build strong international institutions and respect for international law.

2) Trade and Investment:

Support increased trade and investment to raise the standard of living for all Canadians. This includes building and safeguarding an open and inclusive rules-based global trading system; support for Canadian exporters and innovators in their international business development efforts; negotiation of bilateral, plurilateral and multilateral trade agreements; administration of export and import controls; management of international trade disputes; facilitation and expansion of foreign direct investment; and support to international innovation, science and technology.

3) Development, Humanitarian Assistance, Peace and Security Programming:

Contribute to reducing poverty and increasing opportunity for people around the world. This includes alleviating suffering in humanitarian crises; reinforcing opportunities for sustainable and equitable economic growth; promoting gender equality and women’s empowerment; improving health and education outcomes; and bolstering peace and security through programs that counter violent extremism and terrorism, support anti-crime capacity building, peace operations and conflict management.

4) Help for Canadians Abroad:

Provide timely and appropriate travel information and consular services for Canadians abroad, contributing to their safety and security. This includes visits to places of detention; deployment of staff to evacuate Canadians in crisis situations; and provision of emergency documentation.

5) Support for Canada's Presence Abroad:

Deliver resources, infrastructure and services to enable Canada’s whole-of-government presence abroad. This includes the management of our missions abroad and the implementation of a major Duty of Care initiative to ensure the protection of Government of Canada personnel, overseas infrastructure and information.

Legal Responsibilities

The Department is the principal source of advice on public international law for the Government of Canada, including international trade and investment law. Global Affairs Canada lawyers develop and manage policy and advice on international legal issues, provide for the interpretation and analysis of international agreements, and advocate on behalf of Canada in international negotiations and litigation. There are also a number of Department of Justice lawyers at the Department, who provide legal services under domestic law, including on litigation and regulations such as sanctions implementation.

Our Workforce

To deliver on its mandate, the Department relies on a workforce that is flexible, competent, diverse and mobile.

The department counts 10,707 active employees. The majority of them (6,875 – 64 percent) are Canada-Based Staff (CBS), serving either in Canada or at our missions abroad. The remaining 3,832 employees (36 percent of our workforce) are Locally Engaged Staff (LES), usually foreign citizens hired in their own countries to provide support services at our missions. Currently, 56 percent of Canada-based staff are women (compared to 54 percent of LES) and 60 percent have English as their first official language (40 percent French).

A distinctive human resources system allows the Department to meet its complex operational needs in a timely manner. Our staff work in some of the most difficult places on earth, including in active conflict zones. Among the various occupational groups and assignment types, a cadre of rotational employees supports delivery of the Department’s unique mandate through assignments typically ranging between two to four-year periods, alternating between missions abroad and headquarters. They are foreign service officers (in trade, political, economic, international assistance, and management and consular officer streams), administrative assistants, computer systems specialists and executives, including our Heads of Mission.

Heads of Mission serve the Minister further to a cabinet appointment. They develop deep expert knowledge of their countries of accreditation, establish wide networks, and provide advice and guidance on pressing matters of bilateral and international concern. The Head of Mission is responsible for Canada’s “whole of government” engagement in their countries of accreditation and for the supervision of all federal programs present in their mission.

Global Affairs Canada personnel work in Canada and abroad to advance Canadian interests through creative diplomacy ranging from formal negotiations and network building to stakeholder engagement and capacity building. Canadian officials take part in thousands of international meetings every year on a multitude of topics, advancing Canadian interests through formal and informal interactions with representatives from virtually every country on earth. These efforts are aligned carefully with the priorities of the department and are amplified through targeted public diplomacy, including on social media.

The department is also supported by a 24/7 Emergency Watch and Response Centre in Ottawa which is always on guard to assist Canadians in need of consular assistance abroad or to respond in real time to natural disasters and complex emergencies around the globe.

Our finances

The Departments total funding in the 2019-20 Main Estimates was $6.7 billion. This amount is broken down as follows:

- Vote 1 (Operating): $1,743.4 million

- Vote 5 (Capital): $103.1 million

- Vote 10 (Grants and Contributions): $4,192 million

- Vote 15 (LES pension, insurance, social security programs): $68.9 million

- Budget Implementation : $269.5 million

- Statutory items (e.g. direct payments to international financial institutions; contributions to employee benefit plans): $342. 8 million.

The budget distribution by core responsibility of the Department in the 2019-20 Main Estimates was reported as follows:

2019-20 Core Responsibilities and Planned Spending (in millions)

Text version

2019-20 Core Responsibilities and Planned Spending (in millions)

| Core Responsibilities | Planned Spending |

|---|---|

| International Advocacy and Diplomacy | 873.6 |

| Trade and Investment | 327.1 |

| Development, Peace and Security Programming | 3920.9 |

| Help for Canadians Abroad | 51.0 |

| Support for Canada's Presence Abroad | 1031.8 |

| Internal Services | 245.6 |

Our network

The departments extensive network abroad counts 178 missions in 110 countries (see attached placemat for an overview of the network). They range in type and status from large embassies, to small representative offices and consulates.

The departments network of missions abroad also supports the international work of 37 Canadian partner departments, agencies and co-locators (such as Immigration, Refugees and Citizenship Canada; National Defence; Canada Border Services Agency; Public Safety; Royal Canadian Mounted Police; Export Development Canada; several provinces).

The departments headquarters offices are located in the Ottawa-Gatineau region. Most staff are located in the first three buildings:

- Lester B. Pearson Building (125 Sussex)

- John G. Diefenbaker Building(111 Sussex)

- Place du Centre (200 Promenade du Portage)

- Queensway Corporate Campus (4200 Labelle)

- Cooperative House (295 Bank)

- National Printing Bureau(45 Sacré-Coeur)

- Fontaine Building (200 Sacré-Coeur)

- Bisson Centre (the Canadian Foreign Service Institute Bisson Campus)

The department also has six Canadian regional offices to engage directly with Canadians, notably Canadian businesses:

- Vancouver

- Calgary

- Winnipeg

- Toronto

- Montréal

- Halifax

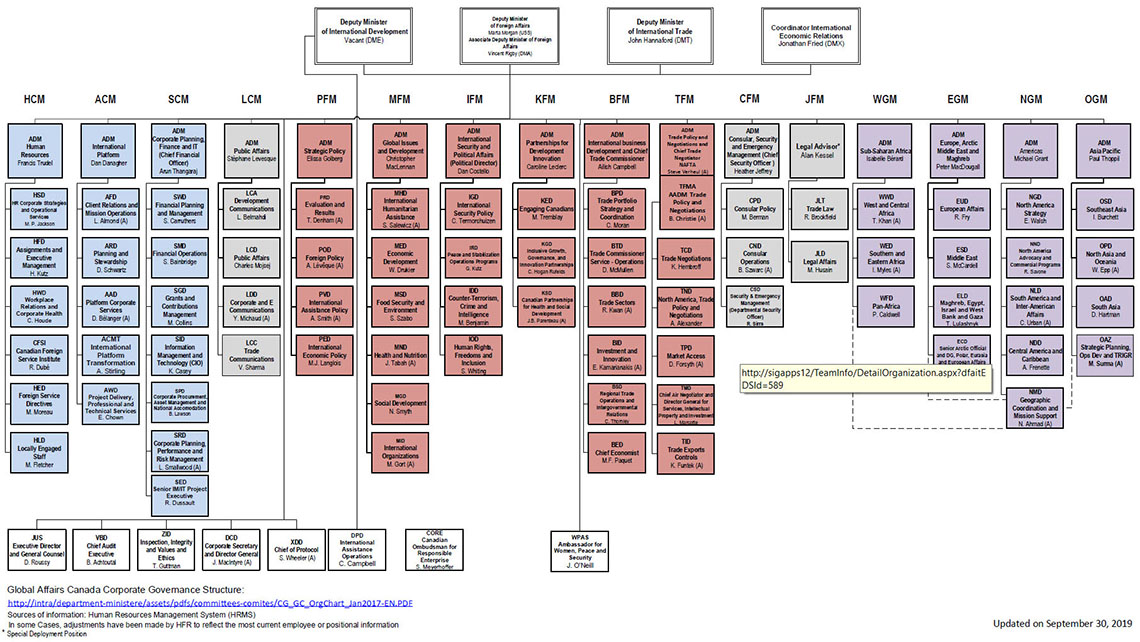

Senior leadership and corporate governance

In support of Ministers, the department’s most senior officials are the Deputy Minister of Foreign Affairs (USS); the Deputy Minister of International Trade (DMT); the Deputy Minister of International Development (DME); the Associate Deputy Minister of Foreign Affairs (DMA); and the Coordinator for International Economic Relations (DMX). Sixteen Branches, headed by Assistant Deputy Ministers, report to the Deputy Ministers and are responsible for providing integrated advice across various portfolios, ranging from geographic regions to corporate and thematic issues. (See separate bios)

Canada’s Heads of mission abroad are responsible for the management and direction of mission activities, and the supervision of the official activities of the various departments and agencies of the Government of Canada in the country or at the international organization to which they are appointed.

The department has a robust corporate governance framework with specific committees for audit, evaluation, resource and corporate management, policy and programs.

Senior managers from headquarters and the mission network manage and integrate the department’s policies and resources in this context to maximize our assets, and ensure accountability for the delivery of departmental programs and results. The amalgamated approach in the Department results in more coherent and cohesive international engagement, supported by an integrated organizational structure.

2019-2020 Corporate Governance Committee Structure

Text version

Chart summarizing 2019-2020 Corporate governance structure

- External Committee: Departmental Audit Committee

- DM-chaired committees: Executive Committee and Performance Measurement and Evaluations Committee

- ADM-chaired Committees: Security Committee; Financial Operations and Management Committee; Corporate Management Committee; and Policy and Programs Committee. All four ADM-chaired committees report to the Executive Committee.

Planning and reporting

The department’s annual planning and reporting process is structured around its Departmental Results Framework.

A Departmental Plan establishes the Government’s foreign affairs, international trade and development agenda for the coming year. It provides a strategic overview of the policy priorities, planned results and associated resource requirements for the coming fiscal year. The document is approved by the Ministers and tabled in Parliament (usually in March-April). The Plan also presents the performance targets against which the department will report its final results at the end of the fiscal year through a Departmental Results Report, typically tabled in Parliament in late fall.

A Corporate Plan acts as a companion piece, and is the Department's operational plan, aligning the work of branches and missions with the strategic plans and priorities established by the Departmental Plan and financial and human resources. The Corporate Plan ensures the integration of key enabling functions, such as human resources, IM/IT, communications, business continuity and risk management, into one operational planning process. The Corporate Plan is finalized in time for the start of each fiscal year in April.

Annex

Global Affairs Canada Network Placemat

Global Affairs Canada Organizational Chart

Biographies of senior officials

Deputy Ministers

Marta Morgan, Deputy Minister of Foreign Affairs

On April 18, 2019, Prime Minister Justin Trudeau appointed Marta Morgan to the position of Deputy Minister of Foreign Affairs, effective May 6, 2019.

Prior to joining Global Affairs Canada, since June 2016, Ms. Morgan was deputy minister of Immigration, Refugees and Citizenship Canada. In that previous role, she led the development of immigration policies and programs to support Canada’s economic growth, developed strategies to manage the significant growth in asylum claims and improved client service.

Before that, Ms. Morgan acquired extensive leadership experience in a range of economic policy roles both at Industry Canada and the Department of Finance Canada. In those departments, as assistant deputy minister and associate deputy minister, she provided leadership in telecommunications policy, spectrum policy, aerospace and automobile sectoral policy, and in the development of two federal budgets.

Prior to her time at Industry Canada, Ms. Morgan held positions at the Forest Products Association of Canada, the Privy Council Office, and Human Resources Development Canada.

She has also been a member of the board of the Public Policy Forum since 2014.

Ms. Morgan has a Bachelor of Arts (Honours) in economics from McGill University and a Master in Public Policy from the John F. Kennedy School of Government at Harvard University.

John Hannaford, Deputy Minister of International Trade

On December 7, 2018, the Prime Minister appointed John Hannaford Deputy Minister of International Trade at Global Affairs Canada, effective January 7, 2019.

From January 2015 to January 2019, Mr. Hannaford was the foreign and defence policy adviser to the Prime Minister and Deputy Minister in the Privy Council Office of the Government of Canada. Until December 2014, Mr. Hannaford was the assistant secretary to the Cabinet for foreign and defence policy in the Privy Council Office. Prior to December 2011,

Mr. Hannaford was Canada’s ambassador to Norway. Before that, for two years, Mr. Hannaford was director general of the Legal Bureau of the Department of Foreign Affairs and International Trade. As a member of Canada’s foreign service, he had numerous assignments in Ottawa and at the Canadian embassy in Washington, D. C. , during the early years of his career.

Mr. Hannaford graduated from Queen’s University in Kingston, Ontario, with a Bachelor of Arts in history. After earning a Master of Science in international relations at the London School of Economics, he completed a Bachelor of Laws at the University of Toronto and was called to the bar in Ontario in 1995.

In addition to his work as a public servant, Mr. Hannaford has been an adjunct professor in both the Faculty of Law and the Graduate School of Public and International Affairs at the University of Ottawa.

Vincent Rigby, Associate Deputy Minister of Foreign Affairs

On July 31, 2019, the Prime Minister appointed Vincent Rigby as Associate Deputy Minister of Foreign Affairs at Global Affairs Canada, effective August 12, 2019.

Prior to this appointment, Mr. Rigby was Associate Deputy Minister of Public Safety Canada from July 2017 until August 2019.

From 2013 to 2017, Mr. Rigby was Assistant Deputy Minister of Strategic Policy at Global Affairs Canada, where he was responsible for providing integrated strategic policy advice reflecting the foreign policy, international assistance and international trade streams of the Department. In this capacity, Mr. Rigby also served as the Personal Representative (Sherpa) to the Prime Minister on the G20, supporting three G20 Leaders’ Summits. Mr. Rigby carried out a number of additional roles as Assistant Deputy Minister, including as the Department’s Chief Results and Delivery Officer, G7 Sous-Sherpa, Chief Negotiator for the Post-2015 Development Agenda, and Chair of the Arctic Council’s Senior Arctic Officials.

Before the creation of Global Affairs Canada, Mr. Rigby was Vice-President of the Strategic Policy and Performance Branch of the former Canadian International Development Agency (CIDA). In this role, Mr. Rigby was responsible for developing and coordinating Canada’s international assistance policy as well as overseeing the performance management and evaluation of Canada’s development programme.

From 2008 to 2010, Mr. Rigby was the Executive Director of the International Assessment Secretariat (IAS) at the Privy Council Office (PCO). Mr. Rigby was also Afghanistan Intelligence Lead Official while at PCO, responsible for coordinating the Canadian intelligence community in support of Canada’s Afghanistan mission.

Before arriving at PCO, Mr. Rigby was Assistant Deputy Minister (Policy) at the Department of National Defence (DND) from 2006 to 2008. Over his 14 years at DND, Mr. Rigby held a number of other positions within the Policy Group, including Director General Policy Planning, Director of Policy Development and Director of Arms and Proliferation Control Policy. Prior to joining DND, he was a defence and foreign policy analyst at the Research Branch of the Library of Parliament, from 1991 to 1994.

Mr. Rigby holds an MA in diplomatic and military history from Carleton University in Ottawa.

Jonathan T. Fried, Coordinator, International Economic Relations

Mr. Fried is the Personal Representative of Prime Minister Justin Trudeau for the G20 and Coordinator for International Economic Relations at Global Affairs Canada, with a horizontal mandate to ensure coherent policy positions and government-wide strategic planning in international economic organizations and forums regarding, for example, Canada-Asia and other international trade and economic issues.

He served as Canada’s Ambassador and Permanent Representative to the WTO from 2012 to 2017, where he played a key role in multilateral trade negotiations, including as Chair of the WTO’s General Council in 2014 and chair of the Dispute Settlement Body in 2013. He was the co-Chair of the G20’s Trade and Investment Working Group with China in 2015, and the “Friend of the Chair” for Germany in 2016. Formerly Canada’s Ambassador to Japan; Executive Director for Canada, Ireland and the Caribbean at the International Monetary Fund; Senior Foreign Policy Advisor to the Prime Minister; Senior Assistant Deputy Minister for the Department of Finance and Canada's G7 and G20 Finance Deputy. Mr. Fried has also served as Associate Deputy Minister; Assistant Deputy Minister for Trade, Economic and Environmental Policy; Chief Negotiator on China’s WTO accession; Director General for Trade Policy; and chief counsel for NAFTA.

Mr. Fried is a member of the World Economic Forum’s Global Agenda Council on Trade and Investment and of the Steering Committee of the e15 initiative on Strengthening the Global Trading System. He serves on the advisory boards of the Columbia Center on Sustainable Investment, the World Trade Symposium and the Central and East European Law Institute. Mr. Fried was named in 2015 as the inaugural recipient of the Public Sector Lawyer Award by the Canadian Council on International Law to honour his service and contribution to public international law.

Organizational Structure

Text version

Level 1 – Deputy Ministers and Coordinator

Deputy Minister of International Development – Vacant (DME)

Deputy Minister of Foreign Affairs – Marta Morgan (USS)

Associate Deputy Minister of Foreign Affairs – Vincent Rigby (DMA)

Deputy Minister of International Trade – John Hannaford (DMT)

Coordinator International Economic Relations – Jonathan Fried (DMX)

Level 2 – Assistant Deputy Ministers and Directors General

Reports to the Deputy Minister of International Development

International Assistance Operations – C. Campbell

Reports to all Deputy Ministers and Coordinator

Assistant Deputy Minister Human Resources – Francis Trudel (HCM)

Assistant Deputy Minister International Platform – Dan Danagher (ACM)

Assistant Deputy Minister Corporate Planning, Finance and IT (Chief Financial Officer) – Arun Thangaraj (SCM)

Assistant Deputy Minister Public Affairs – Stéphane Levesque (LCM)

Assistant Deputy Minister Strategic Policy – Elissa Golberg (PFM)

Assistant Deputy Minister Global Issues and Development – Christopher MacLennan (MFM)

Assistant Deputy Minister International Security and Political Affairs (Political Director) – Dan Costello (IFM)

Assistant Deputy Minister Partnership for Development Innovation – Caroline Leclerc (KFM)

Assistant Deputy Minister International Business Development and Chief Trade Commissioner – Ailish Campbell (BFM)

Assistant Deputy Minister Trade Policy and Negotiations and Chief Trade Negotiator NAFTA – Steve Verheul (A) (TFM)

Assistant Deputy Minister Consular, Security and Emergency Management (Chief Security Officer) – Heather Jeffrey (CFM)

Legal Adviser – Alan Kessel (JFM) – Special Deployment Position

Assistant Deputy Minister Sub-Saharan Africa – Isabelle Bérard (WGM)

Assistant Deputy Minister Europe, Arctic, Middle East and Maghreb – Peter MacDougall (EGM)

Assistant Deputy Minister Americas – Michael Grant (NGM)

Assistant Deputy Minister Asia Pacific – Paul Thoppil (OGM)

Executive Director and General Counsel – D. Roussy (JUS)

Chief Audit Executive – B. Achtoutal (VBD)

Director General, Inspection, Integrity and Values and Ethics – T. Guttman (ZID)

Corporate Secretary and Director General – J. MacIntyre (A) (DCD)

Chief of Protocol – S. Wheeler (A) (XDD)

Ambassador for Women, Peace and Security – Jacqueline O’Neil (WPSA)

Level 3 – Directors General

Reports to the Assistant Deputy Minister Human Resources

HR Corporate Strategies and Operational Services – M. P. Jackson (HSD)

Assignments and Executive Management – H. Kutz (HFD)

Workplace Relations and Corporate Healthcare – C. Houde (HWD)

Canadian Foreign Service Institute – R. Dubé (CFSI)

Foreign Service Directives – M. Moreau (HED)

Locally Engaged Staff – M. Fletcher (HLD)

Reports to the Assistant Deputy Minister International Platform

Client Relations and Mission Operations – L. Almond (AFD)

Planning and Stewardship – D. Schwartz (ARD)

Platform Corporate Services – D. Bélanger (A) (AAD)

International Platform Transformation – A. Stirling (ACTM)

Project Delivery, Professional and Technical Services – E. Chown (AWD)

Reports to the Assistant Deputy Minister Corporate Planning, Finance and IT (Chief Financial Officer)

Financial Planning and Management – S. Carruthers (SWD)

Financial Operations – S. Bainbridge (SMD)

Grants and Contributions Management – M. Colins (SGD)

Information Management and Technology (CIO) – K. Casey (SID)

Director General, Corporate Procurement, Asset Management and National Accommodation – B. Lawson (SPD)

Corporate Planning, Performance and Risk Management – L. Smallwood (A) (SRD)

Senior IM/IT Project Executive – R. Dussault (SED)

Reports to the Assistant Deputy Minister Public Affairs

Development Communications – L. Belmahdi (LCA)

Public Affairs – Charles Mojsej (LCD)

Corporate and E Communications – Y. Michad (A) (LDD)

Trade Communications – V. Sharma (LCC)

Reports to the Assistant Deputy Minister Strategic Policy

Evaluation and Results – T. Denham (A) PRD)

Foreign Policy – A. Lévêque (A) (POD)

International Assistance Policy – A. Smith (A) (PVD)

International Economic Policy – M.J. Langlois (PED)

Reports to the Assistant Deputy Minister Global Issues and Development

International Humanitarian Assistance – S. Salewicz (A) (MHD)

Economic Development – W. Drukier (MED)

Food Security and Environment – S. Szabo (MSD)

Health and Nutrition – J. Tabah (A) (MND)

Social Development – N. Smyth (MGD)

International Organizations – M. Gort (A) (MID)

Reports to the Assistant Deputy Minister International Security and Political Affairs (Political Director)

International Security Policy – C. Termorshuizen (IGD)

Peace and Stabilization Operations Program – G. Kutz (IRD)

Counter-Terrorism, Crime and Intelligence – M. Benjamin (IDD)

Human Rights, Freedom and Inclusion – S. Whiting (IOD)

Reports to the Assistant Deputy Minister Partnership for Development Innovation

Engaging Canadians – M. Tremblay (KED)

Inclusive Growth, Governance and Innovation Partnerships – C. Hogan Rufelds (KGD)

Canadian Partnership for Health and Social Development – J.B. Parenteau (A) (KSD)

Reports to the Assistant Deputy Minister International Business Development and Chief Trade Commissioner

Trade Portfolio Strategy and Coordination – C. Moran (BPD)

Trade Commissioner Service - Operations – D. McMullen (BTD)

Trade Sectors – R. Kwan (A) (BBD)

Investment and Innovation – E. Kamarianakis (A) (BID)

Regional Trade Operations and Intergovernmental Relations – C. Thomley (BSD)

Chief Economist – M.F. Paquet (BED)

Reports to the Assistant Deputy Minister Trade Policy and Negotiations and Chief Trade Negotiator

Associate Assistant Deputy Minister, Trade Policy and Negotiations – B. Christie (A) (TFMA)

Reports to the Associate Assistant Deputy Minister, Trade Policy and Negotiations

Trade Negotiations – K. Hembroff (TCD)

North America, Trade Policy and Negotiations – A. Alexander (TND)

Market Access – D. Forsyth (A) (TPD)

Chief Air Negotiator and Director General for Services, Intellectual Property and Investment – L. Marcotte (TMD-ANA)

Trade and Exports Control – K. Funtek (A) (TID)

Reports to the Assistant Deputy Minister Consular, Security and Emergency Management

Consular Policy – M. Berman (CPD)

Consular Operations – B. Szwarc (A) CND)

Security and Emergency Management (Departmental Security Officer) – R. Sirrs (CSD)

Reports to the Legal Adviser

Trade Law – R. Brookfield (JLT)

Legal Affairs – M. Husain (JLD)

Reports to the Assistant Deputy Minister Sub-Saharan Africa

West and Central Africa – T. Khan (A) (WWD)

Southern and Eastern Africa – I. Myles (A) (WED)

Pan-Africa – P. Caldwell (WFD)

Reports to the Assistant Deputy Minister Europe, Arctic, Middle East and Maghreb

European Affairs – R. Fry (EUD)

Middle East - S. McCardell (ESD)

Maghreb, Egypt, Israel and West Bank and Gaza – T. Lulashnyk (ELD)

Senior Arctic Official and Director General, Polar, Eurasia and European Affairs - D. Sproule (A) (ECD)

Reports to the Assistant Deputy Minister Americas

North America Strategy – E. Walsh (NGD)

North America Advocacy and Commercial Programs – R. Savone (NND)

South America and Inter-American Affairs – C. Urban (A) (NLD)

Central America and Caribbean – A. Frenette (NDD)

Geographic Coordination and Mission Support – N. Ahmad (A) (NMD)

Reports to the Assistant Deputy Minister Asia Pacific

Southeast Asia – Ian Burchett (OSD)

North Asia and Oceania – W. Epp (A) (OPD)

South Asia – D. Hartman (OAD)

Strategic Planning, Ops Dev and TRIGR – M. Suma (A) (OAZ)

Level 4 – Outside of Main Organizational Structure

Canadian Ombudsperson for Responsible Enterprise – Sheri Meyerhoffer (CORE)

Source of information: Human resources Management System (HRMS)

In some cases, adjustments have been made by HFR to reflect the most current employee or positional information.

Link to Global Affairs Canada Corporate Governance Structure (http://intra/department-ministere/assets/pdfs/committees-comites/CG_GC_OrgChart_Jan2017-EN.PDF).

Updated on September 30, 2019

Mission Network

Text version

Summary of Missions / Points of Service

| Designation | Category 1 | Category 2 | Category 3 | Category 4 | Category 5 | Total by Category |

|---|---|---|---|---|---|---|

| Embassies | 9 | 49 | 18 | 2 | 0 | 78 |

| High Commissions | 2 | 12 | 2 | 6 | 0 | 22 |

| Embassy/High Commission of Canada (Program) Offices | 0 | 0 | 1 | 10 | 0 | 11 |

| Offices of the Embassy / High Commission | 0 | 0 | 1 | 11 | 1 | 13 |

| Representative Offices | 0 | 1 | 0 | 1 | 0 | 2 |

| Multilaterals or Permanent | 5 | 4 | 2 | 0 | 0 | 11 |

| Consulates General | 1 | 15 | 6 | 3 | 0 | 25 |

| Consulates | 0 | 0 | 3 | 7 | 0 | 10 |

| Consular Agencies | 0 | 0 | 0 | 6 | 0 | 6 |

| Regional Offices | 0 | 0 | 0 | 0 | 0 | 0 |

| Total | 17 | 81 | 33 | 46 | 1 | 178 |

| Designation | Europe & Middle East | Asia Pacific | Africa | Americas | Canada | Total |

|---|---|---|---|---|---|---|

| Embassies | 42 | 10 | 9 | 17 | 0 | 78 |

| High Commissions | 1 | 9 | 8 | 4 | 0 | 22 |

| Embassy/High Commission of Canada (Program) Offices | 3 | 2 | 3 | 3 | 0 | 11 |

| Offices of the Embassy / High Commission | 2 | 6 | 1 | 4 | 0 | 13 |

| Representative Offices | 1 | 1 | 0 | 0 | 0 | 2 |

| Multilaterals or Permanent | 8 | 1 | 0 | 2 | 0 | 11 |

| Consulates General | 2 | 9 | 0 | 15 | 0 | 26 |

| Consulates | 2 | 3 | 0 | 4 | 0 | 9 |

| Consular Agencies | 0 | 0 | 0 | 6 | 0 | 6 |

| Australian, CCC & Other Offices | 0 | 26 | 0 | 0 | 0 | 26 |

| Regional Offices in Canada | 0 | 0 | 0 | 0 | 5 | 5 |

| Honorary Consulates | 37 | 15 | 17 | 32 | 0 | 101 |

| Total by Geographic Portfolio | 98 | 82 | 38 | 87 | 5 | 310 |

Points of Service excluding Australian, CCC & Other Offices, Regional Offices and Honorary Consulates: 178

Europe & Middle East

Embassies (E)

| Mission | Country | Designation / Title | Category |

|---|---|---|---|

| Abu Dhabi | United Arab Emirates | The Embassy of Canada to the United Arab Emirates | 2 |

| Algiers | Algeria | The Embassy of Canada to Algeria | 2 |

| Amman | Jordan | The Embassy of Canada to Jordan | 2 |

| Ankara | Turkey | The Embassy of Canada to Turkey | 2 |

| Astana | Kazakhstan | The Embassy of Canada to Kazakhstan | 3 |

| Athens | Greece | The Embassy of Canada to Greece | 2 |

| Baghdad | Iraq | The Embassy of Canada to Iraq | 3 |

| Beirut | Lebanon | The Embassy of Canada to Lebanon | 2 |

| Belgrade | Republic of Serbia | The Embassy of Canada to the Republic of Serbia | 2 |

| Berlin | Germany | The Embassy of Canada to Germany | 1 |

| Berne | Switzerland | The Embassy of Canada to Switzerland | 2 |

| Brussels | Belgium | The Embassy of Canada to Belgium | 2 |

| Bucharest | Romania | The Embassy of Canada to Romania | 2 |

| Budapest | Hungary | The Embassy of Canada to Hungary | 2 |

| Cairo | Egypt | The Embassy of Canada to Egypt | 2 |

| Copenhagen | Denmark | The Embassy of Canada, Copenhagen, Denmark | 2 |

| Damascus | Syria | The Embassy of Canada to Syria | 2 |

| Doha | Qatar | The Embassy of Canada to Qatar | 3 |

| Dublin | Ireland | The Embassy of Canada, Dublin, Ireland | 2 |

| Hague, The | Netherlands | The Embassy of Canada to the Netherlands | 2 |

| Helsinki | Finland | The Embassy of Canada to Finland | 2 |

| Kuwait City | Kuwait | The Embassy of Canada to Kuwait | 2 |

| Kyiv | Ukraine | The Embassy of Canada to Ukraine | 2 |

| Lisbon | Portugal | The Embassy of Canada to Portugal | 2 |

| Madrid | Spain | The Embassy of Canada to Spain | 2 |

| Moscow | Russian Federation | The Embassy of Canada to Russia | 1 |

| Oslo | Norway | The Embassy of Canada to Norway | 2 |

| Paris | France | The Embassy of Canada to France | 1 |

| Prague | Czech Republic | The Embassy of Canada to the Czech Republic | 2 |

| Rabat | Morocco | The Embassy of Canada to Morocco | 2 |

| Reykjavik | Iceland | The Embassy of Canada to Iceland | 3 |

| Riga | Latvia | The Embassy of Canada to Latvia | 3 |

| Riyadh | Saudi Arabia | The Embassy of Canada to Saudi Arabia | 2 |

| Rome | Italy | The Embassy of Canada to Italy | 1 |

| Stockholm | Sweden | The Embassy of Canada to Sweden | 2 |

| Tel Aviv | Israel | The Embassy of Canada to Israel | 2 |

| Tripoli | Libya | The Embassy of Canada to Libya | 3 |

| Tunis | Tunisia | The Embassy of Canada to Tunisia | 2 |

| Vatican City | Holy See | The Embassy of Canada to the Holy See | 2 |

| Vienna | Austria | The Embassy of Canada to Austria | 1 |

| Warsaw | Poland | The Embassy of Canada to Poland | 2 |

| Zagreb | Croatia | The Embassy of Canada to Croatia | 3 |

Total: 42

High Commissions (HC)

| Mission | Country | Designation / Title | Category Common (property) |

|---|---|---|---|

| London | United Kingdom | The High Commission of Canada to the United Kingdom | 1 |

Total: 1

Embassy / High Commission of Canada (Program) (PO)

| Mission | Country | Designation / Title | Category Common (property) |

|---|---|---|---|

| Bratislava | Slovakia | The Office of the Embassy of Canada, Bratislava | 4 |

| Tallinn | Estonia | The Office of the Embassy of Canada, Tallinn | 4 |

| Vilnius | Lithuania | The Office of the Embassy of Canada, Vilnius | 4 |

Total: 3

Offices of the Embassy / High Commission (O)

| Mission | Country | Designation / Title | Category |

|---|---|---|---|

| Barcelona | Spain | The Consulate and Trade Office of Canada, Barcelona | 4 |

| Erbil | Iraqi Kurdistan | The Office of the Canadian Embassy, Erbil | 3 |

Total: 2

Representative Offices (RO)

| Mission | Country | Designation / Title | Category |

|---|---|---|---|

| Ramallah | West Bank & Gaza | Representative Office of Canada, Ramallah | 4 |

Total: 1

Australian (A), Canadian Commercial Corporation (CCC) & Other Offices (O)

| Mission | Country | Designation / Title | Category |

|---|---|---|---|

Total: 0

Multilaterals (M)

| Mission | Country | Designation / Title | Category |

|---|---|---|---|

| Brussels EU | Belgium | The Mission of Canada to the European Union | 1 |

| Brussels NATO | Belgium | Canadian Joint Delegation to the North Atlantic Council | 1 |

| Geneva PERM | Switzerland | The Permanent Mission of Canada to the Office of the United Nations and to the Conference on Disarmament | 1 |

| Geneva WTO | Switzerland | The Permanent Mission of Canada to the World Trade Organization | 1 |

| Paris OECD | France | The Permanent Delegation of Canada to the Organization for Economic Cooperation and Development | 2 |

| Paris UNESCO | France | The Permanent Delegation of Canada to the United Nations Educational, Scientific and Cultural Organization | 2 |

| Vienna OSCE | Austria | Canadian delegation to the Organization for Security and Cooperation in Europe | 3 |

| Vienna PERM | Austria | The Permanent Mission of Canada to the International Organizations (IAEA, CBTBO, UNODC/UNOV) | 3 |

Total: 8

Consulates General (CG)

| Mission | Country | Designation / Title | Category |

|---|---|---|---|

| Istanbul | Turkey | The Consulate General of Canada, Istanbul | 4 |

| Dubai | United Arab Emirates | The Consulate General of Canada, United Arab Emirates | 3 |

Total: 2

Consulates (C)

| Mission | Country | Designation / Title | Category |

|---|---|---|---|

| Düsseldorf | Germany | The Consulate of Canada, Düsseldorf | 4 |

| Munich | Germany | The Consulate of Canada, Munich | 4 |

Total: 2

Consular Agencies (CA)

| Mission | Country | Designation / Title | Category |

|---|---|---|---|

Total: 0

Consulates headed by an Honorary Consul

| Point of Service | Country | Status |

|---|---|---|

| Belfast | United Kingdom | Active |

| Bishkek | Kyrgyz Republic | Active |

| Cardiff | United Kingdom | Active |

| Edinburgh | United Kingdom | Active |

| Faro | Portugal | Active |

| Flanders | Belgium | Active |

| Gothenburg | Sweden | Active |

| Jeddah | Saudi Arabia | Active |

| Liège | Belgium | Active |

| Ljubljana | Slovenia | Active |

| Luxembourg | Luxembourg | Active |

| Lviv | Ukraine | Active |

| Lyon | France | Active |

| Malaga | Spain | Active |

| Manama | Bahrain | Active |

| Milan | Italy | Active |

| Monaco | Monaco | Active |

| Muscat | Oman | Active |

| Nice | France | Active |

| Nicosia | Cyprus | Active |

| Nuuk | Greenland | Active |

| Ponta Delgada | Portugal | Active |

| Reykjavic | Iceland | Active |

| Sana'a | Yemen | Active |

| Skopje | Macedonia | Active |

| Sofia | Bulgaria | Active |

| Stavanger | Norway | Active |

| St. Pierre and Miquelon | France | Active |

| Stuttgart | Germany | Active |

| Tashkent | Uzbekistan | Active |

| Tbilisi | Georgia | Active |

| Thessaloniki | Greece | Active |

| Tirana | Albania | Active |

| Toulouse | France | Active |

| Valletta | Malta | Active |

| Vladivostok | Russia Federation | Active |

| Yerevan | Armenia | Active |

Total: 37

Total Europe & Middle East: 98

Asia Pacific

Embassies (E)

| Mission | Country | Designation / Title | Category |

|---|---|---|---|

| Bangkok | Thailand | The Embassy of Canada to Thailand | 2 |

| Beijing | China | The Embassy of Canada to China | 1 |

| Hanoi | Vietnam | The Embassy of Canada to Vietnam | 2 |

| Jakarta | Indonesia | The Embassy of Canada to Indonesia | 2 |

| Kabul | Afghanistan | The Embassy of Canada to Afghanistan | 3 |

| Manila | Philippines | The Embassy of Canada to the Philippines | 2 |

| Seoul | Korea, South | The Embassy of Canada to the Republic of Korea | 2 |

| Tokyo | Japan | The Embassy of Canada to Japan | 1 |

| Ulaanbaatar | Mongolia | The Embassy of Canada to Mongolia | 3 |

| Yangon | Burma | The Embassy of Canada to Burma | 4 |

Total: 10

High Commissions (HC)

| Mission | Country | Designation / Title | Category |

|---|---|---|---|

| Bandar Seri Begawan | Brunei | The High Commission of Canada to Brunei Darussalam | 4 |

| Canberra | Australia | The High Commission of Canada to Australia | 2 |

| Colombo | Sri Lanka | The High Commission of Canada to Sri Lanka | 3 |

| Dhaka | Bangladesh | The High Commission of Canada to Bangladesh | 2 |

| Islamabad | Pakistan | The High Commission of Canada to Pakistan | 2 |

| Kuala Lumpur | Malaysia | The High Commission of Canada to Malaysia | 2 |

| New Delhi | India | The High Commission of Canada to India | 1 |

| Singapore | Singapore | The High Commission of Canada to Singapore | 2 |

| Wellington | New Zealand | The High Commission of Canada to New Zealand | 2 |

Total: 9

Embassy / High Commission of Canada (Program) (PO)

| Mission | Country | Designation / Title | Category |

|---|---|---|---|

| Phnom Penh (1 Sept 2015) | Cambodia | The Office of the Embassy of Canada, Thailand | 4 |

| Vientiane (1 Sept 2015) | Laos | The Office of the Embassy of Canada, Thailand | 4 |

Total: 2

Offices of the Embassy / High Commission (O)

| Mission | Country | Designation / Title | Category |

|---|---|---|---|

| Ahmedabad | India | The Canadian Trade Office, Ahmedabad | 4 |

| Hyderabad | India | The Canadian Trade Office, Hyderabad | 4 |

| Karachi | Pakistan | The Canadian Trade Office, Karachi | 4 |

| Fukuoka | Japan | The Canadian Trade Office, Fukuoka | 5 |

| Kolkata | India | The Canadian Trade Office, Kolkata | 4 |

| Sapporo | Japan | The Canadian Trade Office, Sapporo | 4 |

Total: 6

Representative Offices (RO)

| Mission | Country | Designation / Title | Category |

|---|---|---|---|

| Taipei | Taiwan | The Canadian Trade Office, Taipei | 2 |

Total: 1

Australian (A), Canadian Commercial Corporation (CCC) & Other Offices (O)

| Mission | Country | Designation / Title | Category |

|---|---|---|---|

| Apia | Samoa | Australian High Commissions and Consulates | N/A |

| Chengdu | China | Canadian Commercial Corporation Representative Office | N/A |

| Denpasar | Indonesia | Australian High Commissions and Consulates | N/A |

| Dili | Timor-Leste | Australian High Commissions and Consulates | N/A |

| Hangzhou | China | Canadian Commercial Corporation Representative Office | N/A |

| Honiara | Solomon Islands | Australian High Commissions and Consulates | N/A |

| Honolulu | Hawaii | Australian High Commissions and Consulates | N/A |

| Nanjing | China | Canadian Commercial Corporation Representative Office | N/A |

| Nouméa | New Caledonia | Australian High Commissions and Consulates | N/A |

| Nuku'alofa | Tonga | Australian High Commissions and Consulates | N/A |

| Phnom Penh | Cambodia | Australian High Commissions and Consulates | N/A |

| Pohnpei | Micronesia | Australian High Commissions and Consulates | N/A |

| Port Moresby | Papua New Guinea | Australian High Commissions and Consulates | N/A |

| Port Vila | Vanuatu | Australian High Commissions and Consulates | N/A |

| Pyongyang | Korea, North | Swedish Embassy | N/A |

| Qingdao | China | Canadian Commercial Corporation Representative Office | N/A |

| Shenyang | China | Canadian Commercial Corporation Representative Office | N/A |

| Shenzhen | China | Canadian Commercial Corporation Representative Office | N/A |

| Suva | Fiji | Australian High Commissions and Consulates | N/A |

| Tarawa | Kiribati | Australian High Commissions and Consulates | N/A |

| Tianjin (January 2015) | China | Canadian Commercial Corporation Representative Office | N/A |

| Vientiane | Laos | Australian High Commissions and Consulates | N/A |

| Wuhan | China | Canadian Commercial Corporation Representative Office | N/A |

| Xi'an | China | Canadian Commercial Corporation Representative Office | N/A |

| Xiamen | China | Canadian Commercial Corporation Representative Office | N/A |

| Yangon | Burma | Australian High Commissions and Consulates | N/A |

Total: 26

Multilaterals (M)

| Mission | Country | Designation / Title | Category |

|---|---|---|---|

| ASEAN (1 August 2015) | Indonisia | Association of Southeast Asian Nations | 2 |

Total: 1

Consulates General (CG)

| Mission | Country | Designation / Title | Category |

|---|---|---|---|

| Bangalore | India | The Consulate General of Canada, Bangalore | 4 |

| Chandigarh | India | The Consulate General of Canada, Chandigarh | 3 |

| Chongqing | China | The Consulate General of Canada, Chongqing | 3 |

| Guangzhou | China | The Consulate General of Canada, Guangzhou | 3 |

| Ho Chi Minh City | Vietnam | The Consulate General of Canada, Ho Chi Minh City | 4 |

| Hong Kong | China | The Consulate General of Canada, Hong Kong | 2 |

| Mumbai | India | The Consulate General of Canada, Mumbai | 3 |

| Shanghai | China | The Consulate General of Canada, Shanghai | 2 |

| Sydney | Australia | The Consulate General of Canada, Sydney | 2 |

Total: 9

Consulates (C)

| Mission | Country | Designation / Title | Category |

|---|---|---|---|

| Auckland | New Zealand | The Consulate and Trade Office of Canada, Auckland | 4 |

| Chennai | India | The Consulate of Canada, Chennai | 4 |

| Nagoya | Japan | The Consulate of Canada, Nagoya | 4 |

Total: 3

Consular Agencies (CA)

| Mission | Country | Designation / Title | Category |

|---|---|---|---|

Total: 0

Consulates headed by an Honorary Consul

| Point of Service | Country | Status |

|---|---|---|

| Busan | Korea, South | Active |

| Cebu | Philippines | Active |

| Chiang Mai | Thailand | Active |

| Fukuoka | Japan | Active |

| Hiroshima | Japan | Active |

| Karachi | Pakistan | Active |

| Kathmandu | Nepal | Active |

| Kolkata | India | Active |

| Lahore | Pakistan | Active |

| Melbourne | Australia | Active |

| Nadi | Fiji | Active |

| Osaka | Japan | Active |