Archived information

Information identified as archived is provided for reference, research or recordkeeping purposes. It is not subject to the Government of Canada Web Standards and has not been altered or updated since it was archived. Please contact us to request a format other than those available.

Annual Report Pursuant to the Agreement concerning Annual Reports on Human Rights and Free Trade between Canada and the Republic of Colombia - 2016

July 20, 2016

Executive Summary

This report is Canada’s fifth report pursuant to the Agreement concerning Annual Reports on Human Rights and Free Trade between Canada and the Republic of Colombia. The mandate of the report is to review how actions taken by the Government of Canada in the context of the Canada-Colombia Free Trade Agreement impact human rights in Canada and Colombia.

The promotion and protection of human rights is an integral part of Canadian foreign policy. Canada champions the values of inclusive and accountable governance, peaceful pluralism and respect for diversity, and the rights of women and children, refugees, Indigenous peoples and LGBTQ2 individuals.

Canada works through multilateral organizations, bilateral engagement, development assistance and trade policy to enhance the promotion and protection of human rights internationally.

Canada and Colombia share important values and priorities: fighting climate change; promoting peaceful pluralism; and improving security in the region.

Canada supports Colombia’s ongoing efforts towards greater peace, security, prosperity and respect for human rights. This report and the Canada-Colombia Free Trade Agreement, join a range of actions—including advocacy and bilateral and development cooperation—through which this support is provided.

As per previous years, the report sets out the Government of Canada’s obligations under this reporting mechanism, including its scope and limitations. It includes economic baseline information on the global economy, as well as the Canadian and Colombian economies. It reviews the actions taken under the Canada-Colombia Free Trade Agreement in 2015, and since its entry into force, and provides an analysis of trade gains for different tariff categories.

This year’s report aims to enhance transparency in accordance with the tenets of open and accountable government. As such, this year we have consulted more widely in the preparation of the report. Public consultations were increased to four weeks this year. Consultations also included in-person meetings with a number of NGOs and academics across Canada. In-person consultations were also conducted in Colombia with unions, industry and industry associations in relevant economic sectors.

Most comments received through consultations were not focussed on the impact of the Canada-Colombia Free Trade Agreement, and instead raised broader human rights concerns. Despite being outside the mandate of this report, we believe it is important to include these comments, and have done so this year. A summary of the comments received during the consultations can be found in Section 7 of the report.

For the first time, the report also outlines the various aspects of Canada’s bilateral engagement with Colombia and the programming tools employed to support Colombia in its efforts to address the challenges highlighted in this report.

The report concludes with a summary of findings.

Finally, it is important to note that this year’s report is also prepared at a time when Colombia is making significant progress toward peace. It is expected that a peace agreement and its subsequent implementation will, over time, help provide the conditions conducive to the protection of human rights for all Colombians.

Introduction

Canada and Colombia signed the Agreement concerning Annual Reports on Human Rights and Free Trade between Canada and the Republic of Colombia (“the Agreement”) on May 27, 2010. This unique agreement requires that Canada and Colombia each produce an annual report on the effect of actions taken under the Free Trade Agreement between Canada and the Republic of Colombia (Canada-Colombia Free Trade Agreement, “CCOFTA”) on human rights in both countries.

The Agreement entered into force on August 15, 2011, concurrently with the CCOFTA, as well as two other related agreements, the Agreement on Labour Cooperation between Canada and the Republic of Colombia (“Labour Cooperation Agreement”) and the Agreement on the Environment between Canada and the Republic of Colombia (“Environment Agreement”).

The CCOFTA is consistent with Canada’s aims to enhance its economic interests in Colombia and to deepen its engagement with Latin American countries. It provides greater stability and predictability for Canadian exporters, service providers, and investors, including expanded opportunities in a broad range of sectors, particularly oil and gas, mining, agriculture and agri-food, and manufacturing. The CCOFTA also reduces trade barriers to improve Canada and Colombia’s bilateral economic relationship by allowing both countries to increase their export potential and access new markets. Finally, the services and services-related provisions of the CCOFTA support exporters by encouraging stronger economic ties through the implementation of principles and conditions of regulatory transparency and stability.

Canada tabled its first report pursuant to the Agreement on May 15, 2012. This current report is Canada’s fifth report pursuant to the Agreement.

Reporting Requirement under the Canada-Colombia Free Trade Agreement Implementation Act

Canada’s obligations under the Agreement are incorporated into Canadian domestic law under section 15.1 of the Canada-Colombia Free Trade Implementation Act (“Implementation Act”):

15.1 Pursuant to the Agreement Concerning Annual Reports on Human Rights and Free Trade Between Canada and the Republic of Colombia, the Minister shall cause to be laid before each House of Parliament by May 15 of each year or, if that House is not then sitting, on any of the 30 days next thereafter that it is sitting, a report on the operation of this Act during the previous calendar year, containing a general summary of all actions taken under the authority of this Act, and an analysis of the impact of these actions on human rights in Canada and the Republic of Colombia.

In line with these legal requirements, this annual report contains a general summary of actions taken by Canada during the review period under the CCOFTA, as well as the related Labour Cooperation Agreement and the Environment Agreement; and a review of any perceived human rights changes in Canada or Colombia due to these actions.

2.1 Actions under Consideration

The Implementation Act specifies that the Government of Canada is required to table a report on the impact of human rights in Canada and Colombia of actions taken under the authority of the Implementation Act. As the Implementation Act includes the CCOFTA, the Environment Agreement and the Labour Cooperation Agreement, actions taken under all three agreements are considered by this report.

2.2 Scope and Limitations

Consistent with the parameters provided by the Implementation Act, the mandate of this report is to outline the actions taken by Canada under the CCOFTA and the related agreements on labour cooperation and the environment, and any effect these actions may have had on human rights.

As the Implementation Act governs Canadian domestic implementation of these three agreements, only the impact of actions taken by Canada under these agreements will be considered in this report.

2.3 Time Period under Consideration

The Implementation Act commits Canada to report “on the operation of this Act during the previous calendar year” (Section 15.1 of the Implementation Act). The 2016 annual report will cover the period from January 1, 2015 to December 31, 2015. Additionally, given that the 2016 report is the fifth report on the CCOFTA, this year’s report also takes a retrospective look at the period since the entry into force of the CCOFTA.

2.4 Human Rights under Consideration

The promotion and protection of human rights is an integral part of Canadian foreign policy. Canada champions the values of inclusive and accountable governance, peaceful pluralism and respect for diversity, and human rights including the rights of women and refugees.

The Government of Canada is striving for progress in areas such as relations with Indigenous peoples, the rights of women, gender equality and access to justice.

Canada works through multilateral organizations, bilateral engagement, development assistance and trade policy to enhance the promotion and protection of human rights internationally.

This report joins a range of actions—including advocacy and bilateral and development cooperation—through which Canada supports Colombia’s ongoing efforts towards greater peace, security, prosperity and respect for human rights.

Context

3.1 Colombia

Colombia is a rapidly growing middle-income country with ambitious aspirations for trade and increased global responsibility and membership (including participation in international peacekeeping operations and OECD accession). At the same time, it is emerging from over 50 years of internal armed conflict that has resulted in over 6 million internally-displaced people and the second highest number of landmine casualties worldwide. Poverty, violence and human rights abuses continue to be of concern, mostly in rural areas, especially those where the State’s presence is limited. Following over three years of negotiations between the Government of Colombia and the largest guerrilla group, the Revolutionary Armed Forces of Colombia (FARC), both parties are close to achieving an historic peace agreement. The Colombian government also announced on March 30, 2016 that formal peace talks with the second largest insurgency group, the National Liberation Army (ELN), will be launched. These agreements would end the last armed insurgency in the Americas and contribute to enhancing security and prosperity for all Colombians, especially the most vulnerable. At the request of the Government of Colombia, a resolution to create the mandate of a UN special political mission of unarmed observers to monitor and verify the definitive ceasefire and cessation of all hostilities with the FARC was unanimously approved by the United Nations Security Council on January 25th, 2016.

3.2 Canada-Colombia Bilateral Relations

The Government of Canada takes a whole-of-government approach to its bilateral relations with Colombia through its political, commercial, development, and peace and security programming. The relationship includes: expanding trade and investment, facilitated by the 2011 bilateral free trade agreement; a frank dialogue on human rights; development cooperation; support for Colombia’s justice, security and peace-building efforts; growing mobility between our two countries (tourism, study, business, immigration) and people-to-people relationships; and, close cooperation on multilateral issues. Colombia is a constructive, valued partner for Canada in the region and internationally, with a shared commitment to the values of democracy, transparency, multilateralism, and economic cooperation and integration.

Economic Baseline Information

In order to analyze the impact of actions taken by Canada under the CCOFTA, it is important to consider the economic context in which they occur. The following baseline economic information provides this context.

4.1 Global Economic Trends

The most noticeable trend of the global economy in recent years has been a slower-than-expected economic recovery from the financial crisis in 2008-2009 in most advanced economies and the continuing economic slowdown in emerging markets. The United States has emerged from the financial crisis and continues to lead growth among the advanced economies, but faces substantial headwinds from a slowing global economy and a strong dollar. Many emerging economies are experiencing a slowdown in growth. China, in particular has seen its economic growth slow to less than 7% in 2015. This slowdown in the Chinese economy has been controlled and gradual, but its effects on global growth and commodities markets are nonetheless significant.

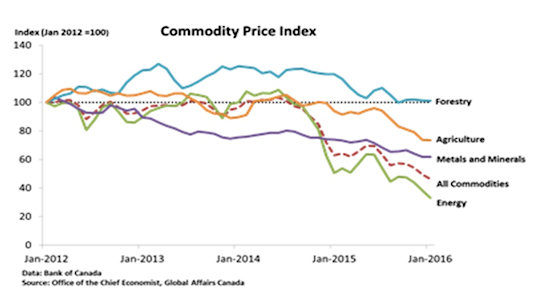

Commodity prices in 2015 were, on average, 50% lower than in January 2014, while oil prices fell over two-thirds in two years. Low commodity prices, particularly oil prices, are a worldwide challenge for many commodities producing countries. (See Annex 1)

Parallel to the general global economic slowdown and low commodity prices is a significant downturn of global trade, which grew less than 3% per year following the financial crisis in 2008-2009, from about 7% on average between 1990 and 2007. This means that global trade has been growing less rapidly than GDP; while in the pre-financial crisis era, growth of global trade had consistently outperformed GDP growth.

Low commodity prices had a significant impact on the exchange rate movements of major commodity exporting countries. Since 2012, the Canadian dollar has depreciated by 38% against the US dollar; similarly, the value of the Colombian peso has depreciated by 77.8% over the same period.

All these changes have profound implications for economic growth in Canada and Colombia and bilateral trade between the countries.

4.2 Canadian Economy

Canada is ranked the eleventh largest economy in the world with GDP standing at US$1.6 trillion in 2015, or about four and a half times that of the Colombian economy. With a population of 35.8 million, Canada’s per capita GDP was US$43,935 in 2015.

Canada is one of the most open economies in the world with very low barriers to trade and investment and international goods trade accounting for 65.1% of its GDP in 2015. The United States is Canada’s largest trading partner with 72.3% of all Canadian merchandise exports destined to that market.

Services constitute a leading sector in the Canadian economy, making up 70% of Canada’s GDP in 2015 and employing 78% of the Canadian labour force. In the past decade, the share of services in Canada’s GDP increased steadily as the importance of other sectors in Canadian GDP declined.

The Canadian economy has been expanding at an average annual rate of 1.8% during the past decade, though it experienced a slowdown during the recent financial crisis in 2008-2009. Benefiting from its solid financial system and skilled labour force, Canada has more than recouped all of the loss in output experienced during the financial crisis, but as a major commodity producer, Canada has been one of the hardest-hit developed economies by the impact of declining commodity prices in recent years. The energy sector was the most affected, which accounted for one-fourth of total Canadian merchandise exports. Excluding the resources sector, Canada’s exports to the world experienced solid growth in the post-financial crisis era.

4.3 Colombian Economy

With a population of 48.2 million, Colombia is the third most populous country in Latin America after Brazil and Mexico. Over the past decade, Colombia has experienced impressive economic growth as a result of pro-market economic policies, significant improvements in domestic security and strong trade growth. Total GDP surged from US$99.8 billion in 2000, to US$380 billion in 2013. However, this sustained, impressive economic growth of over a decade ceased in 2015. Colombia’s GDP is estimated to have decreased from US$380 billion in 2013 to US$274.2 billion in 2015 resulting in per capita GDP of $5,688. This dramatic downturn in the macroeconomic environment has broad implications for Colombia’s economic activities and international trade in particular.

The Colombian economy depends heavily on exports of energy and agricultural commodities. It is the world’s second largest coffee producer after Brazil, and a major global supplier of cut flowers and bananas. Colombia’s aggressive promotion of free trade agreements in the recent decade has strengthened its international trade; its merchandise exports to the rest of the world increased dramatically to the recent peak of US$60.7 billion in 2012 from US$13.1 billion in 2000. Similarly, its imports from the rest of the world increased to US$64 billion in 2014 from US$11.5 billion in 2000. However the significant downturn in world commodity prices and the economic slowdown have taken a heavy toll on the Colombian economy. Colombian exports to the world dropped to US$35.7 billion in 2015 largely due to the decline in exports of mineral fuels and precious metals. Similarly, its imports from the rest of the world also experienced a significant downturn, down from US$64 billion in 2014 to US$54 billion in 2015.

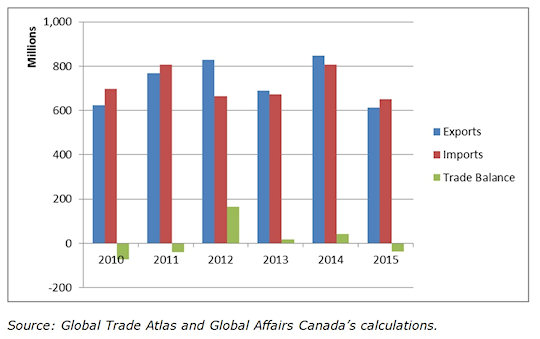

4.4 Canada-Colombia Trade Relations

Since 2010, the year prior to the entry into force of the CCOFTA, bilateral merchandise trade between Canada and Colombia has increased by 19% reaching US$1.3 billion in 2015. (See Annex 2) However, trade between the two countries dropped by 23.7% from US$1.7 billion in 2014, largely due to the decline in trade of energy-related products and the lower price for commodities. Canada’s imports from Colombia dropped by 20% overall from US$807.5 million in 2014, to US$649.7 million in 2015. Canada’s imports of mineral fuels from Colombia dropped by US$119.6 million, which alone explained 76% of the total import loss of US$157.8 million. Similarly, Canada’s exports to Colombia dropped by 27.7% from US$848.6 million in 2014 to US$613.3 million in 2015. The decline in Canadian exports to Colombia was broad-based, led by a drop in exports in cereal, auto products and machinery and equipment, reflective of a deterioration of the macroeconomic environment in Colombia.

Figure 1: Bilateral Trade between Canada and Colombia 2010-2015, US$ million

Text version

| Year | Exports | Imports | Trade Balance |

|---|---|---|---|

| Source: Global Trade Atlas and Global Affairs Canada’s calculations. | |||

| 2010 | 642.3 | 717.3 | -75.0 |

| 2011 | 760.9 | 799.4 | -38.5 |

| 2012 | 828.2 | 664.7 | 163.5 |

| 2013 | 716.9 | 691.3 | 25.6 |

| 2014 | 848.6 | 807.5 | 41.1 |

| 2015 | 613.3 | 649.7 | -36.4 |

Actions Taken by Canada under the CCOFTA Implementation Act in 2015

5.1 Overview of Actions Taken under the CCOFTA Implementation Act in 2015

The Implementation Act requires the Government of Canada to report on actions taken under the authority of the Implementation Act during the period under consideration. Table 1 below, contains a summary of actions taken under the CCOFTA Implementation Act for the period covered by this report.

| Clause Number | Short Description of Clause | Actions taken by Canada for Free Trade Agreement Implementation in 2015 |

|---|---|---|

| 1 | Short Title | None |

| 2-5 | Interpretation | None |

| 6 | Crown bound by the legislation | None |

| 7 | Purpose | None |

| 8 | No cause of action except for investor-state | None: no disputes to date |

| 9-15 | Implementation of the CCOFTA, Labour Cooperation Agreement and Environment Agreement | None |

| 16-22 | Inquiries under the Canadian International Trade Tribunal Act | None: no disputes to date |

| 23 | Arbitration related to violations of the Investment chapter under the Commercial Arbitration Act | None: no disputes to date |

| 24 | Compliance enforcement of the Labour Cooperation Agreement under the Crown Liability and Proceedings Act | None: no disputes to date |

| 25-29 | Application of the Customs Act | None |

| 30-42 | Changes to the Customs Tariff | Reduction of customs duties on goods according to staging categories |

| 43 | Monetary assessment relating to Labour Cooperation Agreement disputes under the Department of Employment and Social Development Act | None: no disputes to date |

| 44-46 | Emergency action safeguard under the Export and Imports Permits Act | None: no disputes to date |

| 47 | Governance of crown corporation under the Financial Administration Act | None |

| 48 | Entry into force date | None for purposes of the Annual Report exercise |

Since the entry into force of the CCOFTA on August 15, 2011, up to December 31, 2015, the actions taken under the Implementation Act have been tariff reductions related to the CCOFTA and actions taken under the Labour Cooperation Agreement and the Environment Agreement. No disputes have arisen to date and no dispute resolution or consultation mechanisms have been utilized including for Canadian Direct Investment Abroad.Actions taken under the Labour Cooperation Agreement and the Environment Agreement can be found in Section 8.

5.2 Tariff Elimination Schedule

The tariff reductions implemented by Canada are undertaken in accordance with the Tariff Elimination Schedule of Canada of the CCOFTA.

Before the CCOFTA entered into force, 51.4% of Canada’s tariff lines were already duty-free on a WTO most-favoured nation basis. At the time the CCOFTA entered into force on August 15, 2011, an additional 45.2% of tariff lines became duty-free for Colombian exporters, and 2.1% of tariff lines were subject to tariff phase-out periods of 3, 7 and 17 years. Tariff lines subject to phase-out periods undergo partial tariff reductions on a yearly basis until they become duty-free. The remaining 1.3% of tariff lines was excluded from tariff elimination commitments under the CCOFTA.

Tariff reductions implemented by Canada during January 1, 2015-December 31, 2015 fall under two staging categories:

Staging Category C (7-year linear phase-out, with yearly tariff reductions, all tariffs to be removed by January 1, 2017); Examples of products covered by category C in Canada include various within-access supply management tariff lines, rubber gloves, certain textiles and ships.

Staging Category D17 (17-year linear phase-out, with yearly tariff reductions, all tariffs to be removed by January 1, 2027). There is only one tariff line being phased-out under staging category D17, which is a refined sugar line. Because of a transversal clause triggered by the entry into force of the US-Colombia Free Trade Agreement in 2012, this tariff line is now subject to accelerated tariff elimination and is being phased-out with yearly tariff reductions to be duty-free by 2025.

| Staging Category | # Lines | % Lines | 2008 Canadian Imports from Colombia (US$, Mil) | % 2008 Canadian Imports from Colombia | Product Examples |

|---|---|---|---|---|---|

| Source: Canada-Colombia Free Trade Agreement, Tariff Elimination Schedule of Canada of the Canada-Colombia Free Trade Agreement, Global Trade Atlas, and Global Affairs Canada calculations. | |||||

| A (Immediate duty-free) | 8138 | 96.6% | 605.043 | 99.8% | Fresh cut flowers, most textiles, apparel, furniture, industrial and electrical machinery |

| B (3-year linear) | 19 | 0.2% | 0.201 | 0.0% | Spent fowl, some footwear (e.g., waterproof, sport, work boots, footwear with metal toe cap) |

| C (7-year linear) | 156 | 1.9% | 0.179 | 0.0% | Within-access supply management tariff lines; rubber gloves, all other textiles (that are not in A), ships, furnishings made of textiles |

| D17 (17-year linear) | 1 | 0.0% | 0.655 | 0.1% | Refined sugar (tariff line 1701.99.00: refined, not containing added flavouring/colouring matter) |

| E (Excluded) | 110 | 1.3% | 0.061 | 0.0% | Over-access supply management tariff lines (dairy, poultry and eggs) from tariff reduction; other refined sugar tariff items |

| Total | 8,424 | 100.0% | 606.141 | 100.0% | |

5.3 Tariff Reductions in 2015

As noted, the actions taken by Canada under the CCOFTA have been tariff reductions according to the Tariff Elimination Schedule of Canada of the CCOFTA. Upon entry into force of the CCOFTA in 2011, 96.6% of tariff lines were eliminated. This represented 99.8% of pre-CCOFTA import levels by Canada of Colombian goods and services. By 2015, tariff reductions were outstanding on only 1.1% of Canada’s tariff lines. In 2015, minor tariff reductions affected sub-sectors of the furniture, textiles, agri-food, and ships, boats and floating structures sectors.

5.4 Future Tariff Reductions

By the end of 2015, only 124 tariff lines, representing 1.5% of the total lines in Canada's tariff schedule, were still in the process of being phased-out. By the end of 2016 it will be 97 tariff lines, representing 1.15% of total lines and by the end of 2017 only one tariff line representing 0.01% of total lines (to be eliminated on January 1, 2027).

Given that the tariff reductions to be implemented on an annual basis from now until 2027 are minimal, the impact of these further tariff reductions on Canada’s bilateral trade with Colombia, can also be expected to be minimal.

Trade Gains Since 2011

Despite the deterioration in Colombia’s macroeconomic environment, in general, and the decline in commodity prices in particular, the CCOFTA effect remains positive if one compares the trade performance before and after the CCOFTA. In the following analysis, (Tables 3 and 4) the monthly trade statistics are first divided into the pre-CCOFTA period (April 2009 to July 2011) and post-CCOFTA period (August 2011 to December 2015) and then divided into five product categories. The categories represent respectively products that were duty-free prior to the implementation of the CCOFTA, products not liberalized, products with 0.1 to 5 percentage points tariff reductions, products with 5.1 to 10 percentage points tariff reductions, and products that had more than 10.0 percentage points tariff reductions. The average monthly changes between the pre-CCOFTA and the post-CCOFTA periods of these categories are then calculated to determine if trade has been enhanced. This simple demonstration does not control for any macroeconomic or other sector- and season-specific factors that were influential to bilateral trade flows.

6.1 Canadian Exports to Colombia

Since the CCOFTA entered into force in 2011, and up until December 2015, Canada experienced solid growth in its merchandise exports to Colombia. Monthly average exports from Canada to Colombia increased from a pre-CCOFTA level of US$50.3 million to the post-CCOFTA level of US$67.7 million, representing an increase of 34.8%. As shown in Table 3, the majority of Canadian exports to Colombia were subject to duties in the pre-CCOFTA era; liberalization under the CCOFTA has facilitated greater Canadian exports to Colombia. As a result, the sectors that experienced tariff reductions, accounted for 93.7% of total export growth. Most trade growth came from the products with up to 5.0 percentage points of tariff reductions and the products with more than 10.0 percentage points of tariff reductions, which grew by US$14.5 million and US$2.1 million respectively. Exempted goods also registered solid growth, although they started from a much lower base.

| Tariff Reductions | Pre-CCOFTA 2009-2011 | Post-CCOFTA 2012-2015 | Change | Percentage Change (%) |

|---|---|---|---|---|

| Source: Global Trade Atlas and Global Affairs Canada’s calculations. Note: Sector figures do not add to the total due to the fact that some trade figures cannot match to tariff lines. | ||||

| Duty-Free Goods | 2,851,935 | 3,891,299 | 1,039,364 | 36.4 |

| Exempted Goods | 11,942 | 77,248 | 65,306 | 546.9 |

| 0.1 – 5% Reductions | 22,265,189 | 36,786,039 | 14,520,850 | 65.2 |

| 5.1 – 10% Reductions | 11,919,862 | 11,900,666 | -19,195 | -0.2 |

| Over 10% Reductions | 11,860,718 | 13,919,362 | 2,058,644 | 17.4 |

| (No Match) | 1,353,421 | 1,157,275 | -196,147 | -14.5 |

| Total | 50,263,066 | 67,731,889 | 17,468,822 | 34.8 |

Canada’s export gains for the products that were already duty-free were dominated by exports of paper and paperboard. Other products that also experienced significant export gains included live animals, animal or vegetable fats and oils, nuclear reactors and machinery, edible preparations of meat and fish, organic chemicals, rubber, as well as iron and steel. (See Annex 3)

Products that had tariff reductions of 0.1 to 5.0 percentage points saw the most significant export gains. Most of these gains took place in the sectors of cereals, motor vehicles, fertilizers, nuclear reactors and machinery, optical or medical instruments, and beverage and spirits. (See Annex 4)

Products that received 5.1 to 10.0 percentage points of tariff reductions and experienced large increases in exports included paper and paperboard, pharmaceutical products, explosives and pyrotechnics, and pulp and paper waste. (See Annex 5)

Products that had more than 10.0 percentage points of tariff reductions had the second largest monthly average export gains. (See Annex 6) Meat and edible meat offal dominated the overall gains in this category. Other products under this category that are also reported to have strong trade growth included toys and sports equipment, cosmetic or toilet preparations, pulp of wood and paper waste, paper and paperboard, as well as electrical machinery and equipment.

6.2 Canadian Imports from Colombia

Since the CCOFTA entered into force in 2011, and up until to December 2015, Colombia has experienced varying levels of merchandise exports to Canada with some years showing an increase and others a decrease. Overall, on a monthly basis, average imports from Colombia decreased by 3.1% between the pre-CCOFTA level of US$58.7 million and the post-CCOFTA level of US$56.8 million. On the other hand, the utilization rates of the CCOFTA for Canadian imports from Colombia remained high with the products facing larger tariff reductions having higher utilization rates, indicating that importers are well aware of the tariff concessions offered by CCOFTA and they are taking advantage of what it offers. The total utilization rate for the duty-free products was 1.2%, 44.5% for the products with 0.1 to 5.0 percentage points tariff reductions, 55.5% for the products with 5.1 to 10.0 percentage points reductions and 77.1% for the products with more than 10.0 percentage points reductions.

It is important to note that more than 80% of all Canadian imports from Colombia were duty-free even before the entry into force of the CCOFTA. The product that gained the most under the duty-free category was mineral fuel. (See Annex 8)

Products with 0.1 to 5.0 percentage points of tariff reductions experienced the most gains in imports. Products that gained most under this category included sugar products, stone, plaster, and cement, and textile fabrics. However, the utilization rates for some of these products were low, which means that the increase in imports of stone articles and impregnated textiles were likely not associated with tariff reductions under the CCOFTA. (See Annex 9)

Products under the category of 5.1 to 10.0 percentage points of tariff reductions that had the largest import gains were tanning and dye, and cocoa and cocoa preparations. (See Annex 10)

In the category of products that received more than 10.0 percentage points of tariff reductions, live trees and textiles had the largest increases in imports with very high utilization rates of the CCOFTA. (See Annex 11)

In contrast, products that were exempted and products with 5.1 to 10.0 percentage points of tariff reductions experienced declines in imports.

| Tariff Reductions | Pre-CCOFTA 2009-2011 | Post-CCOFTA 2012-2015 | Change | Percentage Change (%) | Utilization Rate* (%) |

|---|---|---|---|---|---|

| Source: Global Trade Atlas and Global Affairs Canada calculations. Note: Sector figures do not add to the total due to the fact that some trade figures cannot match to tariff lines. * The utilization rate is a measure that determines how widespread the use of CCOFTA is in bilateral trade between Canada and Colombia. It is calculated as the percentage of trade that takes advantage of the reduced tariffs of the CCOFTA. | |||||

| Duty-Free Goods | 48,097,374 | 46,444,898 | -1,652,477 | -3.4 | 1.2 |

| Exempted Goods | 1,019,688 | 596,565 | -423,123 | -41.5 | 0.0 |

| 0.1 – 5% Reductions | 388,748 | 783,777 | 395,028 | 101.6 | 44.5 |

| 5.1 – 10% Reductions | 6,431,664 | 5,496,508 | -935,156 | -14.5 | 55.5 |

| Over 10% Reductions | 2,639,621 | 3,489,964 | 850,343 | 32.2 | 77.1 |

| (No Match) | 404 | 39,984 | 39,580 | 9,796.1 | 97.2 |

| Total | 58,670,599 | 56,853,623 | -1,816,976 | -3.1 | 13.9 |

6.3 Overall Impact of the CCOFTA on Trade Flows

The comparison of trade flows between the pre- and post-CCOFTA periods shows that the Canada-Colombia bilateral trade relationship has remained at healthy levels. Canadian exports to Colombia grew more quickly in the sectors that were liberalized, supporting the premise that reducing tariffs has a stimulatory impact on trade. On the other hand, while overall imports from Colombia saw a decrease, the utilization rates of the CCOFTA for these imports remained at very high levels and progressed with the extent of tariff concessions provided to Colombian products. This indicates that Canadian businesses adjusted well to the changing trading environment under the CCOFTA and are benefiting from the trade agreement. Without controlling for other non-free trade agreement influenced factors, the above simple data comparison is supportive of the view that the CCOFTA is working as intended.

Consultations with Stakeholders

7.1 Introduction

The previous trade statistics have revealed that despite global economic downturn and sharp decrease in commodity prices, trade between Canada and Colombia has maintained healthy levels and the CCOFTA has presented opportunities which the business sector has seized. The picture would not be complete without the views and opinions of civil society, particularly those looking at the CCOFTA from the perspective of the challenges that have accompanied Colombia’s economic development. In order to provide this perspective, and in keeping with a desire to move towards greater transparency, for the first time the Government of Canada entered into a series of enhanced outreach activities to gather views from the public.

7.2 Public Call for Submissions

On February 2, 2016, the Government of Canada issued a public call for submissions to inform the analysis of the impact of the actions taken under the Implementation Act for the Government of Canada’s Annual Report on Human Rights and Free Trade between Canada and the Republic of Colombia. The public call for submissions was posted on the Global Affairs Canada (GAC) website for a period of four weeks (compared to shorter periods in the past) and was advertised through social media by the Embassy of Canada to Colombia. (See Annex 13) Twelve written submissions were received through the 2016 consultation mechanism, compared to none in 2015, and a cumulative total of fourteen since 2011. Written submissions were received from Canadian as well as Colombian sources. In addition, for the first time GAC officials undertook face-to-face consultations with non-governmental organizations and academics to gain additional insights into the complex situation in Colombia, in order to create an active forum for exchange and better inform the analysis.

Consultations were very well attended and GAC received many submissions both through online and in-person consultations. Many of the submissions received addressed the overall human rights situation in Colombia, often related to the internal armed conflict. Issues and perceptions raised have been summarized below.

7.3 Thematic Summaries of Input Received in Canada

a) Human Rights

Submissions expressed concern about ongoing human rights issues in Colombia and stated that human rights violations had not abated since the implementation of the CCOFTA. It was submitted in 2015, that the situation facing human rights defenders had deteriorated, killings had increased, as had the number of death threats against human rights defenders including Indigenous, afro-Colombian and peasant farmer community leaders, trade unionists, journalists, land activists and those campaigning for justice. By 2015, some 7.8 million victims of the prolonged internal armed conflict, including 6.6 million victims of forced displacement, over 45,000 enforced disappearances and around 263,000 killings had been registered by the state’s Victims Unit. The vast majority of victims were civilians.

Colombia’s Indigenous populations were singled out as being particularly vulnerable. In 2009, Colombia’s Constitutional Court warned that more than a third of Indigenous peoples in Colombia were threatened with physical or cultural extermination amidst a combination of armed conflict, forced displacement and the imposition of economic development projects on their lands without their free, prior and informed consent. Submissions indicated that members of Indigenous and afro-Colombian communities seeking to defend their territorial rights are targeted and continue to face serious human rights violations. Paramilitary and neo-paramilitary groups, perceived to be on the rise, are blamed for the majority of these violations. In 2015, more than 3,400 forced displacements of Indigenous people were recorded by the National Indigenous Organization of Colombia. Submissions referenced respected UN experts who have expressed their concern regarding the acute crisis for Indigenous peoples in Colombia, and the threats posed by mining projects. Statistics indicated that: 80% of human rights violations, 87% of population displacement, and 78% of crime in the last 10 years have occurred in mining and/or energy producing regions in remote locations, many of which overlap with conflict areas.

Labour rights continue to be a concern with trade unionists continuing to be subjected to death threats, and forced displacement due to targeting. Submissions called for Canada to urge Colombia to adhere to the international conventions it has ratified, such as the ILO conventions on freedom of association and the right to strike. In addition the lack of formalization of workers in some sectors, particularly the extractive sector, was singled out as a grave safety and security risk.

Submissions indicated that impunity remains a major issue and that the Colombian state continues to fail to bring to justice the vast majority of those suspected of individual criminal responsibility for crimes under international law. Problems cited were the improper functioning of complaint mechanisms, fundamental issues with the justice system, new legislation that threatens to aggravate the situation and the role of the military justice system in closing investigations into alleged human rights violations by members of the security forces before they are concluded.

b) Business Practices and Governmental Support

Consultations revealed a high-level of concern regarding some companies, including Canadian-owned, doing business in Colombia which were seen to not be respecting international human rights standards. Concerns primarily regarded companies operating in the extractive sector and the potential for exploitation of lands that may have been illegally appropriated or on lands belonging to, occupied or claimed by Indigenous people or afro-Colombian communities without their “free, prior and informed consent”. Concerns were also raised with regard to Canadian government support (e.g. tax credits, grants, financing assistance, loans or political and diplomatic support) for companies whose business practices may be in violation of human rights standards and the need for adequate scrutiny when deciding which companies to support.

c) Scope and Methodology of the Annual Report

The methodology of Canada’s ‘Annual Report on Human Rights and Free Trade between Canada and the Republic of Colombia’ itself was criticized. Comments received argued that past reports had contributed very little to creating change and building a legal and social framework in Colombia that fully respects human rights. It was suggested that the methodology be revisited to better monitor the human rights situation in Colombia and vital issues for Canadian stakeholders, including companies and credit agencies. Specifically, it was suggested that ‘actions taken’ under the CCOFTA be more broadly interpreted to include, in addition to tariff reductions, trade promotion, support to businesses, and also investment decisions.

Some submissions called for a full Human Rights Impact Assessment of the CCOFTA, while others called for the report to be conducted by an independent body and for the Canadian government to develop an impartial, credible, effective process to analyze the findings of the report and then take action to address any negative findings, in compliance with international human rights standards.

d) Summary of Recommendations

Comments received through submissions recommended that Canada use bilateral and multilateral fora to do the following in order to strengthen support for human rights protection and sustainable peace in Colombia:

Human Rights

- Speak up clearly and consistently with regard to the protection of human rights in Colombia;

- Continue to press Colombia to ensure respect and protection of people and communities at particular risk, including women, internally displaced people, Indigenous peoples, afro-Colombian and peasant farmer communities, land claimants, human rights defenders, trade unionists and journalists;

- Encourage Colombia to implement vulnerable populations protection measures awarded by Colombia’s Constitutional Court in 2009;

- Call on the Colombian government to implement effective measures to prevent human rights abuses and violations, including by dismantling paramilitary groups and breaking their links with state actors; and

- Call on the Colombian authorities to address the deficiencies in the Victims and Land Restitution Law and in its implementation, as well as repeal provisions in Law 1753 that could undermine the right to reparation of many land claimants, especially in Indigenous and afro-Colombian territories.

Business Practices and Governmental Support

- Take an active role in ensuring that Canadian investments in Colombia do not exacerbate or benefit from human rights violations;

- Ensure that government support for corporate activities in Canada and internationally, be contingent on company actions being consistent with international human rights standards with respect to the rights of Indigenous peoples, including the right to free, prior and informed consent;

- Adopt a National Action Plan for the implementation of the UN Guiding Principles on Business and Human Rights;

- Adopt an effective corporate accountability mechanism in cases of major violation of human and trade union rights by Canadian companies in Colombia;

- Require greater transparency from government and arms-length agencies (for example EDC) with regard to the conditions placed on recipients of services and compliance guidelines;

- Provide more capacity building support to Colombia in natural resource governance and regulation of the extractive sector. For example, assistance for the formalization of extractive sector workers in such a way that benefits workers’ rights and improves security for corporations.

- Ensure that Canadian companies are aware of the requirements of free, prior, and informed consent before proceeding with new projects;

- Encourage Canadian companies to implement adequate Closure Policies that respect human rights; and

- Encourage Canadian corporations and the human rights community, to work together to ensure better community human rights and more security for Canadian corporations.

7.4 Outcalls in Colombia

In parallel to consultations held in Canada,the Embassy of Canada to Colombia has consulted annually since 2012 with Colombian stakeholders in a selection of active economic sectors. Stakeholders consulted have included businesses, local authorities, labour unions, academia, non-governmental organizations, and local and departmental governments.

Since 2012, consultations have focused on the following sectors: cut flowers, sugar, textiles, cosmetics and personal hygiene products, coffee, and petroleum oil.

Overall, consultations of past years have revealed that industry representatives attribute growth in trade volumes in their sector to factors other than tariff reductions under the CCOFTA. Some of those consulted expressed the opinion that macroeconomic trends (commodity prices, fluctuations in currency) have had a more dominant effect on their industry than that of tariff reductions under the CCOFTA. In addition, many felt that the entry into force of free trade agreements with the United States and the European Union have also had a larger impact on trade, given their relative market size and comparative share of Colombian trade. Nonetheless, business representatives have noted that increased market access through lower tariffs on exports to Canada provides opportunities for long-term business expansion and some appeared to be making human resources and capital investment decisions based, in part, on this knowledge.

With regard to labour conditions and human rights in Colombia, while consultations revealed that industry has a different perspective than labour unions, neither felt that the various free trade agreements into which Colombia has entered in recent years had contributed to any significant change or improvement in labour conditions. In general, union representatives in many of these sectors continue to raise concerns regarding the persistence of informal work, increased rate of outsourcing, low salaries, inequalities between men and women, child labour in some sectors, and the difficulty in unionizing. Industry, on the other hand, maintained that it observes high labour standards, citing the positive incremental impact on working conditions of their relationships with high-profile clients which require them to meet international standards for corporate social responsibility.

In preparation of this report, outcalls were conducted in the cut flowers and textiles sectors, which were first reviewed in 2013 and 2014, respectively.

In the flower industry, outcalls were conducted in the Cundinamarca department, where 73% of the Colombian flower industry is concentrated. Flowers are Colombia’s second leading agricultural export and the country is the second largest exporter worldwide. Over 95% of production is exported and 60% of the employment generated is occupied by women. Most of Colombia’s flower production is exported to the United States (77%); only, 2.8% is destined for Canada. Since the entry into force of the CCOFTA, exports have increased by nearly 70%. Nonetheless, interlocutors attribute this increase in exports, which coincided with overall record sales in the sector, more with the devaluation of the peso than the decrease in tariffs.

Consultations revealed that issues regarding freedom of association, contracting and outsourcing persist. In addition, this particular sector also poses challenges with regard to health-related issues due to the repetitive movements in the work, long hours, and expected higher productivity rates (which are said to have more than quadrupled over the last 20 years). On the other hand, concerns with respect to the use of pesticides and child-labour have considerably diminished.

The flower industry has been subject to numerous inspections as a result of the increased focus afforded by Colombia’s various free trade agreements; however, as noted by the industry association, none of the inspections has yet resulted in a penalty. The Association has a long term corporate social responsibility strategy and programs to which many of its affiliated companies contribute. Initiatives within this strategy and its related programs have helped improve current housing for workers, offer scholarships and training, etc. The association also indicated that 55 of its companies (representing 58% of exports) have acquired the Florverde® Sustainable Flowers certification, an independent and internationally recognized label that contains social, employment rights (freedom of association, outsourcing, working hours) and environmental standards for the flower sector.

In the textile industry, a large exporter to Canada, a small-scale exporter, and two trade unions were consulted. The textile sector has been struggling to remain competitive despite lower tariff rates and a favourable peso to US dollar exchange rate. The two companies consulted noted a decrease in exports to Canada since 2014. However, this decrease had not resulted in a loss of jobs as it only represented a small fraction of their total exports. Both companies credited their diversified portfolio (a mix of domestic sales and exports to other countries) with allowing them to maintain a stable workforce. Neither company attributed the decrease in exports to the effects of the CCOFTA.

Overall, those consulted indicated that labour conditions in the textile sector had not changed significantly since 2014 with the main issues remaining those related to freedom of association, contracting and outsourcing. The continuously deteriorating economic conditions of the textile industry since the late 2000s - pre-dating the implementation of the CCOFTA - appear to be at the source of many of the labour disputes. It is claimed that in order to assure their financial survival, large companies have moved away from traditional collective agreements with unions and negotiated collective pacts with individuals and emerging unions more aligned with the company’s interests. However, larger companies maintain that because of the size and reputation of their clients, their whole supply chain is audited periodically and they have acquired international corporate social responsibility and labour certifications. Union leaders, on the other hand, believe that outsourcing companies usually have more precarious labour conditions, benefits and contract stability. Both unions and companies agree that more effective engagement by government institutions, like the Ministry of Labour, is necessary to resolve labour disputes.

7.5 Consultations with Provinces and Territories

The Government of Canada consulted with provincial and territorial governments with regard to whether any of their respective human rights commissions (or equivalent bodies) raised concerns, or received any comments, questions or expressions of concern, regarding effects on human rights in Canada attributed to Canada’s tariff reductions under the CCOFTA during the period January 1, 2015–December 31, 2015. The Government of Canada received feedback from nine provinces and territories indicating that none of their human rights commissions (or equivalent bodies) raised or received any such comment or expression of concern. Since the entry into force of the CCOFTA on August 15, 2011, no concerns have been registered via these mechanisms.

7.6 Conclusion

The purpose of this report is to analyze the impact on human rights of actions taken under the CCOFTA Implementation Act.

Previous sections have demonstrated that tariff reductions taken under the CCOFTA are working as intended in terms of liberalizing and stimulating trade between Canada and Colombia, while this last section has provided detail regarding important and ongoing human rights concerns in Colombia.

Despite concerns raised regarding the human rights situation in Colombia, as in past years, it has not been possible to draw a direct link between the tariff reductions taken under the CCOFTA and human rights.

The CCOFTA Implementation Act also includes the two related agreements on labour cooperation and the environment. Additional actions taken under these agreements are summarized in the following section.

Canadian Advocacy, Capacity Building and Programming Activities in Colombia

8.1 Introduction

Both Canada and Colombia recognize that Colombia faces challenges in the area of human rights, including those that are in direct relation with the development of its economic activity. In order to support Colombia with its efforts to address these issues, Canada leverages various aspects of its bilateral engagement and programming tools including those found in the provisions of the two CCOFTA-related agreements on Labour Cooperation and Environment.

8.2 Actions Taken under the Labour Cooperation Agreement

The provisions of the Labour Cooperation Agreement are complemented by concrete actions to address the labour situation in Colombia, notably through labour-related information sharing and technical assistance (TA). (See Annex 14)

Since the coming into force of the Labour Cooperation Agreement, the Government of Canada, through the Labour Program of Employment and Social Development Canada (ESDC) has focused on capacity building, project monitoring missions, and opportunities to foster relationships and encourage effective implementation. Since 2011, the Labour Program of ESDC has funded three labour-related TA projects in Colombia totaling almost $950,000.

- The National Strategy for the Prevention and Elimination of the Worst Forms of Child Labour in Colombia project is ongoing and intends to assess the National Strategy for the Prevention and Elimination of the Worst Forms of Child Labour and Protection of Young Workers 2008-2015 to identify best practices and implementation challenges with a view to informing the development and operationalization of the new 2015-2025 Strategy. The bulk of project activities will focus on capacity building.

- The Social Dialogue and Occupational Health and Safety in the Mining Sector project aimed to improve the social and economic conditions of coal mining sector stakeholders in the La Guajira Region through enhanced occupational health and safety practices (OHS) and through strengthened respect for fundamental rights at work. The project extended its scope beyond the extractive sector which led to the inclusion of other productive sectors such as the construction, tourism, health, and electrification sectors. It ended in 2015.

- The Constructing Decent Work Agendas at Local and Regional Levels in Colombia projectfocused on strengthening the National Permanent Commission on Wage and Labour Policies. It further facilitated interactions between government and employer and employee organizations at the local and departmental level. 200 government officials, workers and employers received training in the areas of fundamental labour rights, child labour, collective bargaining and strategic planning. The project was implemented between 2011 and 2013.

Bilateral Dialogue

In addition to these projects, the Canadian and Colombian Ministries of Labour maintained close relations and ongoing dialogue in 2015. Two high-level meetings took place to advance the dialogue on implementation of the Labour Cooperation Agreement and issues of common interest, including more proactive monitoring of Colombia’s labour situation.

Three Ministerial Council meetings have taken place under the Labour Cooperation Agreement where Ministers reviewed progress and discussed labour-related TA programming in Colombia. Ministers also approved Plans of Action for cooperative labour activities and committed to sharing information in specific areas such as labour inspection, occupational health and safety, trade and labour, employment opportunities, labour statistics and migrant workers. At the last Council meeting, child labour was added as an area of interest for cooperation.

In addition to the Ministerial Council meetings, three bilateral meetings took place to further the relationship with Colombia. Discussions focused on recognizing Colombia’s efforts in improving human rights compliance and raising concerns regarding child labour and the security situation of Canadian companies operating in Colombia. In 2015, Canada’s Deputy Minister of Labour met with the Colombian Deputy Minister of Labour Relations and Inspections as well as with the Minister of Labour of Colombia. Discussions included ongoing labour-related TA projects, closer cooperation between officials to address items identified in the 2014-2016 Plan of Action, as well as the Labour Program’s efforts to more proactively monitor Colombia’s compliance with its obligations under the Labour Cooperation Agreement.

Moving Forward

Ensuring the effective implementation of Canada’s labour agreements, including the Canada-Colombia Labour Cooperation Agreement, is a growing priority. This is particularly important in view of Colombia’s known challenges in addressing issues with respect to collective bargaining, freedom of association, and the enforcement of labour law. Such matters have been raised bilaterally on several occasions in recent years at Deputy Minister and Ministerial levels.

Recognizing that a number of challenges remain to be overcome, the Labour Program of ESDC will continue its work with Colombia and stakeholders to address challenges in meeting agreement obligations, through the building the capacity of government institutions and, ultimately, promoting the protection of fundamental labour rights. The Labour Program will also deepen its understanding of partner progress and challenges, and create opportunities to develop strategies to jointly address these issues. This may include direct dialogue with governments, employer and employee groups, academics and non-governmental organizations, as well as site visits to projects funded by the Labour Program of ESDC.

8.3 Actions Taken under the Environment Agreement

The Canada-Colombia Environment Agreement commits both countries to encourage high levels of domestic environmental protection, to foster good environmental governance and to promote transparency and public participation. It also creates a framework for undertaking environmental cooperative activities and addressing key environmental issues of mutual interest to Canada and Colombia. These activities are an opportunity to promote high levels of environmental protection usually through technical exchanges and information sharing. Under the Environment Agreement, Environment and Climate Change Canada has funded environmental projects in Colombia totaling over $2.9 million. (See Annex 15)

Three cooperation work items were completed or ongoing in 2015:

- A Pollutant Release and Transfer Registries (PRTR) workshop was held in August 2015 in Bogotá, Colombia. This binational training workshop focused on building government capacity on design and implementation of PRTRs to meet the OECD standards. This initiative supports commitments under the Environment Agreement related to transparency and high level of environmental protection.

- A multilateral demonstration project under the Climate and Clean Air Coalition (CCAC) Oil and Gas Initiative was implemented, involving the two companies, Pacific Exploration and Mansarovar. This project focused on reducing methane and black carbon emissions from flaring and venting practices.

- A Canada-Americas Trade-Related Technical Assistance (CATRTA) program project was initiated which focuses on conservation of biological diversity. The project aims to establish a regional conservation alliance to conserve critical habitats for birds by improving habitat and economic returns in working landscapes in Colombia. This project will conclude in Spring 2016.

An additional ten projects have been undertaken under the Environment Agreement since its entry into force in 2011. For additional information on some of these initiatives, see Annex 15.

A Demonstration project to reduce Short Lived Climate Pollutant (SLCP) emissions from oil and gas operations aimed to deliver technical advice to Colombia to develop implementable mitigation actions in the Oil and Gas Sector.

The Climate Change Resilience in Protected Areas project provided support to Parques Nacionales Naturales to enhance the resilience of ecosystems and local communities to climate change effects by conserving and restoring protected areas and increasing adaptive capacities to climate change.

The Climate Change Adaptation Educational Program focused on building the capacity to mitigate the effects of natural disasters that arise due to changing weather conditions among municipal and regional government officials, citizen groups and journalists of the Alto Magdalena.

The Nationally Appropriate Mitigation Actions (NAMA) in the Waste and Landfill Sector project supported the implementation of an integrated solid waste management to maximize economic value from waste streams and to reduce SLCPs emissions as well as exploring opportunities and options to improve the quality of life of the city’s informal waste pickers by formalizing policies to provide health and social benefits.

Bilateral Dialogue

The Second Committee meeting under the Canada-Colombia Environment Agreement, comprised of officials, took place in Bogotá, Colombia, on March 4, 2015. At this meeting, Canada and Colombia reviewed the key commitments and institutional arrangements required by the Environment Agreement, undertook a policy dialogue on environmental priorities, reviewed cooperative work, and jointly began work on setting priorities for future cooperative activities. Canada and Colombia will continue to monitor implementation of the Environment Agreement, and will convene at the Third Committee meeting in 2016.

8.4 Advocacy

Canada plays a leading role within the international community regarding the promotion and protection of human rights in Colombia. For example, along with the Netherlands, Canada co‑chairs the Sub‑Group on Human Rights of the Donors’ Group (GRUC). The Sub-Group dedicated three of its 2015 meetings to discussing the situation of human rights defenders and continues to engage with the Office of the Attorney General of Colombia to raise and discuss specific cases of threats to, and killings of, human rights defenders. In addition to joint field visits, thematic meetings for 2016 will address: the rights of ethnic populations, including Indigenous and afro-Colombians; business and human rights; labour rights; as well as children and youth rights with a special focus on Indigenous children. Canada is also actively promoting the protection of women’s rights and gender equality in Colombia in its capacity as Chair of the International Cooperation Gender Roundtable for 2016-2017.

Canada’s Ambassador to Colombia and other embassy officials meet regularly with human rights officials such as the Presidential Advisor on Human Rights, the Representative of the Colombian Office of the UN High Commissioner for Human Rights, the Human Rights Ombudsperson (Defensor del Pueblo), in addition to civil society. Additionally, since July 2009, Canada and Colombia have held annual bilateral human rights consultations where the conditions of vulnerable groups and populations are regularly discussed. These consultations have also recently come to include discussions on political and trade issues. The most recent round took place on August 26, 2015, in Bogotá and one of the sessions was dedicated to the advances and challenges in the implementation of policies with respect to human rights defenders.Supporting the legitimate work of human rights defenders is an integral part of the human rights work undertaken by the Embassy of Canada to Colombia. In addition to meeting with threatened individuals and groups in Bogotá, officials make frequent visits to regions of the country most affected by the conflict. These visits, often in the company of representatives of the United Nations (UN) and other agencies, enable officials to meet with regional groups, local and military authorities, regional human rights ombudspersons and members of international non‑governmental organizations. Through such visits, the Government of Canada is able to gain first‑hand knowledge of the situation in these regions, monitor the progress of investigations, and apply continuing pressure on the authorities to respond to these situations, in addition to lending international solidarity to those at risk. In the fall of 2015, Canada’s Ambassador to Colombia, visited Buenaventura for a series of meetings focussed on human rights issues and to demonstrate Canada’s support to local human rights defenders. Although Canada recognizes the considerable progress made by the Colombian government with respect to human rights, Canadian government officials continue to stress to the Colombian government at the highest levels, the need for Colombia to implement UN recommendations and to uphold international human rights obligations.

8.5 Programming Activities

Canada’s international assistance supports Colombia’s efforts to reduce poverty and inequality, improve human rights and security and build a durable peace. Canada’s total official international assistance to Colombia since 2011 amounts to $192 million. Assistance is delivered via civil society, multilateral, private sector and government partners. Programming is generally provided through GAC’s Bilateral Development Program, the International Humanitarian Assistance Program, the Canada Fund for Local Initiatives (CFLI), and the Global Peace and Security Fund (GPSF).

Canada and Colombia share over 40 years of collaborative engagement on development cooperation and Colombia is a priority country for Canadian development funding. Canada’s bilateral development programming in Colombia amounting to $107 million since 2011, prioritizes two areas: 1) Creating economic opportunities for poor and vulnerable groups via supporting sustainable rural development, youth employment and entrepreneurship and improved natural resources governance; and 2) Protecting the rights of Colombia’s most vulnerable groups (especially children, afro-Colombians and landmine victims) by improving access to quality education and protection services. Canada has also been an important partner in addressing the protection needs of internally displaced person, working closely with the UN High Commissioner for Refugees (UNHCR). (For examples of programming which took place since the entry into force of the CCOFTA. (See Annex 16)

In the last five years, Canada has contributed approximately $23 million to Colombia through its International Humanitarian Assistance program, in response to the annual appeals of humanitarian organizations. This support responds to conflict-related needs and to natural disasters.

Through the Canada Fund for Local Initiatives, Canada also supports local development assistance initiatives in Colombia, most aimed at promoting human rights (particularly those of Indigenous communities and LGBTQ2) governance and democracy.

The Stabilization and Reconstruction Task Force (START) and its Global Peace and Security Fund (GPSF), have provided over $20.7 million in funding to peace and security initiatives in Colombia since 2011. Canada’s GPSF engagement in Colombia has provided critical support to local civil society, multilateral and government partners working on issues including transitional justice, conflict prevention, police reform, human rights, land restitution, landmine clearance, support to the peace process, and preparations for post-conflict following comprehensive peace accords with Colombia’s armed insurgencies.

Since 2011, Canada has also provided $38 million in official development assistance via other channels such as the International Development Research Centre, multi-country initiatives via multilateral and non-governmental organizations, and other government departments.

8.6 Corporate Social Responsibility

Canadian companies are major players in Colombia’s extractive sector with strong trade and investment ties in the country. While there are significant opportunities for foreign investors and exporters along the extractive sector value chain, the industry also faces some challenges in the areas of regulation and policy framework development, capacity building and the responsible management of natural resources as a driver of sustainable and inclusive economic growth.

The Government of Canadais engaged in a range of multi-stakeholder initiatives to actively promote international standards, guidelines, and best practices with the objective of increasing effective governance in resource-rich developing countries and enabling communities to maximize benefits from natural resources development while respecting human rights. International fora where Canada is active and collaborates with Colombia include the following:

The Voluntary Principles on Security and Human Rights Initiative (VPI) is a set of principles designed to guide companies in maintaining the safety and security of their operations within an operating framework that encourages respect for human rights. Canada has collaborated closely with Colombia on issues related to the VPI over the last year including participation in sessions promoting the implementation of the VPI in Colombia and engaging Canadian companies in the extractive sector operating in Colombia. The Government of Canada assumed the Chair of the VPI in April 2016, which will provide an opportunity to advance new and innovative approaches to implementation and enhancement of the VPI.

The Extractive Industries Transparency Initiative (EITI) is a multi-stakeholder initiative to support improved governance in resource-rich countries through the verification and full publication of company payments and government revenues from oil, gas, and mining. Colombia is a candidate country under the EITI and has received funding to improve its legal/regulatory frameworks and technical, environmental and social standards for undertaking transparent and nondiscretionary competitive tenders in strategic mineral reserve areas. Canada has been a long supporter of the Initiative's Multilateral Donor Trust Fund (MDTF) and Technical Advisory Facility (EI-TAF).

The Intergovernmental Forum on Mining, Minerals, Metals and Sustainable Development (IGF) brings together mining officials in developing countries, trading partners and donors, in addition to civil society organizations and mining companies, to discuss and advance issues of mutual concern, such as international standards and best practices in extractive sector management and governance. Over the past year, Canada has encouraged Colombia to join the IGF and supported Colombia’s participation at the IGF Annual General Meeting in Geneva, Switzerland in October 2015.

The OECD Guidelines on Multinational Enterprises are recommendations addressed by governments to multinational enterprises operating in or from adhering countries which provide voluntary principles and standards for responsible business conduct, in a variety of areas including employment and industrial relations, human rights, environment, information disclosure, competition, taxation, and science and technology.Adhering governments have an obligation to set up and maintain a National Contact Point (NCP) and to promote the application of the Guidelines with multinational enterprises. NCPs are the only governmental, non-judicial grievance mechanism providing access to remedy to stakeholders wishing to raise issues related to operations of companies operating in or from adhering countries. Canada has been instrumental in supporting Colombia in setting up its NCP which was officially launched in June 2012.

The Inter-American Development Bank’s (IDB) Transparency Trust Fund (TTF) provides assistance to Latin America and the Caribbean countries, including Colombia, which are committed to strengthening the governance of their extractive industries and to ensuring that the resulting economic growth tangibly improves their peoples' lives. To date, technical cooperation projects executed have included the reinforcement of Colombia’s mining and housing sectors, and the raising of transparency standards in the region’s financial institutions. Canada’s contribution of $10 million to the TTF in 2014 leverages the Fund’s four strategic priority areas: the strengthening of audit and control systems; financial integrity; open government initiatives; and natural resource governance. Through this partnership Canada is working to enhance transparency and accountability to ensure resource development benefits entire communities.

In addition to its work in international fora, the Government of Canada via the Embassy of Canada to Colombia engages the Colombian government and Canadian extractive sector companies in a variety of initiatives to further regulatory and policy framework development, capacity building and responsible natural resource development.

Since the entry into force of the CCOFTA, the Embassy of Canada to Colombia has facilitated or led numerous such initiatives via its political and commercial programming. These initiatives have often been carried out in collaboration with Canadian partners such as provinces and territories, universities and other government departments.

Initiatives have included study tours to Canada for Colombian officials, to share Canadian best practices in the mining industry and contribute to the Colombian government's capacity building. For example, participants to these tours visited a well-managed Canadian firm to hear about their relationship with government entities, or were introduced to a Canadian province’s regulatory model.

Initiatives have also included knowledge transfer of models, best practices and expertise with Colombian entities. For example, support was provided to Colombia’s Strategic and National Interest Projects Office (PINES) by the Natural Resources Canada’s Major Projects Management Office (MPMO).

Other initiatives have included the facilitation of workshops for the extractive industry on issues affecting project development in Colombia and collaboration in industry working groups such as the Energy and Climate Partnership of the Americas’ (ECPA) Heavy Oil Working Group.

Furthermore, via Canadian special programming such as the Canada-Americas Trade-Related Technical Assistance initiative, Canada has provided training to Colombia in the areas of trade promotion, technical barriers to trade, trade facilitation, sanitary & phytosanitary issues, labour and environment.

8.7 Conclusion

The purpose of this report is to analyze the impact on human rights of actions taken under the CCOFTA Implementation Act, including the two CCOFTA-related agreements on Labour Cooperation and Environment.

The previous section provided details regarding important and ongoing human rights concerns in Colombia, while this last section provided an outline of action taken under the Labour Cooperation Agreement, the Environment Agreement, and Canada’s bilateral programming in Colombia.

In total, since the entry into force of the CCOFTA in 2011, Canada has provided $192 million in official international assistance to Colombia. These funds have contributed to Colombia’s ongoing efforts to achieve development, peace and security, all of which are intricately linked to its challenges in the area of human rights.

Summary of Findings

The mandate of this annual report is to summarize the actions taken by Canada under the authority of the Implementation Act (including the CCOFTA, the Labour Cooperation and Environment Agreements) and to provide an analysis of the impact of these actions on human rights in Canada and Colombia. These agreements join a range of actions including this report, advocacy, and bilateral and development cooperation through which Canada supports Colombia’s ongoing efforts towards greater peace, security, prosperity, and respect for human rights.

The actions taken by Canada under the CCOFTA since its inception have consisted of tariff reductions and elimination. Upon entry into force of the CCOFTA in 2011, 96.6% of tariff lines, representing 99.8% of pre-CCOFTA implementation import levels by Canada of Colombian goods and services, were eliminated. Since then, there have been relatively few tariff lines affected and by the end of 2015, only 124 tariff lines, representing 1.5% of the total lines in Canada's tariff schedule, were still in the process of being phased-out. By the end of 2017 only one tariff line representing 0.01% of the total lines will remain and will be eliminated in 2027. Given that tariff reductions to be implemented on an annual basis from now until 2027 are minimal, the impact of these further tariff reductions on Canada’s bilateral trade with Colombia can also be expected to be minimal.

Since its entry into force, the CCOFTA appears to have had an overall positive impact on Canada-Colombia trade performance. Canadian exports to Colombia have increased overall since 2011 and, although Colombian exports to Canada have decreased slightly, data for the utilization rates of tariff lines by Colombian exporters indicates that they are taking advantage of what the CCOFTA offers. As such, in terms of trade liberalization, it can be concluded that the CCOFTA is working as intended.

The preparation of this year’s report also involved consultations with a range of stakeholders.

The Government of Canada issued an online public call for submissions to inform the analysis of the impact of the actions taken under the Implementation Act for the Government of Canada’s 2016 annual report. The public call for submissions was posted on the website of Global Affairs Canada for a period of four weeks. In addition, this year’s consultations included a particular effort to reach out to stakeholders via in-person consultations. Meetings were held with non-governmental organizations and academics in Montreal, Ottawa, Toronto and Vancouver. Twelve written submissions were received through this consultation mechanism raising important concerns about the overall human rights situation in Colombia.

Representatives of the Embassy of Canada to Colombia undertook outcalls to consult with business, associations of exporters, local authorities, labour unions, civil society and local and departmental governments concerning the cut flowers and textiles sectors. While the opinion of labour unions and industry tends to differ, these sectors do face challenges in the areas of labour conditions and related issues. That said, complaints over labour conditions either pre-date the entry into force of the CCOFTA or are related to macroeconomic trends. As a result, none of the entities consulted could demonstrate that any of the factors impacting upon human rights and worker satisfaction are directly related to the implementation of the CCOFTA.