Archived information

Information identified as archived is provided for reference, research or recordkeeping purposes. It is not subject to the Government of Canada Web Standards and has not been altered or updated since it was archived. Please contact us to request a format other than those available.

Annual report to parliament on the administration of the Export and Import Controls Permits Act - 2012

Table oontents

Introduction

Report of the Minister of Foreign Affairs

We are pleased to table the Annual Report to Parliament on the administration of the Export and Import Permits Act (hereinafter referred to as the Act) for the year 2012. This report is submitted pursuant to section 27 of the Act, Chapter E-19 of the 1985 Revised Statutes of Canada, as amended, which provides:

"As soon as practicable after December 31 of each year the Minister shall prepare and lay before Parliament a report of the operations under this Act for that year."

Purpose of the Export and Import Permits Act

The authority to control the import and export of goods and technologies is derived from the Act. The Act finds its origin in the War Measures Act and was passed as an Act of Parliament in 1947 and subsequently amended on a number of occasions.

The Act provides that the Governor in Council may establish lists known as the Import Control List, the Export Control List, the Area Control List, and the Automatic Firearms Country Control List. For each one of these lists, the Act sets out criteria that govern the inclusion of goods, technologies or countries on the respective lists and provides that the Governor in Council may revoke, amend, vary or re-establish any of the lists. Control over the flow of goods and technology contained on these lists or to specific destinations is effected through the issuance of import or export permits.

The Act delegates to the Minister of Foreign Affairs the authority to grant or deny applications for these permits and thus confers on him broad powers to control the flow of the goods and technology contained in these lists. The operations carried out under the Act can be grouped under the following headings:

Import Controls:

- A) Textiles and Clothing

- B) Agricultural and Dairy Products

- C) Steel Products

- D) Weapons and Munitions

Export Controls:

- A) Miscellaneous goods, and technology, where applicable, including logs, softwood lumber, cedar bolts and blocks, roe herring, peanut butter, sugar, sugar-containing products and products of U.S. origin.

- B) Strategic, military and atomic energy goods, materials and technology as well as items controlled for non-proliferation purposes.

- C) Any goods or technology to countries listed on the Area Control List, which includes Belarus and the Democratic People’s Republic of Korea (North Korea).

Offences:

The Act contains provisions pertaining to offences and penalties. Every person (including a corporation, any of its directors or officers) found contravening any provision of the Act is liable to be prosecuted. A prosecution may be instituted at any time within but not later than three years after the time when the subject matter of the complaint arose.

Report

Import Controls

Section 5 of the Act provides that the Governor in Council may establish a list of goods, called an Import Control List, whose importation the Governor in Council deems it necessary to control for any of the following purposes:

- to ensure, in accordance with the needs of Canada, the best possible supply and distribution of an article that is scarce in world markets or is subject to governmental controls in the countries of origin or to allocation by intergovernmental arrangement;

- to restrict, for the purpose of supporting any action taken under the Farm Products Marketing Agencies Act, the importation in any form of a like article to one produced or marketed in Canada the quantities of which are fixed or determined under that Act;

- to collect information with respect to the importation of a certain type of steel or a certain product made of steel that is traded in world markets in circumstances of surplus supply and depressed prices and where a significant proportion of world trade in that type of steel or that product is subject to control through the use of non-tariff measure;

- to restrict the importation of arms, ammunition, implements or munitions of war, army, naval or air stores, or any articles deemed capable of being converted there into or made useful in the production thereof to implement an action taken under the Agricultural Marketing Programs Act or the Canadian Dairy Commission Act, with the object or effect of supporting the price of the article;

- to implement an intergovernmental arrangement or commitment;

- to prevent the frustration or circumvention of the Agreement on Textiles and Clothing in Annex 1A of the World Trade Organization (WTO) Agreement by the importation of goods that are like or directly competitive with goods to which the Agreement on Textiles and Clothing applies.

Economic Significance of Import Permits

In 2012, the Trade Controls Bureau issued over 178,000 permits for the importing of controlled goods.

Economic Significance of Import Permits

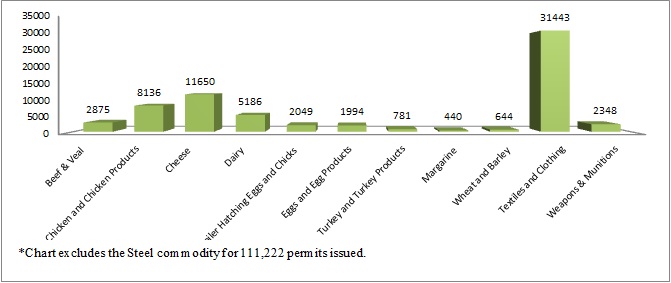

Graphic representation of issued import permits by commodity (excluding steel commodity for which 111,222 permits were issued). In 2012, over 178,000 permits were issued.

- 2,875 permits for beef and veal;

- 8,136 permits for chicken and chicken products;

- 11,650 permits for cheese;

- 5,186 permits for dairy products;

- 2,049 permits for broiler hatching eggs and chicks;

- 1,994 permits for eggs and egg products;

- 781 permits for turkey and turkey products;

- 440 permits for margarine;

- 644 permits for wheat and barley;

- 31,443 permits for textiles and clothing;

- 2,348 permits for weapons and munitions.

Issuance of import permits

Section 14 of the Act stipulates that:

"No person shall import or attempt to import any goods included in an Import Control List except under the authority of and in accordance with an import permit issued under this Act."

Subsection 8(1) authorizes the Minister to:

"...issue to any resident of Canada applying therefore a permit to import goods included in an Import Control List, in such quantity and of such quality, by such persons, from such places or persons and subject to such other terms and conditions as are described in the permit or in the regulations."

Authority is provided under section 12 of the Act for the making of regulations prescribing the information and undertakings to be furnished by applicants for permits, the procedure to be followed in applying for and issuing permits, and the requirements for carrying out the purposes and provisions of the Act.

Section 8 (1.1) of the Act provides for the issuance of general permits authorizing the import of specific goods subject to such terms and conditions as described in the permit.

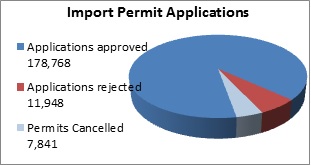

The following is a statistical summary of applications for import permits processed in 2012 for agriculture and dairy products, steel products and weapons and munitions:

- applications approved: 178,768

- applications rejected: 11,948

- permits cancelled: 7,841

Import Permit Applications

Graphic representation of import permits processed in 2012 for agriculture and dairy products, steel products and weapons and munitions.

- 178,768 applications approved;

- 11,948 applications rejected;

- 7,841 permits cancelled.

A) Textiles and Clothing

i) Trade with North American Free Trade Agreement countries:

Products must originate in the North American Free Trade Agreement (NAFTA) countries in order to qualify for NAFTA rates of duties. This is determined through the use of NAFTA rules of origin for yarn, fabric and clothing. For apparel and textiles that do not meet these rules of origin, the NAFTA provides preferential access to the Canadian, U.S. and Mexican markets through the use of Tariff Preference Levels. The four broad categories of Tariff Preference Levels and their corresponding volumes for access to the U.S. market, which have been fixed since 1999, are as follows:

- Wool Apparel: 5,325,413 square metre equivalents

- Cotton or Man-made Fibre Apparel: 88,326,463 square metre equivalents

- Cotton or Man-made Fibre Fabrics and Made-up Goods: 71,765,252 square metre equivalents

- Cotton or Man-made Fibre Spun Yarns: 11,813,664 kilograms

a) Tariff Preference Levels allocation

Subject to the Act, the regulations made under the Act and applicable policies, Canadian companies with apparel tariff preference levels allocations may export products manufactured in Canada from fabrics and yarns imported from outside this area up to the limit of their allocations to customers in the North American free trade area.

As of July 5, 2010, all tariff preference levels except for yarn are allocated on a historical-use basis to the extent of utilization by exporters and on a first-come, first-served basis for those amounts not allocated directly to exporters. The tariff preference levels for yarn is allocated to exporters on a first-come, first-served basis.

b) Tariff Preference Levels utilization in 2012

The 2012 tariff preference levels utilization rates for the four categories of Canadian tariff preference levels exports were as follows:

- Wool Apparel and Made-Up Goods 46% for the United States and 4% for Mexico;

- Cotton or Man-Made Fibre Apparel and Made-Up Goods 18% for the United States and 10% for Mexico;

- Cotton or Man-Made Fibre Fabrics and Made-Up Goods 65% for the United States and 0% for Mexico;

- Cotton or Man-Made Fibre Spun Yarns 31% for the United States and 0% for Mexico.

Tariff Preference Levels utilization statistics are available at: Controlled Products - Textiles & Clothing

As provided for in the NAFTA, the annual growth rates for the Tariff Preference Levels volumes for Canadian goods entering the United States were eliminated at the end of 1999. No growth rates were provided for trade with Mexico.

ii) Issuance of certificates and permits

For the purposes of administering the NAFTA tariff preference levels provisions, the Department of Foreign Affairs, Trade and Development issues import and export certificates of eligibility pursuant to section 9.1 of the Act. The following summary outlines the number of applications for certificates of eligibility processed in 2012:

a) Exports (certificates of eligibility)

- certificates issued: 86,763

- applications denied: 5,235

- certificates cancelled: 2,512

b) Imports (certificates of eligibility)

- certificates issued: 31,443

- applications denied: 4,040

- certificates cancelled: 583

B) Agricultural and Dairy Products

Agricultural Products

Canada is a signatory to the World Trade Organization Agreement on Agriculture concluded in December 1993. This Agreement obliged Canada to convert its existing quantitative agricultural import controls to a system of tariff rate quotas, which came into effect in 1995.

Under tariff rate quotas, imports are subject to low "within access commitment" rates of duty up to a predetermined limit (i.e., until the import access quantity has been reached), while imports over this limit are subject to higher "over access commitment" rates of duty. For most products, the privilege of importing at the within-access commitment rates of duty is allocated to firms through the issuance of import allocations (or "quota-shares"). Those with quota-shares receive, normally, upon application, specific import permits giving access to the within-access commitment rates of duty as long as they meet the terms and conditions of permit issuance. These conditions are normally described in Allocation Method Orders and in Notices to Importers. Imports in excess of access levels are permitted under General Import Permit No. 100 - Eligible Agricultural Goods, which allows unrestricted imports at the higher rate of duty. Canada continues to respect its access level commitments under the NAFTA, and where both WTO and NAFTA commitments exist, Canada applies the higher of the two for the product in question.

Under the EIPA, the Minister may, at his discretion, authorize imports of products subject to TRQs apart from the import access quantity, particularly if the Minister judges that the importation of these products is required to meet Canadian market needs. Supplementary import permits are normally issued for the following specific purposes: to address domestic market shortages; to assist Canadian manufacturers to compete with like imported products that can enter Canada duty-free or at a low rate of duty as a result of the NAFTA (the Import-to-Compete Program); to assist Canadian manufacturers to compete in foreign markets (the Import for Re-Export Program - IREP); to facilitate test marketing in the Canadian market of new products that are, for example, unique or are produced with unique processes and require a substantial capital investment for their production; or to address extraordinary or unusual circumstances.

All tariff rate quotas are based on Customs Tariff item numbers. Therefore, when the tariff rate quotas came into effect in 1995, the Import Control List was amended to replace references to named products (e.g. "turkey and turkey products") with tariff item numbers. However, for ease of understanding, the older product descriptions continue to be used in this report.

1) Poultry and eggs

Effective January 1, 1995, Canada's chicken, turkey, broiler hatching egg and chick, shell egg and egg product quantitative restrictions were converted to tariff rate quotas.

Four product groups were maintained on the Import Control List in order to support supply management of poultry under the Farm Products Marketing Act and to support action taken under the WTO Act. These four product groups were:

- i) chicken and chicken products;

- ii) turkey and turkey products;

- iii) broiler hatching eggs and chicks; and

- iv) eggs and egg products

i. Chicken and chicken products

Chicken was placed on the Import Control List on October 22, 1979. Pursuant to the NAFTA, the import access level for 2012 was 77,024,700 kilograms, expressed in eviscerated equivalent (EE) weight. Within-access commitment permits were issued for 75,492,915 kilograms (EE). While the import access level is set at 7.5% of the previous year's chicken production level, provision is made to issue import permits supplementary to the import access level, inter alia, if needed to meet overall Canadian market needs. During 2012 supplementary import permits were issued for 73,161,827 kilograms (EE) of chicken for re-export and for 4,443,960 kilograms (EE) of chicken to help Canadian processors compete with foreign processors who export chicken-containing products that are not on or otherwise exempt from, the Import Control List.

ii. Turkey and turkey products

Turkey was placed on the Import Control List on May 8, 1974. Pursuant to the NAFTA, the access level is set annually at 3.5% of the domestic production quota for that year or the WTO level of 5,588,000 kilograms (EE), whichever is higher. In 2012, the WTO level was the higher of the two, and thus prevailed. In 2012 within-access commitment permits were issued for 5,540,553 kilograms (EE). Provision is made for import permits supplementary to the import access level, inter alia, if needed to meet overall Canadian market needs. During 2012, supplementary import permits were issued for 38,613 kilograms (EE) for turkey for re-export, for 516,088 kilograms (EE) for turkey for a domestic market shortage, and for 478,410 kilograms (EE) of turkey to help Canadian processors compete with foreign processors who export turkey-containing products that are not on the Import Control List.

iii. Broiler hatching eggs and chicks

Broiler hatching eggs and chicks for chicken production were placed on the Import Control List on May 8, 1989. Pursuant to the NAFTA, the combined import access level for broiler hatching eggs and chicks is 21.1% of the estimated domestic production of broiler hatching eggs for the calendar year to which the tariff rate quota applies. The combined annual import access level is divided into separate levels, of 17.4% for broiler hatching eggs and 3.7% for egg-equivalent chicks.

In 2012 the combined import access level was set at 140,720,109 eggs. Within-access commitment permits were issued for 115,954,827 hatching eggs and 24,532,969 egg-equivalent chicks, for a combined total of 140,487,796. Provision is made to issue import permits supplementary to the import access level, inter alia, if needed to meet overall Canadian market needs. During 2012 supplementary import permits were issued for 4,866,072 eggs and zero eggs-equivalent chicks for market shortages.

iv. Eggs and egg products

Eggs and egg products were placed on the Import Control List on May 9, 1974. Pursuant to the NAFTA, the import access level for shell eggs is calculated at 1.647% of the previous year's domestic production. For 2012 this converted to 9,637,980 dozen eggs. Within access commitment import permits were issued for 9,610,650 dozen eggs.

Pursuant to the NAFTA, the import access levels for egg powder and liquid, frozen or further-processed egg products is calculated at 0.627% and 0.714% of the previous year's domestic production, respectively. For 2012 this amounted to 554,035 kilograms and 2,402,473 kilograms, respectively. Within-access commitment permit issuance totalled 236,125 kilograms for egg powder and 2,350,068 kilograms for liquid, frozen or further processed eggs.

In 1996, an allocation only for eggs for breaking purposes was introduced. This resulted from a WTO commitment to increase the import access quantity to a level greater than the NAFTA access level at the time. The WTO level, 21,370,000 dozen eggs in 2012, continues to be higher than Canada's NAFTA access level. The “eggs for breaking purposes” allocation is equal to the difference between the WTO and NAFTA commitment levels. The 2012 import access level for eggs for breaking purposes only was 3,884,702 dozen eggs. During 2012, within-access commitment permits were issued for this category of eggs for 3,749,806 dozen eggs.

While the basic access levels are fixed each year, provision is made to issue import permits for eggs or egg products supplementary to the import access level, inter alia, if needed to meet overall Canadian market needs.

With regard to shell eggs, supplementary permits were issued to import 5,531,093 dozen to accommodate market shortages.

In 2012, zero supplementary permits were issued for market shortages for powdered eggs or for liquid, frozen and further processed egg products. For eggs for breaking purposes, supplementary permits for market shortages were issued to import 8,576,522 dozen eggs.

For powdered eggs and for liquid, frozen and further processed egg products, zero supplementary import permits were issued for re-export.

In 2012, supplementary permits for 119,160 dozen eggs for breaking purposes were issued for re-export.

For eggs for breaking purposes, supplementary permits for market shortages were issued to import 5,145,223 dozen eggs.

Import permits are required for importing inedible egg products into Canada, although for monitoring purposes only. Permits were issued for 1,276,015 kilograms for this type of product in 2012.

2) Dairy Products

Quantitative restrictions in 11 categories of dairy products were converted to tariff rate quotas in support of supply management under the Canadian Dairy Commission Act and action taken under the WTO Agreement Implementation Act. These products are:

- i) butter (implemented on August 1, 1995);

- ii) cheese of all types other than imitation cheese implemented on January 1, 1995);

- iii) buttermilk in dry, liquid or other form (implemented on January 1, 1995);

- iv) fluid milk (implemented on January 1,1995);

- v) dry whey (implemented on August 1, 1995);

- vi) evaporated and condensed milks (implemented on January 1, 1995);

- vii) heavy cream (implemented on August 1, 1995);

- viii) products consisting of natural milk constituents (implemented on January 1, 1995);

- ix) food preparations (implemented on January 1, 1995 under tariff item 1901.90.33);

- x) ice cream and ice cream novelties in retail packaging (implemented on January 1, 1995);

- xi) milk protein substances with a milk protein content of 85% or more by weight, calculated on the dry matter, that do not originate in the United States, Mexico, Chile, Costa Rica, or Israel (implemented on September 8, 2008).

i. Butter

The access level for butter was 3,274,000 kilograms for the quota year from August 1, 2011 to July 31, 2012. The entire tariff rate quota was allocated to the Canadian Dairy Commission of which 2,000,000 kilograms was reserved for imports from New Zealand. Within-access commitment import permits were issued for 3,274,000 kilograms. Supplementary import permits for butter and butter oil for re-export were issued for 4,008,249 kilograms. Supplementary import permits for other purposes totalled 6,879 kilograms.

ii. Cheese

The access level for cheese has been fixed since 1979 at 20,411,866 kilograms. Under the provisions of a December 1995 Agreement between Canada and the European Union, 66% of the tariff rate quotas is allocated to cheese imports from the European Union and 34% to imports from non- European Union sources. Within-access commitment import permits were issued for 20,411,866 kilograms of cheese, and permits for re-export were issued for 3,022,225 kilograms. Supplementary import permits for other purposes totalled 1,881,982 kilograms.

iii. Powdered buttermilk

The 2012 access level for powdered buttermilk was 908,000 kilograms. The tariff rate quota is reserved exclusively for imports from New Zealand. Within-access commitment import permits were issued for 678,600 kilograms. Supplementary import permits for re-export were issued for 10,493 kilograms of powdered buttermilk product. Supplementary import permits for other purposes totalled 35,322 kilograms.

Liquid buttermilk and other fermented milk products, other than liquid buttermilk

The access levels in 2012 for liquid buttermilk classified under tariff item 0403.90.91.10 and for other fermented milk products, other than liquid buttermilk, classified under tariff item 0403.90.91.90 were zero and there are no associated tariff rate quotas. Supplementary import permits for re-export were issued for zero kilograms of product classified under 0403.90.91.10 and for 28,137 kilograms of product classified under 0403.90.91.90. Supplementary import permits for other purposes were issued for 76,022 kilograms of other fermented milk products, other than liquid buttermilk.

iv. Fluid milk

The fluid milk access level in 2012 was 64,500 tonnes, which represents estimated annual cross-border purchases by Canadian consumers. The goods are imported under General Import Permit No. 1 - Dairy Products for Personal Use. On January 26, 2000 General Import Permit No. 1 was amended. The $20 limit in value for each importation of fluid milk imports for personal use was removed. Supplementary import permits for re-export totalled 34,623,640 kilograms.

v. Dry whey

The dry whey access level in the quota year from August 1, 2011 to July 31, 2012 was 3,198,000 kilograms. Within-access commitment import permits were issued for 1,621,180 kilograms. Supplementary imports for re-export totalled 1,893,310 kilograms.

vi. Evaporated and condensed milk

The access level for evaporated and condensed milk in 2012 was 11,700 kilograms. The tariff rate quota is reserved exclusively for imports from Australia. Within-access commitment import permits were issued for 10,800 kilograms. Supplementary import permits for re-export were issued for 1,712,752 kilograms.

vii. Heavy cream

The heavy cream access level in the quota year from August 1, 2011 to July 31, 2012 was 394,000 kilograms for sterilized cream having a minimum of 23% butterfat and sold in cans having a volume not exceeding 200 milliliters. The entire tariff rate quota was utilized. Supplementary import permits were issued for re-export for 6,391,077 kilograms. Supplementary import permits for other purposes totalled 8,899 kilograms.

viii. Products consisting of natural milk constituents

The access level for these products in 2012 was 4,345,000 kilograms, and within-access commitment import permits were issued for 4,233,532 kilograms. Supplementary import permits for re-export were issued for 759,918 kilograms.

ix. Food preparations

The access level in 2012 for food preparations classified under tariff item 1901.90.33 was 70,000 kilograms, allocated on a first-come, first-served basis. The tariff rate quota covers ingredients for the manufacture of confectionery and other food products, and for soft-serve ice cream. Within access permit issuance totalled 5,373 kilograms. Supplementary import permits for re-export were issued for zero kilograms.

The access level for food preparations classified under tariff items 1901.20.11, 1901.90.21, 1901.90.31, 1901.90.51, 1901.90.53, 2106.90.31 and 2106.90.93 was zero and there are no associated tariff rate quotas. However, supplementary import permits for re-export were issued for 14,878 kilograms of products classified under tariff item 1901.90.53, and for 1,393,790 kilograms of products classified under tariff item 2106.90.93. Supplementary import permits for other purposes were issued for 216,153 kilograms of product classified under tariff item 2106.90.93.

x. Ice cream and yoghurt

The access levels in 2012 were 484,000 kilograms for ice cream and 332,000 kilograms for yoghurt. Within-access commitment import permit issuance in 2012 totalled 431,905 kilograms for ice cream and 332,000 kilograms for yoghurt. For yoghurt, supplementary import permits for other purposes were issued for 304,733.While supplementary import permits for re-export were issued for 351,059 kilograms.

xi. Skimmed and whole milk powder, cream powder, other milk powder, other cream powder, animal feed, non-alcoholic beverages containing milk and chocolate ice cream mix and ice milk mix

These products are not subject to tariff rate quota. Supplementary import permits for re-export were issued for 1,464,429 kilograms of skimmed milk powder and 2,074,543 kilograms of whole milk powder, as well as 83,481 kilograms of cream powder. Supplementary import permits for other purposes were issued for 377,532 kilograms for skim milk powder and 7,389 kilograms for whole milk powder.

xii. Milk protein substances with a milk protein content of 85% or more by weight, calculated on the dry matter, that do not originate in a NAFTA country, Chile, Costa Rica, or Israel

Milk protein substances with a milk protein content of 85% or more by weight, calculated on the dry matter, that do not originate in the United States, Mexico, Chile, Costa Rica, or Israel, were placed on the Import Control List on September 8, 2008, in order to implement a change in Canada’s WTO obligations subsequent to a re-negotiation of a tariff concession outlined in an intergovernmental arrangement.

Effective April 1, 2011, an access level of 10,000,000 kilograms per year for the period of April 1 to March 31 each year was established for these products. For the period of April 1, 2011, to March 31, 2012, within-access commitment import permits were issued for 6,840,562 kilograms of Milk protein substances. Supplementary import permits for re-export were issued for 566,200 kilograms.

3) Margarine

The tariff rate quota for margarine was introduced on January 1, 1995. The import access level for 2012 was 7,558,000 kilograms. Within-access commitment permit issuance totalled 1,701,261 kilograms.

4) Wheat, Barley and Their Products

The restrictions imposed on imports of wheat, barley and their products under the Canadian Wheat Board Act were converted to tariff rate quotas on August 1, 1995. These tariff rate quotas are administered by Foreign Affairs, Trade and Development Canada and Canada Border Services Agency on a first-come first-served basis using an August-July year. Importers may cite General Import Permit No. 20 - Wheat and Wheat Products, Barley and Barley Products to import goods at the lower rate of duty. Once the access levels are filled, importers must cite General Import Permit No. 100 - Eligible Agricultural Goods on Customs entry documents to import goods at the higher rate of duty.

The following annual tariff rate quotas levels for wheat, barley, wheat products and barley products apply:

- wheat: 226,883 tonnes

- wheat products: 123,557 tonnes

- barley: 399,000 tonnes

- barley products: 19,131 tonnes

Imports in the period from August 1, 2011 to July 31, 2012, were 31,213 tonnes, 154,819 tonnes, 40,788 tonnes, and 20,880 tonnes in these four product categories, respectively. Supplementary imports for barley products for market shortages were issued for 3,020 tonnes. Administrative measures are established to ensure full usage of quota which sometimes results in imports over the tariff rate quota limit. Imports exceeding the tariff rate quota limits (i.e., wheat products) remain at the lower tariff rate.

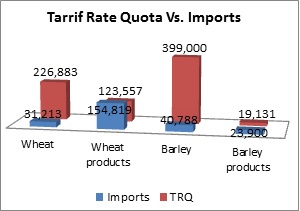

Tarrif Rate Quota Vs. Imports

Graphic representation of Tarrif Rate Quotas (TRQ) versus imports for wheat, wheat products, barley, and barley products.

- Wheat: 226,883 tonnes (TRQ) vs. 31,213 tonnes (imports);

- Wheat products: 123,557 tonnes (TRQ) vs. 154,819 tonnes (imports);

- Barley: 399,000 tonnes (TRQ) vs. 40,788 tonnes (imports);

- Barley products: 19,131 tonnes (TRQ) vs. 23,900 tonnes (imports).

5) Beef and Veal

The restrictions on imports of non- NAFTA beef and veal established under the Meat Import Act were converted to a tariff rate quota on January 1, 1995. The tariff rate quota applies to all imports of fresh, chilled and frozen beef and veal imported from non- NAFTA countries (except Chile) and in 2012 was 76,409 tonnes. Of this total, 35,000 tonnes were reserved for imports from Australia and 29,600 tonnes were reserved for imports from New Zealand. The balance of the tariff rate quotas (11,809 tonnes) was reserved for imports from all countries certified by the Canadian Food Inspection Agency, including Australia and New Zealand once their country-specific reserves were fully used. Within-access commitment import permit issuance in 2012 totalled 46,688 tonnes.

Since May 20, 2003, the government has made changes to the supplementary import policy on three occasions in order to support domestic beef and veal producers facing the challenges and uncertainty brought on by Bovine Spongiform Encephalopathy (BSE). The changes have provided domestic producers with greater opportunities to supply the Canadian market while the government works to restore full access to export markets, and were developed in close consultation with industry stakeholders. The policy was modified once in 2005 and 2007. Since that time, supplemental imports have been limited to those situations where neither the specific product nor reasonable substitutes are available in Canada at competitive prices. No supplementary import permit was authorized in 2012.

C) Steel products

Carbon steel products (semi-finished steel, plate, sheet and strip steel, wire rods, wire and wire products, railway-type products, bars, structural shapes and units, and pipes and tubes) were initially placed on the Import Control List, effective September 1, 1986, following a report by the Canadian Import Tribunal recommending the collection of information on goods of this type entering Canada. Speciality steel products (stainless flat-rolled products, stainless steel bars, wire and wire products, alloy tool steel, mould steel and high speed steel) were added to the Import Control List, effective June 1, 1987, pursuant to an amendment to the Act providing for import monitoring of steel products under certain conditions. The current mandate for the steel monitoring program extends until August 31, 2014.

The purpose of placing carbon and speciality steel on the Import Control List is to provide more timely and precise steel import data. There are no quantitative restrictions.

As of April 1, 2012, the requirement for individual import permits for steel imports was removed. Importers use general import permits, eliminating the need for 270,000 permits annually and saving the industry $10 million a year in permit fees. Import data continues to be collected.

In 2012, 7 million tonnes of steel with a reported value of $7.7 billion was imported into Canada.

D) Weapons and munitions

Pursuant to items 70 to 73 and 91 of the Import Control List, an import permit is required to import into Canada all small- and large-calibre weapons, ammunition, bombs, pyrotechnics, tanks and self-propelled guns. As well, all components and parts specifically designed for these items also require import permits. Firearms classified as restricted or non-restricted, and their parts, are exempted from an import permit provided that they are for sporting or recreational use.

Manufacturers and businesses, licensed by the Provincial Chief Firearms Officers, may import prohibited weapons, prohibited firearms and prohibited devices, under strictly controlled conditions.

Export Controls

Section 3 of the Act provides that the Governor in Council may establish a list of goods and technology, to be called an Export Control List, including therein any article the export of which the Governor in Council deems it necessary to control for any of the following purposes:

- to ensure that arms, ammunition, implements or munitions of war, naval, army or air stores or any articles deemed capable of being converted there into or made useful in the production thereof or otherwise having a strategic nature or value will not be made available to any destination where their use might be detrimental to the security of Canada;

- to ensure that any action taken to promote the further processing in Canada of a natural resource that is produced in Canada is not rendered ineffective by reason of the unrestricted exportation of that natural resource;

- to limit or keep under surveillance the export of any raw or processed material that is produced in Canada in circumstances of surplus supply and depressed prices and that is not a produce of agriculture;

- to implement an intergovernmental arrangement or commitment;

- to ensure that there is an adequate supply and distribution of the article in Canada for defence or other needs; or

- to ensure the orderly export marketing of any goods that are subject to a limitation imposed by any country or customs territory on the quantity of the goods that, on importation into that country or customs territory in any given period, is eligible for the benefit provided for goods imported within that limitation.

The Export Control List comprises seven groups, as follows:

- Group 1: Dual Use List

- Group 2: Munitions List

- Group 3: Nuclear Non-proliferation List

- Group 4: Nuclear-Related Dual Use List

- Group 5: Miscellaneous Goods & Technology

- Group 6: Missile Technology Control Regime List

- Group 7: Chemical and Biological Weapons Non-Proliferation List

Groups 1 and 2 encompass Canada's multilateral strategic commitments under the Wassenaar Arrangement.

Groups 3, 4, 6 and 7 represent our multilateral commitments under the various non-proliferation regimes designed to control the proliferation of weapons of mass destruction (chemical, biological and nuclear weapons) as well as their delivery systems.

Group 5 comprises various strategic and non-strategic goods and technologies which are controlled for other purposes, as provided in the Act. Group 5 also includes controls on the export of U.S. origin goods and technology. This provision is intended to prohibit the diversion of U.S. origin goods and technology through Canada.

Economic Significance of Export Permits

In 2012, the Trade Controls Bureau issued over 289,000 permits for the exporting of controlled goods.

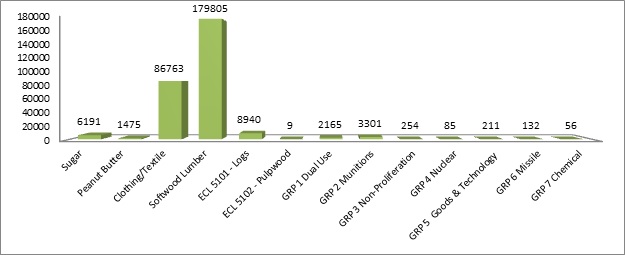

Economic Significance of Export Permits

Graphic representation of issued export permits by commodity. In 2012, over 289,000 permits were issued.

- 6,191 permits for sugar;

- 1475 permits for peanut butter;

- 86,763 permits for clothing and textiles;

- 179,805 permits for softwood lumber;

- 8,940 permits for ECL 5101 Logs;

- 9 permits for ECL 5102 Pulpwood;

- 2,165 permits for GRP 1 Dual Use;

- 3,301 permits for GRP 2 Munitions;

- 254 permits for GRP 3 Non-Proliferation;

- 85 permits for GRP 4 Nuclear;

- 211 permits for GRP 5 Goods and technology;

- 132 permits for GRP 6 Missile;

- 56 permits for GRP 7 Chemical.

Issuance of export permits

Section 13 of the Act stipulates that:

“No person shall export or transfer, or attempt to export or transfer, any goods or technology included in an Export Control List or any goods or technology to any country included in an Area Control List except under the authority of and in accordance with an export permit issued under this Act.”

Subsection 7(1) authorizes the Minister to:

“[…]issue to any resident of Canada applying therefore a permit to export or transfer goods or technology included in an Export Control List or to export or transfer goods or technology to a country included in an Area Control List, in such quantity and of such quality, by such persons, to such places or persons and subject to such other terms and conditions as are described in the permit or in the regulations.”

An export permit is required before any item included in the Export Control List may be exported from Canada to any destination, with the exception (in most cases) of the United States. This requirement enables Canada to meet international commitments, such as its commitment to prevent the proliferation of missile technology and biological, chemical and nuclear weapons. Nuclear material and equipment, logs, automatic firearms, pulpwood, and red cedar bolts and blocks are among the goods requiring permits for export to the United States. Permits are also required to export any goods or technology to countries on the Area Control List.

The following is a statistical summary of export permit applications processed in 2012 for goods or technology included on the Export Control List:

- permits issued: 15,153

- applications denied: 5

- applications withdrawn: 620

- applications returned without action: 309

Export Control List Applications

Graphic representation of export permit applications processed in 2012 for goods or technology included on the Export Control List.

- 15,153 permits issued;

- 5 applications denied;

- 620 applications withdrawn;

- 309 applications returned without action.

Softwood Lumber

Effective April 1, 2001 the Department of Foreign Affairs, Trade and Development introduced a national softwood lumber monitoring program. The objective of this monitoring program was to collect data respecting softwood lumber exports to the United States for all Canadian provinces and territories. This monitoring program was replaced on October 12, 2006 with the introduction of the Canada-United States of America Softwood Lumber Agreement.

The Agreement created a stable, predictable bilateral trade environment for Canadian producers. It revoked U.S. countervailing and anti-dumping duty orders, returned to Canadian exporters over $5 billion in duties collected by the United States between 2002 and 2006, and safeguarded the provinces’ ability to manage their forest resources. It is a seven-year agreement with an option to renew for two additional years that was exercised by Canada and the United States on April 20, 2012.

The Governor in Council placed softwood lumber on the Export Control List, as item 5104, which has the effect of requiring permits issued by the Minister of International Trade for exports to the United States. Any person who holds a permit to export softwood lumber to the United States is required to keep records relating to its issuance for 60 months after the date of issuance of the permit.

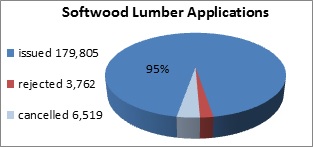

From January 1, 2012 to December 31, 2012, exports of softwood lumber totalled 9.46 billion board feet. The following is a statistical summary Footnote 1 of softwood lumber permit applications processed in 2012:

- permits issued: 179,805

- applications rejected: 3,762

- permits cancelled: 6,519

Softwood Lumber permit Applications

Graphic representation of softwood lumber permit applications processed in 2012.

- 179,805 permits issued;

- 3,762 applications rejected;

- 6,519 permits cancelled.

Logs

Logs are included on the Export Control List in order to ensure an adequate supply and distribution of logs within Canada. Export permits from all provinces and territories other than British Columbia are issued automatically upon the correct completion of an export permit application. In British Columbia, log exports originating from either federally regulated or provincially regulated lands are also subject to a system of “surplus tests”. The administration of the surplus test for logs originating from federal lands in British Columbia is administered by the Department of Foreign Affairs, Trade and Development. The current policies are set forth in Notice to Exporters No 102.

In 2012, the Department of Foreign Affairs, Trade and Development issued nearly 8,950 permits for logs, valued at approximately $982 million.

Agri-food products

As part of its implementation of WTO commitments, the United States established tariff rate quotas for imports of peanut butter, certain sugar-containing products and refined sugar. Within these tariff rate quotas, Canada receives a country-specific quota allocation. The U.S. Government administers these tariff rate quotas on a first-come, first-served basis. In order to help ensure the orderly export of these programs against Canada’s country-specific quotas, Canada placed these products on the Export Control List. Accordingly, in order to comply with the Act and to benefit from the in-quota U.S. tariff rate, Canadian exports of peanut butter, certain sugar-containing products and refined sugar to the United States require an export permit issued by the Bureau. There are no quantitative restrictions or permit requirements for Canadian exports of these products to non-U.S. destinations.

i. Peanut butter

Peanut butter was placed on the Export Control List on January 1, 1995. Within the U.S. peanut butter tariff rate quotas of 20,000 tonnes, the United States provides a country-specific quota to Canada of 14,500 tonnes. During 2012, permits were issued for 11,924,282 kilograms, indicating that the quota was 82% utilized.

ii. Sugar-containing products

Sugar-containing products were placed on the Export Control List on February 1, 1995. The global tariff rate quota of the United States sugar-containing products is 5,459 tonnes and applies to imports of certain sugar-containing products falling under Chapters 17, 18, 19 and 21 of the Harmonized Tariff Schedule of the United States. The quota year for sugar containing products is from October 1 to September 30.

In September 1997, Canada and the United States exchanged letters of understanding, under which Canada obtained an additional country-specific quota of 59,250 tonnes within the United States sugar-containing products tariff rate quotas. The understanding also provides that only goods that are "product of Canada" may benefit from Canada's country-specific reserve. In 2011-2012, export permits were issued for 58,533,649 kilograms of sugar-containing products, indicating that the quota was 98.7% utilized.

iii. Refined Sugar

Refined sugar was placed on the Export Control List on October 1, 1995. The United States refined sugar tariff rate quota is 60,000 tonnes (raw equivalent). The quota year for refined sugar is from October 1 to September 30.

In September 1997, Canada and the United States exchanged letters of understanding, under which Canada obtained a country-specific quota of 12,050 tonnes, raw equivalent (i.e., 11,207 tonnes refined sugar), within the United States refined sugar tariff rate quotas. The understanding also provides that only goods that are "product of Canada" may benefit from Canada's country specific reserve. In 2011-2012, the refined sugar export quota was 100% utilized.

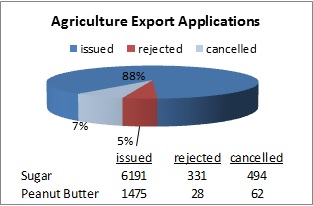

The following summary of agricultural export permits processed in 2012 includes applications for peanut butter, sugar-containing products and refined sugar:

- permits issued: 7,666

- applications rejected: 359

- permits cancelled: 556

Agricultural Export Applications

Graphic representation of agricultural export permits processed in 2012.

- 7,666 permits issued (6,191 for sugar, 1475 for peanut butter);

- 359 applications rejected (331 for sugar, 28 for peanut butter);

- 556 permits cancelled (494 for sugar, 62 for peanut butter).

Area Control List

Section 4 of the Act provides for the control of "any goods or technology to any country included in an Area Control List". Currently there are two countries on the Area Control List, Belarus and the Democratic People’s Republic of Korea (North Korea).

Automatic Firearms Country Control List

The Act provides for the establishment of an Automatic Firearms Country Control List. Export permit applications for automatic firearms and certain other prohibited firearms, weapons, and devices are only considered to countries on the Automatic Firearms Country Control List.

The countries listed on the Automatic Firearms Country Control List in 2012 were:

Albania, Australia, Belgium, Botswana, Bulgaria, Colombia, Croatia, Czech Republic, Denmark, Estonia, Finland, France, Germany, Greece, Hungary, Iceland, Italy, Latvia, Lithuania, Luxembourg, Netherlands, New Zealand, Norway, Poland, Portugal, Romania, Saudi Arabia, Slovakia, Slovenia, Spain, Sweden, Turkey, United Kingdom and United States.

General Export Permits

The Act provides for the issuance of general permits authorizing the export of certain designated goods or technology to all destinations or to specified destinations. General Export Permits are intended to facilitate exports by enabling exporters to export selected goods without applying for individual permits.

The General Export Permits in effect during 2012 included:

- General Export Permits EX. 1 : Goods with a value of less than $100, household articles, personal effects, business equipment required for temporary use outside Canada and personal automobiles

- General Export Permits EX. 3 : Consumable stores supplied to vessels and aircraft

- General Export Permits EX. 5 : Forest products

- General Export Permits EX. 10 : Export of Sugar Permit

- General Export Permits EX. 12 : United States Origin Goods

- General Export Permits EX. 18 : Personal computers

- General Export Permits EX. 27 : Nuclear-related dual use (cancelled on May 2, 2012)

- General Export Permits EX. 29 : Eligible industrial goods

- General Export Permits EX. 30 : Certain industrial goods to eligible countries and territories

- General Export Permits EX. 31 : Peanut butter

- General Export Permits EX. 37 : Chemicals and Precursors to the United States

- General Export Permits EX. 38 : CWC Toxic Chemical and Precursor Mixtures

- General Export Permits EX. 43 : Nuclear Goods and Technology to Certain Destinations

- General Export Permits EX. 44 : Nuclear-Related Dual-Use Goods and Technologies to Certain Destinations

- General Export Permits EX. 45 : Cryptography for the Development or Production of a Product

Import certificates and delivery verification certificates

The issuance of import certificates and delivery verification certificates is provided for under section 9 of the Act and under the Import Certificate Regulations (C.R.C., c. 603). Import certificates enable an importer to describe goods in detail and to certify that he/she will not assist in their disposal or diversion during transit. Such assurances may be required by the country of export before permitting the shipment of certain goods, most notably munitions and strategic goods. An import certificate is not an import permit and does not entitle the holder to import the goods described on the certificate into Canada. Delivery verification certificates may be issued following arrival of the goods in Canada to enable an exporter of goods to Canada to comply with requirements of the exporting country.

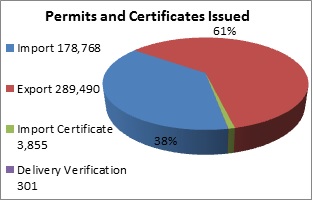

In 2012, the Department issued 3,855 import certificates and 301 delivery verification certificates.

Permits and Certifcates Issued

Graphic representation of import certificate and delivery verification certificates issues in 2011 (excludes Steel products).

- 178,768 import permits;

- 289,490 export permits;

- 3,855 import certificates;

- 301 delivery verifications.

Offences

Penalties are listed in subsection 19(1) of the Act as follows:

"Every person who contravenes any provision of this Act or the regulations is guilty of:

- (a) an offence punishable on summary conviction and liable to a fine not exceeding twenty-five thousand dollars or to imprisonment for a term not exceeding twelve months, or to both; or

- (b) an indictable offence and liable to a fine in an amount that is in the discretion of the court or to imprisonment for a term not exceeding ten years, or to both."

Section 25 of the Act delegates responsibility for the enforcement of the Act to all officers as defined in the Customs Act (subsection 2(1)). The Department of Foreign Affairs, Trade and Development entrusts the enforcement of the Act to the Canada Border Services Agency, and to the Royal Canadian Mounted Police.

Export control enforcement actions for 2012

Voluntary compliance continued to be a key element in Canada's export control system in 2012. The Canada Border Services Agency referred 280 detentions of export shipments to the Department of Foreign Affairs, Trade and Development, as well as one post-export query, to determine the applicability of export controls. The Canada Border Services Agency identified eight instances of offences of sufficient seriousness under the Act warranting referral for further investigation and possible prosecution, in addition to seizure of the goods concerned

Trade Controls and Technical Barriers Bureau Performance Standards

The Bureau is committed to providing clients with prompt and reliable service based on Canadian export and import controls law and policy.

Our aims are: to foster an orderly processing of controlled imports into and exports from Canada; implement our commitments under international agreements; and ensure that the administration of trade controls under the authority of the Act is carried out smoothly and without undue hindrance to Canadian exporters, importers and consumers.

To fulfill this policy, and under the authority of the Act, the Bureau is responsible for issuing permits for importing controlled goods into Canada that are included in the Import Control List, and for exporting goods included in the Export Control List or for exporting goods to destinations included in the Area Control List.

In order to fulfill our responsibilities under the Act, the Bureau has established service standards. The target for processing import and export permits for non-strategic goods within the Export Import Controls System (EICS) is within 4 business hours of receipt. The target for processing of log permit applications for Log exports is within 3 working days. The target for processing permit applications to export controlled strategic goods or technology is within the Export Controls On-line System (EXCOL) is within 10 working days; should consultations outside the Bureau be required, the period is within 40 days. Over 483,000 permit applications were processed within EICS and EXCOL, and approximately 98.6% of those permit applications were processed within the allotted service periods.

Footnotes

- Footnote 1

Based on export permit data compiled by the Foreign Affairs, Trade and Development Canada. The data is subject to corrections and adjustments, and may differ from other official trade statistics of Canada and the United States as they are based on definitions that are specific to the 2006 Canada-United States of America Softwood Lumber Agreement.

- Date modified: