Archived information

Information identified as archived is provided for reference, research or recordkeeping purposes. It is not subject to the Government of Canada Web Standards and has not been altered or updated since it was archived. Please contact us to request a format other than those available.

Annual report to parliament on the administration of the Export and Import Controls Permits Act - 2013

Table of Contents

Introduction

Report of the Minister of Foreign Affairs

We are pleased to table the Annual Report to Parliament on the administration of the Export and Import Permits Act (hereinafter referred to as the Act) for the year 2012. This report is submitted pursuant to section 27 of the Act, Chapter E-19 of the 1985 Revised Statutes of Canada, as amended, which provides:

"As soon as practicable after December 31 of each year the Minister shall prepare and lay before Parliament a report of the operations under this Act for that year."

Purpose of the Export and Import Permits Act

The authority to control the import and export of goods and technologies is derived from the Act. The Act finds its origin in the War Measures Act and was passed as an Act of Parliament in 1947 and subsequently amended on a number of occasions.

The Act provides that the Governor in Council may establish lists known as the Import Control List, the Export Control List, the Area Control List, and the Automatic Firearms Country Control List. For each one of these lists, the Act sets out criteria that govern the inclusion of goods, technologies or countries on the respective lists and provides that the Governor in Council may revoke, amend, vary or re-establish any of the lists. Control over the flow of goods and technology contained on these lists or to the specified destinations is effected through the issuance of import or export permits.

The Act delegates to the Minister of Foreign Affairs the authority to grant or deny applications for these permits and thus confers on him broad powers to control the flow of the goods and technology contained in these lists. The operations carried out under the Act can be grouped under the following headings:

Import Controls:

- A) Textiles and Clothing

- B) Agricultural and Dairy Products

- C) Steel Products

- D) Weapons and Munitions

Export Controls:

- A) Miscellaneous goods, and technology, where applicable, including logs, softwood lumber, cedar bolts and blocks, peanut butter, sugar, sugar-containing products and products of U.S. origin.

- B) Strategic, military and atomic energy goods, materials and technology as well as items controlled for non-proliferation purposes.

- C) Any goods or technology to countries listed on the Area Control List, which includes Belarus and the Democratic People’s Republic of Korea (North Korea).

- D) Textiles and Clothing

Offences:

The Act contains provisions pertaining to offences and penalties. Every person (including a corporation, any of its directors or officers) found contravening any provision of the Act is liable to be prosecuted. A prosecution may be instituted at any time within but not later than three years after the time when the subject matter of the complaint arose.

Report

Import Controls

Section 5 of the Act provides that the Governor in Council may establish a list of goods, called an Import Control List, whose importation the Governor in Council deems it necessary to control for any of the following purposes:

- to ensure, in accordance with the needs of Canada, the best possible supply and distribution of an article that is scarce in world markets or in Canada or is subject to governmental controls in the countries of origin or to allocation by intergovernmental arrangement;

- to restrict, for the purpose of supporting any action taken under the Farm Products Marketing Agencies Act, the importation in any form of a like article to one produced or marketed in Canada the quantities of which are fixed or determined under that Act;

- to collect information with respect to the importation of a certain type of steel or a certain product made of steel that is traded in world markets in circumstances of surplus supply and depressed prices and where a significant proportion of world trade in that type of steel or that product is subject to control through the use of non-tariff measure;

- to restrict the importation of arms, ammunition, implements or munitions of war, army, naval or air stores, or any articles deemed capable of being converted there into or made useful in the production thereof;

- to implement an action taken under the Agricultural Marketing Programs Act or the Canadian Dairy Commission Act, with the object or effect of supporting the price of the article; or

- to implement an intergovernmental arrangement or commitment.

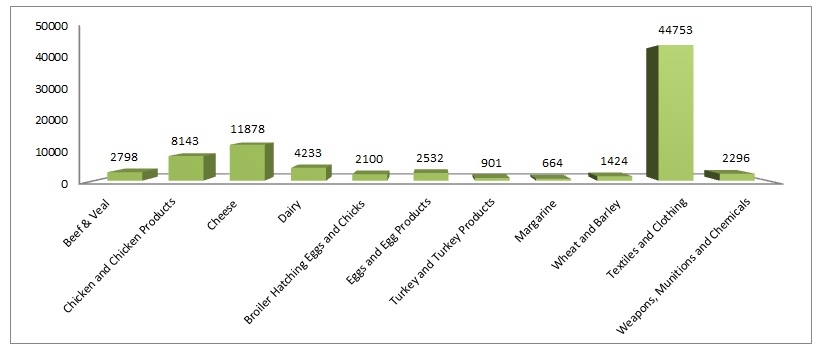

Volume of Import Permits

In 2013, the Trade Controls Bureau issued over 81,722 permits for the importation of controlled goods.

Text Alternative

Volume of Import Permits

Graphic representation of issued over 81,722 permits for the importation of controlled.

- 2,798 permits for beef and veal;

- 8,143 permits for chicken and chicken products;

- 11,878 permits for cheese;

- 4,233 permits for dairy products;

- 2,100 permits for broiler hatching eggs and chicks;

- 2,532 permits for eggs and egg products;

- 901 permits for turkey and turkey products;

- 664 permits for margarine;

- 1,424 permits for wheat and barley;

- 44,753 permits for textiles and clothing;

- 2,296 permits for weapons,munitions, and Chemicals.

Issuance of import permits

Section 14 of the Act stipulates that:

"No person shall import or attempt to import any goods included in an Import Control List except under the authority of and in accordance with an import permit issued under this Act."

Subsection 8(1) authorizes the Minister to:

"...issue to any resident of Canada applying therefore a permit to import goods included in an Import Control List, in such quantity and of such quality, by such persons, from such places or persons and subject to such other terms and conditions as are described in the permit or in the regulations."

Authority is provided under section 12 of the Act for the making of regulations prescribing the information and undertakings to be furnished by applicants for permits, the procedure to be followed in applying for and issuing permits, and the requirements for carrying out the purposes and provisions of the Act.

Section 8 (1.1) of the Act provides for the issuance of general permits authorizing the import of specific goods subject to such terms and conditions as described in the permit.

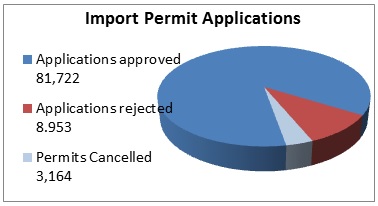

The following is a statistical summary of the import permit applications processed in 2013 for textiles and clothing, agriculture and dairy products, and weapons and munitions:

Text Alternative

Import Permit Applications

Graphic representation of import permits processed in 2013 for textiles and clothing, agriculture and dairy products, and weapons and munitions

- 81,722 applications approved;

- 8,953 applications rejected;

- 3,164 permits cancalled.

A) Textiles and Clothing

North American Free Trade Agreement (NAFTA) countries

Products must originate in the NAFTA countries in order to qualify for NAFTA rates of duties. This is determined through the use of NAFTA rules of origin for yarn, fabric and clothing. For apparel and textiles that do not meet these rules of origin, the NAFTA provides preferential access to the Canadian, United States (U.S.) and Mexican markets through the use of Tariff Preference Levels (TPLs). The four broad categories of TPLs and their corresponding volumes for access to the U.S. and Mexico are, respectively, as follows:

- Wool Apparel – 919,740 and 250,000 square metre equivalents

- Cotton or Man-made Fibre Apparel – 8,995,000 and 6,000,000 square metre equivalents

- Cotton or Man-made Fibre Fabrics and Made-up Goods – 2,000,000 and 7,000,000 square metre equivalents

- Cotton or Man-made Fibre Spun Yarns –1,000,000 and 1,000,000 kilograms

The 2013 TPL utilization rates for the four categories of Canadian TPL imports from the NAFTA countries were as follows:

- Wool Apparel and Made-Up Goods 11% for the U.S. and 100% for Mexico;

- Cotton or Man-Made Fibre Apparel and Made-Up Goods 100% for the U.S. and 30% for Mexico;

- Cotton or Man-Made Fibre Fabrics and Made-Up Goods 100% for the U.S. and 0% for Mexico;

- Cotton or Man-Made Fibre Spun Yarns 1% for the U.S. and 0% for Mexico.

As provided for in the NAFTA, the annual growth rates for the TPL volumes for Canadian goods entering the U.S. were eliminated at the end of 1999. No growth rates were provided for trade with Mexico.

Other Free Trade Agreement countries

In accordance with the authority in the Act to implement an intergovernmental agreement, Textiles and Clothing imports from Chile and Costa Rica have been added to the Import Control List as a result of the Free Trade agreements concluded with those countries.

The broad categories of TPLs and their corresponding volumes for access to Canada from Chile are as follows:

- Wool Apparel – 112,616 square metre equivalents

- Cotton or Man-made Fibre Apparel – 2,252,324 square metre equivalents

- Cotton or Man-made Fibre Fabrics and Made-up Goods – 1,000,000 square metre equivalents

- Cotton or Man-made Fibre Spun Yarns - 500,000 square metre equivalents

- Wool Fabrics and Made-up Goods – 250,000 kilograms

The broad categories of TPL and their corresponding volumes for access to Canada from Costa Rica are as follows:

- Apparel – 1,379,570 square metre equivalents

- Cotton or Man-made Fibre Fabrics and Made-up Goods – 1,000,000 square metre equivalents

- Cotton or Man-made Fibre Spun Yarns -150,000 square metre equivalents

- Wool Fabrics and Made-up Goods – 250,000 kilograms

The 2013 TPL utilization rates for imports from Chile were zero.

The 2013 TPL utilization rate for imports from Costa Rica for Apparel was 65%. The rates for the rest of the categories were zero.

TPL utilization statistics are available at: Textiles & Clothing

All TPLs for imports are made available on a "first-come-first-served" basis. Once the specified annual quantity under a free trade agreement has been fully utilized, non‑originating apparel, textiles and made-up goods will be subject to the Most-Favoured-Nation tariff rate for the remainder of that TPL year. Canadian importers require a shipment specific import permit for all TPL imports into Canada. TPL-eligible shipments entering Canada under a shipment-specific import permit can normally do so at the rate equivalent to the originating rate.

B) Agricultural and Dairy Products

Agricultural Products

Canada is a signatory to the World Trade Organization (WTO) Agreement on Agriculture concluded in December 1993. This Agreement obliged Canada to convert its existing quantitative agricultural import controls to a system of tariff rate quotas (TRQs), which came into effect in 1995.

Under TRQs, imports are subject to low "within access commitment" rates of duty up to a predetermined limit (i.e., until the import access quantity has been reached), while imports over this limit are subject to higher "over access commitment" rates of duty. For most products, the privilege of importing at the within-access commitment rates of duty is allocated to firms through the issuance of import allocations (or "quota-shares"). Those with quota-shares receive, normally, upon application, specific import permits giving access to the within-access commitment rates of duty as long as they meet the terms and conditions of permit issuance. These conditions are normally described in Allocation Method Orders and in Notices to Importers. Imports in excess of access levels are permitted under General Import Permit No. 100 - Eligible Agricultural Goods, which allows unrestricted imports at the higher rate of duty. Canada continues to respect its access level commitments under the NAFTA, and where both WTO and NAFTA commitments exist, Canada applies the higher of the two for the product in question.

Under the Act, the Minister may, at his discretion, authorize imports of products subject to TRQs apart from the import access quantity, particularly if the Minister judges that the importation of these products is required to meet Canadian market needs. Supplementary import permits are normally issued for the following specific purposes: to address domestic market shortages; to assist Canadian manufacturers to compete with like imported products that can enter Canada duty-free or at a low rate of duty as a result of the NAFTA (the Import-to-Compete Program); to assist Canadian manufacturers to compete in foreign markets (the Import for Re-Export Program - IREP); to facilitate test marketing in the Canadian market of new products that are, for example, unique or are produced with unique processes and require a substantial capital investment for their production; or to address extraordinary or unusual circumstances.

All TRQs are based on Customs Tariff item numbers. Therefore, when the TRQs came into effect in 1995, the Import Control List was amended to replace references to named products (e.g. "turkey and turkey products") with tariff item numbers. However, for ease of understanding, the older product descriptions continue to be used in this report.

Effective January 1, 1995, Canada's chicken, turkey, broiler hatching egg and chick, shell egg and egg product quantitative restrictions were converted to TRQs and were maintained on the Import Control List in order to support supply management of poultry under the Farm Products Marketing Act and to support action taken under the WTO Act. The four product groups were:

- i) chicken and chicken products;

- ii) turkey and turkey products;

- iii) broiler hatching eggs and chicks; and

- iv) eggs and egg products

i. Chicken and chicken products

Chicken was placed on the Import Control List on October 22, 1979. Pursuant to the NAFTA, the import access level is set annually at 7.5% of domestic production for that year or the WTO level of 39,900,000 kilograms, expressed in eviscerated equivalent (EE) weight, whichever is higher. For 2013, the import access level was 77,670,900 kilograms (EE). Within-access commitment permits were issued for 75,772,286 kilograms (EE). Supplementary import permits were issued for 39,083,462 kilograms (EE) of chicken for re-export and for 5,731,405 kilograms (EE) of chicken to help Canadian processors compete with foreign processors who export chicken-containing products to Canada that are not on or otherwise exempt from, the Import Control List.

ii. Turkey and turkey products

Turkey was placed on the Import Control List on May 8, 1974. Pursuant to the NAFTA, the access level is set annually at 3.5% of the domestic production quota for that year or the WTO level of 5,588,000 kilograms (EE), whichever is higher. In 2013, the WTO level was the higher of the two, and thus prevailed. In 2013, within-access commitment permits were issued for 5,380,115 kilograms (EE). Supplementary import permits were issued for 53,320 kilograms (EE) for turkey for re-export, for 0 kilograms (EE) for turkey for a domestic market shortage, and for 475,274 kilograms (EE) of turkey to help Canadian processors compete with foreign processors who export turkey-containing products to Canada that are not on the Import Control List.

iii. Broiler hatching eggs and chicks

Broiler hatching eggs and chicks for chicken production were placed on the Import Control List on May 8, 1989. Pursuant to the NAFTA, the combined import access level for broiler hatching eggs and chicks is 21.1% of the estimated domestic production of broiler hatching eggs for the calendar year to which the TRQ applies. The combined annual import access level is divided into separate levels of 17.4% for broiler hatching eggs and 3.7% for egg-equivalent chicks.

In 2013, the combined import access level was set at 142,239,837 eggs. Within-access commitment permits were issued for 116,006,556 hatching eggs and 24,188,304 egg-equivalent chicks, for a combined total of 140,194,860. Supplementary import permits were issued for 2,081,820 eggs and zero eggs-equivalent chicks for market shortages.

iv. Eggs and egg products

Eggs and egg products were placed on the Import Control List on May 9, 1974. Pursuant to the NAFTA, the import access level for shell eggs is calculated at 1.647% of the previous year's domestic production. For 2013, this converted to 9,627,110 dozen eggs. Within access commitment import permits were issued for 9,601,468 dozen eggs.

Pursuant to the NAFTA, the import access levels for egg powder, and liquid, frozen or further-processed egg products is calculated at 0.627% and 0.714% of the previous year's domestic production, respectively. For 2013, this amounted to 553,410 kilograms and 2,399,763 kilograms, respectively. Within-access commitment permit issuance totalled 234,188 kilograms for egg powder and 2,328,728 kilograms for liquid, frozen or further processed eggs.

In 1996, an allocation for eggs for breaking purposes was introduced. This resulted from a WTO commitment to increase the import access quantity to a level greater than the NAFTA access level at the time. The WTO level, 21,370,000 dozen eggs in 2013, continues to be higher than Canada's NAFTA access level. The “eggs for breaking purposes” allocation is equal to the difference between the WTO and NAFTA commitment levels. The 2013 import access level for eggs for breaking purposes was 3,904,423 dozen eggs. During 2013, within-access commitment permits were issued for breaking eggs for 3,283,006 dozen eggs. Supplementary permits were issued to import 9,597,462 dozen to accommodate market shortages.

In 2013, supplementary permits for market shortages were issued for 9,597,462 dozen table eggs; for 280,588 dozen liquid, frozen and further processed egg products; and for 16,362,261 dozen eggs for breaking purposes.

For powdered eggs and for liquid, frozen and further processed egg products, zero supplementary import permits were issued for re-export.

In 2013, supplementary permits for zero dozen eggs for breaking purposes were issued for re-export.

Import permits are required for importing inedible egg products into Canada, for monitoring purposes only. Permits were issued for 1,769,315 kilograms of this type of product in 2013.

1) Dairy Products

Quantitative restrictions in 12 categories of dairy products were converted to TRQs in support of supply management under the Canadian Dairy Commission Act and action taken under the WTO Agreement Implementation Act. These products are:

- butter (implemented on August 1, 1995);

- cheese of all types other than imitation cheese (implemented on January 1, 1995);

- buttermilk in dry, liquid or other form (implemented on January 1, 1995);

- fluid milk (implemented on January 1,1995);

- dry whey (implemented on August 1, 1995);

- evaporated and condensed milks (implemented on January 1, 1995);

- heavy cream (implemented on August 1, 1995);

- products consisting of natural milk constituents (implemented on January 1, 1995);

- food preparations (implemented on January 1, 1995 under tariff item 1901.90.33);

- ice cream and ice cream novelties in retail packaging and yoghurt in retail packaging (both implemented on January 1, 1995);

- dairy products, other than food preparations, not subject to tariff rate quotas, including, skimmed and whole milk powder, cream powder, other milk powder, other cream powder, animal feed, non-alcoholic beverages containing milk and chocolate ice cream mix and ice milk mix (implemented on January 1, 1995);

- milk protein substances with a milk protein content of 85% or more by weight, calculated on the dry matter, that do not originate in the United States, Mexico, Chile, Costa Rica, or Israel (implemented on September 8, 2008).

i. Butter

The access level for butter was 3,274,000 kilograms for the quota year from August 1, 2012 to July 31, 2013. The entire TRQ was allocated to the Canadian Dairy Commission of which 2,000,000 kilograms was reserved for imports from New Zealand. Within-access commitment import permits were issued for 3,271,460 kilograms. Supplementary import permits for butter and butter oil for re-export were issued for 3,935,421 kilograms. Supplementary import permits for other purposes totalled zero kilograms.

ii. Cheese

The access level for cheese has been fixed since 1979 at 20,411,866 kilograms. Under the provisions of a December 1995 Agreement between Canada and the European Union, 66% of the TRQ is allocated to cheese imports from the European Union and 34% to imports from non- European Union sources. Within-access commitment import permits were issued for 20,411,866 kilograms of cheese, and permits for re-export were issued for 2,432,503 kilograms. Supplementary import permits for other purposes totalled 1,782,665 kilograms.

iii. Buttermilk

Powdered buttermilk

The 2013 access level for powdered buttermilk was 908,000 kilograms. The TRQ is reserved exclusively for imports from New Zealand. Within-access commitment import permits were issued for 96,000 kilograms. Supplementary import permits for re-export were issued for 4,044 kilograms of powdered buttermilk product. Supplementary import permits for other purposes totalled 29,150 kilograms.

Liquid buttermilk and other fermented milk products, other than liquid buttermilk

The access levels in 2013 for liquid buttermilk classified under tariff item 0403.90.91.10 and for other fermented milk products, other than liquid buttermilk, classified under tariff item 0403.90.91.90 were zero and there are no associated TRQs. Supplementary import permits for re-export were issued for zero kilograms of product classified under 0403.90.91.10 and for 0 kilograms of product classified under 0403.90.91.90. Supplementary import permits for other purposes were issued for 69,674 kilograms of other fermented milk products, other than liquid buttermilk.

iv. Fluid milk

The fluid milk access level in 2013 was 64,500 tonnes, which represents estimated annual cross-border purchases by Canadian consumers. The goods are imported under General Import Permit No. 1 - Dairy Products for Personal Use. On January 26, 2000 General Import Permit No. 1 was amended. The $20 limit in value for each importation of fluid milk for personal use was removed. Supplementary import permits for re-export totalled 28,842,627 kilograms.

v. Dry whey

The dry whey access level in the quota year from August 1, 2012 to July 31, 2013 was 3,198,000 kilograms. Within-access commitment import permits were issued for 1,311,928 kilograms. Supplementary imports for re-export totalled 1,841,022 kilograms.

vi. Evaporated and condensed milk

The access level for evaporated and condensed milk in 2013 was 11,700 kilograms. The tariff rate quota is reserved exclusively for imports from Australia. Within-access commitment import permits were issued for 10,800 kilograms. Supplementary import permits for re-export were issued for 1,255,599 kilograms. Supplementary import permits for other purposes totalled 14,971 kilograms.

vii. Heavy cream

The heavy cream access level in the quota year from August 1, 2012 to July 31, 2013 was 394,000 kilograms for sterilized cream having a minimum of 23% butterfat and sold in cans having a volume not exceeding 200 milliliters. Within-access commitment import permits were issued for 389,258 kilograms. Supplementary import permits were issued for re-export for 969,775 kilograms.

viii. Products consisting of natural milk constituents

The access level for these products in 2013 was 4,345,000 kilograms, and within-access commitment import permits were issued for 3,177,503 kilograms. Supplementary import permits for re-export were issued for 362,257 kilograms.

ix. Food preparations

The access level in 2013 for food preparations classified under tariff item 1901.90.33 was 70,000 kilograms, allocated on a first-come, first-served basis. The TRQ covers ingredients for the manufacture of confectionery and other food products, and for soft-serve ice cream. Within access permit issuance totalled 70,000 kilograms. Supplementary import permits for re-export were issued for zero kilograms.

The access level for food preparations classified under tariff items 1901.20.11, 1901.90.21, 1901.90.31, 1901.90.51, 1901.90.53, 2106.90.31 and 2106.90.93 was zero and there are no associated TRQs. However, supplementary import permits for re-export were issued for 58,926 kilograms of products classified under tariff item 1901.90.53, and for 870,777 kilograms of products classified under tariff item 2106.90.93. Supplementary import permits for other purposes were issued for 241,208 kilograms of product classified under tariff item 2106.90.93.

x. Ice cream and yoghurt

The access levels in 2013 were 484,000 kilograms for ice cream and 332,000 kilograms for yoghurt. Within-access commitment import permit issuance in 2013 totalled 454,196 kilograms for ice cream and 332,000 kilograms for yoghurt. For yoghurt, supplementary import permits for other purposes were issued for 233,181, while supplementary import permits for re-export were issued for 63,424 kilograms.

xi. Dairy products, other than food preparations, not subject to tariff rate quotas, including, skimmed and whole milk powder, cream powder, other milk powder, other cream powder, animal feed, non-alcoholic beverages containing milk and chocolate ice cream mix and ice milk mix

These products are not subject to TRQs. Supplementary import permits for re-export were issued for 1,327,798 kilograms of skimmed milk powder and 1,905,590 kilograms of whole milk powder, as well as 32,118 kilograms of cream powder. Supplementary import permits for other purposes were issued for 10,457 kilograms for skim milk powder and 20,320 kilograms for whole milk powder.

xii. Milk protein substances with a milk protein content of 85% or more by weight, calculated on the dry matter, that do not originate in a NAFTA country, Chile, Costa Rica, or Israel

Milk protein substances with a milk protein content of 85% or more by weight, calculated on the dry matter, that do not originate in the US, Mexico, Chile, Costa Rica, or Israel, were placed on the Import Control List on September 8, 2008, in order to implement a change in Canada’s WTO obligations subsequent to a re-negotiation of a tariff concession outlined in an intergovernmental arrangement.

Effective April 1, 2011, an access level of 10,000,000 kilograms per year for the period of April 1 to March 31 each year was established for these products. For the period of April 1, 2012, to March 31, 2013, within-access commitment import permits were issued for 5,625,432 kilograms of Milk protein substances. No supplementary import permits for re-export were issued.

2) Margarine

The TRQ for margarine was introduced on January 1, 1995. The import access level for 2013 was 7,558,000 kilograms. Within-access commitment import permit issuance totalled 2,508,139 kilograms.

3) Wheat, Barley and Their Products

The restrictions imposed on imports of wheat, barley and their products under the Canadian Wheat Board Act were converted to TRQs on August 1, 1995. These TRQs are administered by Foreign Affairs, Trade and Development Canada and Canada Border Services Agency on a first-come first-served basis using an August-July year. Importers may cite General Import Permit No. 20 - Wheat and Wheat Products, Barley and Barley Products to import goods at the lower rate of duty. Once the access levels are filled, importers must cite General Import Permit No. 100 - Eligible Agricultural Goods on Customs entry documents to import goods at the higher rate of duty.

The following annual TRQ levels for wheat, barley, wheat products and barley products apply:

- wheat: 226,883 tonnes

- wheat products: 123,557 tonnes

- barley: 399,000 tonnes

- barley products: 19,131 tonnes

Imports in the period from August 1, 2012 to July 31, 2013, were 81,642 tonnes, 160,497 tonnes, 19,124 tonnes, and 30,222 tonnes in these four product categories, respectively. Supplementary imports for barley products for market shortages were issued for 5,833 tonnes. Administrative measures are established to ensure full usage of quota which sometimes results in imports at the within-access rate over the TRQ limit.

4) Beef and Veal

The restrictions on imports of non-NAFTA beef and veal established under the Meat Import Act were converted to a TRQ on January 1, 1995. The TRQ applies to all imports of fresh, chilled and frozen beef and veal imported from non-NAFTA countries (except Chile) and in 2013 was 76,409 tonnes. Of this total, 35,000 tonnes were reserved for imports from Australia and 29,600 tonnes were reserved for imports from New Zealand. The balance of the TRQ (11,809 tonnes) was reserved for imports from all countries certified by the Canadian Food Inspection Agency, including Australia and New Zealand once their country-specific reserves were fully used. Within-access commitment import permit issuance in 2013 totalled 42,907 tonnes.

Since May 20, 2003, the government has made changes to the supplementary import policy in order to support domestic beef and veal producers facing the challenges and uncertainty brought on by Bovine Spongiform Encephalopathy (BSE). The changes have provided domestic producers with greater opportunities to supply the Canadian market while the government works to restore full access to export markets, and were developed in close consultation with industry stakeholders. The policy was modified in 2005 and 2007. Since that time, supplemental imports have been limited to those situations where neither the specific product nor reasonable substitutes were available in Canada at competitive prices. No supplementary import permits were authorized in 2013.

C) Steel products

Carbon steel products (semi-finished steel, plate, sheet and strip steel, wire rods, wire and wire products, railway-type products, bars, structural shapes and units, and pipes and tubes) were initially placed on the Import Control List, effective September 1, 1986, following a report by the Canadian Import Tribunal recommending the collection of information on goods of this type entering Canada. Speciality steel products (stainless flat-rolled products, stainless steel bars, wire and wire products, alloy tool steel, mould steel and high speed steel) were added to the Import Control List, effective June 1, 1987, pursuant to an amendment to the Act providing for import monitoring of steel products under certain conditions. The current mandate for the steel monitoring program extends until October 30, 2017.

The purpose of placing carbon and speciality steel on the Import Control List is to provide more timely and precise steel import data. There are no quantitative restrictions.

As of April 1, 2012, the requirement for individual import permits for steel imports was removed. Importers use general import permits, eliminating the need for 270,000 permits annually and saving the industry $10 million a year in permit fees. Import data continues to be collected.

In 2013, 8.6 million tonnes of steel with a reported value of $9.97 billion was imported into Canada.

D) Weapons and munitions and chemicals

Pursuant to items 70 to 73 and 91 of the Import Control List, an import permit is required to import into Canada all small- and large-calibre weapons, ammunition, bombs, pyrotechnics, tanks and self-propelled guns. As well, all components and parts specifically designed for these items also require import permits. Firearms classified as non-restricted or restricted in legal classification and destined to sporting or recreational use, and their parts, are exempted from an import permit.

Manufacturers and businesses licensed by the Provincial Chief Firearms Officers may import prohibited weapons, prohibited firearms, and prohibited devices under strictly controlled conditions.

Pursuant to item 74 of the Import Control List, an import permit is required to import certain toxic chemicals, precursors and mixtures.

Export Controls

Section 3 of the Act provides that the Governor in Council may establish a list of goods and technology, to be called an Export Control List, including therein any article the export of which the Governor in Council deems it necessary to control for any of the following purposes:

- to ensure that arms, ammunition, implements or munitions of war, naval, army or air stores or any articles deemed capable of being converted there into or made useful in the production thereof or otherwise having a strategic nature or value will not be made available to any destination where their use might be detrimental to the security of Canada;

- to ensure that any action taken to promote the further processing in Canada of a natural resource that is produced in Canada is not rendered ineffective by reason of the unrestricted exportation of that natural resource;

- to limit or keep under surveillance the export of any raw or processed material that is produced in Canada in circumstances of surplus supply and depressed prices and that is not a produce of agriculture;

- to implement an intergovernmental arrangement or commitment;

- to ensure that there is an adequate supply and distribution of the article in Canada for defence or other needs; or

- to ensure the orderly export marketing of any goods that are subject to a limitation imposed by any country or customs territory on the quantity of the goods that, on importation into that country or customs territory in any given period, is eligible for the benefit provided for goods imported within that limitation.

The Export Control List comprises seven groups, as follows:

- Group 1: Dual Use List

- Group 2: Munitions List

- Group 3: Nuclear Non-proliferation List

- Group 4: Nuclear-Related Dual Use List

- Group 5: Miscellaneous Goods & Technology

- Group 6: Missile Technology Control Regime List

- Group 7: Chemical and Biological Weapons Non-Proliferation List

Groups 1 and 2 encompass Canada's multilateral strategic commitments under the Wassenaar Arrangement.

Groups 3, 4, 6 and 7 represent our multilateral commitments under the various non-proliferation regimes designed to control the proliferation of weapons of mass destruction (chemical, biological and nuclear weapons) as well as their delivery systems.

Group 5 comprises various strategic and non-strategic goods and technologies which are controlled for other purposes, as provided in the Act. This includes, inter alia, forest products (logs, softwood lumber and agricultural products (peanut butter, sugar and sugar-containing products). Group 5 also includes controls on the export of U.S. origin goods and technology.

In addition, in accordance with the authority in the Act to implement an intergovernmental agreement, Textile and Clothing exports to countries with relevant free trade agreements (U.S., Mexico, Chile and Costa Rica) are regulated under the Act, Section 9.1 of the Act also authorizes the Minister to issue export certificates of eligibility.

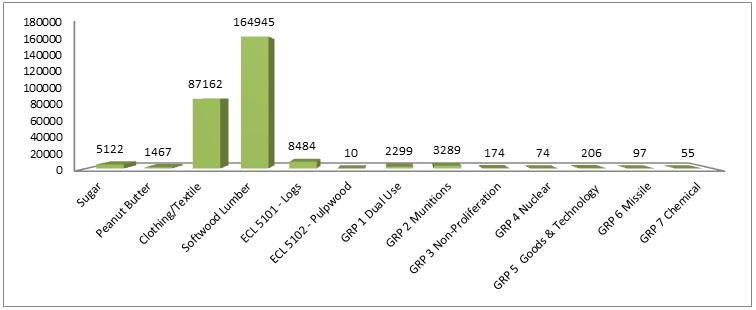

Volume of Export Permits

In 2013, the Trade Controls Bureau issued over 273,000 permits for the exporting of controlled goods.

Text Alternative

Volume of Export Permits

Graphic representation of Volume of Export Permits for the importation of controlled goods. In 2013, over 81,722 permits were issued

- 5,1221 permits for sugar;

- 1,467 permits for peanut butter;

- 87,162 permits for clothing and textiles;

- 164,945 permits for softwood lumber;

- 8,484 permits for ECL 5101 Logs;

- 10 permits for ECL 5102 Pulpwood;

- 2,299 permits for GRP 1 Dual Use;

- 3,289 permits for GRP 2 Munitions;

- 174 permits for GRP 3 Non-Proliferation;

- 74 permits for GRP 4 Nuclear;

- 206 permits for GRP 5 Goods and technology;

- 97 permits for GRP 6 Missile;

- 55 permits for GRP 7 Chemical.

Issuance of export permits

Section 13 of the Act stipulates that:

“No person shall export or transfer, or attempt to export or transfer, any goods or technology included in an Export Control List or any goods or technology to any country included in an Area Control List except under the authority of and in accordance with an export permit issued under this Act.”

Subsection 7(1) authorizes the Minister to:

“[…]issue to any resident of Canada applying therefore a permit to export or transfer goods or technology included in an Export Control List or to export or transfer goods or technology to a country included in an Area Control List, in such quantity and of such quality, by such persons, to such places or persons and subject to such other terms and conditions as are described in the permit or in the regulations.”

An export permit is required before any item included in the Export Control List may be exported from Canada to any destination, with the exception (in most cases) of the United States. This requirement enables Canada to meet international commitments, such as its commitment to prevent the proliferation of missile technology and biological, chemical and nuclear weapons. Nuclear material and equipment, logs, automatic firearms, pulpwood, and red cedar bolts and blocks are among the goods requiring permits for export to the United States. Permits are also required to export any goods or technology to countries on the Area Control List.

The following is a statistical summary of export permit applications processed in 2013 for goods or technology included on the Export Control List:

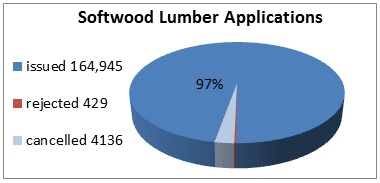

Softwood Lumber

Effective April 1, 2001 the Department of Foreign Affairs, Trade and Development introduced a national softwood lumber monitoring program. The objective of this monitoring program was to collect data respecting softwood lumber exports to the U.S. for all Canadian provinces and territories. This monitoring program was replaced on October 12, 2006 with the introduction of the Canada-United States of America Softwood Lumber Agreement.

The Agreement created a stable, predictable bilateral trade environment for Canadian producers. It revoked U.S. countervailing and anti-dumping duty orders, returned to Canadian exporters over $5 billion in duties collected by the U.S. between 2002 and 2006, and safeguarded the provinces’ ability to manage their forest resources. It is a seven-year agreement with an option to renew for two additional years that was exercised by Canada and the U.S. on April 20, 2012.

The Governor in Council placed softwood lumber on the Export Control List, as item 5104, which has the effect of requiring permits issued by the Minister for exports to the U.S.

From January 1, 2013 to December 31, 2013, exports of softwood lumber totalled 10.9 billion board feet. The following is a statistical summary (Footnote *) of softwood lumber permit applications processed in 2013:

Text Alternative

Volume of Export Permits

Graphic representation of Softwood Lumber Applications

- 164,945 applications issued;

- 429 applications rejected;

- 4,136 applications cancelled

Footnotes

- Footnote *

Based on export permit data compiled by Foreign Affairs, Trade and Development Canada. The data is subject to corrections and adjustments, and may differ from other official trade statistics of Canada and the U.S. as they are based on definitions that are specific to the 2006 Canada-United States of America Softwood Lumber Agreement.

Logs

Logs are included on the Export Control List in order to ensure an adequate supply and distribution of logs within Canada. Export permits from all provinces and territories other than British Columbia are issued automatically upon the correct completion of an export permit application. In British Columbia, log exports originating from either federally regulated or provincially regulated lands are also subject to a system of “surplus tests”. The administration of the surplus test for logs originating from federal lands in British Columbia is administered by the Department of Foreign Affairs, Trade and Development. The current policies are set forth in Notice to Exporters No 102.

In 2013, the Department of Foreign Affairs, Trade and Development issued nearly 8,484 permits for logs, valued at approximately $1.27 billion.

Agri-food products

As part of its implementation of WTO commitments, the U.S. established TRQs for imports of peanut butter, certain sugar-containing products and refined sugar. Within these TRQs, Canada receives a country-specific quota allocation. The U.S. Government administers these tariff rate quotas on a first-come, first-served basis. In order to help ensure the orderly export of these programs against Canada’s country-specific quotas, Canada placed these products on the Export Control List. Accordingly, in order to comply with the Act and to benefit from the in-quota U.S. tariff rate, Canadian exports of peanut butter, certain sugar-containing products and refined sugar to the U.S. require an export permit issued by the Bureau. There are no quantitative restrictions or permit requirements for Canadian exports of these products to non-U.S. destinations.

i. Peanut butter

Peanut butter was placed on the Export Control List on January 1, 1995. Within the U.S. peanut butter TRQ of 20,000 tonnes, the U.S. provides a country-specific quota to Canada of 14,500 tonnes. During 2013, permits were issued for 12,773,899 kilograms, indicating that the quota was 88% utilized.

ii. Sugar-containing products

Sugar-containing products were placed on the Export Control List on February 1, 1995. The global TRQ of the U.S. sugar-containing products is 5,459 tonnes and applies to imports of certain sugar-containing products falling under Chapters 17, 18, 19 and 21 of the Harmonized Tariff Schedule of the U.S. The quota year for sugar containing products is from October 1 to September 30.

In September 1997, Canada and the U.S. exchanged letters of understanding, under which Canada obtained an additional country-specific quota of 59,250 tonnes within the U.S. sugar-containing products TRQ. The understanding also provides that only goods that are "product of Canada" may benefit from Canada's country-specific reserve. In 2012-2013, export permits were issued for 55,013,834 kilograms of sugar-containing products, indicating that the quota was 92.85% utilized.

iii. Refined Sugar

Refined sugar was placed on the Export Control List on October 1, 1995. The U.S. refined sugar tariff rate quota is 60,000 tonnes (raw equivalent). The quota year for refined sugar is from October 1 to September 30.

In September 1997, Canada and the U.S. exchanged letters of understanding, under which Canada obtained a country-specific quota of 12,050 tonnes, raw equivalent (i.e., 11,207 tonnes refined sugar), within the U.S. refined sugar TRQ. The understanding also provides that only goods that are "product of Canada" may benefit from Canada's country specific reserve. In 2012-2013, the refined sugar export quota was 100% utilized.

The following summary of agricultural export permit applications processed in 2013includes applications for peanut butter, sugar-containing products and refined sugar:

- permits issued: 6,589

- applications rejected: 87

- permits cancelled: 565

Textiles and Clothing

NAFTA Countries

Products must originate in the North American Free Trade Agreement (NAFTA) countries in order to qualify for NAFTA rates of duties. This is determined through the use of NAFTA rules of origin for yarn, fabric and clothing. For apparel and textiles that do not meet these rules of origin, the NAFTA provides preferential access to the Canadian, U.S. and Mexican markets through the use of TPLs. The four broad categories of TPLs and their corresponding volumes for access to the U.S. and Mexico are respectively, as follows:

- Wool Apparel – 5,325,413 and 250,000 square metre equivalents

- Cotton or Man-made Fibre Apparel – 88,326,463 and 6,000,000 square metre equivalents

- Cotton or Man-made Fibre Fabrics and Made-up Goods – 71,765,252 and 7,000,000 square metre equivalents

- Cotton or Man-made Fibre Spun Yarns –11,813,664 and 1,000,000 kilograms

As of July 5, 2010, all TPLs for export to the U.S., except for yarn, are allocated on a historical-use basis to the extent of utilization by exporters and on a first-come, first-served basis for those amounts not allocated directly to exporters. The TPL for yarn for exports to the U.S. and all TPL exports to Mexico are allocated to exporters on a first-come, first-served basis.

TPL exports to the U.S. must be accompanied by a certificate of eligibility. TPL exports to Mexico do not require a certificate of eligibility.

The 2013 TPL utilization rates for the four categories of Canadian tariff preference levels exports to the U.S. and Mexico were as follows:

- Wool Apparel and Made-Up Goods 46% for the U.S. and 7% for Mexico;

- Cotton or Man-Made Fibre Apparel and Made-Up Goods 17% for the U.S. and 9% for Mexico;

- Cotton or Man-Made Fibre Fabrics and Made-Up Goods 53% for the U.S. and 0% for Mexico;

- Cotton or Man-Made Fibre Spun Yarns 37% for the U.S. and 0% for Mexico.

TPL utilization statistics are available at: Textiles & Clothing

As provided for in the NAFTA, the annual growth rates for the TPL volumes for Canadian goods entering the U.S. were eliminated at the end of 1999. No growth rates were provided for trade with Mexico.

Other Free Trade Agreement countries

In additional, in accordance with the authority in the Act to implement an intergovernmental agreement, Textile and Clothing exports to countries with relevant free trade agreements (Chile and Costa Rica) are regulated under the Act.

The four broad categories of TPLs and their corresponding volumes for access to Chile are respectively, as follows:

- Wool Apparel – 112,616 square metre equivalents

- Cotton or Man-made Fibre Apparel - 2,252,324 square metre equivalents

- Cotton or Man-made Fibre Fabrics and Made-up Goods – 1,000,000 square metre equivalents

- Cotton or Man-made Fibre Spun Yarn –500,000 kilograms

- Wool Fabrics and Made-up Goods – 250,000 square metre equivalents.

The four broad categories of TPLs and their corresponding volumes for access to Costa Rica are respectively, as follows:

- Apparel – 1,379,570 square metre equivalents

- Cotton or Man-made Fibre Fabrics and Made-Up Goods – 1,000,000 square metre equivalents

- Cotton or Man-made Fibre Spun Yarn –150,000 kilograms

- Wool Fabrics and Made-up Goods – 250,000 square metre equivalents

In 2013, no permits were issued for Textiles and Clothing exports to Costa Rica or Chile.

Certificates of Eligibility

For the purposes of administering the NAFTA tariff preference levels provisions for exports to the U.S., the Department of Foreign Affairs, Trade and Development issues export certificates of eligibility pursuant to section 9.1 of the Act. The following summary outlines the number of certificates of eligibility applications processed in 2013:

- Certificates issued: 87,162

- Applications rejected: 4,407

- Certificates cancelled: 2,081

Area Control List

Section 4 of the Act provides for the control of "any goods or technology to any country included in an Area Control List". Currently there are two countries on the Area Control List, Belarus and the Democratic People’s Republic of Korea (North Korea). In 2013, 12 permits were issued for Belarus and 7 for North Korea, falling within the general humanitarian policy.

Automatic Firearms Country Control List

The Act provides for the establishment of an Automatic Firearms Country Control List. Export permit applications for automatic firearms and certain other prohibited firearms, weapons, and devices are only considered to countries on the Automatic Firearms Country Control List.

The countries listed on the Automatic Firearms Country Control List in 2013 were:

Albania, Australia, Belgium, Botswana, Bulgaria, Colombia, Croatia, Czech Republic, Denmark, Estonia, Finland, France, Germany, Greece, Hungary, Iceland, Italy, Latvia, Lithuania, Luxembourg, Netherlands, New Zealand, Norway, Poland, Portugal, Romania, Saudi Arabia, Slovakia, Slovenia, Spain, Sweden, Turkey, United Kingdom and U.S.

General Export Permits

The Act provides for the issuance of general permits authorizing the export of certain designated goods or technology to all destinations or to specified destinations. General Export Permits are intended to facilitate exports by enabling exporters to export selected goods without applying for individual permits.

The General Export Permits in effect during 2013 included:

- General Export Permit EX. 1: Goods with a value of less than $100, household articles, personal effects, business equipment required for temporary use outside Canada and personal automobiles

- General Export Permit EX. 3: Consumable stores supplied to vessels and aircraft

- General Export Permit EX. 5 : Forest products

- General Export Permit EX. 10: Export of Sugar Permit

- General Export Permit EX. 12: United States Origin Goods

- General Export Permit EX. 18: Personal computers

- General Export Permit EX. 29: Eligible industrial goods

- General Export Permit EX. 30: Certain industrial goods to eligible countries and territories

- General Export Permit EX. 31: Peanut butter

- General Export Permits EX. 37: Chemicals and Precursors to the United States

- General Export Permit EX. 38: CWC Toxic Chemical and Precursor Mixtures

- General Export Permit EX. 43: Nuclear Goods and Technology to Certain Destinations

- General Export Permit EX. 44: Nuclear-Related Dual-Use Goods and Technologies to Certain Destinations

- General Export Permit EX. 45: Cryptography for the Development or Production of a Product

- General Export Permit Ex. 46: Cryptography for use by certain consignees.

Import Certificates and Delivery Verification Certificates

The issuance of import certificates and delivery verification certificates is provided for under section 9 of the Act and under the Import Certificate Regulations (C.R.C., c. 603). Import certificates enable an importer to describe goods in detail and to certify that he/she will not assist in their disposal or diversion during transit. Such assurances may be required by the country of export before permitting the shipment of certain goods, most notably munitions and strategic goods. An import certificate is not an import permit and does not entitle the holder to import the goods described on the certificate into Canada. Delivery verification certificates may be issued following arrival of the goods in Canada to enable an exporter of goods to Canada to comply with requirements of the exporting country.

In 2013, the Department issued 2,956 import certificates and 471 delivery verification certificates.

Offences

Penalties are listed in subsection 19(1) of the Act as follows:

"Every person who contravenes any provision of this Act or the regulations is guilty of:

- (a) an offence punishable on summary conviction and liable to a fine not exceeding twenty-five thousand dollars or to imprisonment for a term not exceeding twelve months, or to both; or

- (b) an indictable offence and liable to a fine in an amount that is in the discretion of the court or to imprisonment for a term not exceeding ten years, or to both."

Section 25 of the Act delegates responsibility for the enforcement of the Act to all officers as defined in the Customs Act (subsection 2(1)). The Department of Foreign Affairs, Trade and Development entrusts the enforcement of the Act to the Canada Border Services Agency, and to the Royal Canadian Mounted Police.

Export control enforcement actions for 2013

Voluntary compliance continued to be a key element in Canada's export control system in 2013. The Canada Border Services Agency referred 196 detentions of export shipments to the Department of Foreign Affairs, Trade and Development.

Trade Controls and Technical Barriers Bureau Performance Standards

The Bureau is committed to providing clients with prompt and reliable service based on Canadian export and import controls law, regulation and policy.

Our aims are: to foster an orderly processing of controlled imports into and exports from Canada; implement our commitments under international agreements; and ensure that the administration of trade controls under the authority of the Act is carried out smoothly and without undue hindrance to Canadian exporters, importers and consumers.

To fulfill this policy, and under the authority of the Act, the Bureau is responsible for issuing permits for importing controlled goods into Canada that are included in the Import Control List, and for exporting goods included in the Export Control List or for exporting goods to destinations included in the Area Control List.

In order to fulfill our responsibilities under the Act, the Bureau has established service standards. The target for processing import and export permit applications for non-strategic goods within the Export Import Controls System (EICS) is within 4 business hours of receipt. The target for processing of log permit applications for Log exports is within 3 working days. The target for processing permit applications to export controlled strategic goods or technology within the Export Controls On-line System (EXCOL) is within 10 working days; should consultations outside the Bureau be required, the period is within 40 days. In 2013, over 380,000 permit applications were processed within EICS and EXCOL, and approximately 92.9% of those permit applications were processed within the allotted service periods.

- Date modified: