Archived information

Information identified as archived is provided for reference, research or recordkeeping purposes. It is not subject to the Government of Canada Web Standards and has not been altered or updated since it was archived. Please contact us to request a format other than those available.

Annual report to parliament on the administration of the Export and Import Controls Permits Act - 2014

Table of Contents

- Introduction

- Report

- Import Controls

- Export Controls

- A) Export Controls: Military, Strategic and Dual-use Items

- B) Export Controls: Area Control List

- C) Export Controls: Automatic Firearms Country Control List

- D) Export Controls: Softwood Lumber

- E) Export Controls: Logs

- F) Export Controls: Agri-food Products to the U.S.

- G) Export Controls: Textiles and Clothing

- H) General Export Permits

- Offences under the Export and Import Permits Act

- Performance Standards

- Glossary

- Annex 1

- Figures

- Tables

- Table 1: Textiles and Clothing: TPLs and Utilization on Imports to Canada in 2014

- Table 2: Poultry and Eggs: Tariff Rate Quotas and Supplementary Imports in 2014

- Table 3: Dairy Imports in 2014

- Table 4: Other Agricultural Product Imports in 2014

- Table 5: ECL Group and Permit Status Summary for 2014

- Table 6: Strategic Export Permits for Top 12 Destinations for 2014

- Table 7: Softwood Lumber Exports to U.S. for 2014

- Table 8: Logs Exports for 2014

- Table 9: Agri-food Exports to the U.S. in 2014

- Table 10: Textiles and Clothing - TPLs and Utilization on Export from Canada in 2014

PDF Version (556 KB)Footnote *

Introduction

The attached Annual Report to Parliament on the administration of the Export and Import Permits Act (EIPA) for the year 2014 is submitted pursuant to Section 27 of the Act, Chapter E-19 of the 1985 Revised Statutes of Canada, as amended, which provides:

"As soon as practicable after December 31 of each year the Minister shall prepare and lay before Parliament a report of the operations under this Act for that year."

Purpose of the Export and Import Permits Act

The authority to control the import and export of goods and technologies is derived from the EIPA. It finds its origin in the War Measures Act and was first introduced as an Act of Parliament in 1947 and subsequently amended on a number of occasions. The EIPA was last amended by Bill C-20 (An Act to implement the Free Trade Agreement between Canada and the Republic of Honduras). That Bill received Royal Assent on June 19, 2014. It amended the EIPA to add the definition Canada-Honduras Free Trade Agreement (CHFTA), and to enable the implementation of obligations in Schedules to the CHFTA.

The EIPA provides that the Governor in Council may establish lists known as the Import Control List (ICL), the Export Control List (ECL), the Area Control List (ACL), and the Automatic Firearms Country Control List. For each one of these lists, the EIPA sets out criteria that govern the inclusion of goods, technologies or countries on the respective lists and provides that the Governor in Council may revoke, amend, vary or re-establish any of the lists. Control over the flow of goods and technology contained on these lists or to the specified destinations is effected through the issuance of import or export permits.

The EIPA delegates to the Minister of Foreign Affairs the authority to grant or deny applications for these permits and thus confers on him broad powers to control the flow of the goods and technology contained in these lists.

While the overall authority for the EIPAis that of the Minister of Foreign Affairs, to ensure the efficient functioning of the administration of the EIPA, the Minister of Foreign Affairs and the Minister of International Trade traditionally divide responsibility for the EIPA. This is in accordance with the Department of Foreign Affairs, Trade and Development Act, whereby the Minister of International Trade may assist with Minister of Foreign Affairs in carrying out responsibilities that are related to international trade.

Through an exchange of letters, the Minister of Foreign Affairs has asked the Minister of International Trade to take responsibility for import and export controls implemented for economic and trade-related reasons. These include import controls on agricultural products (including supply-managed products like poultry, eggs and dairy), along with sugar containing products, textiles and clothing, and steel for monitoring purposes.

The Minister of Foreign Affairs retains decision-making authority for controls over military, dual-use and strategic goods and technology, while first seeking the views and recommendations of the Minister of International Trade for certain sensitive applications. Export controls for these items are intended to safeguard Canada’s foreign and defence policy interests, while not hampering legitimate trade.

The operations carried out under the EIPA include:

- Trade Controls implemented for economic reasons, which are an important element of Canada’s free trade agenda: ensuring that Canadians and Canadian businesses are able to benefit from an open global trading regime, while also supporting vulnerable Canadian industries and important Canadian policies, such as supply management.

- Export Controls over dual-use, military and strategic goods, which are designed to ensure that our exports are consistent with Canadian foreign and defence policies. Canada’s export controls are not intended to hamper legitimate trade but seek to balance the economic and commercial interests of Canadian business with the national interest of Canada.

The information contained in this report is organized under the following headings:

Import Controls

- Textiles and clothing

- Agriculture and dairy

- Steel

- Weapons, munitions and chemicals

Export Controls

- Strategic, dual-use, military and atomic energy goods, materials and technology as well as items controlled for non-proliferation purposes

- Any goods or technology to countries listed on the Area Control List

- Miscellaneous goods and technology, where applicable, including logs, softwood lumber, cedar bolts and blocks, peanut butter, sugar, sugar-containing products and products of U.S. origin

- Textiles and clothing

Report

Import Controls

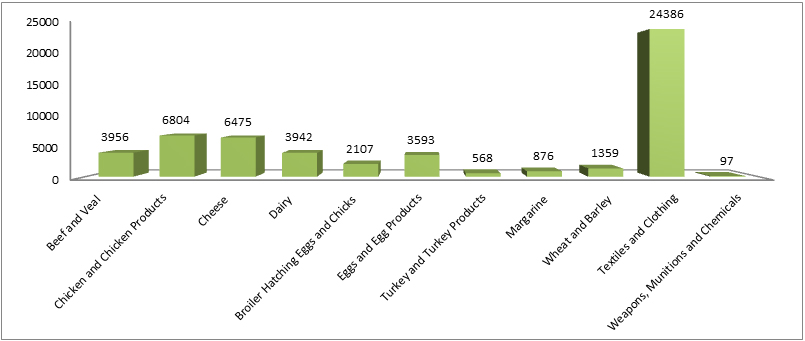

In 2014, Global Affairs Canada issued over 54,163 permits for the import of controlled goods, as indicated in Figure 1. 5,717 applications for permits were rejected and 3,258 were cancelled. The vast majority of permit cancellations were generated by the need to amend permit details, such as quantity, import date or supplier information. A small number of permits were cancelled to address company non-compliance with legislative, regulatory or policy requirements or criteria.

Figure 1

Number of Import Permits Issued for Controlled Goods in 2014

Text Alternative

- 3956 Beef and Veal

- 6804 Chicken and Chicken Products

- 6475 Cheese

- 3942 Dairy

- 2107 Broiler Hatching Eggs and Chicks

- 3593 Eggs and Egg Products

- 568 Turkey and Turkey Products

- 876 Margarine

- 1359 Wheat and Barley

- 24386 Textiles and Clothing

- 97 Weapons, Munitions and Chemicals

A) Import Controls: Textiles and Clothing

Textile and clothing imports are controlled as a result of various free trade agreements, including North American Free Trade Agreement (NAFTA), and the agreements with Chile, Costa Rica and Honduras. The agreements provide for preferential access for non-originating products through the use of Tariff Preference Levels (TPLs).

All TPLs for imports are made available on a "first-come-first-served" basis. Once the specified annual quantity under a free trade agreement has been fully utilized, non‑originating apparel, textiles and made-up goods will be subject to the Most-Favoured-Nation tariff rate for the remainder of that TPL year. Canadian importers require a shipment-specific import permit for all TPL imports into Canada under the negotiated quantity. TPL-eligible shipments entering Canada under a shipment-specific import permit can normally do so at the rate equivalent to the originating rate.

With the implementation of the Canada-Honduras Free Trade Agreement on October 1, 2014, Canada began issuing import permits for TPL imports under this agreement. There were no changes to the administration of the other existing agreements TPL imports and utilization for 2014 are noted in Table 1.

| U.S. | Mexico | Chile | Costa Rica | Honduras | ||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Square metre equivalents (sme) or Kilograms (Kg) | Access Level | Utilization | Access Level | Utilization | Access Level | Utilization | Access level | Utilization | Access Level | Utilization |

| Wool Apparel (sme) | 919,740 | 185,589 | 250,000 | 172,234 | 112,616 | 0 | N/A | N/A | N/A | N/A |

| Cotton or Man-made Fibre Apparel (sme) | 9,000,000 | 8,999,621 | 6,000,000 | 1,297,766 | 2,252,324 | 0 | N/A | N/A | N/A | N/A |

| Cotton or Man-made Fibre Fabrics and Made-up Goods (sme) | 2,000,000 | 1,999,930 | 7,000,000 | 0 | 1,000,000 | 0 | 1,000,000 | 0 | N/A | N/A |

| Cotton or Man-made Fibre Spun Yarns (sme) | 1,000,000 | 49,875 | 1,000,000 | 0 | 500,000 | 0 | 150,000 | 0 | N/A | N/A |

| Wool Fabrics and Made-up Goods (kg) | N/A | N/A | N/A | N/A | 250,000 | 0 | 250,000 | 0 | N/A | N/A |

| Fabric and Made-up Goods (kg) | N/A | N/A | N/A | N/A | N/A | N/A | N/A | N/A | 1,000,000 | 0 |

| Apparel (sme) | N/A | N/A | N/A | N/A | N/A | N/A | 1,379,570 | 0 | 4,000,000 | 17,779 |

B) Import Controls: Agriculture and Dairy Products

Canada is a signatory to the World Trade Organization (WTO) Agreement on Agriculture concluded in December 1993. This Agreement obliged Canada to convert its existing quantitative agricultural import controls to a system of tariff rate quotas (TRQs), which came into effect in 1995.

Under TRQs, imports are subject to low "within access commitment" rates of duty up to a predetermined limit (i.e., until the import access quantity has been reached), while imports over this limit are subject to higher "over access commitment" rates of duty. For most products, the privilege of importing at the within-access commitment rates of duty is allocated to firms through the issuance of import allocations (or "quota-shares"). Those with quota-shares receive, normally, upon application, specific import permits giving access to the within-access commitment rates of duty as long as they meet the terms and conditions of permit issuance. These conditions are normally described in Allocation Method Orders and in Notices to Importers. Imports in excess of access levels are permitted under General Import Permit No. 100 - Eligible Agricultural Goods, which allows unrestricted imports at the higher rate of duty. Canada continues to respect its access level commitments under the NAFTA, and where both WTO and NAFTA commitments exist, Canada applies the higher of the two for the product in question.

Under the EIPA, the Minister may, at his discretion, authorize imports of products subject to TRQs apart from the import access quantity, particularly if the Minister determines that the importation of these products is required to meet Canadian market needs. Supplementary import permits are normally issued for the following specific purposes:

- to address domestic market shortages;

- to assist Canadian manufacturers to compete with similar imported products that can enter Canada duty-free or at a low rate of duty as a result of the NAFTA (the Import-to-Compete Program);

- to assist Canadian manufacturers to compete in foreign markets (the Import for Re-Export Program (IREP));

- to facilitate test marketing in the Canadian market of new products that are, for example, unique or are produced with unique processes and require a substantial capital investment for their production; or

- to address extraordinary or unusual circumstances.

The policy governing supplementary import permits for each commodity can be found at www.eics-scei.gc.ca, with any updates published under a ‘Notice to Importers’.

All TRQs are based on Customs Tariff item numbers. When the TRQs came into effect in 1995, the ICLwas amended to replace named products (e.g. "turkey and turkey products") with tariff item numbers. For ease of understanding, the older product descriptions continue to be used in this report.

1) Poultry Products

Effective January 1, 1995, Canada's chicken, turkey, broiler hatching egg and chick, shell egg and egg product quantitative restrictions were converted to TRQs and were maintained on the ICL in order to support supply management of poultry under the Farm Products Marketing Act and to support action taken under the WTO Agreement Implementation Act. The four product groups were: chicken and chicken products; turkey and turkey products; broiler hatching eggs and chicks; and eggs and egg products.

Chicken was placed on the ICLon October 22, 1979. Pursuant to the NAFTA, the import access level is set annually at 7.5% of domestic production for that year or the WTO level of 39,900,000 kilograms, expressed in eviscerated equivalent (EE) weight, whichever is higher.

Turkey and turkey products were placed on the ICL on May 8, 1974. Pursuant to the NAFTA, the access level is 3.5% of the current year’s domestic production quota or the WTO level of 5,588,000 kilograms (EE), whichever is higher.

Broiler hatching eggs and chicks for chicken production were placed on the ICLon May 8, 1989. Pursuant to the NAFTA, the combined import access level for broiler hatching eggs and chicks is 21.1% of the estimated domestic production of broiler hatching eggs for the calendar year to which the TRQ applies. The combined annual import access level is divided into separate levels of 17.4% for broiler hatching eggs and 3.7% for egg-equivalent chicks.

Eggs and egg products were placed on the ICL on May 9, 1974. Pursuant to the NAFTA, the import access level for eggs and egg products is set at a total of 2.988% of the previous year’s domestic production and in accordance with the following breakdown: 1.647% for shell eggs; 0,714% for liquid, frozen or further-processed egg products; and 0.627% for egg powder.

In 1996, an allocation for eggs for breaking purposes was introduced. This resulted from a WTO commitment to increase the import access quantity to a level greater than the NAFTA access level at the time. The WTO level, 21,370,000 dozen eggs in 2014, continues to be higher than Canada's NAFTA access level. The “eggs for breaking purposes” allocation is equal to the difference between the WTO and NAFTA commitment levels.

There were no changes made regarding the administration of these controls for 2014. Details are summarized in Table 2.

| Tariff Rate Quotas | Supplemental Imports | ||||||

|---|---|---|---|---|---|---|---|

| Description | Unit of Measure | Access Level | Within-Access Imports | IREP | Import to Compete | Market Shortage | Other |

| Import permits are required for importing inedible egg products into Canada, for monitoring purposes only. Permits were issued for 2,802,550 kilograms of this type of product in 2014. | |||||||

| Chicken and Chicken Products (EE) | EE Kilograms | 78,807,225 | 76,537,426 | 23,437,601 | 7,687,763 | 0 | 0 |

| Turkey and Turkey Products (EE) | EE Kilograms | 5,588,000 | 4,678,023 | 7,482 | 4,488 | 0 | 0 |

| Broiler Hatching Eggs and Chicks | Egg Equivalent | 144,659,840 | 141,196,249 | 0 | 0 | 2,192,364 | |

| Eggs and Egg Products | Egg Equivalent | 21,370,000 | 21,076,817 | 1,265,944 | 0 | 51,875,136 | 69,980 |

| Shell Eggs | Dozens | 9,975,204 | 9,966,328 | 15,453,992 | |||

| Shell Eggs for Breaking | Dozens | 3,272,909 | 3,272,909 | 46,605 | 0 | 32,824,210 | 0 |

| Egg Powder | Kilograms | 573,420 | 542,582 | 4,800 | 0 | 10,567 | |

| Liquid, frozen or further processed egg products (kg) | Kilograms | 2,486,533 | 2,440,485 | 682,842 | 0 | 2,068,237 | 0 |

2) Dairy Products

Quantitative restrictions in 12 categories of dairy products were converted to TRQs in support of supply management under the Canadian Dairy Commission Act and action taken under the WTO Agreement Implementation Act. These products are:

- butter, dairy spreads, and oils and fats derived from milk (implemented on August 1, 1995);

- cheese of all types other than imitation cheese (implemented on January 1, 1995);

- buttermilk powder (implemented on January 1, 1995);

- fluid milk (implemented on January 1, 1995)*;

- dry whey (implemented on August 1, 1995);

- concentrated/condensed milk/cream (implemented on January 1, 1995);

- cream (implemented on August 1, 1995);

- products consisting of natural milk constituents (implemented on January 1, 1995);

- food preparations under tariff item 1901.90.33 (implemented on January 1, 1995);

- ice cream and ice cream novelties and yoghurt (implemented on January 1, 1995);

- dairy products, and other food preparations containing dairy, not subject to TRQs, including skimmed and whole milk powder, cream powder, other milk powder, other cream powder, buttermilk (other than powdered buttermilk), curdled milk and cream, kephir and other fermented or acidified milk and cream, animal feed, non-alcoholic beverages containing milk, and chocolate ice cream mix and ice milk mix (implemented on January 1, 1995);

- milk protein substances with a milk protein content of 85% or more by weight, calculated on the dry matter, that do not originate in the United States (U.S.), Mexico, Chile, Costa Rica or Israel (implemented on September 8, 2008).

*The fluid milk access level represents estimated annual cross-border purchases by Canadian consumers. The goods are imported under General Import Permit No. 1 - Dairy Products for Personal Use. On January 26, 2000, General Import Permit No. 1 was amended. The $20 limit in value for each importation of fluid milk for personal use was removed.

There were no changes made regarding the administration of these controls for 2014.TRQ import levels for 2014 are noted in Table 3.

| Kilograms (Kg) except where otherwise indicated with Tonnes (t) | Description/tariff item number | Access Level | Within-Access Imports | Supplementary Imports IREP | Supplementary Import to Compete | Supplementary Market Shortage | Supplementary Other |

|---|---|---|---|---|---|---|---|

| Butter, dairy spreads, and oils and fats derived from milk (Aug. 1 - Jul. 31) | (TRQ allocated to Canadian Dairy Commission with 2,000,000 reserved for NZ) | 3,274,000 | 3,261,658 | 7,025,243 | 0 | 0 | 22,061 |

| Cheese of all types other than imitation cheese | (66% allocated to European Union) | 20,411,866 | 20,354,457 | 2,380,556 | 0 | 0 | 1,867,049 |

| Powdered buttermilk | (reserved for imports from NZ) | 908,000 | 0 | 24,104 | 0 | 0 | 27,365 |

| Buttermilk (other than powdered buttermilk), curdled milk and cream, kephir and other fermented or acidified milk and cream | 0403.90.91.10 0403.90.91.90 | 0 | 0 | 0 | 0 | 0 | 68,889 |

| Fluid milk | 64,500 (t) | 0 | 13,800,808 | 0 | 0 | 0 | |

| Dry whey (Aug. 1 - Jul. 31) | 3,198,000 | 1,118,142 | 1,731,750 | 0 | 0 | 3,562 | |

| Concentrated/condensed milk/cream | (reserved for imports from Australia) | 11,700 | 0 | 1,209,730 | 0 | 0 | 14,971 |

| Cream (Aug. 1 - Jul. 31) | (sterilized, minimum 23% butterfat and sold in cans with volume less than 200 mililiters | 394,000 | 390,764 | 787,704 | 0 | 0 | 5,122 |

| Products consisting of natural milk constituents | 4,345,000 | 4,060,167 | 115,250 | 0 | 0 | 160 | |

| Food preparations | 1901.90.33 | 70,000 | 61,946 | 15,582 | 0 | 0 | 0 |

| 1901.20.11 | 0 | 0 | 0 | 0 | 0 | 0 | |

| 1901.90.21 | 0 | 0 | 0 | 0 | 0 | 0 | |

| 1901.90.31 | 0 | 0 | 0 | 0 | 0 | 0 | |

| 1901.90.51 | 0 | 0 | 0 | 0 | 0 | 0 | |

| 1901.90.53 | 0 | 0 | 661,211 | 0 | 0 | 0 | |

| 2106.90.31 | 0 | 0 | 0 | 0 | 0 | 0 | |

| 2106.90.93 | 0 | 0 | 1,333,148 | 0 | 0 | 208,986 | |

| Ice cream and ice cream novelties and yoghurt | Ice Cream | 484,000 | 417,951 | 0 | 0 | 0 | 9,076 |

| Yoghurt | 332,000 | 201,811 | 90,481 | 0 | 0 | 311,409 | |

| Dairy products, other than food preparations, not subject to tariff rate quotas, including, skimmed and whole milk powder, cream powder, other milk powder, other cream powder, animal feed, non-alcoholic beverages containing milk, and chocolate ice cream mix and ice milk mix | Skimmed Milk Powder | 0 | 0 | 2,745,880 | 0 | 0 | 74,497 |

| Whole Milk Powder | 0 | 0 | 1,173,096 | 0 | 0 | 0 | |

| Other Chocolate Ice Cream Mix and Ice Milk Mix | 0 | 0 | 0 | 0 | 0 | 0 | |

| Non-alcoholic Beverages containing Milk | 0 | 0 | 0 | 0 | 0 | 0 | |

| Complete Feeds and Feed Supplements containing 50% or more Milk Solids | 0 | 0 | 0 | 0 | 0 | 0 | |

| Cream Powder | 0 | 0 | 33,705 | 0 | 0 | 0 | |

| Milk protein substances with a milk protein content of 85% or more by weight, calculated on the dry matter, that do not originate in the U.S., Mexico, Chile, Costa Rica, or Israel (Apr. 1 - Mar. 31) | 10,000,000 | 6,229,397 | 0 | 0 | 0 | 0 |

3) Import Controls: Other Agricultural Products

Other agriculture products subject to controls are: margarine; wheat, barley and their products; and beef and veal.

The TRQ for margarine was introduced on January 1, 1995.

The restrictions imposed on imports of wheat, barley and their products under the Canadian Wheat Board Act were converted to TRQs on August 1, 1995. These TRQs are administered by Global Affairs Canada and Canada Border Services Agency on a first-come first-served basis using an August-July year. Importers may cite General Import Permit No. 20 - Wheat and Wheat Products, Barley and Barley Products to import goods at the lower rate of duty. Once the access levels are filled, importers must cite General Import Permit No. 100 - Eligible Agricultural Goods on customs entry documents to import goods at the higher rate of duty. Administrative measures are established to ensure full usage of quota, which sometimes results in imports at the within-access rate over the TRQ limit.

The restrictions on imports of non-NAFTA beef and veal established under the Meat Import Act were converted to a TRQ on January 1, 1995. The TRQ applies to all imports of fresh, chilled and frozen beef and veal imported from non-NAFTA countries (except Chile).

There were no changes made regarding the administration of these controls for 2014. TRQ import levels for 2014 are noted in Table 4.

| Kilograms (Kg) except where otherwise indicated with Tonnes (t) | Description/tariff item number | Access Level | Within-Access Imports | Supp Imports IREP | Supps Import to Compete | Supps Market Shortage | Supps Other |

|---|---|---|---|---|---|---|---|

| Margarine | 7,558,000 | 3,858,496 | 0 | 0 | 0 | 0 | |

| Wheat, Barley and their Products | Wheat | 226,883 (t) | 51,745 (t) | ||||

| Wheat Products | 123,557 (t) | 146,048 (t) | 0 | 0 | 0 | 0 | |

| Barley | 399,000 (t) | 9,728 (t) | |||||

| Barley products | 19,131 (t) | 32,518 (t) | 0 | 0 | 9,054 (t) | ||

| Beef and Veal (non-NAFTA except Chile) | Imports from Australia | 35,000 (t) | 58,479(t) | N/A | N/A | 1,098,326 | N/A |

| Imports from New Zealand | 29,600 (t) | ||||||

| Imports from all countries certified by the CFIA | 11, 809 (t) |

C) Import Controls: Steel

Carbon steel products (semi-finished steel, plate, sheet and strip steel, wire rods, wire and wire products, railway-type products, bars, structural shapes and units, and pipes and tubes) were initially placed on theICL, effective September 1, 1986, following a report by the Canadian Import Tribunal recommending the collection of information on goods of this type entering Canada. Speciality steel products (stainless flat-rolled products, stainless steel bars, wire and wire products, alloy tool steel, mould steel and high speed steel) were added to the ICL, effective June 1, 1987, pursuant to an amendment to the EIPA providing for import monitoring of steel products under certain conditions. The current mandate for the steel monitoring program extends until October 30, 2017.

The purpose of placing carbon and speciality steel on the ICLis to provide more timely and precise steel import data. There are no quantitative restrictions and the requirement for shipment-specific import permits was removed in 2012.

Each year the Minister of Foreign Affairs also tables a report to Parliament with a statistical summary of any information collected during that year related to the steel. The report is required to be tabled within the first 15 sitting days of Parliament. The 2014 report was tabled on February 20, 2015.

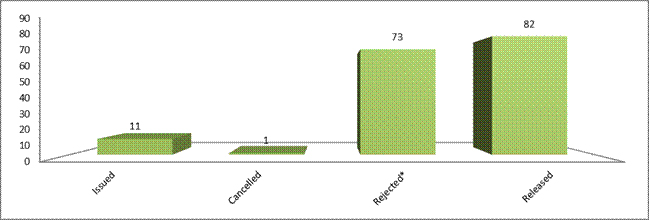

D) Import Controls: Weapons, Munitions and Chemicals

Pursuant to items 70 to 73 and 91 of the ICL, an import permit is required to import into Canada all small- and large-calibre weapons, ammunition, bombs, pyrotechnics, tanks and self-propelled guns. As well, all components and parts specifically designed for these items also require import permits. Firearms classified as non-restricted or restricted in legal classification and destined to sporting or recreational use, and their parts, are exempted from an import permit.

Manufacturers and businesses licensed by the Provincial Chief Firearms Officers may import prohibited weapons, prohibited firearms and prohibited devices under strictly controlled conditions.

Pursuant to item 74 of the ICL, an import permit is required to import certain toxic chemicals, precursors and mixtures.

As a result of the introduction in late 2013 and early 2014 of 18 Broad-Based Import Permit Letters issued to low-risk, high-volume commercial importers of firearms and related goods, the number of import permits for these items processed annually was reduced by approximately 96%.

Figure 2

Number of Import Permits Issued for Weapons, Munitions and Chemicals in 2014

*Import permits issued for weapons, munitions and chemicals are usually rejected due to a lack of appropriate information.

Text Alternative

- 11 Issued

- 1 Cancelled

- 73 Rejected*

- 82 Released

E) International Import Certificates and Delivery Verification Certificates

The issuance of international import certificates and delivery verification certificates is provided for under section 9 of the EIPA and under the Import Certificate Regulations (C.R.C., c. 603). International import certificates enable an importer to describe goods in detail and to certify that he/she will not assist in their disposal or diversion during transit. Such assurances may be required by the country of export before permitting the shipment of certain goods, most notably munitions and strategic goods. An international import certificate is not an import permit and does not entitle the holder to import the goods described on the certificate into Canada. Delivery verification certificates may be issued following arrival of the goods in Canada to enable an exporter of goods to Canada to comply with requirements of the exporting country.

In 2014, Global Affairs Canada issued 2,555 international import certificates (a decline of 40% since 2011, due to the implementation of International Import Certificate Letters to trusted high-volume importers as an administrative streamlining measure) and 496 delivery verification certificates

Export Controls

Section 3 of the EIPA provides that the Governor in Council may establish a list of goods and technology, to be called an Export Control List (ECL), including therein any article the export of which the Governor in Council deems it necessary to control for purposes specified in the EIPA.

The ECL comprises seven groups, as follows:

- Group 1: Dual Use List

- Group 2: Munitions List

- Group 3: Nuclear Non-proliferation List

- Group 4: Nuclear-Related Dual Use List

- Group 5 Miscellaneous Goods and Technology

- Group 6: Missile Technology Control Regime List

- Group 7: Chemical and Biological Weapons Non-Proliferation List

Groups 1 and 2 encompass Canada's multilateral strategic commitments under the Wassenaar Arrangement and control, respectively, Dual-Use and Military goods and technology. The Wassenaar Arrangement was been established in order to contribute to regional and international security and stability, by promoting transparency and greater responsibility in transfers of conventional arms and dual-use goods and technologies, thus preventing destabilising accumulations. The aim is also to prevent the acquisition of these items by terrorists.

Groups 3, 4, 6 and 7 represent Canada’s multilateral commitments under the various non-proliferation regimes (the Nuclear Suppliers Group; the Australia Group; and the Missile Technology Control Regime) designed to control the proliferation of weapons of mass destruction (chemical, biological and nuclear weapons) as well as their delivery systems.

Group 5 comprises various strategic and non-strategic goods and technologies that are controlled for other purposes, as provided in the EIPA. This category includes, inter alia, forest products (logs, softwood lumber) and agricultural products (peanut butter, sugar and sugar-containing products).

Group 5 also includes controls on the export of U.S. origin goods and technology not otherwise controlled on the ECL; and controls over the export of other goods and technology not controlled elsewhere. Group 5 also contains a catch-all provision to control the export of goods or technology that may be destined for use in an activity or facility involved in weapons of mass destruction.

In addition, in accordance with the authority in the EIPA to implement an intergovernmental agreement, textile and clothing exports to countries with relevant free trade agreements (U.S., Mexico, Chile, Costa Rica and Honduras) are regulated under the EIPA, Section 9.1 of the EIPA also authorizes the Minister of Foreign Affairs to issue export certificates of eligibility.

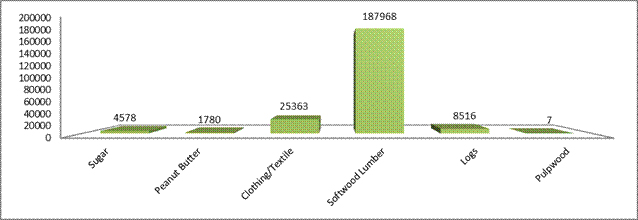

In 2014, Global Affairs Canada issued:

- 228,212 permits for non-strategic exports (softwood lumber, logs, clothing and textiles, and agricultural products) with 2,617 rejected and 7,053 cancelled. (Note that the term “denied” is not used for non-strategic exports.)

- 6,173 permits for military, dual-use and strategic goods, with 354 returned without action, 489 withdrawn and 14 denied.

Figure 3

Number of Export Permits Issued for Controlled Goods in 2014

Non-Strategic

Text Alternative

- 4578 Sugar

- 1780 Peanut Butter

- 25363 Clothing/Textile

- 187968 Softwood Lumber

- 8516 Logs

- 7 Pulpwood

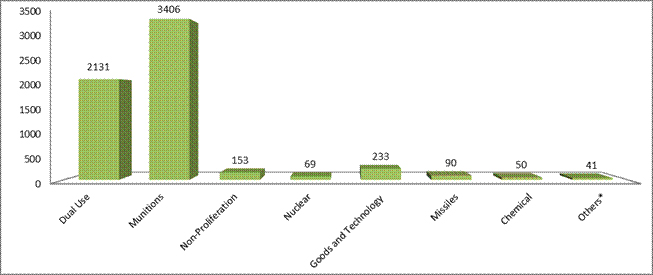

Strategic

*This category captures exports of humanitarian goods to Area Control List (ACL) countries, not captured elsewhere on the ECL

Text Alternative

- 2131 Dual Use

- 3406 Munitions

- 153 Non-Proliferation

- 69 Nuclear

- 233 Goods and Technology

- 90 Missiles

- 50 Chemical

- 41 Others*

A) Export Controls: Military, Strategic and Dual-use Items

The EIPA authorizes the Minister of Foreign Affairs to issue to any resident of Canada a permit to export items included on the ECL or to a country included on the ACL, subject to certain terms and conditions.

An export permit describes, among other things, the quantity, description and nature of the items to be exported, as well as the final destination country and final consignee. Unless otherwise stated, an export permit may authorize multiple shipments, up to the expiry of the permit and as long as the cumulative total of the quantity or value of items exported does not exceed the quantity or value stated on the permit. An export permit constitutes a legally-binding authorization to export controlled goods or technology as described.

The principal objective of export controls is to ensure that exports of certain goods and technology are consistent with Canada’s foreign and defence policies. Among other policy goals, export controls seek to ensure that exports from Canada:

- do not ause harm to Canada and its allies;

- do not ndermine national or international security;

- do not ontribute to national or regional conflicts or instability;

- do not ontribute to the development of nuclear, biological or chemical weapons of mass destruction, or of their delivery systems;

- are not used to commit human rights violations; and

- are consistent with existing economic sanctions’ provisions.

Canada’s export controls are not intended to hamper legitimate trade but seek to balance the economic and commercial interests of Canadian business with the national interest of Canada.

In addition to compliance with the EIPA, exporters of goods and technology that are subject to export controls have a responsibility to conduct due diligence verifications of actual and potential foreign customers and to provide all relevant information in an export permit application. The Government of Canada’s reviews of permit applications to export goods and technology seek to ensure that exports from Canada will not be diverted to illegitimate end-uses or end-users that would be contrary to the policy goals stated above, or that could lead to considerable embarrassment or liability for the exporter. In other words, this review can be seen as another step in the exporter’s due diligence process.

With respect to military goods and technology, Canadian export control policy has, for many years, been restrictive. Under present policy guidelines set out by Cabinet in 1986, Canada closely controls the export of military items to:

- countries which pose a threat to Canada and its allies;

- countries involved in or under imminent threat of hostilities;

- countries under United Nations Security Council sanctions; or

- countries whose governments have a persistent record of serious violations of the human rights of their citizens, unless it can be demonstrated that there is no reasonable risk that the goods might be used against the civilian population.

The current ECL entered into force on December 5, 2014. The amendments served to add controls, clarify controls and remove controls over specific items as agreed upon in the various multilateral export control regimes. A complete list of the new and amended controls was published online.

An update to the ECL is forthcoming, which will bring the ECL into line with commitments taken up to December 2014. The proposed amendment will add items to the ECL that are of importance to national and international security and thereby meet Canada’s commitment to control exports of these goods and technology. The amendment will also remove items that have become less sensitive over time and thereby lift unnecessary regulatory burdens on exporters. Lastly, the amendment will also clarify the control criteria of some items. This will help exporters to better understand if their products are subject to controls and ensure that items and definitions are interpreted consistently by Canadian and foreign government officials. As such, this amendment to the ECL will meet Canada’s international security commitments, while also reducing a regulatory burden on certain Canadian exporters.

| Issued | Returned without action | Withdrawn | Denied | |

|---|---|---|---|---|

| Group 1 | 2,131 | 108 | 70 | 5 |

| Group 2 | 3,406 | 155 | 100 | 6 |

| Group 3 | 153 | 6 | 15 | 0 |

| Group 4 | 69 | 3 | 1 | 0 |

| Group 5 | 233 | 8 | 59 | 1 |

| Group 6 | 90 | 3 | 2 | 0 |

| Group 7 | 50 | 2 | 1 | 0 |

| Others | 41 | 69 | 241 | 2 |

| Totals | 6,173 | 354 | 489 | 14 |

*As this is the first year that this information has been included in the Report in this format, historical data can be found in Annex A. There may be discrepancies with previously-published data as if a permit is amended in a subsequent year from when it was issued, it is deleted from the count in the original year, and added to the count for the current year. This results in difficulties in precisely replicating historical numbers at different points in time.

Definitions:

Issued – means a permit approved and issued.

Returned without action – A permit application is returned without action by Global Affairs Canada if it is administratively incomplete, or if there is inconsistent information. A company that wishes to pursue the export would then be required to submit a new permit application.

Withdrawn - Permit applications may be withdrawn either at the request of the exporter (e.g., if the permit is no longer required because the commercial deal falls through or if the company becomes aware of commercial, political or other types of risk that may affect their application, and decides not to pursue the commercial opportunity), or by the Export Controls Division (e.g., if the goods or technology proposed for export are not controlled, or if a General Export Permit applies).

Denied – means a permit that was denied by the Minister of Foreign Affairs, either directly or further to policy direction received by officials. An export permit application may be denied by the Minister of Foreign Affairs. This is unusual, occurring in fewer than 1% of cases annually, and is generally for reasons of Canada’s foreign and defence policy, as provided in the criteria for controlling the export of military, dual use and strategic goods outlined above.

| Destination | % of Permits Issued | |

|---|---|---|

| *Export permits are only required for a small number of items controlled for strategic purposes on the ECL when exported to the U.S. This chart reflects the top 12 destinations by number of permits issued for all military, dual-use and strategic items on the ECL. The Report on Exports of Military Goods from Canada has a similar table but is a listing of Canada’s top destinations for military items (group2) by value outside of the U.S. | ||

| 1 | United Kingdom | 11.8% |

| 2 | Germany | 7.2% |

| 3 | France | 6.5% |

| 4 | China | 5.0% |

| 5 | South Africa | 4.7% |

| 6 | Australia | 3.8% |

| 7 | U.S. | 3.7%* |

| 8 | South Korea | 3.6% |

| 9 | Japan | 3.5% |

| 10 | Israel | 2.9% |

| 11 | Switzerland | 2.2% |

| 12 | Italy | 2.0% |

B) Export Controls: Area Control List

Section 4 of the EIPA provides for the control of "any goods or technology to any country included in an Area Control List". Currently there are two countries on the ACL: Belarus and the Democratic People’s Republic of Korea (North Korea). In 2014, 40 permits were issued for Belarus and 1 for North Korea, falling within the Government of Canada’s general humanitarian policy, which was established to allow the approval of export permits to countries on the ACL, if the export in question has a humanitarian basis.

C) Export Controls: Automatic Firearms Country Control List

The EIPA provides for the establishment of an Automatic Firearms Country Control List. Export permit applications for automatic firearms and certain other prohibited firearms, weapons and devices are only considered to countries on the Automatic Firearms Country Control List.

The countries listed on the Automatic Firearms Country Control List in 2014 were: Albania, Australia, Belgium, Botswana, Bulgaria, Chile, Colombia, Croatia, Czech Republic, Denmark, Estonia, Finland, France, Germany, Greece, Hungary, Iceland, Italy, Latvia, Lithuania, Luxembourg, Netherlands, New Zealand, Norway, Peru, Poland, Portugal, Romania, Saudi Arabia, Slovakia, Slovenia, Spain, Sweden, The Republic of Korea (South Korea), Turkey, United Kingdom and the U.S.

Of these countries, Chile, Peru and South Korea were added in 2014 further to the completion of public consultations and the regulatory process.

D) Export Controls: Softwood Lumber

Effective April 1, 2001, Global Affairs Canada introduced a national softwood lumber monitoring program. The objective of this monitoring program was to collect data respecting softwood lumber exports to the U.S. for all Canadian provinces and territories. This monitoring program was replaced on October 12, 2006 with the introduction of the Canada-United States of America Softwood Lumber Agreement, continuing the requirement for permits for exports to the U.S.

The Agreement created a stable, predictable bilateral trade environment for Canadian producers. It revoked U.S. countervailing and anti-dumping duty orders, returned to Canadian exporters over $5 billion in duties collected by the U.S. between 2002 and 2006, and safeguarded the provinces’ ability to manage their forest resources. It is a seven-year agreement with an option to renew for two additional years that was exercised by Canada and the U.S. on April 20, 2012 resulting in a new expiry date of October 12, 2015.

For 2014, exports of softwood lumber, based on definitions specific to the Agreement, totalled 12.1 billion board feet, as indicated in Table 7.

| Month | Foot Board Measure (FBM) | Number of Issued Permits |

|---|---|---|

| January | 934,329,937 | 14,322 |

| February | 794,391,849 | 12,666 |

| March | 934,238,857 | 14,676 |

| April | 1,033,989,210 | 16,257 |

| May | 1,113,562,381 | 17,419 |

| June | 1,065,943,047 | 16,859 |

| July | 1,117,177,988 | 16,983 |

| August | 1,010,813,767 | 15,953 |

| September | 1,050,736,992 | 16,700 |

| October | 1,147,797,385 | 17,602 |

| November | 904,282,899 | 13,966 |

| December | 978,175,312 | 14,565 |

| Total | 12,085,439,624 | 187,968 |

E) Export Controls: Logs

Logs are included on the ECL in order to ensure an adequate supply and distribution of logs within Canada. Export permits from all provinces and territories other than British Columbia are issued automatically upon the correct completion of an export permit application. In British Columbia, exports of logs originating from either federally-regulated or provincially-regulated lands are also subject to a system of “surplus tests”. Global Affairs Canada administers the surplus test for logs originating from federal lands in British Columbia. The current policies are set forth in Notice to Exporters No. 102 available on the Global Affairs Canada’s website.

In 2014, Global Affairs Canada issued nearly 8,516 permits for 7.3 million cubic metres (m3) of logs. The value indicated for those logs for the same period was C$923 million. Details provided in Table 8.

| Month | Volume (m3) | Number of Issued Permits |

|---|---|---|

| *These values represent authorized export volumes per month. Since permits are often valid for at least several months, and sometimes years, these do not equate to amounts actually exported. | ||

| January | 790,077.9 | 927 |

| February | 550,330.2 | 552 |

| March | 676,118.8 | 859 |

| April | 568,065.4 | 602 |

| May | 679,809.9 | 776 |

| June | 577,730.1 | 598 |

| July | 511,386.1 | 620 |

| August | 666,504.8 | 678 |

| September | 769,510 | 978 |

| October | 655,688.3 | 826 |

| November | 406,287.6 | 511 |

| December | 500,348.9 | 589 |

| Total | 7,351,858 | 8,516 |

F) Export Controls: Agri-food Products to the U.S.

As part of its implementation of WTO commitments, the U.S. established TRQs for imports of peanut butter, certain sugar-containing products and refined sugar. Within these TRQs, Canada receives a country-specific quota allocation. The U.S. Government administers these TRQs on a first-come, first-served basis. In order to help ensure the orderly export of these programs against Canada’s country-specific quotas, Canada placed these products on the ECL. Accordingly, in order to comply with the EIPA and to benefit from the in-quota U.S. tariff rate, Canadian exports of peanut butter, certain sugar-containing products and refined sugar to the U.S. require an export permit issued by Global Affairs Canada. There are no quantitative restrictions for Canadian exports of these products to destinations outside of the U.S.

Peanut butter was placed on the ECL on January 1, 1995.

Sugar-containing products were placed on the ECLon February 1, 1995. The U.S.’ global TRQ for sugar-containing products is 64,709,000 kilograms and applies to imports of certain sugar-containing products falling under Chapters 17, 18, 19 and 21 of its Harmonized Tariff Schedule. The quota year for sugar containing products is from October 1 to September 30. In September 1997, Canada and the U.S. exchanged letters of understanding, under which Canada obtained a country-specific reserve within the U.S. sugar-containing products TRQ of 59,250,000 kilograms. The understanding also provides that only goods that are "product of Canada" may benefit from Canada's country-specific reserve.

Refined sugar was placed on the ECL on October 1, 1995. The quota year for refined sugar is from October 1 to September 30. In September 1997, Canada and the U.S. exchanged letters of understanding, under which Canada obtained a 10,300,000 kilogram (or 10.3 tonnes) country-specific quota. The understanding also provides that only goods that are "product of Canada" may benefit from Canada's country specific reserve. Exports of agri-food products in 2013 and 2014 are summarized in Table 9.

| Kilograms (Kg) | Quota | Utilization | Permits Issued |

|---|---|---|---|

| Peanut Butter | 14,500,000 | 9,382,456 | 1,780 |

| Sugar-containing Products | 59,250,000 | 51,584,381 | 4,321 |

| Refined Sugar *raw equivalent | 12,050,000 | 10,926,764 | 257 |

G) Export Controls: Textiles and Clothing

Textile and clothing exports are controlled as a result of various free trade agreements, including NAFTA, and the agreements with Chile, Costa Rica and Honduras. The agreements provide for preferential access for non-originating products through the use of Tariff Preference Levels (TPLs).

As of July 5, 2010, all TPLs for export to the U.S., except for yarn, are allocated on a historical-use basis to the extent of utilization by exporters and on a first-come, first-served basis for those amounts not allocated directly to exporters. The TPL for yarn for exports to the U.S. and all TPL exports to Mexico, Chile, Costa Rica and Honduras are made available to exporters on a first-come, first-served basis.

As provided for in the NAFTA, the annual growth rates for the TPL volumes for Canadian goods entering the U.S. were eliminated at the end of 1999. No growth rates were provided for trade with Mexico.

TPL exports to the U.S. and Mexico must be accompanied by a certificate of eligibility. Other TPL exports do not require a certificate of eligibility. Although the Canada-Honduras Free Trade Agreement was implemented on October 1, 2014, there are no Canadian export documents required for exports. As a result, there were no changes necessary for the administration of exports under this agreement. Further, there were no changes to the administration of the existing agreements.

In 2014, Global Affairs Canada issued 25,912 certificates; 1,374 applications were rejected and 1,720 cancelled. The vast majority of permit cancellations are generated by the need to amend permit details, such as quantity or export date. A small number of permits are cancelled to address non-compliance with legislative, regulatory or policy requirements or criteria. TPL export levels and utilization for textiles and clothing during 2014 are summarized in Table 10.

| U.S. | Mexico | Chile | Costa Rica | Honduras | ||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Square metre equivalents (sme) or Kilograms (Kg) | Access Level | Utilization | Access Level | Utilization | Access Level | Utilization | Access level | Utilization | Access Level | Utilization |

| Wool Apparel (sme) | 5,325,413 | 2,519,402 | 250,000 | 26,010 | 112,616 | N/A | N/A | N/A | N/A | N/A |

| Cotton or Man-made Fibre Apparel (sme) | 88,326,463 | 15,715,921 | 6,000,000 | 466,531 | 2,252,324 | N/A | N/A | N/A | N/A | N/A |

| Cotton or Man-made Fibre Fabrics and Made-up Goods (sme) | 71,765,252 | 53,787,521 | 7,000,000 | 119 | 1,000,000 | N/A | 1,000,000 | N/A | N/A | N/A |

| Cotton or Man-made Fibre Spun Yarns (sme) | 11,813,664 | 4,602,354 | 1,000,000 | 1,207 | 500,000 | N/A | 150,000 | N/A | N/A | N/A |

| Wool Fabrics and Made-up Goods (kg) | N/A | N/A | N/A | N/A | 250,000 | N/A | 250,000 | N/A | N/A | N/A |

| Apparel (sme) | N/A | N/A | N/A | N/A | N/A | N/A | 1,379,570 | N/A | 4,000,000 | N/A |

| Fabric and Made-Up Goods (sme) | N/A | N/A | N/A | N/A | N/A | N/A | N/A | N/A | 1,000,000 | N/A |

H) General Export Permits

The EIPA provides for the issuance of general permits authorizing the export of certain designated goods or technology to all destinations or to specified destinations. General Export Permits are intended to facilitate exports by enabling exporters to export selected goods without applying for individual permits.

The following General Export Permits were in effect during 2014. No new General Export Permits were added in 2014.

- General Export Permit EX. 1: Goods with a value of less than $100, household articles, personal effects, business equipment required for temporary use outside Canada and personal automobiles

- General Export Permit EX. 3: Consumable Stores Supplied to Vessels and Aircraft

- General Export Permit EX. 5 : Forest Products

- General Export Permit EX. 10: Export of Sugar Permit

- General Export Permit EX. 12: U.S.-Origin Goods

- General Export Permit EX. 18: Personal Computers

- General Export Permit EX. 29: Eligible Industrial Goods

- General Export Permit EX. 30: Certain Industrial Goods to Eligible Countries and Territories

- General Export Permit EX. 31: Peanut Butter

- General Export Permits EX. 37: Chemicals and Precursors to the U.S.

- General Export Permit EX. 38: Chemical Weapons Convention Toxic Chemical and Precursor Mixtures

- General Export Permit EX. 43: Nuclear Goods and Technology to Certain Destinations

- General Export Permit EX. 44: Nuclear-Related Dual-Use Goods and Technologies to Certain Destinations

- General Export Permit EX. 45: Cryptography for the Development or Production of a Product

- General Export Permit Ex. 46: Cryptography for Use by Certain Consignees.

Offences under the Export and Import Permits Act

Penalties are listed in subsection 19(1) of the EIPA as follows:

Every person who contravenes any provision of this EIPA or the regulations is guilty of:

- an offence punishable on summary conviction and liable to a fine not exceeding C$25,000 or to imprisonment for a term not exceeding 12 months, or to both; or

- an indictable offence and liable to a fine in an amount that is in the discretion of the court or to imprisonment for a term not exceeding ten years, or to both.

A prosecution under section 19(1)(a) may be instituted at any time within but not later than three years after the time when the subject-matter of the complaint arose.

Section 25 of the EIPA delegates responsibility for the enforcement of the EIPA to all officers as defined in the Customs Act (subsection 2(1)). Global Affairs Canada entrusts the enforcement of the EIPA to the Canada Border Services Agency (CBSA), and to the Royal Canadian Mounted Police (RCMP).

Export control enforcement actions for 2014

Export control enforcement continued to be a key element in Canada's export control system in 2014.

Global Affairs Canada’s Export Controls Division works closely with enforcement agencies, in particular the CBSA and the RCMP, which are responsible for enforcing the provisions of the EIPA on behalf of Global Affairs Canada. On receipt of information relating to an unauthorized export of controlled goods or technology, the Export Controls Division may, depending on the circumstances of the case, refer the matter to the RCMP or CBSA for investigation and decision as to whether to proceed with administrative penalties or criminal charges. The Export Controls Division also routinely provides, formally and informally, assistance, expert advice, and investigative support to CBSA, RCMP and other investigative agencies. In 2014, the Export Controls Division responded to 26 formal requests for investigation support.

Alleged violations may come to the attention of Global Affairs Canada directly (e.g., a Canadian exporter may bring a suspected violation to the attention of the Export Controls Division) or indirectly, as the result of an investigation. Potential violations may also be identified in the course of CBSA operations at border control locations and major ports of entry and exit. When CBSA detains a shipment (whether on import or export), they may refer the detention to the Export Controls Division for a control status assessment of the detained goods, CBSA may detain a shipment, referring to the appropriate department, including Global Affairs Canada, to verify that legislative and regulatory requirements controlling exports (e.g. export controls under the EIPA; sanctions; licenses from the Canadian Nuclear Safety Commission for nuclear-related items, etc.) have been met. In 2014, the CBSA referred 182 export detentions to Global Affairs Canada

The Export Controls Division recognizes that, on occasion, responsible exporters inadvertently fail to comply with the EIPA. Exporters finding themselves in such a situation are encouraged to disclose any incidents of non-compliance to Global Affairs Canada as soon as possible. The Export Controls Division looks favourably upon disclosures if, after considering the information provided, it is satisfied that the exporter has fully cooperated and that no further action is warranted. Depending on the gravity or overall circumstances of a case, the Export Controls Division may nonetheless refer disclosures to CBSA or RCMP for further review. In 2014, the Export Controls Division received 41 voluntary disclosures from Canadian exporters.

The Minister of Foreign Affairs has the authority to designate inspectors, who for any purpose related to the administration or enforcement of the EIPA may inspect, audit or examine the records of any person who has applied for an authorization under the EIPA. Such activities are conducted to ensure compliance with the EIPA and its associated regulations.

Global Affairs Canada has verification teams deployed to four major metropolitan areas (i.e. Ottawa, Montreal, Toronto and Vancouver). Between 100 and 140 verification exercises are conducted annually.

Performance Standards

Global Affairs Canada is committed to providing clients with prompt and reliable service based on Canadian export and import controls law, regulation and policy.

Our aims are: to foster an orderly processing of controlled imports into and exports from Canada; implement our commitments under international agreements; and ensure that the administration of trade controls under the authority of the EIPA is carried out smoothly and without undue hindrance to Canadian exporters, importers and consumers.

To fulfill this policy, and under the authority of the EIPA, Global Affairs Canada is responsible for issuing permits for importing controlled goods into Canada that are included in the ICL, and for exporting goods included in the ECLor for exporting goods to destinations included in the ACL.

In order to fulfill our responsibilities under the EIPA, Global Affairs Canada has established service standards.

- The target for processing import and export permit applications for non-strategic goods within the Export Import Controls System (EICS) is within four business hours of receipt.

- The target for processing of log permit applications for log exports is within three working days.

- The target for processing permit applications to export controlled strategic goods or technology within the Export Controls On-line System (EXCOL) is within 10 working days; should consultations be required, the period is within 40 days.

In 2014, over 313,883 permit applications were processed within EICS and EXCOL, and approximately 94.6% of those permit applications were processed within the allotted service periods.

Notes on Data

For the data concerning ‘permits issued’, ‘applications returned without action’ and ‘applications withdrawn’, the data for a given year reflects the date the decision was rendered.

For the data concerning ‘denials’, the data for a given year corresponds with the date an application was received.

The goods or technology described in a permit application may be controlled under more than one group of the ECL. In such cases, a permit is reported under the first ECL item under which it is controlled. This approach avoids double-counting at the cost of some inevitable under-counting of permits against other ECL groups.

The data concerning ‘permits issued’ in this report may differ from that previously published in the Annual Report to Parliament on the Administration of the EIPA. This is due to the following factors:

Data management in the Global Affairs EXCOL system results in differences in search results when reports are run at different points in time.

The single most significant cause of this is permit amendments. When a permit is amended, the system creates a new permit that supersedes the old one, and records it as having been issued in the year of amendment, removing the previous entry. Permits are amended frequently for a variety of business reasons (e.g. changing dates of export, quantities and values).

This apparent discrepancy is magnified by companies whose EXCOL registration data changes during the year. When this happens, all permits that are still in Issued (i.e. ‘valid’) status in EXCOL for the company in question are automatically regenerated with the new corporate tombstone data. A single corporate move or merger can result in hundreds of permits of being regenerated with a new year of issue.

Glossary

- ACL

- Area Control List

- AFCCL

- Automatic Firearms Country Control List

- BSE

- Bovine Spongiform Encephalopathy

- CDC

- Canadian Dairy Commission

- CHFTA

- Canada-Honduras Free Trade Agreement

- ECL

- Export Control List

- EE

- Eviscerated Equivalent

- EICS

- Export and Import Controls System

- EIPA

- Export and Import Permits Act

- EU

- European Union

- EXCOL

- Export Controls System On-line

- FBM

- Foot Board Measure

- GEP

- General Export Permit

- GIP

- General Import Permit

- ICL

- Import Control List

- IREP

- Import for Re-export Program

- MFN

- Most-Favoured-Nation

- NAFTA

- North America Free Trade Agreement

- NZ

- New Zealand

- TRQs

- Tariff Rate Quotas

- WTO

- World Trade Organization

Annex 1

ECL Group and Status based Summary – 2006 – 2013

With respect to the following tables, note that there may be discrepancies with previously-published data as if a permit is amended in a subsequent year from when it was issued, it is deleted from the count in the original year, and added to the count for the current year. This results in difficulties precisely replicating historical numbers at different points in time.

| Issued | Returned without action | Withdrawn | Denied | |

|---|---|---|---|---|

| Group 1 | 816 | 27 | 42/ | 3 |

| Group 2 | 1,310 | 56 | 93 | 3 |

| Group 3 | 180 | 3/ | 5 | |

| Group 4 | 53 | 5 | 1 | |

| Group 5 | 219 | 24 | 21 | 4 |

| Group 6 | 101 | 2 | 7 | 1 |

| Group 7 | 14 | 1 | 1 | 1 |

| Others | 8 | 76 | 148 | / |

| Totals | 2,701 | 194 | 318 | 12 |

| Issued | Returned without action | Withdrawn | Denied | |

|---|---|---|---|---|

| Group 1 | 1,443 | 55 | 65 | 8 |

| Group 2 | 2,010 | 110 | 109 | 3 |

| Group 3 | 362 | 31 | 7 | 0 |

| Group 4 | 74 | 6 | 2 | 1 |

| Group 5 | 323 | 20 | 49 | 4 |

| Group 6 | 142 | 15 | 7 | 1 |

| Group 7 | 50 | 2 | 11 | 0 |

| Others | 22 | 115 | 215 | 5 |

| Totals | 4,426 | 354 | 465 | 22 |

| Issued | Returned without action | Withdrawn | Denied | |

|---|---|---|---|---|

| Group 1 | 1,597 | 42 | 125 | 2 |

| Group 2 | 3,058 | 136 | 126 | 0 |

| Group 3 | 260 | 36 | 9 | 0 |

| Group 4 | 73 | 7 | 1 | 0 |

| Group 5 | 288 | 56 | 67 | 2 |

| Group 6 | 116 | 5 | 7 | 0 |

| Group 7 | 35 | 8 | 2 | 0 |

| Others | 32 | 111 | 217 | 3 |

| Totals | 5,459 | 401 | 554 | 7 |

| Issued | Returned without action | Withdrawn | Denied | |

|---|---|---|---|---|

| Group 1 | 1,660 | 108 | 62 | 2 |

| Group 2 | 2,962 | 179 | 73 | 2 |

| Group 3 | 259 | 45 | 6 | 1 |

| Group 4 | 95 | 4 | 0 | |

| Group 5 | 192 | 34 | 45 | 0 |

| Group 6 | 147 | 1 | 0 | |

| Group 7 | 34 | 2 | 0 | |

| Others | 24 | 140 | 197 | 0 |

| Totals | 5,373 | 513 | 383 | 5 |

| Issued | Returned without action | Withdrawn | Denied | |

|---|---|---|---|---|

| Group 1 | 2,146 | 78 | 65 | 5 |

| Group 2 | 2,998 | 211 | 84 | 1 |

| Group 3 | 291 | 13 | 8 | 0 |

| Group 4 | 104 | 9 | 2 | 0 |

| Group 5 | 194 | 26 | 47 | 0 |

| Group 6 | 147 | 5 | 3 | 0 |

| Group 7 | 49 | 4 | 1 | 0 |

| Others | 23 | 160 | 221 | 0 |

| Totals | 5,952 | 506 | 431 | 6 |

| Issued | Returned without action | Withdrawn | Denied | |

|---|---|---|---|---|

| Group 1 | 2,036 | 81 | 79 | 3 |

| Group 2 | 3,286 | 185 | 132 | 13 |

| Group 3 | 275 | 13 | 4 | 0 |

| Group 4 | 86 | 4 | 1 | 0 |

| Group 5 | 183 | 21 | 24 | 3 |

| Group 6 | 173 | 2 | 0 | |

| Group 7 | 47 | 6 | 0 | |

| Others | 19 | 180 | 232 | 1 |

| Totals | 6,105 | 492 | 472 | 20 |

| Issued | Returned without action | Withdrawn | Denied | |

|---|---|---|---|---|

| Group 1 | 2,103 | 38 | 81 | 6 |

| Group 2 | 3,186 | 109 | 75 | 11 |

| Group 3 | 253 | 26 | 8 | 0 |

| Group 4 | 85 | 6 | 2 | 1 |

| Group 5 | 205 | 11 | 77 | 1 |

| Group 6 | 129 | 7 | 5 | 1 |

| Group 7 | 56 | 2 | 4 | 0 |

| Others | 19 | 87 | 361 | 0 |

| Totals | 6,036 | 286 | 613 | 20 |

| Issued | Returned without action | Withdrawn | Denied | |

|---|---|---|---|---|

| Group 1 | 2,131 | 108 | 70 | 5 |

| Group 2 | 3,406 | 155 | 100 | 6 |

| Group 3 | 153 | 6 | 15 | 0 |

| Group 4 | 69 | 3 | 1 | 0 |

| Group 5 | 233 | 8 | 59 | 1 |

| Group 6 | 90 | 3 | 2 | 0 |

| Group 7 | 50 | 2 | 1 | 0 |

| Others | 41 | 69 | 241 | 2 |

| Totals | 6,173 | 354 | 489 | 14 |

Footnotes

- Footnote *

If you require a plug-in or a third-party software to view this file, please visit the alternative formats section of our help page.

- Date modified: