3. Assessing the economic impact of international students in Canada

The economic impact assessment of international education involved first collecting data and information on the number of international students by level of study, and on the type of student expenditures incurred. These values were adjusted when necessary to arrive at the amount of overall spending by international students on educational fees and living expenditure. These spending values were then applied to Statistics Canada’s expenditure model to generate estimates of the impact that international students’ total spending had on Canada’s gross output, GDP, employment and tax revenues. In this section, we present the resulting estimates and analysis.

On this page

Overall spending

In this subsection, we combine the estimated number of international students in Canada by level of study in each province and territory with estimates on educational and living costs to arrive at an estimation of total expenditures by international students while they study in Canada. All student numbers and expenditure values capture the impact in 2022.

Table 1 shows the total number of international students studying in Canada, with provincial and territorial distribution. The student numbers have also been broken down to show students that are considered “long-term” and those who are considered “short-term.”[1]

| Long-Term Students | Short-Term Students | All Students | |

|---|---|---|---|

| Newfoundland and Labrador | 6,000 | 0 | 6,000 |

| Prince Edward Island | 4,370 | 121 | 4,491 |

| Nova Scotia | 20,110 | 1,090 | 21,200 |

| New Brunswick | 10,915 | 242 | 11,157 |

| Quebec | 92,580 | 9,823 | 102,403 |

| Ontario | 401,070 | 31,202 | 432,272 |

| Manitoba | 21,510 | 255 | 21,765 |

| Saskatchewan | 12,515 | 764 | 13,279 |

| Alberta | 40,315 | 4,451 | 44,766 |

| British Columbia | 159,905 | 26,981 | 186,886 |

| Yukon | 185 | 0 | 185 |

| Northwest Territories | 35 | 0 | 35 |

| Nunavut | 5 | 0 | 5 |

| Canada[2] | 769,515 | 74,929 | 844,444 |

Source: Immigration, Refugees and Citizenship Canada, and Languages Canada, with adjustments by RKA

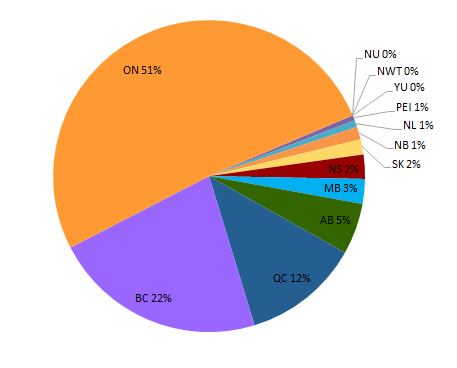

As can be seen in Figure 1, which shows the distribution of the total number of international students in Canada by province and territory, Ontario has the largest share of the international student population (51.2% in 2022). The province with the second-largest share of international students is British Columbia, which accounted for 22.1% of the total in 2022, though its share decreased in comparison to previous years. When compared with British Columbia’s population share in Canada, its share in the international student service market is still much higher. Quebec has the third largest‑ market share in international education services, accounting for 12.1% of the number of students in 2022. All other provinces and territories also hosted the increasing number of international students: Alberta had 5.3% of all international students in 2022; Nova Scotia had 2.5% of all students; Manitoba had 2.6% of students; Saskatchewan had 1.5% of students; New Brunswick had 1.3% of all students; Newfoundland and Labrador had 0.7% of all students; and Prince Edward Island had 0.5% of all students. The three territories also took in a very small number of international students.

Figure 1: Distribution of the total number of international students in Canada, by province/territory, 2022

View accessible version of figure 1

| Combined | distribution | |

|---|---|---|

| NL | 6,000 | 0.7% |

| PEI | 4,491 | 0.5% |

| NS | 21,200 | 2.5% |

| NB | 11,157 | 1.3% |

| Que. | 102,403 | 12.1% |

| ON | 432,272 | 51.2% |

| MB | 21,765 | 2.6% |

| SK | 13,279 | 1.6% |

| AB | 44,766 | 5.3% |

| BC | 186,886 | 22.1% |

| YU | 185 | 0.0% |

| NWT | 35 | 0.0% |

| NU | 5 | 0.0% |

| Canada | 844,444 | 100.0% |

Source: Data from IRCC and Languages Canada, with adjustments by RKA

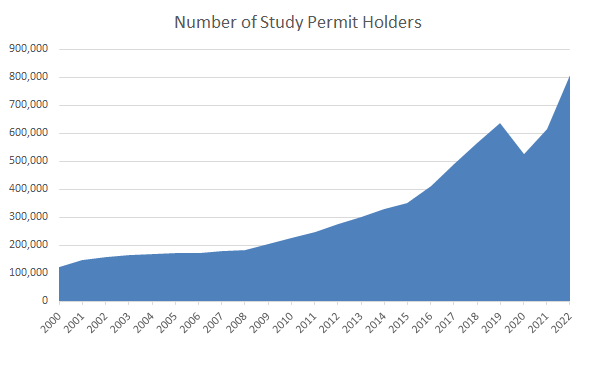

Over the past two decades, the number of study permit holders in Canada increased more than sixfold, with every province and territory recording positive gains. Although Ontario attracted the greatest number of international students, it is worth noting that Prince Edward Island recorded the highest percentage increase in the number of study permit holders – from 2000 to 2022, the percentage increase has been over 1,800%.

Figure 2 shows the number of study permit holders in Canada over the past two decades. These “long-term” students continue to grow steadily, after a dip in 2020 and 2021 due to pandemic related travel restrictions. In fact, the increase in the number of “long term” students between 2021 and 2022 was substantial, from approximately 617,250 to 807,260, an increase of 30.8%. Ontario contributed most toward the growth of long-term students; it had almost 120,690 more students in 2022 than it did in 2021, a 41.4% increase. Detailed data indicates that of the top source countries for long-term students, the biggest increase was from India (+47%, with 319,130 study permit holders in 2022).

Figure 2: Total number of study permit holders in Canada, 2000 to 2022

View accessible version of figure 2

| Number of Study Permit Holders | |

|---|---|

| 2000 | 122,665 |

| 2001 | 145,950 |

| 2002 | 158,125 |

| 2003 | 164,480 |

| 2004 | 168,590 |

| 2005 | 170,440 |

| 2006 | 172,340 |

| 2007 | 179,110 |

| 2008 | 184,140 |

| 2009 | 204,005 |

| 2010 | 225,295 |

| 2011 | 248,470 |

| 2012 | 274,700 |

| 2013 | 301,545 |

| 2014 | 330,105 |

| 2015 | 352,325 |

| 2016 | 410,560 |

| 2017 | 490,760 |

| 2018 | 566,950 |

| 2019 | 637,855 |

| 2020 | 527,365 |

| 2021 | 617,250 |

| 2022 | 807,260 |

Source: IRCC

Other top source countries for long-term international students that experienced strong increase between 2021 and 2022 include these markets:[3]

- Philippines (+112% to 32,455)

- Hong Kong (+73% to 13,100)

- Nigeria (+60% to 21,660)

- Columbia (+54% to 12,440)

Data for short-term students has been derived from Languages Canada’s 2022 Annual Report. It should be noted that the drastic decline in the number of students when compared with student numbers prior to 2019 reflects the severe negative impact due to the Covid-19 pandemic and therefore does not reflect the strength of the sector.

Table 2 shows the annual spending incurred by these international students, including the additional tourism activities associated with visiting family and friends. The data sources and adjustments to raw data to derive estimates of international student expenditures are detailed in Appendix 1.

| Long-Term Students | Additional Tourism Spending of Visiting Families | Short-Term Students | Additional Tourism Spending of Visiting Families | All Students (incl. visiting family spending) | |

|---|---|---|---|---|---|

| Newfoundland and Labrador | $190.3 | $2.2 | $0 | $0.0 | $192.5 |

| Prince Edward Island | $156.2 | $1.4 | $1.9 | $0.0 | $159.5 |

| Nova Scotia | $813.5 | $7.1 | $17.2 | $0.2 | $837.9 |

| New Brunswick | $384.7 | $4.0 | $3.8 | $0.0 | $392.6 |

| Quebec | $4,122.8 | $31.9 | $89.0 | $1.5 | $4,245.1 |

| Ontario | $20,284.9 | $140.3 | $365.4 | $4.7 | $20,795.3 |

| Manitoba | $769.8 | $7.6 | $2.7 | $0.0 | $780.1 |

| Saskatchewan | $448.1 | $4.5 | $8.2 | $0.1 | $460.9 |

| Alberta | $1,816.3 | $14.5 | $61.0 | $0.7 | $1,892.4 |

| British Columbia | $7,174.3 | $56.0 | $289.0 | $4.0 | $7,523.3 |

| Yukon | $5.0 | $0.07 | $0 | $0 | $5.0 |

| Northwest Territories | $0.8 | $0.01 | $0 | $0 | $0.8 |

| Nunavut | $0.1 | $0 | $0 | $0 | $0.1 |

| Canada | $36,166.7 | $269.5 | $838.2 | $11.2 | $37,285.6 |

Source: Detailed data sources, as reported in Appendix 1, with adjustments by RKA

In total, $37.3 billion was put into the Canadian economy in 2022 by international student expenditures across the country.

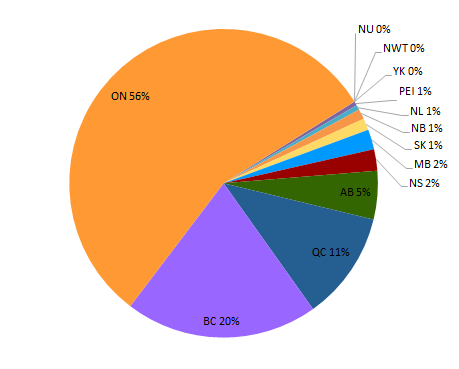

Figure 2 illustrates the distribution of the total amount of international student expenditures in 2022 by province and territory. In line with Figure 1, Ontario accounts for the largest share of total student expenditures of all provinces and territories in Canada, followed by British Columbia. The data in this figure also indicates that Ontario accounts for an even higher expenditure share than its student share (55.8% in 2022), which reflects the tuition fees of students studying in university programs.[5]

Figure 3: Distribution of total international student expenditures in Canada, by province and territory, 2022

View accessible version of figure 3

| Total annual exp | % of total annual expenditure | |

|---|---|---|

| NL | $192,507,418 | 0.5% |

| PEI | $159,468,515 | 0.4% |

| NS | $837,853,604 | 2.2% |

| NB | $392,606,061 | 1.1% |

| Que | $4,245,109,997 | 11.4% |

| ON | $20,795,282,124 | 55.8% |

| MB | $780,119,132 | 2.1% |

| SK | $460,942,824 | 1.2% |

| AB | $1,892,437,124 | 5.1% |

| BC | $7,523,283,114 | 20.2% |

| YK | $5,093,991 | 0.0% |

| NWT | $816,195 | 0.0% |

| NU | $101,322 | 0.0% |

| Canada | $37,285,621,421 | 100.0% |

Source: Various data sources detailed in Appendix 1, with adjustments by RKA

Long-term students accounted for 97.7% of total annual spending, while short-term students accounted for the other 2.3%.

| 2022 | |

|---|---|

| K-12 | $30,200 |

| College | $42,800 |

| University | $53,800 |

| Other | $37,400 |

| All levels of study | $49,500 |

Source: RKA, based on various adjustments detailed in Appendix 1

Table 3 above shows our estimates of the per-student cost of education and living while they stay in Canada. For long-term students, the average per student‑ expenditure (including tuition fees, other fees, books, accommodations and meals, transportation, and discretionary spending, but excluding spending from visiting family and friends) per year was estimated to be $49,500 in 2022.

Short-term students had an average of almost $1,100 in total expenditures per week.

Economic impact

As we pointed out in the methodology section, when a person spends money on a product (goods and/or services), that amount creates a direct requirement for the production of that product. The economic impact, however, does not end there. The increased production of the product leads to increased production of all the intermediate goods and services that are used to make that product, which in turn generates more demand for other goods and services that are used to produce these intermediate products. As demand rises, workers are able to earn a higher wage, and they sometimes decide to spend a portion of their extra earnings on more goods and services. As such, the initial demand for a product creates a chain effect down the production process. This is referred to as the combined direct and indirect impact. Three types of impacts are usually estimated and they are described briefly below.

- Direct impact measures the increase in industrial output and the increase in an industry’s labour force resulting from the inflow of international students and their spending on a yearly basis. Examples of direct impact include tuition and fees paid to educational institutions, purchase of study material, rent, food, recreation, and others.

- Indirect impact measures the change in industrial output and employment demand in sectors that supply goods and services to sectors of the economy that are directly impacted. For example, universities and colleges need to pay for a variety of suppliers providing computers, telecommunication services and other services; food and other grocery sold in a supermarket come from farmers and food manufacturers who must in turn purchase more raw or intermediate material from their suppliers.

- Induced impact measures the changes in output and employment demand over all sectors of the economy as a result of an income increase in households impacted both directly and indirectly. In the sense of spending of international students, this impact is derived from increased spending by, for example, teaching staff from universities and colleges who teach classes for international students, or even the employee working in a drink manufacturer who supply to a local grocery store, that have benefited from an inflow of international students to the area.

Although we present all three types of economic impact values associated with international students spending in this updated report, it should be noted that the report focuses on the combined direct and indirect impacts as representing a complete picture of economic impacts. It is generally acknowledged that direct impacts alone are incomplete and the total impact may sometimes overestimate the impacts of initial spending.

When we compare the value of total spending by international students with other sectors in the economy, GDP, employment and export values are the key variables of interest. Other variables that may be of interest to readers include output, labour income and tax revenues. The results are presented for the aggregate of all international students, as well as long-term and short-term students separately.

To produce these impact values, we used Statistics Canada’s economic impacts simulation model to estimate international students’ contribution to each province’s GDP and employment.[6] Also reported are the values of output and labour income.[7]

The following sections present the combined direct and indirect impacts, first for the aggregate of all students, followed by the analysis for long-term students, then short-term students. Direct economic impacts and total economic impacts (combining direct, indirect and induced impacts) are shown in Appendix 2.

Combined direct and indirect impacts

Aggregate for all students

Table 4 below presents the results of the combined direct and indirect economic impacts associated with all students in Canada, by province and territory, in 2022.

To understand the relationship between international student spending and the different impact values, we note that student expenditure is a big component that contributes to the direct impact to the Canadian economy. However, it does not equal to the value of direct output impact, or the value of direct GDP impact. The sum of $37.3 billion (annual international student spending) represents the gross demand for commodities and services in the domestic market. To meet this demand, the industries impacted will need to increase their production. Some of the $37.3 billion goes to pay for inputs (intermediate inputs). Some commodities these students spend money on are imports (both as an intermediate input and as a final product). As such, these amounts have to be netted out. What the simulation model shows is that Canadian industries collectively needed to produce $34.5 billion (direct output impact, in Table 13 in Appendix 2) worth of goods and services to meet the $37.3 billion student expenditure. Direct GDP impact was $22.2 billion (Table 16, Appendix 2).

| Output | GDP at basic prices | Labour Income | Jobs | |

|---|---|---|---|---|

| Newfoundland and Labrador | $270.1 | $155.4 | $81.5 | 1,663 |

| Prince Edward Island | $197.3 | $107.4 | $62.8 | 1,491 |

| Nova Scotia | $1,124.9 | $686.2 | $394.6 | 8,517 |

| New Brunswick | $602.3 | $328.8 | $183.4 | 3,758 |

| Quebec | $6,819.7 | $3,839.9 | $2,258.1 | 47,762 |

| Ontario | $27,168.9 | $16,873.4 | $9,738.6 | 185,390 |

| Manitoba | $1,162.4 | $688.1 | $384.6 | 7,483 |

| Saskatchewan | $785.4 | $441.5 | $230.9 | 4,324 |

| Alberta | $3,697.0 | $2,091.8 | $1,173.2 | 20,971 |

| British Columbia | $9,220.6 | $5,681.5 | $3,387.5 | 79,769 |

| Yukon | $10.0 | $5.9 | $3.7 | 55 |

| Northwest Territories | $12.8 | $6.2 | $2.7 | 31 |

| Nunavut | $5.6 | $3.1 | $1.5 | 20 |

| Canada | $51,077.0 | $30,909.1 | $17,903.3 | 361,230 |

Source: Customized Statistics Canada expenditure model, based on expenditure produced by RKA

In 2022, the combined direct and indirect GDP contribution of all student expenditures amounted to $30.9 billion in Canada, when we take into account not only the sectors directly impacted by international student spending, but also the many other industries in the supply chain of those directly impacted. In terms of employment, 361,230 jobs (the equivalent of 246,300 FTE) were supported. This impact to Canada’s GDP is equivalent to 1.2% of Canada’s GDP.[8]

Long-term students

Table 5 presents the corresponding direct and indirect impacts of international students who stay in Canada for at least six months on the province or territory’s output, GDP, employment and labour income.

| Output | GDP at basic prices | Labour Income | Jobs | |

|---|---|---|---|---|

| Newfoundland and Labrador | $268.0 | $154.4 | $80.9 | 1,654 |

| Prince Edward Island | $194.7 | $106.0 | $62.0 | 1,472 |

| Nova Scotia | $1,104.1 | $673.9 | $387.7 | 8,365 |

| New Brunswick | $593.9 | $324.6 | $181.0 | 3,710 |

| Quebec | $6,674.3 | $3,760.6 | $2,213.3 | 46,835 |

| Ontario | $26,677.3 | $16,584.4 | $9,578.5 | 182,352 |

| Manitoba | $1,149.5 | $682.0 | $381.3 | 7,421 |

| Saskatchewan | $769.0 | $432.9 | $226.7 | 4,241 |

| Alberta | $3,591.0 | $2,033.1 | $1,142.6 | 20,420 |

| British Columbia | $8,892.8 | $5,483.6 | $3,278.4 | 77,277 |

| Yukon | $9.8 | $5.8 | $3.6 | 53 |

| Northwest Territories | $12.4 | $6.0 | $2.6 | 30 |

| Nunavut | $5.4 | $3.0 | $1.4 | 19 |

| Canada | $49,942.3 | $30,250.2 | $17,540.1 | 353,850 |

Source: Customized Statistics Canada expenditure model, based on expenditure produced by RKA

The values show that the total GDP contribution of students who stayed for at least six months during the year amounted to almost $30.3 billion in 2022 in Canada. In terms of job supported, international education services supported 353,850 jobs (the equivalent of 241,190 FTE) in Canada.

Languages Canada short-term students

When we take into account the spending of short-term language students who are studying in Languages Canada’s private member schools, these international students directly and indirectly contributed an additional $650.9 million to GDP and supported 7,240 jobs (the equivalent of 5,010 FTE) in 2022. This is represented in Table 6.

| Output | GDP at basic prices | Labour Income | Jobs | |

|---|---|---|---|---|

| Newfoundland and Labrador | $2.2 | $1.4 | $0.6 | 12 |

| Prince Edward Island | $1.8 | $1.0 | $0.6 | 17 |

| Nova Scotia | $26.7 | $16.3 | $9.9 | 245 |

| New Brunswick | $9.4 | $4.8 | $3.0 | 72 |

| Quebec | $153.1 | $85.8 | $51.4 | 1,271 |

| Ontario | $523.6 | $316.8 | $191.8 | 4,113 |

| Manitoba | $21.3 | $12.1 | $7.5 | 177 |

| Saskatchewan | $20.0 | $10.9 | $6.0 | 138 |

| Alberta | $128.2 | $73.5 | $42.6 | 829 |

| British Columbia | $346.0 | $222.1 | $138.1 | 3,365 |

| Yukon | $0.2 | $0.1 | $0.1 | 2 |

| Northwest Territories | $0.6 | $0.3 | $0.1 | 2 |

| Nunavut | $0.1 | $0.1 | $0.0 | 1 |

| Canada | $1,233.3 | $745.1 | $451.5 | 10,243 |

Source: Customized Statistics Canada expenditure model, based on expenditure produced by RKA

It should be noted that, even though there were no direct annual student expenditures in Newfoundland and Labrador, there were impact values in output, GDP, labour income and employment because of the effect of interprovincial trade.

Government tax revenue

In this subsection, we further demonstrate the importance of total spending by international students in terms of its contribution to government revenue. In general, government revenues come from personal income taxes, indirect taxes less subsidies, corporate income taxes and natural resource royalties. In this study, we were able to estimate personal income taxes and indirect taxes.

Indirect taxes incurred in the process of producing outputs and services include both indirect taxes on production (such as property taxes) and indirect taxes on products (such as federal and provincial sales taxes).[9]

Government revenue can be derived by Statistics Canada’s expenditure model to calculate the amount of indirect taxes incurred in the process of producing an industry’s outputs and services. It should be noted that Statistics Canada’s model estimates tax revenue impacts for the combined direct and indirect impacts, and total (direct, indirect and induced impacts) scenarios only.

In addition to indirect taxes, another type of tax revenue generated is income taxes associated with labour income.[10] Statistics Canada’s expenditure model did not automatically estimate personal income taxes. Instead, we derived the values by applying the average personal income tax rates in each province and territory to labour income, which is generated in Statistics Canada’s expenditure model.

The following three tables show our estimates of the tax revenue impacts, first for all international student spending in a year, and then for annual spending by long-term students and short-term students, respectively.

| Indirect Taxes | Personal Income Taxes | Total Tax Revenue | |

|---|---|---|---|

| Newfoundland and Labrador | $21.7 | $16.2 | $37.9 |

| Prince Edward Island | $17.4 | $11.0 | $28.5 |

| Nova Scotia | $84.2 | $76.7 | $160.9 |

| New Brunswick | $48.7 | $31.4 | $80.1 |

| Quebec | $643.3 | $452.2 | $1,095.5 |

| Ontario | $2,283.6 | $1,940.7 | $4,224.3 |

| Manitoba | $93.2 | $71.6 | $164.8 |

| Saskatchewan | $39.6 | $40.4 | $80.0 |

| Alberta | $148.4 | $218.1 | $366.5 |

| British Columbia | $602.0 | $562.7 | $1,164.7 |

| Yukon | $0.3 | $0.5 | $0.8 |

| Northwest Territories | $0.3 | $0.4 | $0.7 |

| Nunavut | $0.1 | $0.2 | $0.3 |

| Canada | $3,982.9 | $3,422.2 | $7,405.1 |

Source: Customized Statistics Canada expenditure model, based on expenditure produced by RKA

| Indirect Taxes | Personal Income Taxes | Total Tax Revenue | |

|---|---|---|---|

| Newfoundland and Labrador | $21.7 | $16.1 | $37.8 |

| Prince Edward Island | $17.2 | $10.9 | $28.1 |

| Nova Scotia | $82.1 | $75.3 | $157.5 |

| New Brunswick | $48.1 | $31.0 | $79.1 |

| Quebec | $627.9 | $443.2 | $1,071.2 |

| Ontario | $2,231.9 | $1,908.8 | $4,140.7 |

| Manitoba | $92.6 | $71.0 | $163.6 |

| Saskatchewan | $38.6 | $39.7 | $78.3 |

| Alberta | $142.5 | $212.4 | $354.9 |

| British Columbia | $571.1 | $544.6 | $1,115.7 |

| Yukon | $0.3 | $0.4 | $0.8 |

| Northwest Territories | $0.3 | $0.4 | $0.7 |

| Nunavut | $0.1 | $0.2 | $0.3 |

| Canada | $3,874.3 | $3,354.1 | $7,228.4 |

Source: Customized Statistics Canada expenditure model, based on expenditure produced by RKA

| Indirect Taxes | Personal Income Taxes | Total Tax Revenue | |

|---|---|---|---|

| Newfoundland and Labrador | $0.0 | $0.1 | $0.1 |

| Prince Edward Island | $0.2 | $0.1 | $0.4 |

| Nova Scotia | $2.1 | $1.3 | $3.4 |

| New Brunswick | $0.6 | $0.4 | $1.0 |

| Quebec | $15.1 | $8.8 | $23.9 |

| Ontario | $50.9 | $31.5 | $82.4 |

| Manitoba | $0.7 | $0.6 | $1.3 |

| Saskatchewan | $0.9 | $0.7 | $1.7 |

| Alberta | $5.8 | $5.6 | $11.4 |

| British Columbia | $30.4 | $17.8 | $48.2 |

| Yukon | $0.0 | $0.0 | $0.0 |

| Northwest Territories | $0.0 | $0.0 | $0.0 |

| Nunavut | $0.0 | $0.0 | $0.0 |

| Canada | $106.8 | $67.0 | $173.9 |

Source: Customized Statistics Canada expenditure model, based on expenditure produced by RKA

The total tax revenue generated by indirect taxes and personal income taxes associated with international student spending in 2022 was estimated to be $7.4 billion, when direct and indirect impacts were combined.

Report a problem on this page

- Date modified: