Audit of trade commissioner service advice and guidance on optimizing free trade agreements

Final report

Global Affairs Canada

Office of the Chief Audit Executive

Tabling Date

December 2018

Table of Contents

Acronyms and symbols

- ADM

- Assistant Deputy Minister

- BBD

- Trade Sectors Bureau

- BFM

- International Business Development, Investment and Innovation (Chief Trade Commissioner)

- BFMX

- Free Trade Agreement Promotion Task Force

- BPD

- Trade Portfolio Strategy and Coordination

- BSD

- Regional Trade Operations and Intergovernmental Relations

- BTD

- Trade Commissioner Service - Operations

- BTR

- Trade Commissioner Service Support Division

- CETA

- Comprehensive Economic and Trade Agreement

- EGM

- Europe, Arctic, Middle East and Maghreb Branch

- EUD

- European Affairs Bureau

- FAS

- Finance and Administration System

- FAQ

- Frequently Asked Questions

- FTA

- Free Trade Agreement

- GAC

- Global Affairs Canada

- GMAP

- Global Markets Action Plan

- HOM

- Head of Mission

- ITC

- International Trade Centre

- SME

- Small and medium enterprises

- TCS

- Trade Commissioner Service

- TEU

- Comprehensive Economic and Trade Agreement Secretariat

- TFM

- Trade Policy and Negotiations Branch

Executive summary

Why it is important

International Trade is one of Global Affairs Canada’s principal business lines, which is promoted by 1,400 trade commissioners in 161 mission offices around the world, including five regional offices in Vancouver, Calgary, Toronto, Montreal and Halifax. Globally, the Trade Commissioner Service’s (TCS) mission offices promote Canada's trade and economic interests in their assigned region and support the efforts of Canadian companies that want to market their products, services or technologies. Complementing the work carried out abroad, Canada’s regional offices provide the TCS’ global network with direct access to high-potential clients. These offices engage with targeted small and medium enterprise clients in active sectors and provide sustained and customized support to foster their international expansion.

Canada has signed 14 bilateral and multilateral free trade agreements (FTAs) that are currently in force. Hence, it is important that trade commissioners provide support to Canadian businesses to take advantage of opportunities that flow after trade agreements are signed. On September 21, 2017, the Canada-European Union Comprehensive Economic and Trade Agreement (CETA) came into force provisionally (i.e. not all European Union member states have ratified CETA). With estimated benefits of $8 billion annually, building awareness and technical expertise on CETA within the Canadian business community is critical to ensure its successful implementation. As the first G7 country to sign a comprehensive FTA with the European Union, Canada has a unique opportunity to enhance bilateral commercial opportunities in this market of 500 million consumers and help strengthen and diversify the export profile of Canadian businesses. Prior to CETA, the market share of European Union imports was only about 2%, with significant potential for market growth. The TCS can help Canadian businesses by informing the Canadian private sector on how to take advantage of new business opportunities generated by CETA. The TCS states that with ratification of the Comprehensive and Progressive Trans-Pacific Partnership (CPTPP), Canada will become the first G7 nation with trade agreements with all other G7 nations.

What was examined

The objective of this audit is to provide reasonable assurance that the Trade Commissioner Service has effective processes in place to provide trade commissioners with advice and guidance to help them optimize Canada’s free trade agreements in force.

The audit focused on the Canada-European Union CETA promotion. This agreement involves 28 European Union member states and covers the majority of market sectors prioritized by Canada. The FTAs currently in force and signed by Canada are bilateral or involve a small number of countries and do not include as many priority market sectors as CETA. As a result, they were excluded from the scope of the audit along with the trade agreement with the U.S. and Mexico, which was being renegotiated at the time of the audit.

What was found

The audit team found that the TCS has put effective processes in place to provide trade commissioners with advice and guidance to help them optimize CETA. These processes were found to be carried out in a collaborative manner with relevant stakeholders within and external to the Department. These CETA-related processes can be used as a precedent for current and future Canadian FTAs. However, improvements are needed to retain documentation to support key strategic decisions, accentuate the focus on threats, develop guidance in specific areas, and streamline the communication of guidance.

The Global Markets Action Plan is the TCS’ official strategic document. It was developed in 2013 and may not fully reflect the current government’s strategic direction. A new strategy is currently in the process of being approved. In the meantime, trade commissioners no longer rely on the Global Markets Action Plan for strategic direction, which has not hindered the analysis and development of CETA-related guidance.

The audit found that analysis of CETA was performed before and after it came into force provisionally. The CETA Secretariat and the European Affairs Bureau collaboratively drafted products for trade commissioners that were useful for advocacy and promotional purposes. The audit team noted that CETA-related analysis continue to be performed and shaped by current events; however, it would be beneficial to include information regarding threats.

In an effort to consolidate CETA-related activities, the audit team noted that the FTA Promotion Task Force took over promotional and training activities from other divisions in the Department. Consequently, the FTA Promotion Task Force developed a CETA Promotion Strategy, which outlines a plan of action to build client awareness, enhance investment opportunities and endorse the TCS. The audit team found that the overall approach taken by the FTA Task Force to carry out its responsibilities was comprehensive.

Three internal websites contain CETA-related information and serve as communication tools. The audit team noted that the content on these sites was relevant and aligned with each other, but, for the most part, duplicative. In addition, trade commissioners indicated that greater specificity would be useful regarding priority markets and cross-cutting issues.

The TCS’s senior management received sufficient documentation to make an informed decision regarding CETA promotional events and training workshops. CETA-related guidance was consulted among appropriate stakeholders and verified at the appropriate level. Although the approval of the CETA Promotion Strategy was not formally documented, it was consulted with stakeholders and shared with the Chief Trade Commissioner.

Recommendations

Based on the findings above, the audit team recommended the following:

- The Assistant Deputy Minister (ADM) of International Business Development, Investment and Innovation and Chief Trade Commissioner should update the CETA analysis to include more information about potential threats.

- The ADM of International Business Development, Investment and Innovation and Chief Trade Commissioner, in consultation with relevant branches, should ensure that CETA-related guidance communicated to trade commissioners is not duplicated while being relevant, up-to-date and adapted to each of the specific European Union markets.

- The ADM of International Business Development, Investment and Innovation and Chief Trade Commissioner should retain documentation to support the approval of key decisions that impact strategic direction for the optimal implementation of future free trade agreements.

Statement of Conformance

In my professional judgment as Chief Audit Executive, this audit was conducted in conformance with the Institute of Internal Auditors' International Standards for the Professional Practice of Internal Auditing and with the Treasury Board Policy and Directive on Internal Audit, as supported by the results of the quality assurance and improvement program. Sufficient and appropriate audit procedures were conducted, and evidence gathered, to support the accuracy of the findings and conclusion in this report, and to provide an audit level of assurance. The findings and conclusion are based on a comparison of the conditions, as they existed at the time, against pre-established audit criteria that were agreed upon with management and are only applicable to the entity examined and for the scope and time period covered by the audit.

Chief Audit Executive

Date

1. Background

The Audit of the Trade Commissioner Service (TCS) was selected for Global Affairs Canada’s (GAC) 2018-19 to 2019-20 Risk-based Audit Plan, which was recommended by the Departmental Audit Committee and approved by the Deputy Minister on April 30, 2018.

According to the Department of Foreign Affairs, Trade and Development Act, the Minister of Foreign Affairs and the Minister of International Trade are responsible for fostering the expansion of Canada’s international trade and commerce, assisting Canadian exporters in their international marketing initiatives, and promoting Canadian export sales. Created in 1894 and integrated into GAC in 1983, the TCS supports this mandate by:

- Providing advice and commercial services to Canadian businesses;

- Providing targeted, sector-specific trade opportunities to priority markets;

- Helping Canadian businesses access global value chains and other opportunities; and

- Supporting the facilitation, expansion or retention of foreign direct investment, international innovation and science and technology partnerships.

The TCS’ clients are Canadian businesses that can demonstrate their capacity and commitment to globalize, build meaningful economic ties to Canada, and have the potential to contribute significantly to Canada’s economic growth. In 2016-17, the TCS had 14,509 active clients. Small and medium enterprises (SMEs) with less than 500 employees make up 76% of their client base.

Departmental Context

The TCS has 161 offices around the world, including five regional offices across Canada – in Vancouver, Calgary, Toronto, Montreal, and Halifax – to deliver its mandate. Globally, the TCS’ mission offices promote Canada's trade and economic interests in their assigned region and support the efforts of Canadian companies that want to market their products, services or technologies. Nationwide, Canada’s regional offices provide the TCS’ global network with direct access to high-potential clients in proactive sectors and support initiatives. These offices engage with targeted SME clients in proactive sectors and provide sustained and customized support to foster their international expansion.

There are about 1,400 trade commissioners in Canada and abroad. About 400 work in Canada at headquarters in Ottawa and in regional offices. They report directly to the TCS, which is housed within the International Business Development, Investment and Innovation (Chief Trade Commissioner) Branch (BFM). The TCS had a budget of approximately $91 million in 2017-18. The remaining 1,000 trade commissioners are deployed at missions around the world and they report to their respective Heads of Mission (HOM). The majority of trade commissioners posted abroad (around 700 out of the remaining 1,000) are locally-engaged staff.

The Canada-European Union Comprehensive Economic Trade Agreement (CETA) is a progressive free trade agreement (FTA) between Canada and 28 European Union member states that addresses and eliminates barriers in virtually all sectors and aspects of trade. The provisional application of CETA began on September 21, 2017. Provisional application is in place until all parties ratify the agreement. CETA allows Canadian companies of all sizes to export to the European Union and benefit from the elimination of over 9,000 tariff lines, improves labour mobility and new preferential access to government procurement. With estimated benefits of $8 billion annually, building awareness and technical expertise on CETA within the Canadian business community is critical to ensure its successful implementation and to help Canada maintain an advantage over its international competitors since it is the first G7 country to negotiate an agreement of this scale in this market. Canada and the European Union must also promote CETA’s success for international business development and progressive trade to encourage other European Union member states to complete the ratification process. The TCS states that with ratification of the Comprehensive and Progressive Trans-Pacific Partnership (CPTPP), Canada will become the first G7 nation with trade agreements with all other G7 nations.

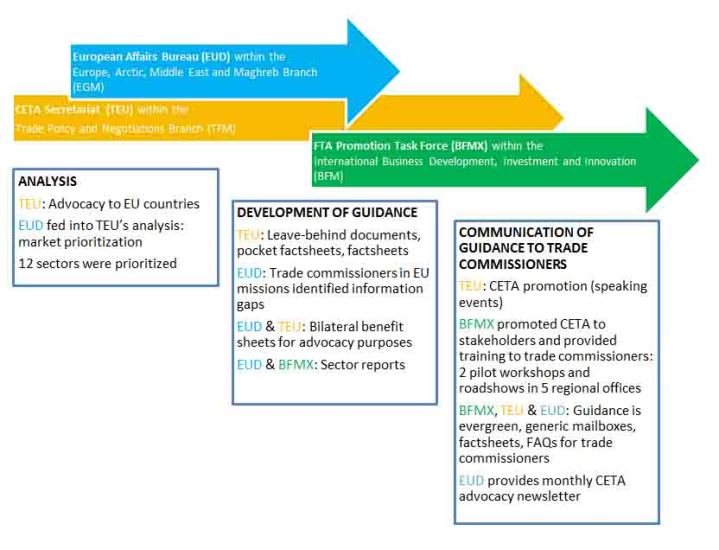

The following three key stakeholders played a role in the analysis of CETA and the development and communication of related guidance.

Text version

TEU is the acronym for the CETA Secretariat.

EUD is the acronym for the European Affairs Bureau.

BFMX is the acronym for the FTA Promotion Task Force.

The following three stages of CETA were reviewed during the scope of the audit.

The first stage was analysis. TEU advocated the benefits of CETA to EU countries to encourage them to sign the trade agreement. EUD fed into TEU’s analysis by prioritizing its markets. At the end of this stage, 12 sectors were prioritized.

The second stage was the development of CETA-related guidance. TEU produced leave-behind documents, pocket factsheets, and factsheets. EUD had trade commissioners in EU missions identify information gaps. TEU worked with EUD to create bilateral benefit sheets for advocacy purposes. EUD worked with BFMX to create sector reports.

The third stage was the communication of guidance to trade commissioners. TEU staff attended speaking events to promote CETA. BFMX promoted CETA to stakeholders and provided training to trade commissioners in the form of two pilot workshops and roadshows in five regional offices. EUD provided monthly CETA advocacy newsletters. BFMX, TEU and EUD worked together to produce guidance that was evergreen, maintain generic mailboxes, factsheets, and FAQs for trade commissioners.

This graphic shows a timeline to depict the start and end of involvement of the three stakeholders in the three stages. TEU leads the Analysis stage with EUD getting involved near the end. TEU and EUD continue into the Development of Guidance stage with BFMX taking over from EUD at the end. In the third stage of Communication of Guidance to Trade Commissioners, BFMX leads and is supported by TEU whose role fades as BFMX becomes the sole player once the trade agreement comes into force provisionally.

2. Observations and recommendations

2.1 Analysis of CETA

According to the Treasury Board Secretariat’s Guide to Integrated Risk Management, risk management is recognized as a core element of effective public administration. In a dynamic and complex environment, organizations require the capacity to recognize, understand, accommodate and capitalize on new challenges and opportunities. Therefore, the audit team expected the TCS to conduct an analysis of CETA to identify opportunities and threats.

CETA Secretariat

When negotiations for CETA began several years prior to its provisional application in September 2017, the Department created the CETA Secretariat (TEU) to coordinate negotiations and translate CETA into practical and comprehensive benefits for Canadian exporters and European Union importers/buyers. The audit team noted that the CETA Secretariat performed the initial analysis of the trade agreement and consulted other federal departments as needed. It resulted in the development of various products that were posted to the CETA Advocacy wiki for internal departmental use. One example is leave-behind documents, which provide CETA-related information on issues such as labour, culture, environment, and food standards. Another example is pocket factsheets, which provide trade statistics for the specific European Union member state and Canada. In addition, the CETA Secretariat prepared factsheets detailing the advantages of CETA to Canadian businesses. During interviews, trade commissioners indicated that these products were helpful in gaining general knowledge on CETA.

When the initial analysis of CETA was performed, the audit team was informed that the CETA Secretariat consulted with various stakeholders (provinces, other government departments, Chief Economist, negotiators for each sector) to identify key markets. In addition, the CETA Secretariat requested European Union missions to identify sectors that would have the most potential business opportunities for Canadian SMEs. Based on the results, the CETA Secretariat prioritized 10 market sectors that formed the basis for the guidance that it developed for trade commissioners. Further communications with missions led to the addition of two market sectors for a total of 12, which aligned with Canadian supply capabilities and interests. As these priority sectors are the basis for CETA-related strategic direction, formal approval would have strengthened this position.

Finally, the CETA Secretariat also invited European Union missions to note any CETA-related topics about which they would like to obtain information. Based on submissions, the CETA Secretariat developed guidance on the various topics such as tariffs, non-tariff barriers, government procurement and an overview of CETA.

European Affairs Bureau (EUD) and FTA Promotion Task Force (BFMX)

Within the Europe, Arctic, Middle East and Maghreb Branch (EGM), the European Affairs Bureau (EUD) is responsible for targeted diplomacy and advocacy initiatives in Europe that support Canada’s trade objectives and advancing Canada’s progressive trade agenda and investment interests in Europe and the European Union, including CETA. During CETA’s initial negotiation, the European Affairs Bureau, in collaboration with the CETA Secretariat, prepared bilateral benefit sheets as guidance for missions to advocate the ratification of CETA by all European Union member states. The audit team reviewed these documents and found that they outline trade opportunities in each country such as trade in goods, government procurement, intellectual property rights, trade in services, investment and geographical indicators. While these bilateral benefit sheets provide useful information about opportunities, the audit team found that they did not include information about market access and threats.

In addition, in June 2017, the European Affairs Bureau requested senior trade commissioners in European Union missions to prepare sector reports of their priority markets. Upon receipt of these reports, the European Affairs Bureau led the review to ensure the accuracy and consistency of the content. Upon completion, these reports were provided to the FTA Promotion Task Force (BFMX) for editing and posting on the CETA wiki. The audit team reviewed a sample of these reports and found pertinent information such as a sector overview, high-level opportunities, current events affecting the specific sector and a list of key players and stakeholders. In addition, challenges were identified along with suggested actions.

Finally, the audit team noted that the European Affairs Bureau in collaboration with the European Union missions continues to perform CETA-related analysis. For example, the audit team found that Canadian missions have developed action plans to address the consequences of recent U.S. trade actions.

Overall, through the European Affairs Bureau, the CETA Secretariat conducted various forms of analysis with valuable input from missions, which were best placed to provide current data based on scans of their business environments. However, the audit team noted that the CETA Secretariat’s initial analysis focused more on opportunities provided by CETA than its potential threats. It would be beneficial for the FTA Promotion Task Force to outline these potential threats in the next stage of CETA-related analysis.

Recommendation 1:

The ADM of International Business Development, Investment and Innovation and Chief Trade Commissioner should update the CETA analysis to include more information about potential threats.

2.2 Development and Communication of CETA-related Guidance

The audit team expected that CETA-related guidance, such as information and tools, would be developed based on strategic direction and on the assessment of opportunities and threats.

The Minister of International Trade’s mandate letter stipulates that a new strategy be developed, which is currently in the process of being approved. The Global Markets Action Plan (GMAP) is the official strategy for the TCS, but it was developed in 2013 and may not fully reflect the current government’s direction. Furthermore, this strategy prioritizes more than 20 sectors with no particular hierarchy thereby hindering a true focus on top priorities. Until a new strategy is developed, the GMAP remains as the TCS’ official strategic document. Trade commissioners and the different units responsible to develop CETA-related guidance do not rely on it for direction.

Development of Guidance

The audit team found that the CETA Secretariat and the FTA Promotion Task Force developed and communicated relevant CETA-related guidance. The CETA Secretariat developed material, such as presentations on priority market sectors and cross-cutting issues (e.g. government procurement and tariff elimination), based on their own analysis. This material was also based upon analysis performed by the European Affairs Bureau. Furthermore, the CETA Secretariat consulted with other divisions in the Trade Policy and Negotiations Branch (TFM) and the International Business Development Branch (Chief Trade Commissioner). In addition, a representative from the CETA Secretariat was sent to industry events to promote CETA to Canadian businesses.

Although the CETA Secretariat started the initial CETA promotion process, it was subsequently taken over by the FTA Promotion Task Force. This unit is responsible for developing and implementing strategies and plans, in coordination with other divisions, to, inform and motivate the Canadian private sector to take advantage of new business opportunities generated by FTAs.

In November 2017, the FTA Promotion Task Force developed a CETA Promotion Strategy, which was widely consulted within the Department and shared with the Chief Trade Commissioner. The strategy outlines the implementation and strategic direction for the TCS to support the provisional application of CETA through the following four elements:

- Build client awareness,

- Client matchmaking and market opportunities,

- Enhance investment opportunities and build world-class value chains and

- Enhance brand awareness and capacity of the TCS.

Overall, the audit team found that the TCS carried out actions in all four areas of the CETA Promotion Strategy and these actions were based on the analysis that had been previously conducted by the CETA Secretariat and the European Affairs Bureau.

While the TCS’ Support Division (BTR) normally provides general training to trade commissioners, the training for CETA was assumed by the FTA Promotion Task Force to consolidate several CETA-related functions. A pilot training workshop to trade commissioners was conducted in November 2017. The FTA Promotion Task Force prepared training manuals that included numerous high-level topics (e.g. tariffs, rules of origin, government procurement, labour mobility, services and investments).

Communication of Guidance

The audit team found that the implementation of the CETA Promotion Strategy resulted in the far reaching communication of CETA across Canada to both trade commissioners as well as external stakeholders. One form of communication was through in-person promotional events. Pilots took place in Mississauga, Ontario and Sydney, Nova Scotia. From January to March 2018, a promotional roadshow took place in the five regional offices. Many representatives were sought to provide a comprehensive overview of CETA: staff from headquarters, trade commissioners from European Union missions, Export Development Canada, Canadian Commercial Corporation, Heads of Mission, local Chambers of Commerce and Canadian provinces.

The audit team also found that the CETA Secretariat, the FTA Promotion Task Force, and the European Affairs Bureau are keeping CETA-related guidance evergreen. Throughout the promotional roadshow and training workshops, stakeholders provided continuous feedback and suggestions for improvement to bring the most value to subsequent participants. Based on feedback forms, 96% of participants said their general knowledge of CETA improved as a direct result of the training offered. This result was reiterated through interviews with a sample of trade commissioners in regional offices and in the European Union missions. However, trade commissioners indicated that greater specificity would be useful regarding priority markets to help them cater to individual European markets. Greater detail on horizontal issues, such as labour mobility and government procurement, would also be useful to trade commissioners. The FTA Promotion Task Force told the audit team that they have noted these comments and are developing additional material to address them.

The CETA Secretariat and the FTA Promotion Task Force also set up generic mailboxes, so trade commissioners and other stakeholders have a forum for CETA-related enquiries. The enquiries sent to the CETA Secretariat mailbox were compiled and the most frequent ones were included in a Frequently Asked Questions (FAQ) document. This tool was completed in March 2017 and posted on the CETA wiki. An updated FAQ was also prepared in June 2018. The audit team analyzed the content of the FAQs and found it to be relevant and informative.

The European Affairs Bureau provided factsheets and a Questions and Answers document to trade commissioners on new European regulations that may have an impact on Canadian enterprises doing business in Europe. In addition, the European Affairs Bureau sent monthly CETA advocacy letters to trade commissioners to support missions with national ratification processes of CETA in European Union member states by highlighting new products, new messaging, upcoming events and other important updates.

Finally, in connection to part 4 of the CETA Promotion Strategy, there are three internal websites that contain information related to CETA and that are used as departmental communication tools:

- iTrain: This site was initiated by the TCS’ Support Division to provide a platform for broad training materials for trade commissioners.

- CETA Advocacy wiki: This site was initiated by the European Affairs Bureau when CETA negotiations first began. It provides information about the benefits of CETA to inform departmental employees who are encouraging European Union member states to complete the ratification process.

- CETA wiki: This site was initiated by the FTA Promotion Task Force when the TCS began promoting CETA to Canadian businesses to raise their awareness about the agreement. This was when the CETA Secretariat’s advocacy efforts resulted in the promise of CETA’s provisional application. This site provides useful information to departmental employees who promote the opportunities and benefits of CETA to Canadian businesses.

Based on a review of all the three sites, the audit team found that a vast amount of CETA-related guidance is available. There is also CETA-related information on GAC’s internet website for public consumption. Although the three sites, which were initiated by different branches, do not contradict each other, they duplicate information. In addition, the audit team noted that some of the information, such as media scans in the CETA Weekly Report, requires updates on the CETA Advocacy wiki.

Recommendation 2:

The ADM of International Business Development, Investment and Innovation and Chief Trade Commissioner, in consultation with relevant branches, should ensure that CETA-related guidance communicated to trade commissioners is not duplicated while being relevant, up-to-date and adapted to each of the specific European Union markets.

2.3 Approval of CETA Promotion and Training

In 2016, the International Trade Centre (ITC), a joint agency of the World Trade Organization and the United Nations, conducted an analysis of the managerial and operational practices of the TCS to highlight its strengths and weaknesses in comparison to other foreign trade organizations. The ITC found that the departmental governance was cumbersome. Given the time that has elapsed to address this finding, the audit team expected that CETA-related guidance would be approved in a timely manner.

The audit team noted that although guidance (e.g. training material) developed for trade commissioners was not formally approved, there was extensive consultation within the Department. This allowed the CETA Secretariat, the FTA Promotion Task Force as well as the European Affairs Bureau to obtain feedback from subject matter experts such as trade commissioners and trade policy officers. Furthermore, the CETA Secretariat and the FTA Promotion Task Force verified the content of their own guidance material at the appropriate level. Given the volume and detailed content of the guidance material, the audit team determined that formal approval was not warranted.

The Director General of the Trade Portfolio Strategy and Coordination Bureau (BPD) shared the CETA Promotion Strategy with Directors General in the following branches: International Business Development, Investment and Innovation (Chief Trade Commissioner) Branch; Trade Policy and Negotiations Branch; and Europe, Arctic, Middle East and Maghreb Branch. Given the horizontal nature of this strategy, Directors General were solicited for comments.

In November 2017, the Chief Trade Commissioner approved the CETA promotion and training calendar covering the period from January to March 2018. The calendar outlines the date, location, and topic of each session. In addition, it provides further details about the partners (e.g. Export Development Canada, Canadian Commercial Corporation, Business Development Bank of Canada and Agriculture and Agri-Food Canada) and the potential audience. It was also noted that the CETA promotion and training calendar had been previously approved by the Chief Trade Commissioner responsible for funding the events in the amount of approximately $291,000. In December 2017, the Chief Trade Commissioner also approved the program for the first event that was scheduled to take place in the Atlantic Provinces. This program includes event details and an annotated agenda. Overall, the TCS’ senior management approved all related documentation no less than a month before the first planned event took place.

The audit team reviewed the documentation submitted to the TCS’ senior management for approval and concluded that they received sufficient documentation to make an informed decision. The audit team found that the training material and CETA Promotion Strategy were widely consulted among the appropriate stakeholders. Although the approval of the CETA Promotion Strategy was not formally documented, it was shared with the Chief Trade Commissioner. The audit team also concluded that CETA-related guidance was verified at the appropriate level and in a timely manner.

Recommendation 3:

The ADM of International Business Development, Investment and Innovation and Chief Trade Commissioner should retain documentation to support the approval of key decisions that impact strategic direction for the optimal implementation of future free trade agreements.

3. Conclusion

The audit team found that the TCS has put effective processes in place to provide trade commissioners with advice and guidance to help them optimize CETA. These processes were found to be carried out in a collaborative manner with relevant stakeholders within and external to the Department. These CETA-related processes can be used as a precedent for current and future Canadian FTAs. However, improvements are needed to:

- Accentuate the focus on threats;

- Develop guidance in specific areas and streamline the communication of guidance; and

- Retain documentation to support the approval of key strategic decisions.

Appendix A: About the audit

Objective

The audit objective is to provide reasonable assurance that the TCS has effective processes in place to provide trade commissioners with advice and guidance to help them optimize Canada’s FTAs in force.

Scope

The Minister of International Trade’s mandate letter states that he is responsible for increasing the support provided to Canadian businesses to take advantage of the opportunities that flow after trade agreements are signed. Canada has signed 14 bilateral and multilateral FTAs that are currently in force. The audit’s focus is on the Canada-European Union CETA, which involves 28 European Union member states. When this audit was conducted, GAC was in the process of renegotiating Canada’s most important FTA with the U.S. and Mexico. Considering the uncertainty of its outcome, this FTA was not included within the scope of this audit. The other FTAs currently in force and signed by Canada are bilateral or involve a small number of countries and do not include as many priority market sectors as CETA; therefore, they were also excluded from the scope of the audit.

Criteria

- The TCS analyzes FTAs to identify opportunities and threats.

- The TCS develops guidance based on strategic direction and on the assessment of opportunities and threats.

- The Department approves guidance in a timely manner.

- The TCS communicates guidance to trade commissioners.

Approach and Methodology

To ensure the audit objective can be achieved and concluded, the following methods will be used to gather audit evidence:

- Identification and assessment of analysis of CETA;

- Identification and crosswalk of guidance with opportunities and threats from CETA;

- Interviews with key departmental personnel;

- Analysis of data from departmental systems, such as Strategia and TRIO; and

- Other audit tests as deemed necessary.

Appendix B: Management action plan

| Audit recommendation | Management action plan | Area responsible | Expected completion date |

|---|---|---|---|

| The ADM of International Business Development, Investment and Innovation and Chief Trade Commissioner should update the CETA analysis to include more information about potential threats. | The ADM (BFM) will implement a SWOT analysis for future iterations of promotion strategies, e.g. CETA, CPTPP, whereby possible threats are articulated, along with strengths, weaknesses, and opportunities, such that when proceeding with planning for outreach, communications and TCS-training, possible pit-falls are articulated in advance, and steps are taken to mitigate them. Key documents approved by the ADM will be stored in InfoBank, and will have a section pertaining specifically to threats. | BFMX-Director | March 2019 |

| The ADM of International Business Development, Investment and Innovation and Chief Trade Commissioner, in consultation with relevant branches, should ensure that CETA-related guidance communicated to trade commissioners is not duplicated while being relevant, up-to-date and adapted to each of the specific European Union markets. | The ADM (BFM) will take steps to reduce unnecessary duplication of data across three internal Intranet sites (iTrain, CETA Advocacy wiki, and CETA wiki) and to ensure macro and micro data for EU and Member States respectively are available for Trade Commissioners. This will be included in the next iteration of the CETA Strategy and in the CPTPP Strategy, while recognizing interdependencies exist with geographic, posts and T-branch sections. | BFMX to liaison with various Intranet site owners. BFMX to liaison with T-branch, geographics, and posts regarding micro data. | June 2019 |

| The ADM of International Business Development, Investment and Innovation and Chief Trade Commissioner should retain documentation to support the approval of key decisions that impact strategic direction for the optimal implementation of future free trade agreements. | The ADM (BFM) will continue to retain, i.e. scan and save to InfoBank, key decisions made by senior management vis-à-vis strategic directions for communicating future trade agreements. Considering the scope of this audit centred on BFMX (FTA Task Force), key documents will be retained concerning the FTA outreach and training efforts of BFMX division. Key decisions for strategic direction of FTAs in general will be retained by Trade Policy bureau (TFM), the lead bureau on negotiating FTAs. | BFMX, TFM | March 2019 regarding BFMX strategic plans. On-going for TFM negotiations. |