CPTPP partner: Peru

- Over the past decade, Peru has been one of the fastest-growing economies in Latin America, with an annual growth rate of 5.5%.

- Peru has been Canada’s second-largest bilateral trading partner in South and Central America (not including Mexico), on average, between 2015 and 2017.

- Also, Peru was Canada’s third-largest destination for direct investment in the region ($12.7 billion in 2016), and 14th-largest destination worldwide.

Canada-Peru trade snapshot

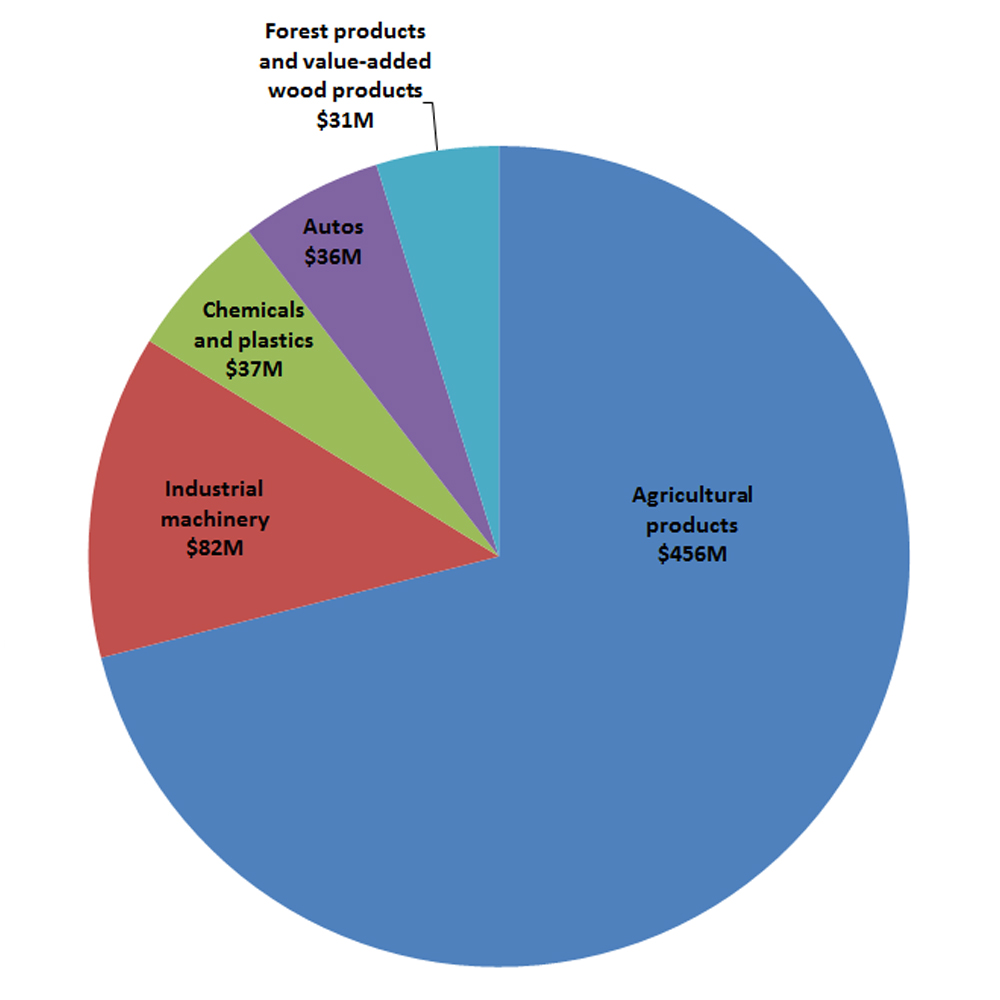

Top Canadian Exports to Peru (2015-2017 average, $CAD)

Text version

Canada's Top Exports to Peru (2015-2017 average, $CAD)

- Total value of exports to Peru: $772,000,000

- Agricultural products (including wheat, pulses): $456,000,000

- Industrial machinery: $82,000,000

- Chemicals and plastics: $37,000,000

- Autos: $36,000,000

- Forest products and value-added wood products: $21,000,000

Key facts and figures

Canada-Peru trade

- Canadian merchandise exports: $772 million (2015-2017 average)

- Canadian merchandise imports: $2.5 billion (2015-2017 average)

- Two-way services trade: no statistics available

Canada-Peru tourism

- In 2016, Canada welcomed some 14,000 Peruvians.

- In 2015, 131,900 Canadians visited Peru.

Canada’s top merchandise imports from Peru (2015-2017 average)

- Metals and minerals (gold): $2.0 billion

- Agricultural products (including fruits, fats and oils, coffee): $324 million

- Fish and seafood products: $114 million

- Textiles and apparel: $47 million

- Industrial machinery: $9 million

Canada’s top merchandise exports to Peru (2015-2017 average)

- Agricultural products (including wheat, pulses): $456 million

- Industrial machinery: $82 million

- Chemicals and plastics: $37 million

- Autos: $36 million

- Forest products and value-added wood products: $31 million

How the CPTPP helps Canada-Peru trade and investment

- The existing Canada-Peru Free Trade Agreement (FTA), which entered into force in 2009, already provides preferential market access and clear trading rules for Canadian exporters.

- Once in force for Peru, the CPTPP will also provide similar preferential market access with modernized trade rules and gives exporters greater flexibility in using inputs from CPTPP members. This will allow Canadian exporters to choose between the trade agreements and claim preferences under the agreement that best fits their needs.

- The CPTPP will allow Canadian companies to invest with greater confidence in Peru, offering them protections from unfair and discriminatory treatment, as well as greater predictability and transparency.

- Through the CPTPP, the service industry will benefit from greater access in Peru than is provided under the Canada-Peru FTA, including in key sectors such as:

- professional services (e.g. legal services) and

- financial services (e.g. accounting, auditing and bookkeeping services).

- New commitments on temporary entry of business persons will make it easier for certain categories of Canadian business persons to temporarily work in Peru, including high-skilled Canadian professionals and technicians as well as their spouses.

- Suppliers of goods or services will also gain enhanced access to open, fair and transparent processes when bidding on government procurement contracts at the sub-national level in Peru, a benefit that is not offered under the Canada-Peru FTA.

- The CPTPP provides enforceable provisions on labour and environment.

Sectoral opportunities in Peru

- Extractives:

- Peru’s extractive sector holds vast potential.

- Canada is one of the largest foreign investors in Peru’s mining sector.

- Canadian companies in Peru are setting an example for responsible natural resource development and innovative corporate social responsibility programs.

- Defence:

- Peru has an ongoing process to modernize its military capabilities and has signed three defence procurement-related memorandums of understanding with Canada since 2013.

- Education:

- Peru is increasingly seeking educational opportunities in Canada because of our high standards, competitive value and geographic proximity.

- In 2017, permits granted to students from Peru to study in Canada grew by approximately 35%, making it one of the fastest-growing source countries in the region for education.

- Infrastructure:

- Peru is using public-private partnership models to address a US$160-billion gap in social and economic infrastructure.

- Peru is prioritizing the development of transport infrastructure (road, rail, port and airport) to increase its competitiveness and establish a logistics network that further integrates Latin America into the Asia-Pacific region.

- Science, technology and innovation collaboration:

- Canada encourages collaboration with Peruvian counterparts between researchers, institutions, funding agencies and private sector organizations on research and development, with a view to accelerate commercialization of innovation and to benefit our economies.

- Date modified: