State of Trade 2024: Supply chains

ISSN 2562-8321

Table of contents

- Message from the Minister

- Executive summary

- Part 1: 2023 in review

- Part 2: Supply chains

- Bibliography

Message from the Minister

It gives me great pleasure to present Canada’s 2024 State of Trade Report, which offers a comprehensive snapshot of Canada’s economy and international trade in 2023.

Trade is an integral part of the Canadian economy. It represents two-thirds of Canada’s GDP and exports alone support nearly 3.3 million – or 1 in 6 – Canadian jobs. Despite a challenging global environment, 2023 showcased the resilience of Canadian trade. Our exports expanded by 1.4%, with imports following suit at 3.1%, a testament to the tenacity of Canadian importers and exporters.

These numbers underscore the world's continued confidence in Canadian goods, services, talent, and innovation. The world also continues to see Canada as a sound investment destination – our businesses and industries attracted over $60 billion in foreign direct investment in 2023.

All of this bodes well for Canadian businesses and investors looking to expand into new markets abroad. When they do, they create more good jobs, better opportunities, and a more robust economy here at home.

This is why Canada remains committed to strengthening rules-based international trade through our work with the World Trade Organization and, specifically, the Ottawa Group on WTO Reform, which Canada leads. Moreover, we remain committed to creating new opportunities in new markets – like the growing and dynamic economies of the Indo-Pacific region – through targeted Team Canada Trade Missions.

I invite you to explore this year's special feature on global supply chains, which highlights remarkable resilience in the face of challenges. Canada’s integration in global supply chains fosters productivity in Canadian businesses, diversifies consumer choice, and contributes to lower prices – undeniable benefits that call for ongoing innovation and adaptation as the global environment evolves.

Looking ahead, we will continue to promote Canadian businesses, industries, and innovation to the world while attracting foreign talent, capital and investment here. We will also continue to create opportunities to expand trade so that it benefits a wider range of entrepreneurs, consumers, and industries.

We continue these efforts knowing that robust trade leads to strong economies and a brighter future for Canadians from coast to coast to coast. I look forward to sharing the results of these successful efforts in future State of Trade reports.

The Honourable Mary Ng

Minister of International Trade, Export Promotion, Small Business and Economic Development

Executive summary

The global and Canadian economies slowed again in 2023 but were nonetheless resilient in the face of headwinds. After reaching record levels in 2022, inflation came down in several economies, but not without a cost. Monetary policy in many countries was restrictive, leading to a slowdown in investment and spending. Advanced economies saw a slowdown in growth to 1.6% in 2023, as weak growth in the European Union and a recession in the United Kingdom outweighed strength in the United States (U.S.) and Japan. In emerging markets and developing economies, growth picked up to 4.3% despite a weaker-than-expected reopening of the Chinese economy and ongoing conflict in Ukraine and the Middle East.

The global trade and investment landscape encountered obstacles such as heightened protectionism, maritime disruptions such as those in the Panama Canal and the Red Sea, and geopolitical tensions. Consequently, global trade volumes dipped notably, and preliminary data indicates subdued global investment for 2023. Overall, global economic growth slowed from 3.5% in 2022 to 3.2% in 2023.

The Canadian economy fared worse but managed to avoid a recession, with growth slowing from 3.8% in 2022 to 1.2% in 2023. Inflation eased from a 40-year peak of 6.8% in 2022 to 3.9% in 2023, slowing further in the first several months of 2024. However, as the Bank of Canada’s policy interest rates reached a 23-year high in 2023, investment and household spending were constrained throughout the year and the effects of higher rates are expected to linger. Household spending supported growth overall but decreased on a per-person basis. Net exports, supported by a strong U.S. economy, were the greatest contributor to growth in 2023.

Services led growth in 2023, expanding by 2.0%, while goods industries contracted by 1.2%. Transportation and warehousing services and public administration, driven largely by gains in local, municipal, regional, provincial, and territorial administrations, contributed the most to services growth. As the post-pandemic expansion in travel continued, and as more workers returned to the office, air travel and urban transit services drove the increase in transportation and warehousing. Conversely, the contraction in goods sectors was widespread, with the interest-rate-sensitive construction and agriculture sectors being significant detractors.

Despite another year of slow global growth and a contraction in global commodity prices, Canada’s international trade posted new records again in 2023. However, growth was much slower compared to the strength seen in 2022. Goods and services exports increased by 1.4% to reach $965.1 billion in 2023. This growth was entirely driven by services as goods exports contracted due to a decline in commodity prices, particularly for energy products. A robust increase in motor vehicle exports, supported by the continued improvement in international supply chains, partially offset the goods contraction. Meanwhile, travel exports drove services trade and finally surpassed their pre-pandemic levels. Goods and services imports increased by 3.1% to reach $978.2 billion, with goods and services advancing. As with exports, motor vehicles and travel drove import growth.

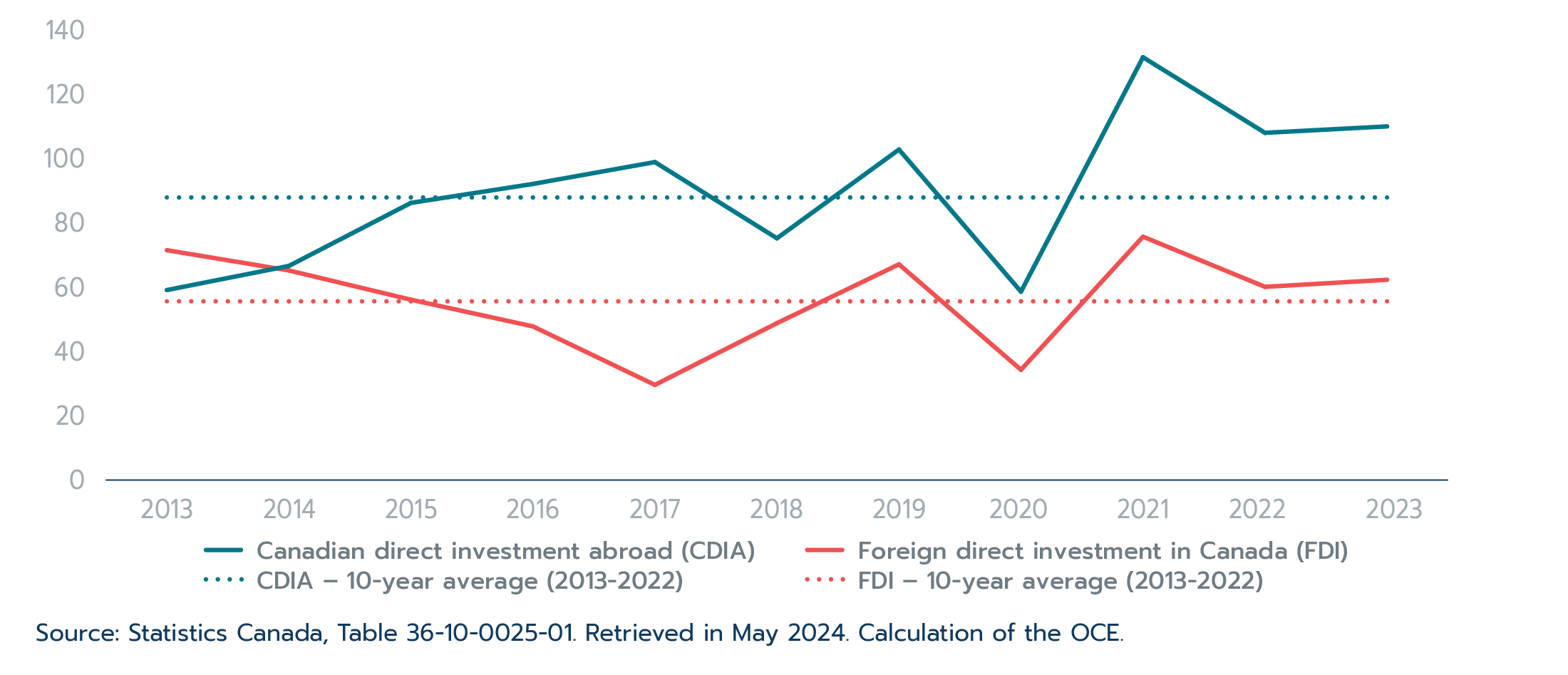

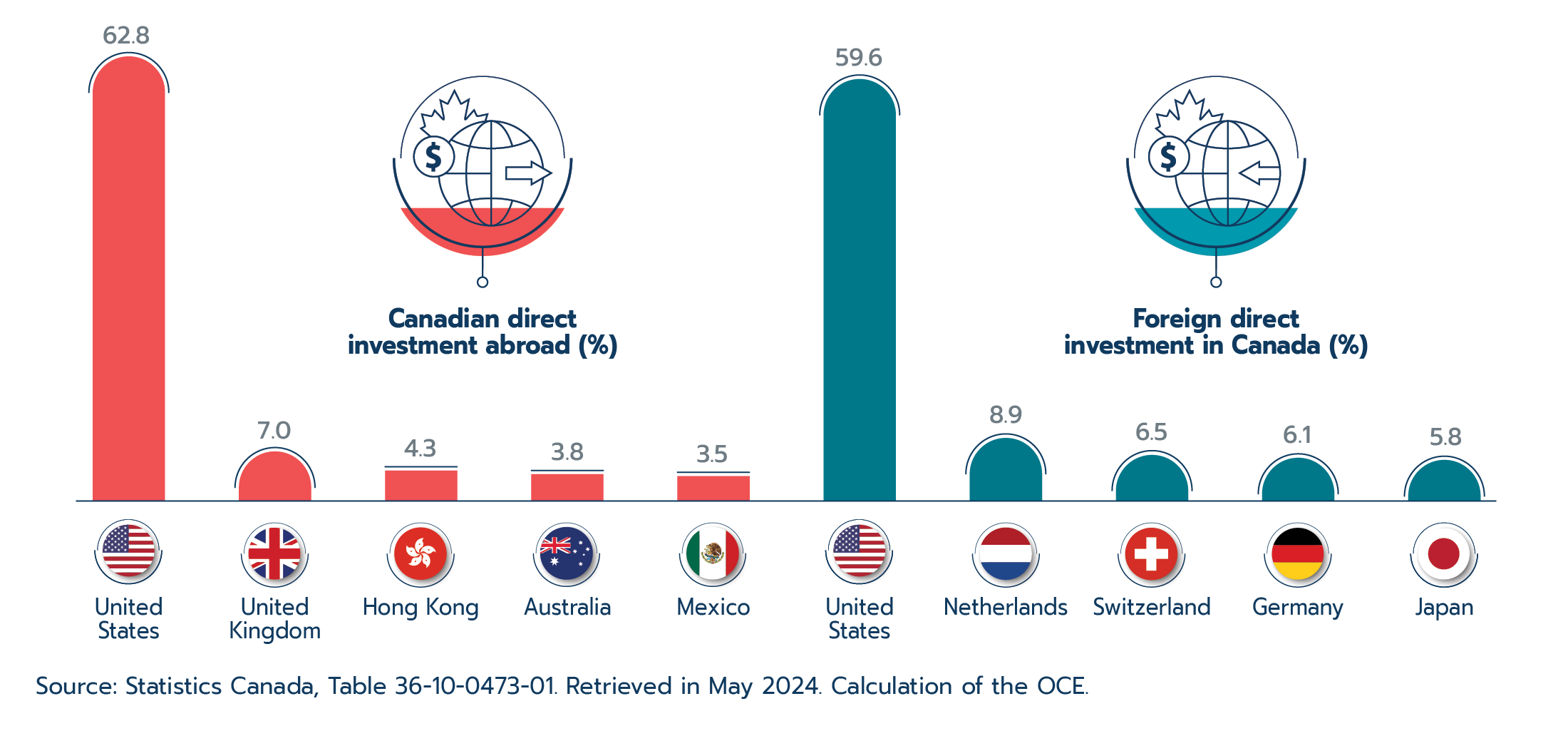

In another demonstration of resilience, Canada's flows of foreign direct investment returned to growth in 2023, after declining in 2022. More specifically, after declining 17.8% in 2022, Canadian direct investment abroad flows increased by 1.8% in 2023, while foreign direct investment flows in Canada increased by 3.7% (compared to -20.6% in 2022).

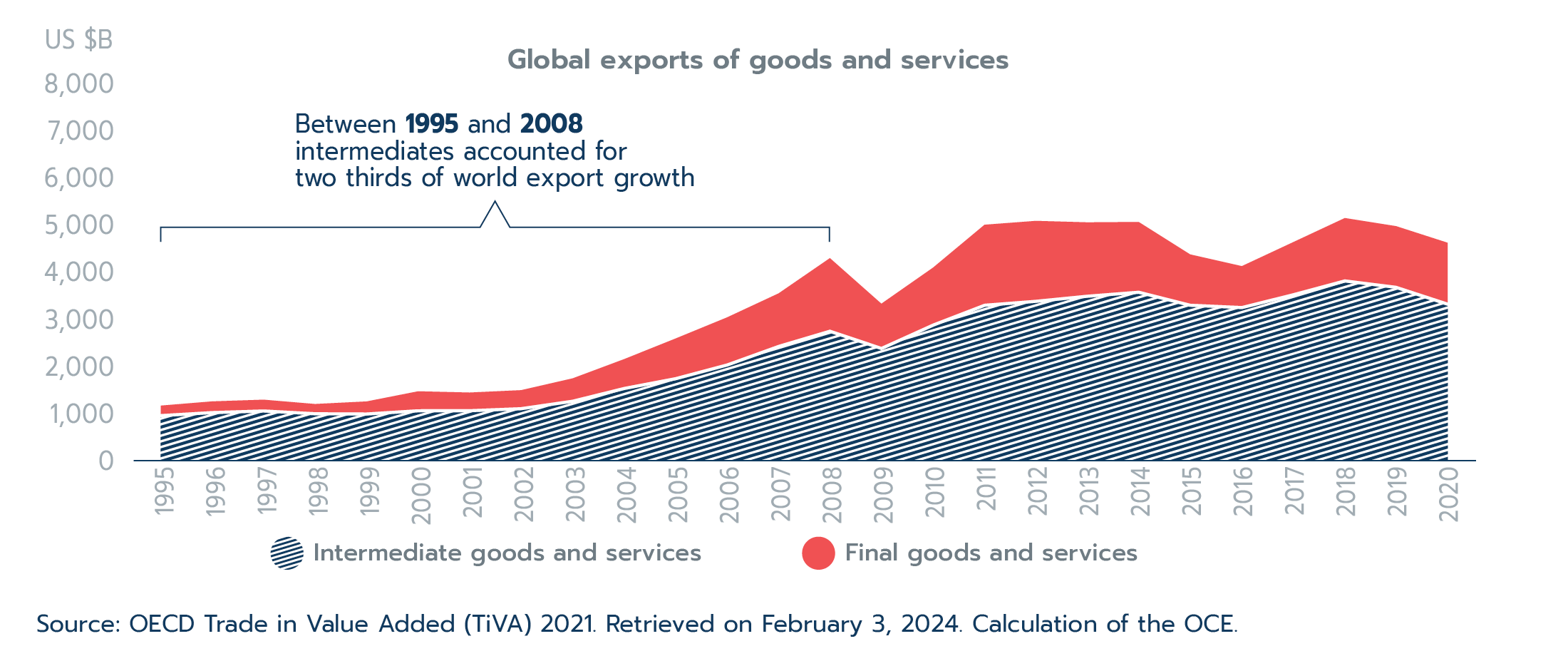

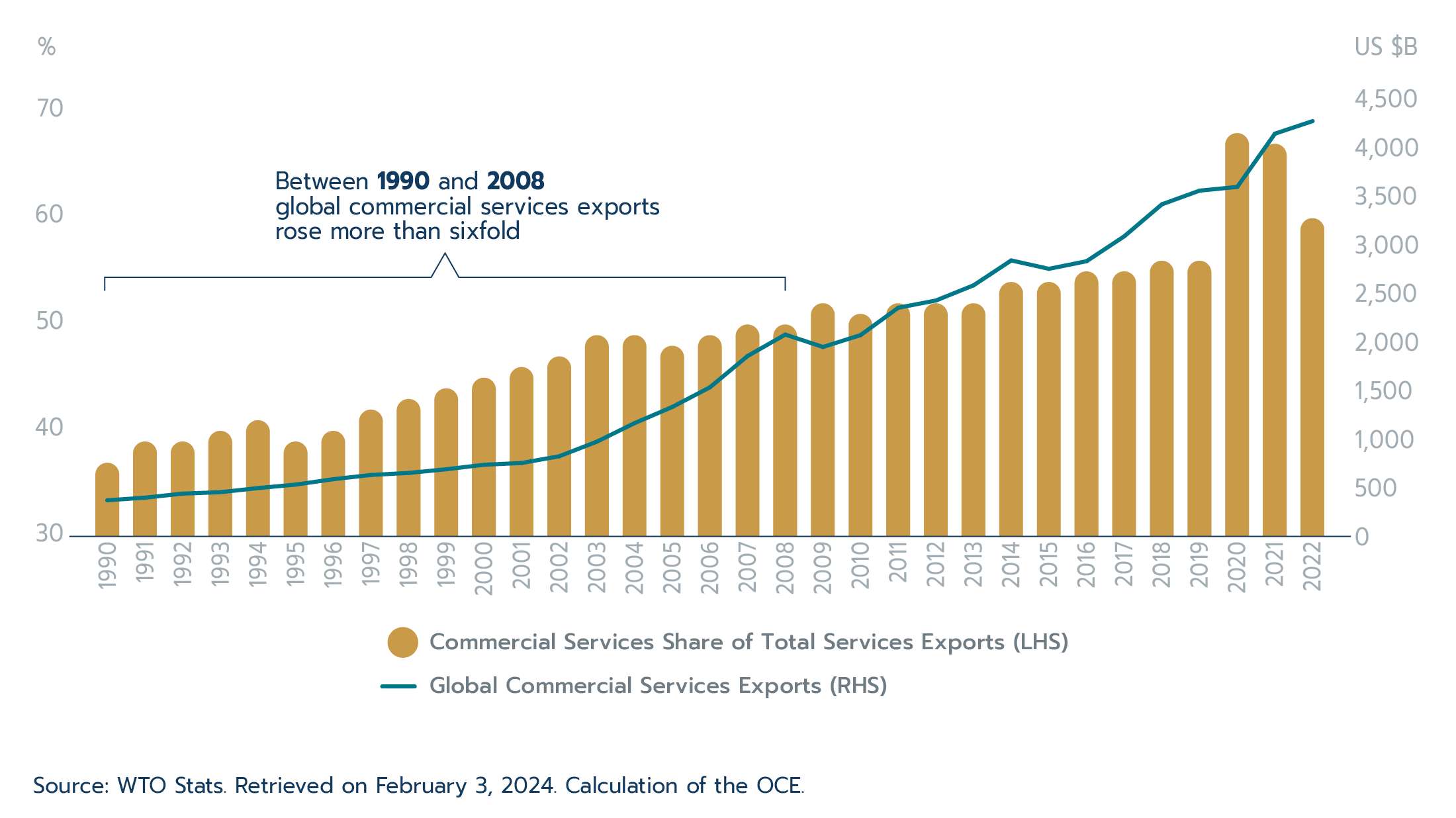

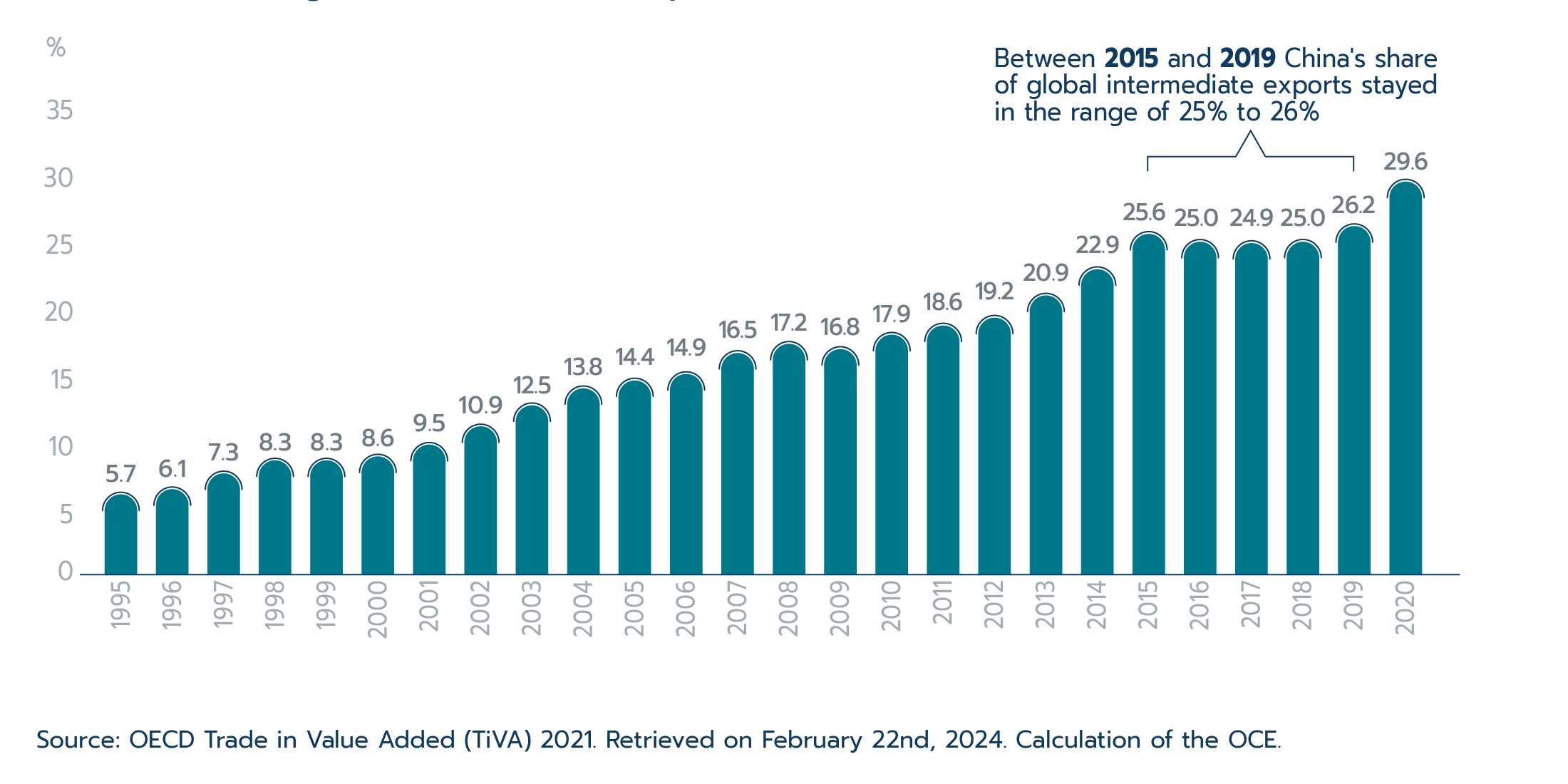

Despite yet another challenging year for global and Canadian economic growth, international trade and the supply chains underlying these transactions continued to hold up well. The State of Trade 2024 provides a comprehensive overview of the evolution of supply chains from before, during, and after the COVID-19 pandemic. International supply chains provide many benefits to Canadians and the Canadian economy. For Canadians, international supply chains help lower prices and increase choice, stability, and variety of products available. For Canadian firms, the benefits can be boiled down to increased productivity. International supply chains allow firms to specialize on core tasks, gain access to specialized inputs, create knowledge spillovers, and increase competition.

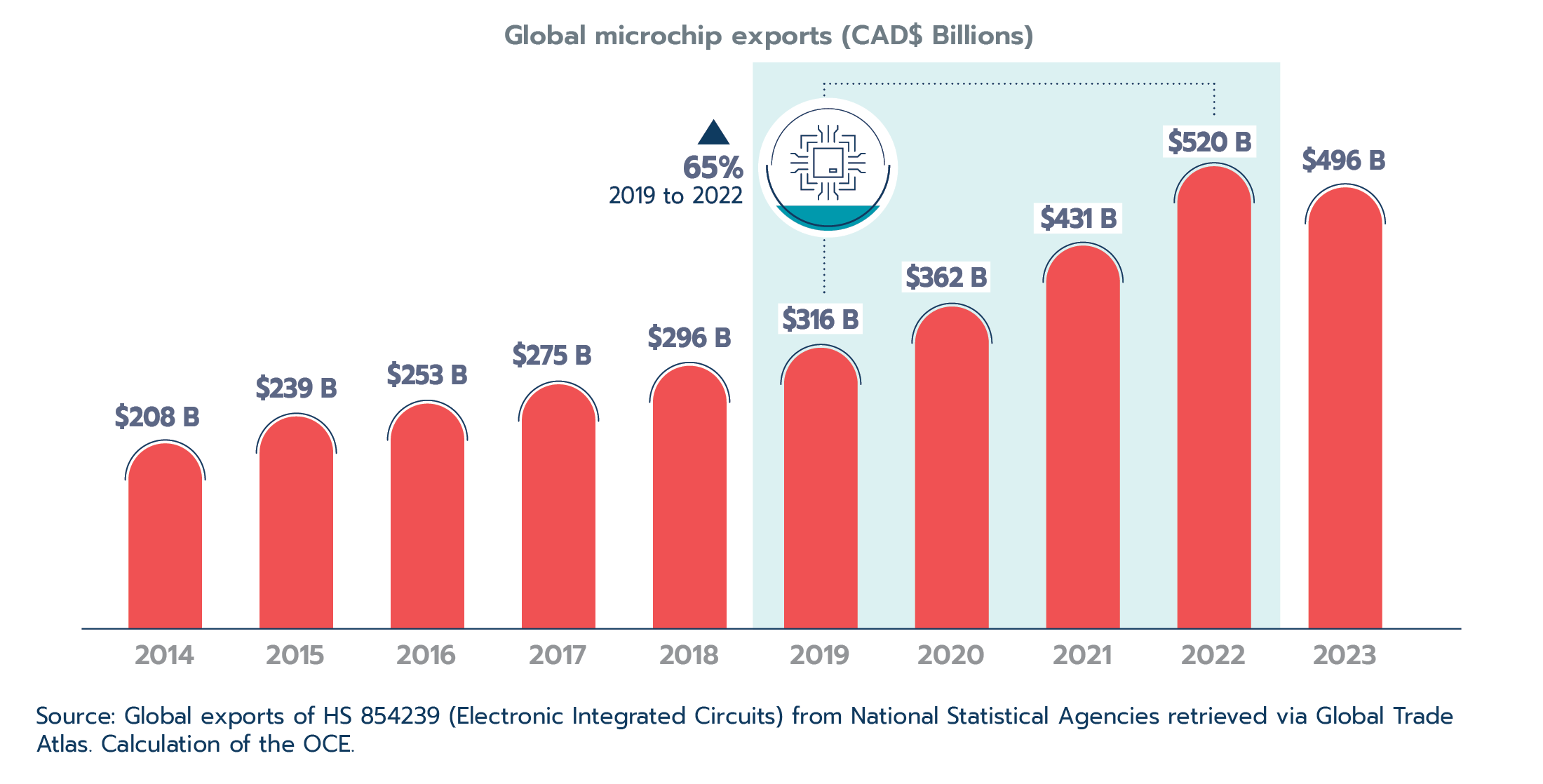

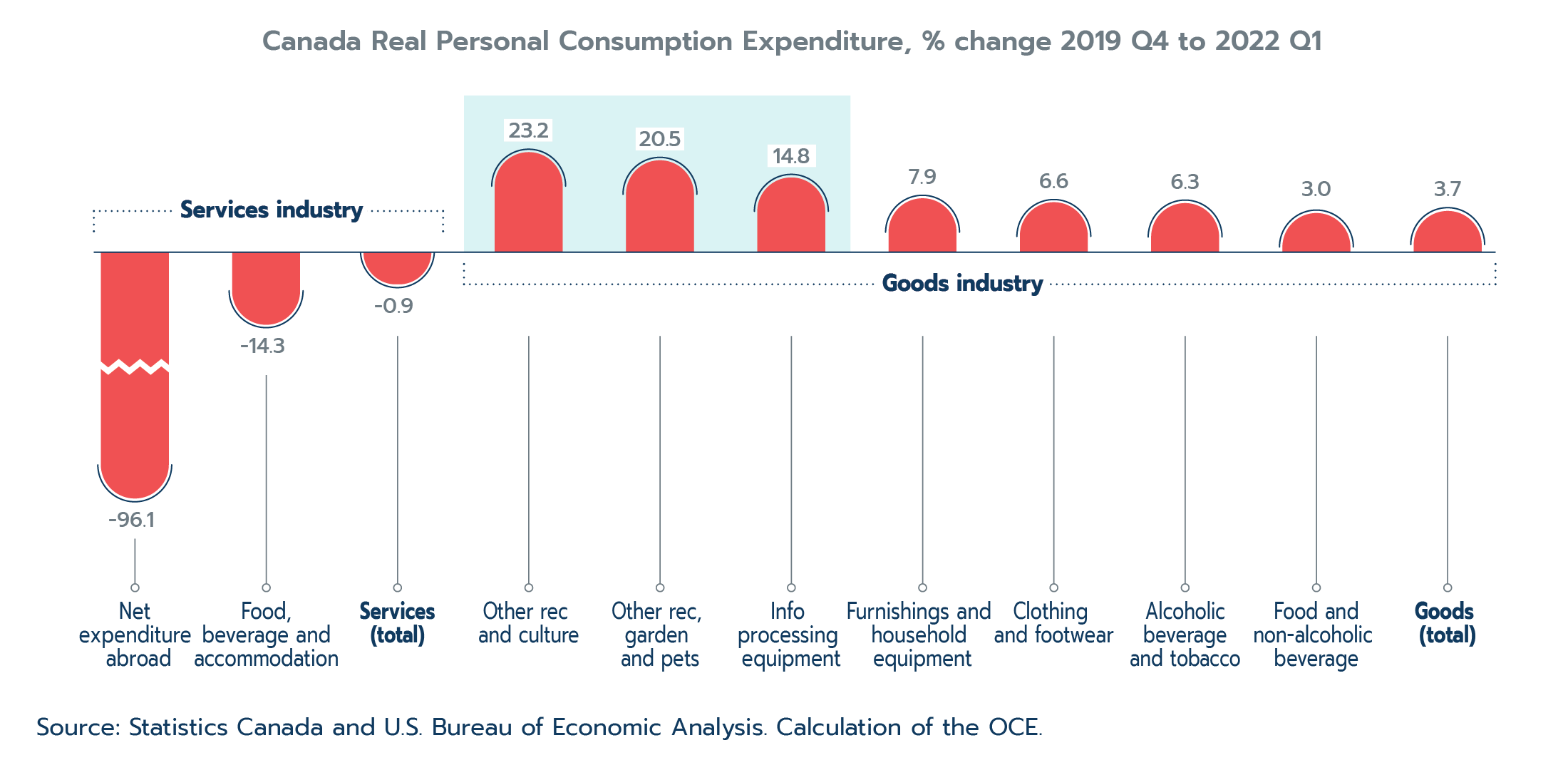

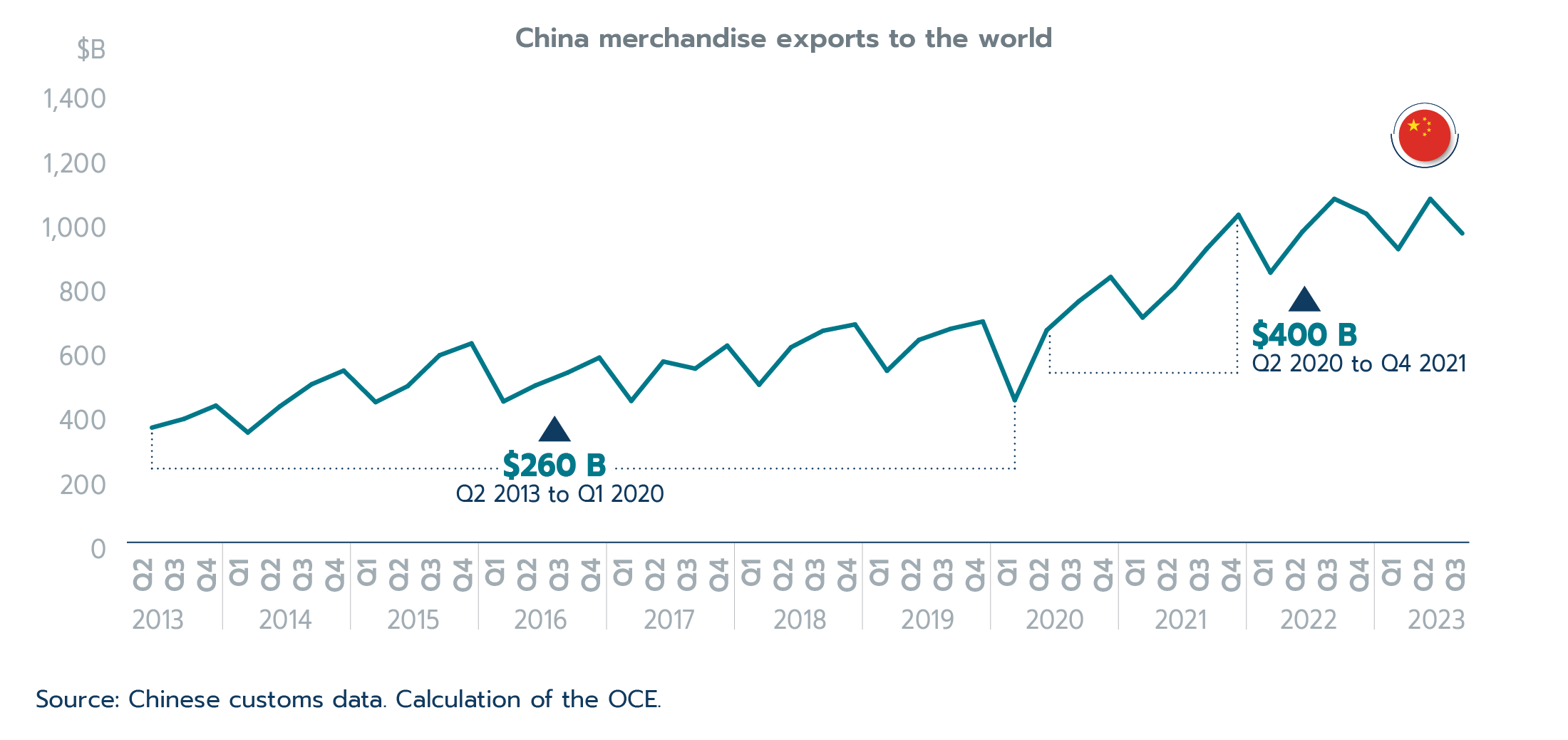

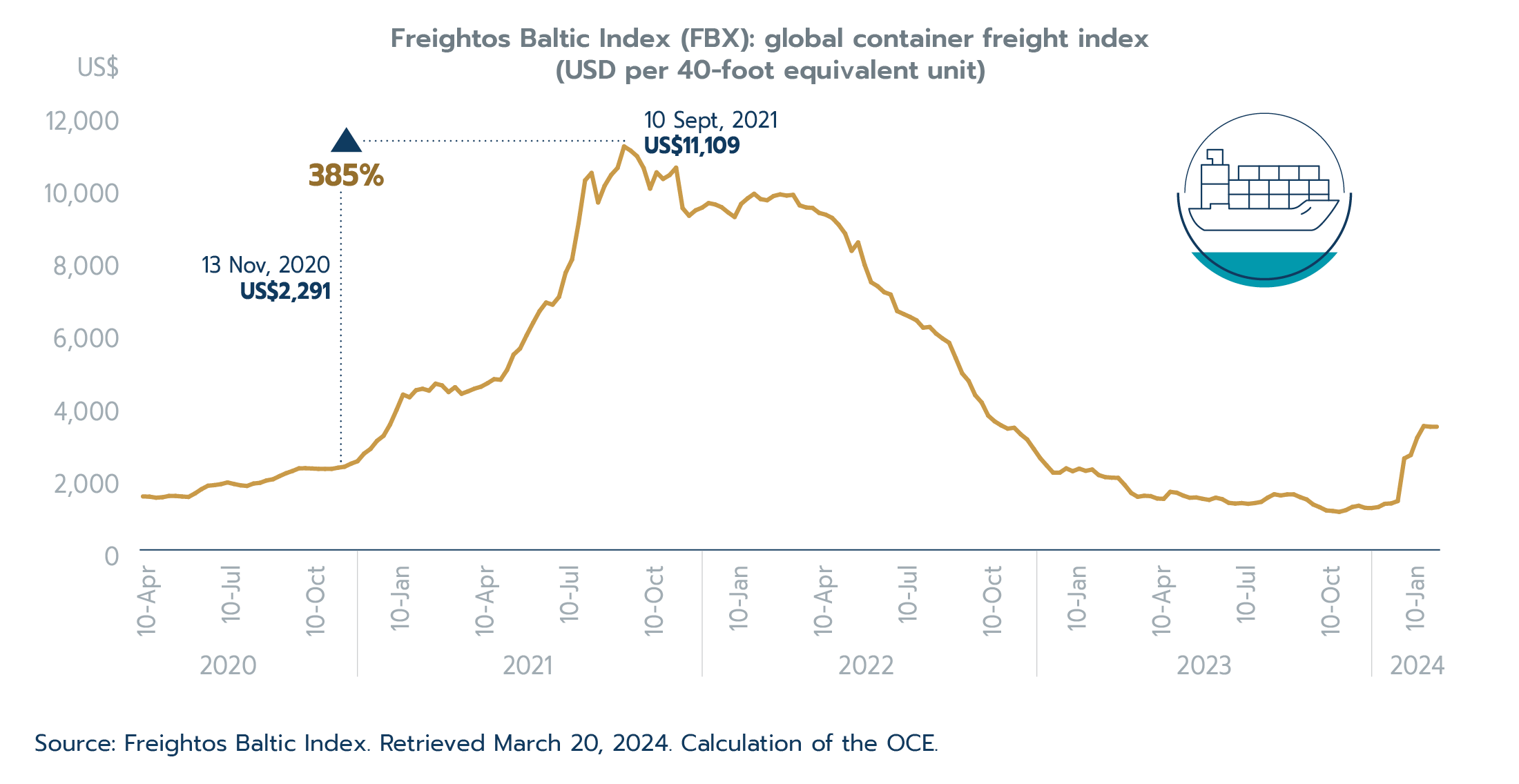

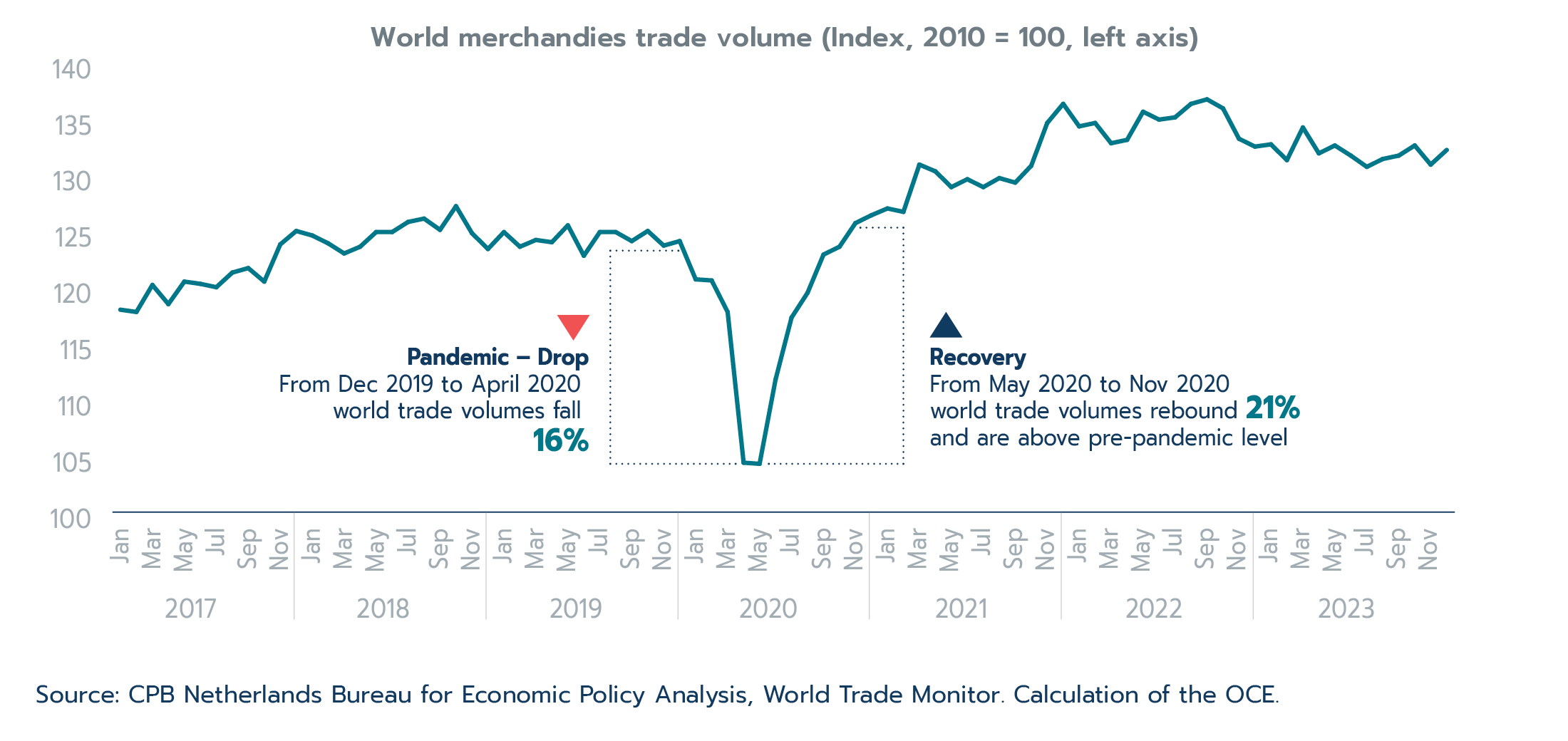

Supply chains held up well in the wake of the COVID-19 pandemic. The pandemic caused a shift in demand from services to consumer durables, which in turn put pressure on transportation infrastructure, causing delays at ports and rising costs in maritime shipping. However, world trade volumes rebounded quickly and were already at their pre-COVID-19 levels by November 2020. During the pandemic, Canadians were able to access most of the goods and services they needed. However, there were some notable disruptions, for example in microchips, which are an important input in many Canadian industries such as automotive manufacturing and are looked at more closely in the special feature.

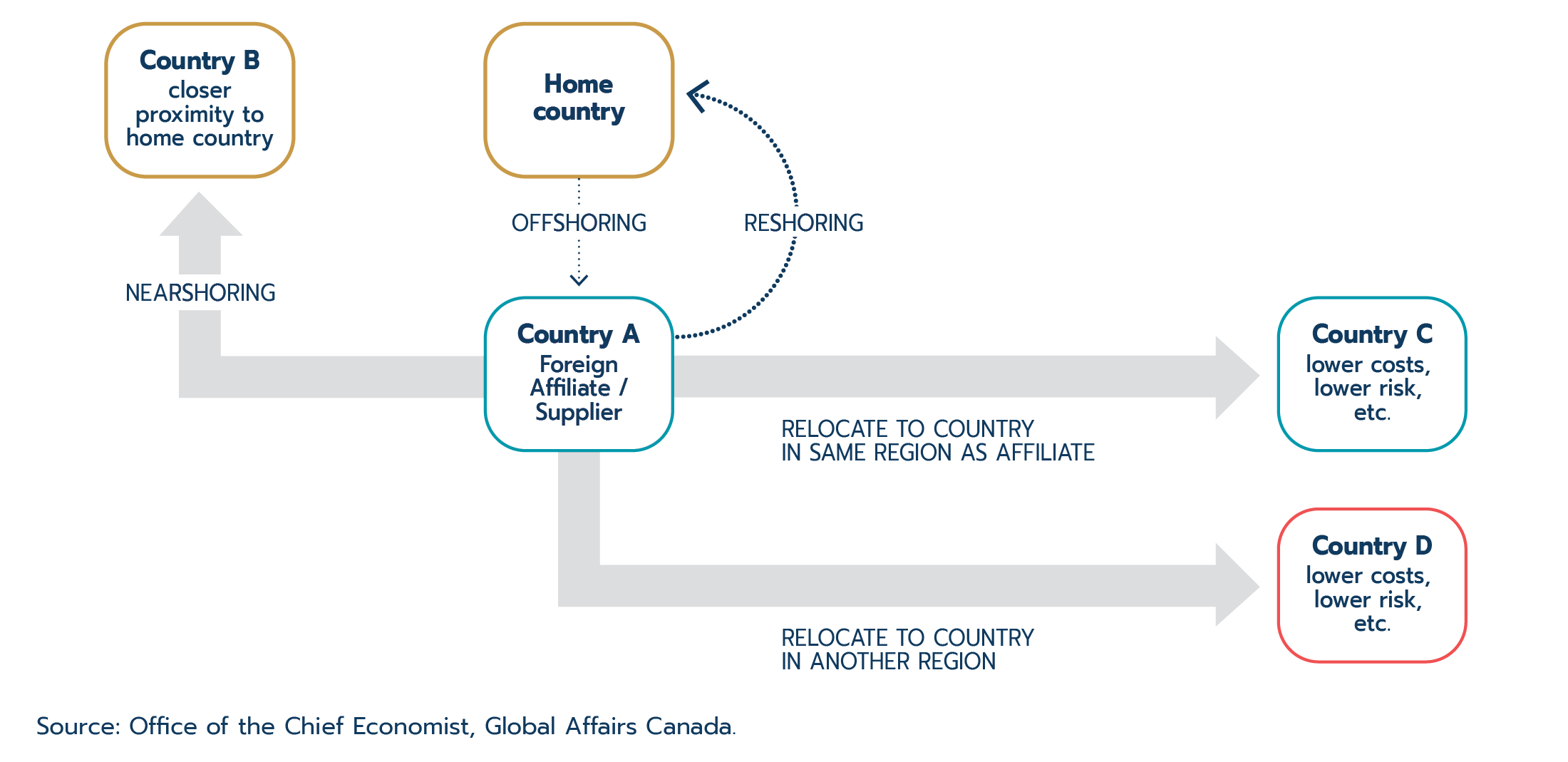

Looking ahead, international supply chains face uncertainty stemming from climate change, human and organizational risks, environmental, social and governance concerns, and geopolitical shifts. There are many ways Canadian firms can bolster their resilience to these challenges, including through supplier diversification, inventory management, process innovation, or supply chain reconfiguration, including reshoring or nearshoring.

Reshoring is a possible response to the current risks facing international supply chains, but it is a costly endeavor for businesses that forgoes benefits provided by international supply chains to consumers and businesses alike. At the time of writing of the State of Trade, there is little evidence of Canadian firms reshoring. However, there is some indication that international supply chains are restructuring and changing the locations of some input sources (nearshoring). Businesses may find relocating to another country to be preferable to reshoring as they can address risks and/or vulnerabilities while continuing to profit from other countries’ comparative advantages.

The future of international supply chains and the challenges they pose to firms remain uncertain. However, their enduring benefits and the need for companies to adapt and innovate are clear. Canadian businesses must confront these challenges, fortify their supply chains, and integrate further into global trade networks to remain competitive.

Part 1: 2023 in review

At a glance

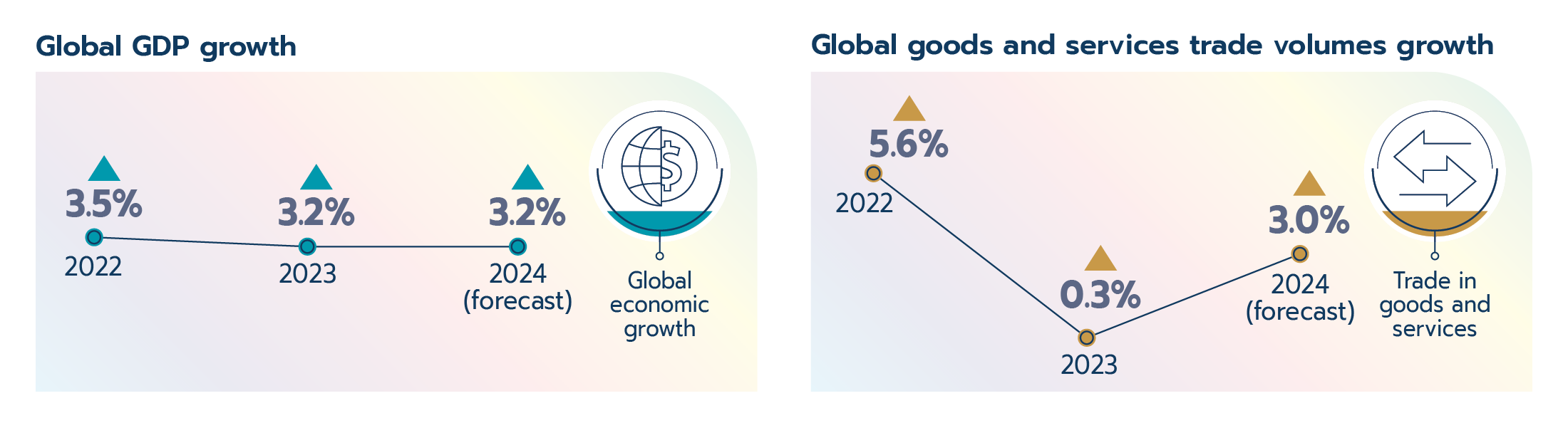

Global economic growth slowed in 2023 amidst still elevated inflation, tight financial conditions, and heightened geopolitical fragmentation.

- Global growth slows: The global economy was more resilient than expected but growth still slowed from 3.5% in 2022 to 3.2% in 2023. Growth in advanced economies (1.6%) slowed significantly while emerging markets and developing economies (4.3%) picked up slightly.

- The International Monetary Fund (IMF) expects global growth to hold at 3.2% in 2024.

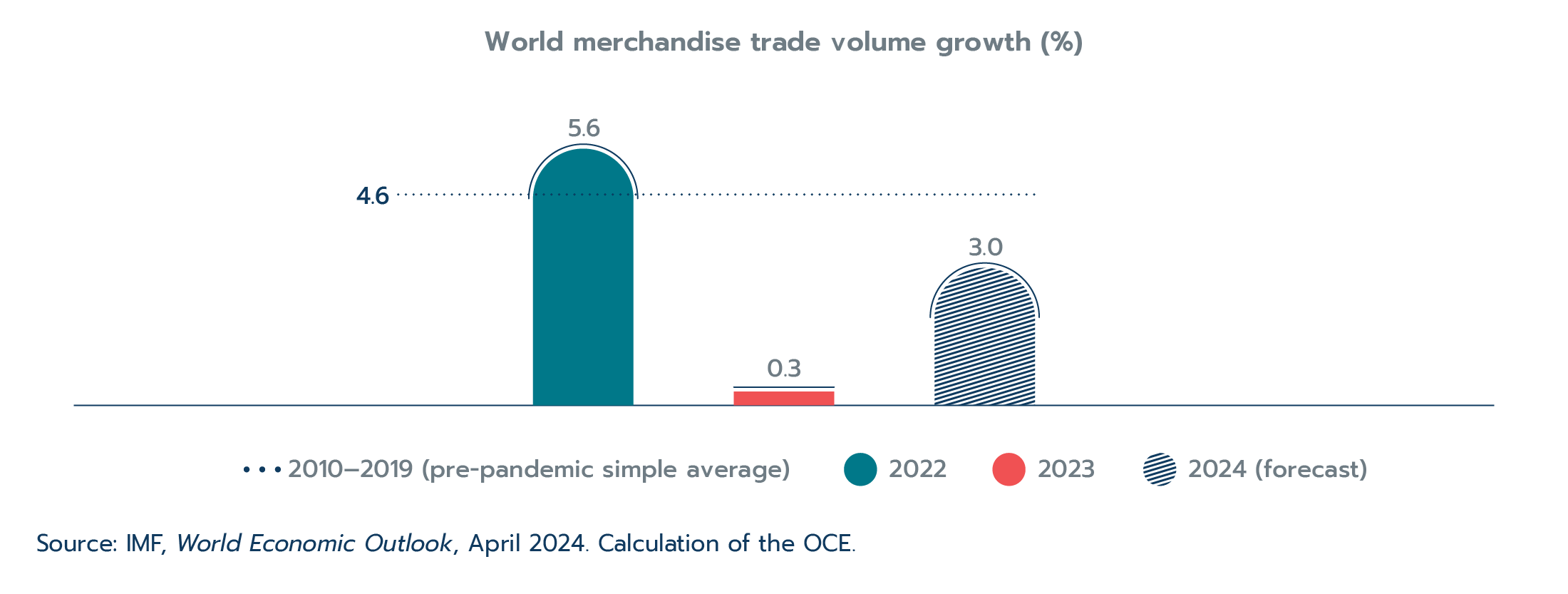

- Trade struggles: World goods and services trade volumes slowed sharply, from 5.6% in 2022 to 0.3% in 2023, as the war in Ukraine, high inflation and tightened financial conditions all weighed on growth.

- World trade is forecasted to pick up to 3.0% in 2024 as inflation and financial conditions ease.

At a glance figure 1: Global GDP growth and Global goods and services trade volumes growth

Text version - At a glance figure 1

- Global GDP growth 2022: 3.5%

- Global GDP growth 2023: 3.2%

- Global GDP growth 2024 (forecast): 3.2%

- Global goods and services trade volumes growth 2022: 5.6%

- Global goods and services trade volumes growth 2023: 0.3%

- Global goods and services trade volumes growth 2024 (forecast): 3.0%

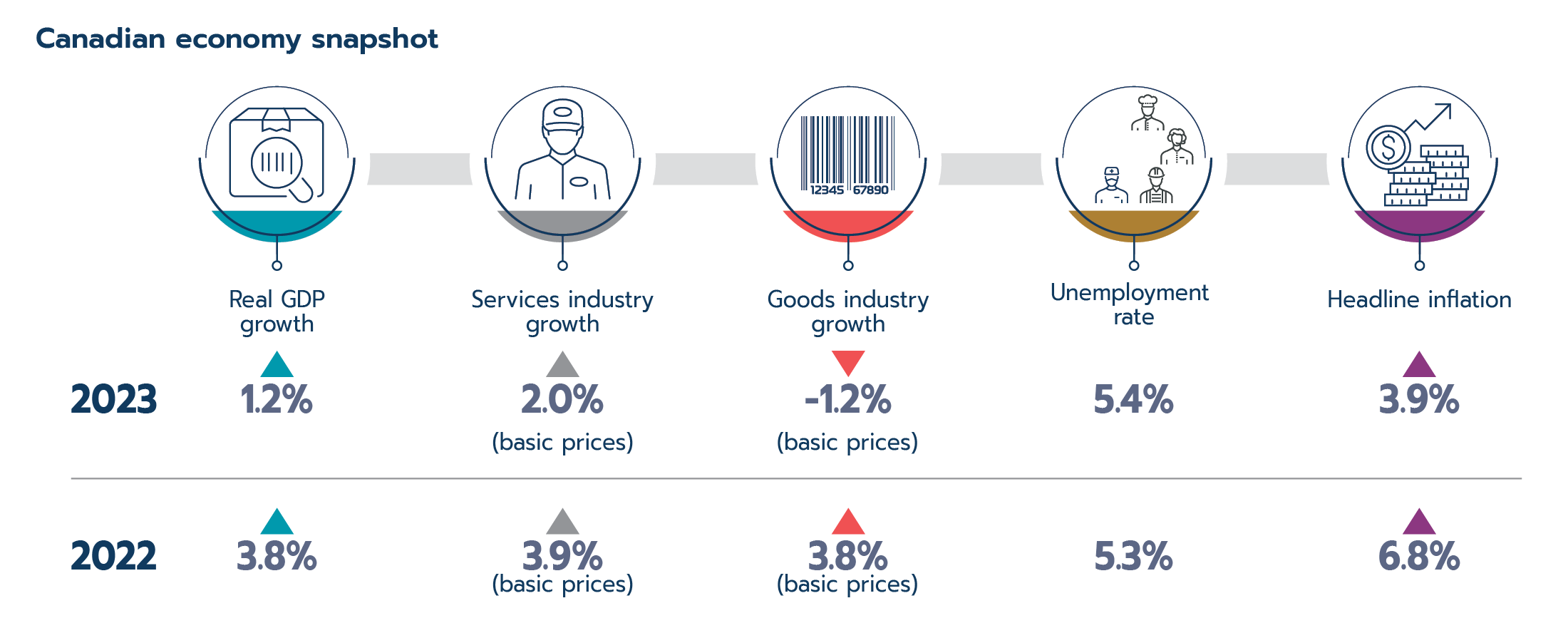

Canadian economic performance slowed sharply to 1.2% in 2023 – nonetheless, Canada saw the third strongest growth among G7 economies, behind the U.S. and Japan.

- Services led growth: Services industries (2.0%) led growth again in 2023, with transportation and warehousing services and public administration driving growth.

- Goods contract: Goods industries declined by 1.2% in 2023. The contraction was widespread, led by the interest-rate-sensitive construction industry.

- Inflation eases: Inflation slowed from a 40-year high of 6.8% in 2022 to 3.9% in 2023, supported by decreasing energy prices and tight monetary policy.

- Labour markets ease: Unemployment increased slightly to 5.4% in 2023 overall and ended the year at 5.8% in December. Job vacancies decreased while labour force participation was essentially unchanged.

At a glance figure 2: Canadian economy snapshot

Text version - At a glance figure 2

- Canadian real GDP growth 2022: 3.8%

- Canadian real GDP growth 2023: 1.2%

- Services industry growth (basic prices) 2022: 3.9%

- Services industry growth (basic prices) 2023: 2.0%

- Goods industry growth (basic prices) 2022: 3.8%

- Goods industry growth (basic prices) 2023: -1.2%

- Unemployment rate 2022: 5.3%

- Unemployment rate 2023: 5.4%

- Headline inflation 2022: 6.8%

- Headline inflation 2023: 3.9%

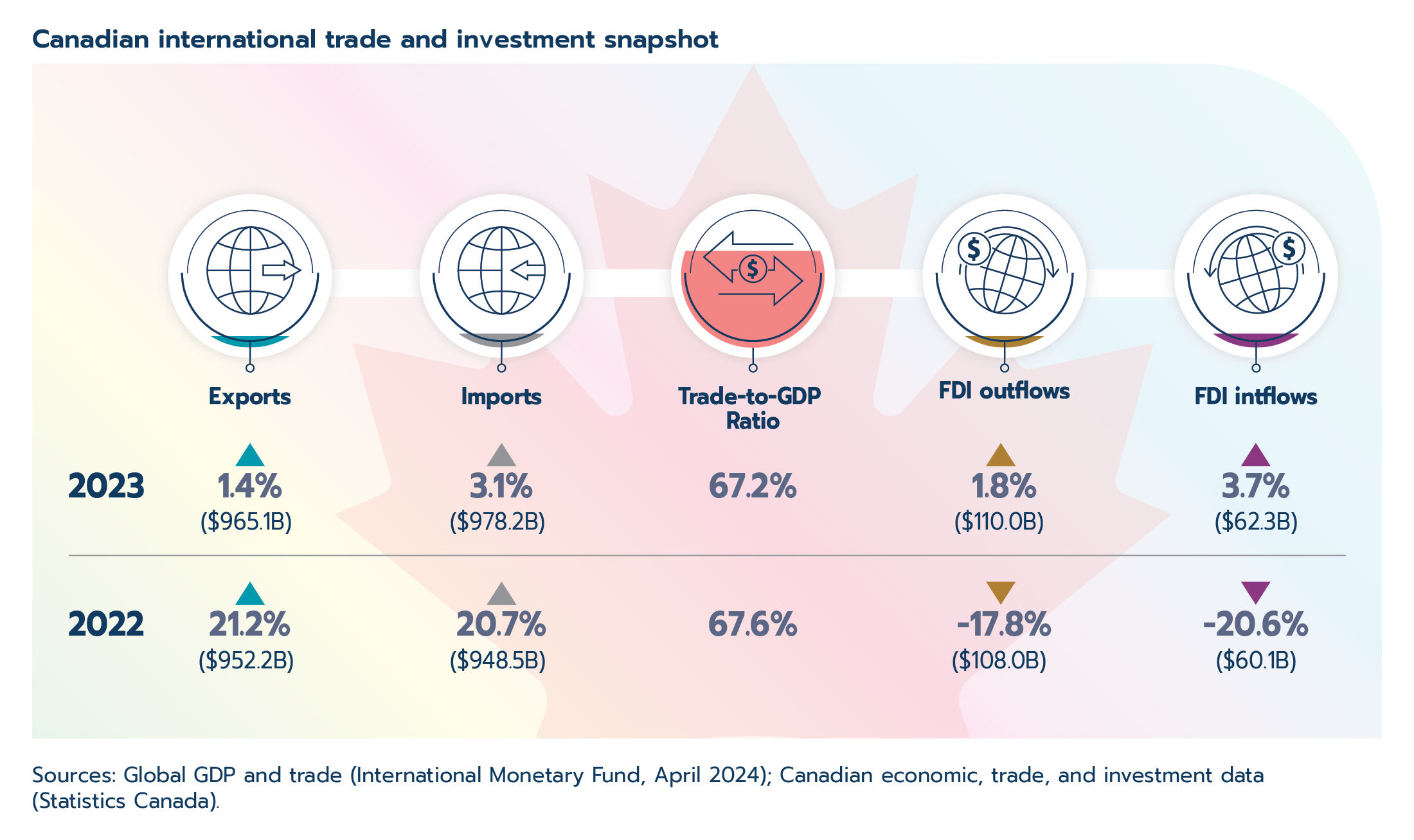

Canadian exports and imports expanded despite a challenging global environment – two-way goods and services trade totalled $1.9 trillion in 2023.

- Trade growth moderates: Canadian goods and services export growth slowed markedly from 21.2% in 2022 to 1.4% in 2023. Growth was driven by services exports (13.8%) as goods (-1.4%) contracted. Travel services and motor vehicles and parts products posted strong gains.

- Goods and services imports growth (3.1%) outpaced export growth, with both services imports (10.1%) and goods imports (1.4%) advancing. As with exports, travel services and motor vehicles and parts products were the greatest contributors to import growth in 2023.

- As COVID-19-related restrictions were lifted, travel services exports and imports surpassed their pre-pandemic 2019 levels for the first time in 2023.

- Investment growth returns: After declining in 2022, Canada’s two-way international investment flows increased in 2023. Finance and insurance drove the increase in Canadian investment abroad, while manufacturing led foreign investment growth in Canada.

- In 2023, international investment inflows and outflows were higher than their respective historical averages (2010 – 2019) but remained below their 2021 levels.

At a glance figure 3: Canadian international trade and investment snapshot

Sources: Global GDP and trade (International Monetary Fund, April 2024); Canadian economic, trade, and investment data (Statistics Canada).

Text version - At a glance figure 3

- Goods and services exports 2022: 21.2% ($952.2 billion)

- Goods and services exports 2023: 1.4% ($965.1 billion)

- Goods and services imports 2022: 20.7% ($948.5 billion)

- Goods and services imports 2023: 3.1% ($978.2 billion)

- Trade-to-GDP ratio 2022: 67.6%

- Trade-to-GDP ratio 2023: 67.2%

- Canadian FDI Outflows 2022: -17.8% ($108.0 billion)

- Canadian FDI Outflows 2023: 1.8% ($110.0 billion)

- Canadian FDI Inflows 2022: -20.6% ($60.1 billion)

- Canadian FDI Inflows 2023: 3.7% ($62.3 billion)

1.1 Introduction

After seeing historic inflation, the outbreak of war in Europe, and synchronized monetary policy tightening in 2022, prospects for 2023 were gloomy. Yet, resilience emerged as the prevailing narrative. While growth slowed, most advanced economies avoided recession territory, and growth in emerging markets and developing economies picked up. Inflation slowed in most regions, prompting rate cuts in some economies and talks of cuts in others, while labour markets remained relatively robust in the process.

Despite the overall resilience, the year had its fair share of trials—conflict in the Middle East, a weaker-than-expected Chinese economic reopening, struggling European growth, and rising geopolitical tensions all weighed on growth. Meanwhile, many low-income economies have yet to recover to their pre-pandemic output levels. Global trade and investment struggled amidst these challenges. For 2024, governments are expected to curtail spending, tightened monetary policy will continue to constrain growth, and underlying productivity growth is expected to be weak. As such, another year of sluggish economic performance is expected. In Part 1 of the State of Trade 2024, we look at the drivers of economic, trade and investment performance in the global and Canadian economies for 2023 and expectations for 2024.

1.2 Global context

At the start of 2023, economies around the world were scrambling to deal with record inflation. Whispers of stagflation, recessions, and general doom and gloom were commonplace. In a positive turn of events, the global economy was resilient in 2023: growth slowed, but the global economy still expanded, as growth in the United States (U.S.) and Japan surpassed expectations.

Several positive developments supported global growth in 2023. Inflation slowed in advanced economies, as well as in emerging markets and developing economies, which averaged 4.6% and 8.3% respectively. A contraction in global energy prices by roughly 29.9% certainly helped (World Bank Group, 2024), as did tighter monetary policy in many economies. Labour markets remained relatively robust in advanced economies, with lower-than-expected unemployment helping consumption spending tick along. Importantly, supportive fiscal policy, particularly in advanced economies, contributed to the 2023 expansion. Indeed, in some major markets, government spending outpaced economic growth.

Yet 2023 was not without its share of challenges. War raged on in Ukraine, and renewed conflict broke out in the Middle East, with devastating human costs and subsequent consequences for global growth. Despite inflation declining, food inflation is still high in many countries, with the greatest impacts faced by vulnerable populations. Higher interest rates have also placed more than half of all low-income economies at risk of financial distress (IMF, 2023).

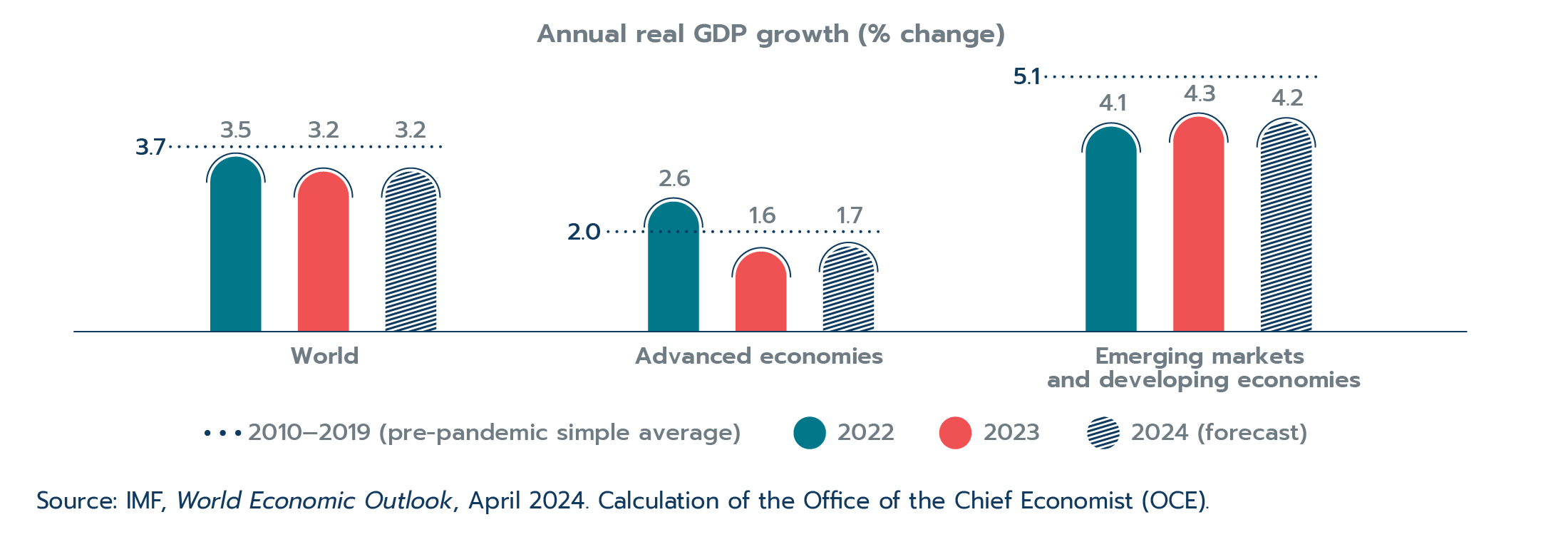

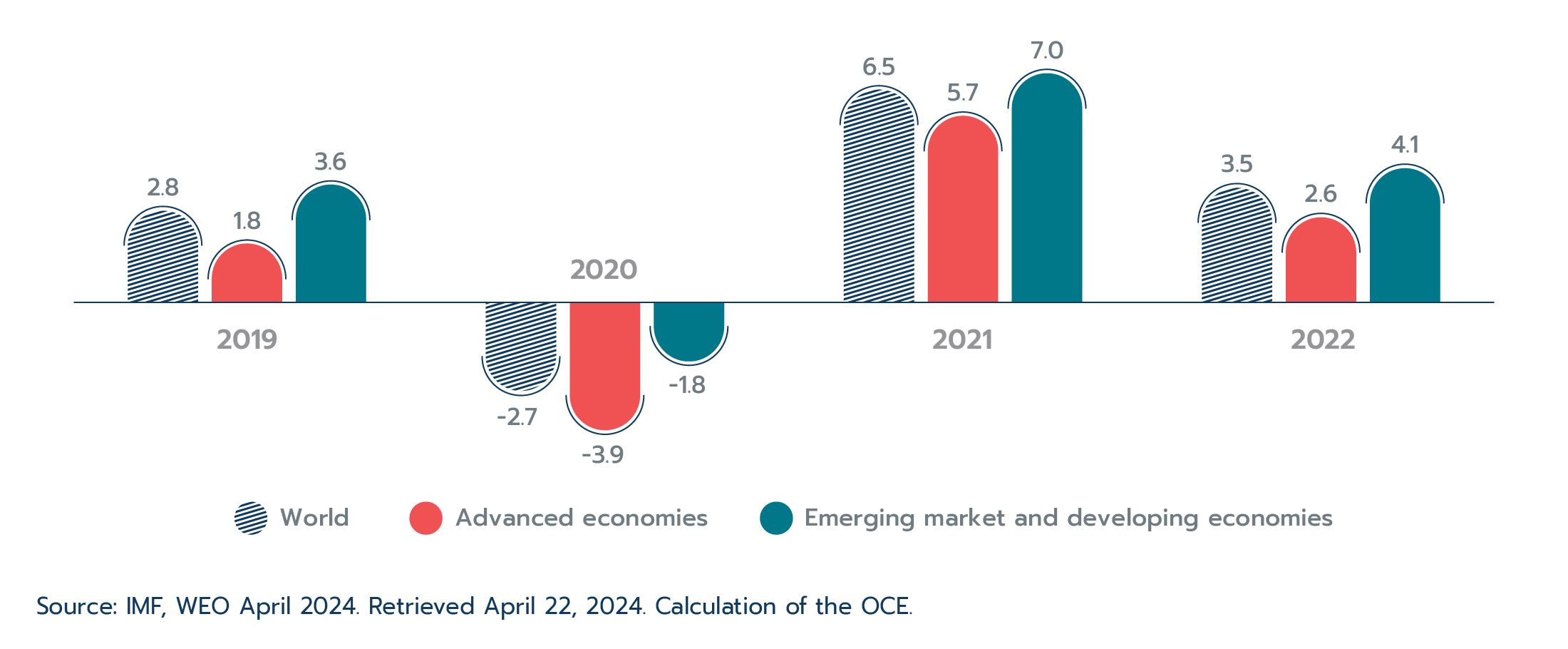

Overall, global economic growth slowed from 3.5% in 2022 to 3.2% in 2023, remaining below pre-pandemic global growth (3.7%). Advanced economies led the slowdown, with growth slowing significantly from 2.6% in 2022 to 1.6% in 2023. Meanwhile, emerging markets and developing economies exceeded expectations, with growth picking up to 4.3% in 2023.

Figure 1.1: Advanced economies drove slowdown while emerging markets picked up

Source: IMF, World Economic Outlook, April 2024. Calculation of the Office of the Chief Economist (OCE).

Text version - Figure 1.1

| GDP growth | 2010-2019 (pre-pandemic simple average) | 2022 | 2023 | 2024 (forecast) |

|---|---|---|---|---|

| World | 3.7 | 3.5 | 3.2 | 3.2 |

| Advanced economies | 2.0 | 2.6 | 1.6 | 1.7 |

| Emerging markets and developing economies | 5.1 | 4.1 | 4.3 | 4.2 |

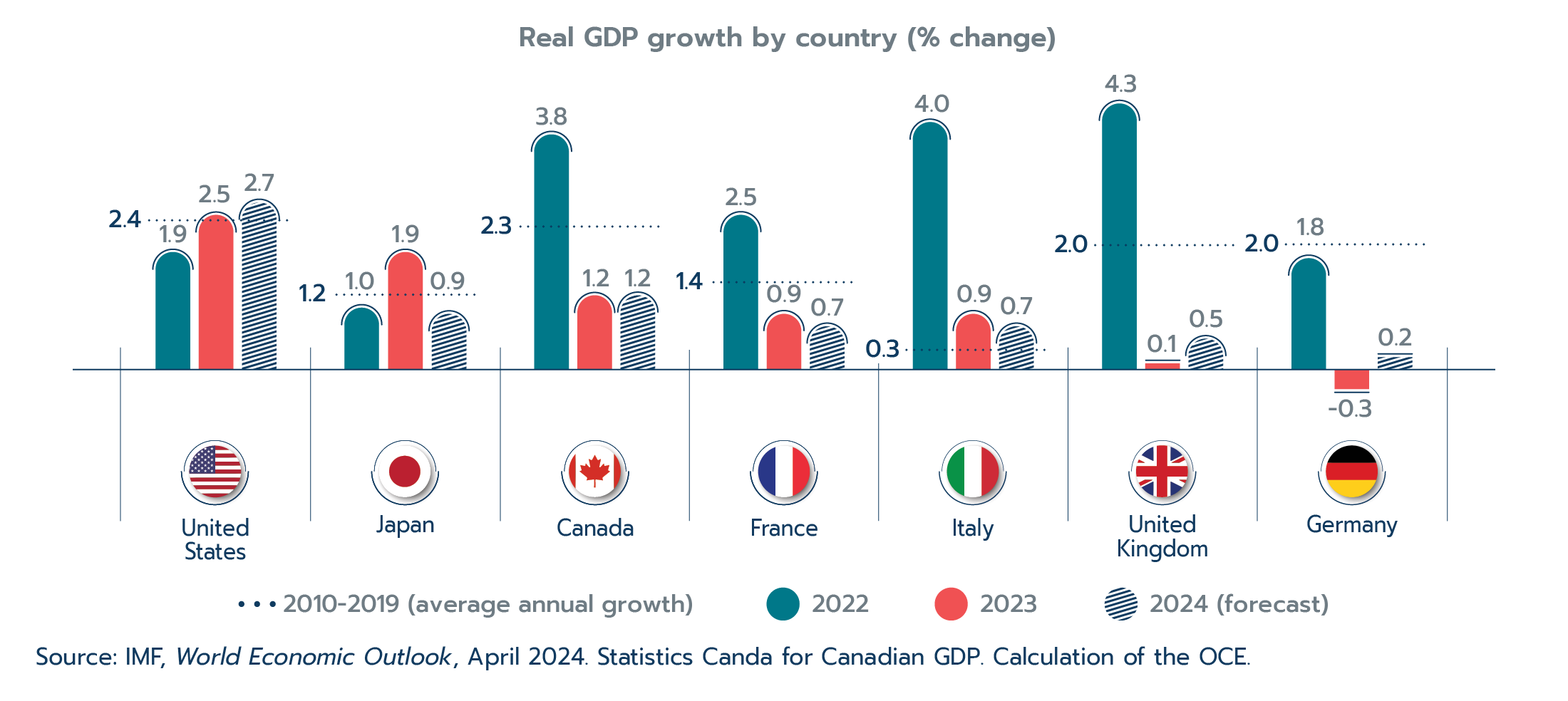

The U.S. led growth in advanced economies, despite a historically rapid rise in interest rates, consumer spending, supported by a still healthy labour market, and robust government spending supported growth. U.S. economic growth surpassed expectations by accelerating from 1.9% in 2022 to 2.5% in 2023. A rebound in fixed investment and net exports helped economic growth in Japan increase from roughly 1.0% in 2022 to 1.9%. Nonetheless, a marked slowdown in the euro area, the United Kingdom (U.K.), and Canada outweighed faster growth in the U.S. and Japan.

The ongoing war in Ukraine, inflation, and high interest rates took their toll on euro area economic growth, which fell sharply from 3.4% in 2022 to 0.4% in 2023. Germany stands out within the euro area as the economy experienced a full-year recession (-0.3%) in 2023. Similar challenges plagued the U.K.; the economy advanced by only 0.1% in 2023 after entering a technical recession with negative growth during the third and fourth quarters of the year.

In emerging markets, a growth rebound in China and Russia was offset by a slowdown in Latin America, the Middle East, and Africa. The rapid and unexpected removal of China’s COVID-19-related restrictions did not produce the economic boom that many expected. China also faced significant issues in its property sector throughout the year. Even so, China managed growth of 5.2% in 2023, an improvement from the 20-year low growth seen in 2022 (excluding 2020). Despite posting slower growth in 2023, India (7.8%) and Indonesia (5.0%), the second and sixth largest emerging markets, grew faster than other emerging markets and developing economies. Tight global financial conditions and inflation continued to pull down growth in other emerging markets and developing economies overall. Meanwhile, Saudia Arabia (-0.8%) dipped into a recession as global energy prices fell.

Global trade and investment

Global goods and services trade volumes slowed markedly, from 5.6% in 2022 to 0.3% in 2023. Advanced economies (0.3%) and emerging markets and developing economies (0.6%) saw trade growth slow significantly. While further improvement in global supply chains and the removal of pandemic-related restrictions in China supported trade, the lingering effects of the war in Ukraine, high inflation and tightened financial conditions all weighed on growth in 2023. Moreover, attacks on ships travelling through the Red Sea decreased trade volumes in the final few weeks of the year. Beyond these challenges, geopolitical fragmentation is working against trade growth: in 2023, roughly 3,388 new trade restrictions were imposed globally (Global Trade Alert, 2024).

Figure 1.2: Goods and services trade volumes growth halted in 2023

Source: IMF, World Economic Outlook, April 2024. Calculation of the OCE.

Text version - Figure 1.2

| Pre-pandemic simple average 2010 ‒ 2019 | 2022 | 2023 | 2024 (forecast) | |

|---|---|---|---|---|

| Goods and services trade volumes (year-over-year % change) | 4.6% | 5.6% | 0.3% | 3.0% |

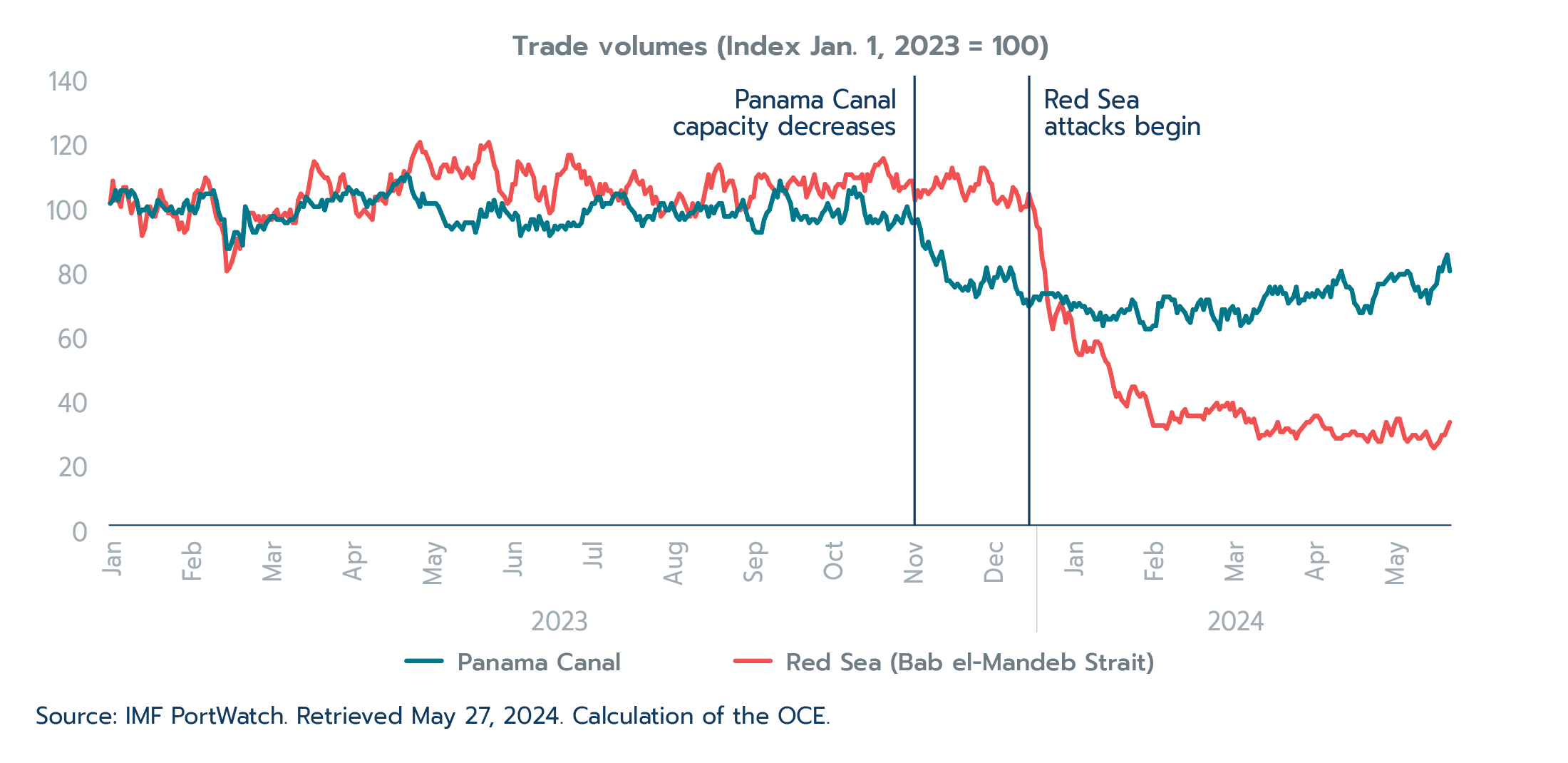

Box 1.1: Maritime trade disruptions in 2023

Thanks to the size of modern ships, the creation of key infrastructure, and the dominance of container shipping, transporting goods by water is far cheaper than it is by plane, train, or truck. In fact, the efficiency of shipping products internationally was an important driver of the rise in international supply chains (see the special feature on supply chains). Today, over 80% of goods traded globally travel by water – equivalent to over $20 trillion in 2023, or roughly seven times Canada’s GDP.Footnote 1 However, recent events have highlighted the multiple factors that can adversely impact maritime trade.

Historic drought conditions driven by climate change in the Panama Canal left canal authorities with no choice but to implement transit caps—the number of ships passing through the canal was gradually reduced from a pre-drought average of 36 ships to just 18 ships in February 2024 (Panama Canal Authority, 2024). While the number of ships able to transit the canal has since increased, the canal was operating well below historic capacity for over four months, and as of March 2024, it was still operating at about 70% capacity. Consequently, trade volumes in the Panama Canal were 32% lower in the first two months of 2024 compared to the first two months of 2023.

Meanwhile, halfway across the world, 2023 ended with a Yemeni militant group attacking ships travelling the Red Sea. The Red Sea fared worse than the Panama Canal, with trade volumes down 59% in the first two months of 2024 compared to the first two months of 2023. As of May 2024, trade volumes in both transit ways were still suppressed.

Figure 1.3: Trade volumes decline in Red Sea and Panama Canal

Source: IMF PortWatch. Retrieved May 27, 2024. Calculation of the OCE.

Text version - Figure 1.3

| Trade volumes (index January 1, 2023 = 100) | Panama Canal | Red Sea (Bab el-Mandeb Strait) |

|---|---|---|

| 2023-01-01 | 100 | 100 |

| 2023-01-01 | 100 | 100 |

| 2023-01-02 | 101 | 107 |

| 2023-01-03 | 104 | 101 |

| 2023-01-04 | 101 | 101 |

| 2023-01-05 | 104 | 99 |

| 2023-01-06 | 104 | 105 |

| 2023-01-07 | 104 | 105 |

| 2023-01-08 | 102 | 101 |

| 2023-01-09 | 104 | 97 |

| 2023-01-10 | 103 | 100 |

| 2023-01-11 | 101 | 101 |

| 2023-01-12 | 97 | 97 |

| 2023-01-13 | 98 | 90 |

| 2023-01-14 | 98 | 92 |

| 2023-01-15 | 99 | 97 |

| 2023-01-16 | 97 | 99 |

| 2023-01-17 | 96 | 97 |

| 2023-01-18 | 98 | 96 |

| 2023-01-19 | 101 | 99 |

| 2023-01-20 | 100 | 104 |

| 2023-01-21 | 99 | 101 |

| 2023-01-22 | 98 | 100 |

| 2023-01-23 | 98 | 97 |

| 2023-01-24 | 99 | 97 |

| 2023-01-25 | 97 | 96 |

| 2023-01-26 | 97 | 96 |

| 2023-01-27 | 98 | 92 |

| 2023-01-28 | 97 | 94 |

| 2023-01-29 | 100 | 91 |

| 2023-01-30 | 101 | 92 |

| 2023-01-31 | 98 | 97 |

| 2023-02-01 | 99 | 99 |

| 2023-02-02 | 97 | 103 |

| 2023-02-03 | 99 | 104 |

| 2023-02-04 | 103 | 103 |

| 2023-02-05 | 102 | 105 |

| 2023-02-06 | 103 | 108 |

| 2023-02-07 | 103 | 107 |

| 2023-02-08 | 103 | 104 |

| 2023-02-09 | 104 | 100 |

| 2023-02-10 | 101 | 96 |

| 2023-02-11 | 97 | 94 |

| 2023-02-12 | 95 | 93 |

| 2023-02-13 | 95 | 90 |

| 2023-02-14 | 86 | 79 |

| 2023-02-15 | 86 | 80 |

| 2023-02-16 | 88 | 82 |

| 2023-02-17 | 91 | 85 |

| 2023-02-18 | 91 | 89 |

| 2023-02-19 | 90 | 86 |

| 2023-02-20 | 87 | 89 |

| 2023-02-21 | 99 | 97 |

| 2023-02-22 | 97 | 97 |

| 2023-02-23 | 93 | 97 |

| 2023-02-24 | 91 | 97 |

| 2023-02-25 | 91 | 95 |

| 2023-02-26 | 93 | 96 |

| 2023-02-27 | 93 | 93 |

| 2023-02-28 | 92 | 96 |

| 2023-03-01 | 94 | 95 |

| 2023-03-02 | 95 | 96 |

| 2023-03-03 | 96 | 95 |

| 2023-03-04 | 96 | 97 |

| 2023-03-05 | 95 | 98 |

| 2023-03-06 | 95 | 95 |

| 2023-03-07 | 95 | 96 |

| 2023-03-08 | 94 | 97 |

| 2023-03-09 | 94 | 96 |

| 2023-03-10 | 95 | 98 |

| 2023-03-11 | 95 | 94 |

| 2023-03-12 | 96 | 94 |

| 2023-03-13 | 98 | 101 |

| 2023-03-14 | 100 | 103 |

| 2023-03-15 | 99 | 102 |

| 2023-03-16 | 102 | 101 |

| 2023-03-17 | 101 | 105 |

| 2023-03-18 | 100 | 110 |

| 2023-03-19 | 99 | 113 |

| 2023-03-20 | 99 | 112 |

| 2023-03-21 | 99 | 110 |

| 2023-03-22 | 101 | 109 |

| 2023-03-23 | 98 | 108 |

| 2023-03-24 | 101 | 108 |

| 2023-03-25 | 101 | 106 |

| 2023-03-26 | 101 | 101 |

| 2023-03-27 | 103 | 103 |

| 2023-03-28 | 102 | 104 |

| 2023-03-29 | 101 | 108 |

| 2023-03-30 | 103 | 109 |

| 2023-03-31 | 103 | 105 |

| 2023-04-01 | 105 | 105 |

| 2023-04-02 | 104 | 104 |

| 2023-04-03 | 103 | 102 |

| 2023-04-04 | 104 | 97 |

| 2023-04-05 | 103 | 96 |

| 2023-04-06 | 103 | 97 |

| 2023-04-07 | 101 | 98 |

| 2023-04-08 | 99 | 97 |

| 2023-04-09 | 101 | 96 |

| 2023-04-10 | 100 | 95 |

| 2023-04-11 | 101 | 102 |

| 2023-04-12 | 102 | 101 |

| 2023-04-13 | 103 | 102 |

| 2023-04-14 | 103 | 101 |

| 2023-04-15 | 102 | 100 |

| 2023-04-16 | 103 | 104 |

| 2023-04-17 | 104 | 109 |

| 2023-04-18 | 106 | 104 |

| 2023-04-19 | 106 | 107 |

| 2023-04-20 | 107 | 103 |

| 2023-04-21 | 108 | 106 |

| 2023-04-22 | 107 | 110 |

| 2023-04-23 | 109 | 109 |

| 2023-04-24 | 108 | 110 |

| 2023-04-25 | 104 | 114 |

| 2023-04-26 | 102 | 116 |

| 2023-04-27 | 101 | 118 |

| 2023-04-28 | 99 | 119 |

| 2023-04-29 | 103 | 116 |

| 2023-04-30 | 100 | 116 |

| 2023-05-01 | 100 | 114 |

| 2023-05-02 | 100 | 112 |

| 2023-05-03 | 100 | 109 |

| 2023-05-04 | 100 | 108 |

| 2023-05-05 | 99 | 108 |

| 2023-05-06 | 97 | 111 |

| 2023-05-07 | 95 | 112 |

| 2023-05-08 | 93 | 112 |

| 2023-05-09 | 93 | 110 |

| 2023-05-10 | 92 | 110 |

| 2023-05-11 | 93 | 114 |

| 2023-05-12 | 94 | 111 |

| 2023-05-13 | 93 | 110 |

| 2023-05-14 | 92 | 108 |

| 2023-05-15 | 94 | 109 |

| 2023-05-16 | 94 | 111 |

| 2023-05-17 | 94 | 109 |

| 2023-05-18 | 94 | 108 |

| 2023-05-19 | 91 | 112 |

| 2023-05-20 | 94 | 113 |

| 2023-05-21 | 98 | 118 |

| 2023-05-22 | 96 | 117 |

| 2023-05-23 | 96 | 118 |

| 2023-05-24 | 100 | 119 |

| 2023-05-25 | 98 | 116 |

| 2023-05-26 | 101 | 112 |

| 2023-05-27 | 98 | 110 |

| 2023-05-28 | 96 | 104 |

| 2023-05-29 | 100 | 103 |

| 2023-05-30 | 98 | 102 |

| 2023-05-31 | 97 | 100 |

| 2023-06-01 | 96 | 101 |

| 2023-06-02 | 95 | 106 |

| 2023-06-03 | 97 | 106 |

| 2023-06-04 | 96 | 113 |

| 2023-06-05 | 90 | 112 |

| 2023-06-06 | 92 | 110 |

| 2023-06-07 | 93 | 109 |

| 2023-06-08 | 92 | 112 |

| 2023-06-09 | 95 | 110 |

| 2023-06-10 | 95 | 108 |

| 2023-06-11 | 92 | 102 |

| 2023-06-12 | 96 | 101 |

| 2023-06-13 | 94 | 103 |

| 2023-06-14 | 92 | 105 |

| 2023-06-15 | 94 | 100 |

| 2023-06-16 | 90 | 97 |

| 2023-06-17 | 91 | 98 |

| 2023-06-18 | 93 | 104 |

| 2023-06-19 | 92 | 109 |

| 2023-06-20 | 93 | 109 |

| 2023-06-21 | 93 | 110 |

| 2023-06-22 | 92 | 111 |

| 2023-06-23 | 94 | 115 |

| 2023-06-24 | 93 | 115 |

| 2023-06-25 | 94 | 112 |

| 2023-06-26 | 93 | 111 |

| 2023-06-27 | 93 | 112 |

| 2023-06-28 | 94 | 108 |

| 2023-06-29 | 98 | 110 |

| 2023-06-30 | 97 | 106 |

| 2023-07-01 | 98 | 108 |

| 2023-07-02 | 100 | 106 |

| 2023-07-03 | 100 | 103 |

| 2023-07-04 | 102 | 101 |

| 2023-07-05 | 102 | 106 |

| 2023-07-06 | 99 | 103 |

| 2023-07-07 | 100 | 106 |

| 2023-07-08 | 100 | 104 |

| 2023-07-09 | 100 | 104 |

| 2023-07-10 | 102 | 102 |

| 2023-07-11 | 103 | 103 |

| 2023-07-12 | 103 | 101 |

| 2023-07-13 | 102 | 104 |

| 2023-07-14 | 103 | 100 |

| 2023-07-15 | 101 | 105 |

| 2023-07-16 | 99 | 106 |

| 2023-07-17 | 98 | 108 |

| 2023-07-18 | 97 | 110 |

| 2023-07-19 | 95 | 107 |

| 2023-07-20 | 96 | 106 |

| 2023-07-21 | 93 | 107 |

| 2023-07-22 | 95 | 103 |

| 2023-07-23 | 96 | 104 |

| 2023-07-24 | 96 | 105 |

| 2023-07-25 | 95 | 100 |

| 2023-07-26 | 98 | 102 |

| 2023-07-27 | 98 | 100 |

| 2023-07-28 | 100 | 96 |

| 2023-07-29 | 100 | 97 |

| 2023-07-30 | 98 | 98 |

| 2023-07-31 | 98 | 98 |

| 2023-08-01 | 100 | 99 |

| 2023-08-02 | 98 | 99 |

| 2023-08-03 | 96 | 101 |

| 2023-08-04 | 95 | 103 |

| 2023-08-05 | 97 | 102 |

| 2023-08-06 | 95 | 100 |

| 2023-08-07 | 96 | 98 |

| 2023-08-08 | 97 | 96 |

| 2023-08-09 | 97 | 100 |

| 2023-08-10 | 98 | 96 |

| 2023-08-11 | 100 | 98 |

| 2023-08-12 | 98 | 98 |

| 2023-08-13 | 99 | 101 |

| 2023-08-14 | 99 | 105 |

| 2023-08-15 | 96 | 109 |

| 2023-08-16 | 99 | 105 |

| 2023-08-17 | 97 | 109 |

| 2023-08-18 | 99 | 111 |

| 2023-08-19 | 100 | 112 |

| 2023-08-20 | 100 | 110 |

| 2023-08-21 | 96 | 104 |

| 2023-08-22 | 96 | 106 |

| 2023-08-23 | 96 | 107 |

| 2023-08-24 | 97 | 107 |

| 2023-08-25 | 96 | 104 |

| 2023-08-26 | 98 | 98 |

| 2023-08-27 | 99 | 98 |

| 2023-08-28 | 101 | 101 |

| 2023-08-29 | 98 | 98 |

| 2023-08-30 | 95 | 99 |

| 2023-08-31 | 95 | 102 |

| 2023-09-01 | 92 | 102 |

| 2023-09-02 | 91 | 108 |

| 2023-09-03 | 91 | 109 |

| 2023-09-04 | 91 | 108 |

| 2023-09-05 | 95 | 109 |

| 2023-09-06 | 97 | 108 |

| 2023-09-07 | 98 | 106 |

| 2023-09-08 | 101 | 105 |

| 2023-09-09 | 104 | 104 |

| 2023-09-10 | 102 | 103 |

| 2023-09-11 | 107 | 105 |

| 2023-09-12 | 104 | 105 |

| 2023-09-13 | 104 | 103 |

| 2023-09-14 | 102 | 106 |

| 2023-09-15 | 100 | 107 |

| 2023-09-16 | 95 | 108 |

| 2023-09-17 | 98 | 107 |

| 2023-09-18 | 96 | 106 |

| 2023-09-19 | 95 | 106 |

| 2023-09-20 | 96 | 108 |

| 2023-09-21 | 96 | 102 |

| 2023-09-22 | 94 | 104 |

| 2023-09-23 | 95 | 106 |

| 2023-09-24 | 95 | 109 |

| 2023-09-25 | 94 | 105 |

| 2023-09-26 | 95 | 103 |

| 2023-09-27 | 97 | 102 |

| 2023-09-28 | 98 | 106 |

| 2023-09-29 | 100 | 105 |

| 2023-09-30 | 98 | 103 |

| 2023-10-01 | 96 | 102 |

| 2023-10-02 | 97 | 105 |

| 2023-10-03 | 98 | 106 |

| 2023-10-04 | 94 | 106 |

| 2023-10-05 | 95 | 105 |

| 2023-10-06 | 98 | 109 |

| 2023-10-07 | 104 | 109 |

| 2023-10-08 | 103 | 109 |

| 2023-10-09 | 105 | 108 |

| 2023-10-10 | 102 | 108 |

| 2023-10-11 | 103 | 108 |

| 2023-10-12 | 102 | 109 |

| 2023-10-13 | 97 | 104 |

| 2023-10-14 | 94 | 109 |

| 2023-10-15 | 96 | 107 |

| 2023-10-16 | 94 | 110 |

| 2023-10-17 | 95 | 112 |

| 2023-10-18 | 94 | 112 |

| 2023-10-19 | 95 | 113 |

| 2023-10-20 | 97 | 114 |

| 2023-10-21 | 96 | 112 |

| 2023-10-22 | 92 | 109 |

| 2023-10-23 | 93 | 108 |

| 2023-10-24 | 94 | 105 |

| 2023-10-25 | 96 | 109 |

| 2023-10-26 | 95 | 104 |

| 2023-10-27 | 94 | 105 |

| 2023-10-28 | 97 | 105 |

| 2023-10-29 | 99 | 106 |

| 2023-10-30 | 96 | 107 |

| 2023-10-31 | 94 | 107 |

| 2023-11-01 | 94 | 101 |

| 2023-11-02 | 95 | 104 |

| 2023-11-03 | 92 | 102 |

| 2023-11-04 | 87 | 104 |

| 2023-11-05 | 86 | 104 |

| 2023-11-06 | 88 | 103 |

| 2023-11-07 | 85 | 104 |

| 2023-11-08 | 83 | 105 |

| 2023-11-09 | 81 | 108 |

| 2023-11-10 | 83 | 106 |

| 2023-11-11 | 85 | 105 |

| 2023-11-12 | 81 | 107 |

| 2023-11-13 | 76 | 109 |

| 2023-11-14 | 76 | 108 |

| 2023-11-15 | 75 | 111 |

| 2023-11-16 | 74 | 108 |

| 2023-11-17 | 75 | 109 |

| 2023-11-18 | 74 | 106 |

| 2023-11-19 | 73 | 103 |

| 2023-11-20 | 74 | 101 |

| 2023-11-21 | 73 | 103 |

| 2023-11-22 | 76 | 105 |

| 2023-11-23 | 75 | 104 |

| 2023-11-24 | 71 | 106 |

| 2023-11-25 | 72 | 106 |

| 2023-11-26 | 75 | 111 |

| 2023-11-27 | 76 | 111 |

| 2023-11-28 | 80 | 110 |

| 2023-11-29 | 76 | 107 |

| 2023-11-30 | 74 | 106 |

| 2023-12-01 | 77 | 101 |

| 2023-12-02 | 77 | 100 |

| 2023-12-03 | 80 | 101 |

| 2023-12-04 | 78 | 102 |

| 2023-12-05 | 76 | 101 |

| 2023-12-06 | 77 | 99 |

| 2023-12-07 | 80 | 101 |

| 2023-12-08 | 78 | 105 |

| 2023-12-09 | 74 | 104 |

| 2023-12-10 | 72 | 102 |

| 2023-12-11 | 72 | 98 |

| 2023-12-12 | 69 | 99 |

| 2023-12-13 | 70 | 99 |

| 2023-12-14 | 68 | 103 |

| 2023-12-15 | 69 | 100 |

| 2023-12-16 | 71 | 98 |

| 2023-12-17 | 71 | 93 |

| 2023-12-18 | 70 | 92 |

| 2023-12-19 | 72 | 83 |

| 2023-12-20 | 72 | 79 |

| 2023-12-21 | 72 | 70 |

| 2023-12-22 | 72 | 65 |

| 2023-12-23 | 72 | 61 |

| 2023-12-24 | 71 | 65 |

| 2023-12-25 | 72 | 67 |

| 2023-12-26 | 71 | 69 |

| 2023-12-27 | 69 | 67 |

| 2023-12-28 | 71 | 63 |

| 2023-12-29 | 69 | 66 |

| 2023-12-30 | 67 | 64 |

| 2023-12-31 | 69 | 58 |

| 2024-01-01 | 68 | 54 |

| 2024-01-02 | 69 | 53 |

| 2024-01-03 | 68 | 53 |

| 2024-01-04 | 68 | 57 |

| 2024-01-05 | 66 | 54 |

| 2024-01-06 | 67 | 55 |

| 2024-01-07 | 66 | 54 |

| 2024-01-08 | 64 | 57 |

| 2024-01-09 | 64 | 57 |

| 2024-01-10 | 66 | 56 |

| 2024-01-11 | 62 | 53 |

| 2024-01-12 | 65 | 51 |

| 2024-01-13 | 64 | 50 |

| 2024-01-14 | 64 | 47 |

| 2024-01-15 | 65 | 43 |

| 2024-01-16 | 64 | 40 |

| 2024-01-17 | 66 | 41 |

| 2024-01-18 | 67 | 39 |

| 2024-01-19 | 66 | 38 |

| 2024-01-20 | 67 | 37 |

| 2024-01-21 | 67 | 41 |

| 2024-01-22 | 70 | 43 |

| 2024-01-23 | 69 | 43 |

| 2024-01-24 | 66 | 41 |

| 2024-01-25 | 63 | 40 |

| 2024-01-26 | 63 | 41 |

| 2024-01-27 | 61 | 40 |

| 2024-01-28 | 61 | 37 |

| 2024-01-29 | 61 | 34 |

| 2024-01-30 | 62 | 31 |

| 2024-01-31 | 62 | 31 |

| 2024-02-01 | 69 | 31 |

| 2024-02-02 | 68 | 31 |

| 2024-02-03 | 71 | 31 |

| 2024-02-04 | 71 | 30 |

| 2024-02-05 | 71 | 32 |

| 2024-02-06 | 70 | 35 |

| 2024-02-07 | 70 | 33 |

| 2024-02-08 | 66 | 33 |

| 2024-02-09 | 68 | 32 |

| 2024-02-10 | 67 | 35 |

| 2024-02-11 | 66 | 36 |

| 2024-02-12 | 64 | 34 |

| 2024-02-13 | 63 | 34 |

| 2024-02-14 | 67 | 34 |

| 2024-02-15 | 67 | 34 |

| 2024-02-16 | 69 | 34 |

| 2024-02-17 | 70 | 34 |

| 2024-02-18 | 67 | 33 |

| 2024-02-19 | 70 | 36 |

| 2024-02-20 | 70 | 35 |

| 2024-02-21 | 66 | 36 |

| 2024-02-22 | 64 | 37 |

| 2024-02-23 | 63 | 39 |

| 2024-02-24 | 61 | 36 |

| 2024-02-25 | 67 | 37 |

| 2024-02-26 | 67 | 37 |

| 2024-02-27 | 64 | 38 |

| 2024-02-28 | 67 | 36 |

| 2024-02-29 | 68 | 38 |

| 2024-03-01 | 66 | 34 |

| 2024-03-02 | 67 | 35 |

| 2024-03-03 | 62 | 36 |

| 2024-03-04 | 63 | 35 |

| 2024-03-05 | 65 | 32 |

| 2024-03-06 | 63 | 33 |

| 2024-03-07 | 64 | 32 |

| 2024-03-08 | 67 | 33 |

| 2024-03-09 | 66 | 30 |

| 2024-03-10 | 67 | 27 |

| 2024-03-11 | 69 | 28 |

| 2024-03-12 | 71 | 28 |

| 2024-03-13 | 72 | 29 |

| 2024-03-14 | 74 | 28 |

| 2024-03-15 | 72 | 29 |

| 2024-03-16 | 74 | 30 |

| 2024-03-17 | 72 | 32 |

| 2024-03-18 | 74 | 29 |

| 2024-03-19 | 72 | 29 |

| 2024-03-20 | 72 | 30 |

| 2024-03-21 | 69 | 30 |

| 2024-03-22 | 70 | 29 |

| 2024-03-23 | 71 | 29 |

| 2024-03-24 | 74 | 27 |

| 2024-03-25 | 69 | 29 |

| 2024-03-26 | 70 | 30 |

| 2024-03-27 | 70 | 31 |

| 2024-03-28 | 72 | 32 |

| 2024-03-29 | 71 | 32 |

| 2024-03-30 | 72 | 33 |

| 2024-03-31 | 71 | 34 |

| 2024-04-01 | 73 | 34 |

| 2024-04-02 | 72 | 33 |

| 2024-04-03 | 71 | 31 |

| 2024-04-04 | 73 | 30 |

| 2024-04-05 | 74 | 30 |

| 2024-04-06 | 71 | 30 |

| 2024-04-07 | 76 | 28 |

| 2024-04-08 | 75 | 27 |

| 2024-04-09 | 77 | 27 |

| 2024-04-10 | 79 | 27 |

| 2024-04-11 | 76 | 28 |

| 2024-04-12 | 74 | 28 |

| 2024-04-13 | 74 | 28 |

| 2024-04-14 | 73 | 29 |

| 2024-04-15 | 69 | 29 |

| 2024-04-16 | 68 | 28 |

| 2024-04-17 | 66 | 28 |

| 2024-04-18 | 66 | 28 |

| 2024-04-19 | 68 | 27 |

| 2024-04-20 | 68 | 26 |

| 2024-04-21 | 66 | 28 |

| 2024-04-22 | 70 | 29 |

| 2024-04-23 | 72 | 27 |

| 2024-04-24 | 75 | 26 |

| 2024-04-25 | 75 | 26 |

| 2024-04-26 | 75 | 29 |

| 2024-04-27 | 76 | 32 |

| 2024-04-28 | 77 | 30 |

| 2024-04-29 | 78 | 28 |

| 2024-04-30 | 76 | 31 |

| 2024-05-01 | 77 | 33 |

| 2024-05-02 | 78 | 33 |

| 2024-05-03 | 78 | 30 |

| 2024-05-04 | 78 | 27 |

| 2024-05-05 | 79 | 26 |

| 2024-05-06 | 78 | 27 |

| 2024-05-07 | 75 | 28 |

| 2024-05-08 | 73 | 28 |

| 2024-05-09 | 74 | 27 |

| 2024-05-10 | 71 | 27 |

| 2024-05-11 | 72 | 28 |

| 2024-05-12 | 73 | 29 |

| 2024-05-13 | 69 | 27 |

| 2024-05-14 | 73 | 25 |

| 2024-05-15 | 74 | 24 |

| 2024-05-16 | 75 | 25 |

| 2024-05-17 | 80 | 26 |

| 2024-05-18 | 79 | 28 |

| 2024-05-19 | 82 | 28 |

| 2024-05-20 | 84 | 30 |

| 2024-05-21 | 79 | 32 |

The Panama Canal and the Red Sea routes combined account for roughly 20% of global maritime trade volumes; finding alternative routes or transport modes can be costly. For example, beyond the Red Sea, the next best alternative for ships travelling from Asia to Northern Europe is to travel around the southern tip of Africa, a journey that adds an additional week or two to transit times. Delays of this length significantly impact fuel, insurance, and other costs.

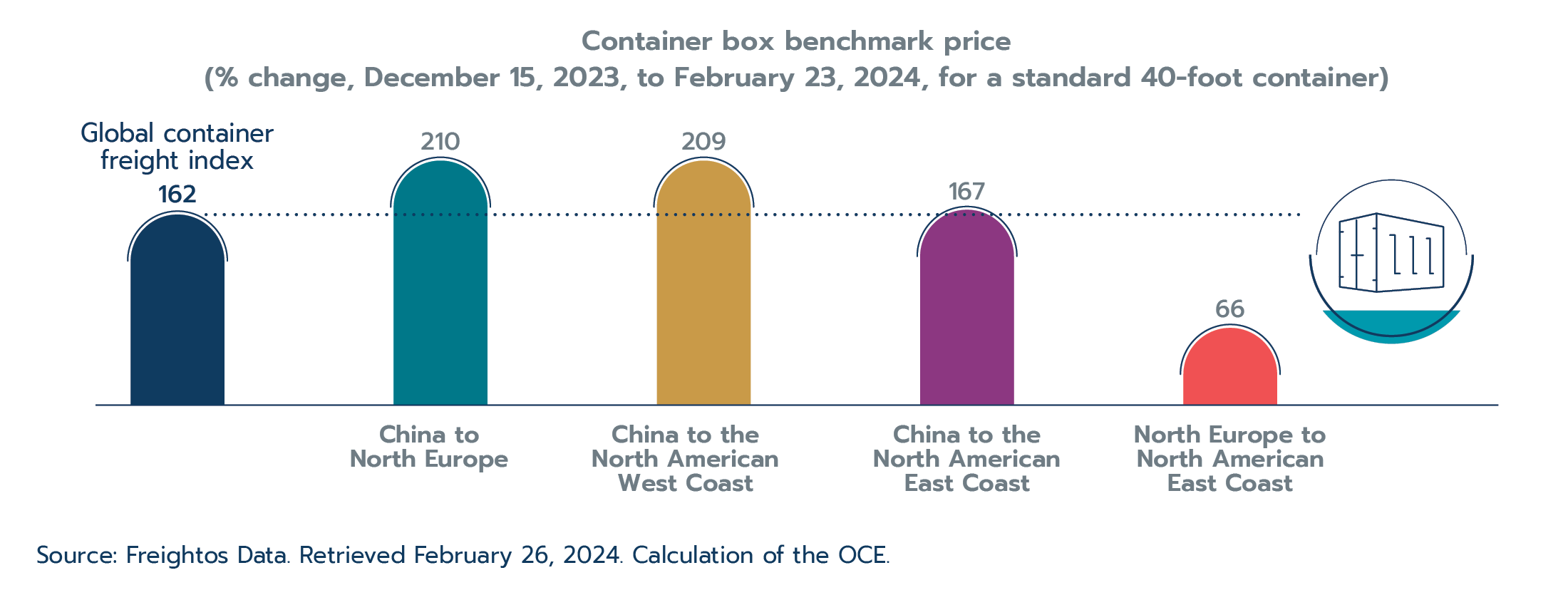

By the end of February 2024, maritime freight prices had increased by 162% on average in response. Price increases for sailings from China to Northern Europe, one of the most affected routes, peaked at approximately 274% in mid-January. While this is a significant uptick, these events have, so far, had a much smaller impact than the COVID-19 pandemic, when prices increased nearly eight-fold given the simultaneous supply and demand shock.

Figure 1.4: Global maritime freight prices spike

Source: Freightos Data. Retrieved February 26, 2024. Calculations of the OCE.

Text version - Figure 1.4

| Container box | Benchmark price |

|---|---|

| Global container freight index | 162 |

| China to North Europe | 210 |

| China to the North American West Coast | 209 |

| China to the North American East Coast | 167 |

| North Europe to North American East Coast | 66 |

Despite being smaller than the price increases seen in the wake of the COVID-19 disruptions, these events put upward pressure on the cost of goods globally at a time when much of the world continues to combat high inflation. The IMF estimates that when global shipping costs double, they add roughly 0.7 percentage points to the global inflation rate (Carrière-Swallow et al., 2022). In the case of the Panama Canal and the Red Sea disruptions, Oxford Economics estimates that they could add roughly 0.25 percentage points to U.S. inflation in 2024 (Sweet, 2024).

Adding fuel to the fire, 2023 also saw maritime shipping disrupted by strikes at major ports, including the Port of Vancouver and the Port of Prince Rupert. The strikes in British Columbia lasted for 13 days in the summer of 2023, causing major disruptions. Moreover, as of May 2024, there is a risk that longshore workers at the Port of Montréal and workers operating ports on the East Coast and Gulf Coast of the U.S. will strike. Shipping on the East Coast U.S. was also disrupted by the collapse of the Francis Scott Key Bridge in Baltimore on March 26, 2024. Trade volumes in the Port of Baltimore, which accounts for nearly 3% of U.S. maritime trade, fell sharply in the immediate aftermath (IMF PortWatch, 2024). The Port of Halifax is one of the top ten largest ports to send and receive ships from Baltimore and may experience higher unplanned volumes, which could result in delays. However, the disruptions are unlikely to have a significant impact on global shipping prices or the Canadian economy.

Ultimately, there have always been risks to maritime shipping, and the industry is used to adapting to disruptions, whether they are driven by environmental, geopolitical, labour, or other factors. Another recent example of this adaptation is when shippers rerouted from the Black Sea to ports on the Danube River in the wake of the war in Ukraine. However, if the frequency and severity of these risks increase, such as what might occur if environmental risks continue their current trajectory (Lee et al., 2023), trade transportation costs could increase in a more meaningful and permanent way. This would negatively impact global trade and economic growth.

With restrictive financial conditions globally and a continued rise in geopolitical fragmentation, global investment fell in 2023. Based on preliminary data from the United Nations Conference on Trade and Development (UNCTAD), global foreign direct investment (FDI) flows contracted by 18% once flows to European conduit economies are removed. In developed economies, flows contracted by 28% as flows to Europe and other developed economies contracted, while flows to North America posted zero growth. FDI flows to developing economies declined by 9%, led by a 12% contraction in flows to Asia. Importantly, FDI flows to China contracted by 6% in 2023, reflecting the country’s financial market and macroeconomic troubles that year.

Preliminary data also showed that cross-border mergers and acquisitions (M&A) sales contracted for the second year in a row (UNCTAD, 2024). The contraction was widespread across all major regions. Meanwhile, announcements for greenfield investments decreased in 2023 (-6%), but the value of projects announced increased (6%), which may support a recovery of FDI flows in 2024.

Looking ahead

While the global economy was more resilient than anticipated in 2023, it is on uncertain footing heading into 2024. The IMF expects global economic growth to remain at 3.2% in 2024 (Figure 1.1), with balanced upside and downside risks. If this growth rate materializes, it would be consistent with a soft landing (i.e., avoiding widespread, deep recessions).

Whether inflation successfully comes back into target range—the process for which is anticipated to be a tricky balancing act—is an important determinant of the IMF’s outlook. Several factors could fuel inflation in 2023. Trade logistics issues, such as those in the Red Sea and Panama Canal, could worsen. Multiple forces could cause global energy prices to spike again, such as an intensification of the ongoing conflict in the Middle East. Furthermore, labour market tightness could persist, or extreme weather events could lead to higher food prices. Any of these events might lead central banks to keep interest rates higher for longer. On the other hand, a faster easing of labour market tightness, stronger pass-through of lower energy prices, or a decrease in the corporate profit margin to avoid further price increases could all lead to a slowdown in the rate of inflation, resulting in central banks lowering interest rates sooner than anticipated.

In advanced economies, the IMF forecasts growth will pick up marginally from 1.6% in 2023 to 1.7% in 2024. The U.S. is forecast to lead growth as it continues to exceptional performance, increasing from 2.5% in 2023 to 2.7% in 2024. The euro area and the U.K. will continue to drag down growth in advanced economies, expanding by just 0.8% and 0.5%, respectively, in 2024. Growth in emerging markets and developing economies is forecast to slow marginally from 4.3% in 2023 to 4.2% in 2024. A slowdown in emerging Asia and Latin America is forecast to be offset by an uptick in the Middle East and Central Asia, as well as Sub-Saharan Africa. Despite its upswing in 2023, China’s economy faces several headwinds. China’s growth is forecast to slow from 5.2% in 2023 to 4.6% in 2024. Meanwhile, India is a potential beneficiary of global supply chain diversification. It will be a growth leader among emerging markets in 2024 but is still forecast to slow, from 7.8% in 2023 to 6.8% in 2024.

If the baseline outlook for the global economy holds and financial restrictions begin to ease, trade and investment should benefit. The IMF forecasts that goods and services trade volumes will rebound in 2024, advancing 3.0%. UNCTAD predicts that a modest increase in FDI flows in 2024 is also possible. Of course, if trade logistics issues persist, global debt burdens prove too much, or geopolitical fragmentation worsens, trade and investment may underperform these estimates.

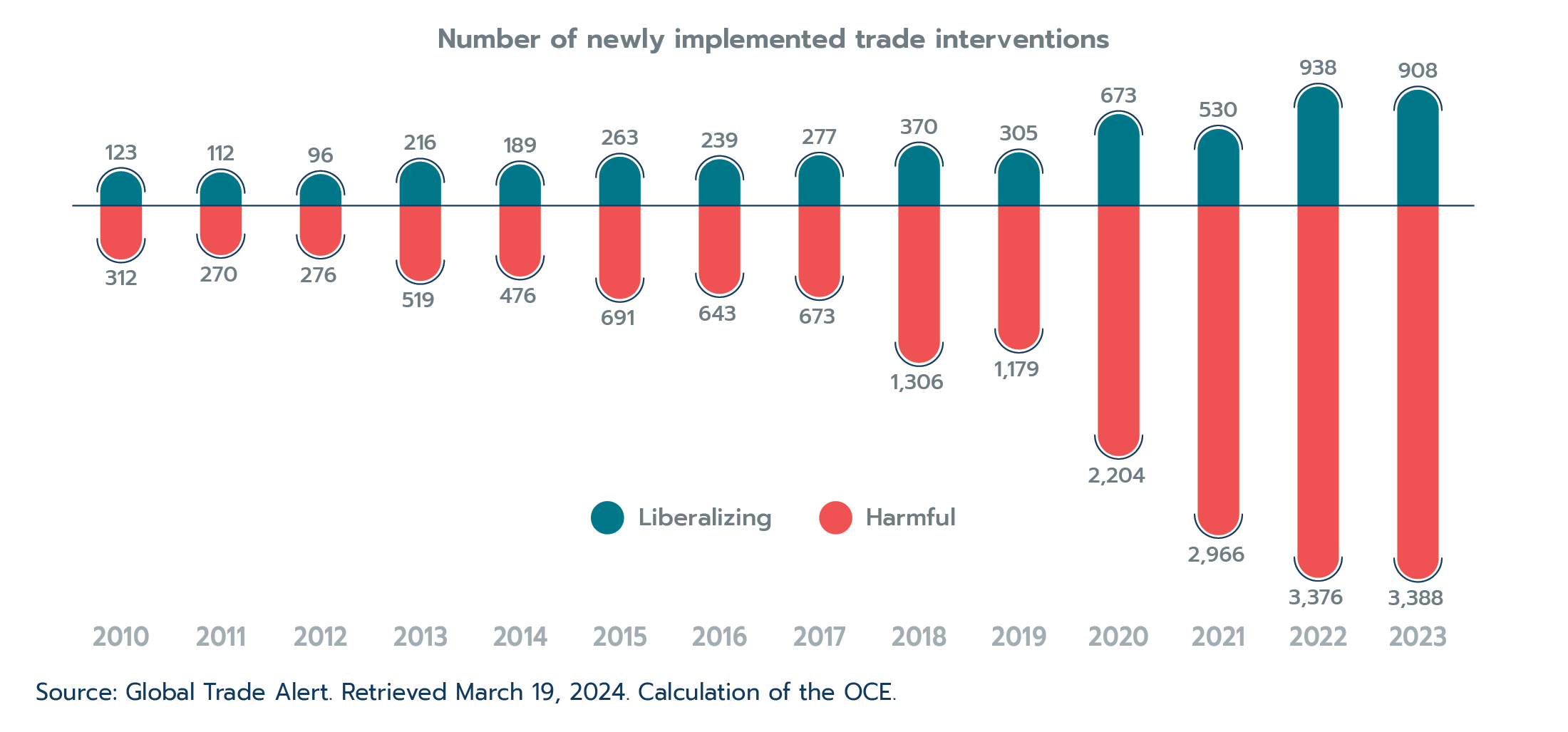

Box 1.2: Harmful trade measures are rising

The year 2023 was another pernicious year for trade policy. Harmful trade measures are on the rise and industrial policies in many economies are increasingly protectionist. Over time, these measures could sap economic growth.

In 2023, nearly 3,400 new harmful trade and investment measures were implemented globally, while only 908 liberalizing measures were implemented.Footnote 2 The average number of new harmful measures implemented between 2020 and 2023 was three times higher compared to measures implemented between 2016 and 2019. China and Germany were the most affected countries, with over 1,100 harmful measures affecting them in 2023. Over 850 harmful measures affected Canada that year.

Figure 1.5: Protectionism has grown substantially post-pandemic

Source: Global Trade Alert. Retrieved March 19, 2024. Calculation of the OCE.

Text version - Figure 1.5

| Number of newly implemented trade interventions | Harmful | Liberalizing |

|---|---|---|

| 2010 | 312 | 123 |

| 2011 | 270 | 112 |

| 2012 | 276 | 96 |

| 2013 | 519 | 216 |

| 2014 | 476 | 189 |

| 2015 | 691 | 263 |

| 2016 | 643 | 239 |

| 2017 | 673 | 277 |

| 2018 | 1,306 | 370 |

| 2019 | 1,179 | 305 |

| 2020 | 2,204 | 673 |

| 2021 | 2,966 | 530 |

| 2022 | 3,376 | 938 |

| 2023 | 3,388 | 908 |

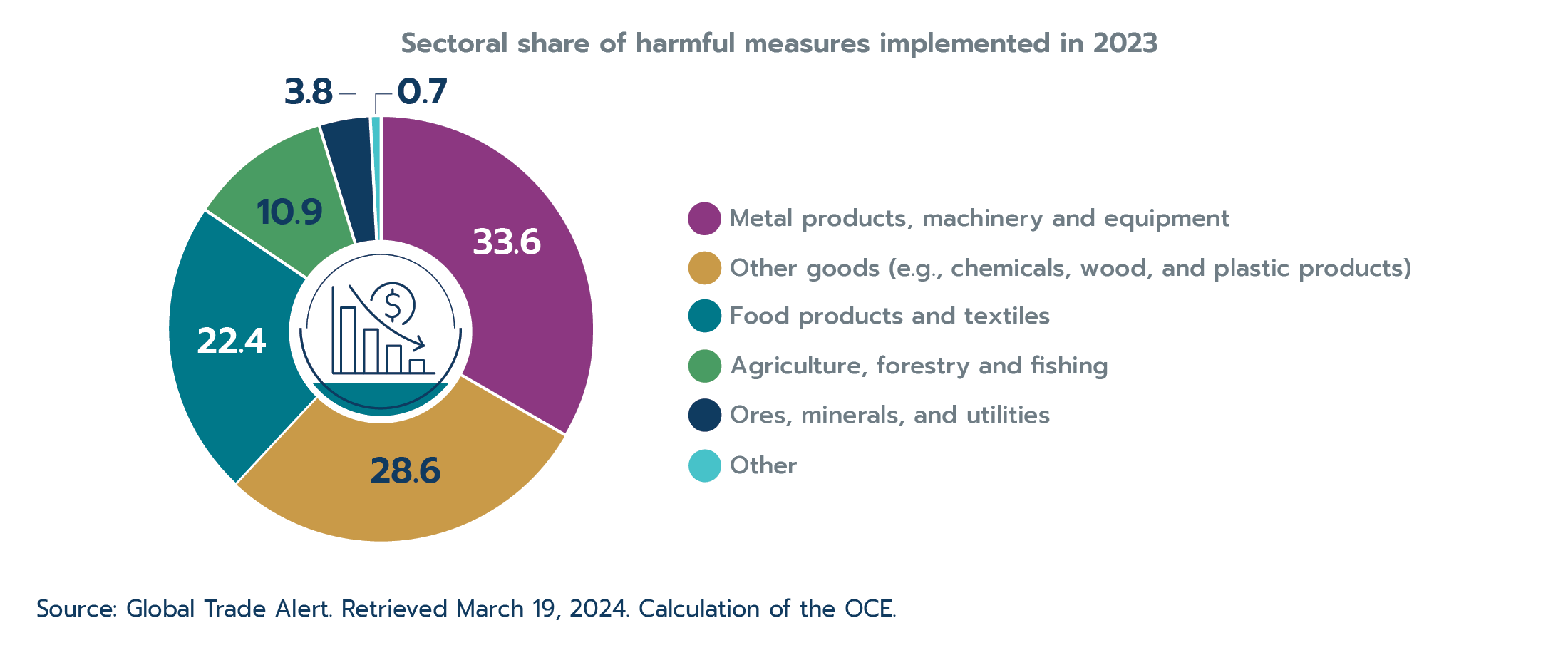

According to Global Trade Alert, the metal products, machinery, and equipment sector (33.6%) accounted for the greatest share of newly implemented harmful measures in 2023, with miscellaneous goods such as chemicals, wood products, and plastics (28.6%), and food products and textiles (22.4%) not far behind. Given their importance in construction, auto manufacturing, and other marquee industries, steel and iron products topped the list of harmful measures, as they have for at least the past decade. In recent years, however, advanced technologies, such as semiconductors or low-carbon technologies, have seen more restrictions placed on them. Overall, estimates suggest that the measures implemented in 2023 cover at least 22.0% of global trade (Evenett et al., 2024).

Figure 1.6: Metal and metal products continue to top the list of trade restrictions

Source: Global Trade Alert. Retrieved March 19, 2024. Calculation of the OCE.

Text version - Figure 1.6

| Sector | Sectoral share of harmful measures implemented in 2023 |

|---|---|

| Metal products, machinery and equipment | 33.6% |

| Transportable goods (e.g., chemicals, plastics, wood) | 28.6% |

| Food products and textiles | 22.4% |

| Agriculture, forestry and fishing | 10.9% |

| Ores, minerals, and utilities | 3.8% |

| Other | 0.7% |

Over half (58.1%) of the harmful trade measures implemented in 2023 were in the form of non-export domestic subsidies, such as government loans, tax relief, or financial grants to businesses or industries.Footnote 3 Export-related measures (including export subsidies) only accounted for 13.4% of the harmful measures implemented. In 2023, most domestic subsidies were implemented by advanced economies, whereas emerging markets and developing economies are more likely to use import and export restrictions. This may change over time and may also reflect the lower fiscal capacity of emerging markets and developing economies to implement domestic subsidies.

The stated motivation for recently implemented harmful measures ranges from strategic competitiveness and geopolitical concerns to climate change mitigation and national security. Regardless of their motivation, protectionist industrial policies risk creating a tit-for-tat environment whereby all countries or country groups are competing to lead in the same industries. According to IMF researchers, for subsidies announced or implemented in 2023, there is a roughly 74.0% chance that if China, the E.U., or the U.S. implement a subsidy for a given product, another major economy will implement a retaliatory subsidy on that same product within one year (Evenett et al., 2024).

Not all restrictive trade measures are inherently bad, as they can sometimes be aimed at supporting other policy objectives. For instance, restricting trade in plastic packaging may help the climate transition, even though it would reduce trade overall. However, many export/import restrictions will raise the cost of goods and services globally and could slow progress towards other global objectives, such as climate change mitigation, by making needed technologies more expensive or by slowing their market entry. Furthermore, subsidies can result in duplication of efforts and oversupply, and they may not be a good use of limited fiscal space.

Ultimately, these harmful trade measures hinder trade and economic growth. The IMF estimates that an increase in trade restrictions could decrease global output from 0.2%, in a limited restriction scenario, to up to 7% of GDP in a high-restriction scenario (Aiyar, 2023). With deeper technological decoupling, the output losses could be as much as 12% for some countries. As Kristalina Georgieva, Managing Director of the IMF, put it, the rise of fragmentation is “a process that begins with increasing barriers to trade and investment and, in its extreme form, ends with countries’ breaking into rival economic blocs—an outcome that risks reversing the transformative gains that global economic integration has produced” (Georgieva, 2023).

1.3 Canadian economic performance

After two consecutive years of solid growth, the Canadian economy slowed from 3.8% growth in 2022 to 1.2% in 2023. The slowdown was expected as the impacts of high inflation and interest rates combined to soften demand and squash investment.

Robust household spending and exports helped the economy kick off 2023 on a high note, with gross domestic product (GDP) expanding by 3.4% (seasonally adjusted at annual rates) in the first quarter. Economic performance was then shaky throughout the rest of the year. GDP edged forward by just 0.7% in the second quarter before contracting by 0.3% in the third quarter. The economy ended 2023 on a flat note, expanding by just 0.1% in the fourth quarter. Overall, a technical recession was avoided in 2023, and a “soft landing” seems increasingly likely.

Throughout the year, household spending helped the Canadian economy avoid recession territory; however, this was largely driven by population growth. On a per-person basis, household spending decreased in 2023. Net exports, supported by a strong U.S. economy, were the greatest contributor to growth. Meanwhile, a decrease in business investment by 4.8% and a contraction in inventories were the largest detractors from growth in 2023.

After reaching a 40-year peak of 6.8% in 2022, inflation slowed to 3.9% in 2023. Driven by the post-pandemic resurgence in demand for in-person activities, services inflation (4.6%) outpaced goods inflation (3.1%). Energy prices played a significant role in slowing goods inflation; after increasing by 22.5% in 2022, energy prices contracted by 4.2% in 2023. Despite the overall inflation slowdown, food (7.5%) and shelter (5.6%) inflation were too high in 2023, which affected Canada’s vulnerable populations disproportionately. Lastly, inflation slowed sharply in the first six months of 2023 but its decline decelerated in the second half of the year. In its continued efforts to combat inflation, the Bank of Canada hiked the policy interest rate three times in 2023; it reached a 23-year high of 5.0% in July, where it remained as of May 2024. Early data for 2024 shows that inflation has dipped into the target range of 1.0% to 3.0%; however, the effects of past rate hikes are expected to linger. The impacts of monetary policy changes on the economy generally take between 18 and 24 months to fully materialize (Bank of Canada, 2021).

Overall, Canada posted the third strongest economic performance among G7 economies in 2023, behind only the U.S. and Japan (Figure 1.7). Looking ahead, the IMF forecasts Canadian economic growth to stay roughly at 1.2% in 2024; only the U.S. is expected to see a stronger performance among G7 countries.

Figure 1.7: Canada posts third-strongest growth among G7 countries in 2023, poised for second-strongest performance in 2024

Text version - Figure 1.7

| Country | 2010–2019 (average annual growth) | 2022 | 2023 | 2024 (forecast) |

|---|---|---|---|---|

| Source: IMF, World Economic Outlook, April 2024. Statistics Canda for Canadian GDP. Calculation of the OCE. | ||||

| United States | 2.4 | 1.9 | 2.5 | 2.7 |

| Japan | 1.2 | 1.0 | 1.9 | 0.9 |

| Canada | 2.3 | 3.8 | 1.1 | 1.2 |

| Italy | 0.3 | 4.0 | 0.9 | 0.7 |

| France | 1.4 | 2.5 | 0.9 | 0.7 |

| United Kingdom | 2.0 | 4.3 | 0.1 | 0.5 |

| Germany | 2.0 | 1.8 | -0.3 | 0.2 |

Industry performance

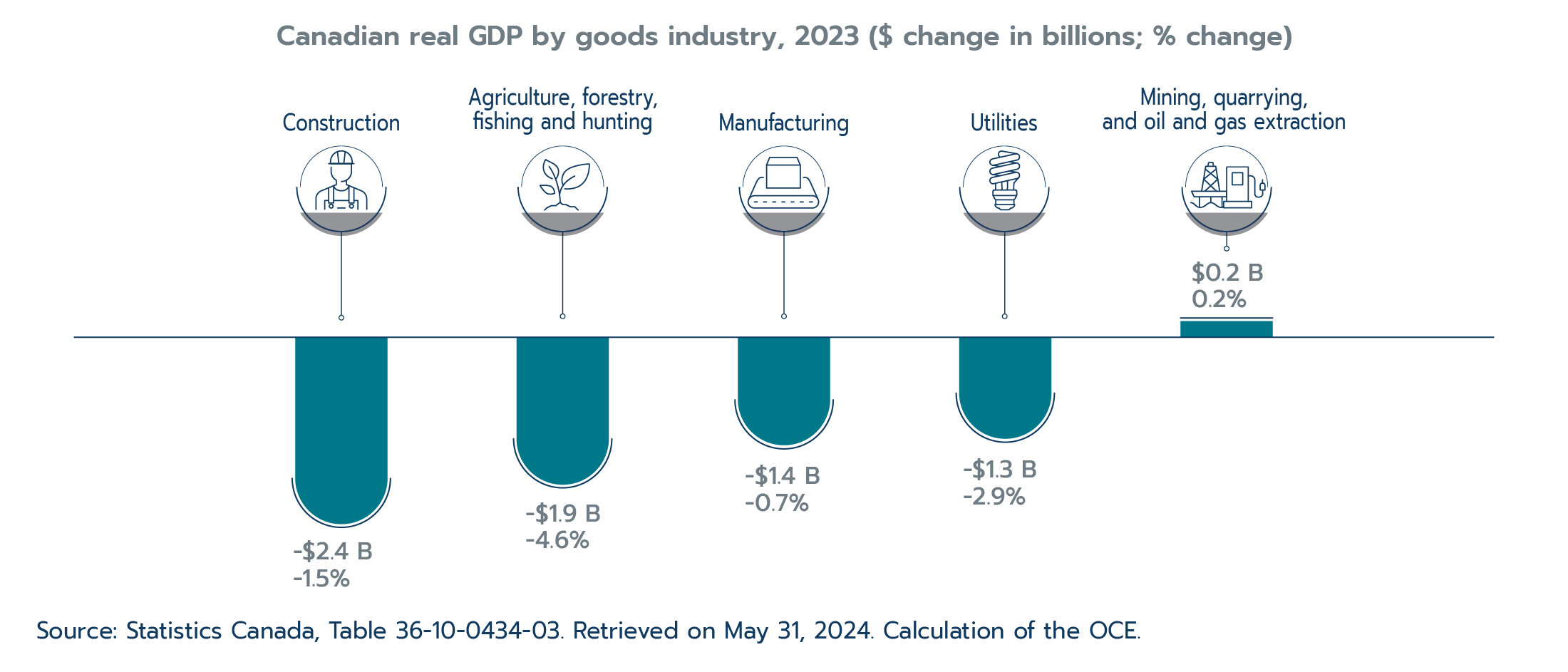

After advancing by 3.8% in 2022, goods industries contracted by 1.2% in 2023. The contraction was widespread, with four of five major goods industries declining. The interest-rate-sensitive construction industry, driven by residential buildings, was the largest detractor from growth in 2023 (Figure 1.8). Dry conditions in Western Canada pushed down crop production, causing agriculture, forestry, and fishing to be the second largest contributor to the goods contraction. Manufacturing contracted for the first time since 2020. Declines across several subindustries, including plastics, wood, and paper manufacturing, outweighed robust growth in motor vehicle and machinery manufacturing. Mining, quarrying, and oil and gas extraction was the only goods industry to expand in 2023, albeit by a modest 0.2%.

Figure 1.8: Goods industries struggle in 2023

Text version - Figure 1.8

| Goods industry | 2023 vs. 2022 ($ change, billions) | 2023 vs. 2022 (% change) |

|---|---|---|

| Source: Statistics Canada, Table 36-10-0434-03. Retrieved on May 31, 2024. Calculation of the OCE. | ||

| Construction | -2.4 | -1.5% |

| Agriculture, forestry, fishing and hunting | -1.9 | -4.6% |

| Manufacturing | -1.4 | -0.7% |

| Utilities | -1.3 | -2.9% |

| Mining, quarrying, and oil and gas extraction | 0.2 | 0.2% |

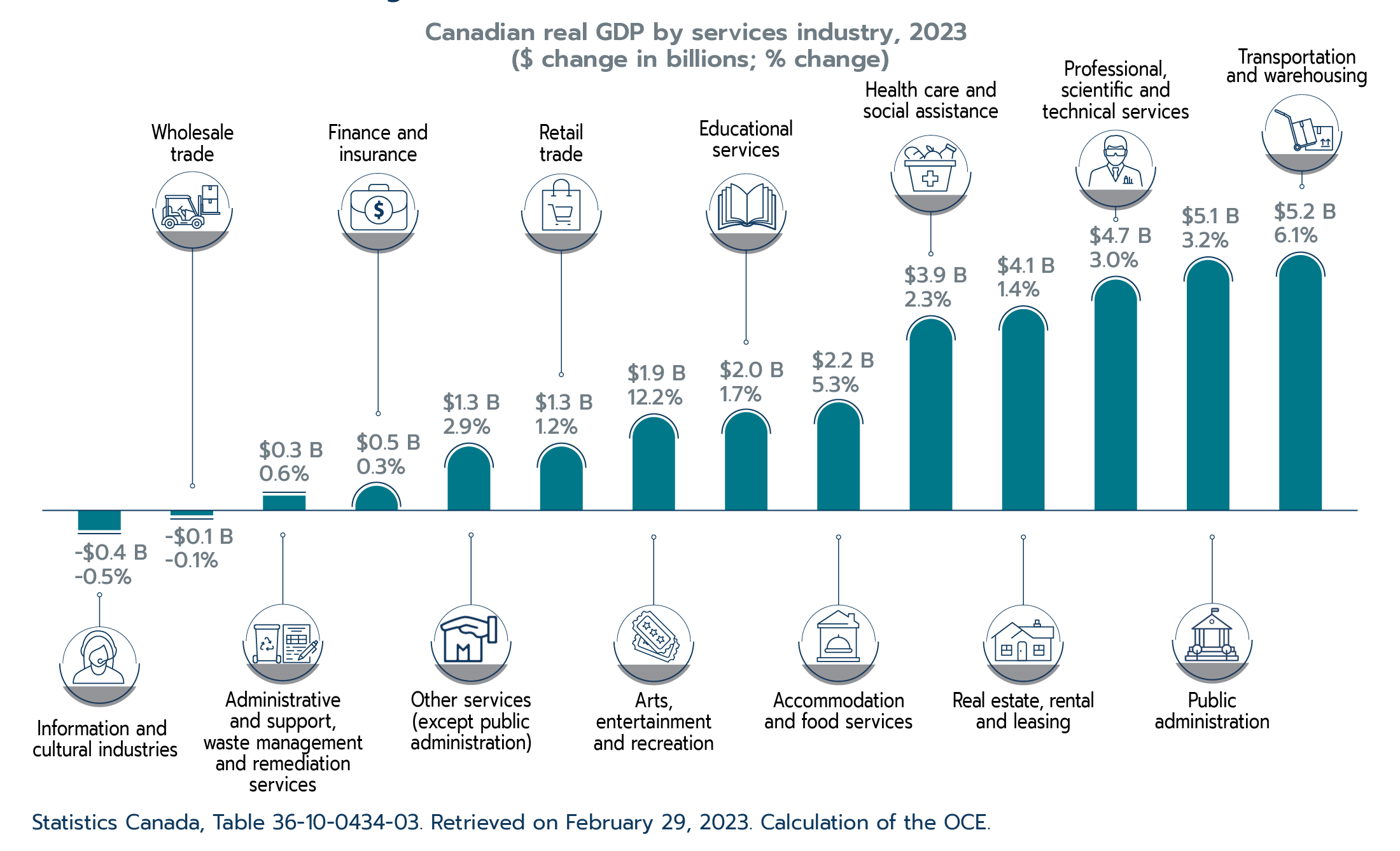

Services industries led growth for the second consecutive year, advancing by 2.0% in 2023. Transportation and warehousing services and public administration, driven largely by gains in local, municipal, regional, provincial, and territorial administration, contributed the most to services growth (Figure 1.9). As the post-pandemic expansion in travel continued, and as more workers returned to the office, air travel and urban transit services drove the increase in transportation and warehousing. Professional and scientific services, real estate, and health care also contributed to services growth. Only information and cultural services and wholesale trade contracted in 2023.

Despite the continued momentum, several services industries remained below their pre-pandemic 2019 levels, including transportation and warehousing, administrative and waste management, and accommodation and food services.

Figure 1.9: Services industries lead growth

Text version - Figure 1.9

| Services industry | 2023 vs. 2022 ($ change, billions) | 2023 vs. 2022 (% change) |

|---|---|---|

| Source: Statistics Canada, Table 36-10-0434-03. Retrieved on May 31, 2024. Calculation of the OCE. | ||

| Information and cultural industries | -0.4 | -0.5% |

| Wholesale trade | -0.1 | -0.1% |

| Administrative and support, waste management and remediation services | 0.3 | 0.6% |

| Finance and insurance | 0.5 | 0.3% |

| Other services (except public administration) | 1.3 | 2.9% |

| Retail trade | 1.3 | 1.2% |

| Arts, entertainment and recreation | 1.9 | 12.2% |

| Educational services | 2.0 | 1.7% |

| Accommodation and food services | 2.2 | 5.3% |

| Health care and social assistance | 3.9 | 2.3% |

| Real estate and rental and leasing | 4.1 | 1.4% |

| Professional, scientific and technical services | 4.7 | 3.0% |

| Public administration | 5.1 | 3.2% |

| Transportation and warehousing | 5.2 | 6.1% |

Labour market performance

Coming off a record year, Canadian labour market tightness somewhat eased in 2023. The unemployment rate increased slightly from 5.3% in 2022 to 5.4% in 2023. However, the annual figure masks the uptick seen in the second half of 2023 and unemployment ended 2023 at 5.8% in December. Labour force participation (i.e., the number of working-age individuals working or looking for work) was essentially unchanged, and roughly 475,000 jobs were added to the economy in 2023, most of which were full-time positions. Finally, after reaching record levels in 2022, job vacancies (i.e., unmet demand for labour) decreased significantly in 2023. Altogether, the Canadian labour market appeared more balanced in 2023, and fears of widespread unemployment did not materialize.

Looking ahead

The Canadian economy is expected to see another year of weak growth in 2024, as high interest rates continue to weigh on spending and investment. A forecasted slowdown in wage growth is expected to reinforce declining per-capita consumption. Another year of soft global growth is also expected to mute Canada’s export performance. With weakening demand, the Bank of Canada expects labour markets to continue easing and inflation to end the year at roughly 2.2% (fourth quarter). However, several factors could lead to higher-than-expected inflation, including a worsening of the conflict in the Middle East, persistently high wage growth, or stronger-than-anticipated growth in house prices. On the flip side, if global or Canadian economic performance is worse than forecasted, inflation could come down faster than expected. Barring any surprises, the Canadian economy is forecasted to pick up in the second half of 2024.

1.4 Highlights of Canada’s trade performance

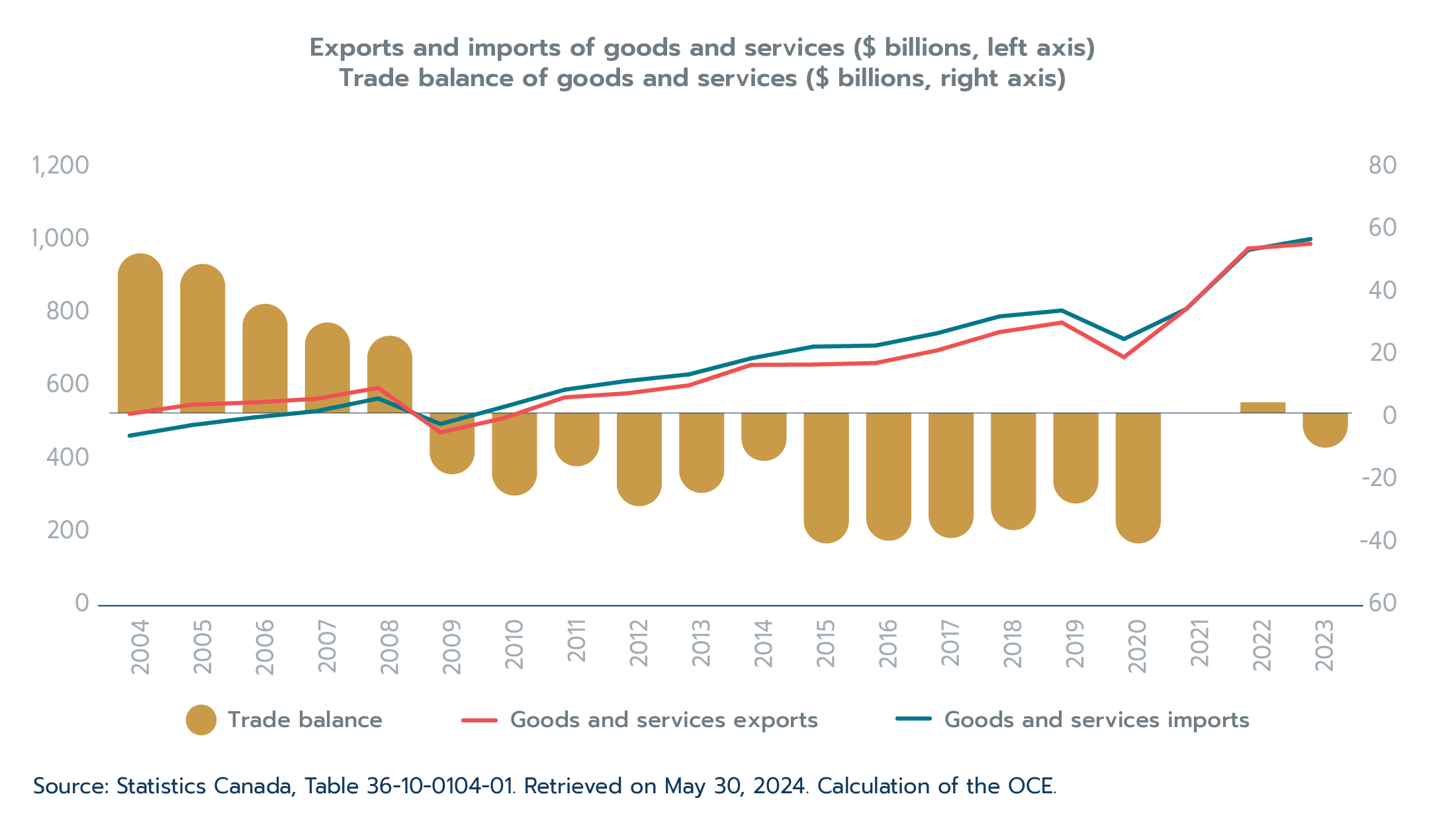

Despite another year of slow global growth and a contraction in global commodity prices, Canada’s international trade posted new records again in 2023, although growth was muted compared to 2022. Goods and services exports advanced by 1.4% to reach $965.1 billion, while imports increased by 3.1% to reach $978.2 billion. Canada posted a small trade deficit of $13.1 billion in 2023, and the ratio of trade-to-GDP edged down to 67.2%.

Strength in the recovering motor vehicle and parts and travel services sectors drove growth in Canada’s international trade throughout 2023. This section describes the year’s trends in goods and services trade on a balance-of-payments basis. See the Office of the Chief Economist (2024) for a review of Canada’s goods trade in 2023 on a customs basis.

Figure 1.10: Canada’s goods and services trade expands for another year in 2023

Text version - Figure 1.10

| Year | Goods and services exports | Goods and services imports | Goods and services trade balance |

|---|---|---|---|

| Source: Statistics Canada, Table 36-10-0104-01. Retrieved on May 31, 2024. Calculation of the OCE. | |||

| 2004 | 499 | 439 | 60 |

| 2005 | 524 | 468 | 56 |

| 2006 | 530 | 489 | 41 |

| 2007 | 540 | 506 | 34 |

| 2008 | 570 | 541 | 29 |

| 2009 | 448 | 471 | -23 |

| 2010 | 486 | 517 | -31 |

| 2011 | 544 | 565 | -20 |

| 2012 | 555 | 589 | -35 |

| 2013 | 577 | 607 | -30 |

| 2014 | 633 | 651 | -18 |

| 2015 | 634 | 683 | -49 |

| 2016 | 638 | 686 | -48 |

| 2017 | 673 | 720 | -47 |

| 2018 | 723 | 766 | -44 |

| 2019 | 749 | 782 | -34 |

| 2020 | 654 | 704 | -49 |

| 2021 | 786 | 786 | 0 |

| 2022 | 952 | 948 | 4 |

| 2023 | 965 | 978 | -13 |

Goods trade

Motor vehicles and parts trade drove growth as resource trade plummeted

While goods and services exports together expanded, Canada’s goods exports decreased by $10.9 billion (or 1.4%) in 2023, driven by a 9.9% contraction in resource exports. Energy product exports led this contraction, decreasing by $40.9 billion (-19.1%). After having spiked in 2022, partially driven by the outbreak of war in Europe, the price of a barrel of crude decreased from US$100.9 in 2022 to US$82.5 in 2023 (global price of Brent crude). The price of Western Canada Select, which is received by most Canadian producers, also contracted along with the price of natural gas. Canada’s energy export prices overall contracted by 20.9% in 2023. In volume terms, however, energy exports expanded by 2.2%. Moreover, despite the sharp contraction, the value of energy exports was still the second highest on record in 2023.

Non-resource exports partially offset the resource contraction, expanding by $36.9 billion (13.8%) in 2023. Supported by further improvement in international supply chains and pent-up demand, motor vehicles and parts exports led growth (+26.1%) (Table 1.1). Aircraft and other transportation equipment and parts (+25.5%) and industrial machinery and parts exports (+12.1%) also posted strong growth. Bucking the trend in resources, exports of farm and fishing products and intermediate food products (+6.5%) and metal and non-metallic mineral products (+6.2%) expanded, albeit at a slower pace compared to 2022. Farm, fishing, and intermediate food product growth slowed due, in part, to improved global supplies of wheat and canola that resulted in lower prices. Meanwhile, forestry products (-16.3%), metal ores and non-metallic minerals (-14.8%), and basic and industrial chemicals and plastic products (-5.6%) all contributed to the resource contraction.

Goods imports expanded by 1.4% in 2023, as growth in non-resource products (+6.0%) offset a contraction in resource imports (-6.6%). Imports increased in just 5 of 11 major product categories overall. Strong increases in imports of motor vehicles and parts (19.6%), aircraft and other transportation equipment and parts (11.3%), and industrial machinery and equipment products (8.5%) led growth. Meanwhile, consumer product imports (-3.3%) fell as Canadian consumers slowed spending. Energy products (-14.7%) also drove the contraction in resource imports, with import prices decreasing while volumes continued to expand. Apart from farm, fishing, and intermediate goods products (+0.5%), imports decreased in all resource sectors.

Table 1.1: Canada’s goods trade by major product category

| Trade | 2023 ($ billions) | 2023 vs. 2022 ($ change, billions) | 2023 vs. 2022 (% change) |

|---|---|---|---|

| Source: Statistics Canada, Table 36-10-0020-01. Retrieved on May 31, 2024. Calculation of the OCE. | |||

| Goods exports | |||

| Farm, fishing and intermediate food products | 61.1 | 3.7 | 6.5% |

| Energy products | 173.7 | -40.9 | -19.1% |

| Metal ores and non-metallic minerals | 29.3 | -5.1 | -14.8% |

| Metal and non-metallic mineral products | 90.9 | 5.3 | 6.2% |

| Basic and industrial chemical, plastic and rubber products | 42.5 | -2.5 | -5.6% |

| Forestry products, and building and packaging materials | 46.8 | -9.1 | -16.3% |

| Industrial machinery, equipment and parts | 51.4 | 5.6 | 12.1% |

| Electronic and electrical equipment and parts | 33.2 | 2.6 | 8.4% |

| Motor vehicles and parts | 102.0 | 21.1 | 26.1% |

| Aircraft and other transportation equipment and parts | 30.5 | 6.2 | 25.5% |

| Consumer goods | 86.0 | 1.4 | 1.7% |

| Total goods exports | 768.3 | -10.9 | -1.4% |

| Goods imports | |||

| Farm, fishing and intermediate food products | 28.5 | 0.2 | 0.5% |

| Energy products | 43.8 | -7.6 | -14.7% |

| Metal ores and non-metallic minerals | 18.7 | -0.4 | -2.1% |

| Metal and non-metallic mineral products | 64.0 | -1.0 | -1.5% |

| Basic and industrial chemical, plastic and rubber products | 59.7 | -7.0 | -10.4% |

| Forestry products, and building and packaging materials | 33.5 | -1.7 | -4.9% |

| Industrial machinery, equipment and parts | 90.0 | 7.1 | 8.5% |

| Electronic and electrical equipment and parts | 85.9 | 0.3 | 0.4% |

| Motor vehicles and parts | 141.8 | 23.2 | 19.6% |

| Aircraft and other transportation equipment and parts | 26.3 | 2.7 | 11.3% |

| Consumer goods | 150.1 | -5.1 | -3.3% |

| Total goods imports | 770.2 | 10.7 | 1.4% |

The U.K., Japan, U.S. pulled down Canada’s goods exports, while goods imports from the U.S. led growth

Canada’s total goods exports decreased by 1.4%, falling to $768.3 billion in 2023 (Table 1.2). Exports to the U.K. (-$4.8 billion) were the largest contributor to the overall goods export decrease in 2023. Despite robust U.S. economic growth, goods exports to the U.S. (-$2.1 billion) contracted in 2023, driven by a decrease in energy exports. Excluding energy, goods exports to the U.S. increased on a customs basis in 2023. Exports to Japan (-$2.3 billion) also posted a substantial and broad-based contraction. Supported by the reopening of its economy, goods exports to China (+$1.8 billion) posted the largest increase among all of Canada’s export partners in 2023. This was largely driven by a significant increase in oilseed exports, which surpassed 2018 levels to hit an all-time high in 2023. Exports to Hong Kong (+$1.5 billion) and the Netherlands (+$1.0 billion) also helped to moderate the overall contraction in goods exports.

Canada’s goods imports from all countries increased by $10.7 billion in 2023, a markedly smaller advance compared to the $125.2 billion increase in 2022. The U.S. (+$10.8 billion; mainly machinery, motor vehicles, and electrical machinery) and the EU (+$5.6 billion; led by machinery and motor vehicles) led growth. Imports from Mexico (+$4.4 billion) and Japan (+$3.2 billion) also experienced strong growth. Meanwhile, imports from China (-$9.4 billion; driven by several goods) contracted significantly, driven by a slowdown in consumer demand.

Table 1.2: Canada’s goods trade with top 10 trading partners

| Partners | 2023 ($ billions) | 2023 vs. 2022 ($ change, billions) | 2023 vs. 2022 (% change) |

|---|---|---|---|

| Source: Statistics Canada, Table 36-10-0023-01. Retrieved on May 30, 2023. Calculation of the OCE. | |||

| Goods exports | |||

| United States | 592.8 | -2.1 | -0.4% |

| China | 31.0 | 1.8 | 6.0% |

| Japan | 16.0 | -2.3 | -12.4% |

| United Kingdom | 15.2 | -4.8 | -23.9% |

| Mexico | 9.6 | -0.3 | -3.3% |

| Netherlands | 7.6 | 1.0 | 14.5% |

| Germany | 7.1 | -0.5 | -7.0% |

| South Korea | 7.1 | -1.8 | -20.0% |

| India | 5.2 | -0.2 | -3.7% |

| Hong Kong | 4.9 | 1.5 | 44.0% |

| All other countries | 72.0 | -3.1 | -4.2% |

| Total goods exports | 768.3 | -10.9 | -1.4% |

| Goods imports | |||

| United States | 484.0 | 10.8 | 2.3% |

| China | 60.2 | -9.4 | -13.6% |

| Mexico | 28.7 | 4.4 | 18.0% |

| Germany | 21.2 | 2.5 | 13.2% |

| Japan | 15.2 | 3.2 | 27.0% |

| South Korea | 11.5 | 0.6 | 5.4% |

| United Kingdom | 10.9 | 1.0 | 9.8% |

| Italy | 9.8 | 0.8 | 9.3% |

| Switzerland | 8.1 | 0.3 | 4.0% |

| Brazil | 8.0 | 0.5 | 7.0% |

| All other countries | 112.7 | -3.9 | -3.4% |

| Total goods imports | 770.2 | 10.7 | 1.4% |

Services trade

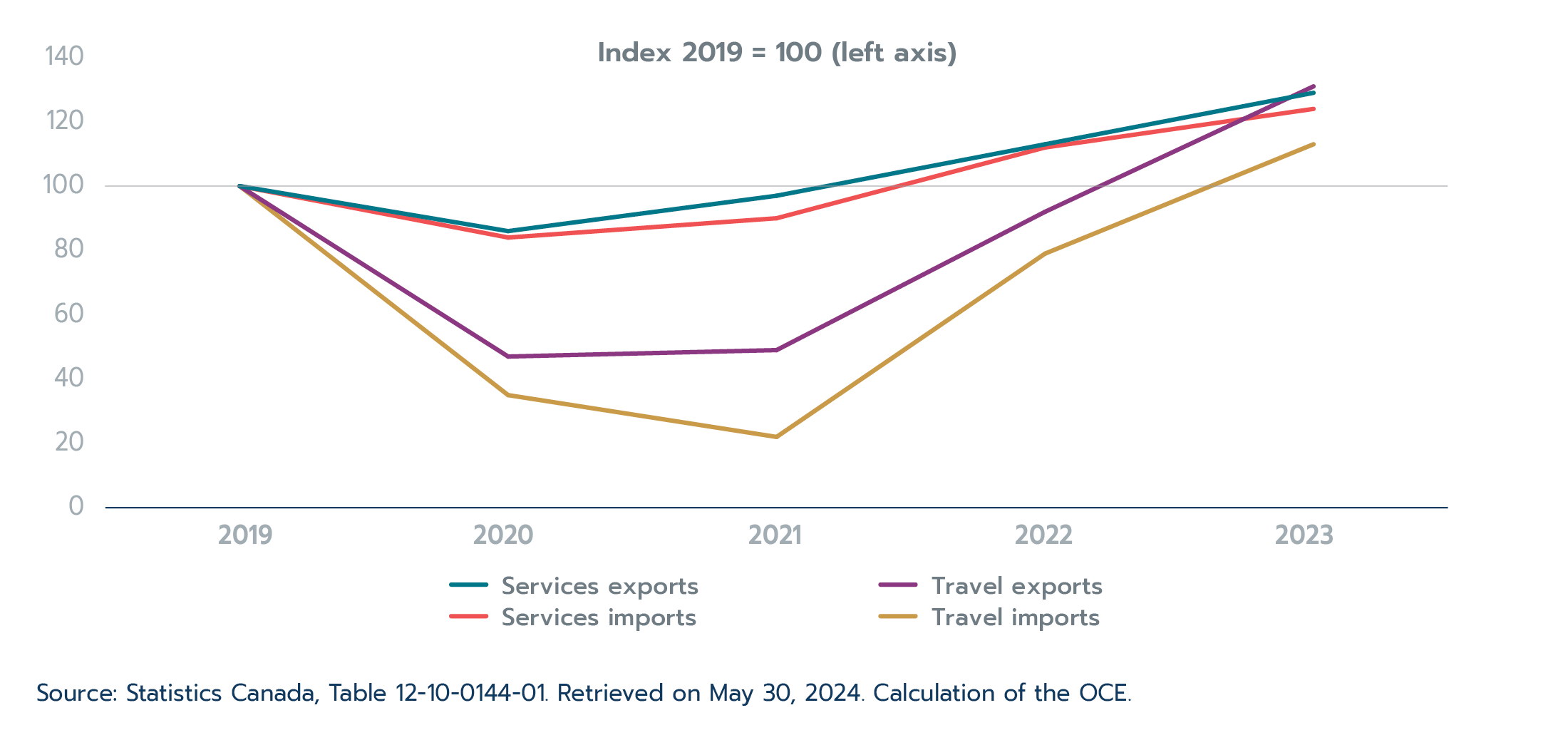

Travel services drive trade growth, surpassing 2019 levels for the first time since the start of the COVID-19 pandemic

Another year of robust growth in Canada’s services exports (+13.8%) outweighed the goods export contraction such that goods and services exports still expanded overall in 2023. Services exports increased across all four major categories, led by growth in travel services, to reach $196.8 billion in 2023 (Table 1.3). After a slow recovery, travel exports finally surpassed their 2019 levels (Figure 1.11), expanding by a robust 42.2% to reach $51.9 billion. Travel services accounted for nearly 65% of the growth in service exports overall in 2023. A 51.8% increase in the number of travellers entering Canada in 2023 reflects this trend; travellers from the U.S. and non-U.S. countries increased by similar amounts. Still, about 5.2 million fewer travellers visited Canada in 2023 compared to 2019. An increase in foreign visitor spending and spending by international students also supported travel services.

Figure 1.11: Travel services trade surpasses pre-pandemic levels for the first time since the start of the COVID-19 pandemic

Text version - Figure 1.11

| Index 2019 = 100 | 2019 | 2020 | 2021 | 2022 | 2023 |

|---|---|---|---|---|---|

| Source: Statistics Canada, Table 12-10-0144-01. Retrieved on May 30, 2024. Calculation of the OCE. | |||||

| Services exports | 100 | 86 | 97 | 113 | 129 |

| Travel exports | 100 | 47 | 49 | 92 | 131 |

| Services imports | 100 | 84 | 90 | 112 | 124 |

| Travel imports | 100 | 35 | 22 | 79 | 113 |

Commercial services exports (+6.5%) continued to expand in 2023, supported by exports of digital business services. Exports to the U.S. (+$5.4 billion) and the EU (+$1.2 billion) accounted for 88.0% of the overall increase in commercial services exports. Transportation services exports (+4.3%), which, like travel, were also impacted by physical restrictions implemented during COVID-19, continued to increase. However, transportation services exports had already surpassed their pre-pandemic levels in 2022. Lastly, government services, which account for less than 1% of services exports, increased by 4.3% in 2023 but remained below pre-pandemic levels.

Table 1.3: Canada’s services trade by sector

| Service | 2023 ($ billions) | 2023 vs. 2022 ($ change, billions) | 2023 vs. 2022 (% change) | ||

|---|---|---|---|---|---|

| Source: Statistics Canada, Table 12-10-0144-01. Retrieved on April 4, 2023. Calculation of the OCE. | |||||

| Services exports | |||||

| Commercial services | 123.4 | 7.5 | 6.5% | ||

| Travel services | 51.9 | 15.4 | 42.2% | ||

| Transportation services | 19.7 | 0.8 | 4.3% | ||

| Government services | 1.8 | 0.1 | 4.3% | ||

| Total services exports | 196.8 | 23.8 | 13.8% | ||

| Services imports | |||||

| Commercial services | 118.7 | 4.9 | 4.3% | ||

| Travel services | 52.8 | 15.5 | 41.6% | ||

| Transportation services | 34.7 | -1.4 | -4.0% | ||

| Government services | 1.9 | 0.1 | 5.4% | ||

| Total services imports | 208.0 | 19.1 | 10.1% | ||

Services imports saw weaker growth than exports in 2023, but still increased by a robust 10.1% to reach $208.0 billion for the year (Table 1.3). Service imports increased in all categories except for transportation services. As with exports, travel services imports (+41.6%) far outpaced import growth overall. Expanding by $15.5 billion, travel services were the largest contributor to import growth in 2023. The number of Canadians travelling to the U.S. (+50.4%) and non-U.S. destinations (+39.9%) increased significantly in 2023. Still, fewer Canadians travelled abroad in 2023 than in 2019. The largest contributor to travel services import growth was Canadians spending abroad, largely in non-U.S. destinations. Overall, travel services imports ended 2023 at 12.5% above their 2019 levels, despite the number of Canadians travelling abroad still being subdued.

Commercial services imports, the second largest contributor to growth, increased by 4.3% in 2023. Commercial services imports from the U.S. (+$2.7 billion) were the largest contributor to growth, despite increasing at a slightly slower pace (+3.5%) compared to commercial services imports overall. Meanwhile, commercial services imports from the EU (+$1.5 billion) posted above-average growth (+11.6%) and were the second largest contributor to commercial services imports in 2023. Government services imports (+5.4%) also expanded. However, transportation services imports decreased by 4.0%; this was partially due to lower payments related to maritime transportation services for goods entering Canada.

Services export growth was robust across all of Canada’s top trading partners, while a contraction in service imports from several Asian economies partially offset gains elsewhere

Canada’s services exports increased by $23.8 billion in 2023, with services exports to the U.S. (+$11.4 billion) accounting for nearly half of this increase, despite posting slower growth than services exports overall (Table 1.4). India (+20.0%) held second place in Canadian services exports for the second year in a row, with exports to the country growing by $1.7 billion in 2023. Service exports to all other major trading partners increased as well, with Mexico (+50.4%), Australia (+36.6%), and France (+22.1%) all posting growth that was well-above average.

Services imports increased by $19.1 billion in 2023, with the U.S. (+$11.8 billion) accounting for over 60% of this increase. After the U.S., services imports from Mexico (+$ 1.4 billion) and Germany (+$0.7 billion) made the largest contributions to growth in 2023. Imports from Japan (+25.6%) increased at a rate that was well above average but remained below their 2019 levels. Service imports for several of Canada’s other top trading partners in Asia either contracted or posted weak growth. Imports from Hong Kong, the third largest source of service imports, decreased by $1.2 billion. Service imports from China ($0.2 billion) expanded marginally while imports from Singapore (-$0.4 billion) decreased.

Table 1.4: Canada’s services trade with top 10 trading partners

| Partner | 2023 ($ billions) | 2023 vs. 2022 ($ change, billions) | 2023 vs. 2022 (% change) | ||

|---|---|---|---|---|---|

| Source: Statistics Canada, Table 12-10-0157-01. Retrieved on May 31, 2024. Calculation of the OCE. | |||||

| Services exports | |||||

| United States | 104.6 | 11.4 | 12.3% | ||

| India | 10.1 | 1.7 | 20.0% | ||

| United Kingdom | 8.9 | 0.8 | 9.9% | ||

| China | 7.3 | 1.1 | 17.6% | ||

| France | 5.5 | 1.0 | 22.1% | ||

| Germany | 4.0 | 0.6 | 15.8% | ||

| Mexico | 3.2 | 1.1 | 50.4% | ||

| Switzerland | 2.9 | 0.2 | 7.5% | ||

| Australia | 2.7 | 0.7 | 36.6% | ||

| Hong Kong | 2.7 | 0.2 | 9.9% | ||

| All other countries | 44.8 | 5.0 | 12.5% | ||

| Total services exports | 196.8 | 23.8 | 13.8% | ||

| Services imports | |||||

| United States | 122.9 | 11.8 | 10.6% | ||

| United Kingdom | 9.6 | -0.3 | -2.6% | ||

| Hong Kong | 5.2 | -1.2 | -18.3% | ||

| Mexico | 5.0 | 1.4 | 38.9% | ||

| Germany | 4.2 | 0.7 | 20.1% | ||

| France | 4.1 | 0.6 | 18.1% | ||

| China | 4.1 | 0.2 | 4.4% | ||

| India | 3.4 | 0.4 | 14.3% | ||

| Japan | 3.0 | 0.6 | 25.6% | ||

| Singapore | 2.8 | -0.4 | -11.8% | ||

| All other countries | 43.7 | 5.1 | 13.2% | ||

| Total services imports | 208.0 | 19.1 | 10.1% | ||

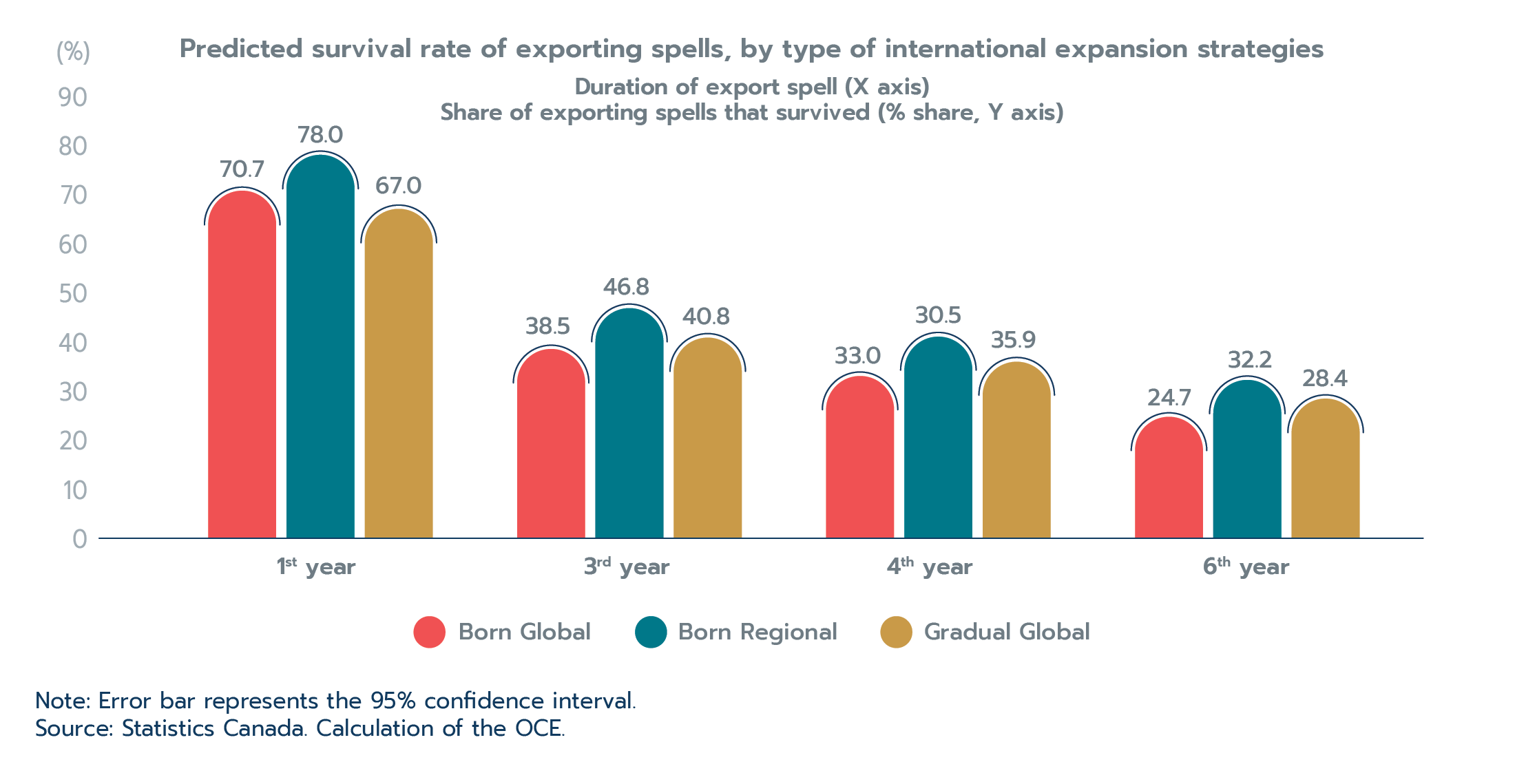

Box 1.3: The export survival of Canadian exporters

While there is a lot of focus on getting firms to export and to grow exports both in terms of value and destinations, export survival—that is, the longevity of a firm’s export activity—has received less attention. It is just as important, since without export survival, a firm cannot participate consistently in the international markets and may struggle to grow its exports. A study by the OCE (Tran, forthcoming) explored the survival dynamic of exporting spells by Canadian firms. An exporting spell is the consecutive number of years that a firm exported. For example, if a firm exported every year between 2005 and 2008 but then did not export in 2009, those years of consecutive exporting would be considered one exporting spell of three years. If the firm then started to export again in 2011, this would be the beginning of a new exporting spell. Unfortunately, exporting spells by Canadian exporters do not last very long: about 40% of exporting spells lasted only one year. Furthermore, only about 30% are still exporting by the fifth year.

The study further classifies exporters into three types, based on their export strategy:

- “Gradual Global”: These are firms that focus on the domestic Canadian market first, then proceed to the export market.

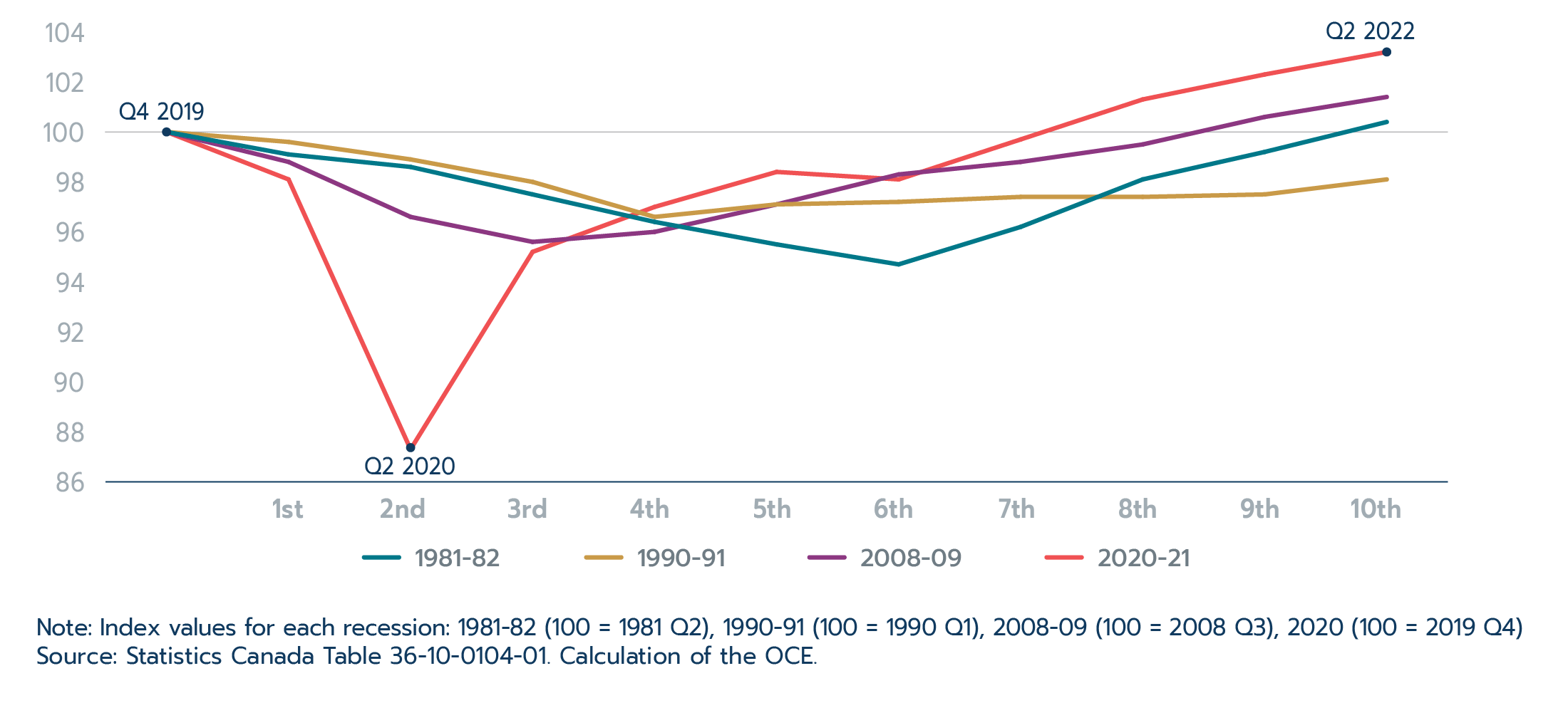

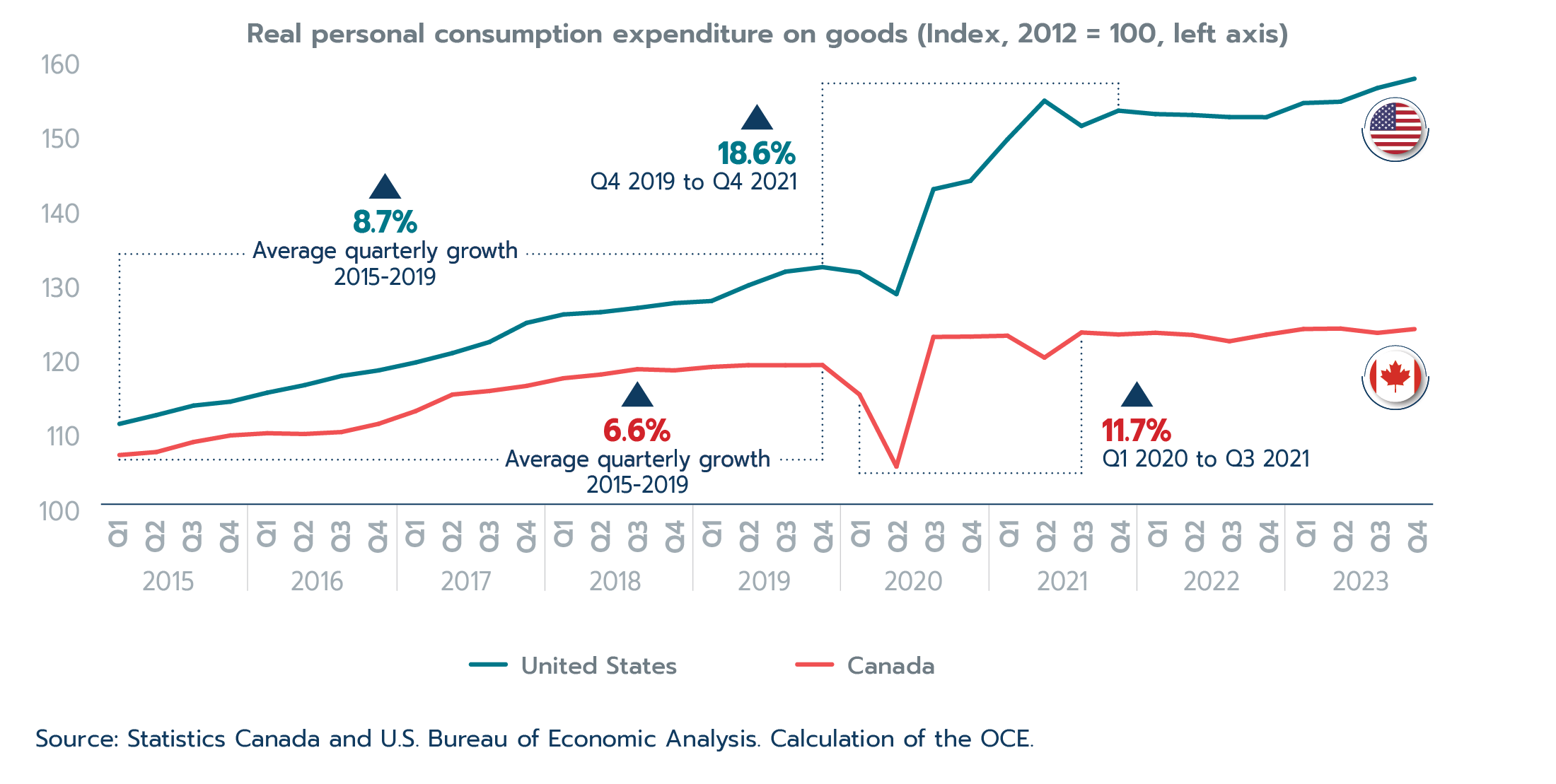

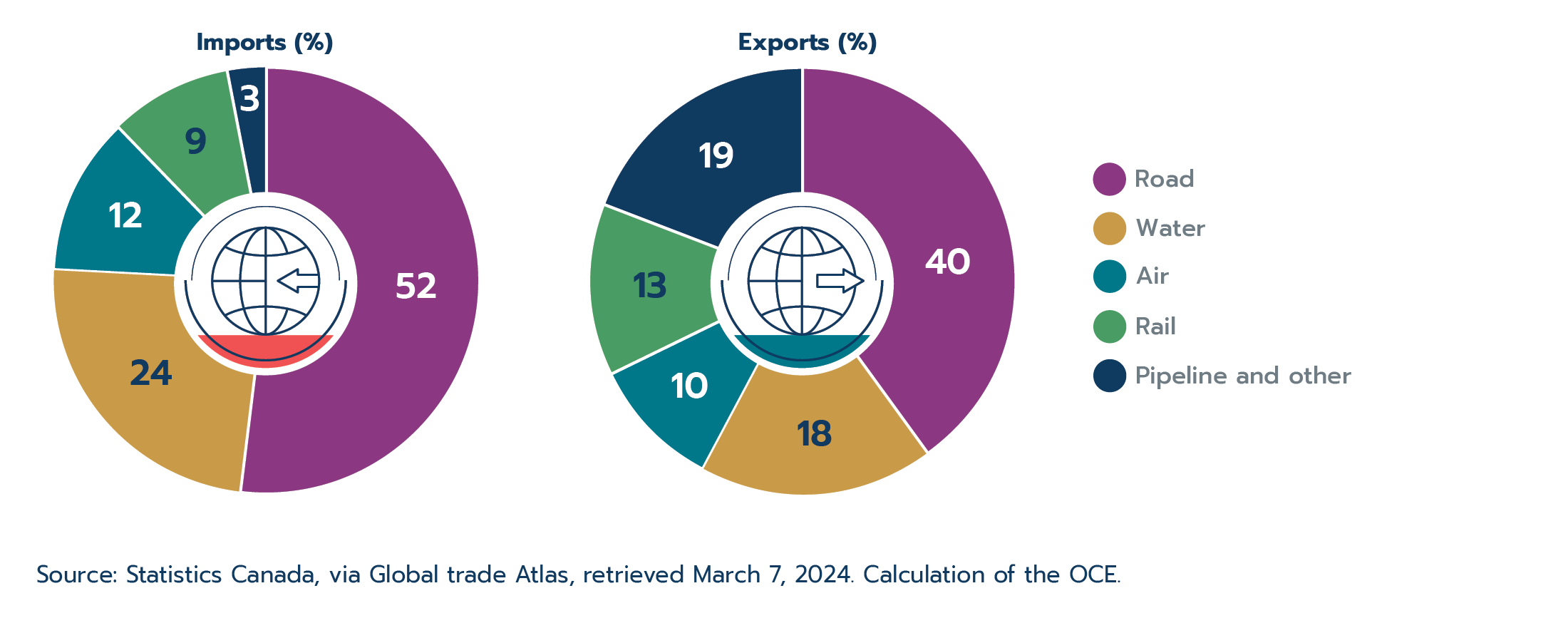

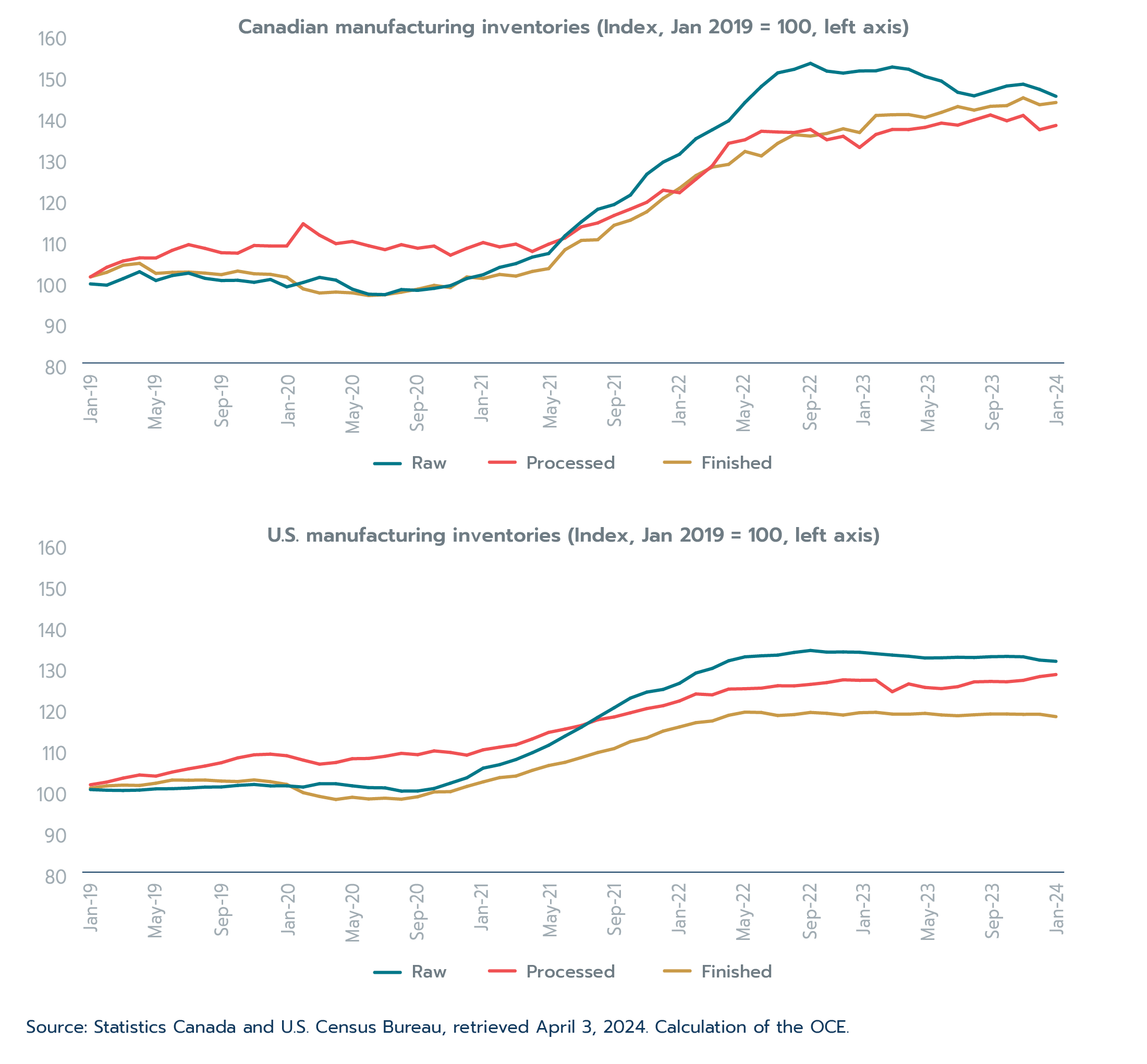

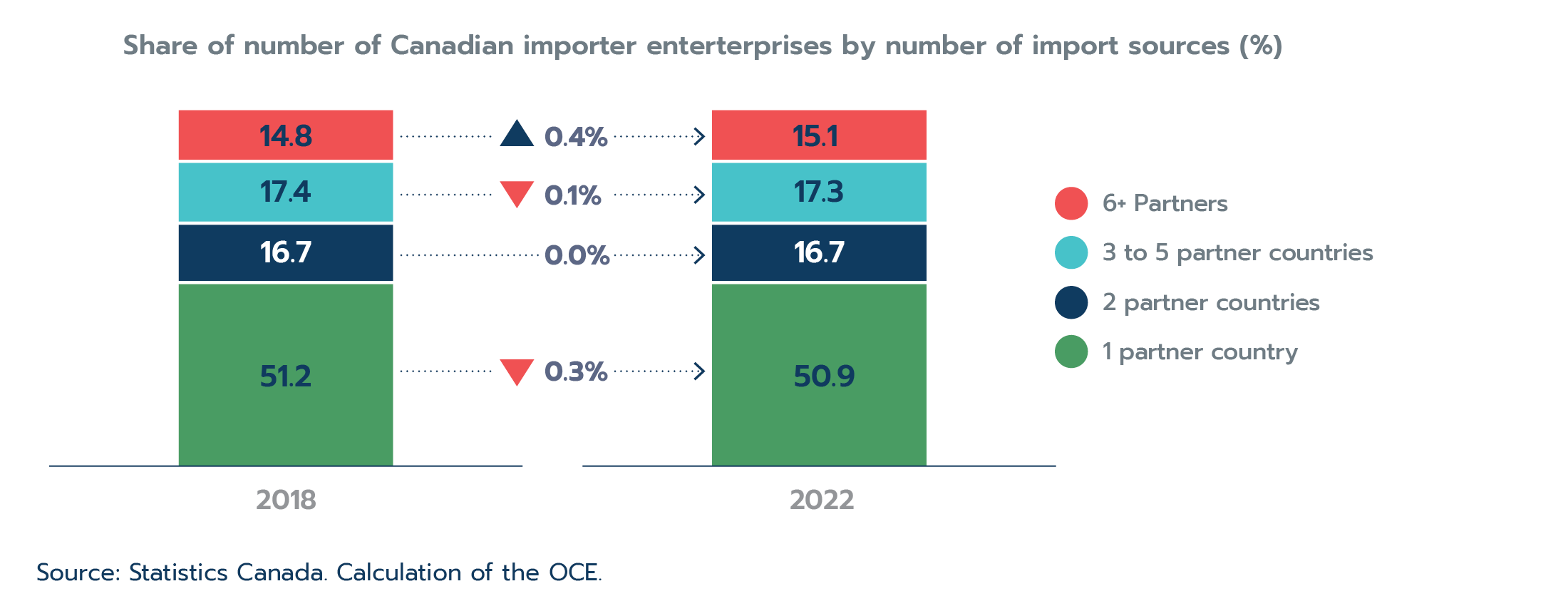

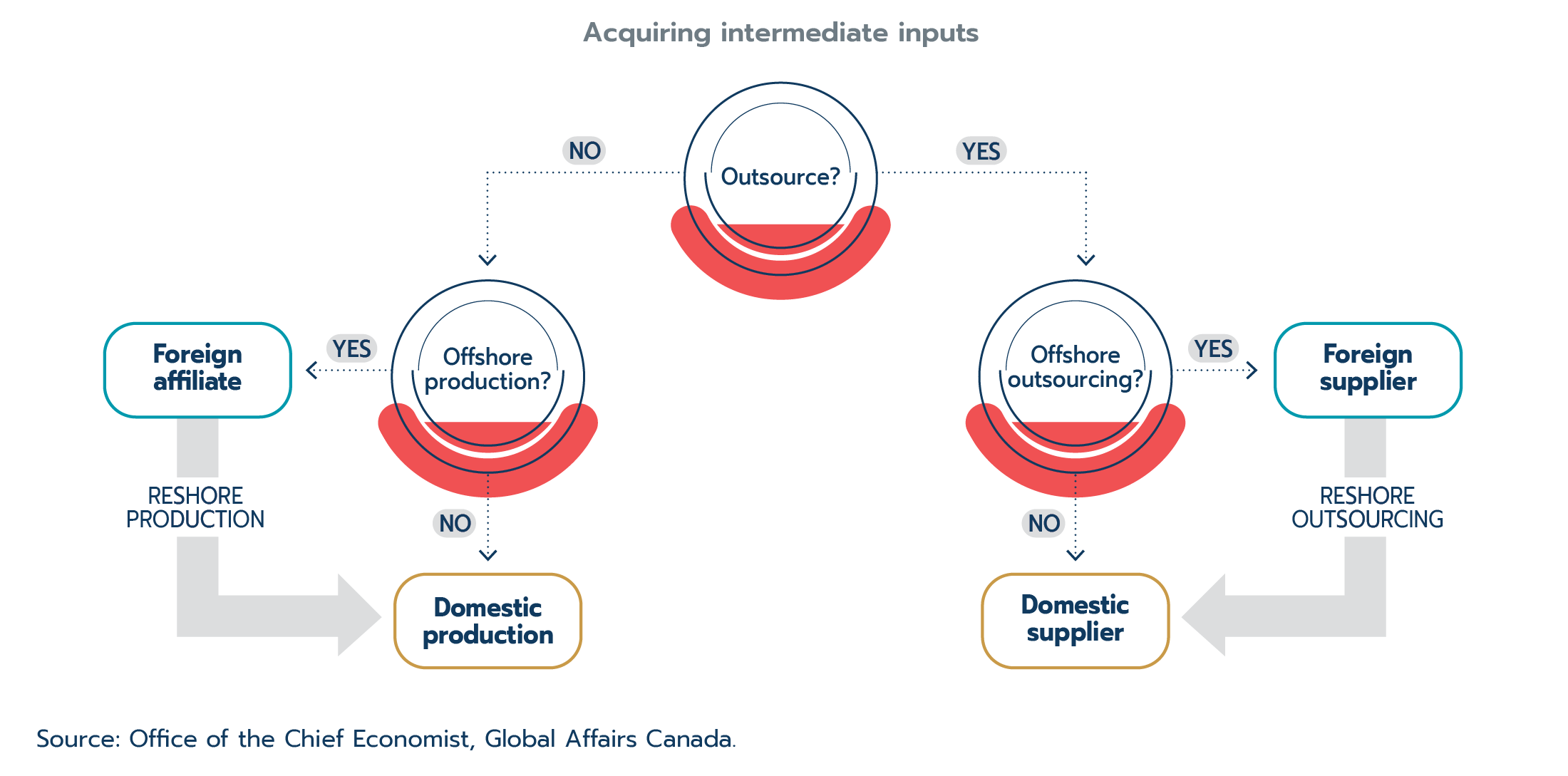

- “Born Regional”: These are firms that export at a young age, but their early export sales are destined for the United States, Canada’s closest trading partner. Later in their export journey, these firms can potentially explore other destinations.