The Inclusive Trade Action Group Three-Year Review of the Comprehensive and Progressive Agreement for Trans-Pacific Partnership

Global Affairs Canada

August 24, 2023

Table of Contents

- Minister’s statement

- Limitations

- Executive summary

- Introduction

- Background

- Summary of findings

- Effectiveness assessment

- Economic impact assessment

- 1. Overview of trade and investment under the CPTPP

- 2. Trade creation under the CPTPP: Dutiable and duty-free trade

- 3. Exports from the inclusive trade perspective

- 4. Trade in environmental goods under the CPTPP

- 5. Utilization of preferential tariffs under the CPTPP

- Conclusion of the economic impact assessment

- Gaps and opportunities

- Recommendations

- Next steps

- Annex A: List of acronyms

- Annex B: CPTPP chapter summaries

- Annex C: List of CPTPP Committees created under the Agreement

- Annex D: Criteria for GTAGA membership

- Annex E: Gender-related provisions in the CPTPP

- Annex F: CPTPP trade and gender infographics

Minister’s statement

Just over five years ago, on the margins of the signing ceremony for the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP), one of the world’s most ambitious and inclusive trade agreements, Canada proudly joined New Zealand and Chile in endorsing the Joint Declaration on Fostering Progressive and Inclusive Trade.

The Joint Declaration led Canada, Chile, and New Zealand to create the Inclusive Trade Action Group (ITAG) as a way to ensure that the CPTPP not only delivered more inclusive trade and sustainability benefits for everyone, but that it also built wider global awareness of the importance of inclusive trade.

The Joint Declaration called for an examination of the CPTPP’s effectiveness with respect to six global issues: gender equality, Indigenous Peoples, domestic regional economic development, small- and medium-sized businesses, labour rights, and environment and climate change.

I am pleased to present the ITAG Three-Year Review of the Comprehensive and Progressive Agreement for Trans-Pacific Partnership Report to our CPTPP trade partners and to Canadians.

Canada’s decision to join the CPTPP was the right choice and is supporting strong economic growth for Canadian businesses. We can do more to maximize the benefits of the CPTPP and share them more broadly.

The ITAG is integral to growing inclusive trade around the globe and ensuring that everyone benefits from trade, which is why Mexico, Costa Rica, and Ecuador have also joined.

ITAG has expanded its scope to promote mutually supportive trade and gender policies that increase women’s participation in trade and advance women’s economic empowerment through the Global Trade and Gender Arrangement (GTAGA). Canada, Chile, Colombia, Costa Rica, Ecuador, Mexico, New Zealand, and Peru have already signed the GTAGA, and Argentina will do so soon. This is a testament to Canada’s leadership in advancing inclusive trade. Seeing more countries join the Arrangement is a high priority for Canada and will guide Canada during our 2024 chairing of CPTPP.

Indeed, recent global events have forced countries around the world to come together in new ways to protect their people, their economies, and the planet.

They have also prompted countries like our own to re-evaluate who trades, what we trade, and how we trade, with a view to expanding trade opportunities for Canadian entrepreneurs from coast to coast to coast across a wide range of industries.

This inclusive trade approach complements our Feminist Foreign Policy and has become a key pillar of Canada’s modern trade policy, helping us to deliver on domestic priorities such as inclusive growth, gender equality, creating good jobs and reconciliation with Indigenous Peoples.

But we know our work is not done, and consultations with Canadians have told us that our country’s trade policies must not only be more inclusive, they must be sustainable and transparent as well.

In order for Canada and the other CPTPP partners to be successful, we must keep striving to ensure that more entrepreneurs – especially women, young people, Indigenous Peoples, small- and medium-sized business owners, and others who have been typically under-represented in trade – can get involved in and benefit from global exchange and our shared economic resilience.

And one way to ensure we remain accountable to our entrepreneurs and to the goals we set for ourselves is through accurate assessments such as this one. I hope you will agree.

The Honourable Mary Ng

Minister of Export Promotion, International Trade and Economic Development

Limitations

Canada’s ITAG Three-Year Review of the CPTPP (the Review), is subject to certain limitations as it relates to a unique and challenging time globally. Of the three years assessed, two were particularly difficult due to the global COVID-19 pandemic.

During the COVID-19 pandemic, countries around the world joined forces to protect the health and safety of their populations while mitigating the pandemic’s economic impact. In response to the pandemic, Canada saw entrepreneurs, workers, and all Canadians come together to support one another. Businesses demonstrated incredible flexibility and creativity to adapt and find innovative solutions to the challenges they faced.

The pandemic resulted in delays in the collection of data and its analysis. It also derailed or delayed certain ITAG initiatives. This Review includes current information where possible; however, to finalize the Review, some sections include information that is limited to September, 2022.

Executive summary

Canada’s Review stems from a March, 2018 commitment made at the time of the CPTPP signing ceremony when Canada endorsed the Joint Declaration on Fostering Progressive and Inclusive Trade alongside Chile and New Zealand. The Inclusive Trade Action Group (ITAG) was established in November, 2018 by co-founding members Canada, Chile and New Zealand, on the margins of the Asia Pacific Economic Cooperation (APEC) Leaders' Summit. ITAG members committed to assessing the effectiveness of the CPTPP three years after its entry into force with respect to the following six global issues of inclusive trade: small and medium-sized enterprises (SMEs); gender equality; Indigenous Peoples; domestic regional economic development; labour rights; and environment and climate change.

Canada has performed a comprehensive review, both qualitative and quantitative, to assess the CPTPP’s effectiveness in advancing the six global issues and the impact on Canada over the first three years of the Agreement’s entry into force. This Review presents the findings of the assessment, identifies gaps and opportunities, and offers recommendations.

Through a qualitative assessment, this Review aims to assess whether the objectives of the CPTPP with respect to the six issues have been achieved and highlight the impacts for Canada in each issue area. This Review is complemented by a quantitative assessment of inclusive elements under the CPTPP, namely, SMEs, workers, and female employees, and how they have benefited from the CPTPP. This Review does not replace or replicate the general review required under CPTPP Chapter 27, which is much broader; rather, it serves to complement it.

The qualitative assessment found the following:

- The CPTPP has trade and investment benefits for Canada, and efforts are being made to integrate inclusive and sustainable development through aspects of the Agreement’s implementation.

- Canada’s Embassies, High Commissions and Consulates across the CPTPP region have a role to play in advancing activities and capacity-building to support inclusivity, sustainability and the ability of underrepresented groups to take advantage of the Agreement.

- Several gaps exist in the CPTPP’s implementation, including regional economic development and measurement of results.

- Opportunities exist for further collaboration amongst CPTPP Parties to address gaps and ensure that the CPTPP’s provisions and activities in relation to inclusive trade and sustainable development are having the intended effect.

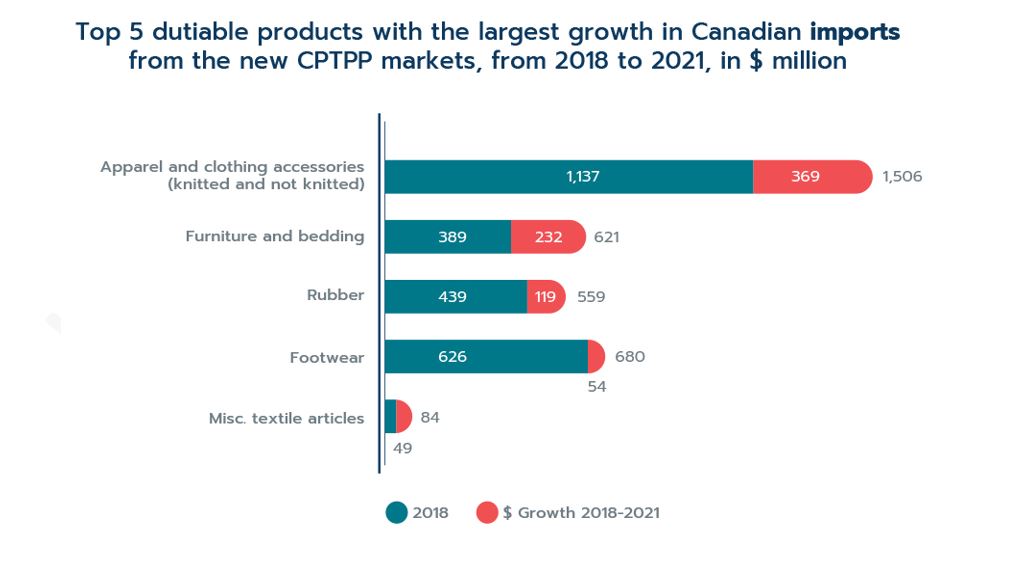

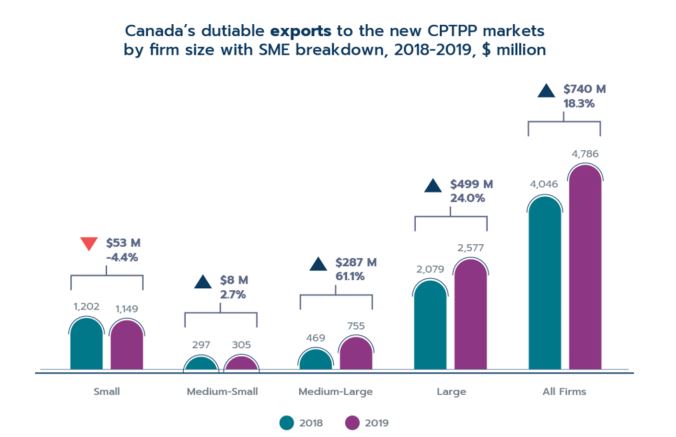

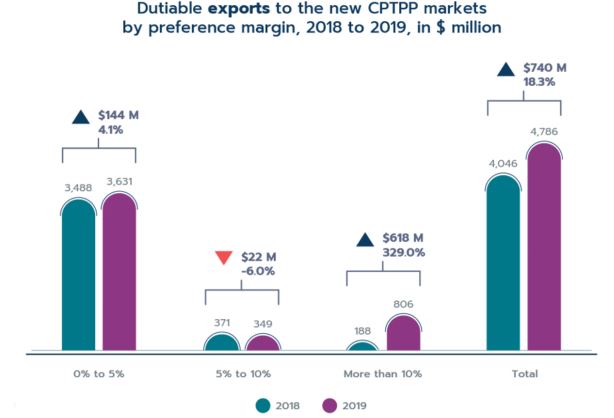

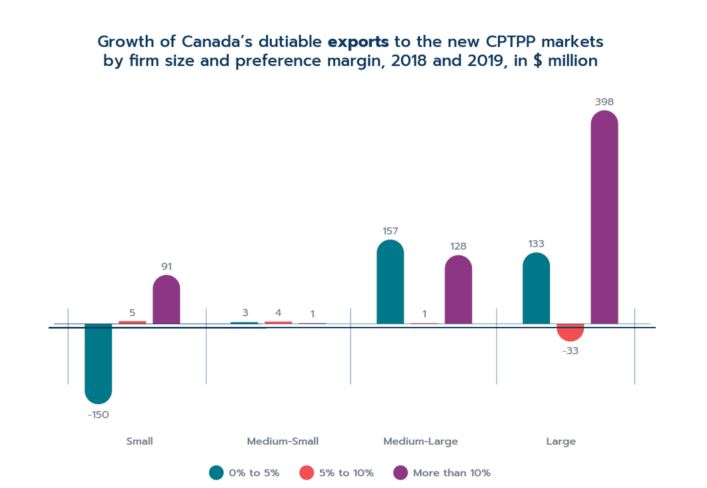

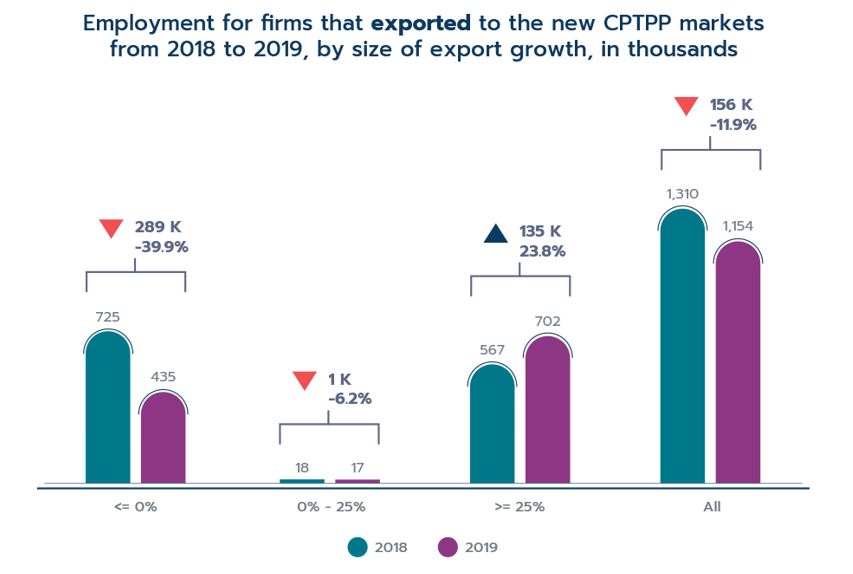

The quantitative assessment delivered the following observations:

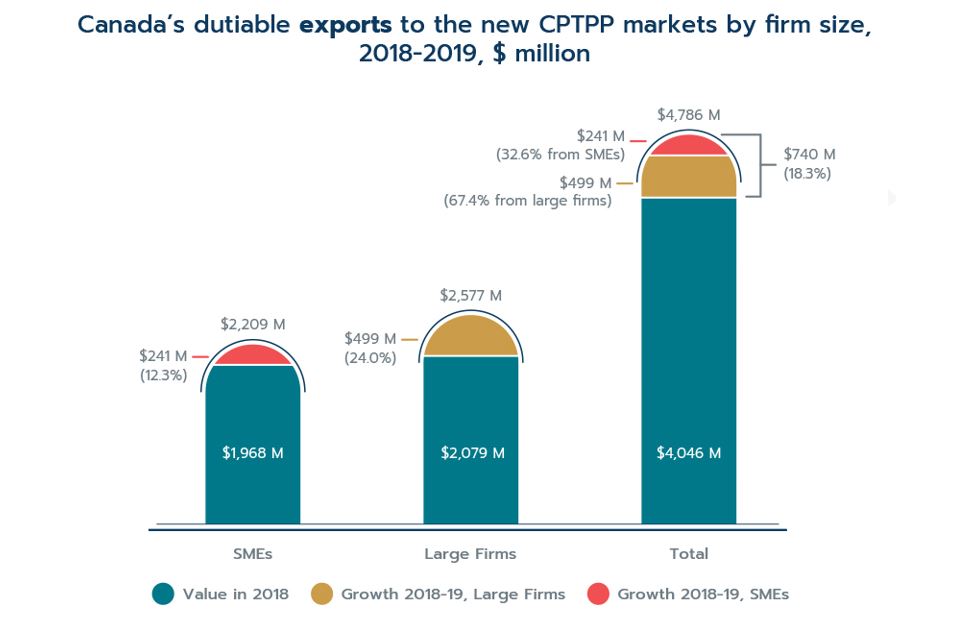

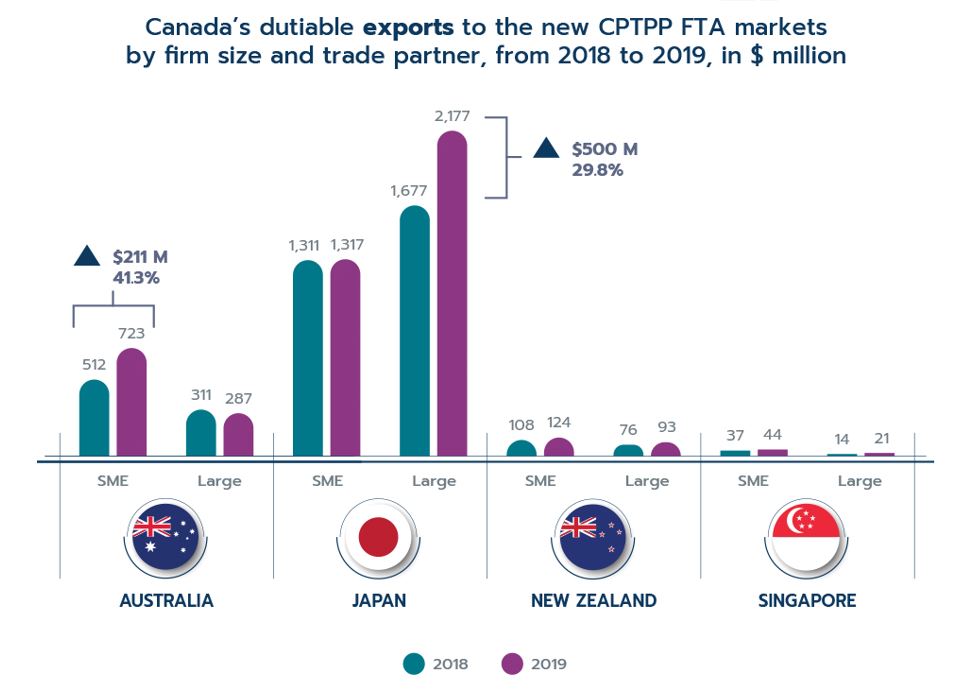

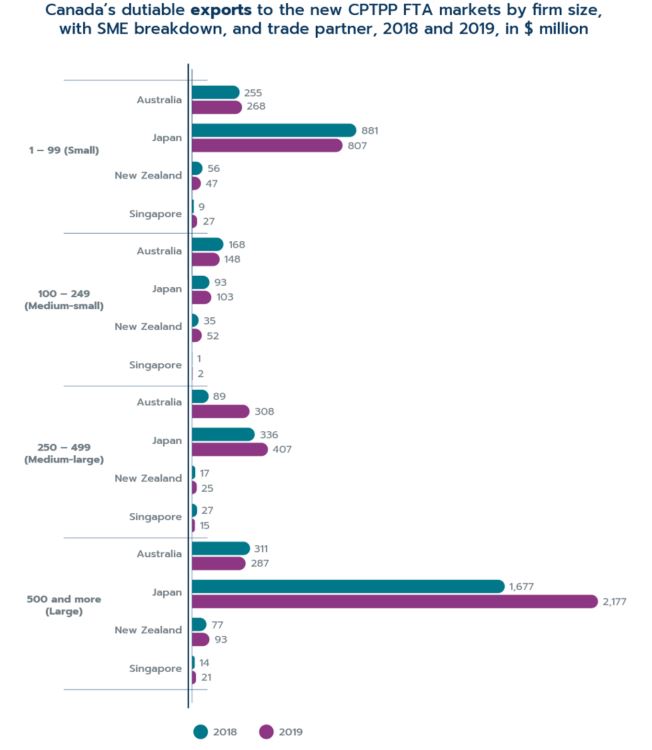

- The CPTPP has delivered clear trade benefits to Canada, including to SMEs and women workers.

- Canadian SMEs increased their dutiable exports to the markets by $241 million (12.3%) during the first year of implemented.

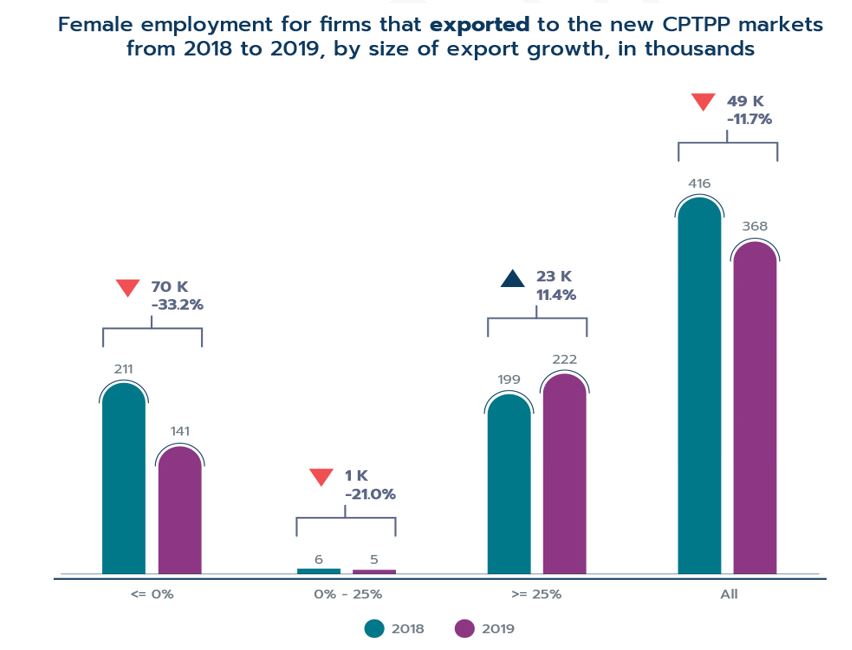

- Canadian firms that significantly increased their exports to new CPTPP markets increased total employment during the first year by 135,000 (23.8%), while female employment increased by 23,000 (11.4%).

In conducting both the qualitative and quantitative assessments of this Review, Canada found several gaps and potential future opportunities to address and explore. The Gaps and Opportunities section of this document identifies many, including: increasing gender and inclusivity in CPTPP implementation; encouraging CPTPP members to join the Indigenous Peoples Economic Trade and Cooperation Arrangement (IPETCA); enhancing action on regional economic development; measuring results of cooperation activities; regular inclusive stakeholder engagement in implementation activities; and, increased promotion of Responsible Business Conduct (RBC) to Canadian businesses in CPTPP markets.

To improve the CPTPP’s effectiveness in advancing inclusive and sustainable-related outcomes, Canada recommends that ITAG members: regularly conduct effectiveness reviews as appropriate; encourage CPTPP members to join ITAG, GTAGA, and IPETCA; encourage CPTPP Committees to advance inclusivity through the CPTPP’s implementation, measure results, engage stakeholders and enhance domestic regional economic development considerations into their work. It is also recommended that Canada seek stakeholder views of this report to be factored into its 2024 CPTPP Chairship.

Following the publication of this Review, Canada will implement the following next steps:

- Seek stakeholder views of this Review.

- Continue to promote ITAG, GTAGA and IPETCA membership to potential members globally.

- Engage with experts on how to develop an approach to measuring results of cooperation activities under the CPTPP.

Introduction

The Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP) is a regional free trade agreement (FTA) among 12 countries spanning the Asia-Pacific region, made up of Australia, Brunei Darussalam, Canada, Chile, Japan, Malaysia, Mexico, New Zealand, Peru, Singapore, the United Kingdom and Vietnam. It is an ambitious trade agreement, with advanced provisions across a range of areas. Specifically, the CPTPP includes 30 distinct chapters (see Annex B) and 20 committees (see Annex C), which play a significant role in the Agreement's implementation. The CPTPP entered into force on December 30, 2018, when Canada, Australia, Japan, Mexico, New Zealand and Singapore became the first six countries to ratify the Agreement. The CPTPP subsequently entered into force for Vietnam on January 14, 2019, for Peru on September 19, 2021, for Malaysia on November 29, 2022, and for Chile on February 21, 2023. Most recently, on May 13, 2023, Brunei deposited its ratification instrument and the CPTPP entered into force for Brunei on July 12, 2023. Several countries have since applied to accede to the Agreement (United Kingdom, China, Chinese Taipei, Ecuador, Cost Rica, Uruguay and Ukraine), and the United Kingdom signed the Agreement on July 16, 2023.

This Review assesses the effectiveness of the CPTPP for Canada in meeting its sustainable development and inclusive trade objectives, in particular with regards to the economic relationships formed with CPTPP partner countries that ratified the CPTPP but have no previous FTAs with Canada, namely, Australia, Japan, New Zealand, Singapore and Vietnam.

Alongside the signing of the CPTPP, Canada, Chile and New Zealand also endorsed the Joint Declaration on Fostering Progressive and Inclusive Trade (hereinafter “the Joint Declaration”) in March, 2018. The Joint Declaration led to the creation of the Inclusive Trade Action Group (ITAG) on the margins of the November 2018 APEC Leaders’ Summit. ITAG partners have agreed to work together to advance sustainable and inclusive trade, to ensure that the benefits of trade are more broadly shared, and to better address rising concerns over environmental issues and labour standards in international trade. These instruments support Canada’s inclusive approach to trade, a core aspect of the Government of Canada’s Trade Diversification Strategy. This Strategy seeks to ensure that the benefits of trade are more widely shared in society at large, including with those that are traditionally underrepresented in trade such as women, small- and medium-sized enterprises (SMEs),Footnote 1 and Indigenous Peoples.

As outlined in the Joint Declaration, Canada, Chile and New Zealand agreed to work together to demonstrate that trade can contribute to sustainable development and help provide solutions to six global issue areas: SMEs; gender equality; Indigenous Peoples; domestic regional economic development; labour rights; and environment and climate change. As such, all three ITAG cofounding countries committed to conduct an assessment of the effectiveness of the CPTPP three years after its entry into force with respect to the six global issues. This Review aims to assess what has been achieved, identify gaps and areas for further collaboration, highlight existing opportunities, and make recommendations. The ITAG Three Year Review evaluates the six global issues through a qualitative assessment. In addition, as required by the Agreement’s Article 27.2.(b), the CPTPP Commission studied the economic relationships among CPTPP Parties within three years of its entry into force.Footnote 2 Canada conducted an Economic Impact Assessment (EIA) to evaluate the quantitative impact of the CPTPP on Canadian trade.Footnote 3 While the findings of the EIA are published separately, a summary of these results is included in this Review. Specifically, Canada’s EIA assesses and evaluates the status of inclusive elements under the CPTPP obligations. It examines whether Canadian SMEs, workers and female employees benefit from the CPTPP’s obligations.

This Review serves as a benchmark for any future analyses, which will provide more robust conclusions over periods longer than the first three years of the CPTPP. Finally, the Review aims to build a better understanding of inclusive trade in the context of the Agreement and encourage other CPTPP signatories to join ITAG.

The Review begins with an overview of the CPTPP and the ITAG initiatives, followed by a summary of the Agreement’s tariff commitments and relevant provisions relating to inclusive trade and sustainable development. The second section describes the assessment framework and methodology used to conduct the Review, and the third section presents the findings from the qualitative assessment and the quantitative EIA. The last section identifies important gaps and opportunities, makes recommendations and identifies next steps.

Background

What is the CPTPP?

The CPTPP is a trade agreement among 12 countries (Australia, Brunei Darussalam, Canada, Chile, Japan, Malaysia, Mexico, New Zealand, Peru, Singapore, the United Kingdom and Vietnam) that represents a regional trading bloc that accounts for 13.5% of global GDP and 15% of global trade. Together, the member countries constitute a significant consumer base, with their combined populations surpassing 511 million in 2021, or 6.5% of the world population.Footnote 4

The Agreement offers Canadian exporters a competitive advantage in the Asia-Pacific region. Once fully implemented, the CPTPP will eliminate tariffs on almost all Canadian exports to CPTPP markets and create better export conditions, including: reduced barriers to trade; increased access to government procurement (GP); and a consistent, transparent and predictable trade environment. Moreover, the Agreement represents a new milestone in contemporary international trade treaties, as it establishes new standards and trade rules, and commits member countries to reaffirm the importance of corporate social responsibility/responsible business conduct, inclusive trade and sustainable development.

The CPTPP provides significant benefits to Canadian goods exporters across all sectors of the economy. Once fully implemented, 99% of all tariff lines among CPTPP Parties will be duty-free, and Canada will have duty-free access for:

- 94% of Canadianagriculture and agri-food productsexports

- 99% of Canadianindustrial productsexports

- 100% of Canadianfish and seafood productsexports

- 100% of Canadianforest productexports

In addition, the CPTPP helps address non-tariff barriers to trade by: reducing the time exporters spend waiting for goods to clear customs; lowering compliance costs; and increasing predictability regarding other countries’ processes; supporting the growing services and digital sectors; and providing greater opportunities to submit a bid for GP contracts in CPTPP markets.

Moreover, the CPTPP will help raise labour and environmental standards in the Asia-Pacific region, reduce the negative impact of certain practices and promote sustainable development. The labour and environmental outcomes of the CPTPP are amongst the most comprehensive Canada has achieved in an FTA. The CPTPP makes labour and environmental standards legally enforceable for the first time in history.

What is ITAG?

The Inclusive Trade Action Group (ITAG) emerged from the Joint Declaration and was formally established on the margins of the 2018 Asia-Pacific Economic Cooperation Leaders' Summit. Canada, Chile and New Zealand are the founding Partners of ITAG, which aims to build on the Joint Declaration’s aspirations. In October, 2021, CPTPP Party Mexico was welcomed as the first new member of ITAG. Costa Rica and Ecuador joined in May, 2023. ITAG membership is open to all countries, even those outside the CPTPP.

ITAG members work together to support inclusive trade, ensure that the benefits of trade are more widely shared in society at large, and better address rising concerns over environmental issues and labour standards in international trade. This work advances Canada’s inclusive approach to trade, which aims to create trade policy that supports sustainable and inclusive economic development and addresses global and regional issues of concern.

ITAG members have developed an evergreen work program that includes Canadian priorities, such as: advancing women’s economic empowerment; enhanced participation of women, SMEs, and Indigenous Peoples in trade; advancing RBC; and promoting best practices in stakeholder engagement.

ITAG initiatives implemented thus far include:

- Advancing the principles of inclusive trade such as sustainability and gender at the World Trade Organization (WTO), and advancing issues related to fisheries and SMEs.

- Co-sponsoring the March, 2019 APEC Capacity Building Workshop on Women and Trade in Chile.

- Participating together in a WTO workshop on Labour in Trade Agreements in March, 2019, where ITAG members shared their experiences on how comprehensive labour provisions in trade agreements can help achieve inclusive outcomes.

- Hosting a webinar on how to support public engagement in trade and trade agreements. The September, 2019 webinar highlighted the benefits of inclusive stakeholder engagement for trade policy development.

- Hosting a webinar on the importance of digital trade to advance the participation of women and other underrepresented groups in trade during Geneva Trade Week at the WTO in October, 2020.

- Staging an ITAG Chief Economists’ panel discussion at the WTO Public Forum in September, 2022 on inclusive trade data and research supporting implementation of inclusive trade.

What is GTAGA?

Notably, ITAG’s most significant accomplishment to date has been the negotiation and entry into effect of the Global Trade and Gender Arrangement (GTAGA). On August 4, 2020, ministers responsible for trade in Canada, Chile and New Zealand held a virtual meeting to sign the GTAGA. Mexico joined GTAGA in October, 2021, followed by Colombia and Peru in June, 2022 and Costa Rica and Ecuador in May, 2023. GTAGA is modelled on the Trade and Gender Chapter that Canada has been seeking to include in FTAs since its first such chapter was negotiated with Chile in 2017. The GTAGA aligns with and advances Canada’s inclusive approach to trade, which seeks to ensure that traditionally underrepresented groups in trade, such as women, can benefit more from—and participate more in—trade. GTAGA is open to other countries to join (for a list of criteria to join, see Annex D).

In particular, the GTAGA seeks to reaffirm important trade-related principles, such as recognizing that protection under domestic laws that promote gender equality should not be weakened to encourage trade and investment. GTAGA also confirms the importance of promoting gender equality in the workplace and commits GTAGA participants to cooperate and share best practices to eliminate discrimination in employment, including on the basis of sex, pregnancy, possibility of pregnancy, maternity, gender and gender identity, and sexual orientation. The GTAGA places a significant focus on jointly implementing cooperation activities to remove barriers to women’s participation in international trade and includes a provision for GTAGA participants to work together in international fora to advance these issues. Furthermore, GTAGA has established a working group to carry out and report on their activities.

GTAGA activities implemented thus far include:

- Sharing information on domestic programming and policies that support women’s economic empowerment and gender in December, 2020.

- Presenting on and promoting GTAGA during a panel at the Organisation for Economic Co-operation and Development (OECD) in June, 2021. More than 300 people from around the world attended the event.

- A panel discussion to support women who are exporting, export-ready, or considering future opportunities in GTAGA markets to learn more about the business opportunities that exist in Canada, Chile and New Zealand in June, 2021. Approximately 120 participants attended the event.

- Providing a presentation on GTAGA’s merits to CPTPP Parties in the context of the annual meeting of the Co-operation Committees in July, 2021.

- Panel discussion to highlight the GTAGA and the necessity of promoting women’s participation in trade in the context of the German Foreign Office’s annual Diplomacy for Sustainability initiative in September, 2021.

- A virtual panel focussed on women’s participation and retention in science, technology, engineering and mathematics (STEM). Participants shared insights and advice on how to encourage and support women in STEM careers which benefit trade. A total of 120 participants from over 22 countries participated.

Assessment framework and methodology

The effectiveness of the CPTPP was analyzed using a hybrid approach that involved a qualitative assessment and a quantitative EIA. The former assesses and identifies progress on the six global issues, while the EIA focuses particularly on the global issues of SMEs and gender equality.

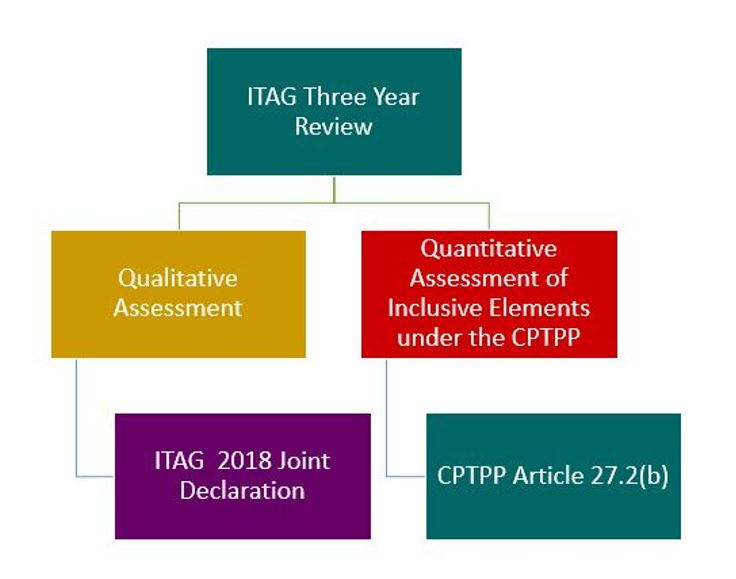

Figure 1:

Figure 1 - Text version

Framework of the ITAG Three Year Review

Figure 1 displays a hierarchical flow chart depicting the various inputs required to develop the ITAG Three Year Review. The left side explains that the ITAG 2018 Joint Declaration guided the development of the qualitative assessment. The right side explains that CPTPP’s Article 27.2(b) guided the development of the quantitative assessment of the inclusive trade elements under the CPTPP.

Effectiveness assessment

Effectiveness is defined as “the ability to be successful and produce the intended results,” A qualitative assessment of the effectiveness of the CPTPP with regard to the six global issues of the Joint Declaration thus entails determining whether the Parties to the Agreement were able to reach the objectives related to these issues. In other words, the effectiveness assessment aims to respond to the question: “Was the CPTPP effective at bringing Parties to reach their stated objective?”

The six global issues reviewed in this report are:

- Small- and medium-sized enterprises;

- Gender equality;

- Indigenous Peoples;

- Domestic regional economic development;

- Labour rights; and

- Environment and climate change.

The effectiveness assessment followed a three-step approach: (1) group the existing provisions in the CPTPP by theme; (2) identify Committee work relevant to each theme; and (3) state results, outcomes and findings. Case studies and success stories are highlighted where possible. The effectiveness assessment involved several rounds of consultation with Canadian CPTPP Committee representatives, as well as with Canadian officials posted to missions within the CPTPP member countries.

Economic impact assessment

An EIA of a FTA aims to quantify the impacts on the economies of the countries involved by analyzing and comparing key indicators before and after the FTA’s implementation. This EIA is the first such exercise of Canada’s trade performance under the CPTPP and aims to evaluate whether the improved market access obligations have led to increased trade between Canada and the other CPTPP Parties.

Canada had FTAs with Chile, Mexico and Peru prior to the CPTPP. To accommodate this fact, the EIA distinguishes between markets with existing FTAs and new markets—those made accessible through the CPTPP. The existing markets include Chile, Mexico and Peru, while the new markets include the five countries that had ratified the CPTPP at the time of this analysis (Australia, Japan, New Zealand, Singapore and Vietnam). Brunei, Chile and Malaysia were not included in the assessment because they ratified the CPTPP after the initial three-year period of implementation.

The EIA measures the trade gains resulting from Canada’s preferential access to the new markets. To better complement the effectiveness review and support the goals of the Joint Declaration, the EIA highlights the benefits experienced by SMEs, workers, and female employees.

The EIA uses relevant trade and tariff data to compare Canada’s trade with the new markets during 2018 (one year before CPTPP implementation), 2019 (the year prior to the COVID-19 pandemic) and 2021, when available. Trade data for 2020, the first year of the pandemic, are also presented. In addition to historical comparisons, the EIA also compares the trade performance between the liberalized and non-liberalized sectors, or between the sectors that are subject to different levels of tariff reductions under the CPTPP. Moreover, the EIA observes the evolution of FTA utilization over time following the implementation of trade agreements and compares the utilization across various FTAs.

Summary of findings

Effectiveness assessment

The results of the effectiveness assessment are presented by global issue. For each issue, the assessment describes CPTPP provisions, relevant efforts and outcomes, and highlights a case study where possible.

1. Small- and medium-sized Enterprises

The CPTPP is Canada’s first FTA to include a chapter dedicated to SMEs to help them take full advantage of opportunities under the Agreement. This reflects the Government of Canada’s commitment to significantly increase the number of Canadian SMEs exporting to new and emerging markets. SMEs make up the majority of Canadian businesses and employ more than 7.5 million Canadians, roughly 70% of the private-sector labour force.

A key feature of the SME Chapter is the requirement that Parties establish user-friendly websites presenting information about how SMEs can take advantage of the CPTPP. These websites include descriptions of CPTPP provisions relevant to SMEs. Canada established its CPTPP SME website in January, 2019; data show that between December, 2020 and December, 2022, the website attracted a total of 3,414 visits with 44% of visitors located in Canada.

The Chapter also established an SME Committee that meets regularly to: review how well the CPTPP serves SMEs; consider ways to further enhance its benefits; and to oversee cooperation and capacity-building activities to support SMEs through export counselling, training programs, information sharing, trade financing and other activities.

In 2019, Committee members exchanged information about these websites and about developing information specifically for SMEs. Canada presented its experience upskilling officials and creating resources and tools for SMEs, as well as lessons learned on promoting SME utilization of the CPTPP. Committee members also exchanged information on current information-sharing and capacity-building practices. The Committee acknowledged that these exchanges, information sharing of Members’ initiatives and learning from industry, academics and SMEs are valuable to advancing its work.

In 2020, the Committee met to discuss the methods by which strategies and policies that address the impact of COVID-19 on supply chains were being implemented to support SMEs, with a particular emphasis on domestic measures to enhance digital-commerce capacity. In that same year, Canada presented a proposal to organize a workshop to share best practices for evaluating the effects of FTAs, with a focus on SMEs and supply chains. The purpose of the meeting was to hear about different approaches to the empirical evaluation of the impact of trade agreements and the measurement of SMEs’ participation in trade and in international supply chains, with the goal of developing a way forward with respect to the evaluation of the CPTPP’s impact on supply chains as required by the agreement. The proposal received widespread support from Committee members and Canada hosted the workshop in September 2020.

Furthermore, Canada’s missions to CPTPP countries have helped deliver benefits for SMEs. Since 2019, these missions have undertaken 20 activities targeting SMEs; several activities targeted SMEs owned and/or led by women and Indigenous Peoples, and environmental/cleantech sector SMEs. Canada’s Trade Commissioner Service (TCS) also supports CPTPP promotion and education tailored to Canadian companies and entrepreneurs. Since 2018–2019, the TCS has organized, supported or presented at over 25 CPTPP-related events featuring over 1,975 attendees, most representatives of Canadian SMEs. In addition to the SME Chapter, the CPTPP further supports Canadian SMEs through streamlined customs and origin procedures, and greater transparency in CPTPP-related regulations.

About the TCS

The Trade Commissioner Service (TCS) helps Canadian companies and organizations of all sizes grow and operate internationally. The TCS network of Trade Commissioners in more than 160 cities around the globe connects exporters with qualified contacts, funding and support programs, and provides key information to help seize international opportunities and succeed in markets around the world.

The TCS helps eligible businesses to: prepare for international business, find global opportunities and qualified contacts, and resolve business problems abroad.

Beyond the SME Chapter, there are SME-related provisions and or efforts undertaken by CPTPP committees that are tied to numerous other chapters of the CPTPP including: Cross Border Trade in Services; Electronic Commerce; Intellectual Property (IP); Regulatory Coherence; Competition Policy; and Competitiveness and Business Facilitation.

Cross-border trade in services

Obligations and commitments in the Cross-Border Trade in Services Chapter enhance transparency and predictability for service providers, including for services delivered online. Key features maintain a level playing field by ensuring that the CPTPP Parties provide the same treatment to Canadian service suppliers as they would to any other third Parties and to their domestic service suppliers. Other provisions of the Chapter encourage best practices for the administration of measures and licensing processes in regulated sectors, including for professional services, such as engineering, architecture and legal services, in which Canadian SMEs are globally competitive. Additionally, women make-upon an average of 43% of professionals in these sectors.

Electronic commerce

The E-Commerce Committee established under the CPTPP held its first meeting in April, 2022. This Committee provides a forum to discuss inclusive trade issues, such as cooperating to facilitate SME participation in digital trade or promoting digital inclusion. As members of this Committee, the Parties developed a virtual workshop on new and innovative provisions in digital economy agreements and the advancement of digital infrastructure. The June 2022 workshop featured presentations from CPTPP Parties, including one by Canada on data-transfer provisions in the Canada-United States-Mexico Agreement (CUSMA). In addition, Parties have commissioned a study on implementation of the commitments under the Electronic Commerce Chapter.

Intellectual property

Canada works with Australia, Chile, Japan and Mexico as part of the Friends of Intellectual Property and Innovation (FOII) Group at the WTO TRIPS Council discussions on national experiences and practices on emerging IP and innovation areas. In preparation for the February 2020 meeting of the TRIPS Council, Canada drafted the FOII discussion paper Making MSMEs Competitive Through Trademarks to facilitate a TRIPS Council discussion on raising awareness among micro-, small- and medium-sized enterprises (MSMEs) of the role trademarks play in international trade. As part of the February 2020 TRIPS Council discussion on this topic, Canada, along with CPTPP Parties Australia, Chile, Japan, Peru and Singapore, shared national experiences in improving trademark awareness, registration and use by MSMEs.

Competition policy chapter

The Competition Policy Chapter recognizes that competition is good for businesses, including SMEs. Competition strengthens business’ ability to succeed in global markets by ensuring that the benefits of trade liberalization are not offset by anti-competitive business conduct. This Chapter furthers the Parties’ goal of creating a fair, transparent, predictable and competitive business environment that ultimately benefits consumers and businesses. In Canada, one of the purposes of the Competition Act is to ensure that SMEs have an equitable opportunity to participate in the Canadian economy. The Competition Bureau operates on the general premise that open, competitive markets and pro-competitive policies support the participation of SMEs in the economy. SMEs are a key competitive driver for the economy, bringing innovative products to market and putting pressure on larger businesses to remain competitive.

Regulatory coherence chapter

The Regulatory Coherence Chapter has potential benefits for SMEs. The Chapter aims to deal with the growing challenge posed by non-tariff barriers by increasing transparency, central coordination and predictability regarding foreign regulatory frameworks and their enforcement. A discussion at the Regulatory Coherence Committee meeting of July 2020 focused on engaging SMEs and interested groups in regulatory-improvement processes.

Success story

Canada’s Trade Commissioner’s Office in Tokyo collaborated with a Vancouver-based women SME graphic illustration studio to design a map of Canada highlighting Canada's top provincial agriculturalexports to Japan benefitting from the CPTPP tariff cuts. The project also includedillustrated imagesof the top 14 agricultural exports from Canada to Japan thathighlighted tariff outcomes from the Agreement.In her work statement, theillustrator noted shefeels strongly about “collaborating with (female-led) organizations that value equality, community and sustainability.”The project was produced in close consultation with Canadian Provinces, which have a significant number of companies that export to Japan (e.g. British Columbia, Alberta, Saskatchewan, Ontario, Quebec) to help identify the top products of export interest to the Japanese market. The illustrations are being used to promote the CPTPP across the Japan Trade Network, from the Sapporo office to the new Fukuoka office in southern Japan.

2. Gender equality

Through its inclusive approach to trade, Canada has made gender equality and women’s economic empowerment a top priority in Canada’s trade policy and trade promotion activities. The Government of Canada is committed to advancing gender equality and the empowerment of women and girls at home and abroad. Achieving these objectives is an effective way to promote Canada’s values and rights-based approach, and foster prosperity, create lasting peace and achieve sustainable development.

The Government of Canada’s Women Entrepreneurship Strategy and the TCS support and promote businesses owned by Canadian women to advance gender equality and women’s economic empowerment. While gender equality and the avoidance of discrimination based on gender are two of many elements that Canada has sought to include in past FTAs—often by negotiating language that aims to eliminate employment discrimination through the Labour chapters—Canada now seeks to include additional gender considerations. These considerations involve conducting a comprehensive Gender Based Analysis Plus (GBA Plus) of individual FTA chapters to mainstream gender-related provisions throughout FTAs; and, working to include standalone chapters on trade and gender.

Although there is no Trade and Gender Chapter in the CPTPP, there are several gender-related provisions in the Labour, Development, and Cooperation and Capacity Building Chapters, as well as in the Agreement’s preamble (see Annex E). These provisions contribute to ensuring women and women-owned business benefit from the CPTPP (see CPTPP Trade and Gender Infographics at Annex F). Furthermore, work is underway to advance women’s economic empowerment and gender equality under five chapters: Cross-Border Trade in Services; IP; Competition Policy; Development; and Cooperation and Capacity Building. Beyond the activities being undertaken, these Chapters may also indirectly benefit women and SMEs participating in and benefiting from trade through the CPTPP.

Cross-border trade in services chapter

The Cross-Border Trade in Services Chapter calls for CPTPP members to establish a Professional Services Working Group. The Working Group finalized non-binding guidelines aiming to facilitate the negotiation of mutual-recognition agreements (MRAs) among regulatory bodies or authorities in charge of recognizing professional services and qualifications. The agreements include specific guidance on inclusiveness, i.e. that MRA requirements and procedures not discriminate based on age, gender or race. The non-binding guidelines on MRAs have been adopted at the ministerial level in October, 2022 and are currently available on Canada’s website.

Intellectual property chapter

On IP, Canada has exchanged with CPTPP Parties experiences on domestic approaches for narrowing the gap in the participation of women and other underrepresented groups in innovation systems. Canada continues to build on its extensive experience in the area of IP to share and exchange knowledge with its trading partners to advance the participation of women and other underrepresented groups in IP systems to better enable them to benefit from the Agreement.

Canada’s experience that we are leveraging in this regard includes:

- Canada’s engagement with Mexico and other Members of the World Intellectual Property Organization (WIPO) in meetings of the WIPO Committee on Development and Intellectual Property (CDIP) to advance work on the participation of women in IP systems. This includes Canada’s and Mexico’s CDIP project proposal, entitled Increasing the Role of Women in Innovation and Entrepreneurship: Encouraging Women in Developing Countries to Use the IP System, which was unanimously adopted by the CDIP and launched in January, 2019. The project aims to increase understanding of the problems facing women inventors and innovators, and identify targeted support mechanisms that can increase the awareness and use of IP by women. In April, 2022, WIPO published a summary report on the project’s international IP mentorship program for women investors.

- Canada’s IP Strategy, launched in 2018, seeks to ensure that Canada’s IP regime is modern and robust, and that Canadian entrepreneurs better understand and protect their IP. In 2019, to better understand how Canadians understand and use IP, Innovation, Science and Economic Development Canada (ISED) and Statistics Canada conducted an IP Awareness and Use Survey”. Survey respondents included traditionally underrepresented groups that have been less likely to use IP, such as women. The results of this study will be shared with the CPTPP Parties as a learning tool.

Competition policy chapter

CPTPP Parties share information and cooperate as research on competition and gender progresses at the OECD. Besides Canada, other CPTPP members that are also members or participants of the OECD Competition Committee include Australia, Chile, Japan, Mexico, New Zealand and Peru.

Canada funds relevant research and has developed gender-consideration tools for competition authorities. To help competition authorities apply gender considerations to their work, the OECD is now at the final stages of preparing a Gender-Inclusive Competition Toolkit. Canada will share this information with CPTPP Parties once it is published in September, 2023. The Competition Bureau will continue to support the OECD and its members (including CPTPP trade partners) to understand and apply the benefits of this gender and inclusive competition policy approach.

Canada recognizes that there is an opportunity to enhance the effectiveness of its competition policies and programs domestically and to share its experiences with CPTPP Parties to achieve gender-responsive and -inclusive outcomes.

Development and cooperation, and capacity-building chapters

Article 23.4 (Women and Economic Growth) in the Development Chapter and Article 21.2 (Areas of Cooperation and Capacity Building) in the Cooperation and Capacity-Building Chapter aim to advance women’s economic empowerment and gender equality. They propose collaborative work on development to promote economic growth and trade by helping women build capacity and skills, enhancing women’s access to markets, technology and financing, establishing women’s leadership networks, and identifying best practices in workplace flexibility.

At the 2019 Development Committee meeting, Committee Members agreed to share information, experiences and best practices on ways to measure the impacts of trade, particularly with regards to data collection and analysis, with a focus on themes (including women in the economy) relevant to the Development Chapter. At the 2020 Committee meeting, under both Chapters, Canada shared updates on ITAG and on the conclusion of the GTAGA to the Committee Members on Development and Capacity-building. Canada also proposed to provide a more substantive briefing on both matters to gain more participants in the Arrangement from within the CPTPP.

In July, 2021, Canada, New Zealand and Chile made a presentation about the benefits of the GTAGA to the CPTPP Committee and encouraged more countries to join. In particular, the presentation highlighted the extensive collaboration through ITAG, the importance of the trade and gender nexus, ITAG benefits to economies and women exporters. Mexico joined GTAGA in October, 2021.

Canadian missions in CPTPP countries also advanced women’s economic empowerment and gender equality in their host countries. Since 2019, Canada’s CPTPP Mission network has undertaken 33 activities related to trade and gender, focusing on a variety of issues, such as development, women’s economic empowerment, Indigenous women, innovation, and sustainability.

Success story:

Born and raised in Canada’s North, Amy Maund demonstrated an early fascination for plants and wildlife. As a child, her family travelled to Great Slave Lake each summer and collected specimens from the forest. Today, she can be found with her young daughter deep in the wilds of the Northwest Territories or northern British Columbia harvesting herbs, berries, lichen and fungi for wildcrafted products.

In 2011, Maund established Laughing Lichen to create and market wildcrafted products such as soaps, salves, teas and seasonings in an ecological way. All aspects of the business are sustainable, from ethical harvesting to manufacturing all of her products off the grid by using solar energy. Laughing Lichen harvests more than 50 different species of wild herbs, berries, lichens and fungi for their products.

“It’s my passion,”says Maund.“The plants are wild and native, not farmed, not near highways, not sprayed, not genetically modified. Wildcrafting in the North is a beautiful way of life, to harvest and forage with your family and friends, enjoy nature sustainably and responsibly and then come back and manufacture products infused with wild harvests.”

The company’s products include Wild Labrador Tea, which is made from a small aromatic shrub that grows in boggy and wet areas, and contains spruce pitch, which has anti-fungal, analgesic and anti-microbial qualities. Her company also produces an imitation Bear Poop Soap that is infused with wild chaga mushrooms and cranberries.

To support her business, she is building a new solar-powered facility on a 12-acre parcel of land 40 minutes northeast of Yellowknife and plans to employ more people and harvest larger volumes.

Laughing Lichen is an example of a successful company located in one of Canada’s isolated regions that has become an exporter to the world. Maund says that she wants to support a lifestyle in the North where you can earn a meaningful wage and continue to live remotely.

Wholesale products from Laughing Lichen are selling well in Asia, with online sales also reaching CPTPP markets of Japan and Australia.

3. Indigenous peoples

The CPTPP seeks to advance economic development and participation in trade for Indigenous Peoples via provisions in four chapters: Intellectual Property (IP); Development; Cooperation and Capacity Building; and Environment. The Asia Pacific Foundation estimates that more than 50 million Indigenous Peoples live in CPTPP countries. Given these realities, it is important to ensure that the benefits and opportunities of increased trade flow to underrepresented groups, including Indigenous Peoples. The provisions related to Indigenous Peoples embedded in Canada’s previous FTAs are also included in the CPTPP, but are designed to protect Indigenous rights and preferential treatment within Canada. For example, Canada maintains reservations for “Aboriginal Affairs” in its schedule of commitments for Services and Investment, and maintains set-asides for Aboriginal businesses in its schedule of commitments for government procurementGP. In a similar vein, New Zealand included in the CPTPP a general exception for the Treaty of Waitangi to protect Maori rights and interests. Canada was inspired by the approach taken by New Zealand and subsequently developed its own Indigenous General Exception, which it pursued successfully in the CUSMA negotiations.

Intellectual property

CPTPP Parties have committed to cooperate through their respective IP agencies (or other relevant institutions) to enhance understanding of issues related to genetic resources and traditional knowledge associated with genetic resources (Article 18.16), which is of particular interest to Indigenous Peoples. As such, Canada works with CPTPP Parties at the WIPO Intergovernmental Committee on Intellectual Property and Genetic Resources, Traditional Knowledge, and Folklore, which brings together technical experts to exchange national experiences on these issues. Canada has shared with CPTPP Parties its national IP Strategy, which seeks to ensure a modern and robust IP regime and to inform Canadian entrepreneurs about how to protect their IP. To better understand how Canadians understand and use IP, ISED and Statistics Canada conducted an IP awareness and use survey in 2021. Survey respondents included traditionally underrepresented groups that have been less likely to use IP, such as Indigenous Peoples. The survey showed that 10.1% of businesses with an Indigenous primary decision-maker owned some form of IP.

As part of the IP Strategy, in 2019, ISED launched the Indigenous IP Program Grant, which helps Indigenous organizations increase their capacity to strategically manage IP. Five organizations have received a total of CAD $116,665 to explore ways to make the IP system more accessible, and develop their own policies, educational resources and IP pilot projects.

Development, cooperation and capacity-building

The Development and Cooperation and Capacity Building Chapters’ committees jointly met in 2019 and agreed to share information, experiences and best practices on ways to measure the impacts of trade, particularly with regards to data collection and analysis. An emphasis was placed on themes relevant to the Development Chapter, including underrepresented groups such as Indigenous Peoples. Since 2019, Canada’s CPTPP Mission network has undertaken 11 trade and Indigenous related activities.

Environment

Under the Environment Chapter, the Parties have core commitments to maintain robust environmental governance by upholding high standards of environmental protection and by effectively enforcing environmental laws in the context of liberalized trade. In Article 20.13, CPTPP Parties also agreed to promote and encourage conservation and sustainable use of biological diversity, and to recognize the importance of respecting, preserving and maintaining knowledge and practices of Indigenous Peoples and local communities relevant to the conservation and sustainable use of biological diversity. Parties also agreed to the importance of public participation and consultation related to conservation and the sustainable use of biological diversity.

Success story

In December 2020, Canada’s mission in Sydney, Australia partnered with the Canadian Council of Aboriginal Business (CCAB) to launch the inaugural Canada-Australia Indigenous Business Export Dialogue, along with six Canadian and Australian Indigenous businesses and the following partners: CCAB, Supply Nation, Business Council of Australia, Austrade and Ignite. Canada’s mission delivered a presentation on Canada’s TCS, including highlighting the CPTPP and Canada’s focus on Indigenous exporters, and underscoring the high level of collaboration amongst Austrade and the TCS, which enhances the services we provide to companies. Participating Canadian companies were interested in both how the TCS could assist them in Australia, how trade agreements affected them and in the CanExport program. With almost all companies operating in the nutrition, health and wellness sector, a natural synergy emerged, resulting in them committing to explore working with each other. A CanExport Associations application was made by the CCAB to, amongst other initiatives, conduct an Indigenous Virtual Trade Mission to Australia in 2021.

4. Domestic regional economic development

Canada provides support to Canadian businesses seeking to take advantage of opportunities in CPTPP markets in a number of ways: producing and distributing promotional materials such as video success stories; posting information online about support programs; and providing helpful tools such as the Canada Tariff Finder. Canada also trains its Trade Commissioners and public-sector staff who work directly with Canadian businesses to advise businesses about CPTPP-related opportunities. Public-sector partners include provincial and territorial governments, Crown corporations and other federal departments. In 2023, Canada initiated, in collaboration with these partners, the development of a digital FTA portal to help Canadian companies take full advantage of FTAs including the CPTPP. The FTA Digital Hub is expected to be launched in 2024.

These initiatives support the efforts of provincial and territorial governments to promote the CPTPP. More can be read about the benefits for provinces and territories on Canada’s website.

Success story

In July 2020, Chile’s Ministry of Social Development coordinated the workshop series Indigenous Women´s Participation in Local Economies: Discussing Institutional Involvement to Promote Capacity Building (English-only PDF) as part of Chile’s 2019 APEC Presidency. The series, sponsored by Canada, Mexico and New Zealand, featured four sessions attended by officials from the public institutions in APEC economies that specialize in Indigenous women’s economic empowerment. APEC economies that participated in this event included many CPTPP Parties, such as: Australia; Canada; Malaysia; Mexico; New Zealand; Peru; and Vietnam. Chile was represented by its Ministry of Women and Gender Equality, Corporación de Fomento de la Producción, Undersecretary of Tourism, and United Nations (UN) Women Chile. Ms. Dawn Madahbee Leach, Chair of the National Indigenous Economic Development Board, represented Canada as a speaker at the event.

The series focused on the challenges and good practices associated with designing and implementing public policies that foster Indigenous women’s participation in local economies. It allowed for a comparative analysis of best practices to be replicated throughout APEC, which could advance policies and programmes to empower Indigenous women in the APEC region. Indigenous Peoples in the APEC region comprise 70% of the global Indigenous population.

5. Labour rights

The Labour Chapter in the CPTPP contains enforceable labour rights and obligations and reaffirms the commitments of the Parties to respect internationally recognized labour rights and standards, and to effectively enforce relevant domestic labour laws. The CPTPP’s labour provisions encourage public participation and allow the public to raise concerns.

All CPTPP Parties are International Labour Organization (lLO) members and recognize the linkage between labour rights and trade. In the CPTPP, Parties agree to adopt and maintain in their laws and practices the fundamental labour rights as recognized in the ILO 1998 Declaration, namely: freedom of association and the right to collective bargaining; elimination of forced labour; abolition of child labour and a prohibition on the worst forms of child labour; and elimination of discrimination in employment. They also agree to maintain and enforce laws governing acceptable conditions of work with respect to minimum wages, hours of work, and occupational safety and health.

Canada is working with CPTPP Parties to support the implementation of Labour standards in their countries. In addition to engaging at the technical level with partner countries, Canada provides technical assistance, through grants and contributions programming, to support capacity building in developing partner countries. The support has helped ratifying countries, including those of the CPTPP, CUSMA, and the Canada-Peru Agreement on Labour Cooperation, to build their capacity to reform or effectively enforce labour regimes and abide by internationally recognized labour standards.

This support entails a series of bilateral cooperation projects involving Canada and CPTPP Partners, either under the CPTPP or other FTAs. While not all examples are CPTPP-specific, it is important to consider existing work being undertaken, such as in other fora, to avoid duplication and recognize the benefits it may provide for the CPTPP context. By focusing on the reinforcement of a rules-based trading system aligned with international labour standards, the support is expected to contribute, directly or indirectly, to the objectives of the CPTPP Labour Chapter, and to three of the cooperation priorities adopted at the 2021 CPTPP Labour Council meeting to promote: ethical and sustainable supply chains; occupational safety and health; and gender equality.

As a development partner, Canada financially supports the ILO implementation of the National Industrial Relations Systems, a $1.5 million five-year project in Vietnam starting in fiscal year 2020–2021 that aims to: facilitate the reform of national industrial-relations law; assist new approaches of collective bargaining and social dialogue at local levels; and to strengthen the industrial-relations service function of the Government of Vietnam. Additionally, the project aims to reinforce the Government of Vietnam’s role as mediator and promoter of collective bargaining and social dialogue. The project is expected to support Vietnam’s ability to meet international labour standards and obligations under the Labour Chapter. The project supports the operationalization of the Vietnam Labour Code 2019, which came into force on January 1, 2021 and sets out, for the first time, the right of employees to establish and join independent labour unions, bringing Vietnam’s legislation in line with the 1998 ILO Declaration on Fundamental Principles and Rights at Work.

Although this is an important step for Vietnam, Canada received a public communication in March, 2023 alleging that Vietnam’s labour laws are not in compliance with the Labour Chapter’s obligations pertaining to freedom of association and collective bargaining. The Canadian Contact Point designated for the Labour Chapter has accepted the public submission for review and will examine the issues raised. Throughout this process and beyond, Canada will continue to provide support, to the extent possible, so that Vietnam can continue to implement these reforms and meet its obligations.

Following Malaysia’s ratification of the CPTPP, Canada launched in March 2023 an ILO project valued at $800,000. The project is designed to enhance national and sectoral actions to enact and implement international labour standards in Malaysia. It focusses on tackling child and forced labour, particularly in the electrical and electronics sector, and on strengthening freedom of association and the right to collective bargaining as effective means to improve labour protections. The project is slated for completion in September 2025.

In Mexico, Canada supported the Maquila Solidarity Network (in English and Spanish only) a Canada-based organization, in implementing a two-year project worth $250,000 that aims to support the rights of workers in Mexico’s garment and other export sectors to join or form unions of their choice and to bargain collectively. To this end, project activities included the development and dissemination of a wide range of resources about labour reform, as well as the promotion of constructive dialogue on freedom of association and collective bargaining among enterprises, manufacturers, governments and labour-rights advocates. Project activities ended in June 2021.

Furthermore, Canada has committed $20 million over four years, starting in fiscal year 2021–2022, to support Mexico’s implementation of its labour reforms and obligations under the labour provisions of CUSMA. In September 2021, Canada approved two four-year worker-focused projects, including one worth $4.4 million being implemented by the Steelworkers Humanity Fund to improve labour-rights protection, wages, and working conditions for unionized and non-unionized workers in targeted states and economic sectors, and another worth $5 million being implemented by Unifor to improve the exercise of Mexican workers’ rights as set out in Mexican labour law and in CUSMA. Additionally, in 2022, a three-year, $2.4 million initiative implemented by World Vision Canada was launched to improve working conditions and the effective exercise of labour rights by Mexican workers, particularly migrant and Indigenous women and youth, by addressing forced and child labour in key export-oriented agricultural sub-sectors (i.e. tomato, cucumber and eggplant) in the Mexican states of Sinaloa and Jalisco.

Canada has also assisted Peru with various labour-related issues. Notably, since the Canada-Peru Agreement on Labour Cooperation came into force in 2009, Canada has provided Peru with labour-related technical assistance in the areas of child labour, occupational health and safety, and compliance and enforcement of labour rights. For instance, Canada supported the Programa Laboral de Desarrollo, a Peruvian non-governmental organization, in completing a three-year project worth $600,000. The project enhanced the capacity of labour stakeholders in Peru to comply with and enforce labour laws, particularly those guaranteeing the rights to associate freely and bargain collectively. The project also aimed to ensure timely access to justice for labour-related grievances. Project activities included training for court officials and union representatives, as well as establishing tools to facilitate collective bargaining. The project activities ended in November, 2021.

Additionally, as committed under CUSMA’s Labour Chapter, Canada has enacted legislation prohibiting the importation of goods that are mined, manufactured or produced, wholly or in part, by forced labour. The legislation came into force July 1, 2020. Canada will continue to inform members of the CPTPP Labour Council of its actions to combat forced labour and seek to exchange information about relevant best practices.

6. Environment and climate change

The CPTPP’s Environment Chapter is very ambitious, committing the Parties to maintain robust environmental governance by upholding high standards of protection and effectively enforcing relevant laws while liberalizing trade. It also prohibits Parties from weakening environmental standards or laws to promote trade or attract investment. Notably, the Chapter’s obligations can be enforced through the CPTPP’s dispute-settlement mechanism, a first for an FTA involving Canada. An Environment Committee composed of senior government representatives from each Party oversees the implementation of the provisions. The CPTPP recognizes the right of Parties to set their own environmental priorities and corresponding levels of protection. With this in mind, the Parties commit to strive for high levels of protection in their domestic laws and policies. The Parties also agree to cooperate on matters of mutual interest related to climate change (transitioning to low-emission economies), including clean and renewable energy, low-emission technologies, sustainable transport and urban infrastructure, preventing deforestation, and market and non-market mechanisms.

The Environment Committee has been active and has met five times, including intersessionally, and has also implemented several cooperation activities with the purpose of exchanging information, raising awareness, and sharing best practices and lessons learned to promote better environmental practices across the region.

In 2019, Committee Members shared information related to provisions found in the Environment Chapter, including on domestic environmental programmes, strategies to improve public awareness of environmental laws and policies, various consultative mechanisms deployed by Parties to engage stakeholders on environmental issues, and voluntary mechanisms put in place by Parties to enhance environmental performance.Footnote 5 The Committee also agreed that a list of cooperation priorities would be submitted by each Party to form a reservoir of cooperation opportunities for the future. The Committee held a public session in 2019, bringing together government officials and members of civil society, including non-governmental organizations and businesses, from each CPTPP country. The session focused on biodiversity, fisheries management and subsidies, marine pollution, and the circular economy.

At an Environment Committee meeting held in October 2020, Canada strived to inspire engagement by proposing: a virtual dialogue on green recovery from COVID-19, which took place on December 2, 2020; a dialogue on cooperation frameworks, which took place in 2021; a discussion about public sessions, which was held during the Environment Committee meeting in June, 2021; and two workshops on illegal trade in wildlife, which took place in March, 2021 and May, 2023.

In August, 2020, the public session “Green Recovery from COVID-19: Building resilience for a greener, healthier and prosperous future” was held and featured presentations from three experts. The first presentation provided an overview of international green stimulus measures and recommended a variety of actions, such as investments in clean-energy infrastructure, energy efficiency and nature infrastructure. The second presentation focused on measures to increase resilience and prevent future zoonotic diseases such as COVID-19. The last presentation made the case for environmental pathways to recovery, including investment in low-carbon technologies and infrastructure.

During an intersessional meeting held in October 2020, Japan, as Chair of the Committee, agreed to Canada’s suggestion to hold a dialogue on Parties’ experiences on cooperation in bilateral FTA contexts at the next CPTPP meeting, as a way of bolstering buy-in for cooperation in the Environmental Committee. This dialogue occurred during the following Environment Committee meeting in June 2021, when Canada presented examples of its cooperation activities under the CPTPP and other FTAs to initiate a discussion on future engagement amongst the Parties.

In addition, the Environment Committee and the Sanitary and Phytosanitary (SPS) Chapter Committee worked together to organize a workshop held in June, 2020 which, aimed to identify opportunities to share information and management experiences related to the movement, prevention, detection, control and eradication of invasive alien species, with a view to enhancing efforts to assess and address risks and adverse impacts. This is important, as the SPS Chapter centers on protecting human, animal and plant health, and invasive alien species can negatively impact all of these.

Following through on its previous proposal, Canada hosted a Dialogue on Green Recovery from COVID-19 in December 2020. Government officials from nine of the eleven CPTPP countries participated and the dialogue focused on three topics: circular economy for green recovery; building back better to meet the 2030 UN Sustainable Development Goals (SDGs); and conservation actions to prevent pandemics. The dialogue raised important issues, which may contribute to greater CPTPP cooperation, including cross-border trade in recycled goods, green investment and mitigation of non-tariff barriers arising from green protectionism in post-COVID recovery.

In March 2021, Canada and Mexico co-hosted a workshop on combatting illegal trade in wildlife. Attended by 180 delegates from eight of the eleven CPTPP countries, the workshop centred on the illegal trade of endangered turtles and tortoises, and served to strengthen capabilities for the inspection, sampling and monitoring of cross-border movements of protected wild species. Canada and Mexico organized a second edition of the workshop in May 2023, which focused on sharks and stingrays. More than 70 people attended the second workshop, which sought to strengthen the capacity to address the supply and demand of illicit wildlife trade.

From June to August 2021, Japan hosted four webinars, which served as cooperation activities and Public Sessions under the Environment Chapter of the CPTPP. The themes were:

- Preventing the spread of invasive alien species.

- Conservation and sustainable use of biodiversity.

- Circular economy and resource efficiency.

- Climate change and decarbonization.

Canada participated in all four webinars.

Given that many Parties have never faced environmental obligations in an FTA, the levels of understanding regarding the implementation of the environment provisions and of motivation to achieve progress were initially uneven. This imbalance presented a challenge and created delays in dealing with initial procedural matters and the implementation of the Chapter. However, while some Parties are not heavily engaged, others have demonstrated high levels of interest and engagement in the Committee.

Success story

In support of Canada’s Trade Diversification Strategy, Canada’s TCS in Singapore and MaRS Discovery District collaborated to showcase fifteen Canadian companies and two Canadian cleantech accelerators (MaRS and Alacrity) at the second edition of the Cleantech Forum Asia in October 2019. Canada’s delegation was the second largest at the conference, and most Canadian participants were formal speakers at the event, which included pitching sessions and panel discussions. In addition to showcasing innovative Canadian clean technologies, the Canadian delegation stood out as a gender-diverse group, as women-owned/led companies comprised one-third of the delegation. The High Commission of Canada to Singapore organised a full-day program on October 7 for the Canadian companies participating in the Cleantech Forum Asia. The program included a site visit, a briefing and a networking session at Singapore’s national water agency, as well as presentations about market opportunities and trends. In collaboration with Enterprise Singapore (a Government of Singapore agency under the Ministry of Trade and Industry), a networking session including pitching sessions by five Canadian and one Singaporean women-owned or led cleantech companies, along with pre-arranged B2B meetings, were organized.

In addition, meetings were actively facilitated by the TCS through introductions to local companies during and on the margins of the Cleantech Forum. The dedicated space for Canada at the Forum provided prime meeting and networking space to the Canadian companies. This dedicated matchmaking service, offered to all Canadian participants, connected local, regional (Southeast Asia), and global networks of companies, investors and corporations focused on business related to the future of energy, power, mobility, waste and more.

Canada also hosted a Women in Cleantech lunch to showcase Canada as a leader in inclusivity and diversity, two elements that contributed to the uniqueness of the Canadian delegation. Two representatives from the women-owned/led Canadian companies, RWI Synthetics and EcoWaste Solutions, were speakers at the panel discussion moderated by MaRS Discovery District. The discussion focussed on how to provide more opportunities to women to become entrepreneurs, especially in technology-related sectors. The women-led companies and organizations from Canada showcased at the lunch were: Ecowaste solutions, XpertSea, RWI Synthetics, Genecis Bioindustries, Open Ocean Robotics and MaRS.

Conclusion of the effectiveness assessment

The effectiveness assessment highlights some of the important CPTPP outcomes that have the potential to advance inclusive trade-related issues for CPTPP Parties. Namely, the CPTPP’s dedicated Chapter on SMEs stands out as a substantive outcome as it recognizes the role and contribution of SMEs and facilitates their participation in international trade and investment with CPTPP Parties. As seen through this review, several CPTPP Committees are working to improve SMEs’ access to opportunities and potential to benefit from the Agreement. While the CPTPP does not include a chapter on Trade and Gender, several provisions throughout the Agreement recognize the importance of women’s participation in the economy and trade. Further, to date, several CPTPP Committees or Contact Points (the Committee on Cross-Border-Trade and Services, the Contact Points on Intellectual Property, the Committee on Development, and the Committee on Cooperation and Capacity-Building) have made efforts to integrate gender-responsive and inclusive considerations into their work. Similarly, various Committees or Contact Points (the Contact Points on Intellectual Property, the Committee on Development, the Committee on Cooperation and Capacity-Building, and the Committee on Environment) collaborate on issues related to Indigenous Peoples. The CPTPP’s enforceable outcomes on Labour and Environment are integral to the Agreement’s commitments to inclusivity, equity, sustainability and human rights. They complement commitments made by CPTPP Parties in other forums, such as the International Labour Organization. Cooperation and implementation of the CPTPP Chapters on Labour and Environment have been significant, including at the Committee level and bilaterally between Canada and CPTPP Parties.

The assessment demonstrates that along with implementing cooperation activities through Committees, Canada’s missions have played an important role in advancing inclusivity and ensuring that underrepresented groups, including SMEs, women, and Indigenous Peoples benefit from the CPTPP. Canada’s missions to CPTPP countries have implemented dozens of activities to support these groups.

While good work has been done in these areas, there is an opportunity to address more inclusive aspects of the CPTPP’s implementation, especially regarding cooperation on regional economic development. Evidently, this is an area where CPTPP Parties—including Canada, given its large landmass and diverse population—could better collaborate to advance inclusive regional economic development.

On all accounts, the CPTPP’s implementation would benefit from greater consideration of underrepresented groups either through Committee work or bilateral cooperation. This may require working more closely, through targeted consultation, with underrepresented groups to better understand the challenges and barriers they face in accessing international trade opportunities. ITAG Partners could support this work by sharing experiences and best practices and by encouraging inclusive and transparent dialogue, including with SMEs, women, and Indigenous Peoples. For more on this idea, consult the Gaps and Opportunities, Recommendations and Next Steps sections of this report.

Economic impact assessment

The objective of the ITAG is to advance sustainable and inclusive trade, ensure that the benefits of trade are more broadly shared, and better address rising concerns over environmental issues and labour standards in international trade. To this end, Canada’s economic impact assessment evaluates the status of inclusive elements under the CPTPP obligations. It examines whether Canadian SMEs and Canadian workers and female employees benefit from CPTPP obligations.

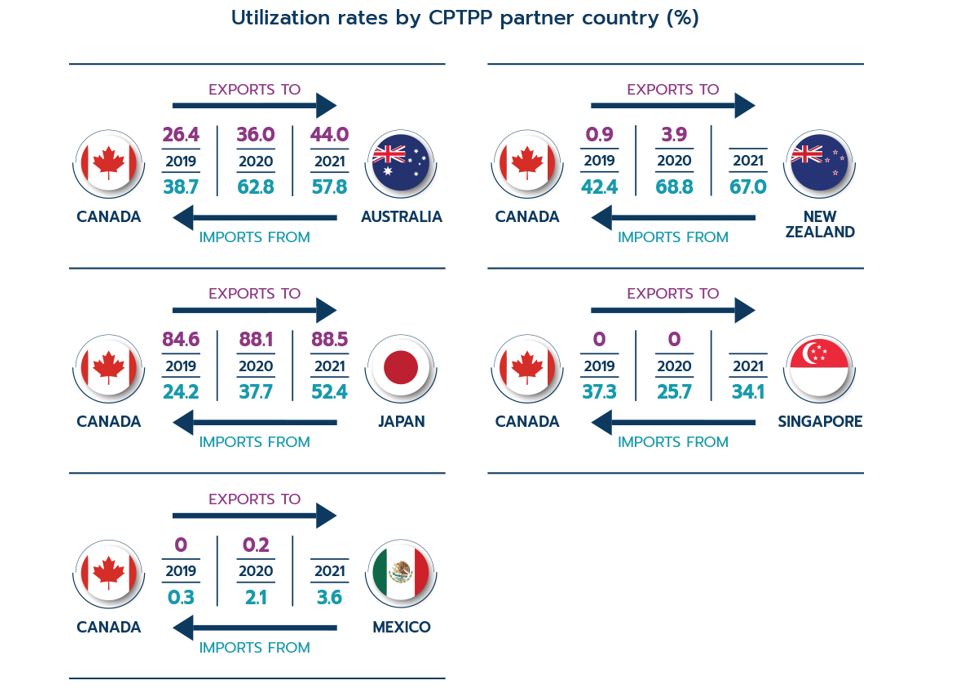

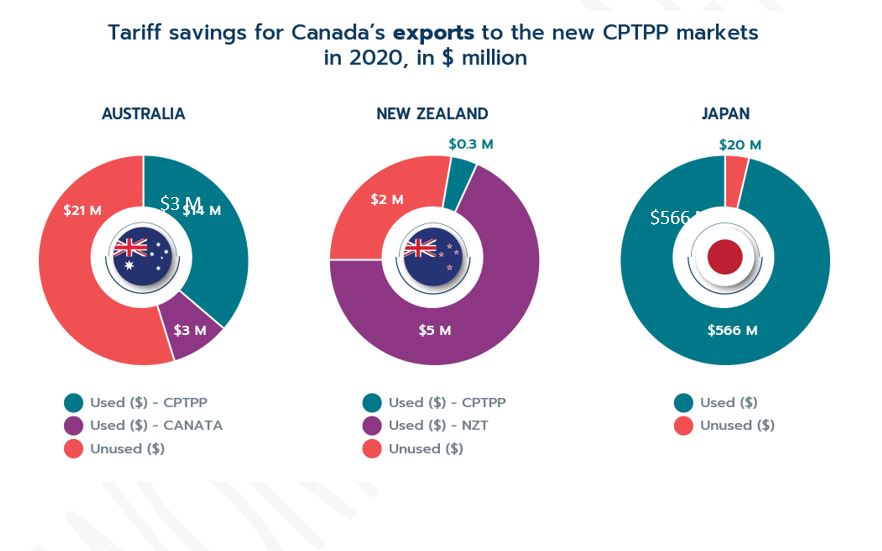

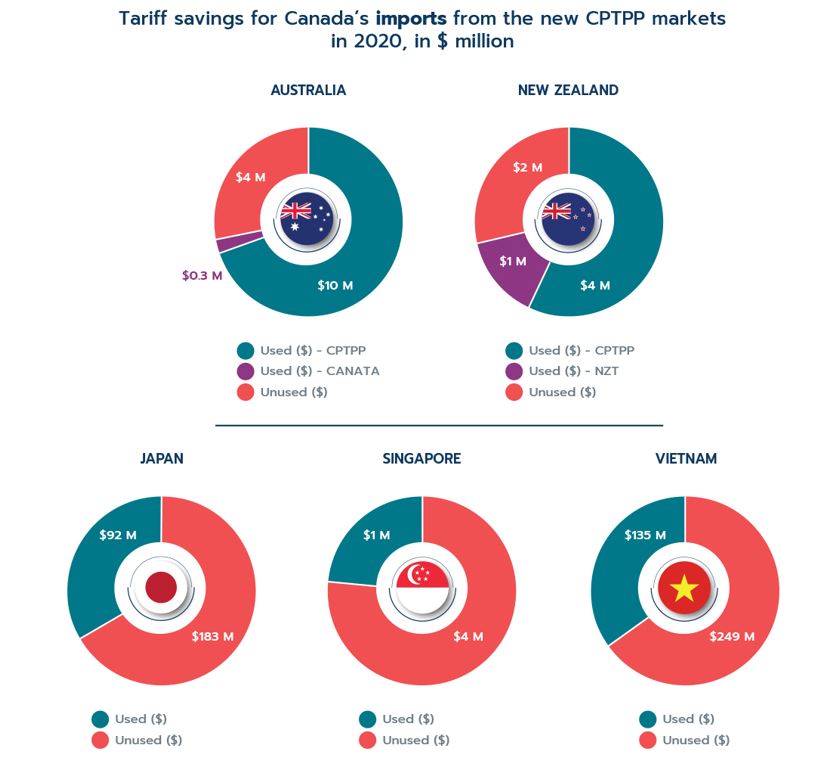

The economic impact assessment starts with an overview of Canada’s trade and investment with CPTPP partner countries following the Agreement’s entry into force. The second section evaluates the amount of trade creation under the CPTPP by comparing Canada’s trade performance with the new CPTPP markets prior to and following the Agreement’s entry into force, for all products covered by the CPTPP. This is followed by a closer examination of inclusive trade elements under the CPTPP obligations, with a focus on the trade performance of Canadian SME exporters (for the products covered by the Agreement), and the performance of Canada’s employment of female workers exporting to the new markets using Statistics Canada’s firm-level data. To complement ITAG’s core theme “Environment and Climate Change”, the fourth section looks at Canada’s trade in environmental goods with the new markets, and the last section reviews the utilization of CPTPP preferences by partner country.

1. Overview of trade and investment under the CPTPP

1.1 Merchandise trade

Three years after CPTPP entered into force, total merchandise trade between Canada and the new CPTPP markets (includes Australia, Japan, New Zealand, Singapore and Vietnam; and excludes Mexico and Peru, with which Canada has established trade agreements) increased by 10.0%, from $47.3 billion in 2018 to $52.1 billion in 2021.

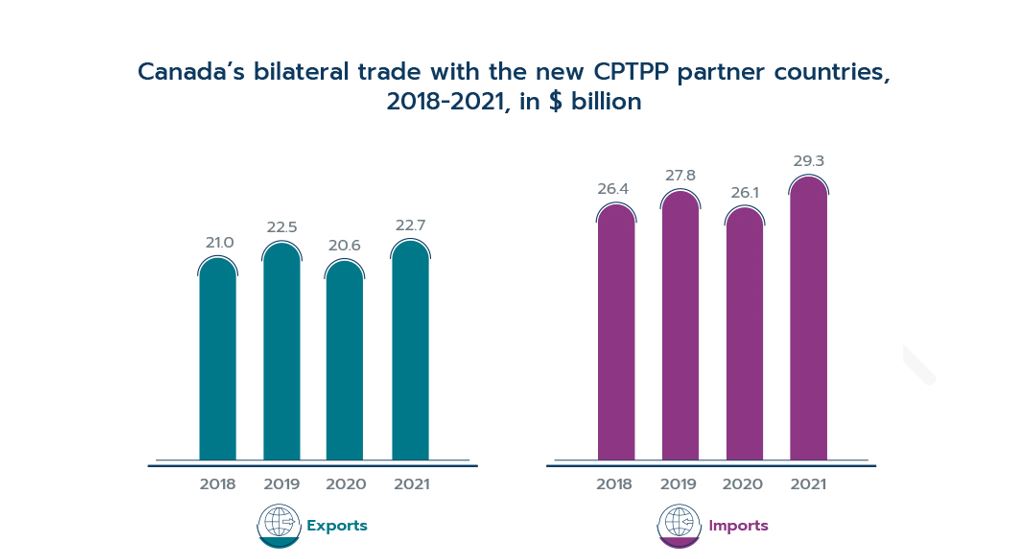

Canadian merchandise exports to the new CPTPP markets increased 7.1% from $21.0 billion in 2018, one year before the CPTPP came into force, to $22.5 billion in 2019, the first year under the CPTPP (see Figure 2). Most of the growth from 2018 to 2019 was driven by higher exports to Singapore and Japan. The onset of the COVID-19 pandemic in 2020 rocked the global economy and substantially disrupted the growth of bilateral trade between CPTPP countries. However, by 2021, Canada’s exports to the new markets grew sufficiently to recoup all pandemic-inflicted losses, reaching a historical high of

$22.7 billion, which is equivalent to an 8.3% increase relative to 2018, outpacing the growth of Canada’s merchandise exports to the world of 8.1% over the same period. The growth in Canadian exports from 2018 to 2021 was primarily driven by exports to Japan and Australia.

Figure 2Footnote 6:

Data: Global Trade Atlas

Source: Office of the Chief Economist, Global Affairs Canada

Figure 2 - Text version

Canada’s bilateral trade with the new CPTPP partner countries, 2018-2021, in $ billion

| Year | Exports ($ billion) | Imports ($ billion) |

|---|---|---|

| 2018 | 21.0 | 26.4 |

| 2019 | 22.5 | 27.8 |

| 2020 | 20.6 | 26.1 |

| 2021 | 22.7 | 29.3 |

Data: Global Trade Atlas

Source: Office of the Chief Economist, Global Affairs Canada

At the sector level, most of the increase in Canada’s exports to the new CPTPP markets during the first year of the Agreement derived from the sale of mechanical machinery, pharmaceutical products, meat, mineral fuels, and ores, slag and ash. On the import side, electrical machinery was the key sector driving the growth and made up more than 80% of Canada’s total import gains from the new CPTPP markets between 2018 and 2019.

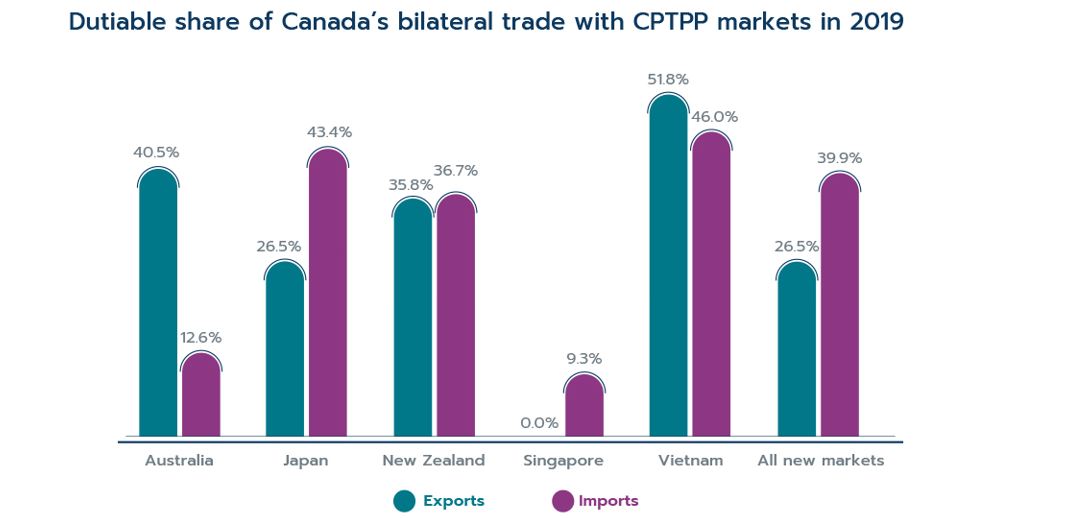

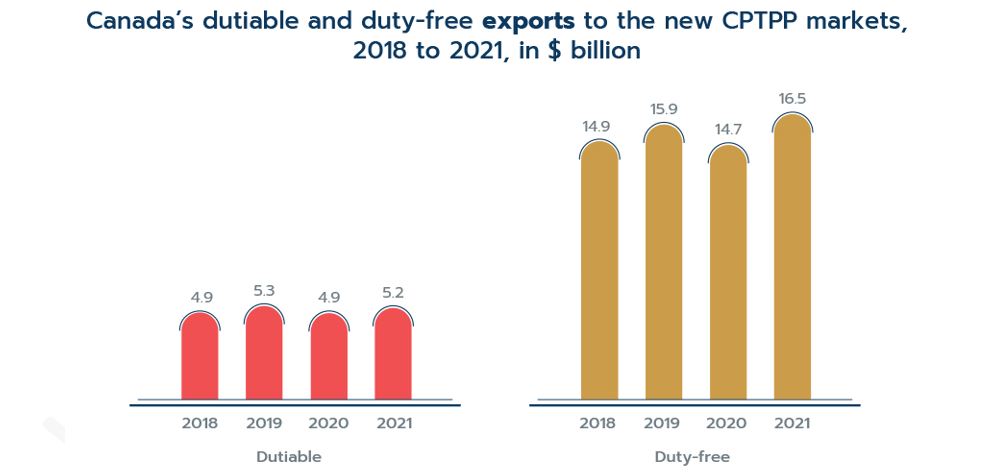

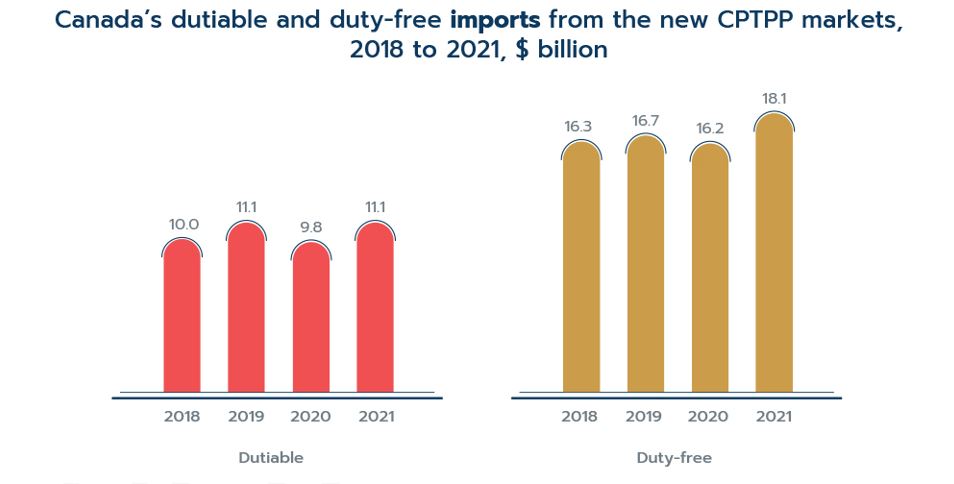

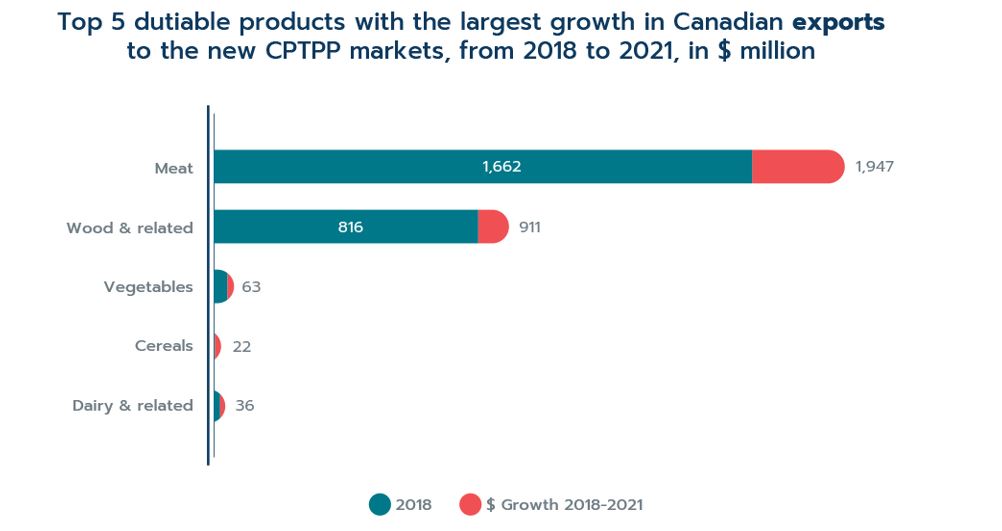

1.2 Services trade